FT: Huawei tries to re-invent Itself: Pivot from smart phones/telecom gear to cloud services, 6G, EV’s and HiSilicon

Condensed and edited Financial Times article by Kathrin Hille in Taipei, Eleanor Olcott in London and James Kynge in Hong Kong

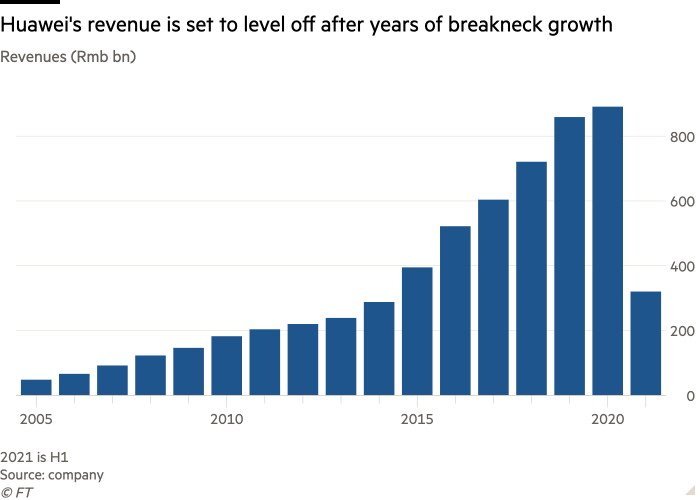

In the first half of this year, revenues at Huawei fell by almost 30 per cent compared with the same period last year, the largest ever drop. As U.S. restrictions have begun to derail Huawei’s traditional business, the group is now in a scramble to try to reinvent itself. The company is turning away from the development and sale of telecommunications network gear and smartphones into areas less dependent on foreign chip supplies — such as cloud services and software for smart cars. Huawei is also doubling down on its own research and development in an effort to escape the stranglehold of American sanctions. It is investing heavily to be a leader in the emerging 6G technology so that other companies are dependent on its patents — rather than Huawei relying on technology imports from the US. “In the current climate, the best way to describe the atmosphere within Huawei and the way we go about things, is like a huge collection of start-ups,” says Henk Koopmans, the company’s head of research and development in the UK.

At stake is not just the fate of one of China’s most prominent and successful companies, but the broader technological competition between Beijing and Washington. Chinese officials are clear that Huawei has been a vital part of the country’s network of innovation.

“Many have viewed Huawei as the only possibility for China to make a breakthrough in semiconductors and telecoms,” says a local government official in Shenzhen, the technology industry hub in southern China that is Huawei’s home. “So Huawei must survive. It is a national mission.”

The company’s smartphone sales dropped by more than 47 per cent in the first half of this year compared with the same period last year. Last week, rotating chairman Eric Xu predicted that in the full year, the company will lose up to $40bn of its $50bn smartphone business, a slide that analysts estimate will drive the share of the consumer business in Huawei’s total revenues from 42 per cent earlier this year to just over 30 per cent. “Huawei’s component bottlenecks are now starting to bite,” says Ben Stanton, a smartphone analyst at market research group Canalys. “Stockpiles are running low, and its volume will almost certainly continue to fall each quarter.” Noting that Huawei’s smartphone arm has retreated to its Chinese home market, he adds that its strength in previous overseas strongholds such as Europe “has completely evaporated.”

In the network equipment business, the decline is happening more slowly, partly because product cycles are longer. Although Huawei can no longer procure custom application-specific chips for its telecom products, it was assuring analysts that it had enough inventory to keep the infrastructure business running in the near term. In response to these losses, the first big push has been to strengthen Huawei’s software capabilities so that it is less dependent on producing hardware that it will struggle more and more to deliver without access to chip supplies.

The main software-driven business Huawei is rushing to build is cloud services. Some of the functions in a telecoms network traditionally performed by base stations can be transferred to software processes in the cloud with newer technology. Moreover, Huawei is rapidly developing new cloud services, which it offers to companies and government departments. Last week, the company announced plans to invest $100m in the next three years for small and medium-sized businesses to develop on Huawei Cloud. The company’s cloud business grew by 116% in the first quarter of this year to take a 20% share of the Chinese market (second only to Alibaba Cloud).

According to Canalys, Huawei’s cloud business grew by 116 per cent in the first quarter of this year to take a 20 per cent share of a $6bn market in China, behind Alibaba Cloud but ahead of Tencent. “Huawei Cloud’s results have been boosted by internet customers and government projects, as well as key wins in the automotive sector. It is a growing part of Huawei’s overall business,” says Matthew Ball, chief analyst at Canalys. He says that while about 90 per cent of this business is in China, Huawei Cloud has a stronger presence in Latin America and Europe, Middle East and Africa compared with Alibaba Cloud and Tencent Cloud. There are limits on Huawei’s cloud business, however.

In July, Chinese media reported that the company was considering selling a part of its server business that runs on x86 central processing units after Intel’s export license for providing Huawei with that component expired. Servers are indispensable for cloud companies because they are where the hardware data is stored and much of the computing needed for cloud services is performed. Huawei and Intel both declined to comment, but industry experts say processor supplies are a headache for Huawei.

“Selling the server business is highly likely,” says Ben Sheen, semiconductor research director for network and communication infrastructure at research firm IDC. “The CPU is a central component, and if Intel cannot ship, Huawei is in big trouble.” As in the network gear business, providers of cloud services such as Amazon Web Services or Google try to boost performance by improving their software. If Huawei can achieve the same, it will be in less urgent need to get new processor supplies. “In smartphones, your revenue share goes down very quickly if you don’t have the latest chips. In cloud, you can keep running a decent business for much longer, and maybe even expand your revenue if you invest in software differentiation,” says Jue Wang, an associate partner in the technology practice of Bain, a consulting company.

Although companies such as Intel and AMD release new CPUs every year, the majority of cloud service providers’ servers run on processors two to five years old. The cloud companies increasingly generate new revenues by investing in new AI services and tools — even if their servers run on older chips. “But eventually you will need new ones — you cannot offer cloud services without CPUs,” Wang says.

One of the fields where Huawei finds it relatively easy to pick up new business is helping to digitize industries that have been laggards in the adoption of information technology. It is offering telecom, IT and software tools to Chinese companies in sectors such as coal mining and port operations, enabling them to lower costs and enhance security. Driven by these operations, Huawei’s enterprise business revenues grew by 23 per cent last year and 18 per cent in the first half of this year.

“The enterprise business will likely continue to be a growth point for Huawei,” says Ethan Qi, an analyst at Counterpoint Research, who forecasts revenues in that segment to increase by up to 15 per cent a year in the next few years. Still, Huawei frets that this is not enough to offset the death blow the US sanctions are dealing to the smartphone business. The new industry verticals “may not even be able to compensate for those lost revenues in 10 years,” Huawei rotating Chairman Xu told reporters last week.

Huawei is making some striking bets on new areas. One of the biggest is in electric and autonomous vehicles (EV’s). Huawei made its first R&D foray into vehicles in 2014, but now the company is drastically cranking up commitment, with plans to form a 5,000-strong R&D team and investment of $1bn in the segment this year. The company says it will not build cars itself, but its engineers are clearly looking into everything short of that. “Initially, we just thought we would help the car connect, but after a while we realized that we can also help make it more intelligent,” says a Huawei official.

A vehicle released by Chinese automaker Beiqi at the Shanghai Auto Show this year featured an entire in-car electronics solution developed by Huawei. For this shift, the company is harnessing strengths built over years in its telecoms hardware business — executives say experience in designing base stations that can withstand extreme weather conditions comes in handy because temperature controls are a key requirement in electric vehicles. “They have refocused their teams in the research centers they run in Europe: In the past, those were 3G and 4G-facing, and now they are focused on [advanced driver-assistance systems],” says Jean-Christophe Eloy, chief executive and president of Yole, a French technology research and consultancy firm.

A large portion of the chips required in automotive electronics are manufactured with more mature processing technology, which does not need to be imported. “Much of that technology is available in China,” Eloy says. “Focusing on automotive therefore can also help them get away from their chip supply problem.”

But Huawei has its sights set far beyond keeping the business running in the near term: If anything, its ambition to be a tech pioneer has grown even stronger. Ren Zhengfei, founder and chief executive and Meng’s father, is letting some of Huawei’s researchers off the leash to focus on basic science and explore technology breakthroughs even without a clear understanding of its potential business applications.

“We will not demand you to put down your quill and join the troops,” Ren told R&D staff at a meeting in August. He added that the research team at HiSilicon, Huawei’s chip design unit, would be kept even though the US sanctions have robbed the Shenzhen-based operation of the chance to manufacture its advanced chips. “We allow HiSilicon to continue to scale the Himalayas,” Ren said. “The majority of us others will stay down here to grow potatoes, herd livestock and keep sending provisions to the climbers, because you can’t grow rice on Mount Everest,” Ren added.

Last year, Huawei invested Rmb141.9bn ($22bn) in R&D, almost 16 per cent of its revenue. The driver behind this focus on high-end research is the urge to become less dependent on foreign technology — while also laying the groundwork for growing intellectual property royalties.

In 5G, Huawei is one of the most significant owners of patents, forcing rival network gear makers such as Ericsson or Nokia to make certain payments to Huawei even if the Chinese company is excluded from 5G contracts in many western countries. Exhorting research staff to seek global technology leadership at the August meeting, Ren said: “We research 6G as a precaution, to seize the patent front, to make sure that when 6G one day really comes into use, we will not depend on others.” Elaborating on the potential uses of 6G for the first time, Ren said the technology might, beyond telecom’s traditional realm of connectivity, be used for sensing and detection — functions with potential for use from healthcare to surveillance. That expectation has grown out of the results of the “collection of start-ups” approach touted by Huawei’s UK research director Henk Koopmans. Ren’s encouragement for Huawei to pursue basic science is instilling what he hopes will be a start-up mentality in many of the company’s own R&D staff.

In addition, it is also tapping into a growing number of start-ups in which it invested in recent years. Engineers at the Centre for Integrated Photonics, a start-up based in Ipswich, eastern England, which Huawei acquired in 2012, recently developed a laser on a chip that can direct light into a fiber-optic cable — an alternative to established telecoms technology that sends pulses of infrared light through the cable. The researchers built the chip themselves, using Indium Phosphide technology instead of mainstream silicon-based semiconductors where US-owned tool technology gives Washington a stranglehold and which Huawei is struggling to obtain.

A circuit board on display at Huawei’s HQ. Image Credit: Bloomberg

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

Koopmans says one future use of the technology could be transferring data from sensors on the skin measuring blood oxygen content in remote healthcare services. “And all this photonics activity came from a really research background where we never knew if a product would ever see the light of day. But this is how we are doing things now — reutilize our R&D capabilities in a non-monolithic way.” Ren is not short on ambition for the group’s R&D operations, but acknowledges that they might not provide short-term results.

“Some theories and papers may not be put to use until one or two hundred years after they were first published,” he told R&D staff, reminding them that the significance of Gregor Mendel’s genetics discoveries was not understood until decades later. “Your paper may even have a fate like van Gogh’s paintings — nobody showed interest in them for more than 100 years, but now they are priceless. Van Gogh starved.”

Additional reporting by Nian Liu in Beijing and Qianer Liu in Shenzhen

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

References:

https://www.ft.com/content/9e98a0db-8d0a-4f78-90d3-25bfebcf3ac9

Huawei announces seven innovations in digital infrastructure for next decade

5 thoughts on “FT: Huawei tries to re-invent Itself: Pivot from smart phones/telecom gear to cloud services, 6G, EV’s and HiSilicon”

Comments are closed.

Podcast transcript: Catherin Hille is the FT’s Greater China Correspondent.

Marc Filippino

So, Kathrin, to recap, the US sanctions on Huawei have made, you know, virtually impossible for the group to buy semiconductor chips. And it’s a company that really relies on the chips for the smartphones and telecommunications equipment it sells. To what extent have these sanctions affected the company?

Catherine Hille

So, until last year, the impact of sanctions was not so visible. But in the first half of this year, we had the first really concrete evidence in terms of numbers. The company reported a 30 percent drop in overall revenue. And last week, one of the group’s top executives predicted that the global smartphone business, which grosses around $ 50 billion a year, would likely lose as much as $ 40 billion of those 50 billion. billion by the end of the year. So that basically means it’s going to be eradicated.

Marc Filippino

Wow. And so given all of these existing issues, it would probably make sense for Huawei to try to reinvent itself.

Catherine Hille

This is exactly what they are trying to do. Now the management of the company after the first scramble in the past two years to try to react to the US sanctions and try to keep themselves afloat, which they have now come to the point where they have a little more time to think about their long term future and develop a strategy and make new plans. If you look at what they do, there are basically two elements – one is trying to find new sources of income or new sources of income that can make up for at least some of the income that they lose, and the second element tries to stay ahead in the long term in the race for innovation. So the types of businesses they are now targeting for short-term income generation are businesses that are less reliant on advanced semiconductors. So where they would need fewer chips and if they need chips, they would be more mature chips that can be made in China.

Marc Filippino

And what kind of businesses is she developing now, Kathrin? Can you tell us a little more about the sectors where Huawei is innovating?

Catherine Hille

Sure. So one direction Huawei is pushing really hard is in electric vehicles and smart cars. The chips used in most electric car applications are chips that can be made in older chip manufacturing plants. So you don’t need the newest of all. And that means these chip factories wouldn’t need new machines or new software from the United States. And the other big area, which is more of a future ambition for Huawei, is of course 6G. We recently saw Huawei founder and CEO Ren Zhengfei talking to employees about the importance of focusing on research and development for 6G. And he himself said that for Huawei it was crucial to stay ahead in the race for technology so that he likes to use military language and military metaphors, so he said we have to grab the patent front. . So in order to enable Huawei in the future to be a big owner of patents that other companies should look to and pay for.

Marc Filippino

Are there any major obstacles in Huawei’s path in its planned transformation?

Catherine Hille

I think the big question remains how they’re going to pay their way through all of this. And if the Chinese state is going to pay for it or pay part of it, can they really succeed or will it somehow be in line with the direction the company itself might want? The other big question remains about China’s future semiconductor supplies. The reason these US sanctions are relatively effective against Huawei right now is that US companies control the technology and equipment in a few key niches. I’m only talking about certain types of equipment, machines needed to produce the new types of semiconductors. And as long as semiconductor technology does not move away from this mode of manufacturing to other segments, the stranglehold of the United States will remain. And until China breaks through, I don’t see how this situation will change. And so it still remains settled with this key obstacle.

https://oltnews.com/huawei-tries-to-reinvent-itself-financial-times

Cloud services in China are state security tools of the CCP. As long as the CCP lets Huawei share the cloud market with Alibaba Cloud and Tencent Cloud, Huawei will probably survive.

In China, there are no free markets, so business success depends on politics. Who wins and who loses is determined by the CCP.

Again, don’t trust any stats or numbers China published.

Canalysis agrees! CHINESE REGULATORS IMPEDE CLOUD GROWTH

China’s cloud infrastructure market grew 54% year on year in Q2 2021 to US$6.6 billion, led by Tencent Cloud, which grew 92%. Tencent Cloud accounted for nearly 19% of total cloud infrastructure spending in China, but remained third behind Alibaba Cloud and Huawei Cloud, and ahead of Baidu AI Cloud. The four Chinese Cloud Titans managed to maintain their dominance of the market, collectively growing 56% to account for 80% of total cloud spending. But pressure is mounting on the BAT (Baidu, Alibaba and Tencent) companies as the Chinese government pursues a series of antitrust regulations and Internet-related policies. Each of the BAT companies has seen its share price fall between 18% and 30% over the past six months as investors become cautious of regulatory pressures.

https://canalys.com/newsroom/china-cloud-infrastructure-Q2-2021

How the Huawei Fight Is Changing the Face of 5G Sanctions on the once-mighty Chinese telecom giant have plunged it into survival mode

IEEE Spectrum: https://spectrum.ieee.org/huawei-sanctions-fight-changing-5g#toggle-gdpr

US sanctions targeting China’s telecommunications giant Huawei Technologies have crippled the company, effectively forcing it out of the global smartphone market and now threatening its domestic phone business as well. They have also shrunk Huawei’s market for fifth-generation wireless network infrastructure around the world.

Huawei chairman Eric Xu said last week that the company’s smartphone revenue will drop by $30 to $40 billion in 2021 from the $136.7 billion reported last year, adding that there are no prospects for recovering that money in the next few years. Xu had said earlier that the company’s goal now is to simply survive.

Xu’s latest comments came as the US dropped its extradition battle over Meng Wanzhou, Huawei’s chief financial officer and daughter of the company’s founder, who had been trapped in Canada for three years. That led to the release two Canadian citizens who had been held hostage in China as a result. But it may also signal a de-escalation of the pressure Washington has brought to bear on the Chinese company now that Huawei is on its heels.

What’s at stake is control of international 5G networks, which are expected to transform global communications.

Three years ago, Huawei was on the cusp of dominating the world’s 5G infrastructure with equipment priced far below competitors. That alarmed the US, which equated Huawei’s dominance with Chinese-control of global telecommunications—under a 2017 Chinese law all domestic companies are compelled to help the Chinese intelligence services on demand. Huawei has said it would not comply with such a request and believes that it cannot be legally forced to do so.

Washington embarked on an intense campaign to block Huawei, and Ms. Meng’s arrest on fraud charges was widely seen as part of that campaign.

Huawei has long been regarded as a rogue player in the international telecoms market with deep ties to the Chinese Communist Party. It was founded in 1987 by a former People’s Liberation Army officer and Party member and got its start reverse engineering telephone switching equipment from Hong Kong. By the mid-1990s, China was promoting it as a ‘national champion’ in the country’s effort to build up industrial giants that could compete on the world stage.

In subsequent decades, the company was accused of stealing Western intellectual property, supplying sensitive telecoms equipment to North Korea and Iran, and expanding its global market share by undercutting Western telecom equipment prices by as much as a third. Huawei benefits from various Chinese government policies that act as subsidies to its operations.

“Huawei is slow in fixing their vulnerabilities. It’s very difficult to tell the difference between sloppy programming and deliberate backdoors.”

—Roger Entner, founder of Recon Analytics

Most explosively, Huawei is accused of installing backdoors in its software that could allow China to monitor data flowing through its international networks or even shut networks down in the event of a war. Huawei denies doing so, but as a result, the U.S. has pressured allies to exclude Huawei equipment from their 5G networks.

“Huawei is slow in fixing their vulnerabilities,” said Roger Entner, founder of Recon Analytics, a telecommunications research company. “It’s very difficult to tell the difference between sloppy programming and deliberate backdoors.”

The global adoption of fast, high capacity 5G is expected to usher in a new era of smart devices, extending AI deep into the Internet of things, including autonomous vehicles. AI models in the cloud that are too large to reside on an edge device, such as a phone or security camera, will be able to receive and process data from those devices through the network in near real time. 5G devices, meanwhile, can connect directly to each other through radio networks forming an “edge cloud” of their own.

“Data is going to travel along that edge at the speed of light,” said a former US official involved with the issue. With 5G, he said, “the edge is not distinct from the core” in the way that it has been for previous generations of wireless technology.

That’s a problem for all governments connected to the network.

“If you can’t trust the company that’s providing you that infrastructure, even if you tried to push it out to the edge, you’re still attaching it to the network,” said Gilman Louie, a commissioner on the National Security Commission on AI and a former chief executive of the intelligence community’s venture arm, In-Q-Tel, speaking on a podcast.

US President Joe Biden on Thursday signed into law bipartisan legislation that will ban companies like Huawei and ZTE from getting approval for network equipment licences in the US.

The legislation, Secure Equipment Act of 2021, will require the Federal Communications Commission (FCC) to adopt new rules that clarify it will no longer review or approve any authorisation applications for networking equipment that pose national security threats.

Last year, the FCC formally designated Huawei and ZTE as national security threats, with that decision being made as the agency found that both companies had close ties to the Chinese Communist Party and China’s military apparatus.

Since March, FCC commissioner Brendan Carr has made repeated calls for the legislation to be passed, saying at the time that the FCC has authorised 3,000 applications for Huawei networking equipment to be used.

“Once we have determined that Huawei or other gear poses an unacceptable national security risk, it makes no sense to allow that exact same equipment to be purchased and inserted into our communications networks as long as federal dollars are not involved. The presence of these insecure devices in our networks is the threat, not the source of funding used to purchase them,” Carr said at the time.

Besides Huawei and ZTE, other Chinese companies flagged as national security threats are Hytera Communications Corporation, Hangzhou Hikvision Digital Technology Company, and Dahua Technology Company.

At the end of last month, the FCC also removed the authority for China Telecom to operate in the US, with the telco required to pack its bags and stop providing domestic and international services by the end of Christmas.

Citing a recommendation from the Trump-era Justice Department, the Commission said China Telecom America “failed to rebut” a series of concerns raised.

“China Telecom Americas, a US subsidiary of a Chinese state-owned enterprise, is subject to exploitation, influence, and control by the Chinese government and is highly likely to be forced to comply with Chinese government requests without sufficient legal procedures subject to independent judicial oversight,” the FCC said.

With the US clampdown especially focused on Huawei, alongside other countries following suit, the Chinese tech giant reported a steep decline in its first-half revenue, with its business to the end of June reporting 320 billion yuan in sales, compared to 454 billion yuan at this time last year.

In providing the financial results, rotating chair of Huawei Eric Xu said the aim of the company moving forward would be to survive sustainably.

Source: ZDNET