Strand Consult: What NTIA won’t tell the FCC about Open RAN

by John Strand, CEO and Founder of Strand Consult (see company profile and bio below)

Introduction:

In “NTIA Comments on Promoting the Deployment of 5G Open Radio Access Networks,” (Docket Number: GN-Docket No. 21-63) the National Telecommunications and Information Administration (NTIA) makes many claims about Open RAN [1] and states what appears to be official U.S. Executive Branch policy promoting that technology. In particular:

As stated in the Implementation Plan of the National Strategy to Secure 5G, the U.S. Executive Branch agrees that “close coordination between the United States Government, private sector, academic, and international government partners is required to ensure adoption of policies, standards, guidelines, and procurement strategies that reinforce 5G vendor diversity and foster market competition.” One promising solution in line with these objectives is open, interoperable networks, including Open RAN. While this response focuses on Open RAN, the Executive Branch’s policy is to promote the development of Open RAN alongside other policies, technologies, and architectures that support 5G vendor diversity and foster market competition.

Strand Consult analyzes these claims, their references, and the assumptions underpinning them from security and economics perspectives. Strand Consult’s report also includes an appendix fact checking 35 claims by NTIA and well as 133 additional references to help investigate the technology.

OpenRAN (open radio access network) is an evolving topic. It is an industrial concept, not a technical standard. Stakeholders, including NTIA may define OpenRAN differently, provide different definitions, ascribe different purposes to it, and have different expectations.

Editor’s Note:

There are two Open RAN spec writing bodies- the O-RAN Alliance and the Telecom Infra Project Open RAN Group. Neither of them have a liaison with either 3GPP or ITU-R WP 5D which have produced specifications/standards for 4G-LTE Advanced and 5G RAN/RIT specifications (3GPP Release 10 and Release 15 & 16, respectively) and ITU-R standards (M.2012-4, and M.2150, respectively). The O-RAN Alliance does have a liaison arrangement with GSMA which this author claims was an Ultra-Oxymoron.

……………………………………………………………………………………….

Strand Consult’s research question is to determine if, when, and how OpenRAN and O-RAN will replace conventional RAN on a 1:1 basis without compromising network quality, security, energy efficiency, and other important factors. Mobile operators have little ability to raise price, so operators must compete on network quality coverage and other factors.

Executive Summary:

We don’t believe NTIA’s comments provide insight to answer our questions. Strand Consult has found that most of the comments in NTIA’s report restate talking points from the OpenRAN industry and present policy arguments as if they were fact or technical analysis. As advisor to the US President and policy lead for the Executive Branch on telecommunications, NTIA is considered an authority and is expected to produce serious, objective policy. Indeed it would be welcome for an objective report from NTIA on OpenRAN with an authoritative list of critical references and information from test installations of the technology. Unfortunately NTIA’s report falls short of this expectation.

In our opinion, the main shortcoming of the report is that NTIA has either overlooked, ignored, or is unaware of the role of Chinese vendors in the OpenRAN industry. The separate but related ORAN Alliance has 44 Chinese vendors, many which are explicitly state-owned and military-aligned. At least 7 of these entities are on the US Dept of Commerce Entity List and others have lost their Federal Communications Commission operating license. NTIA has not conducted a security assessment of OpenRAN and yet it blesses the technology and pronounces that it is Executive Branch policy to pursue it. Strand Consult investigates NTIA’s other comments about the infrastructure market, competition, prices, and innovation and finds that many of them are either unevidenced or proffered by self-interested OpenRAN actors.

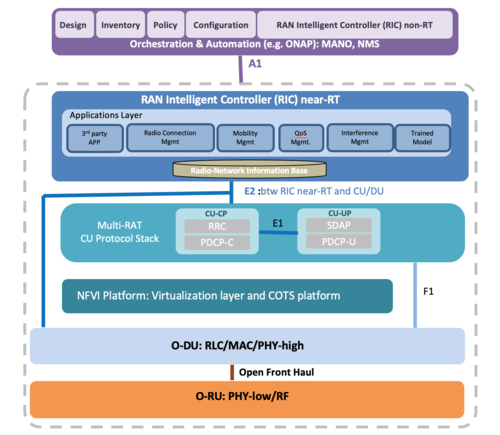

O-RAN Alliance Reference Architecture:

Image Credit: O-RAN Alliance

……………………………………………………………………………………………

Strand Consult’s Analysis:

In an effort to lift the level of policy discussion, Strand Consult reviewed “NTIA Comments on Promoting the Deployment of 5G Open Radio Access Networks” from July 16th to the U.S. Federal Communications Commission’s (FCC) a part of the Inquiry in the proceeding on open radio access networks (Open RAN). The highly respected NTIA is chartered to advise the President and represent the Executive Branch view on telecommunications, and there is an expectation that NTIA’s reports are objective, authoritative, and empirical, particularly with its roster of employee scientists and technologists. The document submitted to the FCC appears to be written by staff lawyers and makes many debatable claims which are either unsupported or based on advocacy materials from the OpenRAN industry.

NTIA’s OpenRAN document does not live up to expectations for the following reasons:

Its lack of objectivity and empirical support

Its overlooking role of Chinese vendors in OpenRAN ecosystem

Its misunderstanding of the economics of infrastructure and innovation

Its unfounded assertions about competition and the role of OpenRAN.

Lack of objectivity and empirical support. Citing of interested parties as experts. The OpenRAN document published by NTIA offers very little empirical, or even academic policy, evidence for its assertions. Most of references cited, 55%, come from OpenRAN advocacy groups or companies with a financial interest in OpenRAN, for example self-described OpenRAN vendors. The main part of the document’s references are not technical studies but rather policy arguments.

Moreover, NTIA fails to disclose that its preferred sources are advocacy organizations. While there is nothing illegal about citing advocacy organizations, government agencies like NTIA are supposed to be above touting advocacy as fact, science, and official policy.

The O-RAN Alliance [2] develops technical specifications for 4G and 5G RAN internal functions and interface, not for 2G and 3G. The O-RAN Alliance is not a standards development organization (SDOs) [3] like ITU-R and ITU-T. The O-RAN Alliance does not satisfy the openness criteria laid down in Word Trade Organization Principles [4] for the Development of International Standards, Guides and Recommendations.

The O-RAN Alliance is a closed industrial collaboration developing technical RAN specification on top of 3GPP specifications and ITU-R standards for 4G and 5G.

While industrial cooperation is important, there can be no mobile networks without the basic work of organizations like ITU-R WP 5D, 3GPP (which is NOT a SDO) and its seven regional members (which are SDOs) [5].

OpenRAN concepts include: cloudification, automation and open RAN internal interfaces do follow some elements of 3GPP specifications.

It appears that NTIA is attempting to elevate the O-RAN Alliance, essentially a closed association, with established WTO compliant SDOs (e.g. ITU and IEEE) and global consortia like 3GPP. Such an elevation is false and deceptive, and NTIA should clarify why it promotes a closed association that doesn’t meet openness requirements in WTO.

NTIA could have balanced this shortcoming by referencing some the widely published critical reviews of OpenRAN. Unfortunately, it does not. For example, U.S. federal documents can create credibility by objectively stating competing views and discussing the merits, similar to the Congressional Research Service [6].

Because NTIA appears only to provide favorable views of OpenRAN from interested parties, its document is tainted with bias. It reads like a set of talking points from the OpenRAN Policy Coalition, the a front for the OpenRAN industry’s interests.

Overlooking the role of Chinese vendors in the OpenRAN ecosystem:

Another shortcoming is the apparent ignorance of the role of Chinese vendors in the OpenRAN ecosystem. NTIA forgets to name the 44 Chinese companies that make up the second largest national group in the O-RAN Alliance. It failed to disclose that seven of these actors are either on the U.S. Entity List [7] and have lost their FCC license to operate [8] . Those companies include: China Mobile, China Telecom, China Unicom, ZTE, Inspur, Phytium and Kindroid, companies

which are integrated with the Chinese government and military.

Nor does NTIA disclose that the European telco Memorandum of Understanding (MoU) [between Deutsche Telekom, Telefonica, TIM, Vodafone and Orange] that OpenRAN should be built on top of Kubernetes [9], which is a software

technology platform that has been infiltrated by the Chinese.

While it began life in 2014 as a Google project, Kubernetes currently is under the jurisdiction of the Cloud Native Computing Foundation, an offshoot of the Linux Foundation (perhaps the world’s largest open-source organization).

By late 2017, Huawei had gained a seat on the Kubernetes Steering Committee. Huawei claims to be the fifth-biggest contributor of software code to Kubernetes.

According to the “Report on the 2020 FOSS Contributor Survey” [10] from The Linux Foundation & The Laboratory for Innovation Science at Harvard, the open source community spends very little time responding to security issues (an average of 2.27% of their total contribution time) and reports that it does not desire to increase this metric significantly.

It appears to be a problem that Huawei and ZTE are increasingly involved in the leading open source technology 11 used by OpenRAN developers. It is not clear how this acceptance of Chinese involvement in OpenRAN is consistent with President Biden’s tough stance on security vis-à-vis China and other threat actors [12].

Conclusions:

NTIA’s document appears to endorse the O-RAN Alliance for the security of OpenRAN. However, NTIA doesn’t provide technical analysis or a security assessment of O-RAN Alliance specifications. It is not clear from the document whether NTIA had access to these specifications to conduct an assessment. In any event, ORAN Alliance members exchange specifications on OpenRAN every 6 months. This means that the 44 Chinese companies in the O-RAN Alliance get fresh OpenRAN “code” at least twice a year, NTIA provides no threat analysis, risk assessment nor potential mitigation of these processes.

–>This is a breathtaking omission that alone warrants further attention by the NTIA.

NTIA could have strengthened its credibility by providing an authoritative, empirical document to inform policymakers objectively about OpenRAN. Instead NTIA offers a document which merely restates the talking points of OpenRAN advocacy groups and industry. This fails the U.S. Executive branch and the American people who expect quality information and impartial judgement from an expert agency.

More importantly, the NTIA document mis-informs readers about the security risks of OpenRAN which greatly extends the cyber security attack surface with its many “open interfaces.”

Hopefully, NTIA will review the empirical information and update its assessment in a new report.

…………………………………………………………………………………….

Readers who know something about OpenRAN are welcome to weigh in with their comments in the box below this article.

…………………………………………………………………………………….

Notes & Hyperlinks:

https://www.ntia.gov/files/ntia/publications/ntia_comments_-_open_ran_noi_gn_21-63_7.16.21.pdf

2. https://www.o-ran.org/

3. https://en.wikipedia.org/wiki/Standards_organization 4. https://www.wto.org/english/tratop_e/tbt_e/principles_standards_tbt_e.htm

5. https://www.3gpp.org/about-3gpp

6. Disruptive Analysis Report: Telecom & 5G Supply Diversification A long term view: demand diversification, Open

RAN & 6G path dependence

https://www.lightreading.com/open-ran/verizon-t-mobile-outline-their-open-ran-fears/d/d-id/769201 https://www.lightreading.com/open-ran/open-ran-has-missed-5g-boat-says-three-uk-boss/d/d-id/766258?

7. https://www.bis.doc.gov/index.php/policy-guidance/lists-of-parties-of-concern/entity-list

8. https://www.fcc.gov/document/fcc-denies-china-mobile-telecom-services-application-0

https://www.reuters.com/article/us-usa-china-telecom-idUSKBN2B92FE 9.https://www.telefonica.com/documents/737979/146026852/Open-RAN-Technical-Priorities-Executive-Summary.pdf/cdbf0310-4cfe-5c2f-2dfb-c68b8c8a8186

10. Page 5 of: https://www.linuxfoundation.org/wp-content/uploads/2020FOSSContributorSurveyReport_121020.pdf

11. https://merics.org/en/short-analysis/china-bets-open-source-technologies-boost-domestic-innovation

12. https://www.reuters.com/article/us-usa-biden-cyber-war-idUSKBN2EX2S9

………………………………………………………………………………………………..

About Strand Consult:

Strand Consult is an independent consultancy with 25 years of telecom industry experience. Strand Consult is known for its expert knowledge and many reports which help mobile operators and their shareholders navigate an increasing complex world. It has 170 mobile operators from around the world on its client list.

John Strand (photo below) is CEO of Strand Consult. He founded Strand Consult in 1995.

The mobile industry exploded in the 1990s, and Strand Consult grew along with its new clients from the mobile industry, analyzing market trends, publishing reports and holding executive workshops that have helped telecom operators, mobile services providers, technology manufacturers all over the world focus on their business strategies and maximizing the return on their investments.

References:

ntia_comments_-_open_ran_noi_gn_21-63_7.16.21.pdf (doc.gov)

Ultra Oxymoron: GSMA teams up with O-RAN Alliance without liaison with 3GPP or ITU

Strand Consult: The 10 Parameters of Open RAN; AT&T memo to FCC

Strand Consulting: Why the Quality of Mobile Networks Differs

7 thoughts on “Strand Consult: What NTIA won’t tell the FCC about Open RAN”

Comments are closed.

As an analyst of the mobile industry for the last 25 years, I make the following observations about OpenRAN and invite reply comments.

As I understand, some services will reside in the core network while others could be in the cloud. However, it is not clear whether certain services will be OpenRAN dependent and whether they need to deployed on the actual OpenRAN cell site, or with which set of OpenRAN modules/components.

It is also not clear who will develop these OpenRAN-based services, who will market them, what are the underlying business models, whether they will be focused on corporate or consumer markets, or whether these services only be available where the operators have implemented OpenRAN sites, in cities or in rural areas?

If it is true that OpenRAN will lead to more innovation and services, then will a customer be only able to access these new, innovative services where OpenRAN is deployed? It would be strange, for example, that SMS or voice would only be available on some parts of the network in some locations, but not all.

Today, 5G mobile operators use 3GPP Release 15 specifications in their deployed 5G NSA networks. 3GPP releases 16 and 17 promise increased functionality for 5G and are scheduled to be deployed within two years.

As of May 2021, there were more than 169 3GPP-5G commercial networks deployed, but only one proprietary OpenRAN 5G network (Rakuten).

According to Dell’Oro, OpenRAN accounts for less than 5% of the 2020 to 2025 RAN market, on a cumulative basis. Furthermore, they say that OpenRAN will have a 10% share of total RAN spending in 2025. Effectively, this means that OpenRAN sites will probably make up less than 1% of the installed 5G RAN base by 2025.

In conclusion, it seems unrealistic to expect much development and growth from a market associated with just 1% of the mobile sites that supply 5G OpenRAN.

People who know something about OpenRAN are welcome to weigh in.

FCC acknowledges open RAN is cheaper, albeit with reservations, MIKE DANO of Light Reading

Some elements of open RAN technology are officially less expensive than traditional RAN products, at least according to a new network equipment pricing catalogue published by the FCC.

That’s a noteworthy development considering an initial version of the agency’s pricing catalogue didn’t show much daylight between the prices for open RAN equipment and traditional RAN equipment.

As a result, some vendors made sure to call out that pricing situation: “The draft cost catalog also demonstrates that there are not cost savings being offered through open RAN equipment estimates compared to integrated RAN estimates,” Nokia wrote to the FCC in April following the release of the agency’s initial, draft pricing catalogue. Finland’s Nokia built its business around traditional RAN equipment but has been supplying hardware and software for open RAN networks.

Mavenir said in May that it was working with the FCC and Widelity – the company the agency hired to assemble its pricing catalogue – to “correct cost estimates … used for open RAN.”

Mavenir warned that the FCC’s open RAN pricing information was “being used for negative marketing against the open RAN community,” arguing it could result in the “detriment of open RAN in the marketplace.”

Based on details within the FCC’s new, official pricing catalogue, Mavenir appears to have been somewhat successful in its efforts to change the FCC’s open RAN pricing data.

“We agree with Mavenir that we should modify the catalog to reduce the low end of the range of estimated costs for ‘Open vRAN eNodeB,’ and ‘RAN (Open RAN/vRAN Components)’ to reflect the lower pricing information Mavenir submitted to Widelity,” the FCC wrote in its final pricing catalogue, published earlier this month.

https://www.lightreading.com/open-ran/fcc-acknowledges-open-ran-is-cheaper-albeit-with-reservations/d/d-id/771467?

When it comes to network equipment cost, one must consider not only the cost of equipment itself, but the “total cost of ownership” or TCO. That involves tradeoffs between one vendor or another, and the associated maintenance, volume discounts, add-ons, cross-sells and so forth. In practice, a firm will focus on individual items as well as the total cost.

Historically, there are many examples of mobile network operators choosing one supplier at the expense of another based on a TCO analysis. The latest case is this from the new 5G network “DNB” in Malaysia. The estimated cost of RM11 billion to design, build and maintain a 5G network by one vendor is around RM700 million lower than the Total Cost of Ownership of the next closest bid.

Reference:

https://soyacincau-com.cdn.ampproject.org/c/s/soyacincau.com/2021/07/08/dnb-malaysia-why-ericsson-was-picked-out-of-4-bidders-to-build-malaysia-5g-network/amp/

The very recent assessment of the O-RAN Alliance by the European Commission (EC) is that it does not obviously meet WTO transparency requirements because it does not make essential information “easily accessible to all interested parties.” The group’s procedures, moreover, are “not open in a non-discriminatory manner during all stages of the standard-setting process.”

Perhaps the most worrying aspect of the group is the veto it effectively gives to founding members. In the paper it published just last month, the EC notes that “although interested contributors have opportunities to contribute to the elaboration of the specifications, the founding members have a privilege, because they have the necessary minority of more than 25% to block proposals.”

These founding members, according to the O-RAN Alliance’s own website, comprise AT&T, China Mobile, Deutsche Telekom, NTT DoCoMo and Orange. Their identities should not influence any WTO judgement, but the inclusion of China Mobile in that inner sanctum may horrify some US politicians. In June, the White House imposed financial sanctions on China Mobile as part of the “military-industrial complex of the People’s Republic of China.”

Inconsistency reigns

In its recent paper, the EC stops short of delivering a final verdict on the O-RAN Alliance, instead calling for an “independent assessment” of its status. But to ensure it is compliant with US law, the group may have to become more transparent and make changes to its modus operandi. That will probably not be easy. Removing the veto held by founding members, in particular, could meet resistance. And transparency has not come naturally so far. Journalistic enquiries are left to moulder for days without being answered. At the time of writing, it had not responded to questions on this topic sent on September 1.

But if the O-RAN Alliance is opaque, successive US governments have already shown they are not afraid of inconsistency. ZTE was taken off the trade blacklist in 2018 after paying multi-billion-dollar fines, replacing managers and agreeing to be supervised by US regulators. Yet its links to the Chinese government are far more obvious than Huawei’s. If Huawei and far smaller Chinese companies are a security threat, then why isn’t ZTE?

https://www.lightreading.com/open-ran/o-ran-alliance-open-by-name-closed-by-nature-reckons-europe/a/d-id/771897

“The Nokia announcement is part of an effort to make open RAN a political issue,” Monica Paolini, principal analyst at Senza Fili, told SDxCentral. “Open RAN is not a Chinese, U.S., Western Europe technology. This is something that has been growing with the contribution of multiple countries, different viewpoints, and the result is a new model for the RAN that is open, that is very flexible, that allows operators to do different things.”

The O-RAN Alliance is one of the most powerful multinational organizations developing technical specifications for open RAN, but it’s not the center of power. Some operators and vendors are pushing ahead on open RAN irrespective of the status of activities at the O-RAN Alliance.

Frontrunners like Rakuten Mobile, Dish Network, Telefónica, and others “are not waiting for the O-RAN Alliance to plan and build their open RAN networks,” Light Counting’s Stephane Téral said.

“I believe this event reflects some friction within the alliance. Let’s not forget that every member company has its own agenda, and in the end the open RAN market is finite and cutting into the oligopolistic traditional RAN market,” he added.

https://www.sdxcentral.com/articles/news/can-o-ran-alliance-contain-fallout-from-nokias-geopolitical-posturing/2021/09/

BT officials remain interested – but cautious – about open RAN technology.

“In the short term, it’s not good enough,” argued Richard MacKenzie, a principle researcher with BT, during Light Reading’s Open RAN Digital Symposium this week. But he added: “It’s early days for open RAN.”

“In the long term, it’s a real competitor,” he predicted.

MacKenzie’s overall attitude echoes that of Neil McRae, the chief network architect of BT, who outlined his own thoughts on open RAN last month. “Could we build the network we have today purely with open RAN? Absolutely not,” McRae said then.

BT’s MacKenzie, in comments this week, offered a similar take: “We have to be aware that there are some drawbacks” with current open RAN deployments.

Importantly, MacKenzie specifically pointed to open RAN costs as a topic in need of further work. “We don’t focus too much on the cost savings as the primary goal,” he said, explaining that BT “is not going to sacrifice the customer experience just to achieve these cost savings.”

However, MacKenzie said BT is deep into a research project to discover more about the capabilities of open RAN. He said the company, as part of its work in the Telecom Infra Project (TIP), is testing some open RAN technologies in East Anglia, near its London headquarters.

MacKenzie said that BT is investigating non-real-time RAN intelligent controller (Non-RT-RIC) functions including SON (self-organizing network) technology, energy savings, interference mitigation and massive MIMO.

He said BT would feed its findings back into TIP in order to move the open RAN ecosystem further toward maturity, and to ensure vendor interoperability.

Open RAN, of course, is a major new trend in the 5G industry that promises to open up network elements via interoperable interfaces. Such technology would allow operators like BT to mix and match products and services from different vendors – a major change from the networks of today that are often supplied by just one vendor.

Open RAN proponents argue that the technology can be cheaper and just as good as classical, traditional open RAN equipment. However, Vodafone remains the only major UK operator with a firm open RAN commitment. Earlier this year, Vodafone named suppliers for a 2,500-site deployment in parts of the UK where it must replace Huawei equipment before 2028, under government orders.

https://www.lightreading.com/open-ran/bt-opens-up-on-open-ran-testing/d/d-id/773893?

Is Open RAN Too Little, Too Late for 5G? by Matt Kapko

Open RAN bears all the histrionics of an emerging technology that pits wireless industry giants and the status quo against those who want to unlock and open network interfaces to a larger group of players. It’s also mired in geopolitical posturing, highlighting a troubling chasm that threatens global cooperation and agreement on cellular technology standards.

Hundreds of billions of dollars are on the line, including the power and influence of multinational companies that effectively control the market today. It may sound hyperbolic, but it’s not a stretch to consider open RAN the most divisive technology to confront the wireless industry in many years, perhaps decades.

Open RAN commands a lot of attention, and for good reason. If it succeeds at scale, it will completely change how mobile networks are designed, deployed, and operated.

In theory, open RAN enjoys broad support. In practice, it remains rare.

“Open RAN is certainly complex, particularly given the numerous stakeholders that you have. Everyone from the OEMs to the operators, to the regulators, software companies, you name it — a lot of different people to try to align behind a common purpose,” said Dan Hays, principal at PwC’s Strategy& consultancy.

“While open RAN has run into some challenges, I don’t think that it’s going to impede the progress of the general move toward a more open architecture and toward a more software driven set of network infrastructure. That seems inevitable, but what we are seeing is that open RAN may well miss most of the 5G generation,” he said.

Of the at least 180 commercially deployed 5G networks today, one, Rakuten Mobile, is running on open RAN. Dish Network is poised to be the second sometime in early 2022.

“If you look at 5G rolling out in the most economically developed and populous countries in the world, as it already is, it’s unlikely that you’re going to have operators go back and rip and replace the 5G equipment that they’ve already invested in just to deploy open RAN,” Hays said.

Moving the Goalposts to 6G

“At this point even though it seems far away, open RAN may wind up being more of a 6G type of architecture versus one that’s widely adopted for 5G,” he added.

John Strand, CEO at the Denmark-based consultancy Strand Consult, agrees with this assessment and claims Ericsson and Nokia, despite their heavy involvement in open RAN development, don’t expect the technology to gain significant traction until the latter end of this decade.

“This is too little, too late for 5G,” he said. “Some of these things will be part of 6G,” but the standardization hasn’t yet effectively leveled up to the industry’s primary standards body 3GPP.

“The question is: How big of a percent of the installed base will be open RAN?” Strand said. “I think in 2025, less than 1%. And in 2030, less than 3%.”

Projections aside, questions also remain as to the technical readiness of open RAN, particularly in brownfield networks. Bear in mind that “decisions on mobile network infrastructure purchases, which can range in the billions of dollars, typically get made years before we ever see a commercially available service,” Hays explained.

https://www.sdxcentral.com/articles/news/is-open-ran-too-little-too-late-for-5g/2021/11/