Light Counting: Large majority of CSPs remain skeptical about Disaggregated Open Routers

LightCounting’s second annual report provides an update on the emergence of the Disaggregated Open Routers (DOR) market in wireless infrastructure. DOR are white-box cell site, aggregation and core routers based on an open and disaggregated architecture for existing 2G/3G/4G and future 5G network architectures.

The DOR architecture was hailed as a new paradigm as early as 2012, using open source software for a centralized SDN Controller from the Open Network Foundation and Linux Foundation. The “open networking architecture” was envisioned to be used by tier 1 telcos and hyperscale cloud service providers and later extend to enterprise/campus networks. Well, that never happened!

Instead, hyperscalers developed their own proprietary versions of SDN, sometimes using a bit of open sourced software (e.g. Microsoft Azure). A few start-ups (e.g. Pica 8 and Cumulus Networks) developed their own software to run on white boxes and bare metal switches, including network operating systems, routing and network management.

One company that’s succeeded at customized software running over white boxes is

Israel based DriveNets. Indeed, the DriveNets software (see References below) is custom built- not open source! It’s an “unbundled” networking software solution, which runs over a cluster of low-cost white box routers and white box x86 based compute servers. DriveNets has developed its own Network Operating System (NOS), rather than use open source or Cumulus’ NOS as several other open networking software companies have done.

LightCounting’s research indicates that the overall DOR market remains incipient and unless proof of concept (PoC), testing and validation accelerate, volumes will take some time to materialize.

“Despite TIP’s (Facebook’s Telecom Infra Project) relentless efforts to push network disaggregation to all network elements and domains, and a flurry of communication service providers (CSPs) taking the lead with commercial DOR deployments like AT&T with DriveNets (NOS), UfiSpace (hardware) and Broadcom (networking silicon), a large majority of CSPs (Communications Service Providers) remain skeptical about the potential opex reduction, the maturity of transport disaggregation, and the impact on operations, administration, maintenance, procurement and support.” said Stéphane Téral, Chief Analyst at LightCounting Market Research.

Source: Light Counting

That quote is quite different from Stephane’s comment one year ago that the DOR market was poised for imminent growth:

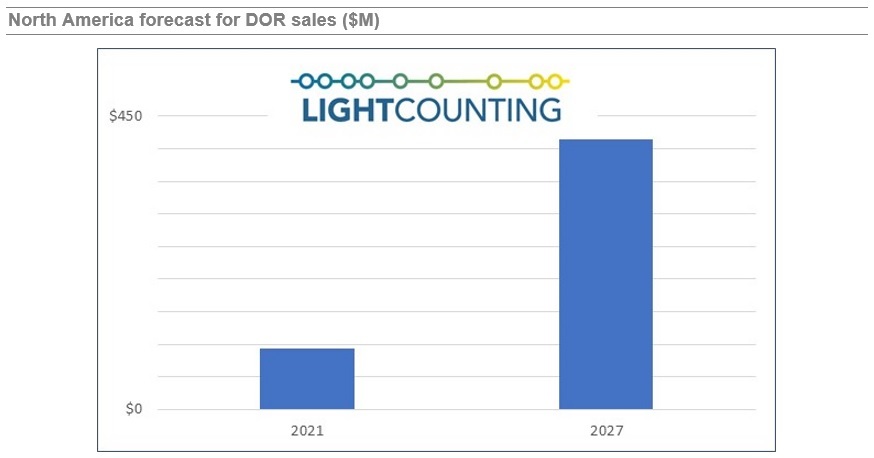

“Still incipient, the DOR market is just about to take off and is here to stay but requires more CSPs (Communications Service Providers) to take the plunge and drive volumes. And with China’s lack of appetite for DOR, North America is taking the lead.”

Major findings in the report are the following:

- The open RAN ascension brought router disaggregation to the spotlight and paved the way to four fundamental routes. This phenomenon would have never happened without TIP’s initiative.

- Although NOS software vendors are mushrooming and by far outnumbering the white box hardware suppliers dominated by UfiSpace, there have been some casualties down the DOR road. In the networking silicon domain, Broadcom remains predominant.

- CSPs remain cautiously optimistic about router disaggregation but have yet to see more maturity and the full benefits. As AT&T is showing the DOR way, KDDI and LG U+ could be DriveNets’ next major customers.

- With all inputs from all vendors and CSPs with DOR rollout plans taken into consideration, our cell site-based model produced a forecast showing a slow start that reflects the early stage of this market and an uptick at the end of the 2021-2026 forecast period marked by a double digit CAGR.

About the report:

LightCounting’s Disaggregated Open Routers report explores the emergence of the Disaggregated Open Routers (DOR) market. Disaggregated open routers are white-box routers based on separated white box hardware and software with cloud enabled software functions for existing 2G/3G/4G and future 5G network architectures. The report analyzes the disaggregated open routers’ (aggregation and core) architectures and implementations in wireless infrastructure, including the emerging vendor ecosystem, and tracks white box hardware units and sales, and software sales, all broken down by region including North America, Europe Middle East Africa, Asia Pacific, and Caribbean Latin America. It includes the total number of cell sites worldwide and a 5-year market forecast.

Historical data accounts for sales of the following vendors:

| Vendor | Software | Hardware/White Box | Source of Information | |

| Adva | Ensemble Activator | Survey data and estimates | ||

| Altran | Intelligent Switching Solution (ISS) | |||

| Alpha Networks | Hardware platform | |||

| Arrcus | ArcOS | |||

| Aviat Networks & Metaswitch (Microsoft) | AOS | |||

| Cisco | IOS XR7 | |||

| Datacom | DmOS | |||

| Dell Technologies | NOS | Hardware platform | ||

| Delta Electronics | AGCXD40V1, AGCV208S/AGCV208SV1, AGC7008S | Estimates | ||

| DriveNets | DNOS | |||

| Edgecore Networks | AS7316-26XB, AS7315-27X, AS5915-18X | Survey data and estimates | ||

| Exaware | ExaNOS | |||

| IP Infusion | OcNOS, DANOS | Estimates | ||

| Infinera | CNOS | DRX Series | Survey data and estimates | |

| Niral Networks | NiralOS | |||

| UfiSpace | S9700-53DX, S9700-23D, S9705-48D, S9500-30XS | Survey data and estimates | ||

| Volta Networks (now in IBM) | VEVRE | |||

| Note: Not all vendors provide services |

References:

https://www.lightcounting.com/report/march-2022-disaggregated-open-routers-135