Altice USA transition to fiber access; MoffettNathanson analysis of low population growth on cablecos broadband growth

Altice USA recently disclosed a plan to overbuild its hybrid fiber-coaxial (HFC) network to blanket 6.5 million locations with fiber by 2025. The NYC based cableco/MSO operates the Optimum and Suddenlink brands, which it plans to rebrand under the Altice USA name.

During a New Street Research investor conference, Altice USA EVP of corporate finance and development Nick Brown said the decision to make that move was a “no brainer” for the company, but acknowledged that it’s in a slightly different position than fellow cable giants Comcast and Charter Communications. Brown stated Altice USA’s own experience and that of its sister companies in Europe gave it better insight into what the transition to fiber would look like in terms of costs and returns, leaving it unafraid to take the leap. But it also already faces “a lot of fiber-based competition relative to others,” especially from Verizon Fios in its legacy Cablevision footprint in the eastern part of the country.

Altice has already upgraded its head ends and backbone rings with fiber. Since DOCSIS would require it to push fiber deeper and deeper into the network anyway, Brown said it made sense to go all-in to pull forward the benefits full fiber has to offer. “The FTTH end-to-end glass network that we’re deploying here in the U.S. for us is pretty much the end state, the logical end state, of a coax upgrade anyway,” Brown argued.

Brown said the move to fiber will allow Altice USA to save in the “low hundreds of millions” of dollars in operating expenses and “materially” reduce its capital expenditures over time. It’s also expected to help Altice more effectively compete by allowing it to offer a better product, reduce churn and improve network reliability. He also pointed out it’ll make future network upgrades easier. Today, it has around half a million active components in its coax network, nearly all of which need to be touched for a DOCSIS upgrade. But with fiber “the equivalent is about 1,000 to 2,000 pieces of equipment that you would need to upgrade to go to next generations of fiber technology as we’re doing this year as we’re moving to XGS-PON,” he said, noting its current fiber footprint of more than 1 million locations was originally built with GPON technology.

“I think it’s just a lot more scalable, a lot more future-proof in our mind, and a lot more cost effective to move to future broadband technologies,” Brown concluded.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………………

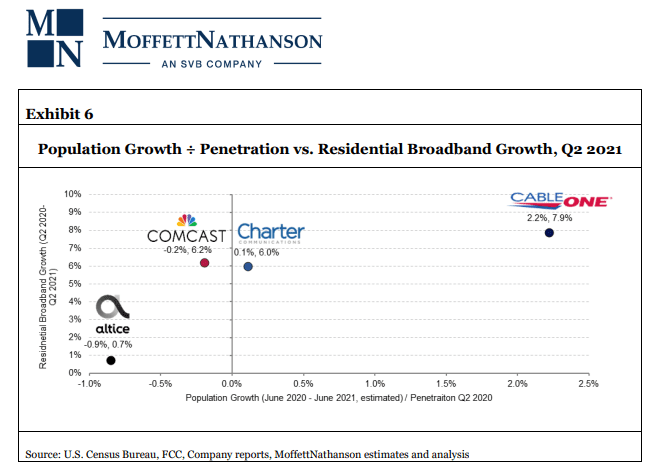

To determine which operators might have been most negatively affected by low population growth (and therefore likely low household growth) from July 2020 to July 2021, and which might have been net beneficiaries of the fastest growth, analysts at MoffettNathanson aggregated the population by county in each cable operator’s footprint using FCC Form 477 data as of Q4 2020. Using those totals, we calculated a weighted average population growth for each operator’s total footprint based on the county-level annual estimates published by the Census Bureau. The weighted-average population growth implies a meaningful headwind to Altice USA (at -0.4% growth), and a significant tailwind to Cable One (at 0.7% growth).

Craig concluded: “Again, there’s a lot more at work in broadband subscriber growth rates than just population (new household formation) growth or starting penetration. Different operators have different demographics. They face different overlaps with fiber, and some will face more FWA than others. They have different pricing strategies.”

References:

https://www.fiercetelecom.com/telecom/altice-usa-exec-fiber-logical-end-state-coax

One thought on “Altice USA transition to fiber access; MoffettNathanson analysis of low population growth on cablecos broadband growth”

Comments are closed.

Today, reports from Bloomberg suggest that Altice USA has began looking for buyers for its cable operator subsidiary, Suddenlink.

Altice USA acquired Suddenlink back in 2015, with the deal being valued at around $9 billion. Today, the unit Suddenlink operates fixed TV and broadband internet services in 17 states in the Midwest, southern and western parts of the US, with analysts suggesting it has around 1.8 million subscribers for its almost four million homes passed.

The sources suggest that the unit could fetch a price tag of around $20 billion.

Goldman Sachs has been hired to help Altice explore its options.

The decision to sell Suddenlink should not come as too much of a surprise. Back in May, Alice USA’s CEO, Dexter Goei, noted that he was open to the idea of selling Suddenlink.

“Suddenlink in itself is a great asset, great growth matrices, under-penetrated markets, less competitive areas, despite that it’s very rural,” said Goei. “But strategically, it’s not a footprint that makes you sit there and say ‘Wow, that’s the most strategic footprint out there.’ So are we sellers or restructurers of certain of our assets in other areas outside of Cablevision? We’re always open to listening to people out there if it makes sense for us to trade, swap, sell certain assets.”

In related news, Altice USA is currently in the process of uniting all of its operations under the ‘Optimum’ brand. Earlier this year, Altice made the decision to unite the Suddenlink brand with its larger brand, Optimum, having already rebranded its mobile service, Altice Mobile, to Optimum Mobile back in 2021.

https://www.totaltele.com/513911/Altice-USA-seemingly-selling-Suddenlink