Fixed Wireless Access (FWA)

U.S. Home Internet prices DECLINE amidst fierce competition between wireless carriers and cablecos

Home internet prices in the U.S. are being driven down by fierce competition between mobile carriers offering Fixed Wireless Access (FWA) and cable internet companies offering legacy Hybrid Fiber Coax connections. The increased competition has driven down the cost of home internet service, a welcome break for consumers when prices are rising for many other essential products. The price of home internet service fell 3.1% in May from a year earlier, while the overall consumer-price index rose 2.4%, according to the Labor Department.

The WSJ reports that major home-internet service providers including Verizon VZ, Comcast/Xfinity and T-Mobile launched a flurry of price-lock guarantees, promising steady rates for as long as five years. CableCos Charter, which is acquiring Cox, unveiled a three-year deal last year.

Cable companies have struggled to retain broadband internet subscribers since mobile carriers began offering more affordable 5G fixed-wireless access (FWA) internet service in 2018. FWA, which relies on over the air transmission to cell towers instead of HFC access, brought competition into markets where cable companies had long enjoyed being the only game in town. Now both types of providers are growing more aggressive to attract—and keep—customers.

“The cable companies went from gaining subscribers and raising rates every year to declining subscribers and giving people price locks,” said John Hodulik, a UBS analyst. “They’re seeing churn rise in their broadband subscriber base. And they’re trying to nip that in the bud.” Fixed wireless can sometimes cost half as much as a cable-provided internet plan. Though network congestion and other connectivity issues can be an issue for some users, the lower price point has been luring cable customers away.

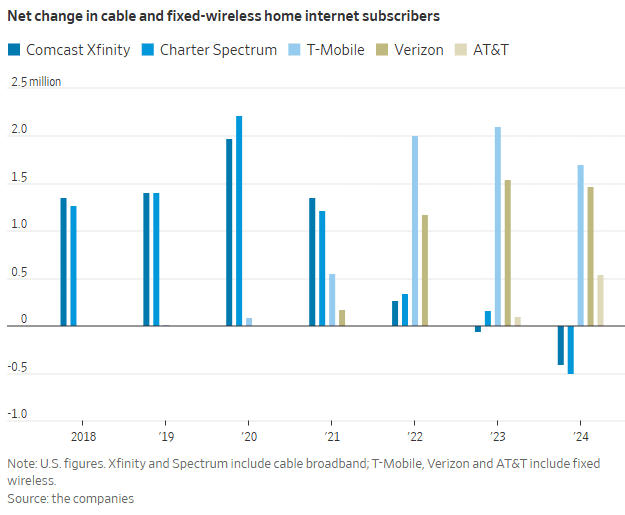

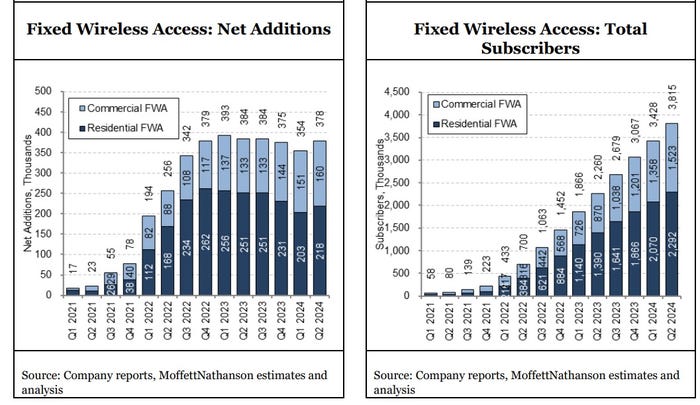

T-Mobile, Verizon and AT&T added a combined 3.7 million FWA customers in 2024. In sharp contrast, Comcast’s Xfinity and Charter’s Spectrum lost more than 900,000 home internet subscribers. That’s depicted in this graph:

“Our pricing wasn’t breaking through in the marketplace,” said Steve Croney, chief operating officer for Comcast’s connectivity and platforms business. He said the company’s five-year price lock, introduced in April, competes well against the telecom companies’ offerings.

Frank Boulben, chief revenue officer at Verizon’s consumer group, said his company has been trying to address the “pain points” customers have with cable companies, such as price hikes. That’s why the telco is emphasizing FWA vs its FiOS fiber to the home based service. Boulben said his company would focus on selling fiber service to customers as it becomes available to them.

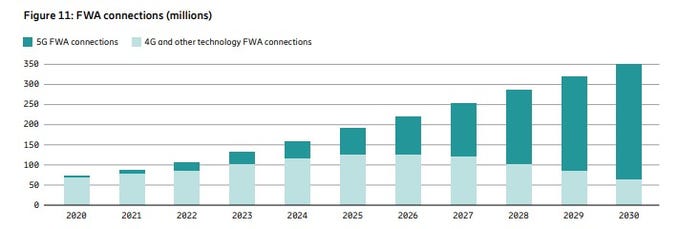

Is FWA the ONLY real killer application for 5G? Even though it was NOT one of the envisioned use cases? Ericsson’s recently released Mobility Report says FWA will account for more than 35% of all new fixed broadband connections, with an expected increase to 350 million by the end of 2030. The report states that more than half of all network service providers (wireless telcos) who offer FWA now do so with “speed-based monetization benefits enhanced by 5G.”

About 80% of the global network operators sampled by Ericsson currently offer FWA, with the most rapid area of growth among CSPs (communications service providers) offering 5G-enabled speed-based tariff plans. These opportunities are about the ability to offer a range of subscriber packages with different downlink and uplink data options with 5G FWA. As with fiber deals, “increasing monetization opportunities for CSPs compared to earlier generations of FWA.” 51% of operators with FWA offerings now include these speed-based options, which is up from 40% on the same period in June 2024 and represents a 27.5% increase. The June 2024 number had grown 50% on the June 2023 equivalent.

Source: Ericsson Mobility Report

…………………………………………………………………………………………………………………………………………………………………..

“We are at an inflection point, where 5G and the ecosystem are set to unleash a wave of innovation,” said Erik Ekudden, Ericsson Senior Vice President and Chief Technology Officer. “The recent advancements in 5G standalone (SA) networks, coupled with the progress in 5G-enabled devices, have led to an ecosystem poised to unlock transformative opportunities for connected creativity. Service providers have recognized this potential of 5G and are beginning to monetize it through innovative service offerings that extend beyond merely selling data plans. To fully realize the potential of 5G, it is essential to continue deploying 5G SA and to further build out mid-band sites. 5G SA capabilities serve as a catalyst for driving new business growth opportunities.”

Fixed-wireless doesn’t work everywhere. Besides congestion weak signals can make coverage spotty. If your cell phone doesn’t pick up 5G coverage smoothly, fixed-wireless from the same company probably won’t work either.

Verizon, AT&T and T-Mobile are winning converts to FWA at a faster pace than many anticipated, said Jonathan Chaplin, a managing partner at equity research firm New Street Research. Charter agreed to buy Cox last month for $21.9 billion in equity and assume $12 billion of its outstanding debt, in part to acquire scale to better compete with fixed wireless access. However, fixed-wireless growth can’t last indefinitely. The wireless networks on which they run will eventually hit capacity, limiting how many subscribers they can add. Chaplin estimates the networks can support around 19 million total fixed-wireless subscribers—which he predicts they will reach in about five years, accounting for planned network expansions that the companies have announced. When that limit is reached, cable companies may regain the upper hand and keep growing their fiber customer base, Chaplin said.

The big three wireless carriers (AT&T, Verizon and T-Mobile) have all been investing in fiber-based wired networks via build-outs and acquisitions. AT&T is bringing new customers in via FWA, with the long-term goal to convert them to fiber-based service, said Erin Scarborough, who runs that company’s broadband and connectivity initiatives.

References:

https://www.telecoms.com/5g-6g/ericsson-says-fwa-is-boosting-telco-monetization-opportunities

https://www.ericsson.com/en/reports-and-papers/mobility-report

https://www.consumeraffairs.com/news/cable-vs-wireless-war-is-driving-prices-down-062525.html

Dell’Oro: 4G and 5G FWA revenue grew 7% in 2024; MRFR: FWA worth $182.27B by 2032

Latest Ericsson Mobility Report talks up 5G SA networks and FWA

T-Mobile posts impressive wireless growth stats in 2Q-2024; fiber optic network acquisition binge to complement its FWA business

5G Advanced offers opportunities for new revenue streams; 3GPP specs for 5G FWA?

FWA a bright spot in otherwise gloomy Internet access market

Dell’Oro: 4G and 5G FWA revenue grew 7% in 2024; MRFR: FWA worth $182.27B by 2032

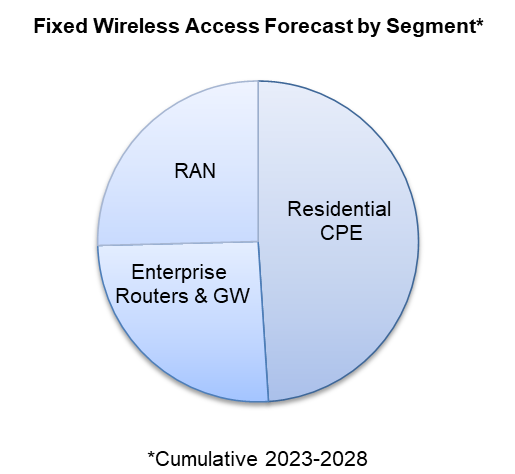

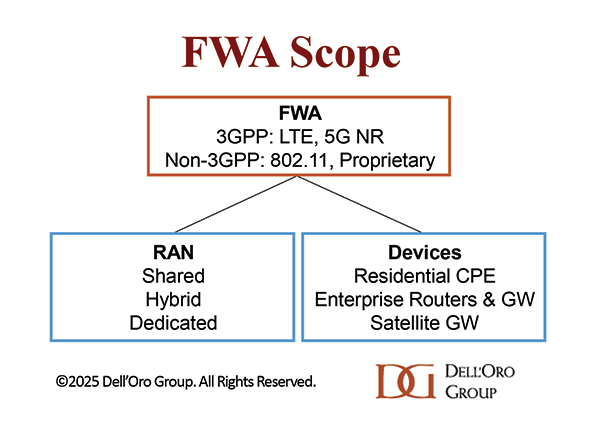

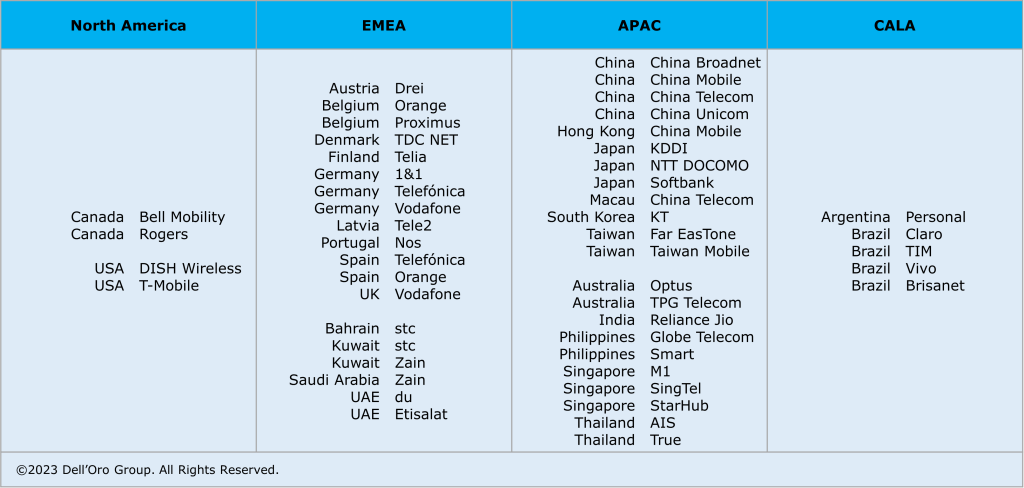

According to Dell’Oro Group, Fixed Wireless Access (FWA) has surged in recent years to support both residential and enterprise connectivity due to its ease of deployment along with the more widespread availability of 4G LTE and 5G Sub-6GHz networks. Preliminary findings suggest total FWA revenues, including RAN equipment, residential CPE, and enterprise router and gateway revenue remain on track to advance 7% in 2024, driven largely by residential subscriber growth in North America and India, as well as growing branch office connectivity more globally.

“Initially viewed as a way to monetize under-utilized spectrum, FWA has grown to become a major tool for connecting homes and businesses with broadband,” said Jeff Heynen, Vice President with the Dell’Oro Group. “What started in the U.S. is now expanding to India, Southeast Asia, Europe, and the Middle East, as mobile operators continue to expand their 5G-based FWA offerings to both residential and enterprise customers,” added Heynen.

Additional highlights from the Fixed Wireless Access Infrastructure and CPE Advanced Research Report:

- Total FWA equipment revenue for the 2023-2027 period have been revised upward by 17 percent, reflecting continued positive subscriber growth in North America and India.

- Long-term subscriber growth is expected to occur in emerging markets in Southeast Asia and MEA, due to upgrades to existing 3G and LTE networks and a need to connect subscribers economically.

- The Satellite Broadband market will also be a key enabler of broadband connectivity in emerging markets as well as rural markets where existing infrastructure either doesn’t exist or is cost-prohibitive to deploy. Subscriber growth will generally come from LEOS-based providers including Starlink, OneWeb, and Project Kuiper.

The Dell’Oro Group Fixed Wireless Access Infrastructure and CPE Report includes 5-year market forecasts for FWA CPE (Residential and Enterprise) and RAN infrastructure, segmented by technology, including 802.11/Other, 4G LTE, CBRS, 5G sub-6GHz, 5G mmWave, and 60GHz technologies. The report also includes regional subscriber forecasts for FWA and satellite broadband technologies, as well as Residential Gateway forecasts for satellite broadband deployments. To purchase this report, please contact us by email at [email protected].

In a related Dell’Oro post, Stefan Pongratz wrote that Dedicated FWA RAN < $1B:

The market opportunity for DSL and fiber replacements or alternative solutions is vast. According to the ITU and Ericsson’s Mobility Report, approximately 35% of the world’s two billion households remain underserved, lacking broadband connectivity. Beyond these unconnected households, FWA technologies can also address the needs of secondary homes and small businesses. With nearly half of 5G operators supporting 5G FWA (GSA), fixed wireless is already a mature technology, boosting both the RAN and the broadband markets.

Despite these advancements, the fundamental economics driving FWA are not expected to shift significantly in 2025. While technological improvements are expanding the TAM, the business case remains constrained by the mobile network’s capacity and the ROI of dedicated FWA RAN deployments. Operators continue refining their targets, but the existing mobile network infrastructure offers the most favorable RAN economics.

Although operators are gradually increasing their investments in dedicated RAN solutions for high-traffic areas, mobile networks are expected to maintain dominance in the near term. According to our latest FWA report, which covers the broader FWA ecosystem—including 3GPP and non-3GPP RAN and devices—dedicated FWA RAN investments are projected to stay below $1 billion in 2025.

…………………………………………………………………………………………………………………

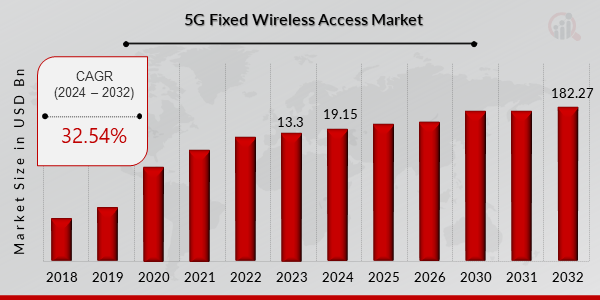

Separately, MRFR says the FWA market will be worth $182.27 Billion by 2032. Here’s a chart of 5G Fixed Wireless Access Market Growth:

FWA Growth Drivers:

Rising Demand for High-Speed Internet: With the increasing reliance on digital infrastructure and applications, there is a surging demand for high-speed and reliable internet connectivity. 5G FWA solutions offer ultra-fast broadband to underserved and remote areas, addressing connectivity gaps effectively.

Growing Adoption of IoT and Advanced Technologies: The proliferation of IoT devices and the need for seamless connectivity are driving the adoption of 5G FWA solutions. Additionally, advancements in mmWave technology enhance bandwidth efficiency, boosting market adoption.

Cost-Effective Alternative to Fiber Networks: 5G FWA provides a cost-efficient and rapid deployment option compared to traditional fiber-based internet, making it an attractive solution for internet service providers and enterprises.

References:

https://www.delloro.com/what-to-expect-from-ran-in-2025/

https://www.marketresearchfuture.com/reports/5g-fixed-wireless-access-market-7561

Latest Ericsson Mobility Report talks up 5G SA networks (?) and FWA (!)

Fiber and Fixed Wireless Access are the fastest growing fixed broadband technologies in the OECD

Ericsson: Over 300 million Fixed Wireless Access (FWA) connections by 2028

Latest Ericsson Mobility Report talks up 5G SA networks and FWA

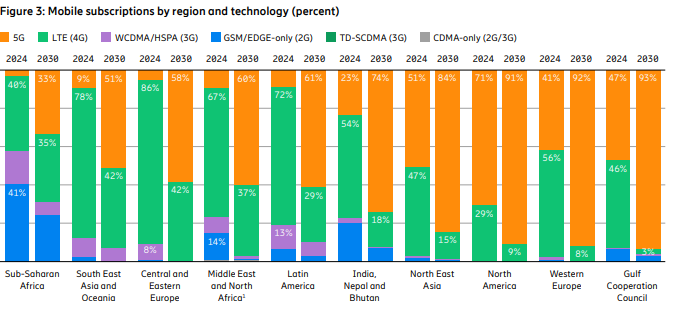

Ericsson’s November 2024 Mobility Report predicts that global 5G standalone (SA) connections will top 3.6 billion by 2030. That compares to 890 million at the end of 2023. Over that same period of time, 5G SA as a proportion of global mobile subscriptions is expected to increase from 10.5% to 38.4%, while average monthly smartphone data consumption will grow to 40 GB from 17.2 GB. By the end of the decade, 80% of total mobile data traffic will be carried by 5G networks.

That rosy forecast is in sharp contrast to the extremely slow and disappointing pace of 5G SA deployments to date. In January, Dell’Oro counted only 12 new 5G SA deployments in 2023, compared to the 18 in 2022. “The biggest surprise for 2023 was the lack of 5G SA deployments by AT&T, Verizon, British Telecom EE, Deutsche Telekom, and other Mobile Network Operators (MNOs) around the globe. As we’ve stated for years, 5G SA is required to realize 5G features like security, network slicing, and MEC to name a few.”

Fifty 5G Standalone enhanced Mobile Broadband (eMBB) networks commercially deployed (2020 – 2023):

The report states, “Although 5G population coverage is growing worldwide, 5G mid-band is only deployed in around 30% of all sites globally outside of mainland China. Further densification is required to harness the full potential of 5G.” Among the report highlights:

- Global 5G subscriptions will reach around 6.3 billion in 2030, equaling 67% of total mobile subscriptions.

- 5G subscriptions will overtake 4G subs in 2027.

- 5G is expected to carry 80% of total mobile data traffic by the end of 2030.

- 5G SA subscriptions are projected to reach around 3.6 billion in 2030.

Source: Ericsson Mobility Report -Nov 2024

“Service differentiation and performance-based opportunities are crucial as our industry evolves,” said Fredrik Jejdling, EVP and head of Ericsson’s networks division. “The shift towards high-performing programmable networks, enabled by openness and cloud, will empower service providers to offer and charge for services based on the value delivered, not merely data volume,” he added.

The Mobility Report provides two case studies in T-Mobile US and Finland’s Elisa – both of which have rolled out network slicing on their 5G SA networks and co-authored that section of the report:

- T-Mobile has been testing a high priority network slice to carry mission-critical data during special events.

- Elisa has configured a slice to support stable, high-capacity throughput for users of its premium fixed-wireless access (FWA) service, called Omakaista.

The Mobility Report doesn’t say if those two telcos are deriving any monetary benefit from network slicing, or more broadly from their 5G SA networks.

……………………………………………………………………………………………………………………………………………………………………………………………………………..

The Fixed Wireless Access (FWA) market has momentum:

- Ericsson predicts FWA connections will reach 159 million this year, up from 131 million in 2023.

- By 2030, connections are expected to hit 350 million, with 80% carried by 5G networks.

- In four out of six regions, 83% or more wireless telcos now offer FWA.

- The number of FWA service providers offering speed-based tariff plans – with downlink and uplink data parameters similar to cable or fiber offerings – has increased from 30% to 43% in the last year alone.

- An updated Ericsson study of retail packages offered by mobile service providers reveals that 79% have a FWA offering.

- There are 131 service providers offering FWA services over 5G, representing 54 percent of all FWA service providers.

- In the past 12 months, Europe has accounted for 73%of all new 5G FWA launches globally.

- Currently, 94% of service providers in the Gulf Cooperation Council region offer 5G FWA services.

- In the U.S. two service providers (T-Mobile US and Verizon) originally set a goal to achieve a combined 11–13 million 5G FWA connections by 2025. After reaching this target ahead of schedule, they have now revised their goal to 20–21 million connections by 2028.

- The market in India is rapidly accelerating, with 5G FWA connections reaching nearly 3 million in just over a year since launch. • An increasing number of service providers are launching FWA based on 5G standalone (SA).

References:

https://www.ericsson.com/en/reports-and-papers/mobility-report/reports/november-2024

https://www.ericsson.com/4ad0df/assets/local/reports-papers/mobility-report/documents/2024/ericsson-mobility-report-november-2024.pdf

5G Advanced offers opportunities for new revenue streams; 3GPP specs for 5G FWA?

FWA a bright spot in otherwise gloomy Internet access market

Where Have You Gone 5G? Midband spectrum, FWA, 2024 decline in CAPEX and RAN revenue

GSA: More 5G SA devices, but commercial 5G SA deployments lag

Vodafone UK report touts benefits of 5G SA for Small Biz; cover for proposed merger with Three UK?

Building and Operating a Cloud Native 5G SA Core Network

Verizon Q2-2024: strong wireless service revenue and broadband subscriber growth, but consumer FWA lags

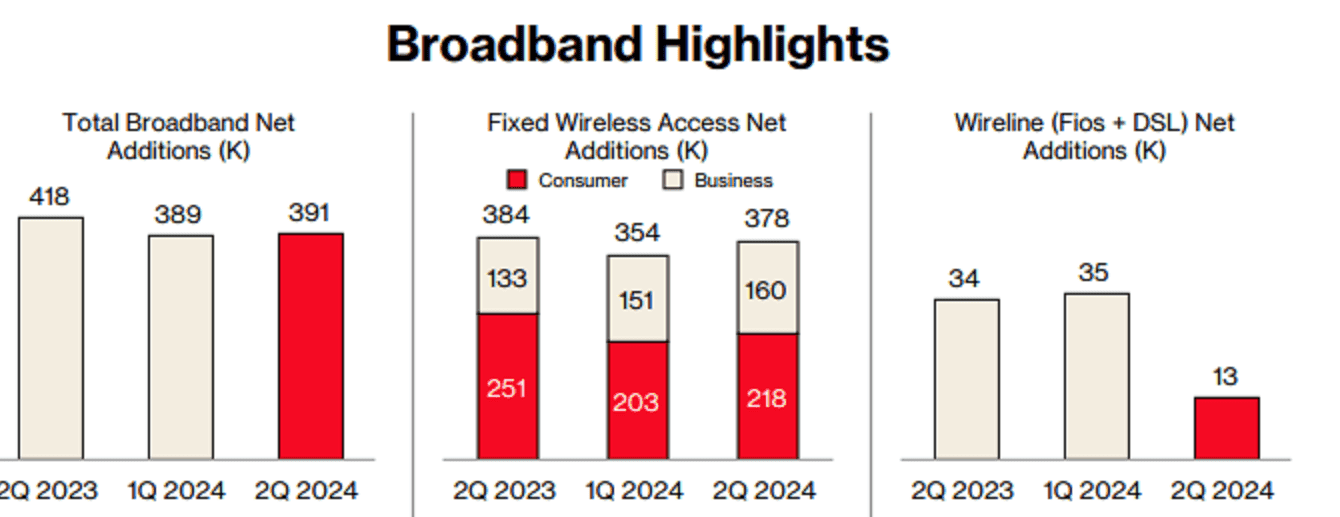

Verizon Communications wireless and wireline subscriber growth expectations in the second quarter beat estimates with 148K postpaid phone net additions vs. 118K expected. There were 391,000 total broadband wireline net additions. The company ended the quarter with 11.5 million broadband subscribers, up 17.2% year over year. However, the telecom company posted lower operating revenue that was below expectations. Earnings mostly matched expectations, but were below the year ago level.

“Demand for the service is strengthening as small businesses and enterprises continue to trust the reliability of the product and the speed and east of deployment,” Verizon CFO Tony Skiadas said on Monday’s earnings call.

- Verizon added 160,000 business Fixed Wireless Access (FWA) subs in 2Q-2024 – a record quarterly gain in the category that was better than the 138,000 expected by analysts. That quarterly intake was up from a gain of 133,000 in the year-ago quarter and improved from a gain of 151,000 in the prior quarter. Verizon ended Q2 with 1.52 million business FWA subs.

- The company added 218,000 residential FWA subs in Q2 2024, down from a gain of 251,000 in the year-ago quarter, but ahead of the 208,000 residential FWA subs added in the prior quarter. Verizon ended the period with 2.29 million residential FWA subs.

A recent OpenSignal study revealed that Verizon’s 5G customers are rarely connected to the 5G network – in range just 7.7% of the time compared to AT&T (11.8%) and T-Mobile (67.9%). Verizon has not come close to adding as many FWA subs as T-Mobile has each quarter, particularly in the residential market.

New Street Research expects Verizon to cross the 4 million FWA subscriber mark in mid-August. In New Street’s follow-up note, analyst Jonathan Chaplin points to a recent estimate from the firm that data consumption among consumer FWA subs could be four to five time greater than business subscribers. On that basis, an estimate of FWA capacity for 4.1 million Verizon subs would really equate to 6.1 million total customers, he wrote.

2Q 2024 Highlights:

Wireless: Accelerated growth in wireless service revenue

- Total wireless service revenue1 of $19.8 billion, a 3.5 percent increase year over year.

- Retail postpaid phone net additions of 148,000, and retail postpaid net additions of 340,000.

- Retail postpaid phone churn of 0.85 percent, and retail postpaid churn of 1.11 percent.

Broadband: Double-digit broadband subscriber growth

- Total broadband net additions of 391,000. This was the eighth consecutive quarter with more than 375,000 broadband net additions.

- Total fixed wireless net additions of 378,000. At the end of second-quarter 2024, the company had a base of more than 3.8 million fixed wireless subscribers, representing an increase of nearly 69 percent year over year.

- 11.5 million total broadband subscribers as of the end of second-quarter 2024, representing a 17.2 percent increase year over year.

- Fixed wireless revenue for second-quarter 2024 was $514 million, up more than $200 million year over year.

Other results and FY 2024 forecast:

- Verizon reported adjusted earnings of $1.15 a share for the quarter, in line with analyst expectations, but a slowdown from last year’s adjusted earnings of $1.21 a share. This was also the lowest earnings per share for a second quarter since 2017.

- Total operating revenue came in at $32.8 billion, 0.6% higher than a year ago, but below estimates of $33.8 billion.

- Total wireless service revenue was $19.8 billion, up 3.5% year over year, driven primarily by growth in Consumer wireless service revenue.

- FY-2024 Outlook: Verizon reiterated a 2.0% – 3.5% wireless service revenue growth. It maintained an adjusted EPS of $4.50 – $4.70 versus consensus of $4.58.

References:

5G Advanced offers opportunities for new revenue streams; 3GPP specs for 5G FWA?

A Mobile World Live webinar on 5G-advanced upgrades identified new opportunities for network operator revenue streams, mostly due to improved network efficiencies and reduced costs. 5G Advanced, the next step in 5G evolution, will be specified in 3GPP Release 18 and 19. There is no work on it in ITU-R which is now focused on IMT-2030 (6G).

Egil Gronstad, T-Mobile senior director-technology development and strategy, said 5G Advanced will present opportunities for new revenue streams: 5G IoT will have lower cost and lower power consumption of endpoint devices (Redcap). Another 5G Advanced capability will be Ambient IoT (coming in Rel 19) which has a lot of opportunities via lower cost and no battery required in IoT devices. A bit further out is Integrated sensing and communications -using the network as a radar system to detect objects of interest. Improved spectrum efficiency will be improved using AI/ML for beam management.

Egil said 3GPP should develop specs for fixed wireless access (FWA). He’s disappointed with 3GPP not pursuing 5G FWA. “We haven’t really done anything in the 3GPP specs to specifically address fixed wireless,” he said. Neither has ITU-R WP 5D, which is responsible for developing all ITU-R recommendations for IMT (3G, 4G, 5G, 6G). FWA was not identified as an ITU use case for 5G and that hasn’t changed with 5G Advanced.

References:

https://www.nokia.com/about-us/newsroom/articles/5g-advanced-explained/

What is 5G Advanced and is it ready for deployment any time soon?

Huawei pushes 5.5G (aka 5G Advanced) but there are no completed 3GPP specs or ITU-R standards!

China Mobile & ZTE use digital twin technology with 5G-Advanced on high-speed railway in China

ZTE and China Telecom unveil 5G-Advanced solution for B2B and B2C services

ABI Research: 5G-Advanced (not yet defined by ITU-R) will include AI/ML and network energy savings

Point Topic: FTTP broadband subs to reach 1.12bn by 2030 in 29 largest markets

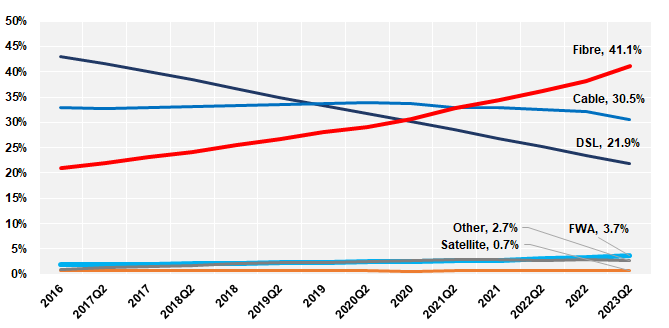

Point Topic forecasts 1.39 billion fixed broadband connections by the end of the decade in the 29 largest broadband markets in the world. Fiber to the Premises (FTTP) is already dominating most of the markets and it will be the preferred option for most consumers, where it is available.

Between 2023 and 2030 Point Topic projects a 15% growth in total fixed broadband subscribers in the top 29 markets. The growth will come mainly from FTTP – although the increase in the total fiber lines will be lower than that in Fixed Wireless Access lines – 25% and 61% respectively, the sheer number of already existing and new FTTP connections will drive the total growth.

Figure 1. Fixed broadband lines by technology (Top 29 markets)

………………………………………………………………………………………………………..

Split by technology we estimate that by 2030 there will be 1.12 billion FTTP, 149 million cable, 79 million FTTX, 16 million FWA[1] and only 28 million DSL lines in these markets.

Figure 2. Change in fixed broadband lines, 2023-2030 (Top 29 markets)

Figure 2. Change in fixed broadband lines, 2023-2030 (Top 29 markets)Cable is a term used as a proxy for those legacy MSOs/cablecos (e.g. Charter, VMO2, Comcast, etc.) that still have significant networks based on coaxial cable, mainly DOCSIS 3.0 and 3.1. We forecast some decline (-6%) in cable broadband lines by the end of the decade as these networks are being replaced with full fibre. The new generation DOCSIS4, which is in development, will match the capabilities of FTTH with XGPON, so markets with established cable networks will see a slight growth or stable take-up figures for ‘cable’ broadband lines.

FTTX (where fibre is present in the local loop with copper, mainly fiber to the cabinet) will decline over the next seven years (-19%). Some modest growth from new subscribers will remain in a few markets where legacy infrastructure is still widespread. Also, it will remain a cheaper option even where other technologies are available as it still offers enough bandwidth for some users.

DSL will see the largest decline at -44%. However, while being a slower and less reliable solution, it can provide enough bandwidth at a low price to some single or older households that are reluctant to upgrade. Besides, some of them will not have a choice of other technologies, especially in certain regions and markets.

………………………………………………………………………………………………………………

Figure 3. Fixed broadband penetration, 2023 and 2030 (top 29 markets)

…………………………………………………………………………………………………………………………

Point Topic only included FWA in its data in significant markets and where it was able to source reliable figures, such at the U.S., Canada, and Italy. Therefore, the total number of FWA subscribers could end up higher if FWA takes off in other markets.

In the U.S., T-Mobile US and Verizon are the FWA leaders with 8.6 million connections between them as of March 2024. T-Mobile recently added a new FWA service offer to its portfolio aimed at customers who might need a back-up for unreliable fiber or cable connections.

……………………………………………………………………………………………………………………..

China will be among the 16 markets with 90%-plus broadband penetration in seven years time. The potential for signing up new customers in those markets will shrink, leaving broadband providers with the task of converting existing customers to higher bandwidths and more advanced technologies for growth.

At the other end of the scale, there is still lots of room for broadband growth. India will have the lowest percentage of premises with a fixed broadband connection by 2030 at 33%, up from just 11% last year.

“There is significant growth to come in the ‘youthful’ markets with low fixed broadband penetration, with plenty of consumers in India, Indonesia and other fast-growing economies hungry for the advantages offered by fixed broadband and full fibre in particular,” Point Topic said.

……………………………………………………………………………………………………………………..

References:

https://www.point-topic.com/post/fttp-broadband-subscriber-forecasts-q4-2023

https://www.telecoms.com/fibre/fibre-to-drive-15-broadband-growth-by-2030

U.S. broadband subscriber growth slowed in 1Q-2024 after net adds in 2023

Dell’Oro: Broadband access equipment sales to increase in 2025 led by XGS-PON deployments

Altice USA transition to fiber access; MoffettNathanson analysis of low population growth on cablecos broadband growth

FWA a bright spot in otherwise gloomy Internet access market

Parks Associates’ newly launched Broadband Market Tracker, states that U.S. Fixed Wireless Access (FWA) adoption from a mobile network operator hit 7.8 million U.S. residential home internet connections in Q1-2024. That’s in comparison to 106.3 million U.S. households that had home internet service at the end of 2023.

Kristen Hanich, director of research at Parks Associates, told Fierce Network FWA and satellite internet are the “fastest growing” segments of the broadband market, “attracting consumers who were previously unserved or underserved by traditional providers.” She noted for the past several years, the FWA base has grown by 700,000 to 900,000 subscribers per quarter while cable connections have declined.

T-Mobile in Q1-2024 passed the 5 million mark for FWA subscribers and Verizon reported a total FWA tally of 3.4 million subscribers. These figures include both residential and business FWA customers.

Key FWA Findings from OpenSignal:

- 5G FWA has reshaped the U.S. broadband market. It has allowed U.S. mobile operators to rapidly expand their broadband footprints for minimal incremental network investment. This has seen 5G FWA absorb all broadband subscriber growth in the market since mid-2022.

- FWA is the secret sauce for 5G monetization. FWA benefits from lower prices compared to wireline competition, access to existing mobile retail channels and subscribers, and the ability to deliver a “good enough” broadband service.

- U.S. mobile networks have proven to be resilient. Despite adding millions of 5G FWA subs since 2021, 5G speeds on T-Mobile and Verizon’s mobile networks have continued to improve. Their success in managing FWA traffic is due to a variety of factors, including plentiful access to mid-band spectrum, localized load management, and differences in peak usage time of day patterns between mobile and FBB usage.

- Elsewhere, there are mixed results. In India, Jio is seeing no discernible impact from FWA on the mobile experience of its users, while in Saudi Arabia Zain is seeing the additional load on its network from FWA having a greater influence on mobile users’ experience, depending on the time of day or the level of FWA penetration.

“Despite adding more than eight million 5G FWA subs using 400+ GB per month of data since Q1 2021, the overall mobile network experience on T-Mobile and Verizon’s mobile networks has not been compromised,” Opensignal analyst Robert Wyrzykowski wrote in the firm’s new assessment of FWA technology.

In its new report, Opensignal found that areas in the U.S. with a larger number of FWA customers actually showed better networking performance than areas with fewer FWA customers. Meaning, Verizon and T-Mobile offered increasingly speedy connections even in geographic locations with higher concentrations of FWA users.

“We would expect low-FWA penetration areas to see better mobile and FWA performance because of less load on the network. However, our data demonstrates the opposite trend,” Wyrzykowski explained.

Other Opensignal findings:

- Around 6% of urban Internet customers subscribe to FWA; in rural areas that figure is 7%.

- Some 74% of FWA customers pay less than $75 per month for their services.

- 35% of FWA customers are between 18-34 years old, whereas that age range is 25% for cable.

Opensignal’s findings provide an important view into the FWA industry in the US as its subscriber growth begins to slow. For example, T-Mobile added 405,000 FWA customers during the first quarter, far less than the 541,000 FWA customers it added during the fourth quarter of 2023.

“5G FWA services have been on a dramatic growth trajectory in the U.S., absorbing all broadband subscriber growth in the market since mid-2022 and amassing more than 600-700 thousand net adds per quarter,” wrote Opensignal’s Wyrzykowski. “This is despite the USA being a mature broadband market with nearly 97% broadband adoption and modest household growth.”

…………………………………………………………………………………………………………….

U.S. cable companies have recorded historic declines in their core Internet businesses amid the growth of FWA in the U.S. Financial analysts at TD Cowen predict the U.S. cable industry will collectively lose more than half a million customers in the second quarter of this year. They attribute that decline to FWA competition as well as other factors including the end of the U.S. government’s Affordable Connectivity Program (ACP).

The situation for cable might get even worse if FWA providers like T-Mobile and Verizon decide to invest further into their fixed wireless businesses.

“The pain for cable may continue for longer than expected as the ability for cable to return to broadband subscriber growth may take longer (if ever),” wrote the TD Cowen analysts in a recent note to investors.

Others agree. For example, the analysts at S&P Global wrote that cable service providers in general have been losing value to wireless network operators despite cable’s efforts to bundle mobile services into cable offerings.

………………………………………………………………………………………………………

Parks’ Hanich said fiber optic access technology is on an upswing and Parks is seeing “excellent growth in the markets where it is available and high customer satisfaction with the customers who have it.”

“But the numbers are not quite as dramatic as what’s been going on with T-Mobile, Verizon and Starlink,” she said, noting the “growing convergence” of satellite and mobile networks is something else to keep an eye on.

Asked whether the demise of the Affordable Connectivity Program has had any impact on Parks’ findings, Hanich said, “we are concerned that the end of the program will result in households and families needing to disconnect from the internet for financial reasons.”

“For a good percentage of Americans, household budgets have been hit by rising inflation and lower-income families especially are having to cut back,” she said. “Thankfully we are seeing ISPs step up, try and transition people onto other plans and initiatives.”

…………………………………………………………………………………………………………….

Separately, Parks found adoption of mobile virtual network operator (MVNO) services reached over 15 million residential customer mobile lines in the quarter. In an MVNO model, broadband operators lease spectrum capacity from a wireless network to stand up their own mobile offering.

NTIA published some findings from its latest Internet Use Survey. Unsurprisingly, internet usage in the U.S. has gone up, with 13 million more people using the internet in 2023 compared to 2021. However, a lot of that usage is coming from lower-income households. Specifically, internet adoption among households making less than $25,000 per year increased from 69% in 2021 to 73% in 2023.

References:

https://www.fierce-network.com/broadband/fixed-wireless-continues-its-climb-among-us-homes-parks

https://www.lightreading.com/fixed-wireless-access/fwa-in-the-usa-getting-ready-for-phase-2

Fiber and Fixed Wireless Access are the fastest growing fixed broadband technologies in the OECD

Summary of Verizon Consumer, FWA & Business Segment 1Q-2024 results

Verizon’s 2023 broadband net additions led by FWA at 375K

AT&T’s fiber business grows along with FWA “Internet Air” in Q4-2023

Ericsson: Over 300 million Fixed Wireless Access (FWA) connections by 2028

Fiber and Fixed Wireless Access are the fastest growing fixed broadband technologies in the OECD

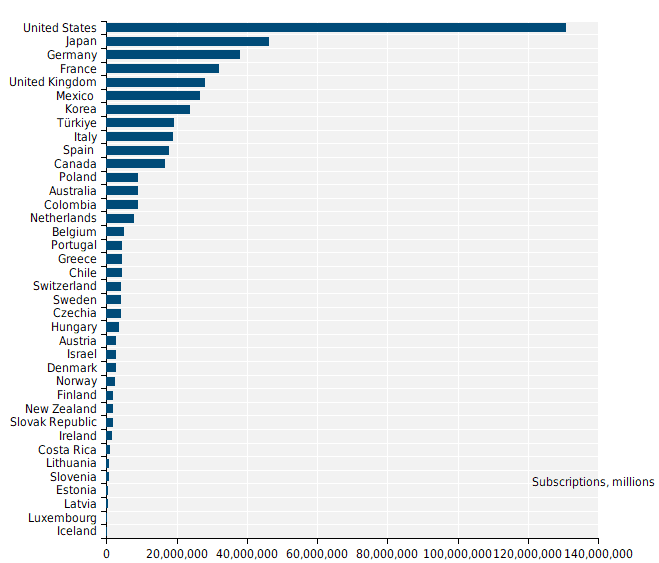

The latest OECD statistics show that Fiber and Fixed Wireless Access (FWA) have seen the strongest growth in fixed broadband technologies in three years. Fibre subscriptions have increased by 56% between June 2020 to June 2023, and FWA subscriptions have increased by 64%. The United States (252%), Estonia (153%), Norway (139%) and Spain (118%) led this FWA growth. The dynamism of fiber and FWA stands in stark contrasts to the decline in DSL (-24%).

Nine OECD countries have more than 70% of fibre connections over total broadband, with Korea, Japan, Iceland, Spain leading the way with the highest fibre penetration rates of 89%, 86%, 85% , and 84%, respectively. The highest fibre growth rates are in Europe, with Austria and Belgium having growth rates of 75% and 73% over the last year, closely followed by Mexico with a growth in fibre of 68%. Two other Latin American countries are in the top 7: Costa Rica and Colombia with fibre growth rates of 42% and 34%, respectively.

Mobile data usage per subscription grew substantially by 28% in one year passing from 10.2 GB to 13 GB per subscription per month in OECD countries as of June 2023. The amount of data consumed in countries vary greatly from 6 GB to 46 GB, with Latvia being the OECD leader.

Despite an already very high mobile broadband penetration in the OECD area, overall mobile subscriptions continue to grow by 4.6% over the last year, which totalled 1.8 billion as of June 2023, up from 1.74 billion a year earlier. Mobile broadband penetration is highest in Japan, Estonia, the United States and Finland, with subscriptions per 100 inhabitants at 200%, 192%, 183% and 161%, respectively.

Eighteen countries were able to provide the number of their 5G subscriptions separately from mobile broadband subscriptions. The share of 5G in total mobile broadband subscriptions is 23% on average for the OECD countries that provided this data.

Machine-to-machine (M2M) SIM cards grew 14% increase in one year. The two leading countries are Sweden with 238 M2M SIM cards per 100 inhabitants and Iceland (203), followed by Austria (179), the Netherlands (93) and Norway (76). Both Sweden and Iceland issue M2M SIM cards for international use.

Total number of fixed broadband subscriptions, by country, millions, June 2023:

……………………………………………………………………………………………………………………….

Kuwait stc/Huawei deploy 5G Redcap FWA in Kuwait; Huawei’s 5G core wins

Kuwait Telecommunications Company – stc [1.], which provides innovative services and platforms to customers that enable digital transformation in Kuwait, announced the Middle East’s first commercial deployment of 5G RedCap Fixed Wireless Access (FWA) using Huawei network equipment. The announcement was made at the second forum of the ELITE FWA Club, held on the sidelines of MWC 2024.

Note 1. stc is Saudi Telecom Group, Kuwait Telecoms parent organization.

The service represents a transformative advancement in high-speed, reliable internet access for both residential and commercial clientele. The forum attracted founding members alongside an array of global telecom leaders and ecosystem stakeholders.

5G RedCap FWA heralds a new era in broadband services, offering users unparalleled, seamless connectivity. It stands out for its ability to provide stable, reliable speeds while ensuring cost-effectiveness. This innovation is achieved through optimized hardware design, which includes extended battery life, reduced power consumption, and improved spectrum efficiency on 5G CPE routers, making high-quality 5G technology accessible at significantly lower costs. Consequently, it not only enhances customer experience but also lowers the barriers to 5G adoption, encouraging the transition from 4G to 5G.

Key features of 5G RedCap FWA service include:

- High-Speed Connectivity: Delivers robust and consistent internet speeds, catering to the digital needs of today’s lifestyle.

- Unmatched Reliability: Ensures a stable and dependable home broadband connection, providing uninterrupted access to online services.

- Innovation Leadership: Demonstrates stc’s dedication to leading innovation in the region, introducing the latest technological breakthroughs to its customers.

Eng. Amer Atoui, Chief Consumer Officer of stc Kuwait, stated, “Launching 5G RedCap FWA ushers in a groundbreaking chapter for internet connectivity in the Middle East. We take pride in being the region’s pioneer, reaffirming our commitment to delivering innovative solutions that enrich our customers’ lives.”

…………………………………………………………………………………………………………

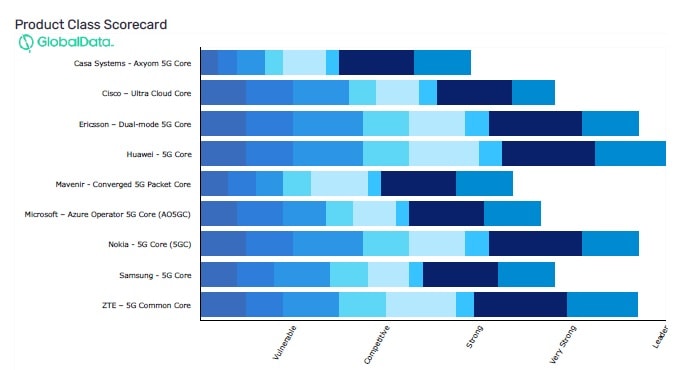

Separately, GlobalData’s “5G Mobile Core: Competitive Landscape Assessment report” rated Huawei 5G Core as a “Leader” in the 5G mobile core network field for the sixth consecutive year. Huawei’s 5G Core was also awarded full scores in all dimensions for the first time. Since the inception of this report in 2018, Huawei is the only vendor to ever get perfect scores in all dimensions.

Source: 5G Mobile Core: Competitive Landscape Assessment, by GlobalData

…………………………………………………………………………………………………………….

The GlobalData report highlights the competitive advantages of Huawei 5G Core products. By leveraging Cloud Native architecture, Huawei 5G Core converges full-range services across the 2G to 5G spectrum, marking an industry first. The solution also stands out with an innovative disaster recovery (DR) architecture for high reliability. And on top of this, Huawei provides professional integration and O&M services with extensive experience. All of the above capabilities have made Huawei 5G Core a market leader in terms of the in-depth and broad commercial use.

References:

Nokia and du (UAE) complete 5G-Advanced RedCap trial; future or RedCap?

Ericsson, Vodafone and Qualcomm: 1st Reduced Capability (RedCap) 5G data call in Europe

https://www.huawei.com/en/news/2024/3/leader-5g-core

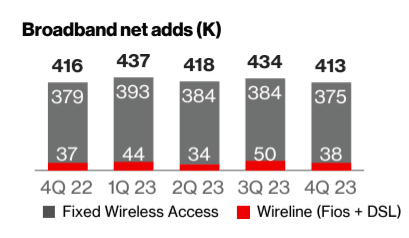

Verizon’s 2023 broadband net additions led by FWA at 375K

At the end of 2023, Verizon’s total broadband base was 10.7 million, with fixed wireless access (FWA) customers making up the bulk of quarterly net additions. For all of 2023, Verizon posted 375,000 net FWA additions, bringing its total fixed wireless subscriber base to over 3 million.

Total broadband net additions were 413,000, compared to 416,000 in Q4 2022. Although Verizon doesn’t post metrics for its DSL customers, overall wireline net adds were 38,000, implying the company lost 17,000 DSL subscribers in the quarter.

In the 4th quarter of 2023, Verizon added 55,000 Fios Internet customers, marking a year-on-year decline of 4,000. Consumer Fios revenue of $2.9 billion increased 1% from Q4 2022, but for the full year was relatively flat at $11.6 billion. Business Fios revenue for the quarter increased 2.6% to $312 million, while jumping 2.8% to $1.2 million for full-year 2023.

CEO Hans Vestberg noted on the earnings call broadband net adds for full-year 2023 totaled more than 1.7 million, “with more than one and a half million from fixed wireless access.” Fios net additions for the year came to 248,000.

Total Broadband:

- Total broadband net additions of 413,000, represented the fifth consecutive quarter that Verizon reported more than 400,000 broadband net additions. Total broadband net additions included 375,000 fixed wireless net additions, bringing the subscriber base to over 3 million. In fourth-quarter 2023, more than 80 percent of Consumer fixed wireless gross additions were in Verizon’s first 76 C-Band markets. Verizon is ahead of schedule to achieve its goal of 4 to 5 million subscribers by the end of 2025.

- 55,000 Fios Internet net additions, down 4,000 from the fourth-quarter 2022.

- 10.7 million total broadband subscribers as of the end of fourth-quarter 2023.

Total Wireless:

- Total wireless postpaid net additions for full-year 2023 increased 26 percent compared to 2022.

- Total wireless service revenue of $19.4 billion, a 3.2 percent increase year over year.

- Retail postpaid phone net additions of 449,000, and retail postpaid net additions of 1,460,000.

- Retail postpaid churn of 1.18 percent, and retail postpaid phone churn of 0.93 percent.

“After delivering continuous improvement throughout 2023, we ended the year strong and continue to pursue the right balance of growth and profitability,” CEO Hans Vestberg said in the 4th quarter earnings statement.

References:

https://www.verizon.com/about/investors/quarterly-reports/4q-2023-earnings-conference-call-webcast