Month: November 2022

Frontier’s Big Fiber Build-Out Continued in Q3-2022 with 351,000 fiber optic premises added

Frontier Communicatons massive fiber build-out continued in the third quarter (Q3-2022), as the company added record number of fiber subscribers to reach a total of 4.8M fiber locations. Frontier is poised to reach 5 million locations passed with fiber-to-the-premises (FTTP) networks this month, putting it at the halfway point toward a goal to reach at least 10 million locations with fiber by the end of 2025. The company added a record 64,000 fiber subscribers, beating the 57,000 expected by analysts. That helped to offset greater than expected copper subscriber losses of -58,000. Consumer fiber Q3 revenue climbed 14% to $424 million while consumer copper fiber dropped 3% to $361 million.

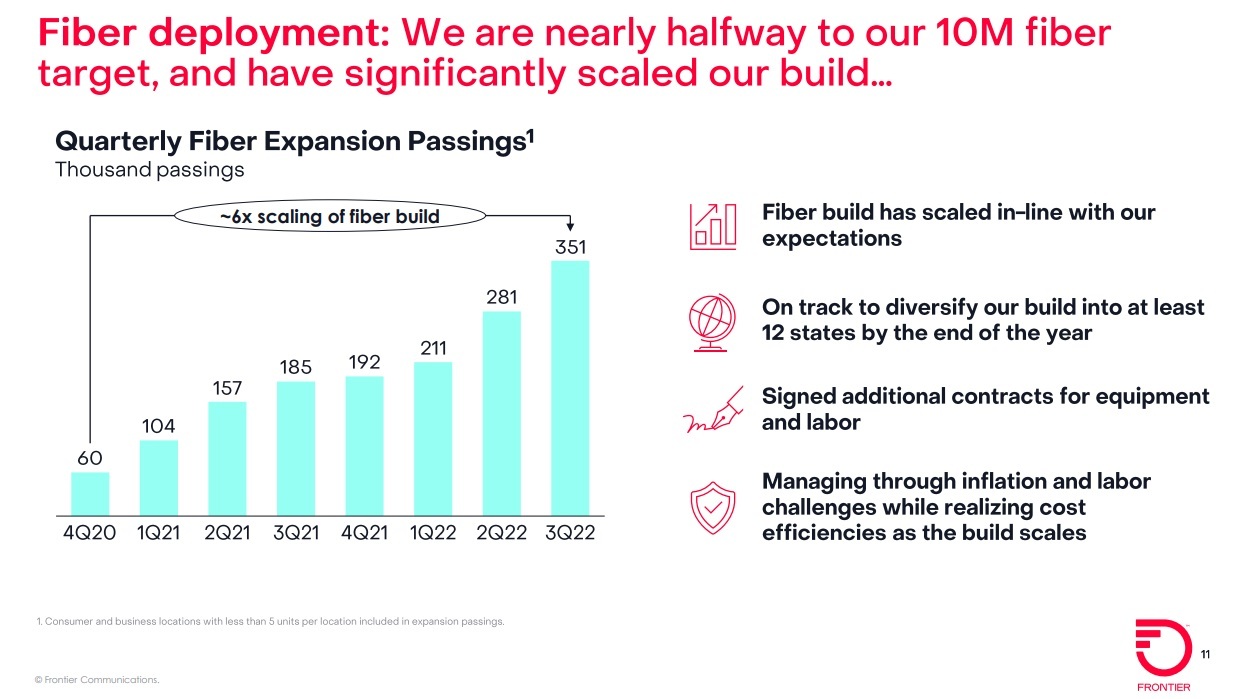

Frontier built FTTP to a record 351,000 fiber optic premises in Q3-2022, handily beating the 185,000 built out in the year-ago quarter and the 281,000 built in Q2 2022. Frontier ended Q3 with 1.50 million fiber subs, up 16% versus the year-ago quarter.

“We delivered another quarter of record-breaking operational results,” said Nick Jeffery, President and Chief Executive Officer of Frontier. “Our team set a new pace for building and selling fiber this quarter. At the same time, we radically simplified our business and delivered significant cost savings ahead of plan. This is a sign of a successful turnaround.

“Our team has rallied around our purpose of Building Gigabit America and is laser-focused on executing our fiber-first strategy. As the second-largest fiber builder and the largest pure-play fiber provider in the country, we are well-positioned to win.”

Third-quarter 2022 Highlights:

- Built fiber to a record 351,000 locations to reach a total of 4.8 million fiber locations, nearly halfway to our target of 10 million fiber locations

- Added a record 66,000 fiber broadband customers, resulting in fiber broadband customer growth of 15.8% compared with the third quarter of 2021

- Revenue of $1.44 billion, net income of $120 million, and Adjusted EBITDA of $508 million

- Capital expenditures of $772 million, including $18 million of subsidy-related build capital expenditures, $442 million of non-subsidy-related build capital expenditures, and $170 million of customer-acquisition capital expenditures.

- Net cash from operations of $284 million, driven by healthy operating performance and increased focus on working capital management

- Nearly achieved our $250 million gross annual cost savings target more than one year ahead of plan, enabling us to raise our target to $400 million by the end of 2024

In Frontier’s “base” fiber footprint of 3.2 million homes (in more mature areas where fiber’s been available for several years), penetration rose 30 basis points in Q3 to 42.9%. “When we look at the growth over the past year, we see a clear path to achieving our long term target of 45% penetration in our base markets,” Frontier CEO Nick Jeffery said.

Penetration rates in Frontier’s expansion fiber footprint for the 2021 cohort is on target and is exceeding expectations in the 2020 expansion fiber footprint, he said.

Fiber ARPU (average revenue per user) was up 2.6% year-over-year, but came a little short of expectations thanks in part to gift card promotions. Frontier’s consumer fiber ARPU, at $62.97, missed New Street Research’s expectation of $63.67 and a consensus estimate of $64.51. Copper ARPU, however, beat estimates: $49.65 versus an expected $48.57.

Frontier CEO Jeffery said faster speeds remain a top ARPU driver, with 45% to 50% of new fiber subs selecting tiers offering speeds of 1Gbit/s or more. Fiber subs taking speeds of 1Gbit/s or more now make up 15% to 20% of Frontier’s base, up from 10% to 15% last quarter, he said.

Frontier currently has no plans to raise prices due to inflation and other economic pressures, but the company left the door open to such a move.

“We’ll be a rational pricing actor in this market,” Jeffery said. “If those [inflationary pressures] don’t moderate, then of course we maybe consider pricing actions to compensate…just as we’re seeing others doing.”

Frontier also has no immediate plans to strike an MVNO deal that would enable it to use mobile in a bundle to help gain and retain broadband subscribers – a playbook already in use by Comcast, Charter Communications, WideOpenWest and Altice USA.

As churn rates remain stable and low, Jeffery explained, “the argument for using some of that scarce capital to divert into an MVNO to solve a problem that we don’t yet have, I think, would probably not make our shareholders super happy.” Importantly, Frontier has experience in the mobile area from execs who previously worked at Vodafone, Verizon and AT&T.

“We’re watching it very closely and if consumer behavior changes or if the market changes in a material way that impacts us such that moving some of our scarce capital to build or partner with an MVNO would be a smart thing to do, we’ll do it and we’ll do it very quickly,” Jeffery said. “But now isn’t the moment for us.”

Frontier ended the quarter with $3.3 billion of liquidity to fund its fiber build. Beasley said Frontier has additional options if needed, including taking on more debt, selling non-core real estate assets, access to government subsidies and the benefits of a cost-savings plan that has exceeded the target (from an original $250 million to $400 million).

References:

The conference call webcast and presentation materials are accessible through Frontier’s Investor Relations website and will remain archived at that location.

https://events.q4inc.com/attendee/387527166

https://www.lightreading.com/broadband/frontiers-big-fiber-build-nears-halfway-point-/d/d-id/781503?

JC Market Research: 5G FWA market to reach $21.7 billion in 2029 for a CAGR of 65.6%

Introduction:

According to JC Market Research, the 5G fixed wireless access (FWA) market was valued at US $296 million in 2021. In a new report ““Worldwide 5G Fixed Wireless Access (FWA) Industry Analysis,” the market research firm forecasts that global 5G FWA rеvеnuе will rеасh а vаluе оf UЅ$ 21,710 million іn 2029. That’s a remarkable CAGR of 65.6% over the forecast period.

Yesterday, we posted an article on South Africa’s Telkom deploying 5G FWA before 5G mobile and it appears that 5G FWA is a stronger use case than 5G mobile.

Glоbаl 5G Fixed Wireless Access (FWA) Industry Dуnаmісѕ:

In many of smart cities, 5G IoT will be the technology of choice for niche applications. Smart cities, with applications such as HD cameras to monitor safety, Smart energy, such as smart grid control, smart security, including the provision of emergency services and connected health, such as mobile medical monitoring is possible with the help of 5G networks. Advanced sensing for environmental monitoring can be done using this module.

The increasing adoption of connected devices such as smartphones, laptops, and smart devices in several commercial and residential applications such as distance learning, autonomous driving, multiuser gaming, videoconferencing, and live streaming, as well as in telemedicine and augmented reality, is expected to generate the demand for 5G fixed wireless access solutions to achieve extended coverage.

Global 5G Fixed Wireless Access (FWA) Industry Analysis Маrkеt Drіvеrѕ Rеgіоnаl Ѕеgmеntаtіоn аnd Аnаlуѕіѕ:

Rеgіоn-wіѕе ѕеgmеntаtіоn in the global 5G fixed wireless access (FWA) industry іnсludеѕ North Аmеrіса, Еurоре, Аѕіа Расіfіс, Ѕоuth Аmеrіса, аnd the Міddlе Еаѕt & Аfrіса. North Аmеrіса ассоuntѕ for hіghеѕt rеvеnuе ѕhаrе in the global 5G fixed wireless access (FWA) industry analysis market, аnd іѕ рrојесtеd tо rеgіѕtеr а rоbuѕt САGR оvеr thе fоrесаѕt реrіоd. While serving rural markets and developing nations is still a costly proposition, governments around the globe stand ready to provide aid. In the USA, phase two of the Connect America Fund (CAF) is supporting broadband initiatives in underserved communities. The connecting Europe Broadband fund is performing a similar role for underserved populations in EU member countries.

The report also indicated that North Аmеrіса, Еurоре, Аѕіа Расіfіс, Ѕоuth Аmеrіса аnd the Міddlе Еаѕt & Аfrіса as FWA market leaders.

JC Market Research is not the only research firm exploring the potential growth of the FWS market; ABI Research forecasts that the total number of FWA subscriptions will grow from 81 million globally in 2021 to slightly over 180 million in 2026, representing a Compound Annual Growth Rate (CAGR) of 17%. Consequently, ABI Research believes that global FWA Customer Premises Equipment (CPE) shipments will reach 47 million annually by 2026, with 5G FWA CPE making up the majority of shipments by the same year.

References:

https://jcmarketresearch.com/report-details/1538805/discount

5G FWA launched by South Africa’s Telkom, rather than 5G Mobile

5G fixed wireless access market to reach $22 million in 2029: Report