disaggregated routers

KDDI Deploys DriveNets Network Cloud: The 1st Disaggregated, Cloud-Native IP Infrastructure Deployed in Japan

Israel based DriveNets announced today that Japanese telecommunications provider KDDI Corporation has successfully deployed DriveNets Network Cloud as its internet gateway peering router. DriveNets Network Cloud provides carrier-grade peering router connectivity across the KDDI network, enabling KDDI to scale its network and services quickly, while significantly reducing hardware requirements, lowering costs, and accelerating innovation. Additional applications will be deployed on DriveNets Network Cloud in the future.

“KDDI prides itself on deploying the most advanced and innovative technology solutions that allow us to anticipate and respond to the ever-changing usage trends, while providing considerable value to our customers,” said Kenji Kumaki, Ph.D. General Manager and Chief Architect, Technology Strategy & Planning, KDDI Corporation. “DriveNets Network Cloud enables us to quickly scale our network as needed, while controlling our costs effectively.”

“While many of Japan’s service providers have been aggressively pursuing the virtualization of network functions on their 4G and 5G networks, disaggregation of software and hardware in service providers’ routing infrastructure is just getting started,” said Ido Susan, DriveNets’ co-founder and CEO. “I am extremely proud that our Network Cloud solution was selected by KDDI, a leading innovative service provider, and is already deployed in their network, supporting the needs of KDDI‘s customers.”

The deployment of DriveNets Network Cloud on the KDDI network is the culmination of several years of testing and verification in KDDI‘s labs. It also reflects the growing adoption of disaggregated network architectures in service provider networks around the world.

“The move to disaggregated networking solutions will continue to be a prevailing trend in 2023 and beyond as savvy service providers try new technologies that can enable them to innovate faster and reduce costs. We are now seeing this technology also adopted in other high-scale networking environments, such as AI infrastructures,” said Susan.

DriveNets Run Almog wrote in an email, “KDDI is using white box devices from Delta. These are the “same” OCP compliant NCP devices which are deployed at AT&T (UFISpace in the AT&T case). they are using it as a peering router (vs. AT&T’s core use case). so this announcement is public indicative to several things: a 2nd Tier #1, another use case, and another ODM vendor, all in commercial deployments with our network cloud.”

DriveNets Inbar Lasser-Raab wrote in an email, “Getting a tier-1 SP to announce is very hard. They are cautious and our solution needs to be working and validated for some time before they are willing to talk about it. We are working on our next PR, but you never know when we’ll get the OK to release” ![]()

Compared to traditional routers that are comprised of software, hardware and chips from a single vendor, a DDBR solution combines software and equipment from multiple vendors, allowing service providers to break vendor lock and move to a new model that enables greater vendor choice and faster scale and introduction of new services through modern cloud design.

In addition to KDDI, DriveNets is already working with other service providers in Asia Pacific to meet the growing interest in its disaggregated networking solutions in the region. In mid-2021, the company established a Tokyo-based subsidiary to enhance its presence in the region.

DriveNets offers an architectural model similar to that of cloud hyperscalers, leading to better network economics and faster innovation. DriveNets Network Cloud includes an open ecosystem with elements from leading silicon vendors and original design manufacturers (ODMs), certified by DriveNets and empowered by our partners, which ensure the seamless integration of the solutions into providers’ networks.

About DriveNets:

DriveNets is a leader in cloud-native networking software and network disaggregation solutions. Founded at the end of 2015 and based in Israel, DriveNets transforms the way service and cloud providers build networks. DriveNets’ solution – Network Cloud – adapts the architectural and economic models of cloud to telco-grade networking. Network Cloud is a cloud-native software that runs over a shared physical infrastructure of white-boxes, radically simplifying the network’s operations, increasing network scale and elasticity and accelerating service innovation. DriveNets continues to deploy its Network Cloud with Tier 1 operators worldwide (like AT&T) and has raised more than $587 million in three funding rounds.

About KDDI:

KDDI is telecommunication service provider in Japan, offering 5G and IoT services to a multitude of individual and corporate customers within and outside Japan through its “au”, “UQ mobile” and “povo” brands. In the Mid-Term Management Strategy (FY23.3–FY25.3), KDDI is promoting the Satellite Growth Strategy to strengthen the 5G-driven evolution of its telecommunications business and the expansion of focus areas centered around telecommunications.

Specifically, KDDI is especially focusing on following five areas: DX (digital transformation), Finance, Energy, LX (life transformation) and Regional Co-Creation. In particular, to promote DX, KDDI is assisting corporate customers in bringing telecommunication into everything through IoT to organize an environment in which customers can enjoy using 5G without being aware of its presence, and in providing business platforms that meet industry-specific needs to support customers in creating businesses.

In addition, KDDI places “sustainability management” that aims to achieve the sustainable growth of society and the enhancement of corporate value together with our partners at the core of the Mid-Term Management Strategy. By harnessing the characteristics of 5G in order to bring about an evolution of the power to connect, KDDI is working toward an era of the creation of new value.

References:

https://drivenets.com/products/

IEEE/SCU SoE May 1st Virtual Panel Session: Open Source vs Proprietary Software Running on Disaggregated Hardware

DriveNets raises $262M to expand its cloud-based alternative to core network routers

AT&T Deploys Dis-Aggregated Core Router White Box with DriveNets Network Cloud software

DriveNets Network Cloud: Fully disaggregated software solution that runs on white boxes

KDDI claims world’s first 5G Standalone (SA) Open RAN site using Samsung vRAN and Fujitsu radio units

Disaggregation of network equipment – advantages and issues to consider

Introduction (by Alan J Weissberger):

Through network disaggregation of hardware and modular software, as proposed by the OCP, TIP, and O-RAN Alliance, network operators can select cheaper/commodity hardware from Taiwanese and/or Chinese manufacturers (ODMs)while using open source software or purchasing software from a trusted source.

For example, open source or proprietary software can turn a bare-metal-switch into an Internet gateway or a 5G core router. That software will also provide network management and security. It can easily be changed if the network operator, or the national government, decides the security landscape has evolved – without the need to replace any physical equipment.

IEEE and SCU SoE are sponsoring a virtual panel session which is described here.

Disaggregation Issues (by Richard Brandon, VP of Strategy at RtBrick):

As you move closer towards the core, disaggregation will certainly result in more physical boxes being used than traditional network systems, but closer to the edge it is usually a one-for-one replacement, substituting a single proprietary box with an open one. Even in the core though, this won’t necessarily mean many more outward facing physical interfaces. For example, a white box switch really just takes the place of a line-card in a conventional chassis-based router, with the same number of outward facing networking ports. So at that level, little changes.

Q & A (Alan and Richard):

1. Which of the consortiums (OCP, TIP, O-RAN) are doing a good job of specifying disaggregated hardware modules and the exposed interfaces between them?

We’ve been working closest with TIP and its operator members, specifically on the Open BNG initiative. They’ve issued a set of requirements for different use-cases, which have been driven by several operators. There is always the risk that this requirements list can become a superset of everything that’s ever been implemented, but the process is doing its best to manage that challenge.

2. Any success stories of multi-vendor interoperability of those disaggregated network modules?

For Open BNG, TIP selected several hardware and software vendors that met their criteria, which includes interoperability. For example, RtBrick’s routing software can run on nine different hardware platforms from three different vendors, and those platforms can be mixed and matched to optimize for scale and cost. RtBrick’s BNG software has been deployed in Deutsche Telekom’s production network, working on different vendor switches.

3. The cyber attack surface is greatly increased with many more exposed interfaces. What extra cyber security is needed to prevent attacks?

Of course, there are more distinct switching entities, but in some ways, this is actually an advantage because if any individual switch is compromised by a DDos Attack, for example, the blast radius of the attack is actually reduced with disaggregation.

Either way, it is usually the software where any vulnerabilities may lie. Here, disaggregation opens up some interesting dynamics when it comes to security threats, particularly those security concerns that derive from equipment provided by ‘untrusted nation states.’ Up until now, telcos have had a choice between lower-cost equipment from these untrusted states, or using trusted vendors with higher cost-bases.

Conclusions:

Disaggregation brings the best of both worlds. The hardware can be sourced from countries with low manufacturing costs, but the software, which is where the vulnerabilities may be, can be supplied by vendors from open democratic countries.

Biography:

Richard Brandon is a strategic and operational IT marketeer who is focused on results for his customers. He has experience within the networking, telecoms and TV industries.

References:

https://www.rtbrick.com/products-and-technology

https://www.rtbrick.com/news-and-events/rtbrick-wins-gold-at-the-merit-awards?c=press-releases

IEEE/SCU SoE May 1st Virtual Panel Session: Open Source vs Proprietary Software Running on Disaggregated Hardware

Light Counting: Large majority of CSPs remain skeptical about Disaggregated Open Routers

IEEE/SCU SoE May 1st Virtual Panel Session: Open Source vs Proprietary Software Running on Disaggregated Hardware

Complete Event Description at:

https://scv.chapters.comsoc.org/event/open-source-vs-proprietary-software-running-on-disaggregated-hardware/

The video recording is now publicly available:

https://www.youtube.com/watch?v=RWS39lyvCPI

……………………………………………………………………………………………………………………………………………….

Backgrounder – Open Networking vs. Open Source Network Software

Open Networking was promised to be a new paradigm for the telecom, cloud and enterprise networking industries when it was introduced in 2011 by the Open Networking Foundation (ONF). This “new epoch” in networking was based on Software Defined Networking (SDN), which dictated a strict separation of the Control and Data planes with OpenFlow as the API/protocol between them. A SDN controller running on a compute server was responsible for hierarchical routing within a given physical network domain, with “packet forwarding engines” replacing hop by hop IP routers in the wide area network. Virtual networks via an overlay model were not permitted and were referred to as “SDN Washing” by Guru Parulkar, who ran the Open Networking Summit’s for many years.

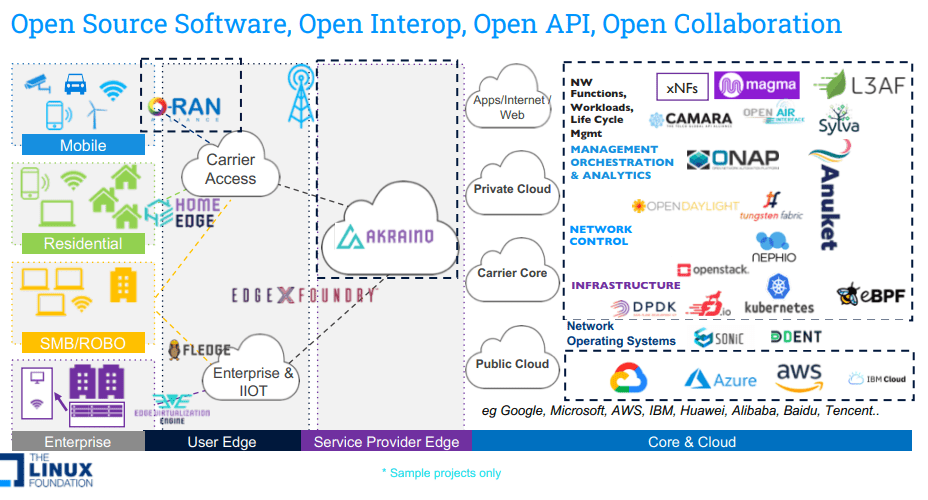

Today, the term Open Networking encompasses three important vectors:

A) Beyond the disaggregation of hardware and software, it also includes: Open Source Software, Open API, Open Interoperability, Open Governance and Open collaboration across global organizations that focus on standards, specification and Open Source software.

B) Beyond the original Data/Control plane definition, today Open Networking covers entire software stack (Data plane, control plane, management, orchestration and applications).

C) Beyond just the Data Center use case, it currently covers all networking markets (Service Provider, Enterprise and Cloud) and also includes all aspects of architecture (from Core to Edge to Access – residential and enterprise).

Open Source Networking Software refers to any network related program whose source code is made available for use or modification by users or other developers. Unlike proprietary software, open source software is computer software that is developed as a public, open collaboration and made freely available to the public. There are several organizations that develop open source networking software, such as the Linux Foundation, ONF, OCP, and TIP.

Currently, it seems the most important open networking and open source network software projects are being developed in the Linux Foundation (LF) Networking activity. Now in its fifth year as an umbrella organization, LF Networking software and projects provide the foundations for network infrastructure and services across service providers, cloud providers, enterprises, vendors, and system integrators that enable rapid interoperability, deployment and adoption.

Event Description:

In this virtual panel session, our distinguished panelists will discuss the current state and future directions of open networking and open source network software. Most importantly, we will compare open source vs. proprietary software running on disaggregated hardware (white box compute servers and/or bare metal switches).

With so many consortiums producing so much open source code, the open source networking community is considered by many to be a trailblazer in terms of creating new features, architectures and functions. Others disagree, maintaining that only the large cloud service providers/hyperscalers (Amazon, Microsoft, Google, Facebook) are using open source software, but it’s their own versions (e.g. Microsoft SONIC which they contributed to the OCP).

We will compare and contrast open source vs proprietary networking software running on disaggregated hardware and debate whether open networking has lived up to its potential.

Panelists:

- Roy Chua, AvidThink

- Arpit Joshipura, LF Networking

- Run Almog, DriveNets

Moderator: Alan J Weissberger, IEEE Techblog, SCU SoE

Host: Prof. Ahmed Amer, SCU SoE

Co-Sponsor: Ashutosh Dutta, IEEE Future Networks

Co-Sponsor: IEEE Communications Society-SCV

Agenda:

- Opening remarks by Moderator and IEEE Future Networks – 8 to 10 minutes

- Panelist’s Position Presentations – 55 minutes

- Pre-determined issues/questions for the 3 panelists to discuss and debate -30 minutes

- Issues/questions that arise from the presentations/discussion-from Moderator & Host -8 to 10 minutes

- Audience Q &A via ZOOM Chat box or Question box (TBD) -15 minutes

- Wrap-up and Thanks (Moderator) – 2 minutes

Panelist Position Statements:

1. Roy will examine the open networking landscape, tracing its roots back to the emergence of Software Defined Networking (SDN) in 2011. He will offer some historical context while discussing the main achievements and challenges faced by open networking over the years, as well as the factors that contributed to these outcomes. Also covered will be the development of open networking and open-source networking, touching on essential topics such as white box switching, disaggregation, OpenFlow, P4, and the related Network Function Virtualization (NFV) movement.

Roy will also provide insight into the ongoing importance of open networking and open-source networking in a dynamic market shaped by 5G, distributed clouds and edge computing, private wireless, fiber build-outs, satellite launches, and subsea-cable installations. Finally, Roy will explore how open networking aims to address the rising demand for greater bandwidth, improved control, and strengthened security across various environments, including data centers, transport networks, mobile networks, campuses, branches, and homes.

2. Arpit will cover the state of open source networking software, specifications, and related standards. He will describe how far we have come in the last few years exemplified by a few success stories. While the emphasis will be on the Linux Foundation projects, relevant networking activity from other open source consortiums (e.g. ONS, OCP, TIP, and O-RAN) will also be noted. Key challenges for 2023 will be identified, including all the markets of telecom, cloud computing, and enterprise networking.

3. Run will provide an overview of Israel based DriveNets “network cloud” software and cover the path DriveNets took before deciding on a Distributed Disaggregated Chassis (DDC) architecture for its proprietary software. He will describe the reasoning behind the major turns DriveNets took during this long and winding road. It will be a real life example with an emphasis on what didn’t work as well as what did.

……………………………………………………………………………………………………………….

References:

https://lfnetworking.org/

https://lfnetworking.org/how-

https://lfnetworking.org/

https://lfnetworking.org/open-

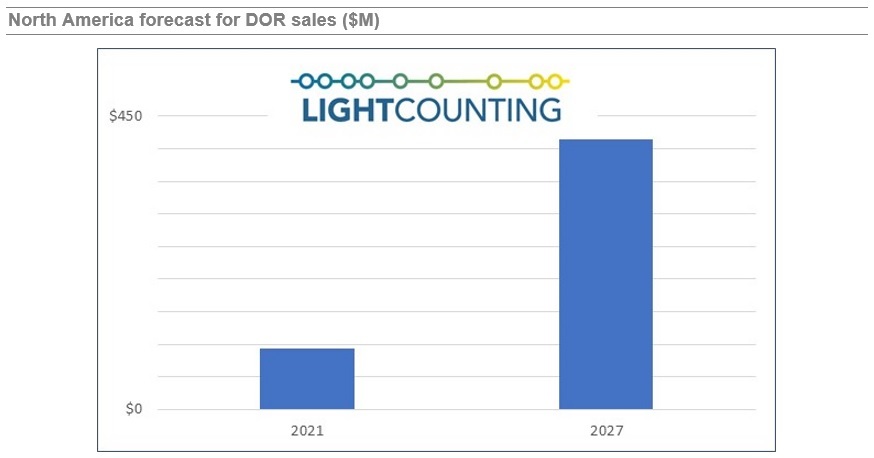

Light Counting: Large majority of CSPs remain skeptical about Disaggregated Open Routers

LightCounting’s second annual report provides an update on the emergence of the Disaggregated Open Routers (DOR) market in wireless infrastructure. DOR are white-box cell site, aggregation and core routers based on an open and disaggregated architecture for existing 2G/3G/4G and future 5G network architectures.

The DOR architecture was hailed as a new paradigm as early as 2012, using open source software for a centralized SDN Controller from the Open Network Foundation and Linux Foundation. The “open networking architecture” was envisioned to be used by tier 1 telcos and hyperscale cloud service providers and later extend to enterprise/campus networks. Well, that never happened!

Instead, hyperscalers developed their own proprietary versions of SDN, sometimes using a bit of open sourced software (e.g. Microsoft Azure). A few start-ups (e.g. Pica 8 and Cumulus Networks) developed their own software to run on white boxes and bare metal switches, including network operating systems, routing and network management.

One company that’s succeeded at customized software running over white boxes is

Israel based DriveNets. Indeed, the DriveNets software (see References below) is custom built- not open source! It’s an “unbundled” networking software solution, which runs over a cluster of low-cost white box routers and white box x86 based compute servers. DriveNets has developed its own Network Operating System (NOS), rather than use open source or Cumulus’ NOS as several other open networking software companies have done.

LightCounting’s research indicates that the overall DOR market remains incipient and unless proof of concept (PoC), testing and validation accelerate, volumes will take some time to materialize.

“Despite TIP’s (Facebook’s Telecom Infra Project) relentless efforts to push network disaggregation to all network elements and domains, and a flurry of communication service providers (CSPs) taking the lead with commercial DOR deployments like AT&T with DriveNets (NOS), UfiSpace (hardware) and Broadcom (networking silicon), a large majority of CSPs (Communications Service Providers) remain skeptical about the potential opex reduction, the maturity of transport disaggregation, and the impact on operations, administration, maintenance, procurement and support.” said Stéphane Téral, Chief Analyst at LightCounting Market Research.

Source: Light Counting

That quote is quite different from Stephane’s comment one year ago that the DOR market was poised for imminent growth:

“Still incipient, the DOR market is just about to take off and is here to stay but requires more CSPs (Communications Service Providers) to take the plunge and drive volumes. And with China’s lack of appetite for DOR, North America is taking the lead.”

Major findings in the report are the following:

- The open RAN ascension brought router disaggregation to the spotlight and paved the way to four fundamental routes. This phenomenon would have never happened without TIP’s initiative.

- Although NOS software vendors are mushrooming and by far outnumbering the white box hardware suppliers dominated by UfiSpace, there have been some casualties down the DOR road. In the networking silicon domain, Broadcom remains predominant.

- CSPs remain cautiously optimistic about router disaggregation but have yet to see more maturity and the full benefits. As AT&T is showing the DOR way, KDDI and LG U+ could be DriveNets’ next major customers.

- With all inputs from all vendors and CSPs with DOR rollout plans taken into consideration, our cell site-based model produced a forecast showing a slow start that reflects the early stage of this market and an uptick at the end of the 2021-2026 forecast period marked by a double digit CAGR.

About the report:

LightCounting’s Disaggregated Open Routers report explores the emergence of the Disaggregated Open Routers (DOR) market. Disaggregated open routers are white-box routers based on separated white box hardware and software with cloud enabled software functions for existing 2G/3G/4G and future 5G network architectures. The report analyzes the disaggregated open routers’ (aggregation and core) architectures and implementations in wireless infrastructure, including the emerging vendor ecosystem, and tracks white box hardware units and sales, and software sales, all broken down by region including North America, Europe Middle East Africa, Asia Pacific, and Caribbean Latin America. It includes the total number of cell sites worldwide and a 5-year market forecast.

Historical data accounts for sales of the following vendors:

| Vendor | Software | Hardware/White Box | Source of Information | |

| Adva | Ensemble Activator | Survey data and estimates | ||

| Altran | Intelligent Switching Solution (ISS) | |||

| Alpha Networks | Hardware platform | |||

| Arrcus | ArcOS | |||

| Aviat Networks & Metaswitch (Microsoft) | AOS | |||

| Cisco | IOS XR7 | |||

| Datacom | DmOS | |||

| Dell Technologies | NOS | Hardware platform | ||

| Delta Electronics | AGCXD40V1, AGCV208S/AGCV208SV1, AGC7008S | Estimates | ||

| DriveNets | DNOS | |||

| Edgecore Networks | AS7316-26XB, AS7315-27X, AS5915-18X | Survey data and estimates | ||

| Exaware | ExaNOS | |||

| IP Infusion | OcNOS, DANOS | Estimates | ||

| Infinera | CNOS | DRX Series | Survey data and estimates | |

| Niral Networks | NiralOS | |||

| UfiSpace | S9700-53DX, S9700-23D, S9705-48D, S9500-30XS | Survey data and estimates | ||

| Volta Networks (now in IBM) | VEVRE | |||

| Note: Not all vendors provide services |

References:

https://www.lightcounting.com/report/march-2022-disaggregated-open-routers-135

LightCounting: the rise of disaggregated white box routers for wireless infrastructure

LightCounting’s new report explores the emergence of the Disaggregated Open Routers (DOR) [1.] market in wireless infrastructure. DOR are white-box cell site, aggregation and core routers based on an open and disaggregated architecture for existing 2G/3G/4G and future 5G network architectures.

Note 1. A disaggregated router is an open approach to routing where the customer can choose hardware and software from a range of vendors that best meets their needs. This open approach enables innovation, avoids vendor lock-in, and drives cost down. The hardware is provided by a whitebox vendor while the software is mostly proprietary from vendors like Israel’s Drivenets.

“Still incipient, the DOR market is just about to take off and is here to stay but requires more CSPs (Communications Service Providers) to take the plunge and drive volumes. And with China’s lack of appetite for DOR, North America is taking the lead,” said Stéphane Téral, Chief Analyst at LightCounting Market Research.

SOURCE: LightCounting

………………………………………………………………………………………………………………………….

The major findings in the report are:

- The Open RAN ascension brought router disaggregation to the spotlight and paved the way to 4 fundamental routes. This phenomenon would have never happened without TIP’s DOR initiative [2].

- Although NOS software vendors are mushrooming and by far outnumbering the white box hardware suppliers, one vendor dominates the networking silicon domain.

- Communications service providers (CSPs) remain cautiously optimistic about router disaggregation but have yet to see more maturity and the full benefits because an onslaught of software can boost OPEX.

- With all inputs from all vendors and CSPs with DOR rollout plans taken into consideration, our cell site-based model produced a forecast showing a slow start that reflects the early stage of this market and an uptick at the end of the 2021-2026 forecast period marked by a double digit CAGR.

Note 2. Telecom Infra Project (TIP)’s Disaggregated Open Routers (DOR) group is led by KDDI and Vodafone. The DOR project group is part of TIP’s Open Optical & Packet Transport (OOPT) Group. The DOR group will focus on open and disaggregated routing platforms for transport networks and will drive technological development toward white box solutions for backbone networks including aggregation routers and open BNGs.

The Telecom Infra Project (TIP) is a global community of companies and organizations working together to accelerate the development and deployment of open, disaggregated, and standards-based solutions that deliver the high-quality connectivity that the world needs – now and in the decades to come. Founded in 2016 by Deutsche Telekom, Intel, Facebook, Nokia and SK Telecom, TIP has grown into a diverse membership that includes hundreds of member companies – from service providers and technology partners, to system integrators and other connectivity stakeholders.

LightCounting’s Disaggregated Open Routers report explores the emergence of the Disaggregated Open Routers (DOR) market. Disaggregated open routers are white-box routers based on separated white box hardware and software with cloud enabled software functions for existing 2G/3G/4G and future 5G network architectures. The report analyzes the disaggregated open routers’ (aggregation and core) architectures and implementations in wireless infrastructure, including the emerging vendor ecosystem, and tracks white box hardware units and sales, and software sales, all broken down by region including North America, Europe Middle East Africa, Asia Pacific, and Caribbean Latin America. It includes the total number of cell sites worldwide and a 5-year market forecast. As this market is just emerging, it is too early to publish vendor market shares.

……………………………………………………………………………………………………………………………………………………

More information on the report is available at: https://www.lightcounting.com/products/DOR/