Frontier Communications

Frontier Communications fiber growth accelerates in Q1 2025

Frontier Communications reported record fiber subscriber net adds in Q1-2025. However, the “fiber first” carrier had a loss of $0.26 per share, compared to break-even earnings per share a year ago. The telco posted revenues of $1.51 billion for the quarter ended March 2025, compared to year-ago revenues of $1.46 billion.

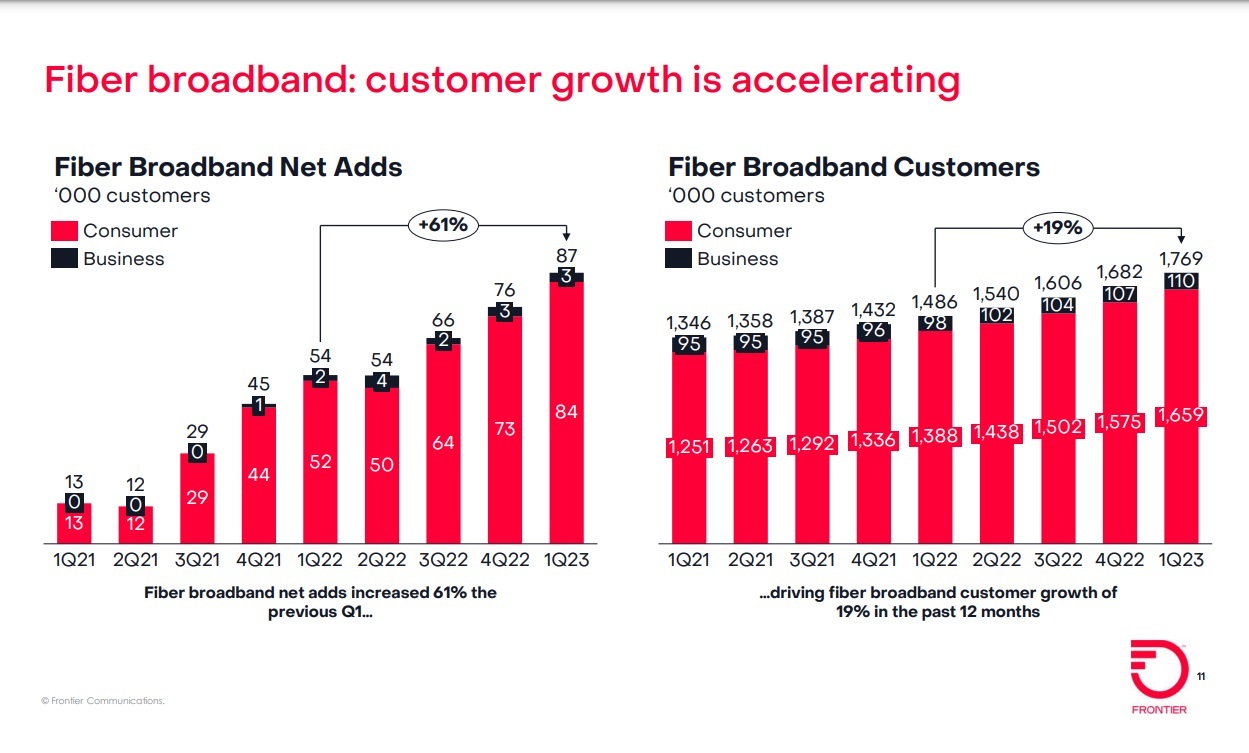

“We had the strongest start to a year yet, led by continued strength in our fiber business,” said Nick Jeffery, President and Chief Executive Officer of Frontier. “Consumers, business owners and technology companies are increasingly relying on fiber to power networks and connect to the digital economy – and that trend is shining through in our results. The team delivered 19% growth in fiber broadband customers and 24% growth in fiber broadband revenues this quarter, which taken together drove record first-quarter growth in both revenue and Adjusted EBITDA.”

Jeffery continued, “We also hit a milestone in the first quarter, growing our fiber network to reach more than 8 million passings. We started this turnaround journey with a goal of 10 million fiber passings and four years later, I’m proud to say that we’re nearly there. As we scale our network, we’re expanding access for millions of Americans and building a legacy that will continue to endure long after our planned combination with Verizon.”

First-Quarter 2025 Highlights

- Added 321,000 fiber passings to reach 8.1 million total locations passed with fiber

- Added 107,000 fiber broadband customers, resulting in fiber broadband customer growth of 19.3% year-over-year

- Consumer fiber broadband ARPU of $68.21 increased 4.7% year-over-year

- Revenue of $1.51 billion increased 3.4% year-over-year as growth in fiber-based products was partly offset by declines in copper-based products

- Operating income of $76 million and net loss of $64 million

- Adjusted EBITDA of $583 million increased 6.6% year-over-year driven by revenue growth and lower content expense, partially offset by higher customer acquisition costs1

- Cash capital expenditures of $757 million plus $16 million of vendor financing payments resulted in total cash capital investment of $773 million2

- Generated net cash from operations of $519 million

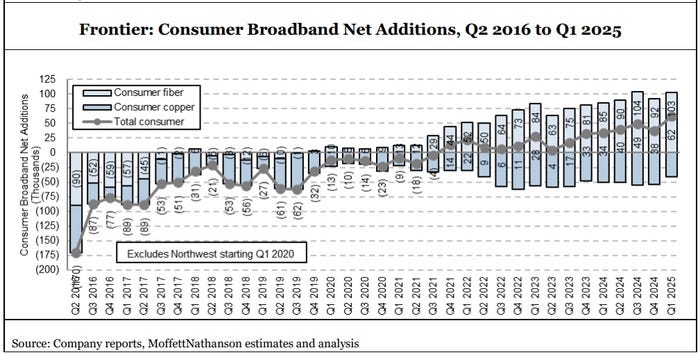

Frontier added 103,000 residential fiber broadband customers in Q1 2025, beating the 95,000 expected by MoffettNathanson (see graph below). Frontier’s residential fiber additions in the quarter were just shy of the record 104,000 it added in Q3-2024. The fiber facilities based carrier gained a record 59,000 net broadband customers in the period, which included losses of legacy copper subscribers.

Frontier built another 321,000 fiber passings in Q1-2025, pushing its total past the 8 million mark. Alongside subscriber growth, Frontier’s consumer fiber broadband average revenue per unit (ARPU) also climbed – to $68.21, up 4.7% versus the year-ago period.

Frontier said the “vast majority” of new fiber subs are now taking multi-gigabit speeds. A specific number wasn’t shared, but back in Q2 2024 more than 60% of new Frontier fiber customers took speeds of 1 Gbit/s or more.

CEO Jeffery said Frontier is sticking with its plan to build fiber to 1.3 million locations in 2025. The current pace puts Frontier on a path to reach its 10 million fiber passing goal around the third quarter of 2026, New Street Research analyst Jonathan Chaplin said in a research note.

Jeffery said Frontier’s “fiber build machine” is capable of going faster, but he stressed that the current pace gives the company the time it needs to also sell, service and support fiber broadband as it builds. “The whole company needs to be in balance. We want more customers and higher ARPU, and we’ve demonstrated that it’s doable,” Jeffery said.

He attributed ARPU growth to multiple factors, including customers taking higher-level speed tiers and subscribing to additional, premium services. Frontier estimates that more than 50% of new customers take some type of add-on, including whole-home Wi-Fi and YouTube TV.

Jeffery said Frontier is seeing good adoption of “Unbreakable Wi-Fi,” a $25 per month add-on that flips to 4G cellular backup (with 130 gigabytes of data per billing cycle) when the primary fiber connection is down. Those customers can also opt for a battery backup that provides up to four hours of backup power.

Frontier’s Q1 results come as it moves ahead with its proposed acquisition by Verizon which is currently expected to close by the first quarter of 2026. Jeffery would only say that the deal process is going smoothly at the state and federal levels.

“My job is now very much to deliver this asset in the best possible shape it can be to its future owner, Verizon,” he said. “I’m delighted to say that that’s really been evident in our first quarter results.”

References:

https://www.businesswire.com/news/home/20250429128668/en/Frontier-Reports-First-Quarter-2025-Results

Verizon to buy Frontier Communications

Frontier Communications recovering from unknown cyberattack!

Building out Frontier Communications fiber network via $1.05 B securitized debt offering

Frontier Communications fiber build-out boom continues: record number of fiber subscribers added in the 1st quarter of 2023

Frontier Communications offers first network-wide symmetrical 5 Gig fiber internet service

Fiber builds propels Frontier Communication’s record 4th Quarter; unveils Fiber Innovation Labs

AT&T to use Frontier’s fiber infrastructure for 4G/5G backhaul in 25 states

Verizon to buy Frontier Communications

Wall Street Journal reported today that Verizon is on the verge of buying Frontier Communications for as much as $7 billion in a deal that would bolster the company’s fiber network to compete with rivals notably AT&T. With a market value of over $7 billion, Dallas, TX based Frontier provides broadband (mostly fiber optic) connections to about three million locations across 25 states. Frontier is in the midst of upgrading its legacy copper landline network to cutting-edge fiber. Rising interest rates sparked fears among investors, however, that the business would run out of cash and not be able to raise more before completing those upgrades. Frontier has a 25-state footprint and serves largely rural areas. It reported sales of $5.8 billion in 2023, with about 52% of total revenue from activities related to its fiber-optic products and bills itself as “largest pure-play fiber internet company in the US.”

An all-cash deal between the two companies could be announced as soon as Thursday, a person familiar with the negotiations told Bloomberg.

Fiber M&A has heated up as telecom companies and financial firms pour capital into neighborhoods that lack high-speed broadband or offer only one internet provider, usually from a cable-TV company. New fiber-optic construction is expensive and time-consuming, making existing broadband providers attractive takeover targets.

Verizon, with a market valuation of around $175 billion, will be under pressure from shareholders to justify any big purchase after the company paid more than $45 billion to secure C-band 5G wireless spectrum licenses and spent billions more to use them. Executives have said they are focused on trimming the telecom giant’s leverage to put it on a firmer financial footing.

Verizon, the top cellphone carrier by subscribers, has faced increased pressure from competitors and from cable-TV companies that offer discounted wireless service backed by Verizon’s own cellular network. Faced with slowing wireless revenue growth and an expensive dividend, Verizon has invested in expanding its home-internet footprint. It has both 5G fixed wireless access (FWA) and its Fios-branded fiber to the premises network.

T-Mobile is the only major U.S. cellphone carrier that lacks a large landline business. Since its 2020 takeover of rival carrier Sprint, the company has focused on 5G dominance and succeeded in growing its cellphone business faster than rivals. That network has also linked millions of customers to its fixed 5G broadband service, which offers cablelike service over the air. T-Mobile’s strategy has shifted in recent months, however, as the company dabbles in partnerships and wholesale leasing agreements with companies that build fiber lines to homes and businesses. The wireless “un-carrier” in July agreed to spend about $4.9 billion through a joint venture with private-equity giant KKR to buy Metronet, a Midwestern broadband provider.

Photo Credit: Jeenah Moon/Bloomberg News

…………………………………………………………………………………………………………………………………………………………

A deal for Frontier would be a round trip of sorts for some of the network infrastructure that Frontier bought from Verizon in 2016 for $10.54 billion in cash. Frontier later filed for Chapter 11 bankruptcy in April 2020 as it burned through cash and was burdened by a heavy debt load. It emerged as a leaner business in 2021 with about $11 billion less debt and focused on building a next-generation fiber optic network.

Frontier’s biggest investors today include private-equity firms Ares Management and Cerberus Capital Management. The company drew the attention of activist Jana Partners last year, which built a stake in the business. Jana delivered a letter to Frontier’s board late last year asking the company to take steps immediately to help reverse its sinking share price, including a possible outright sale.

…………………………………………………………………………………………………………………………………………………………..

AT&T has focused on expanding its fiber network since spinning off its WarnerMedia assets in 2022 to Warner Brothers Discovery. AT&T has 27.8 million fiber homes/businesses passed, growing at ~2.4 million per year, plus more locations passed via its Gigapower joint venture. AT&T’s fiber internet business is expected to contribute to an increase in consumer broadband and wireline revenue. AT&T expects broadband revenue to increase by at least 7% in 2024, which is more than double the rate of growth for wireless service revenue. In contrast, Verizon only has about 18 million fiber locations, growing at about 500,000 per year.

Other recent deals in the fiber transport market sector include the $3.1 billion acquisition, including debt, of fiber provider Consolidated Communications in late 2023 by Searchlight Capital Partners and British Columbia Investment Management.

………………………………………………………………………………………………………………………………………………………….

It’s All About Convergence (fiber based home internet combined with mobile service):

Speaking at a Bank of America investors conference today, Verizon’s CEO for the Consumer Group Sowmyanarayan Sampath said when Verizon bundles Fios with wireless, it sees a 50% reduction in mobile churn and a 40% reduction in broadband churn. He said they don’t see the same benefits with FWA. Sampath was scheduled to speak at the Mobile Future Forward conference tomorrow, but he canceled at the last minute, which may be a sign that this deal for Frontier is imminent.

The analysts at New Street Research led by Jonathan Chaplin said Verizon’s rationale for the purchase is “convergence baby.” They wrote, wrote, “Verizon seemed complacent. No longer.” Indeed, Verizon CEO Hans Vestberg was challenged on the company’s second quarter 2024 earnings call by analysts who questioned whether Verizon had a big enough fiber footprint to compete in the future. The New Street analysts said Sampath’s comments today “marked a shift in rhetoric from: ‘convergence is important, but we can do it with FWA.”

The analysts at New Street wrote today, “We have been arguing for a couple of years that all the fiber assets would eventually be rolled up into the three big national carriers (AT&T, Verizon, T-Mobile). We always knew that if one carrier started the process, others would have to follow swiftly because there are three wireless carriers and only one fiber asset in every market with a fiber asset.”

Other potential fiber companies that the big three national carriers might be eyeing include Google Fiber, Windstream, Stealth Communications and TDS Telecom.

After its annual summer conference in August in Boulder, Colorado, the analysts at TD Cowen, led by Michael Elias, said there was a lot of conversation about the wireline-wireless “convergence” frenzy. “We believe convergence is a race to the bottom, but if one player is going in with a slight advantage (AT&T), the others must reluctantly follow,” wrote TD Cowen. In the mid-term they speculated that T-Mobile might look at fiber roll-ups with Ziply or Lumen (formerly or other regional players.

References:

https://www.wsj.com/business/deals/verizon-nearing-deal-for-frontier-communications-9e402bb4

https://www.fierce-network.com/broadband/verizon-rumored-buy-frontier-its-convergence-game

https://finance.yahoo.com/news/verizon-talks-buy-frontier-communications-180419091.html

https://videos.frontier.com/detail/videos/internet/video/6322692427112/why-fiber

Building out Frontier Communications fiber network via $1.05 B securitized debt offering

Fiber builds propels Frontier Communication’s record 4th Quarter; unveils Fiber Innovation Labs

Frontier Communications fiber build-out boom continues: record number of fiber subscribers added in the 1st quarter of 2023

Frontier’s Big Fiber Build-Out Continued in Q3-2022 with 351,000 fiber optic premises added

AT&T and BlackRock’s Gigapower fiber JV may alter the U.S. broadband landscape

AT&T Highlights: 5G mid-band spectrum, AT&T Fiber, Gigapower joint venture with BlackRock/disaggregation traffic milestone

AT&T to use Frontier’s fiber infrastructure for 4G/5G backhaul in 25 states

Frontier Communications offers first network-wide symmetrical 5 Gig fiber internet service

Frontier Communications adds record fiber broadband customers in Q4 2022

Verizon Q2-2024: strong wireless service revenue and broadband subscriber growth, but consumer FWA lags

Summary of Verizon Consumer, FWA & Business Segment 1Q-2024 results

Frontier Communications recovering from unknown cyberattack!

Frontier Communications provides fiber optic based gigabit Internet access to millions of consumers and businesses across 25 states. Frontier Communications said on Thursday that it’s ‘experiencing technical issues with our internal support platforms.’ Frontier’s mobile apps are also down, with the same warning message being displayed after launching the application. A company representative did not respond to questions about the situation.

The Texas-based telecommunications company reported a cyberattack to the Securities and Exchange Commission (SEC) on Thursday. Frontier said it detected unauthorized access to its IT systems on April 14th and began instituting “containment measures” that included “shutting down certain of the Company’s systems.” The shutdowns caused operational disruption that the company said “could be considered material.”

“Based on the Company’s investigation, it has determined that the third party was likely a cybercrime group, which gained access to, among other information, personally identifiable information,” the company said in the SEC filing.

“As of the date of this filing, the Company believes it has contained the incident and has restored its core information technology environment and is in the process of restoring normal business operations. Based on the company’s investigation, it has determined that the third party was likely a cybercrime group, which gained access to, among other information, personally identifiable information,” the company said.

Investigations into the incident are ongoing and they have hired cybersecurity experts to help with the incident. Law enforcement agencies have been notified.

Despite saying that the shutdowns could be considered material, Frontier later wrote that it “does not believe the incident is reasonably likely to materially impact the Company’s financial condition or results of operations.”

According to Leichtman Research Group, Frontier is the seventh largest broadband Internet supplier in the US, with almost 3 million customers. The company’s copper and fiber network stretches across large portions of the East and West Coasts.

Light Reading reported on Thursday of warnings from Frontier. “We’re experiencing technical issues with our internal support platforms,” said a message on the company’s website homepage. “Our residential and business networks are not affected by this issue. In the meantime, please call for assistance.”

……………………………………………………………………………………………………………………………

Last week, AT&T reported that more than 51 million people were affected by a recently-disclosed data breach that included troves of customer information including Social Security numbers, AT&T account numbers and AT&T passcodes.

EchoStar’s Dish Network last year reported a “cybersecurity incident” that impacted its ability to install services, take payments and provide customer care for several weeks.

Fierce reported this week about an intentional cable cut in AT&T’s network that interrupted services at Sacramento Airport.

……………………………………………………………………………………………………………………..

The Federal Communications Commission (FCC) updated its data breach rules for the first time in 16 years in December, expanding regulations on how telecommunication companies report cybersecurity incidents. FCC Chairwoman Jessica Rosenworcel argued that the rules the agency created more than 15 years ago are no longer compatible with a modern world where telecommunication carriers have access to a “treasure trove of data about who we are, where we have traveled, and who we have talked to.”

References:

https://therecord.media/telecom-giant-frontier-cyberattack-sec

https://www.sec.gov/ix?doc=/Archives/edgar/data/20520/000119312524100764/d784189d8k.htm

https://www.lightreading.com/security/frontier-we-were-probably-hacked

Building out Frontier Communications fiber network via $1.05 B securitized debt offering

Frontier Communications has nearly three million broadband internet subscribers across 25 states, on a network that reaches about 5.5 million homes and businesses via fiber and another 10 million via copper. About a third of Frontier’s potential fiber customers subscribe, three times the rate of those on copper lines. Frontier built fiber to an additional 339,000 locations in Q1 2023, ending the quarter with 5.5 million fiber passings and 15.4 million total passings. The company also added a record 87,000 fiber subs in the period, extending that customer total to 1.76 million (1.65 million residential and 110,000 business customers).

However, building out its fiber network will cost more than Frontier’s management forecast when the company emerged from bankruptcy in early 2021. Its latest two million locations cost an average of $830 to deploy. In May, management said it expects the remainder of this year’s build to cost between $1,000 and $1,100 per location. It costs Frontier another $600 or so to send a technician to a customer’s home to plug in all the necessary equipment and the like.

Light Reading reports that Vikash Harlalka, telecom analyst at New Street Research, estimates that Frontier’s fiber buildout plan faces a funding gap of about $2.3 billion. However, Frontier Communications’ plan to offer $1.05 billion in securitized debt, with the potential to upsize it, will significantly cut down the company’s funding gap to build fiber to 10 million locations by 2025. The company said:

An indirect subsidiary of the Company intends to offer approximately $1.05 billion aggregate principal amount of secured fiber network revenue term notes (the “Notes”), with the potential to upsize, subject to market conditions and other factors. The Notes will be secured by certain of Frontier’s fiber assets and associated customer contracts in the Dallas metropolitan area and constitute the first offering of green bonds by a Frontier subsidiary.

“The offering should close nearly half the gap (more than half, if the offering is upsized. It takes most of the funding risk off the table,” Harlalka explained in a research note, adding that the move also unlocks a new market for Frontier to tap into for its funding needs. Harlalka noted that Frontier had about $2.7 billion in liquidity at the end of the first quarter of 2023 – enough to meet the company’s capital needs until mid-2024. “This new debt raise should extend that beyond 2024,” he added.

Frontier said the debt offer will be secured by a portion of the company’s fiber assets and associated customer contracts in the Dallas metropolitan area, and marks the first offering of “green bonds” by a Frontier subsidiary. The offer will go toward capital expenditures and research and development, “in line with Frontier’s fiber expansion and copper migration strategies,” the company said.

Last week, Frontier stock dropped 21.3% after The Wall Street Journal reported on potential health risks posed by lead-sheathed copper wires in old networks across the U.S. Frontier declined to comment. The stock decline continued on Monday July 17th with FYBR hitting a low of $11.65 on huge volume of 12,063,100 shares. It rebounded 43.95% in the next four trading days to close at $16.77 on Friday July 21st (albeit on very light volume).

New Street analyst Jonathan Chaplin estimates that remediation costs to Frontier could reach $6 billion if it is required to rip out all the lead-covered copper on its own dime within five years. But there’s overlap with upgrading those same lines to fiber, and Chaplin calculates a $75 fair value for the stock in this unlikely scenario. “Even if it comes to pass, we see upside to the stock,” he writes.

Frontier is scheduled to announce Q2 2023 results on Friday, August 4th.

References:

https://www.barrons.com/articles/buy-frontier-communications-stock-price-pick-a2f82599

Frontier Communications fiber build-out boom continues: record number of fiber subscribers added in the 1st quarter of 2023

Fiber builds propels Frontier Communication’s record 4th Quarter; unveils Fiber Innovation Labs

AT&T to use Frontier’s fiber infrastructure for 4G/5G backhaul in 25 states

Frontier Communications offers first network-wide symmetrical 5 Gig fiber internet service

Frontier Communications adds record fiber broadband customers in Q4 2022

Frontier Communications fiber build-out boom continues: record number of fiber subscribers added in the 1st quarter of 2023

Frontier Communications added record number of fiber broadband customers in the 1st quarter of 2023. The fiber facility based network operator added 87,000 fiber subscribers (including 83,000 residential subs) in the first quarter of 2023, up from +54,000 in the year-ago quarter. Those results beat the 76,000 residential fiber subs Frontier was expected to add in the period. Frontier ended the quarter with 1.76 million fiber customers: 1.65 million residential subscribers and 110,000 business customers.

“We delivered another strong quarter and reached a critical milestone in our transformation. Thanks to our team’s consistent operational performance, we achieved EBITDA growth for the first time in five years,” said Nick Jeffery, President and Chief Executive Officer of Frontier.

“We are creating an internet company that people love. Over the last two years, we have rallied around our purpose of Building Gigabit America, invested in fiber, enhanced our product, put the customer at the center of everything we do and made it easier to do business with us. We are quickly becoming an agile, digital infrastructure company, and I’m confident we will return to growth this year.”

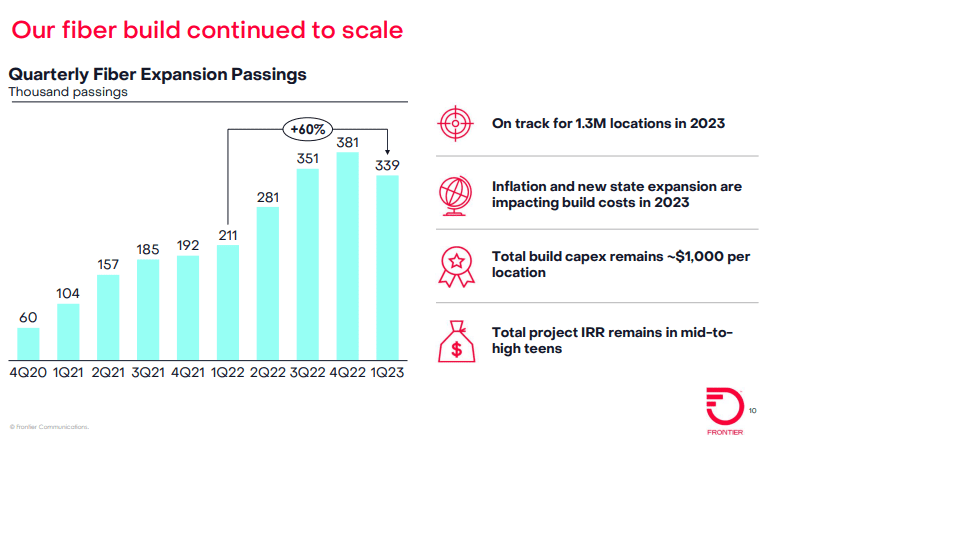

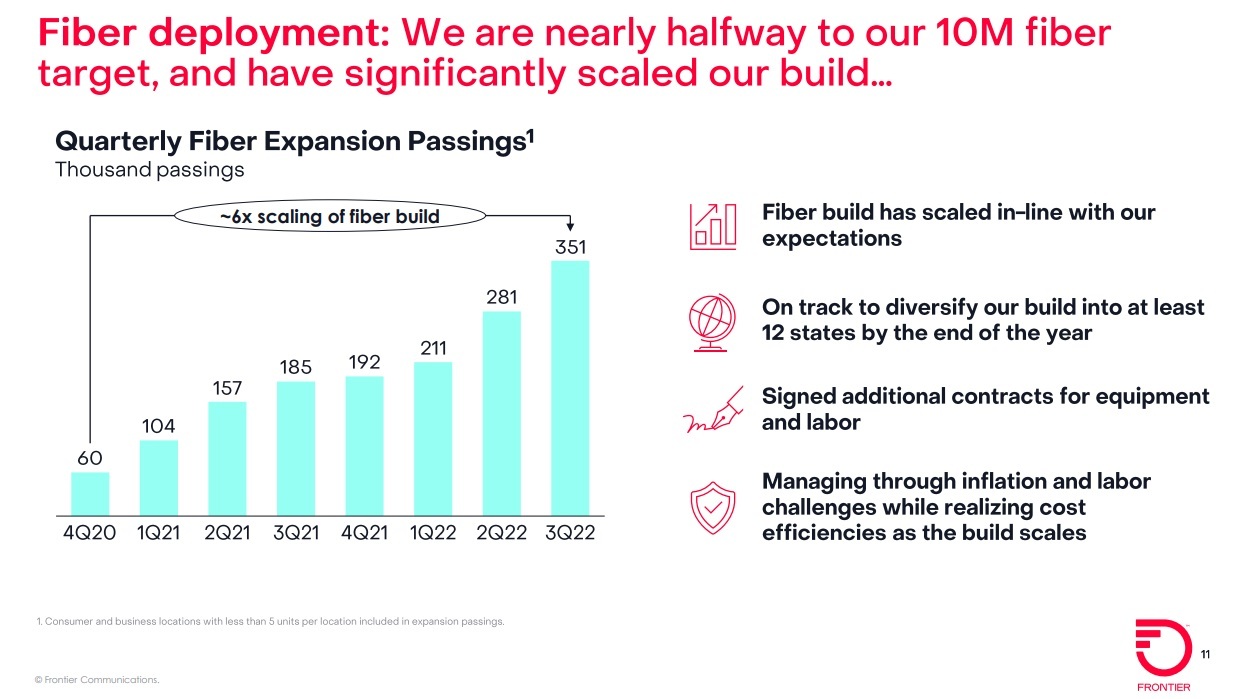

Frontier said it built fiber to an additional 339,000 locations in Q1 2023, up 60% from the 211,000 it built in the year-ago period. Frontier’s Q1 buildout was better than the 300,000 locations expected by the analysts at New Street Research. Frontier ended the quarter with 5.5 million fiber passings and 15.4 million total passings.

First-Quarter 2023 Consolidated Financial Results:

• Revenue of $1.44 billion decreased 0.5% from the first quarter of 2022 as growth in consumer, business and wholesale fiber was more than offset by declines in legacy copper

• Operating income was $143 million and net income was $3 million

• Adjusted EBITDA of $519 million increased 2.0% over the first quarter of 2022 as revenue declines were more than offset by lower content, selling, general and administrative expenses, and cost-saving initiatives

• Adjusted EBITDA margin of 36.0% increased from 35.2% in the first quarter of 2022

• Capital expenditures of $1.15 billion increased from $0.45 billion in the first quarter of 2022 as fiber expansion initiatives accelerated First-Quarter 2023

Consumer Results:

• Consumer revenue of $761 million decreased 1.9% from the first quarter of 2022 as strong growth in fiber broadband was more than offset by declines in legacy copper broadband and voice

• Consumer fiber revenue of $448 million increased 10.1% over the first quarter of 2022 as growth in consumer broadband, voice, and other more than offset declines in video

• Consumer fiber broadband revenue of $298 million increased 17.3% over the first quarter of 2022 driven by growth in fiber broadband customers

• Consumer fiber broadband customer net additions of 84,000 resulted in consumer fiber broadband customer growth of 19.5% from the first quarter of 2022

• Consumer fiber broadband customer churn of 1.20% was roughly flat with churn of 1.19% in the first quarter of 2022

• Consumer fiber broadband ARPU of $61.44 decreased 1.1% from the first quarter of 2022 driven primarily by the autopay and gift-card incentives introduced in the third quarter of 2021 First-Quarter 2023

Business and Wholesale Results:

• Business and wholesale revenue of $657 million decreased 1.4% from the first quarter of 2022 as growth in fiber was more than offset by declines in copper

• Business and wholesale fiber revenue of $281 million increased 6.0% over the first quarter of 2022 as growth in business was partly offset by modest declines in wholesale

• Business fiber broadband customer churn of 1.45% increased from 1.24% in the first quarter of 2022

• Business fiber broadband ARPU of $104.38 decreased 1.2% from the first quarter of 2022

………………………………………………………………………………………………………………………………..

While Frontier’s fiber growth engine continues to hum along, the company is dealing with higher costs related to its fiber initiative. The company raised its 2023 capex guidance to a range of $3 billion to $3.2 billion, up from an original outlook of $2.8 billion.

Frontier blamed the increase on a couple of factors – a decision to build inventory opportunistically where it saw supply chains ease a bit in the quarter and higher build costs as it scales its build into new geographies. Frontier is also seeing higher labor costs being driven by general inflation and higher rates as some of its multi-year labor contracts come up for renewal.

The anticipated increase in capex this year concerned investors. Frontier shares were down $2.33 (-10.94%) to $19.13 each in Friday morning trading.

Overall, Frontier expects fiber build costs in 2023 to be in the range of $1,000 to $1,100. But it’s confident that total project build costs will remain at about $1,000 per location as it mixes in lower-cost locations in some new-build states and benefits from aerial builds and an increased focus on multiple dwelling units (MDUs), Frontier CFO Scott Beasley said on Friday’s earnings call.

The current capex picture isn’t expected to impact Frontier’s overall fiber buildout/upgrade plan. “We’re confident that the 10 million locations is still attractive to build out,” Beasley said. Frontier is also continuing to explore an additional 1 million to 2 million additional fiber passings beyond the original 10 million target.

Frontier says it’s too early to tell how this year’s cost headwinds might impact future opportunities coming by way of the $42.5 billion Broadband Equity, Access and Deployment (BEAD) program. New Street Research estimates that there are 1.2 million BEAD-eligible locations in Frontier’s footprint. New Street Research expects ARPU pressure at Frontier to ease in the second quarter of the year and return to growth in the third quarter.

Frontier recently initiated several consumer pricing changes for value-added services that were previously free. Whole-home Wi-Fi, for example, now costs $10 per month, its Home Shield Elite product is now $6 per month extra and the company is now charging $50 for professional installs. Those actions are driving new fiber customer monthly ARPU to a range of $65 to $70, the company said.

Frontier is also speeding up its original cost savings target to $500 million by the end of 2024. Its prior target was $400 million by the end of 2024. Frontier is approaching that target through a range of streamlining and simplification initiatives, including improved field operations, self-service capabilities, the consolidation of call centers and an ongoing reduction in copper infrastructure.

Frontier’s guidance for the full year 2023:

• Adjusted EBITDA of $2.11 – $2.16 billion, unchanged from prior guidance

• Fiber build of 1.3 million new locations, unchanged from prior guidance

• Cash capital expenditures of $3.00 – $3.20 billion, an increase from prior guidance of $2.80 billion, reflecting higher inventory levels and fiber build costs

• Cash taxes of approximately $20 million, unchanged from prior guidance

• Net cash interest payments of approximately $655 million, an increase from prior guidance of $630 million, reflecting the $750 million of debt raised in March 2023

• Pension and OPEB expense of approximately $50 million (net of capitalization), unchanged from prior guidance

• Cash pension and OPEB contributions of approximately $125 million, unchanged from prior guidance

References:

Fiber builds propels Frontier Communication’s record 4th Quarter; unveils Fiber Innovation Labs

AT&T to use Frontier’s fiber infrastructure for 4G/5G backhaul in 25 states

Frontier Communications offers first network-wide symmetrical 5 Gig fiber internet service

Frontier Communications adds record fiber broadband customers in Q4 2022

Frontier’s Big Fiber Build-Out Continued in Q3-2022 with 351,000 fiber optic premises added

Frontier Communications sets another fiber buildout record; raises FTTP buildout target for 2022

“Fiber is the future” at Frontier, which added a record 54K fiber broadband customers in 1Q-2022

Frontier’s FTTP to reach 10M locations by 2025; +192,000 FTTP passings in 4Q-2021

Frontier Communications reports added 45,000 fiber broadband subscribers in 4Q-2021 – best in 5 years!

Fiber builds propels Frontier Communication’s record 4th Quarter; unveils Fiber Innovation Labs

Frontier Communications Parent, Inc. (“Frontier”) reported impressive 4th quarter and full-year 2022 results today. The fiber facilities based carrier added a record 76,000 fiber subs in the last quarter, more than two times what it added in the year-ago quarter. The bulk of those fiber subscriber gains are coming from cable competitors, execs said.

Frontier ended 2022 with 1.7 million fiber customers, a figure that represents the majority of its total base of 2.8 million broadband subs. Frontier also built out a record 381,000 new fiber locations in Q4, ending 2022 with 5.2 million fiber locations. That gets Frontier past the halfway point toward a goal of building fiber-to-the-premises to 10 million locations by 2025.

Total revenues were down year-over-year, but consumer fiber revenues rose 7.7% to $436 million versus the prior year period, offsetting declines in video. Consumer fiber broadband revenues surged 15.5%, to $283 million.

“We ended the year strong with another quarter of record operational results. We now have the fiber engine we need to power our growing digital infrastructure business. This is how we advance our purpose of Building Gigabit America,” said Nick Jeffery, President and Chief Executive Officer of Frontier.

“This year, we will accelerate our fiber build and give customers more reasons to choose the un-cable provider. The team is fired up and ready to return to growth in 2023.”

Frontier expects to accelerate its fiber build to 1.3 million homes in 2023 – about 20% faster than its 2022 pace – and end the year with 6.5 million fiber locations. Frontier is also exploring fiber builds beyond its initial goal of 10 million. The company has identified 1 million to 2 million copper locations where it can upgrade to fiber cost-effectively. There’s another 3 million to 4 million locations in its footprint that remain financially unattractive but could get over the hump with government subsidies or partnerships.

Even with its faster build pace, Frontier expects 2023 capital expenditures to reach $2.8 billion, essentially flat versus 2022’s $2.74 billion. Frontier anticipates its fiber buildout costs will stay in its envelope of $900 to $1,000 per location passed.

Frontier believes it’s set to grow its average revenue per user (ARPU) by 2% to 3% in 2023. Tied in, it’s updating its pricing and looking to upsell customers to higher speeds (more than half of new subs are choosing speeds of 1-Gig or more) while also reducing its reliance on perks such as gift cards.

Source: Frontier Q4 2022 earnings presentation

……………………………………………………………………………………………………………………………………………………………………

On the wholesale side, Frontier has fiber tower deals with AT&T, Verizon and T-Mobile and recently inked an expanded deal with AT&T to connect it to Frontier’s central offices. Company President and CEO Nick Jeffery suggested that the same model could apply to the likes of Amazon, Microsoft and other cloud companies that are distributing data and could make use of cache locations where data is being consumed.

But that handwork with wireless network operators has yet to drive Frontier toward deals that could enable it to add mobile services to the bundle, and follow the path being taken by major cable operators such as Comcast and Charter Communications.

Jeffery reiterated a position that Frontier is keeping close watch on potential MVNO partnerships but that no such agreement is imminent. Such a deal could be a “distraction of our capital,” he said.

“For the moment, we don’t see the need to launch with an MVNO and bundle with our core broadband offer,” Jeffery explained. “We think it’s something we could spin up relatively quickly and efficiently if we needed to.”

Full-Year 2022 Highlights:

- Built fiber to 1.2 million locations, bringing total fiber passings to 5.2 million by the end of 2022 – more than halfway to our target of 10 million fiber locations.

- Added a record 250,000 fiber broadband customer net additions, resulting in fiber broadband customer growth of 17.5% from 2021.

- Revenue of $5.79 billion, net income of $441 million, and Adjusted EBITDA of $2.08 billion.

- Capital expenditures of $2.74 billion, including $1.52 billion of non-subsidy-related build capital expenditures and $0.06 billion of subsidy-related build capital expenditures.

- Surpassed our $250 million gross annualized cost savings target more than one year ahead of plan and raised our target to $400 million by the end of 2024.

4th-Quarter 2022 Highlights:

- Built fiber to a record 381,000 locations

- Added a record 76,000 fiber broadband customers

- Revenue of $1.44 billion, net income of $155 million, and Adjusted EBITDA of $528 million

- Capital expenditures of $878 million, including $517 million of non-subsidy-related build capital expenditures and $33 million of subsidy-related build capital expenditures

- Net cash from operations of $360 million, driven by strong operating performance and increased focus on working capital management

- Achieved annualized run-rate cost savings of $336 million

4th-Quarter 2022 Consolidated Financial Results:

- Frontier reported revenue for the quarter ended December 31, 2022, of $1.44 billion, a 6.9% decline compared with the quarter ended December 31, 2021, as growth in consumer, business and wholesale fiber was more than offset by declines in copper and subsidy.

- Revenue growth was negatively impacted by the expiration of CAF II funding at the end of the fourth quarter of 2021.

- Excluding subsidy-related revenue, revenue for the quarter ended December 31, 2022, declined 2.5% compared with the quarter ended December 31, 2021, an improvement in the year-over-year rate of decline reported for the quarter ended September 30, 2022.

- Fourth-quarter 2022 operating income was $136 million and net income was $155 million.

- Capital expenditures were $878 million, an increase from $559 million in the fourth quarter of 2021, as fiber expansion initiatives accelerated.

4th-Quarter 2022 Consumer Results:

- Consumer revenue of $764 million declined 2.3% from the fourth quarter of 2021, as strong growth in fiber broadband was more than offset by declines in legacy video and voice.

- Consumer fiber revenue of $436 million increased 7.7% over the fourth quarter of 2021, as growth in consumer broadband, voice, and other more than offset declines in video.

- Consumer fiber broadband revenue of $283 million increased 15.5% over the fourth quarter of 2021, driven by growth in fiber broadband customers.

- Consumer fiber broadband customer net additions of 73,000 resulted in consumer fiber broadband customer growth of 17.9% from the fourth quarter of 2021.

- Consumer fiber broadband customer churn of 1.32% was flat with the fourth quarter of 2021.

- Consumer fiber broadband ARPU of $61.20 declined 1.6% from the fourth quarter of 2021, as price increases and speed upgrades were more than offset by the autopay and gift-card incentives introduced in the third quarter of 2021.

- Excluding the impact of gift-card incentives, consumer fiber broadband ARPU increased 0.9% over the fourth quarter of 2021.

4th-Quarter 2022 Business and Wholesale Results:

- Business and wholesale revenue of $659 million declined 2.6% from the fourth quarter of 2021, as growth in our fiber footprint was more than offset by declines in our copper footprint.

- Business and wholesale fiber revenue of $285 million increased 5.5% over the fourth quarter of 2021, driven by growth in both business and wholesale.

- Business fiber broadband customer churn of 1.33% increased from 1.23% in the fourth quarter of 2021.

- Business fiber broadband ARPU of $107.68 increased 0.8% from the fourth quarter of 2021.

…………………………………………………………………………………………………………………………………………………..

Separately, Frontier introduced its Fiber Innovation Labs yesterday – National Innovation Day – designed for inventing and testing new patents, technologies and processes that will advance its fiber-optic network. Improving the customer experience and driving efficiencies are key to accelerating Frontier’s fiber-first strategy. Frontier’s labs serve as a testing ground to find new technologies and procedures to advance the way it delivers blazing-fast fiber internet to consumers and businesses across the country.

“The work we are doing in our Fiber Innovation Labs will change the way we serve our customers and will ultimately change the industry,” said Veronica Bloodworth, Frontier’s Chief Network Officer. “We have the best team in the business – they live and breathe innovation. They have been awarded several patents and are in the process of bringing those new inventions to life to deliver the best ‘un-cable’ internet experience to our customers. Be prepared to be amazed.”

As part of Frontier’s Fiber Innovation Labs, the company has launched its first-ever outside plant facility in Lewisville, Texas. The facility is designed as a miniature suburban neighborhood that mimics the real-life experiences of its techs serving customers every day. It features roads, sidewalks, a state-of-the-art central office, a small house and a reconstructed manhole system. It also simulates weather elements and temperature changes. Here, the Frontier team can test and learn new methods in real-world environments to install and maintain its fiber-optic network.

References:

AT&T to use Frontier’s fiber infrastructure for 4G/5G backhaul in 25 states

\

AT&T to use Frontier’s fiber infrastructure for 4G/5G backhaul in 25 states

Frontier Communications and AT&T today announced a deal that will enable AT&T cell towers to connect to Frontier’s ultra-fast fiber network. Specifically, AT&T will use Frontier’s fiber infrastructure [1.] in areas where AT&T doesn’t currently own fiber. This will improve the resiliency, reliability and speed of the wireless service that AT&T offers to its customers. AT&T is the first tenant to rent space in Frontier’s hyper-local offices and will utilize Frontier’s fiber-optic network to connect with its cell towers that are in Frontier’s network.

Note 1. Frontier’s fiber network is available in 25 states.

Frontier’s footprint is complementary to AT&T’s existing network, which will help accelerate the company’s 5G deployment. AT&T will tap into Frontier’s fiber-to-the-tower (FTTT) infrastructure to connect to AT&T’s wireless cell towers. AT&T is the first tenant to rent space in Frontier’s local central office facilities, they said.

This deal is an extension of AT&T and Frontier’s 2021 agreement that brought the two complementary fiber networks together to power business customers nationwide. That multi-year agreement, focused on Frontier service territories in parts of 25 states, also mentioned support for deployment of AT&T’s 5G network.

The deal comes together as Frontier pushes ahead with a fiber upgrade and buildout plan. Frontier announced late last year that it had neared the halfway point toward a goal of reaching at least 10 million locations with fiber by the end of 2025. While a good portion of that work is focused on delivering services to Frontier’s own residential and business customers, the agreement with AT&T highlights the buildout’s wholesale opportunity.

Fiber backhaul is increasingly critical to support the data demands of wireless networks, including 5G. This agreement enables AT&T to stay ahead of those demands and build on an existing relationship between the two companies. Also, fiber backhaul could help spark a wholesale business that’s been in decline. Frontier’s overall business and wholesale revenues dropped 7.5% in Q3 2022 year-over-year, primarily due to declines in its copper footprint. Meanwhile, business and wholesale fiber revenues rose 1.1%, to $267 million, sequentially.

As illustrated in the figure below, backhaul comprises the Transport network, that connects the Tower / Access Point (mobile base station), which is part of the Radio Access Network (RAN), to the Core Network, where most computing resources are located.

“We’re excited to collaborate with AT&T in strengthening their wireless service with our fiber infrastructure,” said Vishal Dixit, Frontier’s Chief Strategy Officer & EVP Wholesale. “As one of the largest fiber builders in the country, our fiber infrastructure offers an attractive opportunity for tech companies to use this future-proof foundation for their wireless services. This is another example of how innovation is helping to transform Frontier.”

”Fiber is central to our wireless strategy and to our overall connectivity approach,” said Cheryl Choy, Senior Vice President, Network Planning & Engineering, AT&T. “This expanded collaboration with Frontier is a win for both companies, as they can fully utilize their fiber infrastructure, and we can continue to ensure our wireless services are powered by the unparalleled capacity of fiber optic networks.”

About Frontier:

Frontier is a leading communications provider offering gigabit speeds to empower and connect millions of consumers and businesses in 25 states. It is building critical digital infrastructure across the country with its fiber-optic network and cloud-based solutions, enabling connections today and future proofing for tomorrow. Rallied around a single purpose, Building Gigabit America™, the company is focused on supporting a digital society, closing the digital divide, and working toward a more sustainable environment. Frontier is preparing today for a better tomorrow. Visit frontier.com.

About AT&T:

We help more than 100 million U.S. families, friends and neighbors, plus nearly 2.5 million businesses, connect to greater possibility. From the first phone call 140+ years ago to our 5G wireless and multi-gig internet offerings today, we @ATT innovate to improve lives. For more information about AT&T Inc. (NYSE:T), please visit us at about.att.com. Investors can learn more at investors.att.com.

Media Contacts:

Chrissy Murray

VP, Corporate Communications

[email protected]

Anne Tidrick

Director, Corporate Communications

+1 469-516-5862

[email protected]

References:

Frontier Communications offers first network-wide symmetrical 5 Gig fiber internet service

Frontier Communications adds record fiber broadband customers in Q4 2022

Frontier’s Big Fiber Build-Out Continued in Q3-2022 with 351,000 fiber optic premises added

Frontier Communications sets another fiber buildout record; raises FTTP buildout target for 2022

“Fiber is the future” at Frontier, which added a record 54K fiber broadband customers in 1Q-2022

Frontier’s FTTP to reach 10M locations by 2025; +192,000 FTTP passings in 4Q-2021

Frontier Communications offers first network-wide symmetrical 5 Gig fiber internet service

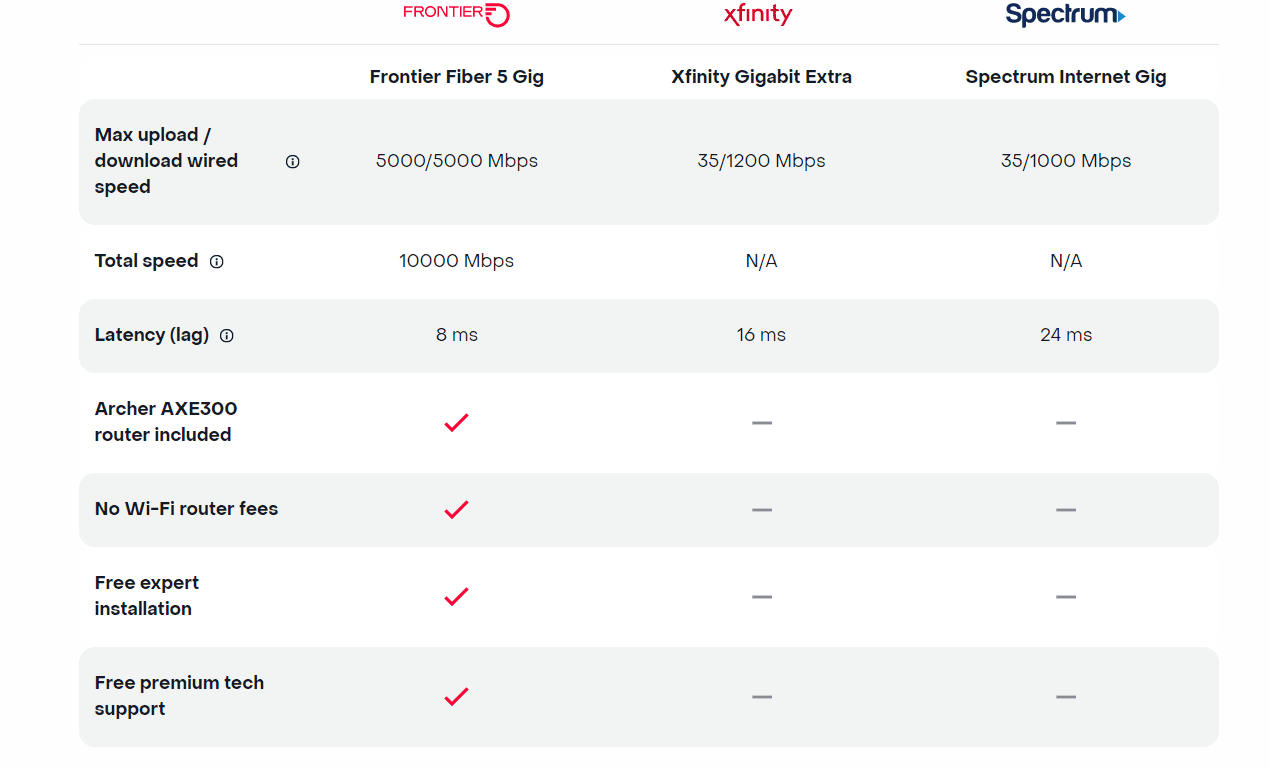

Today, Frontier Communications launched the nation’s only network-wide 5 Gig fiber internet service. With the launch of 5 Gig, Frontier will provide customers across its 25 state fiber network – not just select markets – the opportunity to sign up for the new premium service with blazing-fast speeds. The company says that 5 Gig internet has 125x faster upload speeds, 5x faster download speeds and 2.5x less latency than cablecos [1.], but they don’t specify the cable network speeds or latency.

Note 1. Comcast currently offers 1 and 2 Gig Internet. The company announced a successful trial of the world’s first live, multigigabit symmetrical Internet connection powered by 10 Gbps and Full Duplex DOCSIS 4.0 last December. Charter Communications is also planning a DOCSIS 4.0 upgrade to deliver download speeds of 5 Gbps and 10 Gbps over the coming years, but isn’t currently planning to bring symmetrical service offerings to market.

Frontier’s 5 Gig fiber internet service enables customers to run multiple connected devices at their fastest possible speeds. This means:

- Symmetrical download and upload speeds at up to 5 gigabits per second

- 125x faster upload speed than cable

- 1.6 seconds to download Adobe Photoshop on PC (1GB)

- <36 seconds to download a House of Dragons episode in 4K (22 GB)

- <2 minutes to download a 100-minute 8K movie (67 GB)

- 99.9% network reliability

The 5 Gig internet offer starts at $154.99 a month with autopay and includes uncapped data + Wi-Fi router + free installation + premium tech support. There are no additional Wi-Fi or router fees, no data caps or overage charges. The inclusion of a Archer AXE300 Wi-Fi 6E router is a major advantage, because most installed WiFi routers are WiFi 5= IEEE 802.11ac which won’t support giga bit speeds.

Frontier also dropped the price of its 2-gig internet service, which debuted in February 2022 at a cost of $149.99 per month. That service is now priced at $109.99 per month.

New Street Research stated that Frontier’s 5-gig rollout will “help establish Frontier as a leader in network capabilities and drive the message that this is a new Frontier.” The analysts added, “It also helps drive the message that they are delivering a product that Cable can’t.” Furthermore, New Street noted the move could contribute to growth in average revenue per user (ARPU) given the price drop for the 2-gig plan could “drive some incremental demand for that too.”

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

On Frontier’s Q3 2022 earnings call, CEO Nick Jeffrey noted 45% to 50% of new customers were taking its 1 Gbps and 2 Gbps plans. Among its installed base, uptake of 1-gig or faster speeds stood at 15% to 20%. That was up sequentially from 10% to 15% in Q2, Jeffrey said at the time.

Frontier is set to report Q4 2022 earnings on February 24th. In a 4Q 2022 earnings preview, the ISP disclosed it added 75,000 new fiber customers and 8,000 total broadband subscribers in the quarter. That was 17% more fiber broadband customers than it had at the end of 2021. For the fifth consecutive quarter, fiber broadband customer additions outpaced copper broadband customer losses, resulting in 8,000 total broadband customer net additions in the fourth quarter of 2022.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Other Competition:

AT&T, Altice USA, Lumen Technologies and Ziply Fiber all already provide symmetrical speeds of 5 Gbps or faster. And Google Fiber has announced plans to debut 5-gig and 8-gig plans early this year. But Frontier claimed it is the only operator thus far to roll out such speeds networkwide.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

About Frontier Communications:

Frontier is a leading communications provider offering gigabit speeds to empower and connect millions of consumers and businesses in 25 states. It is building critical digital infrastructure across the country with its fiber-optic network and cloud-based solutions, enabling connections today and future proofing for tomorrow. Rallied around a single purpose, Building Gigabit America™, the company is focused on supporting a digital society, closing the digital divide, and working toward a more sustainable environment. Frontier is preparing today for a better tomorrow. Visit frontier.com.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

Media Contact:

Chrissy Murray, VP, Corporate Communications

+1 504-952-4225 [email protected]

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

References:

https://frontier.com/shop/internet/fiber-internet/5-gig

Frontier Communications adds record fiber broadband customers in Q4 2022

Frontier Communications sets another fiber buildout record; raises FTTP buildout target for 2022

Frontier Communications adds record fiber broadband customers in Q4 2022

Frontier Communications previewed its Q4 2022 results today, revealing it gained 75,000 new fiber customers and had 8,000 total broadband net additions.

- Strong customer growth in Q4 led Frontier to finish 2022 with 17% more fiber broadband customers than it had at the end of 2021.

- For the fifth consecutive quarter, fiber broadband customer additions outpaced copper broadband customer losses, resulting in 8,000 total broadband customer net additions in the fourth quarter of 2022.

During a Citi investor conference presentation following the announcement, CFO Scott Beasley said growth spanned both new and existing markets and resulted in part from gains made against cable competitors. “We continue to outpace our cable competitors, gaining share in nearly every geography we operate in. Our new position as the ‘un-cable’ provider is taking hold. We are bringing customers a superior product and it is paying off in record broadband customer growth.”

According to Beasley, the vast majority of its net additions are customers who are new to Frontier rather than those converting from a legacy DSL service. That means most either moved into or within the operator’s territory during the quarter or switched from cable. “We had success against every competitor in every geography,” the CFO stated. Asked whether cable’s recent efforts to woo consumers with fixed-mobile bundles presented a challenge, Beasley said Frontier hasn’t yet “seen much of an impact from their converged offerings.”

Frontier doesn’t appear to be concerned about advances from fixed wireless access (FWA) rivals either. New Street Research noted Frontier’s net add announcement implied it lost 67,000 copper subscribers, which was significantly higher than the 56,000 the analyst firm had expected. However, Beasley said fixed wireless has had “very little impact” on its fiber gross additions.

Regarding its DSL based services, Beasley said “we haven’t seen any significant impact from fixed wireless (FWA)” in terms of churn but acknowledged FWA is “nibbling around the edges” where new movers only have the choice between Frontier’s DSL or a fixed wireless product.

Beasley added despite macroeconomic challenges and a recessionary environment, Frontier hasn’t seen any slowdown in bill payments or tier step-downs from customers. In fact, as it works to achieve a goal of 3% to 4% year-on-year average revenue per user (ARPU) growth by the end of 2023, he said it will actually look to encourage customer plan step-ups. Beasley noted uptake of its gigabit plans currently stands around 15% among Frontier’s base and around 45% for new customers, leaving plenty of room for movement. The company will also implement “normal base price increases to reflect higher input costs” and use gift card promotions to retain and gain other subscribers, he said.

Media Contact:

Chrissy Murray

VP, Corporate Communications

+1 504-952-4225

[email protected]

References:

https://investor.frontier.com/news/news-details/2023/Frontier-Adds-Record-Fiber-Broadband-Customers-in-Q4-2022/default.aspx

https://investor.frontier.com/events-and-presentations/events/event-details/2023/Citi-Communications-Media–Entertainment-Conference/default.aspx

https://www.fiercetelecom.com/broadband/frontier-bags-75k-fiber-subs-q4-2022-eyes-arpu-gains-23

Frontier’s Big Fiber Build-Out Continued in Q3-2022 with 351,000 fiber optic premises added

Frontier Communications sets another fiber buildout record; raises FTTP buildout target for 2022

“Fiber is the future” at Frontier, which added a record 54K fiber broadband customers in 1Q-2022

Frontier Communications reports added 45,000 fiber broadband subscribers in 4Q-2021 – best in 5 years!

Frontier’s FTTP to reach 10M locations by 2025; +192,000 FTTP passings in 4Q-2021

Frontier Communications Accelerates Fiber Build Out -10 Million locations passed by 2025

Frontier Communications and Ziply Fiber to raise funds for fiber optic network buildouts

Frontier’s Big Fiber Build-Out Continued in Q3-2022 with 351,000 fiber optic premises added

Frontier Communicatons massive fiber build-out continued in the third quarter (Q3-2022), as the company added record number of fiber subscribers to reach a total of 4.8M fiber locations. Frontier is poised to reach 5 million locations passed with fiber-to-the-premises (FTTP) networks this month, putting it at the halfway point toward a goal to reach at least 10 million locations with fiber by the end of 2025. The company added a record 64,000 fiber subscribers, beating the 57,000 expected by analysts. That helped to offset greater than expected copper subscriber losses of -58,000. Consumer fiber Q3 revenue climbed 14% to $424 million while consumer copper fiber dropped 3% to $361 million.

Frontier built FTTP to a record 351,000 fiber optic premises in Q3-2022, handily beating the 185,000 built out in the year-ago quarter and the 281,000 built in Q2 2022. Frontier ended Q3 with 1.50 million fiber subs, up 16% versus the year-ago quarter.

“We delivered another quarter of record-breaking operational results,” said Nick Jeffery, President and Chief Executive Officer of Frontier. “Our team set a new pace for building and selling fiber this quarter. At the same time, we radically simplified our business and delivered significant cost savings ahead of plan. This is a sign of a successful turnaround.

“Our team has rallied around our purpose of Building Gigabit America and is laser-focused on executing our fiber-first strategy. As the second-largest fiber builder and the largest pure-play fiber provider in the country, we are well-positioned to win.”

Third-quarter 2022 Highlights:

- Built fiber to a record 351,000 locations to reach a total of 4.8 million fiber locations, nearly halfway to our target of 10 million fiber locations

- Added a record 66,000 fiber broadband customers, resulting in fiber broadband customer growth of 15.8% compared with the third quarter of 2021

- Revenue of $1.44 billion, net income of $120 million, and Adjusted EBITDA of $508 million

- Capital expenditures of $772 million, including $18 million of subsidy-related build capital expenditures, $442 million of non-subsidy-related build capital expenditures, and $170 million of customer-acquisition capital expenditures.

- Net cash from operations of $284 million, driven by healthy operating performance and increased focus on working capital management

- Nearly achieved our $250 million gross annual cost savings target more than one year ahead of plan, enabling us to raise our target to $400 million by the end of 2024

In Frontier’s “base” fiber footprint of 3.2 million homes (in more mature areas where fiber’s been available for several years), penetration rose 30 basis points in Q3 to 42.9%. “When we look at the growth over the past year, we see a clear path to achieving our long term target of 45% penetration in our base markets,” Frontier CEO Nick Jeffery said.

Penetration rates in Frontier’s expansion fiber footprint for the 2021 cohort is on target and is exceeding expectations in the 2020 expansion fiber footprint, he said.

Fiber ARPU (average revenue per user) was up 2.6% year-over-year, but came a little short of expectations thanks in part to gift card promotions. Frontier’s consumer fiber ARPU, at $62.97, missed New Street Research’s expectation of $63.67 and a consensus estimate of $64.51. Copper ARPU, however, beat estimates: $49.65 versus an expected $48.57.

Frontier CEO Jeffery said faster speeds remain a top ARPU driver, with 45% to 50% of new fiber subs selecting tiers offering speeds of 1Gbit/s or more. Fiber subs taking speeds of 1Gbit/s or more now make up 15% to 20% of Frontier’s base, up from 10% to 15% last quarter, he said.

Frontier currently has no plans to raise prices due to inflation and other economic pressures, but the company left the door open to such a move.

“We’ll be a rational pricing actor in this market,” Jeffery said. “If those [inflationary pressures] don’t moderate, then of course we maybe consider pricing actions to compensate…just as we’re seeing others doing.”

Frontier also has no immediate plans to strike an MVNO deal that would enable it to use mobile in a bundle to help gain and retain broadband subscribers – a playbook already in use by Comcast, Charter Communications, WideOpenWest and Altice USA.

As churn rates remain stable and low, Jeffery explained, “the argument for using some of that scarce capital to divert into an MVNO to solve a problem that we don’t yet have, I think, would probably not make our shareholders super happy.” Importantly, Frontier has experience in the mobile area from execs who previously worked at Vodafone, Verizon and AT&T.

“We’re watching it very closely and if consumer behavior changes or if the market changes in a material way that impacts us such that moving some of our scarce capital to build or partner with an MVNO would be a smart thing to do, we’ll do it and we’ll do it very quickly,” Jeffery said. “But now isn’t the moment for us.”

Frontier ended the quarter with $3.3 billion of liquidity to fund its fiber build. Beasley said Frontier has additional options if needed, including taking on more debt, selling non-core real estate assets, access to government subsidies and the benefits of a cost-savings plan that has exceeded the target (from an original $250 million to $400 million).

References:

The conference call webcast and presentation materials are accessible through Frontier’s Investor Relations website and will remain archived at that location.

https://events.q4inc.com/attendee/387527166

https://www.lightreading.com/broadband/frontiers-big-fiber-build-nears-halfway-point-/d/d-id/781503?