Fiber to the building

UK’s CityFibre launches 5.5Gbit/s wholesale broadband service- 3 times faster than BT Openreach

CityFibre, the UK’s largest independent full fiber optic platform, has unveiled a new 5.5Gbit/s wholesale broadband internet service based on 10Gbit/s XGS-PON technology that has already been rolled out across 85% of the company’s network. CityFibre claims its new product is more than three times faster than the highest rate available service from its much larger rival, Openreach (the network access arm of BT). and available at a much lower wholesale cost, CityFibre’s 5.5Gb symmetrical product will enable partners to offer a range of Multi-Gig speed tiers to customers, improving margins whilst providing a valuable customer retention tool for the long term.

Highlights:

- CityFibre’s new 5500/5500Mbps service offers >3x faster downloads, >45x faster uploads than BT Openreach’s fastest full fibre service which is 1800/120Mbps and is delivered over its GPON network.

- CityFibre’s upgraded XGS-PON network provides numerous benefits over GPON technology, including network cost savings, reduced power consumption, improved performance, and enhanced efficiency.

- CityFibre’s launch of its new Multi-Gig products enables the UK to keep pace with countries including France, the Netherlands, New Zealand and the United States of America where consumers are already making the most of affordable Multi-Gig services.

Photo Credit: CityFibre

Greg Mesch, CEO of CityFibre, said: “The UK’s full fibre future is here, thanks to CityFibre’s powerful, 10Gb XGS-PON network. Our ISP partners are already connecting customers with speeds over 2Gb and exceeding expectations when it comes to quality and reliability, but our next generation of full fibre will set a new standard for what’s possible.

“CityFibre started out to challenge the incumbents and bring choice and competition to the UK market. This is another huge step-forward, giving ISPs more power and flexibility than ever before and bringing affordable Multi-Gig speeds and an unrivalled experience to millions of UK consumers.”

Even faster multi-gig services will be launched in 2026 the company promises.

CityFibre’s network now passes more than 4.3 million premises, which the company says means it is more than halfway along its journey towards its “rollout milestone” of 8 million premises. Actual service take-up, however, has reached just 518,000, an increase of around 181,000 customers on its previous total. During the year covered by the earnings statement, CityFibre announced a partnership with Sky that will see the UK’s second-largest broadband provider launch services on CityFibre’s network later this year.

References:

https://cityfibre.com/news/cityfibre-unveils-new-5-5gb-wholesale-product-its-fastest-ever

Nokia and CityFibre sign 10 year agreement to build 10Gb/second UK broadband network

Dell’Oro: Broadband access equipment sales to increase in 2025 led by XGS-PON deployments

Frontier Communications offers first network-wide symmetrical 5 Gig fiber internet service

Frontier Communications fiber growth accelerates in Q1 2025

AT&T grows fiber revenue 19%, 261K net fiber adds and 29.5M locations passed by its fiber optic network

Google Fiber planning 20 Gig symmetrical service via Nokia’s 25G-PON system

STELLAR Broadband offers 10 Gigabit Symmetrical Fiber Internet Access in Hudsonville, Michigan

Verizon to buy Frontier Communications

Wall Street Journal reported today that Verizon is on the verge of buying Frontier Communications for as much as $7 billion in a deal that would bolster the company’s fiber network to compete with rivals notably AT&T. With a market value of over $7 billion, Dallas, TX based Frontier provides broadband (mostly fiber optic) connections to about three million locations across 25 states. Frontier is in the midst of upgrading its legacy copper landline network to cutting-edge fiber. Rising interest rates sparked fears among investors, however, that the business would run out of cash and not be able to raise more before completing those upgrades. Frontier has a 25-state footprint and serves largely rural areas. It reported sales of $5.8 billion in 2023, with about 52% of total revenue from activities related to its fiber-optic products and bills itself as “largest pure-play fiber internet company in the US.”

An all-cash deal between the two companies could be announced as soon as Thursday, a person familiar with the negotiations told Bloomberg.

Fiber M&A has heated up as telecom companies and financial firms pour capital into neighborhoods that lack high-speed broadband or offer only one internet provider, usually from a cable-TV company. New fiber-optic construction is expensive and time-consuming, making existing broadband providers attractive takeover targets.

Verizon, with a market valuation of around $175 billion, will be under pressure from shareholders to justify any big purchase after the company paid more than $45 billion to secure C-band 5G wireless spectrum licenses and spent billions more to use them. Executives have said they are focused on trimming the telecom giant’s leverage to put it on a firmer financial footing.

Verizon, the top cellphone carrier by subscribers, has faced increased pressure from competitors and from cable-TV companies that offer discounted wireless service backed by Verizon’s own cellular network. Faced with slowing wireless revenue growth and an expensive dividend, Verizon has invested in expanding its home-internet footprint. It has both 5G fixed wireless access (FWA) and its Fios-branded fiber to the premises network.

T-Mobile is the only major U.S. cellphone carrier that lacks a large landline business. Since its 2020 takeover of rival carrier Sprint, the company has focused on 5G dominance and succeeded in growing its cellphone business faster than rivals. That network has also linked millions of customers to its fixed 5G broadband service, which offers cablelike service over the air. T-Mobile’s strategy has shifted in recent months, however, as the company dabbles in partnerships and wholesale leasing agreements with companies that build fiber lines to homes and businesses. The wireless “un-carrier” in July agreed to spend about $4.9 billion through a joint venture with private-equity giant KKR to buy Metronet, a Midwestern broadband provider.

Photo Credit: Jeenah Moon/Bloomberg News

…………………………………………………………………………………………………………………………………………………………

A deal for Frontier would be a round trip of sorts for some of the network infrastructure that Frontier bought from Verizon in 2016 for $10.54 billion in cash. Frontier later filed for Chapter 11 bankruptcy in April 2020 as it burned through cash and was burdened by a heavy debt load. It emerged as a leaner business in 2021 with about $11 billion less debt and focused on building a next-generation fiber optic network.

Frontier’s biggest investors today include private-equity firms Ares Management and Cerberus Capital Management. The company drew the attention of activist Jana Partners last year, which built a stake in the business. Jana delivered a letter to Frontier’s board late last year asking the company to take steps immediately to help reverse its sinking share price, including a possible outright sale.

…………………………………………………………………………………………………………………………………………………………..

AT&T has focused on expanding its fiber network since spinning off its WarnerMedia assets in 2022 to Warner Brothers Discovery. AT&T has 27.8 million fiber homes/businesses passed, growing at ~2.4 million per year, plus more locations passed via its Gigapower joint venture. AT&T’s fiber internet business is expected to contribute to an increase in consumer broadband and wireline revenue. AT&T expects broadband revenue to increase by at least 7% in 2024, which is more than double the rate of growth for wireless service revenue. In contrast, Verizon only has about 18 million fiber locations, growing at about 500,000 per year.

Other recent deals in the fiber transport market sector include the $3.1 billion acquisition, including debt, of fiber provider Consolidated Communications in late 2023 by Searchlight Capital Partners and British Columbia Investment Management.

………………………………………………………………………………………………………………………………………………………….

It’s All About Convergence (fiber based home internet combined with mobile service):

Speaking at a Bank of America investors conference today, Verizon’s CEO for the Consumer Group Sowmyanarayan Sampath said when Verizon bundles Fios with wireless, it sees a 50% reduction in mobile churn and a 40% reduction in broadband churn. He said they don’t see the same benefits with FWA. Sampath was scheduled to speak at the Mobile Future Forward conference tomorrow, but he canceled at the last minute, which may be a sign that this deal for Frontier is imminent.

The analysts at New Street Research led by Jonathan Chaplin said Verizon’s rationale for the purchase is “convergence baby.” They wrote, wrote, “Verizon seemed complacent. No longer.” Indeed, Verizon CEO Hans Vestberg was challenged on the company’s second quarter 2024 earnings call by analysts who questioned whether Verizon had a big enough fiber footprint to compete in the future. The New Street analysts said Sampath’s comments today “marked a shift in rhetoric from: ‘convergence is important, but we can do it with FWA.”

The analysts at New Street wrote today, “We have been arguing for a couple of years that all the fiber assets would eventually be rolled up into the three big national carriers (AT&T, Verizon, T-Mobile). We always knew that if one carrier started the process, others would have to follow swiftly because there are three wireless carriers and only one fiber asset in every market with a fiber asset.”

Other potential fiber companies that the big three national carriers might be eyeing include Google Fiber, Windstream, Stealth Communications and TDS Telecom.

After its annual summer conference in August in Boulder, Colorado, the analysts at TD Cowen, led by Michael Elias, said there was a lot of conversation about the wireline-wireless “convergence” frenzy. “We believe convergence is a race to the bottom, but if one player is going in with a slight advantage (AT&T), the others must reluctantly follow,” wrote TD Cowen. In the mid-term they speculated that T-Mobile might look at fiber roll-ups with Ziply or Lumen (formerly or other regional players.

References:

https://www.wsj.com/business/deals/verizon-nearing-deal-for-frontier-communications-9e402bb4

https://www.fierce-network.com/broadband/verizon-rumored-buy-frontier-its-convergence-game

https://finance.yahoo.com/news/verizon-talks-buy-frontier-communications-180419091.html

https://videos.frontier.com/detail/videos/internet/video/6322692427112/why-fiber

Building out Frontier Communications fiber network via $1.05 B securitized debt offering

Fiber builds propels Frontier Communication’s record 4th Quarter; unveils Fiber Innovation Labs

Frontier Communications fiber build-out boom continues: record number of fiber subscribers added in the 1st quarter of 2023

Frontier’s Big Fiber Build-Out Continued in Q3-2022 with 351,000 fiber optic premises added

AT&T and BlackRock’s Gigapower fiber JV may alter the U.S. broadband landscape

AT&T Highlights: 5G mid-band spectrum, AT&T Fiber, Gigapower joint venture with BlackRock/disaggregation traffic milestone

AT&T to use Frontier’s fiber infrastructure for 4G/5G backhaul in 25 states

Frontier Communications offers first network-wide symmetrical 5 Gig fiber internet service

Frontier Communications adds record fiber broadband customers in Q4 2022

Verizon Q2-2024: strong wireless service revenue and broadband subscriber growth, but consumer FWA lags

Summary of Verizon Consumer, FWA & Business Segment 1Q-2024 results

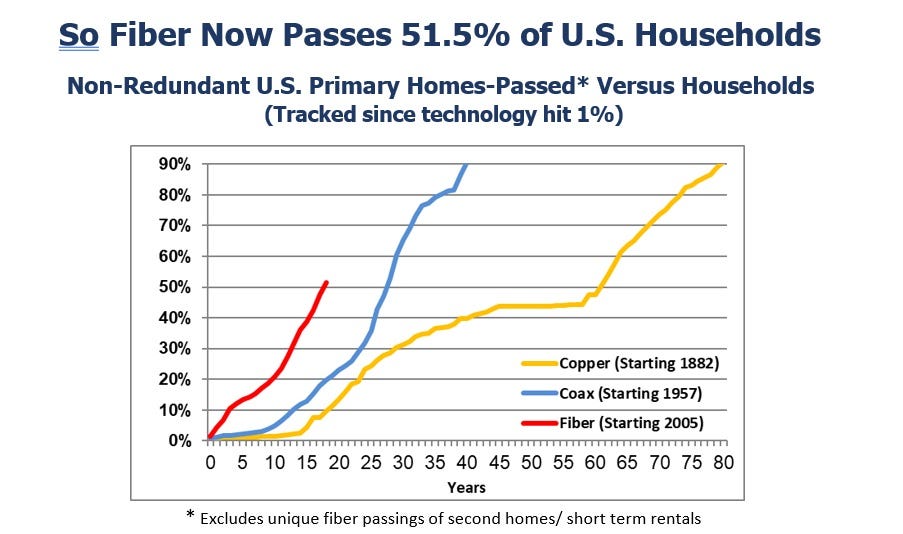

U.S. fiber rollouts now pass ~52% of homes and businesses but are still far behind HFC

Fiber optic network deployments have reached a milestone as they now pass more than 50% of U.S. households, according to recent report from the Fiber Broadband Association (FBA) [1.] and RVA Market Research and Consulting. Fiber broadband deployment set a new historical record in 2023, passing nine million new homes at a growth rate of 13% year-over-year. The 2023 North America Fiber Provider Survey, sponsored by the FBA, concluded that 77.9 million U.S. homes were passed with fiber, with nearly 52% of all the nation’s unique homes and businesses passed.

Note 1. The FBA is an all-fiber trade association that provides resources, education, and advocacy for companies, organizations, and communities that want to deploy fiber networks. The FBA’s goal is to raise awareness and provide education about the fiber deployment process, safe worksites, and effective fiber installs.

Image Credit: The Fiber Broadband Association (FBA)

………………………………………………………………………………………………………………………………………………………………………………………….

The last $10 billion U.S. Treasury American Rescue Plan (ARP) funding for infrastructure projects such as broadband networks is being distributed this year. The $42.5 billion in NTIA BEAD funding available over the next few years will significantly contribute to enabling and upgrading communities across America with the high-speed, low-latency broadband necessary for participation in today’s 21st-century society. We are seeing a steady stream of NTIA approvals and expect the first states to make BEAD awards in the second half of 2024.

Here’s how the growth of fiber has risen in recent years compared to coax cable (or hybrid fiber/coax, HFC) and the long history of copper.

“Thanks to this latest surge, fiber lines now pass nearly 78 million U.S. homes, up 13% from a year ago,” Alan Breznick, Heavy Reading analyst and the cable/video practice leader at Light Reading, explained in recorded opening remarks here at Light Reading’s 17th’s annual Cable Next-Gen event. Almost 69 million of those locations are “unique” fiber homes, meaning that about 9 million are passed by more than one fiber provider, Breznick added.

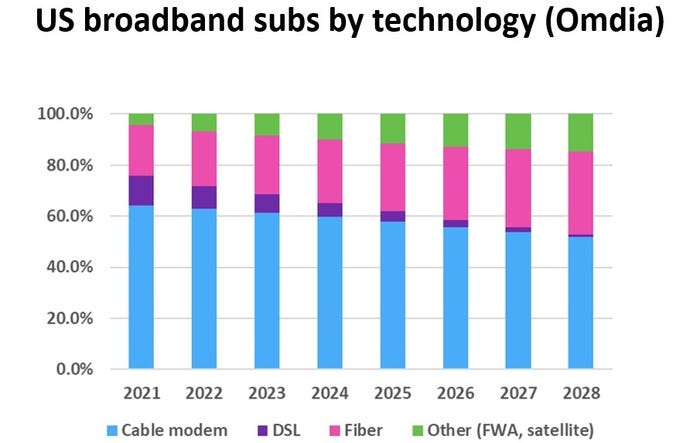

The share of broadband technology is also evolving. While HFC remains the primary way of delivering broadband, fiber-to-the-premises (FTTP) and fixed wireless access (FWA) will continue to make their presence felt in the coming years. Omdia (owned by Informa) expects cable’s share of that mix to drop over the next four years, hitting about 55% by 2028, while fiber’s share is expected to rise to 30% by that time, Breznick explained.

For the cable industry, fiber and FWA are not solely about competition. Many operators are also using FTTP extensively in greenfield deployments and subsidized rural buildouts. They are deploying it on a targeted basis via a new generation of nodes that can support multiple access technologies, including HFC and wireless.

CableLabs has put fiber-to-the-premises on the front burner via a pair of new working groups. A recent survey from Omdia shows that more than one-third of cable operators have already deployed passive optical networking (PON) in some form. That number will “undoubtedly keep rising” thanks to initiatives such as the Broadband Equity Access and Deployment (BEAD) program, Breznick said. Omdia expects spending on next-gen cable technologies to tick up in 2024 and 2025 and then reach a relatively steady annual state through 2029.

Meanwhile, operators such as Mediacom Communications have tapped into FWA to extend the reach of broadband in rural areas. Combined, they demonstrate some of the reasons why the industry has been shedding the “cable” label via rebranding efforts and name changes in recent years.

Cable’s broadband challenge is to grow broadband subscribers as it faces more broadband competition combined with historically low churn and a slow housing move market. “If it feels like an uphill battle for cable, maybe that’s because it is. But that doesn’t mean it has to be a losing battle,” Breznick said. “That’s because the cable industry still has plenty of tricks left up its sleeve.”

Those tricks include the use of next-generation DOCSIS 3.1 (sometimes called DOCSIS 3.1+ or extended DOCSIS 3.1) that can bump up speeds as high as 8 Gbit/s by opening up new orthogonal frequency division multiplexing (OFDM) channels. Some operators, including Comcast, Charter Communications, Rogers Communications, Cox Communications and Cable One, have begun to deploy DOCSIS 4.0 or have put it squarely on their network upgrade roadmaps.

And though cable operators’ network spending is expected to be down in the first half of 2024, vendors are optimistic that the spigots will start to open up again in the second half of the year as operators pick up the pace.

References:

https://www.lightreading.com/fttx/us-fiber-rollouts-reach-tipping-point-but-are-still-far-behind-hfc

Fiber Connect 2023: Telcos vs Cablecos; fiber symmetric speeds vs. DOCSIS 4.0?

Dell’Oro: Broadband access equipment sales to increase in 2025 led by XGS-PON deployments

Nokia’s launches symmetrical 25G PON modem

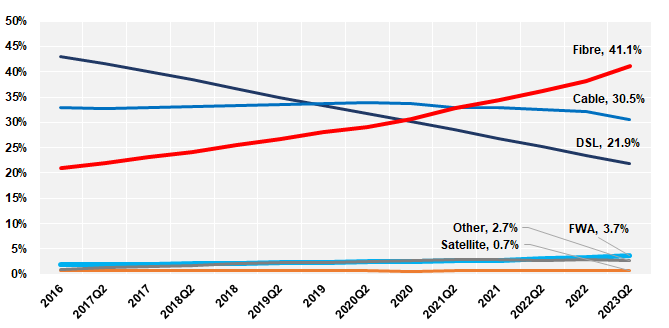

Fiber and Fixed Wireless Access are the fastest growing fixed broadband technologies in the OECD

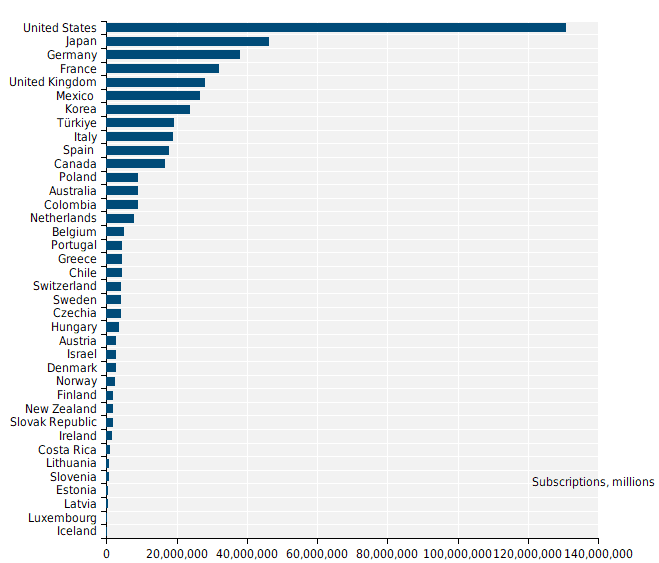

The latest OECD statistics show that Fiber and Fixed Wireless Access (FWA) have seen the strongest growth in fixed broadband technologies in three years. Fibre subscriptions have increased by 56% between June 2020 to June 2023, and FWA subscriptions have increased by 64%. The United States (252%), Estonia (153%), Norway (139%) and Spain (118%) led this FWA growth. The dynamism of fiber and FWA stands in stark contrasts to the decline in DSL (-24%).

Nine OECD countries have more than 70% of fibre connections over total broadband, with Korea, Japan, Iceland, Spain leading the way with the highest fibre penetration rates of 89%, 86%, 85% , and 84%, respectively. The highest fibre growth rates are in Europe, with Austria and Belgium having growth rates of 75% and 73% over the last year, closely followed by Mexico with a growth in fibre of 68%. Two other Latin American countries are in the top 7: Costa Rica and Colombia with fibre growth rates of 42% and 34%, respectively.

Mobile data usage per subscription grew substantially by 28% in one year passing from 10.2 GB to 13 GB per subscription per month in OECD countries as of June 2023. The amount of data consumed in countries vary greatly from 6 GB to 46 GB, with Latvia being the OECD leader.

Despite an already very high mobile broadband penetration in the OECD area, overall mobile subscriptions continue to grow by 4.6% over the last year, which totalled 1.8 billion as of June 2023, up from 1.74 billion a year earlier. Mobile broadband penetration is highest in Japan, Estonia, the United States and Finland, with subscriptions per 100 inhabitants at 200%, 192%, 183% and 161%, respectively.

Eighteen countries were able to provide the number of their 5G subscriptions separately from mobile broadband subscriptions. The share of 5G in total mobile broadband subscriptions is 23% on average for the OECD countries that provided this data.

Machine-to-machine (M2M) SIM cards grew 14% increase in one year. The two leading countries are Sweden with 238 M2M SIM cards per 100 inhabitants and Iceland (203), followed by Austria (179), the Netherlands (93) and Norway (76). Both Sweden and Iceland issue M2M SIM cards for international use.

Total number of fixed broadband subscriptions, by country, millions, June 2023:

……………………………………………………………………………………………………………………….

Deutsche Telekom Network Day: Fiber, Mobile Network, Open RAN and 5G SA Launch in 2024

2023 Deutsche Telekom (DT) Highlights:

- Fiber offensive: more than 2.5 million new fiber connections made possible in 2023, reaching a total of more than ten million fiber households in 2024

- 5G front-runner: 5G population coverage of 96%, 5G Standalone also for private customers in 2024

- State-of-the-art technologies: Artificial intelligence supports fiber and mobile rollout

- EURO 2024: Deutsche Telekom connects all stadiums, fan zones & team quarters, data gift for all mobile customers

………………………………………………………………………………………………………………………………………

DT Network Day photo courtesy of Deutsche Telekom

………………………………………………………………………………………………………………………………………

Deutsche Telekom announced that it has successfully enabled more than 2.5 million new fiber connections this year, thereby realizing its fiber plant expansion target. The company invested EUR 2.5 billion in fiber expansion, expanding coverage in almost 3,500 towns and municipalities. According to the announcement, the company projects a total investment of EUR 30 billion in the fiber optic rollout by 2030.

Its Fiber-to-the-home (FTTH) network is set to reach eight million households by the end of the year, with plans to extend this to ten million fiber optic connections by 2024.

………………………………………………………………………………………………………………………………………..

In mobile, Deutsche Telekom currently provides 5G coverage to 96 percent of the population, serving 80 million people through a network of over 80,000 5G antennas, including 10,000 in the 3.5 GHz band spread across more than 800 cities and municipalities. The network delivers download speeds of up to 1 Gbps.

The company aims to achieve 99 percent 5G coverage for the German population by 2025 and plans to launch 5G Standalone (SA) core network for private customers in 2024. DT indicates that 10,000 antennas are compatible with 5G SA in the 3.6 GHz band, covering more than 800 cities and municipalities. This is up from 9,700 antennas in August 2023.

Deutsche Telekom’s business customers are already using 5G SA technology with functions such as network slicing. For example, for live TV transmission of media or in 5G campus networks for industry and research. “In the coming year, 5G SA should then offer all customers real added value,” DT said.

Meanwhile, rival operators Telefónica Deutschland (O2 Germany) and Vodafone Germany already offer standalone 5G services.

…………………………………………………………………………………………………………………………

DT began the deployment of its open radio access network (O-RAN) in Germany in December, in collaboration with Nokia and Fujitsu. The first O-RAN commercial deployment will be in Neubrandenburg. Nokia and Fujitsu are supplying the necessary technology components.

“Open RAN increases the choice of manufacturers and therefore our flexibility. The open access network enables more automation. And makes our networks even more resilient. This benefits the people that our mobile network connects,” says Claudia Nemat.

The German telco expects to have 3,000 O-RAN compatible antennas by the end of 2026.

…………………………………………………………………………………………………………………………

Deutsche Telekom also says it’s using Artificial Intelligence (AI) in network expansion and mobile communications. AI aids in analyzing and evaluating cell usage and capacity utilization, with the ongoing development of a large language model for telco-specific applications in collaboration with SK Telekom. Additionally, AI contributes to enhanced network security through automated pattern recognition, according to the company.

References:

https://www.telekom.com/en/media/media-information/archive/telekom-network-day-2023-1055364

https://www.fiercewireless.com/wireless/deutsche-telekom-plans-5g-standalone-launch-2024

Fiber Connect 2023: Telcos vs Cablecos; fiber symmetric speeds vs. DOCSIS 4.0?

Derek Kelly, Lumos’ VP of market development, went as far as to say that “fiber is always the answer,” and suggested cable alternatives will not stand the test of time. Kelly claimed that as $42.5 billion is set to roll out through the Broadband, Equity, Access, and Deployment (BEAD) program, relying on investments in fiber will provide stability over the next 15 years.

“I think we’ve all seen DSL and fixed wireless projects get funded over the last couple of years. And then what happens? Those areas ultimately become blocked from future funding until the definitions change. And then they become available for another grant. And we see public dollars going on top of previous public dollars.” Kelly said. He noted Lumos defines “unserved being no cable, underserved means they’re stuck with cable. And then there’s everyone else that has life-changing fiber. So we don’t care about speeds at this point.”

While acknowledging the need for funding in areas without even cable access, he noted another large-scale program after the BEAD initiative is unlikely. “Cable modems aren’t going to keep up with these definitions forever. Their lobbyists aren’t going to be able to convince people forever just make sure that they just barely can meet the definition of unserved,” he said. “We have communities that don’t have access to fiber. The FCC and NTIA may consider them as served today. And I agree the funding should go to areas that don’t even have cable yet, but the time is coming, where cable is going to be what’s unserved or underserved.”

Fiber execs mostly targeted cable’s “Achilles heel,” which is its lacking symmetric speed capabilities (upstream and downstream).

AT&T Fiber’s EVP Chris Sambar told a large keynote audience, “Don’t ask cable about symmetrical speeds, they don’t even know what that means.” In an earlier blog post, he wrote, “Fiber is superior technology for things like uploading large files and increased bandwidth. It delivers an amazing experience, with multi-gig speeds and equally fast up- and downlinks. It’s also critical for powering technologies like 5G (backhaul) and edge computing (fiber access for ultra low latency). And with a far superior upgradeable capacity to handle soaring demand for high-quality bandwidth well into the future.”

However, Jay Lee, CTO of ATX Networks said that cable operators are “right in the throes” of upgrading their networks to get to full DOCSIS 3.1, and that high-split type of architecture will allow them to achieve competitive speeds in the upstream. “Their downstream is probably two gigabits per second now and there’s a line of sight to be more than that,” he said. “Is it 10 Gig PON? No. But it’s still in that gig threshold that I think is as important from a consumer standpoint,” he added.

The next plan phase for cable is to move up to DOCSIS 4.0, which starts to get toward multi-gigabit upstream and five-plus in the downstream, sometimes upwards of 10 in the downstream. Lee noted that plenty of cable companies are doing “lots” of their own fiber buildouts. “Some of the statements made on cable were like ‘they can’t do anything about it’ and certainly they can. DOCSIS 3.1 high-split is just the start.”

Jeff Heynen, VP at Dell’Oro Group echoed Lee’s comments, noting that current DOCSIS 3.1 mid-split can deliver 2 Gbps downstream and up to 200 Mbps upstream, which is what Comcast is offering today. Charter and Cox’s high-split offerings can go even further, delivering 2 Gbps downstream and up to 1 Gbps upstream.

A recent interoperability test conducted by Cable Labs showed that DOCSIS 4.0 modems paired with CCAP and vCMTS platforms in high-split configurations could deliver up to 8.6 Gbps downstream and 1.5 Gbps upstream. Cable operators have claimed DOCSIS 4.0 modems should become available later this year, with volumes in 2024. Those downstream speeds would give cable “very comparable service tiers to most fiber providers,” Heynen said. “And this is before the outside plant is upgraded to DOCSIS 4.0, which will be capable of delivering up to 10 Gbps down and 6 Gbps up.” However, other analysts have hinted that DOCSIS 4.0 rollouts will take longer than cable companies are saying.

References:

https://www.fiercetelecom.com/broadband/cable-fiber-rivalry-separating-fact-fiction

https://www.business.att.com/learn/articles/docsis-vs-fiber-why-knowing-the-difference-matters.html

https://about.att.com/innovationblog/2022/sambar-fiber-expansion.html

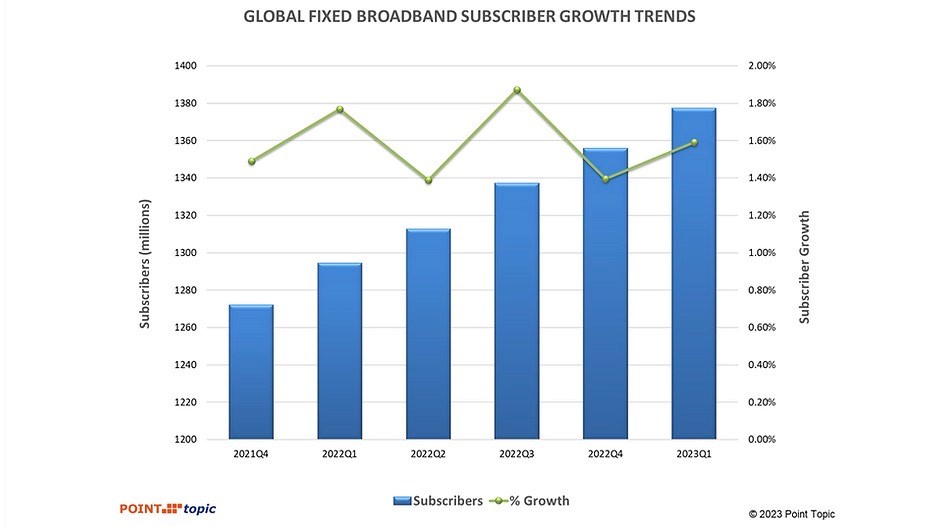

Point Topic Comprehensive Report: Global Fixed Broadband Connections at 1.377B as of Q1-2023

Global fixed broadband connections reached 1.377 billion as of Q1-2023, up by 83 million from a year earlier and reflecting an annual growth rate of 1.59%, according to Point Topic.

There was a decline in fixed broadband subscriptions in 18 countries[1] which mainly include emerging markets, as well as some saturated markets such as Singapore. However, while there were fluctuations in growth rates across regions and markets, the overall trend indicates a steady expansion of global broadband connectivity.

Highlights:

-

Among global regions, Africa, East Asia and America Other saw the fastest growth in broadband connections (2.9%, 2.2% and 1.8%), not least due to healthy increases in broadband subscribers in the vast markets of Egypt, Brazil and China.

-

The share of FTTH/B in the total fixed broadband subscriptions continued to increase and stood at 66.7%. Broadband connections based on other technologies saw their market shares shrink further, with an exception of satellite and wireless (mainly FWA).

-

VDSL subscriber numbers grew in ten countries, while they dropped in at least 22 markets as consumers migrated to FTTH/B.

-

The highest FTTH/B broadband subscriber growth rates in Q1 2023 were in Algeria, Peru and UK.

At 21.6 million, the quarterly net adds were close to the figure we recorded a year ago, though the growth rate (1.59%) was slower, compared to 1.77% in Q1 2022, with global inflation and economic instability having an impact.

East Asia continued to dominate in Q1 2023, maintaining its position as the largest market with a 49.6% share of global fixed broadband subscribers. This substantial market share is primarily driven by China with its vast population.

In Q1 2023, broadband subscriber base grew faster in China, Hong Kong and Korea, compared to Q4 2022. As a result, the region’s net adds share globally went up from 63.2% to 68.8%. Asia Other accounted for 10.8% of the global broadband market, similarly to the previous quarter, though the region’s net adds share went down from 12.8% to 9.4%.

Europe’s market shares remained rather consistent, though Eastern Europe saw their net adds share decline from 3.4% to 0.5%, as a result of slower growth in almost all markets and the decline in broadband subscribers in Russia having an especially significant impact due to its market size.

Similarly, Americas maintained relatively stable market shares of 10.3% and 8.1% respectively, while America – Other’s net adds share increased from 7.8% to 9%, driven by higher growth in such sizeable markets as Brazil, Mexico, Colombia and Chile, to name a few.

Next Point Topic looks at fixed broadband penetration among population, comparing it to growth rates across the regions.

Africa and Asia Other continue to have relatively low fixed broadband penetration rates among their populations. In Q1 2023, this metric in Africa stood at 4.6%, while Asia Other reached 5.6%. These figures indicate the potential for future expansion in these regions. Not surprisingly, Africa also recorded the highest quarterly growth rate of 2.9%.

The markets of East Asia and America Other followed closely with growth rates of 2.2% and 1.8% respectively, despite East Asia already having the highest population penetration at 41.9%. This reflects a widespread adoption of fixed broadband services in East Asia, while America Other showcases steady growth in a region with significant potential, where broadband penetration is among the lowest, at 17.2%.

Eastern Europe displayed a modest growth rate of 0.2% with a population penetration of 24.8%. Some markets in this region still have a lot of headspace when it comes to broadband adoption but the growth was sluggish, likely due to economic pressures. Other European regions showed a slightly higher growth rate, with Europe Other at 0.5%, coupled with the second highest population penetration of 39.4%. These figures indicate a mature market with limited growth opportunities.

Among the largest twenty broadband markets all but one saw fixed broadband subscribers grow in Q1 2023, although in ten of them the growth was slower than in the Q4 2022. There was a slight drop in broadband subscribers in Russia which is under international sanctions.

The less saturated broadband markets of India, Egypt, Brazil and Mexico recorded the highest quarterly growth rates in Q1 2023, all higher than 2%. China recorded an above 2% growth as well. At the other end of the spectrum, the mature markets of Germany, France, Japan, UK, and Italy saw modest growth rates at below 0.5%. At the same time, Italy was among the countries that saw one of the largest improvements in growth rates, from -0.44% in Q4 2022 to 0.04% in Q1 2023, as its GDP growth also went from negative to positive in that period[2]. Mexico, China and Brazil recorded the largest improvements in their growth rates, at +1.14.%, +0.52% and +0.41% respectively.

Between Q4 2022 and Q1 2023, the share of FTTH/B connections in the total fixed broadband subscriptions went up by 0.7% and stood at 66.7%. Broadband connections based on other technologies saw their market shares shrink further, with an exception of satellite and wireless (mainly FWA), which remained stable.

FTTx (mainly VDSL) share stood at 6.7%[3]. VDSL subscriber numbers grew in ten countries (including modest quarterly increase in the large VDSL markets of Turkey, Czech Republic, Greece and Germany, for example), while they fell in 22 other markets as consumers migrated to FTTH/B.

It remains to be seen whether consumers will continue to gravitate toward fibre broadband offerings, particularly as global economies face potential slowdown and inflationary pressures.

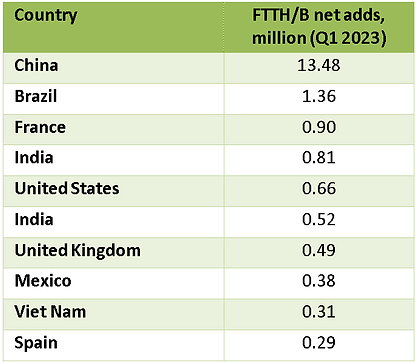

In terms of FTTH/B broadband net additions in Q1 2023, China continued to maintain a significant lead with 13.5 million while Brazil added 1.4 million. Mexico is back in the top ten league, having pushed out Argentina this quarter.

Satellite broadband also saw a modest growth of 1.3% while wireless broadband demonstrated continued relevance with a respectable growth rate of 4.9%. These trends can be attributed to the demand for connectivity in remote or underserved areas where traditional broadband infrastructure is not feasible.

The diverse growth rates among different broadband technologies highlight the dynamic nature of the industry as consumers seek more reliable and high-speed connections. The significant increase in FTTH/B connections and the growth of satellite and wireless broadband underline the ongoing efforts to bridge the digital divide and ensure connectivity for all.

The top ten countries by fixed broadband subscribers remained unchanged (Figure 5). As of Q1 2023, China exceeded 0.6 billion fixed broadband subscribers, having added 14.6 million in the quarter. Also, the country is approaching 1.2 billion 5G subscribers, with the service now being used by 84% of the population.

Overall, the latest fixed broadband subscriber data reveals a clear trend towards advanced, high-speed broadband solutions like FTTH/B, while older technologies such as copper-based broadband (ADSL and VDSL) are experiencing a decline, suggesting that the broadband landscape is continuously evolving to meet the growing demand for faster and more reliable connectivity.

References:

https://www.point-topic.com/post/global-broadband-subscriptions-q1-2023

Point Topic: Global Broadband Tariff Benchmark Report- 2Q-2022

Point Topic: Global fixed broadband connections up 1.7% in 1Q-2022, FTTH at 58% market share

STELLAR Broadband offers 10 Gigabit Symmetrical Fiber Internet Access in Hudsonville, Michigan

STELLAR Broadband, a fiber internet and technology service provider, will provide leading edge technologies and Internet connectivity up to 10Gbps to Elmwood Lake Apartments in Hudsonville, Michigan.

Elmwood Lake Apartments is a suburban haven of elevated comfort, where sweet serenity meets desirable convenience. From cozy interiors and relaxing leisure spaces to an idyllic setting next to private Elmwood Lake, the welcoming apartments in Hudsonville, MI, are ready to deliver a heightened living experience.

“With STELLAR Broadband, residents of Elmwood Lake Apartments will enjoy the fastest and most reliable internet service available. STELLAR Broadband’s fiber optic network provides symmetrical speeds of up to 10Gbps so residents can stream, game, and work from home without any lag or buffering,” said Richard Laing, president of STELLAR Broadband.

“Bosgraaf Homes has been building homes in West Michigan for four generations. Over the years, we’ve seen the industry change dramatically thanks to advances in technology. Construction methods have evolved, and the amenities that homeowners expect have grown more sophisticated. We’re grateful for our partnership with STELLAR Broadband, a company that has been at the forefront of the industry for 22 years. Their experience and leadership have helped us make the transition into multi-family housing,” said Mike Bosgraaf, president of Bosgraaf Homes.

The first in the U.S. to bring 10Gbps Internet to the apartment in student housing, STELLAR today serves over 149 communities totaling over 10,000 residents with a wide range of technology solutions, from managed Wi-Fi, TV, and access control to security.

“DTN is excited to partner with Bosgraaf Homes and STELLAR Broadband to provide Elmwood Lake residents with a unique and enjoyable experience. Bosgraaf is building beautiful homes that will be easy to lease, and STELLAR will provide residents and our office with the best possible internet service,” said Dayle Braden, DTN property manager.

“We’ve seen and have been on the forefront of technology evolving from a desired amenity to a necessity. We are proud to partner with Bosgraaf to provide the high-quality technology that their residents expect and deserve,” Laing stated.

About Spartan Net Co, dba STELLAR Broadband:

STELLAR Broadband is the largest residential fiber internet service provider in Michigan, servicing over 149 communities with multi-Gigabit fiber internet. STELLAR provides technology design and installation services for the full portfolio of technologies for multi-tenant developments, including network design, structured wiring, consulting, door entry and access control, engineered Wi-Fi, security, voice, television services, and various Internet of Things solutions. To learn more, visit: www.stellarbb.com

References:

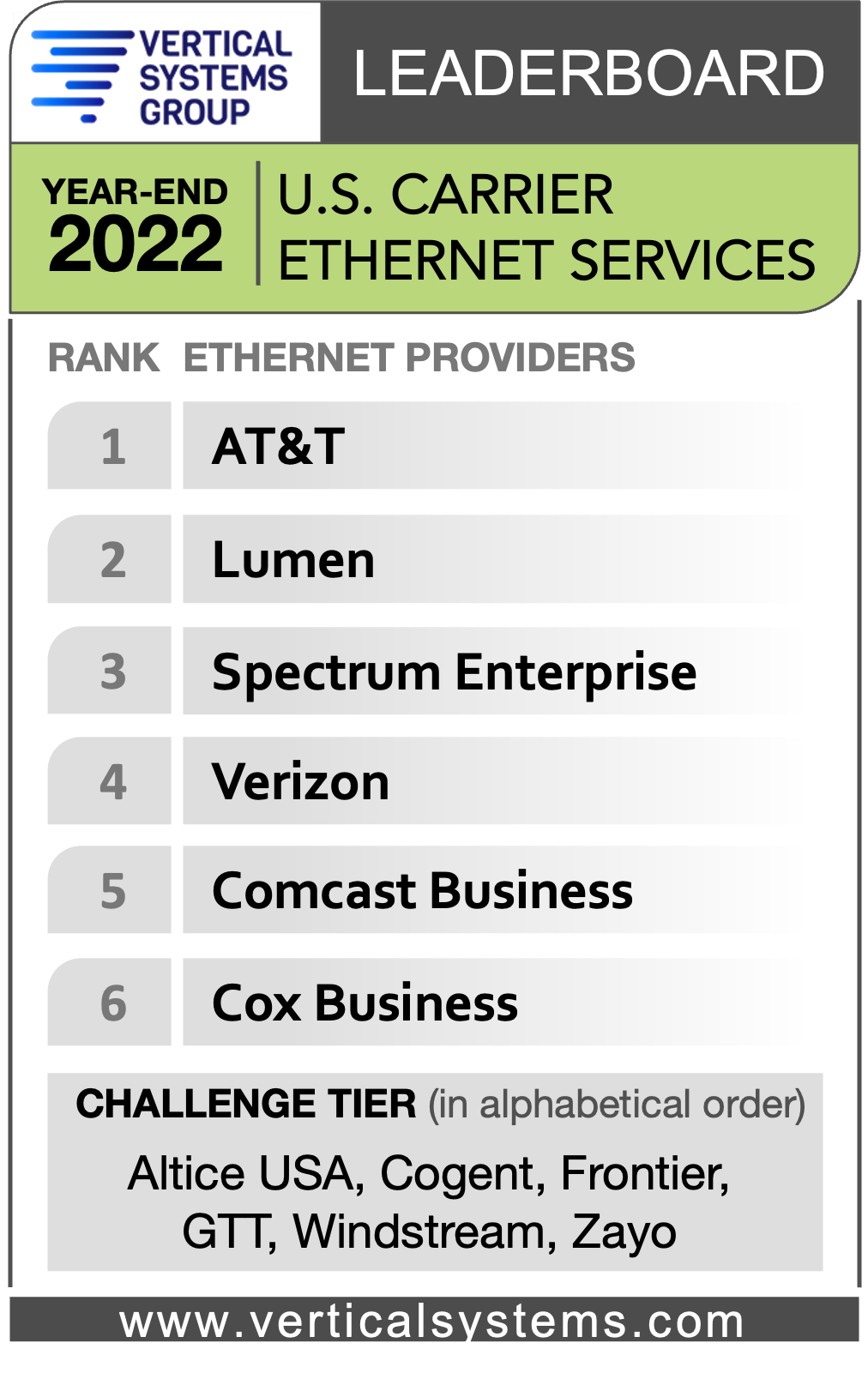

No Surprise: AT&T tops leaderboard of commercial fiber lit buildings for 7th year!

Once again, AT&T ranked #1 in the U.S. Fiber Lit Buildings Leaderboard fromVertical Systems Group (VSG) for a seventh consecutive year. The fiber focused U.S. carrier retained the top spot with the highest number of fiber lit buildings across its footprint in 2022. But there’s a whole lot more AT&T #1 rankings that the carrier has not gotten proper credit for achieving:

- AT&T also holds the #1 ranking in VSG 2022 U.S. Carrier Ethernet LEADERBOARD.

- AT&T ranked #1 for the fifth consecutive year in VSG’s year end 2022 U.S. managed carrier SD-WAN leaderboard.

–>Please see the images below, courtesy of VSG.

Major mobile operators like AT&T and Verizon are actively installing new fiber for their 5G network backhaul, which facilitates new fiber connectivity to nearby commercial sites. T-Mobile no longer has any fiber assets from their Sprint acquisition. They were sold to Cogent along with all other wireline assets in a deal that closed May 1, 2023.

Verizon, Spectrum Enterprise, Lumen, Comcast Business, Cox Business, Zayo, Crown Castle, Frontier, Brightspeed, Breezeline and Optimum followed. Those retail and wholesale fiber providers qualified for the leaderboard with 15,000 or more on-net U.S. fiber lit commercial buildings as of year-end 2022.

-

“Fiber installations at U.S. commercial sites increased in 2022, driven by escalating requirements for gigabit-speed connectivity to support cloud-based services, data centers, 5G rollouts, and other applications,” said Rosemary Cochran, principal of Vertical Systems Group. “New fiber investments in the U.S. will continue to be impacted by pending federal programs and funding initiatives. Opportunities in the commercial segment include monetizing the millions of small buildings underserved.”

U.S. Fiber Lit Buildings LEADERBOARD Highlights:

- The 2022 LEADERBOARD roster increases to twelve commercial fiber providers, up from eleven in 2021.

- AT&T retains the #1 rank on the 2022 U.S. Fiber Lit Buildings LEADERBOARD for the seventh consecutive year.

- Rankings for the top six companies on the 2022 LEADERBOARD are unchanged from 2021, which includes AT&T, Verizon, Spectrum Enterprise, Lumen, Comcast Business, and Cox Business.

- The next six LEADERBOARD provider rankings change as compared to the previous year. Zayo advances to rank seventh ahead of Crown Castle, which dips to eighth. Frontier moves up to ninth position from tenth. Brightspeed debuts in tenth position with fiber assets acquired from Lumen. Breezeline (formerly Atlantic Broadband) falls to eleventh position from ninth. Optimum (Altice USA brand) drops from eleventh to the twelfth and final position.

- The number of 2022 Challenge Tier citations expands from eight to nine with the addition of Ritter Communications.

Market Players include all other fiber providers with fewer than 5,000 U.S. commercial fiber lit buildings. The 2022 Market Players tier covers more than two hundred metro, regional and other fiber providers, including the following companies (in alphabetical order): 11:11 Systems, ACD, Alaska Communications, American Telesis, Armstrong Business Solutions, Astound Business, C Spire, Centracom, Cogent, Conterra, DFN, DQE Communications, Everstream, ExteNet Systems, Fatbeam, FiberLight, First Digital, Flo Networks, Fusion Connect, Google Fiber, GTT, Horizon, Hunter Communications, Logix Fiber Networks, LS Networks, Mediacom Business, MetroNet Business, Midco, Pilot Fiber, PS Lightwave, Shentel Business, Silver Star Telecom, Sonic Business, Sparklight Business, Syringa, T-Mobile, TDS Telecom, TPx, U.S. Signal, Vast Networks, WOW!Business, Ziply Fiber and others.

For this analysis, a fiber lit building is defined as a commercial site or data center that has on-net optical fiber connectivity to a network provider’s infrastructure, plus active service termination equipment onsite. Excluded from this analysis are standalone cell towers, small cells not located in fiber lit buildings, near net buildings, buildings classified as coiled at curb or coiled in building, HFC-connected buildings, carrier central offices, residential buildings, and private or dark fiber installations.

……………………………………………………………………………………………………………………………………..

References:

AT&T expands its fiber-optic network amid slowdown in mobile subscriber growth

https://www.verticalsystems.com/2023/02/15/2022-u-s-ethernet-leaderboard/

AT&T tops VSG’s U.S. Carrier Managed SD-WAN Leaderboard for 4th year

VSG LEADERBOARD : AT&T #1 in Fiber Lit Buildings- Year end 2020

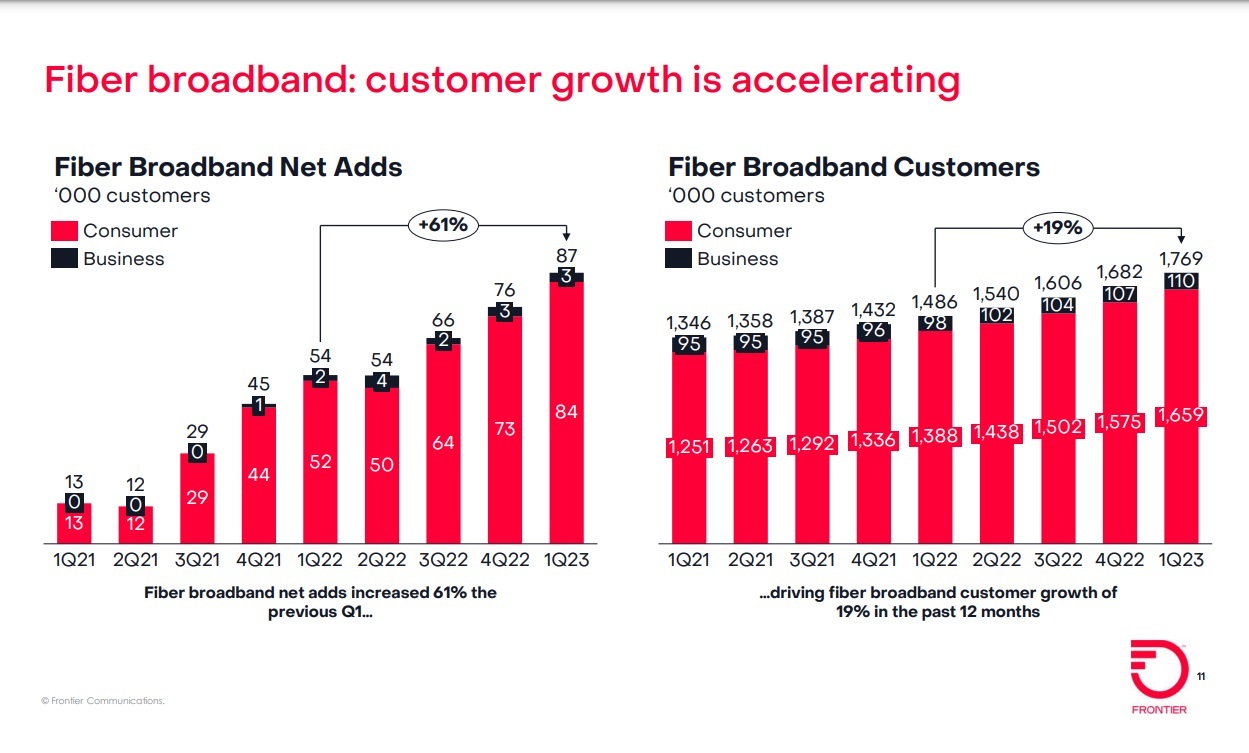

Frontier Communications fiber build-out boom continues: record number of fiber subscribers added in the 1st quarter of 2023

Frontier Communications added record number of fiber broadband customers in the 1st quarter of 2023. The fiber facility based network operator added 87,000 fiber subscribers (including 83,000 residential subs) in the first quarter of 2023, up from +54,000 in the year-ago quarter. Those results beat the 76,000 residential fiber subs Frontier was expected to add in the period. Frontier ended the quarter with 1.76 million fiber customers: 1.65 million residential subscribers and 110,000 business customers.

“We delivered another strong quarter and reached a critical milestone in our transformation. Thanks to our team’s consistent operational performance, we achieved EBITDA growth for the first time in five years,” said Nick Jeffery, President and Chief Executive Officer of Frontier.

“We are creating an internet company that people love. Over the last two years, we have rallied around our purpose of Building Gigabit America, invested in fiber, enhanced our product, put the customer at the center of everything we do and made it easier to do business with us. We are quickly becoming an agile, digital infrastructure company, and I’m confident we will return to growth this year.”

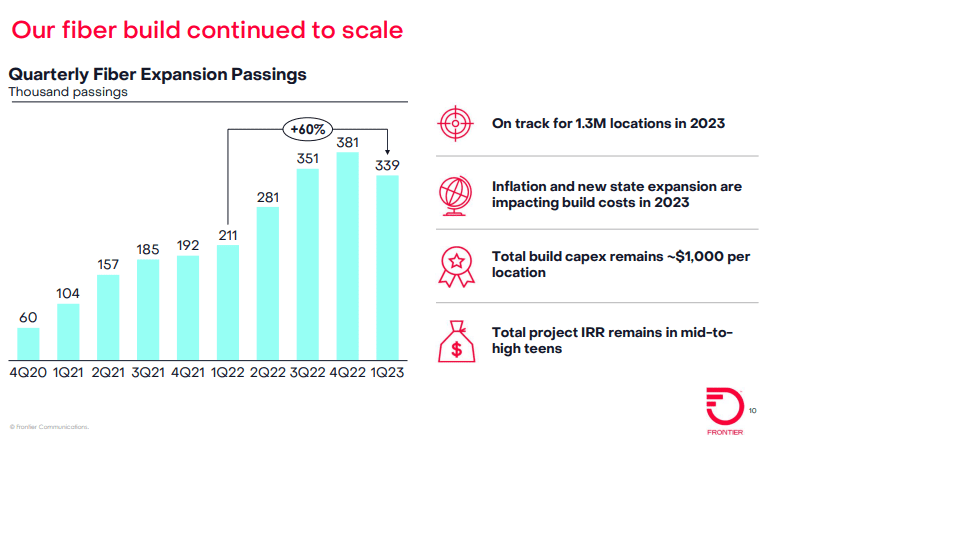

Frontier said it built fiber to an additional 339,000 locations in Q1 2023, up 60% from the 211,000 it built in the year-ago period. Frontier’s Q1 buildout was better than the 300,000 locations expected by the analysts at New Street Research. Frontier ended the quarter with 5.5 million fiber passings and 15.4 million total passings.

First-Quarter 2023 Consolidated Financial Results:

• Revenue of $1.44 billion decreased 0.5% from the first quarter of 2022 as growth in consumer, business and wholesale fiber was more than offset by declines in legacy copper

• Operating income was $143 million and net income was $3 million

• Adjusted EBITDA of $519 million increased 2.0% over the first quarter of 2022 as revenue declines were more than offset by lower content, selling, general and administrative expenses, and cost-saving initiatives

• Adjusted EBITDA margin of 36.0% increased from 35.2% in the first quarter of 2022

• Capital expenditures of $1.15 billion increased from $0.45 billion in the first quarter of 2022 as fiber expansion initiatives accelerated First-Quarter 2023

Consumer Results:

• Consumer revenue of $761 million decreased 1.9% from the first quarter of 2022 as strong growth in fiber broadband was more than offset by declines in legacy copper broadband and voice

• Consumer fiber revenue of $448 million increased 10.1% over the first quarter of 2022 as growth in consumer broadband, voice, and other more than offset declines in video

• Consumer fiber broadband revenue of $298 million increased 17.3% over the first quarter of 2022 driven by growth in fiber broadband customers

• Consumer fiber broadband customer net additions of 84,000 resulted in consumer fiber broadband customer growth of 19.5% from the first quarter of 2022

• Consumer fiber broadband customer churn of 1.20% was roughly flat with churn of 1.19% in the first quarter of 2022

• Consumer fiber broadband ARPU of $61.44 decreased 1.1% from the first quarter of 2022 driven primarily by the autopay and gift-card incentives introduced in the third quarter of 2021 First-Quarter 2023

Business and Wholesale Results:

• Business and wholesale revenue of $657 million decreased 1.4% from the first quarter of 2022 as growth in fiber was more than offset by declines in copper

• Business and wholesale fiber revenue of $281 million increased 6.0% over the first quarter of 2022 as growth in business was partly offset by modest declines in wholesale

• Business fiber broadband customer churn of 1.45% increased from 1.24% in the first quarter of 2022

• Business fiber broadband ARPU of $104.38 decreased 1.2% from the first quarter of 2022

………………………………………………………………………………………………………………………………..

While Frontier’s fiber growth engine continues to hum along, the company is dealing with higher costs related to its fiber initiative. The company raised its 2023 capex guidance to a range of $3 billion to $3.2 billion, up from an original outlook of $2.8 billion.

Frontier blamed the increase on a couple of factors – a decision to build inventory opportunistically where it saw supply chains ease a bit in the quarter and higher build costs as it scales its build into new geographies. Frontier is also seeing higher labor costs being driven by general inflation and higher rates as some of its multi-year labor contracts come up for renewal.

The anticipated increase in capex this year concerned investors. Frontier shares were down $2.33 (-10.94%) to $19.13 each in Friday morning trading.

Overall, Frontier expects fiber build costs in 2023 to be in the range of $1,000 to $1,100. But it’s confident that total project build costs will remain at about $1,000 per location as it mixes in lower-cost locations in some new-build states and benefits from aerial builds and an increased focus on multiple dwelling units (MDUs), Frontier CFO Scott Beasley said on Friday’s earnings call.

The current capex picture isn’t expected to impact Frontier’s overall fiber buildout/upgrade plan. “We’re confident that the 10 million locations is still attractive to build out,” Beasley said. Frontier is also continuing to explore an additional 1 million to 2 million additional fiber passings beyond the original 10 million target.

Frontier says it’s too early to tell how this year’s cost headwinds might impact future opportunities coming by way of the $42.5 billion Broadband Equity, Access and Deployment (BEAD) program. New Street Research estimates that there are 1.2 million BEAD-eligible locations in Frontier’s footprint. New Street Research expects ARPU pressure at Frontier to ease in the second quarter of the year and return to growth in the third quarter.

Frontier recently initiated several consumer pricing changes for value-added services that were previously free. Whole-home Wi-Fi, for example, now costs $10 per month, its Home Shield Elite product is now $6 per month extra and the company is now charging $50 for professional installs. Those actions are driving new fiber customer monthly ARPU to a range of $65 to $70, the company said.

Frontier is also speeding up its original cost savings target to $500 million by the end of 2024. Its prior target was $400 million by the end of 2024. Frontier is approaching that target through a range of streamlining and simplification initiatives, including improved field operations, self-service capabilities, the consolidation of call centers and an ongoing reduction in copper infrastructure.

Frontier’s guidance for the full year 2023:

• Adjusted EBITDA of $2.11 – $2.16 billion, unchanged from prior guidance

• Fiber build of 1.3 million new locations, unchanged from prior guidance

• Cash capital expenditures of $3.00 – $3.20 billion, an increase from prior guidance of $2.80 billion, reflecting higher inventory levels and fiber build costs

• Cash taxes of approximately $20 million, unchanged from prior guidance

• Net cash interest payments of approximately $655 million, an increase from prior guidance of $630 million, reflecting the $750 million of debt raised in March 2023

• Pension and OPEB expense of approximately $50 million (net of capitalization), unchanged from prior guidance

• Cash pension and OPEB contributions of approximately $125 million, unchanged from prior guidance

References:

Fiber builds propels Frontier Communication’s record 4th Quarter; unveils Fiber Innovation Labs

AT&T to use Frontier’s fiber infrastructure for 4G/5G backhaul in 25 states

Frontier Communications offers first network-wide symmetrical 5 Gig fiber internet service

Frontier Communications adds record fiber broadband customers in Q4 2022

Frontier’s Big Fiber Build-Out Continued in Q3-2022 with 351,000 fiber optic premises added

Frontier Communications sets another fiber buildout record; raises FTTP buildout target for 2022

“Fiber is the future” at Frontier, which added a record 54K fiber broadband customers in 1Q-2022

Frontier’s FTTP to reach 10M locations by 2025; +192,000 FTTP passings in 4Q-2021

Frontier Communications reports added 45,000 fiber broadband subscribers in 4Q-2021 – best in 5 years!