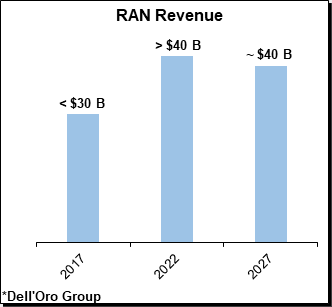

Dell’Oro: 5G RAN growing; total RAN growth is slowing over next 5 years

According to a newly published forecast report by Dell’Oro Group, after four years of extraordinary growth that propelled the radio access network (RAN) market to reach new record levels, the RAN market is now transitioning from the expansion phase to the next phase in this 5G journey with more challenging comparisons and slower growth.

“It is still early days in the 5G journey but at the same time, the coverage and capacity phases that have shaped the capex cycles with previous technology generations still hold,” said Stefan Pongratz Vice President and analyst with the Dell’Oro Group. “Still, even with the expected changes in capital intensities as the operators reach their initial 5G coverage targets, the plethora of 5G frequencies taken together with the upside from FWA and eventually private 5G, will curb the peak-to-trough decline relative to 2G-4G,” continued Pongratz.

Editor’s Note: In December, Ericsson said it expects the RAN market to be flat with 5G build-out still in its early days.

Additional highlights from the Mobile RAN 5-Year January 2023 Forecast Report:

- Global RAN is projected to grow at a zero percent CAGR outside of China by 2027. See chart below.

- The less advanced MBB regions are expected to grow while RAN investments in both China and North America are expected to decline at mid-single digit CAGRs over the forecast period.

- 5G RAN is expected to grow another 25 percent to 30 percent by 2027, though this will barely be enough to offset steep declines in LTE.

- mmWave projections have been revised downward over the near term and upward in the outer part of the forecast to reflect the potential upside with higher EIRP solutions.

- Small cell RAN revenue growth has been outpacing macros for some time now and these trends are expected to extend throughout the forecast period, with small cell RAN revenues growing more than 20 percent by 2027.

Dell’Oro Group’s Mobile RAN 5-Year Forecast Report offers a complete overview of the Mobile RAN industry by region – North America, Europe, Middle East & Africa, Asia Pacific, China, and Caribbean & Latin America, with tables covering manufacturers’ revenue and unit shipments for 5GNR, 5G NR Sub 6 GHz, 5G NR mmW and LTE pico, micro, and macro base stations. The report also covers Open RAN, Virtualized RAN, small cells, and Massive MIMO. To purchase this report, please contact by email at [email protected].

Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications, security, enterprise networks, and data center infrastructure markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions. For more information, contact Dell’Oro Group at +1.650.622.9400 or visit www.delloro.com

References:

5G RAN is Growing but Total RAN Growth is Slowing over Next Five Years, According to Dell’Oro Group

\

2 thoughts on “Dell’Oro: 5G RAN growing; total RAN growth is slowing over next 5 years”

Comments are closed.

I am tickled with how Dell’Oro derives its market numbers and projects how future sales will develop. If you want to get a true picture of the RAN market, the important figure is the share of manufacturers (including OpenRAN providers) across the installed base.

The way Dell’Oro calculates their numbers suggests which company is successful this month. That tells you little about next month, next year, or the next decade.

Strand Consult has studied OpenRAN sales projections. If OpenRAN gets the growth its proponents predict, it will account for less than 1 percent of the 5G mobile sites in 2025; not more than 3 percent in 2030 (of the total installed base). It looks like OpenRAN is too little, too late to make a difference in a world in which operators are deploying 10,000 classic 5G sites every month.

Dell’Oro makes money on financial projections for RAN. However what shareholders want to know is whether OpeRAN is 3, 5, 7 or 10 percent of the installed 5G base in 2025, 2030 or 2032.

There may be a business model in financial projections, but all the same, it is important to know the share of the equipment market across vendors and operators. That provides the most compelling evidence of whether OpenRAN makes a difference or not.

According to ReportLinker: The global Open RAN market is projected to grow from USD 1.1 billion in 2022 to USD 15.6 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 70.5% during the forecast period. Advantages such as solution flexibility, reduced costs and supply chain diversity is driving the Open RAN market growth.

The adoption of Open RAN services is expected to increase among service providers and enterprises with the increasing adoption of Open RAN solutions.The Open RAN market has been segmented based on services into consulting, deployment and implementation, and support and maintenance.

These services assist end users in reducing costs, lowering operational costs, increasing overall revenues, and improving business performance.

Sub-6GHz segment is expected to account for a larger market share during the forecast period

Businesses are already on the way to Sub-6GHz 5G.Huawei proposed bands below 6 GHz as the primary working frequency of 5G.

Qualcomm announced a 5G New Radio model system and trial platform.The 5G NR prototype system operates in the Sub-6GHz spectrum bands and is utilized to showcase the company’s 5G designs to efficiently achieve multigigabit per second data rates and low latency.

Mobile operators will continue to rely heavily on the Sub-6GHz spectrum. This is because it will take time for mmWave technology to be fully developed and harmonize the availability of the new spectrum bands.

Public segment to account for the largest market share during the forecast period

Public 5G wireless networks provide the same level of service and security to all clients.But the security risk is higher in case of public access and comes from the public sharing the network.

Also, when the network is busy, it can impact all users at the same time.The spectrum is usually owned by a mobile network operator (MNO), and in the public 5G network, the service and management are the responsibility of the MNO.

The public 5G network is intended for use by the public, with tens of millions of subscribers on a given nationwide network.

Among regions, Asia Pacific recorded the highest CAGR during the forecast period

Asia Pacific constitutes thriving economies, such as Singapore, Japan, China, India, and Australia, which are expected to register high growth rates in the Open RAN market.Asia Pacific houses many large countries with a wide population spread over remote locations and wide geographical areas.

Major leading companies such as Rakuten Mobile, NTT Docomo, KDDI, Reliance Jio, Bharti Airtel, Vodafone and more are involving and contributing to Open RAN technology in Asia Pacific region which is driving the growth of the market.

https://www.prnewswire.com/news-releases/the-global-open-ran-market-is-projected-to-grow-from-usd-1-1-billion-in-2022-to-usd-15-6-billion-by-2027–at-a-compound-annual-growth-rate-cagr-of-70-5-301712449.html