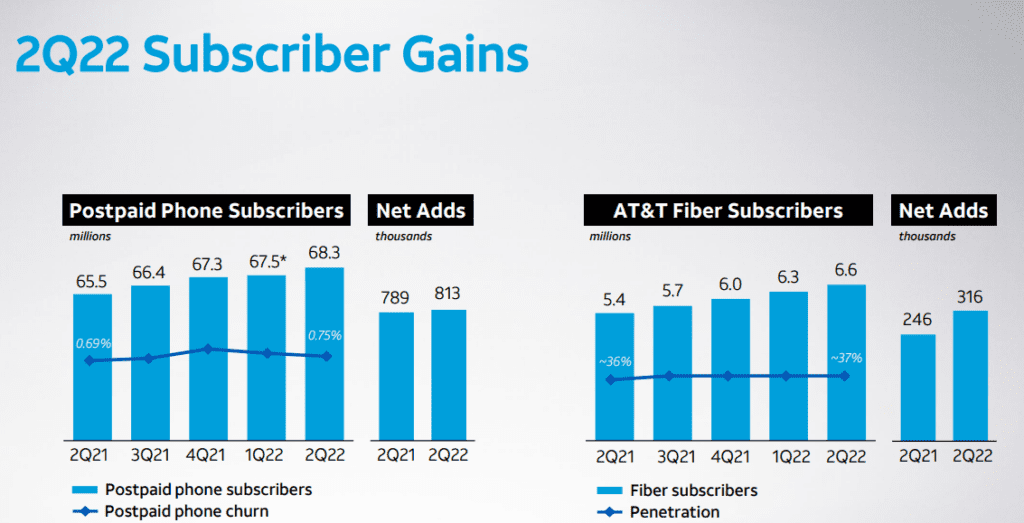

AT&T added 813K mobile postpaid subscribers & >300K net fiber subs during 2Q-2022

AT&T remains committed to investing in its network operations, including a focus on its 5G and fiber-optic related assets. AT&T gained 813,000 mobile postpaid subscribers during the quarter that ended in June, more than doubling analyst predictions and raising its wireless revenue forecast for 2022.

AT&T posted flat results for its now dominate communications segment, which includes its 5G wireless, wireline, and fiber operations. Segment revenues increased 2% year over year to $28.7 billion. However, increased costs and a loss of wireline customers dropped segment operating income by 2.1% to $7.2 billion.

AT&T CEO John Stankey said on today’s earnings call:

“In Fiber, we continue to invest in building out a premium network, drive a great build velocity and deliver on our stated expectations for accelerated customer growth through improved penetration rates. We’re finding success in serving more customers in new and existing markets with what we believe is the best wired Internet offering available. This is evidenced by our more than 300,000 second quarter AT&T Fiber net adds, marking our 10th straight quarter with more than 200,000 Fiber net adds.

The strength and value of the AT&T Fiber experience is enabling us to increase share in our Fiber footprint and convert more IP broadband Internet subscribers to Fiber subscribers. Ultimately, our Fiber strategy is a sustainable and long-term technology play that will support key macro trends.

We expect to see a continuation of favorable ARPU trends as we expand the availability of what we believe is a best-in-class network with a multi-decade lifespan. So I’m very pleased with the strong customer growth we’re seeing.

Our success only reinforces the improved value proposition we’re providing, and we expect our investment in top-tier technology to translate into strong resiliency for our services for years to come.

Over the last eight quarters, we’ve achieved an industry-best six million postpaid phone net adds while adding nearly 2.3 million AT&T Fiber customers, increasing our Fiber subscriber base by more than 50%. I’m also very proud with the progress our teams have made in rapidly expanding our 5G and fiber footprints.

I’m pleased to say that we’ve achieved our target of covering 70 million mid-band POPs 2 quarters ahead of our year-end target, and are now on track to approach 100 million mid-band POPs by the end of this year.”

……………………………………………………………………………………………………………………………………………..

AT&T reduced its free cash flow expectations (FCF), saying that customers were paying bills later than usual due to economic stress. AT&T said it now expects 2022 free cash flow of $14 billion. About $1 billion of the difference was tied to the “timing of customer collections.”

The gloomier FCF outlook overshadowed second-quarter results that topped estimates for profit and wireless subscriber growth.

…………………………………………………………………………………………………………………………………

AT&T CFO Pascal Desroches told investors that AT&T was bracing for a delay in consumers paying their bills due to surging recession concerns. He explained that “it’s taking about two more days than last year to collect customer receivables,” which resulted in a $1 billion impact in Q2, and that AT&T had around $130 million in higher bad debt expense.

“While bad debt is now slightly higher than pre-pandemic levels, it is being offset by better than expected customer revenue growth,” Desroches said, citing recent price increases.

Desroches also warned that AT&T was cutting its full-year free-cash-flow guidance from $16 billion down to $14 billion due to ongoing economic and recession uncertainty. That cut looked modest next to the carrier only posting $4 billion in free cash flow for the first half of the year, which was well below expectations.

The executive explained that AT&T had front-loaded its $24 billion in full-year capex due to its mid-band 5G and fiber deployments. This will lessen second-half spend needs, though AT&T remains committed to spending another $24 billion on capex in 2023.

“It underscores the importance of transitioning to our own operating connectivity services as well as rolling 5G and fiber integrated solutions,” Desroches said of its capex push. “In fact, our connectivity services revenue growth continues to accelerate as we are up nearly 15% year over year. Both areas, business 5G and fiber, continue to perform well.”

AT&T has previously stated that its ability to tie together its 5G and fiber networks allow it to better support enterprise SD-WAN, secure access service edge (SASE), and security needs. The carrier has struck a number of deals with vendors like Cisco, Fortinet, and Palo Alto Networks to power these SD-WAN, SASE, and security initiatives.

“As people migrate away from VPN and we have a more dense fiber base, we’re selling more fundamental underlying transport, frankly, at higher speeds and therefore higher connection values in that segment of the market, and that’s where our future is,” added AT&T CEO John Stankey on the Q2 call.

Analyst Craig Moffett Comments:

To be sure, AT&T’s results in Mobility haven’t been bad. They’ve walked a tightrope of heavy promotions in return for good-enough subscriber growth, and, up to now. On the back

of those passably good results in Mobility, the company has (arguably) provided at least some degree of confidence that they can sustain their new, lowered, dividend.

Meanwhile, they’ve promised faster capital spending on fiber deployment in their Consumer Wireline segment, something they have promised will result in at least positive longer-term growth in a segment that accounts for about 10% of revenues. (They’ve largely been silent about their much larger Business Wireline segment, which is shrinking badly and still getting worse).

AT&T’s consolidated growth prospects rest entirely on their Mobility segment. Their Business Wireline segment, which represents nearly 20% of revenues, is shrinking by high single digits, while their Consumer Wireline segment is at best marginally better than flat. Their Mobility segment has maintained modest service revenue growth through a mix of relatively rapid subscriber growth, offset by shrinking ARPU. Mobility is AT&T’s largest and most important business, accounting for two-thirds of consolidated pro forma revenues.

Subscriber growth trends remain very strong:

• AT&T added 1.06M post-paid subscribers, much better than the Street consensus expectation of 804K, in line with last year’s 1.16M.

• Better still, they added 813K post-paid phone subscribers on an as-reported basis, and with migrations (for comparability to the reporting of the other carriers), would have been a still-impressive 793K. Reported post-paid phone net additions were much better than consensus of 562K, and better than last year’s 789K.

• Pre-paid net additions of 231K also beat Street consensus of 131K, but were down from last year’s 297K gain.

We won’t know the industry’s growth rate until everyone else has reported, but it seems clear that AT&T is gaining unit market share. At their heart of their subscriber gain story is low churn. AT&T’s “best deals for all” promotion continues to keep churn very low.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

According to Seeking Alpha, six analysts rate AT&T stock (“T”) a Strong Buy, while seven have a Buy rating on the stock. 15 analyst rate “T” as a Hold, while there are 0 Sell recommendations.

References:

https://investors.att.com/financial-reports/quarterly-earnings/2022

9 thoughts on “AT&T added 813K mobile postpaid subscribers & >300K net fiber subs during 2Q-2022”

Comments are closed.

AT&T earnings were ‘actually good’ despite stock selloff, says analyst:

LightShed Partners analyst Walt Piecyk titled his research note: “AT&T’s Q2 Was Actually Good. Here’s Why.”

Admittedly, AT&T’s management team didn’t win points from Piecyk for its handling of cash-flow forecasting over the past few months. Piecyk recalled flagging issues with AT&T’s older free-cash forecast back in March, namely a “liberal use of rounding, aversion to simply stating a cash tax estimate for presumably political reasons, and ultimately the use of working capital and DirecTV distributions in their free-cash-flow presentation.”

AT&T said Thursday that various trends contributed to the lowered forecast, including slower customer payment times and higher-than-expected cash expenses related to its own device purchases from suppliers.

“It’s startling that the stock would sell off this steeply on working capital, but management is largely to blame,” Piecyk wrote. “Free-cash-flow guidance should not be this complex and investors shouldn’t include ephemeral working capital benefits in their calculations.”

Elsewhere, however, he saw positives in the report. AT&T’s free-cash-flow metric is important to investors because the company pays a large dividend, but Piecyk doesn’t think that the company will that the company will need to cut its dividend.

“Its core business is performing well and the 5G capex cycle should be winding down,” he wrote. “In 2023, we believe AT&T can generate over $12 billion of free-cash flow. The full-year benefit of the dividend cut means that $12 billion covers ~$8.2 billion of expected dividend payments,” before taking into account working-capital impacts or about $3 billion in anticipated DirecTV distributions.

Piecyk also had an upbeat view on the company’s wireless performance, especially in light of investor debate about the company’s pricing and promotional strategies.

“The increased pricing on its rate plans did not spike churn and helped deliver post-paid phone ARPU [average revenue per user] growth for the first time in over two years,” he wrote. “This also sends a signal to the wireless industry that there is pricing power in this market.”

Piecyk sees additional room for the company to grow ARPU as the year progresses. He acknowledged that “investors are understandably concerned that AT&T is buying revenue growth with handset subsidies to both new and existing subscribers” but noted that the company was able to grow wireless earnings before interest, taxes, depreciation, and amortization (Ebitda) in the latest quarter. In addition, the company’s upgrade rate fell relative to a year earlier, suggesting that the upgrade cycle is stretching out.

While AT&T is feeling some pain in its business wireline business, Piecyk was impressed by the performance of the company’s fiber business, with net adds up 25% relative to a year before. “This further validates our industry assumptions of target market share for fiber overbuilders and the increased share that can be obtained in legacy markets,” he wrote.

Overall, Piecyk sees opportunities for AT&T moving forward, especially given what the latest numbers indicated about pricing actions. “We continue to believe wireless operators can increase price and cut costs,” he wrote, including through a potential curtailing of device subsidies.

Piecyk rates the stock a buy with a $26 target price. Other analysts are also bullish on AT&T stock (symbol “T”).

https://www.marketwatch.com/story/at-t-earnings-were-actually-good-despite-stock-selloff-says-analyst-11658453072

AT&T beats wireless subscriber additions estimate on 5G demand:

AT&T which also raised its full-year revenue and adjusted earnings per share growth forecasts, added 789,000 net new postpaid phone subscribers during the quarter, above FactSet estimates of 278,000.

AT&T has been shelling out billions of dollars to upgrade its networks to the 5G technology, as demand for the faster service surges with people working from home and learning online.

WarnerMedia, the company’s media unit, added 2.8 million U.S. subscribers for its premium channel HBO and streaming platform HBO Max during the quarter.

AT&T raised its forecast for global HBO Max subscribers to between 70 million and 73 million by the end of the year. The company had earlier estimated 67 million to 70 million subscribers for the service.

The company in May said it would spin off and combine its media content with Discovery into a new global entertainment business.

Total revenue at AT&T rose 7.6% to $44 billion, beating analysts’ average estimate of $42.67 billion, according to IBES data from Refinitiv.

AT&T now expects revenue growth in the 2% to 3% range and adjusted earnings per share to rise in the low- to mid-single digits.

The company had previously expected revenue growth in the 1% range and adjusted earnings per share to be stable with the previous year.

Net income attributable to common stock rose to $1.5 billion, or 21 cents per share, in the second quarter, from $1.2 billion, or 17 cents per share, a year earlier.

https://www.cnbc.com/2021/07/22/att-beats-wireless-subscriber-additions-estimate-on-5g-demand.html

Let’s compare with Q2 2021 to see how AT&T has increased their fiber footprint!

AT&T Q2 2021: Consumer Fiber Subscribers On-Pace for 1 Million

Broadband and DSL Subscribers:

During Q2 2021, AT&T gained 246k fiber broadband subscribers, lost 195k non-fiber broadband subscribers, and lost 23k DSL subscribers.

Fiber Broadband Subscribers:

AT&T ended Q2 2021 with 5.4 million fiber broadband subscribers, an increase of 1.1 million subscribers year-over-year. Indeed, this represents a 25.7% gain in subscriber count, as compared to AT&T’s 4.3 million fiber broadband subscribers as of Q2 2020.

AT&T estimates that nearly 80% of net new fiber subscriber additions are new AT&T broadband customers. This represents a difference in trend from gaining fiber subscribers via upgrades of its own high-speed Internet customers using older technologies, such as VDSL and DSL.

Overall, AT&T now has a fiber broadband penetration rate of 36%, on the nearly 15 million customer locations that the company passes with fiber. Importantly, AT&T has increased its fiber broadband penetration rate from 31% in Q2 2020.

Broadband ARPU:

AT&T’s broadband average revenue per user (ARPU) reached $54.76 as of Q2 2021. Indeed, this represents a 6.1% increase year-over-year from ARPU figures of $51.61 at Q2 2020. AT&T notes that increases to ARPU reflect fiber subscriber growth and customer take-up of higher speed/pricing tiers.

https://dgtlinfra.com/att-q2-2021-consumer-fiber-subscribers/

Verizon’s 2Q-2022 weak subscriber growth results in lower forecasts

Verizon gained 12,000 postpaid wireless connections in the second quarter, a sign of relatively weak growth in its core customer base. In sharp contrast, AT&T Inc. reported a net gain of 813,000 equivalent connections over the same span.

Verizon said it expects wireless-service revenue growth of 8.5% to 9.5% in 2022, down from its earlier forecast of a 9% to 10% increase. The company also predicted its adjusted earnings would be flat to negative instead of growing this year. Meanwhile, AT&T raised its wireless service revenue target, a sign it could be claiming some business from its wireless telco rival.

https://techblog.comsoc.org/2022/07/23/verizon-weak-subscriber-growth/

AT&T raised its forecast for annual revenue growth at its wireless service business after total revenue of $29.6 billion came in-line with market estimates of $29.55 billion, according to IBES data from Refinitiv.

“As a result of our higher-than-forecasted customer growth, we’re increasing our mobility service revenue guidance to 4.5%-5% growth for the full year,” Chief Executive Officer John Stankey said. The company had earlier forecast wireless service revenue growth of 3% or more.

Excluding items, the company earned 65 cents per share, beating estimates of 61 cents per share.

Source: Reuters

Chuck Watson wrote in Seeking Alpha:

“A one-time shortfall in FCF that leads to a high payout ratio for a quarter is of little consequence over the long haul.”

While investors in AT&T were set aback by the cut in projected annual FCF, there were a number of positives to be found in the quarterly report. Adjusted for the Warner spinoff, DirecTV transaction, and Latin American asset sale, total revenue increased 2.2% year-over-year.

By front loading capex, AT&T is experiencing a surge in wireless service revenue. The company reported that over the last 8 quarters, it led the industry with 6 million postpaid phone net additions.

AT&T added 813,000 postpaid phone customers during Q2 alone. That’s a year-over-year increase from 798,000, and marks the strongest second quarter in a decade. Average revenue per postpaid phone customer also increased by 1.1%.

It’s important to take note of the strength in AT&T’s wireless Mobility results, as that business generates nearly 70% of post-spinoff revenue.

Mobility EBITDA increased by 2.5% year over year, and management projects improved Mobility-adjusted EBITDA in the second half of the year.

AT&T’s Fiber also gained 316,000 net subscribers during the quarter. This marked the tenth consecutive quarter in which the company recorded more than 200,000 fiber net adds. Over the last 8 quarters, T increased the number of fiber subscribers by 50%.

AT&T also leads the industry over the last 8 quarters with 6 million net postpaid phone additions.

https://seekingalpha.com/article/4526293-at-and-t-block-out-the-noise-focus-on-the-facts

AT&T (T) posted solid telecom results for the second quarter, keeping the firm on pace to meet or exceed management’s 2022 subscriber growth expectations. The continued growth in wireless additions led to an increase in the mobility services revenue growth target to 4%-5% from “at least 3%.” However, management cut its free cash flow target for 2022 by $2 billion to $14 billion due to continued growth investments and the timing of collections. Our fair value estimate, which reflects the Warner spinoff, remains $25 per share. We continue to like AT&T’s strategic position and its network investment plans, which we expect will deliver improving revenue and profit growth over the next several years.

Adjusted for the Warner spinoff, DirecTV transaction, and Latin American asset sale, total revenue (now roughly two thirds wireless, with most of the remainder enterprise and consumer fixed-line services) increased 2.2% year over year to $29.6 billion. Wireless service revenue growth accelerated to 4.8% year over year, ahead of management’s previous 2022 target and in line with the new one, on strong postpaid phone customer growth in recent quarters. AT&T added 813,000 postpaid phone customers during the quarter, up from 798,000 a year ago, the strongest second quarter in a decade. Despite more than two years of blistering industrywide growth, we still believe that postpaid customer additions will eventually have to tick down and match population growth more closely, but AT&T has yet to see any sign of falling demand.

Average revenue per postpaid phone customer was also strong, growing 1.1% versus a year ago as promotional credits, which are amortized against revenue, declined in the quarter and more customers traded up to higher-priced unlimited plans. Management expects average revenue per postpaid phone customer to improve further in the second half. Segment EBITDA expanded by 2.5% year over year, with further expansion projected in the second half of 2022.

https://www.morningstar.com/articles/1103730/att-earnings-show-continued-wireless-momentum-during-q2

Zack’s Research Report:

AT&T has been divesting its non-core assets to increase its liquidity and shed excess baggage to be nimbler. The company inked an agreement in first-quarter 2021 with private equity firm TPG to divest its U.S. video business. AT&T is likely to receive $7.6 billion from this transaction, while retaining stake within the newly formed DIRECTV. The cash resources are likely to be utilized to augment its network infrastructure throughout the country. A paradigm shift to the core telecom operations might also have been triggered by the inherent growth prospects of the sector triggered by the multi-billion infrastructure investment plan by President Biden. The $2 trillion investment plan over an eight-year period includes a $100 billion provision to significantly expand broadband access to Americans, as the administration aims to fortify its technological prowess to thwart the dominance of countries like China. Moreover, a focused entertainment company from by the merger of WarnerMedia and Discovery assets is likely to be better placed to capitalize on the booming direct-to-consumer streaming services market and unlock value from media assets. AT&T remains focused on business transformation efforts to augment operational efficiency and facilitate optimum utilization of resources to enhance value. The company expects this holistic growth policy to add significant customer value and generate healthy ROI across the business.

AT&T is planning a major expansion of its fiber network. The company currently delivers fiber internet to customers in 21 states, most of which are in the South and Midwest.

AT&T fiber is currently unavailable in Arizona, but the company intends to launch service for 100,000 homes in Mesa by next year.

Corning Inc. invented optical fiber in 1970 and is now a major provider of cable across the world.

The Corning-AT&T relationship is mutually essential; The two companies develop products and processes together, and AT&T relies on Corning for cable.

“They supply not 100 percent, but nearly all of our fiber,” Stankey said in an interview. “They provide 100 percent of our fiber for last mile distribution. This is the latest example of cooperation around a new way of assembling fiber units and deploying it into the field that is faster, lower costs, higher reliability, less disruption in the neighborhood.”

Stankey said fiber optic internet is far more reliable than cable internet and it provides better upload bandwidth, which is important for video conferencing or sharing other large files. AT&T’s hope is that deploying residential and consumer fiber will in turn help bolster its business and consumer wireless units as well.

Corning’s optical communications segment is its largest, generating about 30% of the company’s $14 billion in revenue during 2021. CEO Weeks said he only expects the segment to continue growing.

“We’re seeing double-digit growth for as far as we can see going forward,” he said.

https://www.bizjournals.com/phoenix/news/2022/08/31/corning-att-fiber-infastructure-plant.html