Ericsson expresses concerns about O-RAN Alliance and Open RAN performance vs. costs

In a letter to the FCC, Jared M. Carlson, Ericsson’s Vice President, Government Affairs and Public Policy expressed his company’s concern with the O-RAN Alliance. In particular, an August report of the European Commission could not determine whether the O-RAN Alliance was complying with various WTO criteria, including transparency and open procedures, and also noted a concern that any one of the five founding members could effectively veto any proposed specification.

Some O-RAN Alliance specifications are proceeding slowly, according to Ericsson. One reason why can be explained simply by the resources devoted to the group. For example, O-RAN front-haul meetings (a more mature O-RAN specification) sees about 60 members attending, with only about ten members actively contributing. In contrast, in a typical 3GPP RAN Plenary, there are approximately 600 members delivering 1000 contributions per quarter.

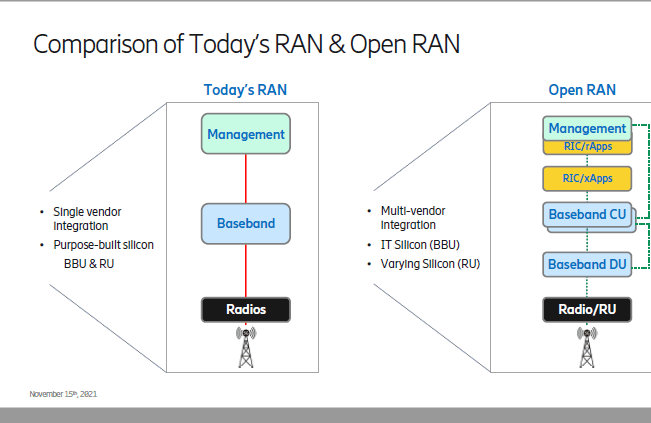

The lack of completed O-RAN specifications means that any such deployments require individual vendors to come to mutual agreements—a far cry from the “plug-and-play” vision of a complete set of Open RAN network interface standards. Light Reading referred to that months ago as another form of “vendor lock-in.”

Mike Murphy, CTO, Ericsson North America told the FCC that Ericsson has dedicated a number of resources to making O-RAN Alliance specifications successful, delivering about 1000 of 7000 total specifications,” the company told the FCC, citing Murphy’s presentation. “Indeed, without Ericsson’s contributions to the O-RAN Alliance, the timeline for more fully developed standards would likely be even further out in the future.”

Regarding security, Mr. Murphy noted that, again, Ericsson is one the top three contributors to the O-RAN Alliance Security working group. Yet there are no security specifications from the O-RAN Alliance Security group—there is only a set of requirements. He also noted that the performance of Open RAN does not compare to (vendor specific, purpose built) integrated RAN. Even if the so called 40% cost saving estimates were true on a per-unit cost basis, the two different types of RAN equipment would not deliver the same level of performance.

Furthermore, Ericsson’s own estimates have indicated that Open RAN is more expensive than integrated RAN given the need for more equipment to accomplish what purpose-built solutions can deliver and increased systems integration costs. That’s quite shocking considering that many upstarts (e.g. Rakuten, Inland Cellular, etc) have stated Open RAN is cheaper. For example, “Open RAN will allow for cost savings over proprietary architectures,” Open RAN vendor Mavenir declared in its own recent meeting with FCC officials. The company said open RAN equipment can reduce network providers’ operating expenses by 40% and total cost of ownership by 36%.

Ericsson isn’t the only 5G company cautioning the FCC on Open RAN. Nokia – another major 5G equipment vendor – made similar arguments in a recent presentation to the FCC. “While there are some vendors that only offer open RAN architecture and/or limited RAN products, Nokia is able to provide a choice of classical or open RAN depending on the desires of our customers,” Nokia explained. “To date, the vast majority of service providers have chosen classical RAN solutions, deferring investment in open RAN until further commercial maturity has been demonstrated.”

Nokia also took issue with the notion that open RAN equipment is dramatically cheaper than traditional, classic RAN equipment. “The draft cost catalog also demonstrates that there are not cost savings being offered through open RAN equipment estimates compared to integrated RAN estimates,” Nokia wrote to the FCC in April following the release of the agency’s initial, draft pricing catalogue.

Many telecom professionals, like John Strand, argue that open RAN is not yet mature. They contend that government mandates that would require the use of the technology – in a furtherance of geopolitical goals – would be misguided. “The US has clearly demonstrated that open and intense competition, not government mandates, is the most effective way to mobilize the telecom industry to enable unprecedented innovation and value creation,” Ericsson told the FCC. “The US led the world in 4G and the ‘app economy’ not by insisting on any particular network standard, but by creating an open, predictable and attractive investment climate for all industry stakeholders and allowing operators to select the best technology based on their needs.”

Mr. Murphy concluded that the Commission and the U.S. government more generally should continue to “keep their eyes on the prize.” Notably, ensuring that the U.S. continues to smooth the way for 5G deployments will continue to pay dividends for the U.S. economy, with over $500 Billion added to the U.S. economy from 5G-enabled business, is the critical job of the day. The key step the Commission can take is to continue to foster the deployment of 5G.

References:

https://ecfsapi.fcc.gov/file/1117953022367/Ericsson%20Open%20RAN%20ex%20parte%20Nov%2017%20FINAL.pdf

https://ecfsapi.fcc.gov/file/1117953022367/Ericsson%20O-RAN%20Update%20FINAL.pdf

https://www.lightreading.com/open-ran/ericsson-actually-open-ran-is-more-expensive/d/d-id/773617?

TIP OpenRAN and O-RAN Alliance liaison and collaboration for Open Radio Access Networks

Addendum -Tuesday 23 November 2021:

German study warns of security risks in Open RAN standards

Open Radio Access Networks (Open RAN) based on the standards of the O-RAN Alliance carry significant security risks in their current form, according to a study commissioned by Germany’s Federal Office for Information Security (BSI). The analysis was carried out by the Barkhausen Institute, an independent research institution, in cooperation with the group Advancing Individual Networks in Dresden and the company Secunet Security Networks.

The implementation of Open RAN standards by the O-RAN Alliance is based on the 5G-RAN specifications developed by the 3GPP. Using a best / worst case scenarios analysis, the German study demonstrated that the Open RAN standards have not yet been sufficiently specified in terms of ‘security by design’, and in some cases carry security risks. The BSI called for the study’s findings to be taken into account in the further development of the Open RAN ecosystem, in order to support the rapid growth of the market with security from the start.

The open RAN project is supported by all three mobile operators in Germany – Deutsche Telekom, Vodafone and Telefonica – as well as the 1&1, which is building a fourth network in the country. The German government also recently awarded EUR 32 million in subsidies to support further development of the open RAN technology.

https://www.telecompaper.com/news/german-study-warns-of-security-risks-in-open-ran-standards–1405252

12 thoughts on “Ericsson expresses concerns about O-RAN Alliance and Open RAN performance vs. costs”

Comments are closed.

It sounds like the reliability and security issues for O-RAN could be significant. For carriers, it sounds like a trade-off might be between vendor lock-in versus network reliability.

If it isn’t cheaper or more reliable, why would anyone go with O-RAN? Perhaps some are willing to sacrifice reliability or cost for either faster time-to-market or the ability to develop new applications.

I wonder if the market will bifurcate along the lines of incumbents going with traditional approaches, while upstarts like Dish go the O-RAN approach?

Orange, BT, AT&T, Telefonica, Vodafone, Deutsche Telekom, TIM are some of the legacy carriers that are interested in Open RAN, primarily to save costs (?). Among upstarts, the most notable are Rakuten and Dish Network.

How could all of the above telcos not realize the deficiencies of Open RAN that both Ericsson and Nokia have cited?

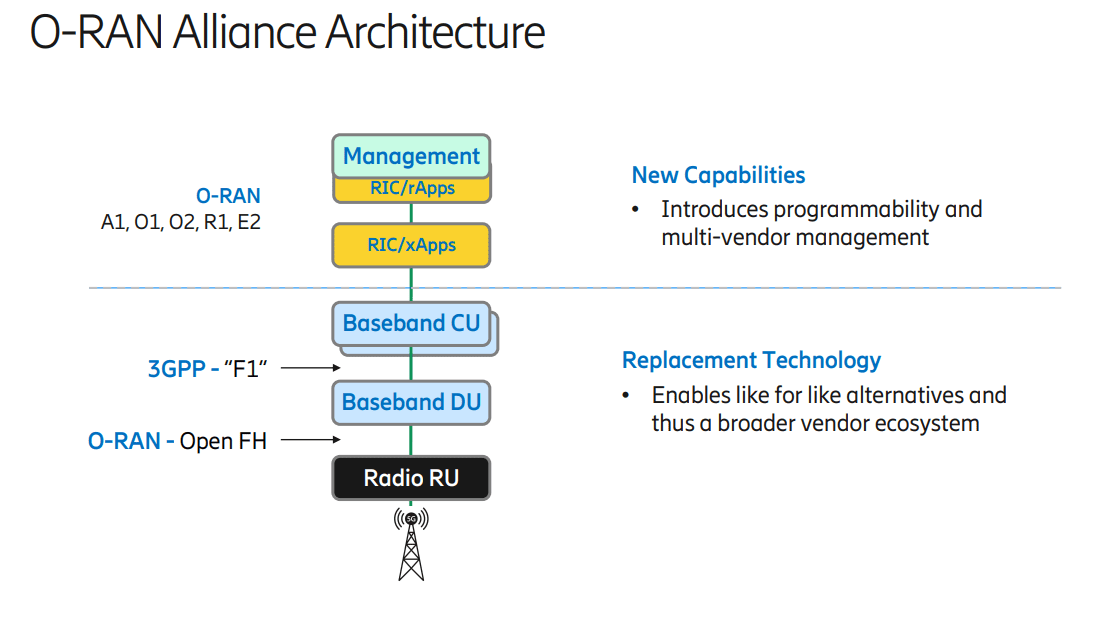

Widely neglected, but ultra important is that there are 2 different spec writing entities (O-RAN Alliance and TIP Open RAN WG), neither of which have liaisons with either 3GPP or ITU-R which produce 4G, 5G specs and standards. This almost guarantees there won’t be universal interoperability between Open RAN module vendors.

Counterpoint: Europe urged to act now to build Open Ran ecosystem

Deutsche Telekom, Orange, Telecom Italia (TIM), Telefónica and Vodafone deliver 5 recommendations for building an Open RAN ecosystem for Europe.

A new report, published today by five of the leading European telecommunications companies, and based on findings from independent analyst house, Analysys Mason, called upon policymakers, EU Member States, and industry stakeholders to collaborate and urgently prioritise Open Radio Access Network (Open RAN). This will ensure that Europe continues to play a leading role in 5G, and in the future, in 6G.

Open, intelligent, virtualised and fully interoperable RAN (enabling more effective and efficient mobile communications) is essential if Europe is to meet its target of 5G for all by 2030. It will help drive stronger, more resilient supply chains and platforms, as well as promote digital autonomy and continued technology leadership. New open and disaggregated architectures, software and hardware such as Open RAN, give operators the flexibility to extend 5G to more users in a cost-effective, secure and energy efficient way. This flexibility will stimulate greater innovation across industries in areas such as telemedicine and smart factories.

However, if the EU is to maintain its competitiveness, technology leadership and resilience, decisive action and collaboration is needed now. If not, Europe risks falling behind North America and Asia in the development and deployment of next generation networks, according to the report.

Entitled ‘Building an Open RAN ecosystem for Europe’, the report shows that Europe currently has just 13 major Open RAN players, versus 57 for the rest of the world. However, many European players are at an early stage of development and have not yet secured commercial Open RAN contracts, whilst vendors from other regions are moving ahead.

https://www.orange.com/en/newsroom/press-releases/2021/europe-urged-act-now-build-open-ran-ecosystem

TIP Open RAN group:

Goal*: Enable MNOs and OpenRAN ecosystem to collaborate on the 5G NR RAN use case development, testing and deployment that leverage the strength of Data Science and AI/ML technologies and open, standard interfaces to leapfrog proprietary solutions on performance, efficiency and total cost of ownership. *In accordance with the TIP-O-RAN Alliance Liaison Agreement, membership in this sub-group is restricted to members of the TIP OpenRAN 5G NR Project Group and the O-RAN Alliance * Drive AI/ML use case productization to enable OpenRAN ecosystem to leapfrog ClosedRAN solutions on performance, efficiency and total cost of ownership. * Enable OpenRAN ecosystem to leverage AI/ML and Data Science technologies * Initiate testing and MNO trials and share results with the OpenRAN community * Develop joint contributions, as needed, for O-RAN architecture and interface specifications

Many OpenRAN pronouncements sound too good to be true, for example a technology that can reduce mobile operators infrastructure CAPEX and OPEX by 30-40 percent. Investors and other decision makers want objective information about the latest mobile industry hype. Strand Consult’s report “Debunking 25 Myths of OpenRAN” examines the claims made by OpenRAN proponents. Strand Consult, having witnessed the launch of WiMax, OneAPI, and the iPhone among other hyped technologies promised to bring windfall revenues to mobile operators, provides critical questions to evaluate OpenRAN in its latest report.

Strand Consult is an independent research company with 25 years industry experience in the mobile telecom industry with over 170 mobile operators globally as clients. Strand Consult is known for its expert knowledge and many reports which help mobile operators and their shareholders navigate an increasing complex world.

We at Strand Consult has nothing against OpenRAN. However we want to create the transparency at the O-RAN Alliance, and some of its members have pushed back. Indeed Strand Consult’s transparency concerns are shared by policymakers in the EU and US, notably the House of Representatives Foreign Affairs Committee.

Strand Consult has studied OpenRAN and produced many reports and research notes on the topic. Strand Consult first identified that there are at least 44 Chinese firms participating in the OpenRan Alliance, debunking the assertion that OpenRAN would be free of Chinese influence. Strand Consult has also posited that Huawei is influencing OpenRAN indirectly through its largest customer China Mobile, which is a founding member of the O-RAN Alliance. However inspiring companies like Mavenir, Parallell Wireless, and Altiostar may be to storytellers, they are bit players. Most of the contributions to OpenRAN specifications come from old established technology providers and China Mobile.

Strand Consult’s goal is to create objectivity and transparency about the actors promoting OpenRAN so that mobile operators, investors and others stakeholders can make informed decisions. Strand Consult finds it telling that OpenRAN proponents have not wanted to answer its critical questions addressing financial, economic, technical, and practical points about the technology. This is particularly evident at many OpenRAN webinars over the last 18 months when Strand Consult posts its questions publicly in the chat and the moderator ignores the questions, or Strand Consult’s emailed questions to the event organizer are ignored.

In an effort to lift the level of policy discussion, Strand Consult offers a comprehensive review of the official public documents promoting deployment of 5G Open Radio Access Networks (OpenRAN). These include the set of industrial, think tank, advocacy, and academic papers and reports as well as official proceedings by regulators and authorities in the United States and European Union. Official inquiries on OpenRAN have been undertaken by the Federal Communications Commission (FCC), the National Telecommunications and Information Administration (NTIA), and the DG Connect at European Union.

These inquiries have a variety of goals. One objective of these inquiries is to explore resilience in the network infrastructure market. Another is to promote alternative suppliers to Chinese providers Huawei and ZTE. Yet another is to explore and develop industrial policy and promote domestic companies.

Strand Consult believes that such processes and subsequent reports are important. Telecommunications regulatory authorities are tasked with providing policymakers with objective information for decision making as well as cost benefit and other analyses.

In the report “Debunking 25 Myths of OpenRAN”, Strand Consult investigates the quality of the literature describing OpenRAN. It categorizes the 25 myths into 6 categories: security, competition, innovation, engineering, economics, and public policy. Among the OpenRAN reports, articles, and investigations, there is little information which can be classified as empirical, scientific, or peer-reviewed. Outside of a few exceptions, most materials are marketing/advocacy promoted by OpenRAN proponents or news/press releases/opinion pieces. The key shortcomings of the OpenRAN discussion include

Lack of objectivity and/or empirical support

Preconceived notions, assumptions, and assertions about the economics of infrastructure, competition, and innovation

Little to no discussion of the infrastructure value chain beyond the large infrastructure equipment providers

Ignorance or failure to disclose that OpenRAN is not a technical standard. The O-RAN Alliance develops technical specifications for 4G and 5G RAN internal functions and interface, not for 2G and 3G. The O-RAN Alliance is not a standards development organization (SDOs) like the 3GPP.

Ignorance or failure to disclose that OpenRAN only supports 4G and 5G and therefore it is not a 1:1 commercial alternative for 5G networks. Moreover OpenRAN does not support 2G and 3G, the prevailing network generation in many developing countries, and yet OpenRAN is reported as a solution for developing countries.

Ignorance or failure to disclose that 182 commercial 5G networks have been launched globally. These are classic RAN installations that support 2, 3, 4 and 5G in one base station. There is only 1 commercial OpenRAN installation, Rakuten in Japan.

Ignorance or failure to disclose how small expectations are for the OpenRAN install base by 2025 and 2030 compared to the entire market. This is likely just 1 percent in 2025 and under 3 percent in 2030.

Ignorance or failure to disclose the role of Chinese vendors in OpenRAN ecosystem and their leading role in OpenRAN governance and specification setting

The report “Debunking 25 Myths of OpenRAN” takes a critical view of the claims made about OpenRAN, including the claim that OpenRAN will stimulate the 5G service market. Strand Consult doesn’t believe OpenRAN will stimulate the 5G service market. We understand which services there will be in the core network and which in the cloud. They key problem for OpenRAN community is that they can’t explain which services are based on RAN that require OpenRAN on a cell site to be implemented. And the OpenRAN community cannot tell us who will develop these OpenRAN-based services, who will sell them, what business models underlie these services, whether they will address corporate or consumer market. And they cannot tell us about whether these services only be available on the few mobile sites where the operators have implemented OpenRAN, e.g. outside the big cites.

The report “Debunking 25 Myths of OpenRAN” will provide the objectivity and transparency needed by decision makers. This is the sort of information and analysis which is not available in most mainstream outlets. At the end of the day, mobile operators’ job is to deliver a great network experience to their customers. OpenRAN proponents have not succeeded to communicate, let alone demonstrate, specifically or empirically the difference they will make to mobile operators’ bottom line in a world where 182 commercial 5G networks on classic RAN have been launched.

For more than 25 years, Strand Consult has debunked the many myths of mobile industry hype. With its new and free report “Debunking 25 Myths of OpenRAN”, Strand Consult provides valuable information to mobile operators, investors and other mobile industry stakeholders.

Contact Strand Consult today to get your free copy of the report “Debunking 25 Myths of OpenRAN”

“Nokia has developed open RAN software functions, but these only run on Nokia proprietary hardware,” said Deutsche Telekom, Orange, Telecom Italia, Telefónica and Vodafone in a report aimed at European authorities.

NTT DoComo’s Open RAN partners now include four major silicon suppliers – Intel, Nvidia, Qualcomm and Xilinx – as well as Dell, Fujitsu, HPE (which joined in October), Mavenir, NEC, NTT Data (a sister company), Red Hat, VMware and Wind River.

Gabriel Brown, a principal analyst with Omdia (a Light Reading sister company) points out that NTT DoCoMo has been running multivendor networks for many years, having previously mixed baseband and radio suppliers in its 4G network. Given the activities of Rakuten and other Japanese operators, the Asian country is now clearly in the vanguard.

“You can make a strong case that Japan is the most technically advanced open RAN market,” says Brown.

https://www.lightreading.com/open-ran/ntt-docomo-not-rakuten-may-be-open-ran-leader/d/d-id/773840

BT officials remain interested – but cautious – about open RAN technology.

“In the short term, it’s not good enough,” argued Richard MacKenzie, a principle researcher with BT, during Light Reading’s Open RAN Digital Symposium this week. But he added: “It’s early days for open RAN.”

“In the long term, it’s a real competitor,” he predicted.

MacKenzie’s overall attitude echoes that of Neil McRae, the chief network architect of BT, who outlined his own thoughts on open RAN last month. “Could we build the network we have today purely with open RAN? Absolutely not,” McRae said then.

BT’s MacKenzie, in comments this week, offered a similar take: “We have to be aware that there are some drawbacks” with current open RAN deployments.

Importantly, MacKenzie specifically pointed to open RAN costs as a topic in need of further work. “We don’t focus too much on the cost savings as the primary goal,” he said, explaining that BT “is not going to sacrifice the customer experience just to achieve these cost savings.”

However, MacKenzie said BT is deep into a research project to discover more about the capabilities of open RAN. He said the company, as part of its work in the Telecom Infra Project (TIP), is testing some open RAN technologies in East Anglia, near its London headquarters.

MacKenzie said that BT is investigating non-real-time RAN intelligent controller (Non-RT-RIC) functions including SON (self-organizing network) technology, energy savings, interference mitigation and massive MIMO.

He said BT would feed its findings back into TIP in order to move the open RAN ecosystem further toward maturity, and to ensure vendor interoperability.

Open RAN, of course, is a major new trend in the 5G industry that promises to open up network elements via interoperable interfaces. Such technology would allow operators like BT to mix and match products and services from different vendors – a major change from the networks of today that are often supplied by just one vendor.

Open RAN proponents argue that the technology can be cheaper and just as good as classical, traditional open RAN equipment. However, Vodafone remains the only major UK operator with a firm open RAN commitment. Earlier this year, Vodafone named suppliers for a 2,500-site deployment in parts of the UK where it must replace Huawei equipment before 2028, under government orders.

https://www.lightreading.com/open-ran/bt-opens-up-on-open-ran-testing/d/d-id/773893?

Is Open RAN Too Little, Too Late for 5G? by Matt Kapko

Open RAN bears all the histrionics of an emerging technology that pits wireless industry giants and the status quo against those who want to unlock and open network interfaces to a larger group of players. It’s also mired in geopolitical posturing, highlighting a troubling chasm that threatens global cooperation and agreement on cellular technology standards.

Hundreds of billions of dollars are on the line, including the power and influence of multinational companies that effectively control the market today. It may sound hyperbolic, but it’s not a stretch to consider open RAN the most divisive technology to confront the wireless industry in many years, perhaps decades.

Open RAN commands a lot of attention, and for good reason. If it succeeds at scale, it will completely change how mobile networks are designed, deployed, and operated.

In theory, open RAN enjoys broad support. In practice, it remains rare.

“Open RAN is certainly complex, particularly given the numerous stakeholders that you have. Everyone from the OEMs to the operators, to the regulators, software companies, you name it — a lot of different people to try to align behind a common purpose,” said Dan Hays, principal at PwC’s Strategy& consultancy.

“While open RAN has run into some challenges, I don’t think that it’s going to impede the progress of the general move toward a more open architecture and toward a more software driven set of network infrastructure. That seems inevitable, but what we are seeing is that open RAN may well miss most of the 5G generation,” he said.

Of the at least 180 commercially deployed 5G networks today, one, Rakuten Mobile, is running on open RAN. Dish Network is poised to be the second sometime in early 2022.

“If you look at 5G rolling out in the most economically developed and populous countries in the world, as it already is, it’s unlikely that you’re going to have operators go back and rip and replace the 5G equipment that they’ve already invested in just to deploy open RAN,” Hays said.

Moving the Goalposts to 6G

“At this point even though it seems far away, open RAN may wind up being more of a 6G type of architecture versus one that’s widely adopted for 5G,” he added.

John Strand, CEO at the Denmark-based consultancy Strand Consult, agrees with this assessment and claims Ericsson and Nokia, despite their heavy involvement in open RAN development, don’t expect the technology to gain significant traction until the latter end of this decade.

“This is too little, too late for 5G,” he said. “Some of these things will be part of 6G,” but the standardization hasn’t yet effectively leveled up to the industry’s primary standards body 3GPP.

“The question is: How big of a percent of the installed base will be open RAN?” Strand said. “I think in 2025, less than 1%. And in 2030, less than 3%.”

Projections aside, questions also remain as to the technical readiness of open RAN, particularly in brownfield networks. Bear in mind that “decisions on mobile network infrastructure purchases, which can range in the billions of dollars, typically get made years before we ever see a commercially available service,” Hays explained.

https://www.sdxcentral.com/articles/news/is-open-ran-too-little-too-late-for-5g/2021/11/

Some claim that Open RAN is 30% cheaper than classic RAN

• Let’s give 100% of the savings to the end users.

• The calculation is like this

• Average ARPU in US is $37

• RAN costs make up only 3% of customers’ ARPU equal to $1 month.

• If OpenRAN is 30% cheaper than classic RAN, and operators would pass along these savings to consumers, then the average mobile bill in the U.S. would decrease.

• That is a savings of maximum $0.30 (30 cents) per month per subscriber.

• In any event, no operator or vendor has documented such a cost differential or consumer savings.

The big question CxO and shareholders must ask themselves is how can you measure the value of OpenRAN and what will it mean for carriers customers and the customer satisfaction (QoS) that is becoming more important and important in a world where products and prices are nearly identical.

Many talk about OpenRAN but few dare to ask the critical questions which concern mobile operators

Many OpenRAN pronouncements sound too good to be true, for example a technology that can reduce mobile operators infrastructure CAPEX and OPEX by 30-40 percent. Investors and other decision makers want objective information about the latest mobile industry hype. Strand Consult’s report “Debunking 25 Myths of OpenRAN” examines the claims made by OpenRAN proponents. Strand Consult, having witnessed the launch of WiMax, OneAPI, and the iPhone among other hyped technologies promised to bring windfall revenues to mobile operators, provides critical questions to evaluate OpenRAN in its latest report.

Strand Consult is an independent research company with 25 years industry experience in the mobile telecom industry with over 170 mobile operators globally as clients. Strand Consult is known for its expert knowledge and many reports which help mobile operators and their shareholders navigate an increasing complex world.

We at Strand Consult has nothing against OpenRAN. However we want to create the transparency at the O-RAN Alliance, and some of its members have pushed back. Indeed Strand Consult’s transparency concerns are shared by policymakers in the EU and US, notably the House of Representatives Foreign Affairs Committee.

Strand Consult has studied OpenRAN and produced many reports and research notes on the topic. Strand Consult first identified that there are at least 44 Chinese firms participating in the OpenRan Alliance, debunking the assertion that OpenRAN would be free of Chinese influence. Strand Consult has also posited that Huawei is influencing OpenRAN indirectly through its largest customer China Mobile, which is a founding member of the O-RAN Alliance. However inspiring companies like Mavenir, Parallell Wireless, and Altiostar may be to storytellers, they are bit players. Most of the contributions to OpenRAN specifications come from old established technology providers and China Mobile.

Strand Consult’s goal is to create objectivity and transparency about the actors promoting OpenRAN so that mobile operators, investors and others stakeholders can make informed decisions. Strand Consult finds it telling that OpenRAN proponents have not wanted to answer its critical questions addressing financial, economic, technical, and practical points about the technology. This is particularly evident at many OpenRAN webinars over the last 18 months when Strand Consult posts its questions publicly in the chat and the moderator ignores the questions, or Strand Consult’s emailed questions to the event organizer are ignored.

In an effort to lift the level of policy discussion, Strand Consult offers a comprehensive review of the official public documents promoting deployment of 5G Open Radio Access Networks (OpenRAN). These include the set of industrial, think tank, advocacy, and academic papers and reports as well as official proceedings by regulators and authorities in the United States and European Union. Official inquiries on OpenRAN have been undertaken by the Federal Communications Commission (FCC), the National Telecommunications and Information Administration (NTIA), and the DG Connect at European Union.

These inquiries have a variety of goals. One objective of these inquiries is to explore resilience in the network infrastructure market. Another is to promote alternative suppliers to Chinese providers Huawei and ZTE. Yet another is to explore and develop industrial policy and promote domestic companies.

Strand Consult believes that such processes and subsequent reports are important. Telecommunications regulatory authorities are tasked with providing policymakers with objective information for decision making as well as cost benefit and other analyses.

In the report “Debunking 25 Myths of OpenRAN”, Strand Consult investigates the quality of the literature describing OpenRAN. It categorizes the 25 myths into 6 categories: security, competition, innovation, engineering, economics, and public policy. Among the OpenRAN reports, articles, and investigations, there is little information which can be classified as empirical, scientific, or peer-reviewed. Outside of a few exceptions, most materials are marketing/advocacy promoted by OpenRAN proponents or news/press releases/opinion pieces. The key shortcomings of the OpenRAN discussion include

Lack of objectivity and/or empirical support

Preconceived notions, assumptions, and assertions about the economics of infrastructure, competition, and innovation

Little to no discussion of the infrastructure value chain beyond the large infrastructure equipment providers

Ignorance or failure to disclose that OpenRAN is not a technical standard. The O-RAN Alliance develops technical specifications for 4G and 5G RAN internal functions and interface, not for 2G and 3G. The O-RAN Alliance is not a standards development organization (SDOs) like the 3GPP.

Ignorance or failure to disclose that OpenRAN only supports 4G and 5G and therefore it is not a 1:1 commercial alternative for 5G networks. Moreover OpenRAN does not support 2G and 3G, the prevailing network generation in many developing countries, and yet OpenRAN is reported as a solution for developing countries.

Ignorance or failure to disclose that 182 commercial 5G networks have been launched globally. These are classic RAN installations that support 2, 3, 4 and 5G in one base station. There is only 1 commercial OpenRAN installation, Rakuten in Japan.

Ignorance or failure to disclose how small expectations are for the OpenRAN install base by 2025 and 2030 compared to the entire market. This is likely just 1 percent in 2025 and under 3 percent in 2030.

Ignorance or failure to disclose the role of Chinese vendors in OpenRAN ecosystem and their leading role in OpenRAN governance and specification setting

The report “Debunking 25 Myths of OpenRAN” takes a critical view of the claims made about OpenRAN, including the claim that OpenRAN will stimulate the 5G service market. Strand Consult doesn’t believe OpenRAN will stimulate the 5G service market. We understand which services there will be in the core network and which in the cloud. They key problem for OpenRAN community is that they can’t explain which services are based on RAN that require OpenRAN on a cell site to be implemented. And the OpenRAN community cannot tell us who will develop these OpenRAN-based services, who will sell them, what business models underlie these services, whether they will address corporate or consumer market. And they cannot tell us about whether these services only be available on the few mobile sites where the operators have implemented OpenRAN, e.g. outside the big cites.

The report “Debunking 25 Myths of OpenRAN” will provide the objectivity and transparency needed by decision makers. This is the sort of information and analysis which is not available in most mainstream outlets. At the end of the day, mobile operators’ job is to deliver a great network experience to their customers. OpenRAN proponents have not succeeded to communicate, let alone demonstrate, specifically or empirically the difference they will make to mobile operators’ bottom line in a world where 182 commercial 5G networks on classic RAN have been launched.

For more than 25 years, Strand Consult has debunked the many myths of mobile industry hype. With its new and free report “Debunking 25 Myths of OpenRAN”, Strand Consult provides valuable information to mobile operators, investors and other mobile industry stakeholders.

Contact Strand Consult today to get your free copy of the report “Debunking 25 Myths of OpenRAN”

https://strandconsult.dk/debunking-25-myths-of-openran/

What is your rss as I can not to find any subscription hyperlink or e-newsletter service. Do you have any? Please let me know how I may subscribe to be notified of new IEEE Techblog posts.

Many Thanks!

You can follow me on LinkedIn to get notified of IEEE Techblog posts immediately:

https://www.linkedin.com/in/alan-j-weissberger-a284a1/

Or you can subscribe to Feedspot to be notified only once per week

https://www.feedspot.com/infiniterss.php?_src=feed_title&followfeedid=5036996&q=site:https%3A%2F%2Ftechblog.comsoc.org%2Fcategory%2F5g%2Ffeed%2F