Dell’Oro: RAN Market Disappoints in 2Q-2022

Dell’Oro Group preliminary findings suggest the Radio Access Network (RAN) market is weakening. The overall 2G-5G RAN infrastructure equipment market – including hardware and software – declined in the second quarter, recording the first year-over-year contraction in more than two years and the third consecutive quarter of RAN coming in below expectations. Although the RAN market is not immune to external risks, initial readings suggest that the RAN impact from deteriorating macro conditions, high levels of inflation, and supply chain disruptions were limited in the quarter.

“The shift in the pendulum is not a surprise, but admittedly it has swung a bit faster toward the negative than initially expected”, said Stefan Pongratz, Vice President at Dell’Oro Group. “Slower momentum is not a sign that the 5G deployment phase is over. The message we have communicated for some time now, namely that the 5G cycle will be longer than previous technology cycles, still holds. At the same time, market conditions in the quarter were impacted by APAC excluding China, Russia, and foreign exchange,” continued Pongratz.

Additional highlights from the 2Q 2022 RAN report:

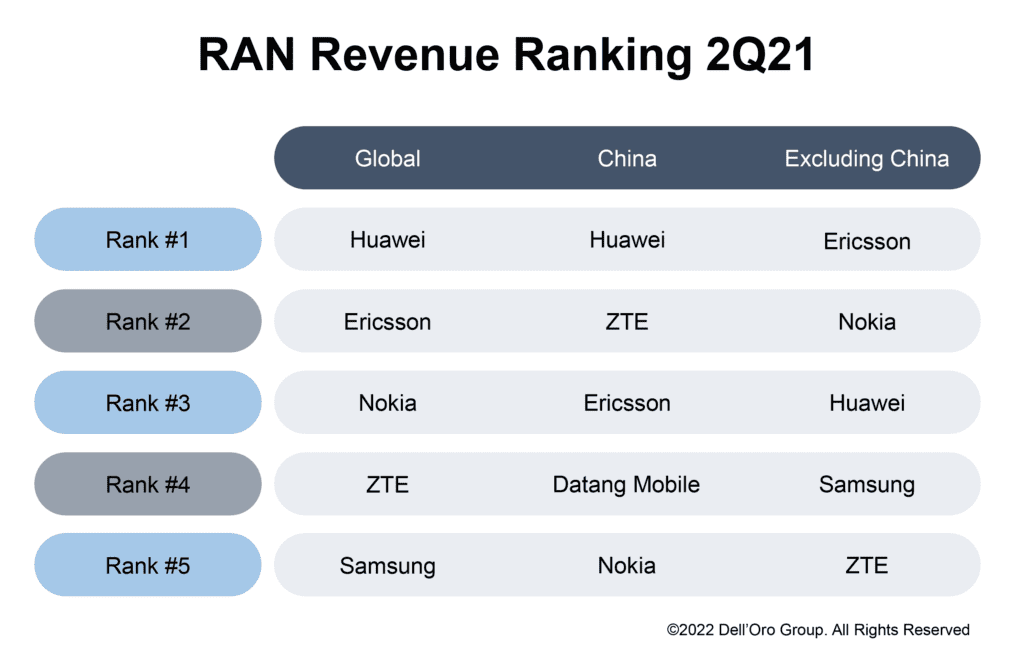

- Top 5 global suppliers in the quarter include Huawei, Ericsson, Nokia, ZTE, and Samsung.

- Top 4 suppliers outside of China in the quarter include Ericsson, Nokia, Huawei, and Samsung.

- Huawei and ZTE continued to dominate in China, together accounting for 90 to 95 percent of 1H 2022 revenues. Note that state owned Datang Mobile is ranked #4 in China’s RAN market.

- Ericsson maintained its top position in the RAN market outside of China, accounting for 39 percent of the revenues for the 1H 2022.

- Nokia’s RAN position outside of China improved between 1Q and 2Q 2022.

- Samsung’s 1H 2022 RAN share improved both in North America and globally.

- Even though RAN results disappointed in the quarter and first half revenues are tracking below expectations, RAN is still projected to record a fifth consecutive year of growth in 2022.

Dell’Oro Group’s RAN Quarterly Report offers a complete overview of the RAN industry, with tables covering manufacturers’ and market revenue for multiple RAN segments including 5G NR Sub-6 GHz, 5G NR mmWave, LTE, macro base stations and radios, small cells, Massive MIMO, Open RAN, and vRAN. The report also tracks the RAN market by region and includes a four-quarter outlook. To purchase this report, please contact us by email at [email protected].

…………………………………………………………………………………………………………………………..

Dell’Oro’s RAN vendor rankings come as no surprise.

- Ericsson in the second quarter reported a 13% increase in net sales compared with the year-earlier period.

- Nokia reported an 11% increase in net sales during the same period.

- Huawei, which has long been the world’s biggest supplier of RAN equipment, posted revenues in the first half of 2022 that were down 5.9% from last year, its lowest such results in five years.

References: