RAN

Omdia: Huawei increases global RAN market share due to China hegemony

Due to China’s enormous mobile network market (where foreign vendors are mostly shut out), Huawei remained the world’s largest vendor of radio access network (RAN) equipment – a market worth about $35 billion last year – according to Omdia (an Informa owned company). In 2023, the Chinese behemoth had a 31.3% share of the global RAN market. Omdia says Huawei’s market share was up by an unspecified amount in 2024, due to “a more favorable regional mix as well as market share gains in emerging markets,” according to Remy Pascal, principal analyst at Omdia.

Huawei recently reported a 22% increase in sales last year, to 860 billion Chinese yuan (US$ 118.6 billion), and it looks in better shape than its ailing western rivals. Its share of the global 5G networks market appears to have grown, according to the market research firm.

Omdia’s findings seems further to highlight the futility of U.S. sanctions against Huawei, originally imposed by Donald Trump in his first term as U.S. President and then expanded by President Joe Biden.

Image Credit: Huawei

China still lacks the ability to make the most advanced chips featuring the tiniest transistors. But technical workarounds or loopholes in trade rules have enabled Huawei to revive its smartphone business and remain competitive in networks. Late last year, telco executives who spoke on condition of anonymity said there had been no discernible impact on the quality of its products. And Ericsson continues to regard Huawei as its chief rival.

……………………………………………………………………………………………………………………………………….

“After two years of significant acceleration and exceptionally high investment in 2021 and 2022, and two years of steep decline in 2023 and 2024, Omdia expects 2025 to be a year of stabilization for the RAN market,” said Remy Pascal of Omdia. “Different regions will follow different trajectories, but at a global level, the market is expected to be flattish. North America has returned to growth in 2024 and we expect this to continue, we also expect a positive trajectory in some emerging markets.”

……………………………………………………………………………………………………………………………..

Other results and forecasts from Omdia:

- The total global RAN market (which includes hardware and software but not services) was just over $35 billion last year, which represented a 12 percent decline on the previous year.

- There was a very slight drop in the aggregate market share of the top five RAN equipment vendors – Huawei, Ericsson, Nokia, ZTE and Samsung. In 2023, Omdia had that figure at about 95%. In 2024, it was roughly 94%.

- Ericsson was one of the main gainers last year thanks to its huge AT&T (non) OpenRAN contract.

- As a result, Nokia lost market share in the U.S., but claims that its global RAN footprint grew by 18,000 sites in 2024.

- Tejas Networks, an Indian RAN equipment vendor (not in the top five) that landed a large 4G contract with state-owned BSNL was another winner.

- Global RAN revenue will be “essentially flat” this year and marked by “low single digit percentage growth” outside China.

- A “positive trajectory” in emerging Asian markets as well as Africa, the Middle East and Latin America is forecast. Europe risks falling behind other parts of the world in mobile network markets.

Top RAN vendors, full year 2024 RAN revenue:

|

Global |

Global ex-China |

|---|---|

|

Huawei |

Ericsson |

|

Ericsson |

Nokia |

|

Nokia |

Huawei |

|

ZTE |

Samsung |

|

Samsung |

ZTE |

Top RAN vendors, full year 2024 RAN revenue, top 3 by region:

|

North America |

Asia & Oceania |

Europe |

Middle East and Africa |

Latin America & the Caribbean |

|---|---|---|---|---|

|

Ericsson |

Huawei |

Ericsson |

Huawei |

Huawei |

|

Nokia |

ZTE |

Nokia |

Nokia |

Ericsson |

|

Samsung |

Ericsson |

Huawei |

Ericsson |

……………………………………………………………………………………………………………………………………….

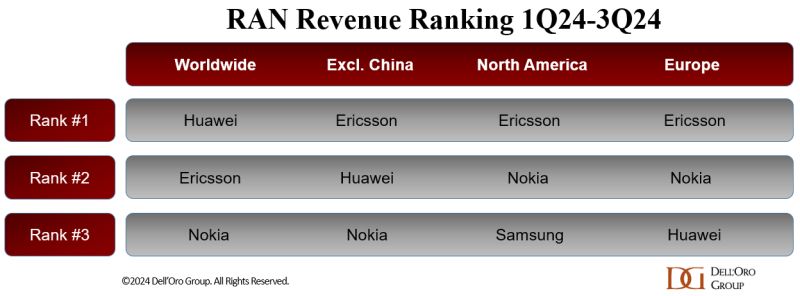

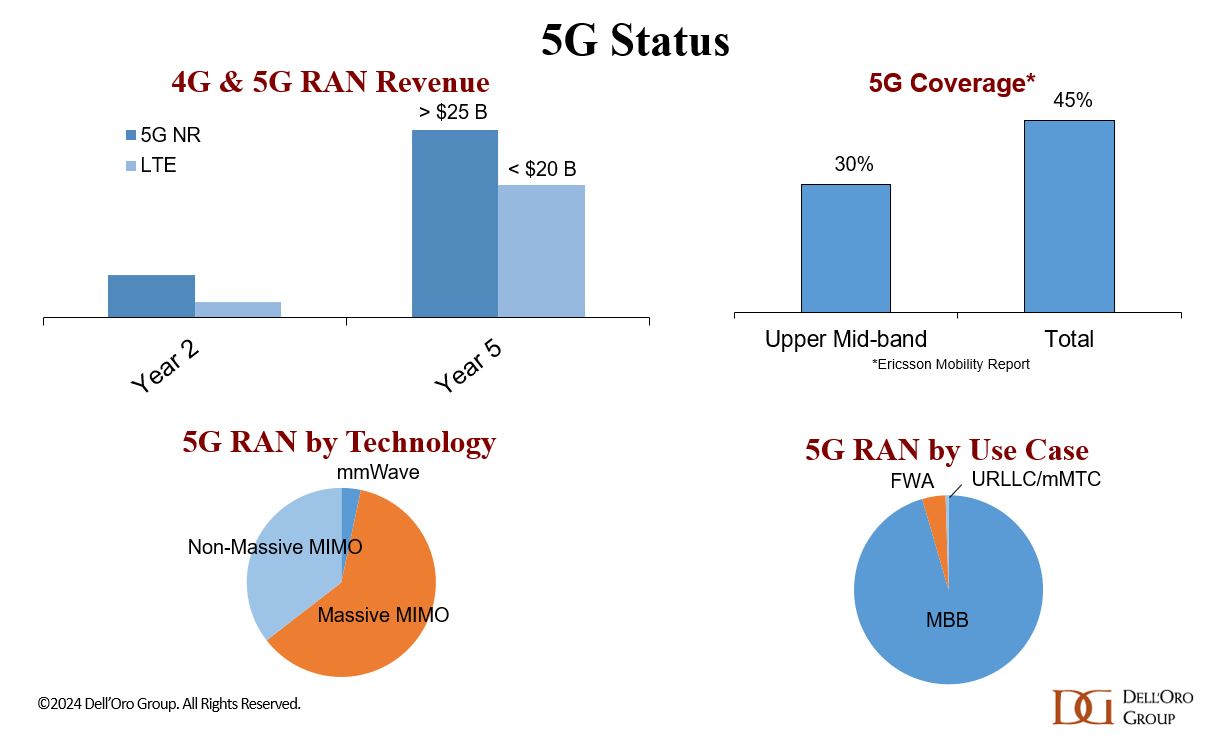

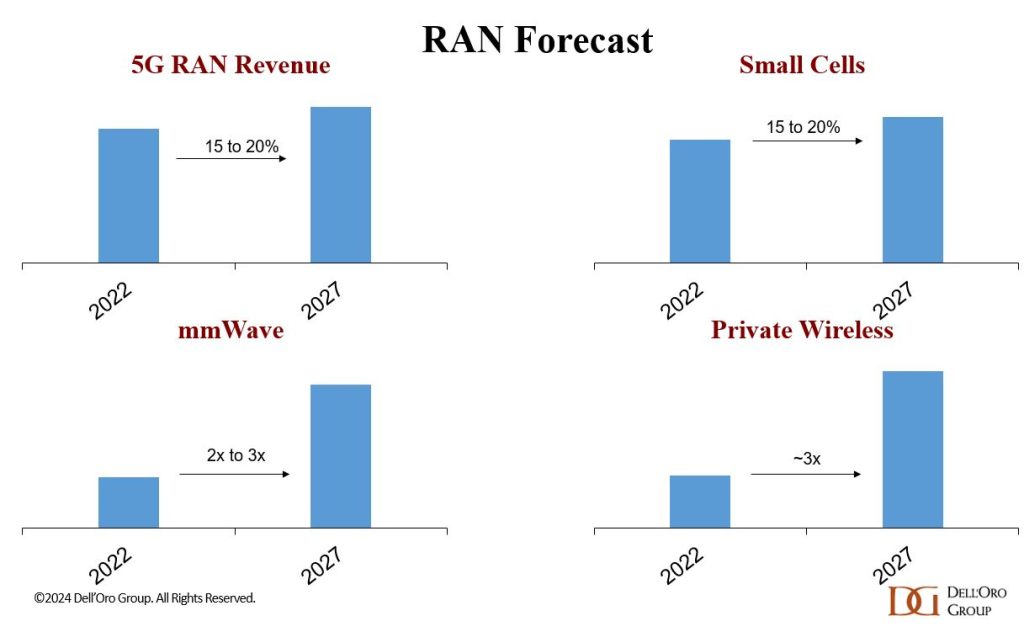

Dell’Oro Group’s most recent RAN report a few weeks ago stated that the global RAN market is expected to improve slightly over the short term, but the long-term outlook remains subdued. “The underlying message we have communicated for some time has not changed,” said Stefan Pongratz, Vice President for RAN market research at Dell’Oro Group. “Regional imbalances will impact the market dynamics over the short term while the long-term trajectory remains flat. This is predicated on the assumption that new RAN revenue streams from private wireless and FWA, taken together with MBB-based capacity growth, are not enough to offset slower MBB coverage-based capex,” said Dell’Oro’s Stefan Pongratz.

References:

https://www.lightreading.com/5g/huawei-defies-us-to-grow-market-share-as-ran-decline-ends-omdia

RAN Equipment Market to Remain Uninspiring, According to Dell’Oro Group

Network equipment vendors increase R&D; shift focus as 0% RAN market growth forecast for next 5 years!

Telco spending on RAN infrastructure continues to decline as does mobile traffic growth

vRAN market disappoints – just like OpenRAN and mobile 5G

Mobile Experts: Open RAN market drops 83% in 2024 as legacy carriers prefer single vendor solutions

Network equipment vendors increase R&D; shift focus as 0% RAN market growth forecast for next 5 years!

In 2024, Ericsson’s R&D spending was SEK53.5 billion ($4.8 billion). “It is our firm commitment to really ensure that we have capacity to do the investments in R&D over time,” said Lars Sandström, Ericsson’s chief financial officer. “I think that has been the guiding star for the company for quite some years and I think, if you go long back into history, we felt that has been hurting our ability to invest when not having the right cash position.” Meanwhile, Nokia’s R&D spending rose 5% on the year, to about €4.5 billion ($4.6 billion).

Combined, that was only one-third of Huawei’s projected 2024 R&D spending of around 197.8 billion yuan or $27.3 billion which was ~20% higher than 2023. Huawei’s R&D spending has increased in recent years, from 102 billion yuan in 2018 to 164.7 billion yuan in 2023. It invests more than 10% of its sales revenue into R&D each year. In addition to telecom and IT equipment/software, Huawei is a leader in China’s efforts to develop advanced chips and technology. The company is involved in a government-funded project to develop memory units for AI chips.

Mobile network market shrinkage has not helped ROI in wireless network R&D projects. Overall RAN sales fell 11% in 2023, to about $40 billion, said researchers at Informa owned Omdia. At the midpoint of its most recently published data, Omdia was anticipating another contraction of 15% in 2024 to ~$35 billion.

Stefan Pongratz of Dell’Oro said that mobile infrastructure investments slowed significantly in 2024. Preliminary findings indicate that the Radio Access Network (RAN) market contracted by 10 to 20% year-over-year (YoY) during the 1Q24 to 3Q24 period (final 4Q24 and full-year data expected around mid-February). Network operators in many countries paused spending after their initial 5G rollouts did not lead to meaningful improvements in sales or profitability.

Following the intense 5G acceleration phase from 2017 to 2022, RAN investments declined sharply in 2023 and 2024, with the exception of India where RAN market growth is now tapering off.

While data for 2024 is unavailable, the top five vendors – Huawei, Ericsson, Nokia, ZTE and Samsung – served ~95.1% of the global RAN market in 2023, according to Omdia. That doesn’t leave much room for start-up or other RAN equipment makers (like Fujitsu, NEC, Datang Mobile, Mavenir, CICT Mobile, Comba, and other small players).

“The underlying message we have communicated for some time has not changed,” said Stefan Pongratz, Vice President for RAN market research at Dell’Oro Group. “Regional imbalances will impact the market dynamics over the short term while the long-term trajectory remains flat. This is predicated on the assumption that new RAN revenue streams from private wireless and FWA, taken together with MBB-based capacity growth, are not enough to offset slower MBB coverage-based capex,” continued Pongratz.

Additional highlights from Del’Oro’s Mobile RAN 5-Year January 2025 Forecast Report:

- Worldwide RAN revenues are projected to grow at a 0% CAGR over the next five years, as rapidly declining LTE revenues will offset continued 5G investments.

- Medium-term risks to the baseline are balanced, while the long-term risks are tilted to the downside and characterized by the data growth uncertainty with the existing MBB use case. As the investment focus gradually shifts from coverage to capacity, one of the most significant forecast risks is slowing mobile data traffic growth. Given current network utilization levels and data traffic trends in more advanced markets, there are serious concerns about the timing of capacity upgrades.

- The mix between existing and new use cases has not changed. Private/enterprise RAN is expected to grow at a 20 percent plus CAGR while public RAN investments decline. At the same time, because of the lower starting point, it will take some time for private RAN to move the broader RAN needle.

- 5G-Advanced positions remain unchanged. The technology will play an essential role in the broader 5G journey. However, 5G-Advanced is not expected to fuel another major capex cycle. Instead, operators will gradually transition their spending from 5G towards 5G-Advanced within their confined capex budgets.

- RAN segments that are expected to grow over the next five years include 5G NR, FWA, mmWave, Open RAN, vRAN, private wireless, and small cells.

…………………………………………………………………………………………………………………………………………………………..

So how do incumbent RAN vendors cope? Ericsson is becoming more heavily reliant on software sales. CEO Börje Ekholm told analysts on the company’s last earnings call: “It is going to take some time for customers to realize we are increasingly becoming a software business. If you go back 15 years, we were much more hardware-centric, and then it was a bigger question for customers. As you move into becoming a software vendor, the working capital becomes less and less and less.”

Nokia is turning to data center connectivity for growth. CEO Pekka Lundmark declared that data centers are now the company’s top growth target, shifting away from its traditional focus on telecommunications networks and services. Nokia is developing and promoting data center switching platforms, IP networking solutions, and automation technologies to cater to the needs of hyperscalers and enterprise customers. The company has secured notable contracts with companies like CoreWeave, a leading AI hyperscaler, which demonstrates their growing presence in the data center space. It’s also in the process of acquiring fiber optic equipment company Infinera which will enhance both inter and intra- data center connect capabilities. Nokia is emphasizing open-source software like SONiC alongside its own SR Linux operating system to provide flexibility and cater to diverse customer requirements.

References:

https://www.lightreading.com/5g/ericsson-and-nokia-flaunt-cash-as-open-ran-pack-struggles

RAN Equipment Market to Remain Uninspiring, According to Dell’Oro Group

Dell’Oro: Global RAN Market to Drop 21% between 2021 and 2029

Highlights of Dell’Oro’s 5-year RAN forecast

Mobile Experts: Open RAN market drops 83% in 2024 as legacy carriers prefer single vendor solutions

Dell’Oro: OpenRAN revenue forecast revised down through 2027

Dell’Oro: RAN market still declining with Huawei, Ericsson, Nokia, ZTE and Samsung top vendors

Dell’Oro & Omdia: Global RAN market declined in 2023 and again in 2024

Dell’Oro: RAN market declines at very fast pace while Mobile Core Network returns to growth in Q2-2023

Dell’Oro: RAN Market to Decline 1% CAGR; Mobile Core Network growth reduced to 1% CAGR

Telco spending on RAN infrastructure continues to decline as does mobile traffic growth

Telco spending on radio access network (RAN) infrastructure, which is the largest share of capex, has dropped sharply in the last couple of years. It fell 11% in 2023, to about $40 billion, according to Informa owned market research firm Omdia (see References below for Dell’Oro’s numbers).

For 2024, Omdia predicts another decline of between 7% and 9%. Instead of buying new equipment, telcos have used existing supplies in their where houses.

Traffic growth rates also appear to have slowed. The graphic used in Ericsson’s latest mobility report pictures this very clearly, showing a church steeple of a traffic spike in 2019 and 2020 before a shallower downward-sloping gradient to the first half of 2024. That’s shown in this chart:

.jpg?width=700&auto=webp&quality=80&disable=upscale)

Source: Ericsson

Ericsson’s latest numbers, available through its mobility visualizer tool, shows the monthly volume of global mobile data rose by just 4.34% in the second quarter of 2024, compared with the first quarter. This is much lower than the rate of 10.76% Ericsson observed in the corresponding quarter four years earlier. The actual increase in 2024 was 6.27 exabytes. In 2020, it was 4.86 exabytes.

RAN product revenues have been falling at their sharpest rate in many years despite the 6.27-exabyte increase in monthly data volumes that happened in the second quarter. There are no signs that current 4G and 5G networks are about to keel over beneath an avalanche of data. It remains to be seen whether mobile networks are sufficiently robust to cope with many more exabytes of mobile data traffic or if telcos care about any service problems caused by congestion due to increased traffic.

There is also no obvious correlation between traffic growth and expenditure, according to Coleago Consulting. Spain’s Telefónica supported 17,054 petabytes of data on its global networks in 2015, its annual reports show. By 2023, the amount had rocketed to 146,074. Yet its capital intensity has fallen from more than 17% to just 14% over this period. Energy use, a proxy for operating costs, is also down, dropping from about 6,578 gigawatt hours in 2015 to 6,012 last year. Despite all that data consumption by its customers, Elisa’s capital intensity last year was less than 15%.

In Germany, the average monthly data usage per mobile customer (rather than per capita) amounted to 7.4 Gbytes and this may have risen to around 8 Gbytes in 1H 2024. In 2024, mobile data consumption in Finland was around 10 times higher compared to Germany. In Finland mobile operators have implemented 5G-SA and sell a user experience in terms of speed (Mbits/s) as opposed to data volume (Gbytes). As of October 2024, Elisa Finland offered a speed of 300 Mbits/s with unlimited data volume for €34.99. By contrast, in Germany, Telekom’s offer for 20 Gbytes is priced at €39.95 per month. For unlimited data usage Telekom charges €84.95, which is 2.5 times more costly than Elisa’s unlimited offer. It is unreasonable to assume that there is no price elasticity of demand. Surely, if prices in Germany were like those in Finland, monthly mobile data usage per customer would be much higher.

Monthly average revenue per user (ARPU) for a postpaid customer of Deutsche Telekom, Germany’s biggest telco, has fallen from €22 (US$23.7) before the launch of 5G to about €20 ($21.6) for the most recent quarter. Clearly, cost realities are especially awkward for Europe’s telcos, which have refused to give up their “fair share” argument that big content companies should pay for network usage because of all the traffic they supposedly generate. Critics disagree, saying that the telco’s own customers are the traffic generators, and they have already paid for it, even if pricing schemes do not help telcos to grow their sales.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

References:

https://www.lightreading.com/5g/data-traffic-growth-or-decline-there-s-no-upside-for-telecom

https://www.coleago.com/insights/the-end-of-telecoms-history-not-really/

Analysys Mason & Light Reading: cellular data traffic growth rates are decreasing

Dell’Oro: Global RAN Market to Drop 21% between 2021 and 2029

Dell’Oro: RAN market still declining with Huawei, Ericsson, Nokia, ZTE and Samsung top vendors

Dell’Oro & Omdia: Global RAN market declined in 2023 and again in 2024

Dell’Oro: RAN market declines at very fast pace while Mobile Core Network returns to growth in Q2-2023

China’s mobile data consumption slumps; Apple’s market share shrinks-no longer among top 5 vendors

Analysts: Telco CAPEX crash looks to continue: mobile core network, RAN, and optical all expected to decline

Ookla: T-Mobile and Verizon lead in U.S. 5G FWA

Dell’Oro: Global telecom CAPEX declined 10% YoY in 1st half of 2024

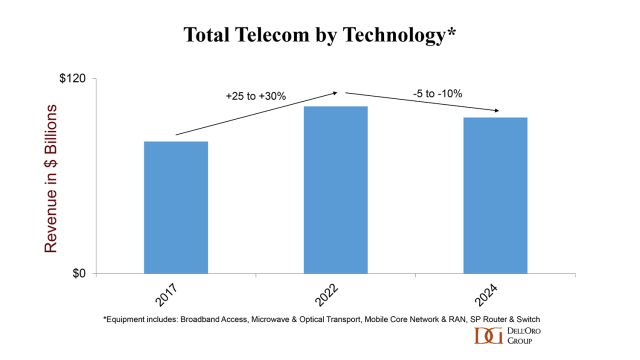

According to a recent report by Dell’Oro Group, telecom operators are now scaling back their investments in 5G and fixed broadband technologies. Of course, that’s nothing new as telco CAPEX has been declining for quite some time (see References below). Preliminary Dell’Oro findings show that the more challenging conditions that shaped the second half of 2023 extended into the first half of 2024.

Worldwide telecom capex, the sum of wireless and wireline/other telecom carrier investments, declined 10% year-over-year (YoY) in the first half of 2024, partly due to built-up inventory, weaker demand in China, India, and US, challenging 5G comparisons, excess capacity, and elevated uncertainty.

“The high-level message is clear. The flattish revenue trajectory and the difficulties with monetizing new technologies and opportunities are impacting the risk appetite and willingness to raise the capital intensity levels for extended periods,” said Stefan Pongratz, Vice President for RAN and Telecom Capex research at Dell’Oro Group. “In addition, the reduced gap between advanced and less advanced regions, when it comes to adopting new technologies, is impacting the investment intensity on the way up and down,” continued Pongratz.

Additional highlights from the September 2024 Telecom Capex report:

- Global carrier revenues are expected to increase at a 1 percent CAGR over the next 3 years.

- Worldwide telecom capex is projected to decline at a mid-single-digit rate in 2024 and at a negative 2 percent CAGR by 2026.

- The mix between wireless and wireline remains largely unchanged, reflecting challenging times still ahead for wireless. Wireless-related capex will decline at a 3 percent CAGR by 2026.

- Capital intensity ratios are modeled to approach 15 percent by 2026, down from 17 percent in 2023.

In a previous Dell’Oro report last month, telecom equipment revenues fell by 17% worldwide during the first half of the year. Dell’Oro described that as ‘abysmal results’ and again blamed excess inventory, weaker demand in China, ‘challenging 5G comparisons’, and elevated uncertainty.

In a previous Dell’Oro report last month, telecom equipment revenues fell by 17% worldwide during the first half of the year. Dell’Oro described that as ‘abysmal results’ and again blamed excess inventory, weaker demand in China, ‘challenging 5G comparisons’, and elevated uncertainty.

The Dell’Oro Group Telecom Capex Report provides in-depth coverage of around 50 telecom operators, highlighting carrier revenue, capital expenditure, and capital intensity trends. The report provides actual and 3-year forecast details by carrier, by region by country (United States, Canada, China, India, Japan, and South Korea), and by technology (wireless/wireline). To purchase this report, please contact by email at [email protected].

References:

Telecom Capex Down 10 Percent in 1H24, According to Dell’Oro Group

Dell’Oro: Abysmal revenue results continue: Ethernet Campus Switch and Worldwide Telecom Equipment + Telco Convergence Moves to Counter Cable Broadband

Analysts: Telco CAPEX crash looks to continue: mobile core network, RAN, and optical all expected to decline

Analysys Mason’s gloomy CAPEX forecast: “there will not be a cyclical recovery”

China Mobile & China Unicom increase revenues and profits in 2023, but will slash CAPEX in 2024

Dell’Oro: RAN market still declining with Huawei, Ericsson, Nokia, ZTE and Samsung top vendors

Highlights of Dell’Oro’s 5-year RAN forecast

Dell’Oro: 2023 global telecom equipment revenues declined 5% YoY; Huawei increases its #1 position

Dell’Oro & Omdia: Global RAN market declined in 2023 and again in 2024

Global 5G Market Snapshot; Dell’Oro and GSA Updates on 5G SA networks and devices

Dell’Oro: RAN market still declining with Huawei, Ericsson, Nokia, ZTE and Samsung top vendors

RAN market conditions continued to remained challenging in the second quarter despite some faint signs of improvements. Dell’Oro estimates that the overall 2G–5G Radio Access Network (RAN) market—including baseband plus radio hardware and software, excluding services—declined at a double-digit rate for a fourth consecutive quarter in 2Q24. The results in the second quarter were mostly an extension of what we have seen over the past year, characterized by cautious capex spending and challenging comparisons.

“Even if the RAN market is still down at a double-digit rate in the first half, the second quarter offered some glimmer of hope that the nadir of this cycle with double-digit declines might now be in the past for the time being,” said Stefan Pongratz, Vice President and analyst at the Dell’Oro Group. “This does not change the fact that the RAN market is expected to decline at a 2 percent CAGR over the next five years. But the pace of the decline should moderate somewhat going forward,” continued Pongratz.

Additional highlights from the 2Q 2024 RAN report:

- Total RAN revenues were mostly in line with expectations.

- Strong growth in North America and stable trends in China were not enough to offset steep declines in the Asia Pacific region, partly driven by sharp drops in India.

- Vendor rankings are mostly unchanged. The top 5 RAN suppliers based on worldwide revenues are Huawei, Ericsson, Nokia, ZTE, and Samsung.

- Relative to 2023, Huawei’s 1H 2024 revenue share is up, ZTE is stable, and Nokia/Ericsson are together down 3 to 4 percentage points.

- Short-term RAN projections are mostly unchanged since the 5-year forecast update. Global RAN is expected to decline 8 percent to 12 percent outside of China.

On the bright side, the overall results were fairly aligned with expectations, and more regions are now growing. Our initial analysis shows that three out of the six tracked regions advanced on a year-over-year basis in the quarter, up from just one region in the first quarter (North America, MEA, and CALA increased while Europe, China, and Asia Pacific Excl. China declined).

Strong growth in North America and stable trends in China were not enough to offset steep declines in the Asia Pacific region, partly driven by sharp drops in India.

The supplier landscape is mostly unchanged with Huawei, Ericsson, Nokia, ZTE Corporation, and Samsung Networks still leading the way, while many of the non-top 5 suppliers are declining.

Relative to 2023, Huawei’s 1H 2024 revenue share is up, ZTE is stable, and Nokia/Ericsson are together down 3 to 4 percentage points.

Short-term RAN projections have remained mostly unchanged since the 5-year forecast update. Global RAN is expected to decline 8% to 12% outside of China. This implies a stronger-than-typical 2024 second half, comprising more than 53% of full-year revenues.

References:

RAN Market Still Down with Some Glimmer of Hope, According to Dell’Oro Group

Analysts: Telco CAPEX crash looks to continue: mobile core network, RAN, and optical all expected to decline

Where Have You Gone 5G? Midband spectrum, FWA, 2024 decline in CAPEX and RAN revenue

Dell’Oro & Omdia: Global RAN market declined in 2023 and again in 2024

Dell’Oro: RAN market declines at very fast pace while Mobile Core Network returns to growth in Q2-2023

Dell’Oro: RAN Market to Decline 1% CAGR; Mobile Core Network growth reduced to 1% CAGR

AI RAN Alliance selects Alex Choi as Chairman

Backgrounder:

The AI RAN Alliance, formed earlier this year, is a groundbreaking collaboration aimed at revolutionizing the RAN industry. Partnering with tech giants, the goal is to transform traditional Radio Access Networks (RANs) into intelligent, self-optimizing systems using advanced AI technologies. Their website states:

Bringing together the technology industry leaders and academic institutions, the AI-RAN Alliance is dedicated to driving the enhancement of RAN performance and capability with AI. Moreover, we aim to optimize RAN asset utilization, and unlock new revenue streams. By pioneering AI-based innovations in RAN, we aspire to profitably propel the telecom industry towards 6G.

The alliance’s founding members include Amazon Web Services, Inc. (AWS), Arm, DeepSig Inc. (DeepSig), Telefonaktiebolaget LM Ericsson (Ericsson), Microsoft Corporation (Microsoft), Nokia, Northeastern University, NVIDIA, Samsung Electronics, SoftBank Corp. (SoftBank) and T-Mobile USA, Inc. (T-Mobile).

The group’s mission is to enhance mobile network efficiency, reduce power consumption, and retrofit existing infrastructure, setting the stage for unlocking new economic opportunities for telecom companies with AI, facilitated by 5G and 6G.

Image Courtesy of the AI RAN Alliance.

Purpose:

The AI RAN Alliance is dedicated to eliminating the inefficiencies of traditional RAN systems by embedding AI directly into network infrastructures. This shift will enable, for example, dynamic resource allocation, predictive maintenance, and proactive network management.

Industry Benefits:

Enhanced Network Efficiency: Real-time optimized bandwidth allocation and improved user experiences.

Economic Advantages: Cost savings from AI-driven automation and reduced energy consumption.

Innovative Revenue Opportunities: New services such as real-time AI Assistants on your mobile devices.

Key Focus Areas:

- AI for RAN

- AI on RAN (RAN for AI)

- AI and RAN

………………………………………………………………………………………………………………………….

New AI RAN Alliance Chairman:

On August 15, 2024, the AI RAN Alliance appointed Dr. Alex Jinsung Choi, Principal Fellow of SoftBank Corp.’s Research Institute of Advanced Technology as Chairman.

“The AI-RAN Alliance is set to transform telecommunications through AI-RAN advancements, increased efficiency, and new economic opportunities,” said Choi. “As Chair, I’m excited to lead this AI-RAN initiative, working with industry leaders to enhance mobile networks, reduce power consumption, and modernize infrastructure with 5G and 6G with AI/ML. Our goal is to drive societal progress through AI-RAN, transitioning from traditional to next-generation communications infrastructure.”

Satadal Bhattacharjee, Sr. Director of Marketing, Infrastructure BU, ARM, said, “We’re excited to collaborate with Choi, the Chair of the AI-RAN Alliance. Like Choi, we believe that AI will fundamentally change the way wireless services are deployed, fostering broad innovation and enhancing operational efficiency. We look forward to working with key industry leaders from silicon to software to fulfill the promise of ubiquitous AI and 6G.”

Jim Shea, Co-founder and CEO of DeepSig, said, “As a pioneer in AI-native communications together with his prior experience growing the O-RAN ALLIANCE, Choi will lead this important initiative that is shaping the future of intelligent radio access networks. DeepSig’s extensive AI/ML wireless expertise will play a key role in this exciting collaboration to leverage advanced technologies to help the industry unlock unprecedented network efficiency and accelerate innovation.”

Mathias Riback, VP & Head of Advanced Technology U.S., Ericsson, said, “I’m thrilled to welcome Dr. Choi as Chair of the AI-RAN Alliance. As a non-standardization organization, the Alliance can uniquely complement the work of existing SDOs by focusing on shaping innovative use cases that integrate AI with RAN. In addition to realizing benefits from AI in RAN implementations, it will be important to advance ‘AI on RAN’ use cases, where mobile networks play a critical role in enabling AI applications. Ericsson is fully committed to fostering a collaborative environment that unites all players in the evolving AI ecosystem to shape the future of telecom together.”

Shawn Hakl, VP of 5G Strategy, Microsoft, said, “At Microsoft, we recognize artificial intelligence (AI) as a pivotal technology of our era. We are excited to be a part of the AI-RAN Alliance and are particularly pleased to see Choi step into the role of Chair. Choi’s leadership will be key as we collaborate to leverage AI in optimizing RAN infrastructure investments and expanding the capabilities of RAN to introduce new AI-driven services for modern mobile applications.”

Ari Kynäslahti, Head of Strategy and Technology, Mobile Networks at Nokia commented, “Nokia is proud to be part of the AI-RAN Alliance and contribute towards integrating AI into radio access networks. The potential of AI to optimize networks, predict and resolve issues, and enhance performance and service quality is significant. As we embark on this transformative journey, collaboration is essential to harness our collective expertise. We are pleased to see Dr. Alex Choi appointed to this role, and look forward to him guiding our efforts to achieve these goals.”

Tommaso Melodia, William L. Smith Professor, Northeastern University, said, “We are pleased to have Choi as the Chair of the AI-RAN Alliance, leading our efforts to transform the industry. Choi has been a strong advocate for the evolution towards a more open, software-driven, and AI-integrated future. Under Choi’s leadership, the AI-RAN Alliance is set to fast-track the development of new services and use cases by leveraging openness, softwarization, and AI integration to enhance network performance, energy efficiency, spectrum sharing, and security, ultimately redefining the landscape of global communications.”

Soma Velayutham, GM, AI and Telecoms, NVIDIA, said, “The AI-RAN Alliance is a critical initiative for advancing the convergence of AI and 5G/6G technologies to drive innovation in mobile networks. The consortium’s new leadership will bring a fresh perspective and focus on delivering the next generation of connectivity.”

Dr. Ardavan Tehrani, Samsung Research, AI-RAN Alliance Board of Directors Vice Chair, said, “We are excited to have Dr. Alex Choi leading the AI-RAN Alliance as the Chair of the Board. The Alliance will play a pivotal role in fostering collaboration, driving innovation, and transforming future 6G networks utilizing AI. Under Dr. Choi’s leadership, the Alliance will strive to deliver substantial value to end users and operators through pioneering AI-based use cases and innovations.”

Ryuji Wakikawa, VP and Head of Research Institute of Advanced Technology, SoftBank Corp., said, “SoftBank is committed to realizing an AI-powered network infrastructure, and we strongly believe that Choi’s extensive background and expertise will be a great force in advancing AI-RAN technology and driving significant progress for the mobile industry in this AI era with lightning speed.”

John Saw, EVP and CTO, T-Mobile, said, “We are thrilled to have Alex Choi as Chair of the AI-RAN Alliance. AI is advancing at an unprecedented rate and with our 5G network advantage we have a unique opportunity to harness this momentum. By developing solutions that make the most of both RAN and AI on GPUs — and working alongside Choi and the top industry leaders within the Alliance — we believe there is potential for change that will revolutionize the industry.”

Dr. Akihiro Nakao, Professor, The University of Tokyo, said, “Dr. Alex Jinsung Choi’s appointment as Chair of the AI-RAN Alliance represents a pivotal step in advancing AI within the telecommunications sector. His leadership is expected to unite academic and industry efforts, nurturing the next wave of innovators who will drive the future of AI and telecommunications. This initiative will not only fast-track the adoption of AI across diverse applications but also foster international collaboration and set new standards for efficiency, energy management, resilience, and the development of AI-driven services that will reshape the telecommunications industry and benefit society worldwide.”

……………………………………………………………………………………………………………………………………………….

References:

https://ai-ran.org/news/industry-leaders-in-ai-and-wireless-form-ai-ran-alliance/

AI sparks huge increase in U.S. energy consumption and is straining the power grid; transmission/distribution as a major problem

Dell’Oro & Omdia: Global RAN market declined in 2023 and again in 2024

Nokia’s 760 global private networking contracts are mostly 4G-LTE Advanced

Backgrounder:

Private Wireless Radio Access Network (RAN) revenue growth slowed in the fourth quarter of 2023 on a year-over-year basis. However, full-year revenues accelerated by approximately 40% in 2023, propelling private wireless to comprise around 2% of the overall RAN market.

“Private wireless RANs are now growing at a formidable pace, in contrast to public RAN and enterprise WLAN – both segments are projected to contract in 2024,” said Stefan Pongratz, Vice President at Dell’Oro Group in April.

The top 3 Private Wireless RAN suppliers in 2023 were Huawei, Nokia, and Ericsson. Excluding China, they were Nokia, Ericsson, and Samsung.

……………………………………………………………………………………………………………………………………………..

Nokia leads in Private RANs:

Nokia recently told Fierce Network that it signed 30 new private networking contracts in the second quarter of 2024. Nokia has said that it has signed more than 760 private network contracts around the world. NGIC, Sigma Lithium and Solis are some of the most recent names it has signed.

Nokia said that 78% of its private network business is based on 4G LTE-Advanced [1.], compared to 18% being 5G only, and the remaining 4% combining the two broadband cellular technologies.

Note 1. In October 2010, LTE-Advanced successfully passed the ITU-R’s evaluation process and was found to meet or exceed IMT-Advanced requirements. It was standardized a “IMT Advanced,” which support low to high mobility applications and a wide range of data rates in accordance with user and service demands in multiple user environments. IMT Advanced also has capabilities for high quality multimedia applications within a wide range of services and platforms, providing a significant improvement in performance and quality of service.

Image courtesy of Research Gate

…………………………………………………………………………………………………………………………………………….

David de Lancellotti, VP of enterprise campus edge business at Nokia talked to Fierce about Nokia’s performance in the private networking space. “Thirty in Q2, and roughly 50 — a little more than 50 — in the first half,” he said of contracts signed.

“We kind of jumped into this a bit earlier than anybody else,” Nokia’s de Lancellotti explained. “I think we’ve always taken a real service provider approach in terms of quality, in terms of feature set [and] in terms of roadmap,” while noting Nokia’s “real drive to pick up the enterprise space.”

Industry verticals – transportation, energy and manufacturing – continue to “lead the way” for private networking contracts in Q2. “When we talk about transportation, I think that’s the port side of business, which continues to be strong for us,” David said.

References:

https://www.fierce-network.com/wireless/nokia

Private Wireless RAN Revenues up ~40 Percent in 2023, According to Dell’Oro Group

https://en.wikipedia.org/wiki/LTE_Advanced

https://www.itu.int/en/ITU-R/study-groups/rsg5/rwp5d/imt-adv/Pages/default.aspx

https://www.researchgate.net/figure/Network-architecture-of-LTE-Advanced_fig1_333886291

Highlights of Dell’Oro’s 5-year RAN forecast

Market conditions remain challenging for the broader RAN market. Following the 40% to 50% ramp between 2017 and 2021, the RAN market has been declining since then. These trends are expected to prevail throughout the forecast period. However, the pace of the decline should moderate somewhat after 2024.

“It is not a surprise that there is rain after sunshine,” said Stefan Pongratz, Vice President for RAN market research at Dell’Oro Group. “In addition to MBB-based coverage-related challenges, this disconnect between mobile data traffic growth and the capacity boost provided by the mid-band, taken together with continued monetization uncertainty, is clearly weighing on the market,” Pongratz added.

- Worldwide RAN revenues are projected to decline at a 2 percent CAGR over the next five years, as continued 5G investments will be offset by rapidly declining LTE revenues.

- The Asia Pacific region is expected to lead the decline, while easier comparisons following steep contractions in 2023 will improve the growth prospects in the North American region. Even with some recovery, North American RAN revenues are expected to remain significantly lower relative to the peak in 2022.

- 5G-Advanced positions remain unchanged. The technology will play an essential role in the broader 5G journey. However, 5G-Advanced is not expected to fuel another major capex cycle. Instead, operators will gradually transition their spending from 5G towards 5G-Advanced within their confined capex budgets.

- RAN segments that are expected to grow over the next five years include 5G NR, FWA, mmWave, Open RAN, vRAN, private wireless, and small cells.

Commentary:

Worldwide RAN revenues are projected to decline at a 2% CAGR between 2023 and 2028, as rapidly declining LTE revenues will offset continued 5G investments. This is predicated on the assumption that the MBB portion of the RAN market will continue to trend downward, and the upside from new growth opportunities is not enough to change the trajectory.

The mix between existing and new use cases has not changed. We still forecast private/enterprise RAN to grow at a 20%+ CAGR while public RAN investments decline. At the same time, because of the lower starting point, it will take some for private RAN to move the broader RAN needle.

As the investment focus gradually shifts from coverage to capacity, one of the most significant forecast risks is slowing mobile data traffic growth. Given current network utilization levels, there are serious concerns about the timing of capacity upgrades. The network utilization metric will play a much more significant role as we move further into the capacity phase.

Generally, the less advanced 5G regions are expected to perform better than the mature 5G markets. As a result, markets with lower 5G POP coverage, including Middle East & Africa, Caribbean and Latin America, and APAC Excluding China/India should perform better.

Easier comparisons following steep contractions in 2023 will improve the North American region’s growth prospects. Even with some recovery, North American RAN revenues are expected to remain significantly below peak levels in 2022.

5G-Advanced will play an essential role in the broader 5G journey. However, 3GPP Releases 18-20 are not expected to fuel another major capex cycle. Instead, operators will gradually transition their spending from 5G towards 5G-Advanced within their confined capex budgets. Also, ITU-R WP5D has not started any work related to a 5G-Advanced recommendation(s).

More importantly, some RAN segments will stand out even as the broader RAN market shrinks. RAN segments expected to grow over the next five years include 5G NR, Non-MM 5G NR, FWA, mmWave, Open RAN, vRAN, private wireless, and small cells.

References:

Analysts: Telco CAPEX crash looks to continue: mobile core network, RAN, and optical all expected to decline

Dell’Oro: 2023 global telecom equipment revenues declined 5% YoY; Huawei increases its #1 position

Dell’Oro & Omdia: Global RAN market declined in 2023 and again in 2024

Dell’Oro: RAN market declines at very fast pace while Mobile Core Network returns to growth in Q2-2023

Dell’Oro: RAN Market to Decline 1% CAGR; Mobile Core Network growth reduced to 1% CAGR

Global 5G Market Snapshot; Dell’Oro and GSA Updates on 5G SA networks and devices

ITU-R: IMT-2030 (6G) Backgrounder and Envisioned Capabilities

Dell’Oro: 2023 global telecom equipment revenues declined 5% YoY; Huawei increases its #1 position

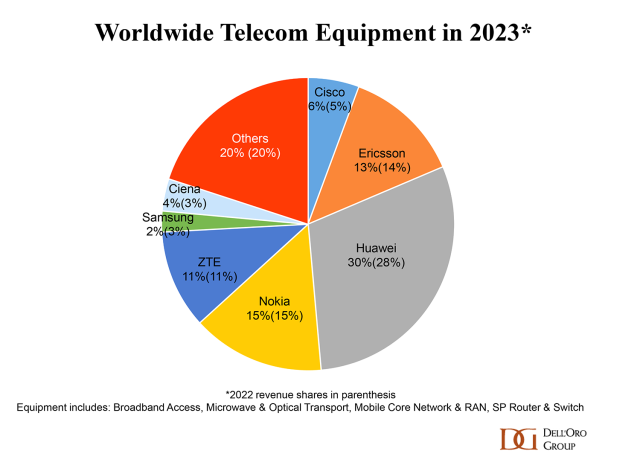

Preliminary Dell’Oro Group data found that worldwide telecom equipment revenues across the six telecom programs tracked – Broadband Access, Microwave & Optical Transport, Mobile Core Network (MCN), Radio Access Network (RAN), and SP Router & Switch – declined 5% year-over-year (YoY) for the full year 2023, performing worse than expected. First and foremost, challenging comparisons in some of the advanced 5G markets with higher 5G population coverage taken together with the slow transition towards 5G SA helped to partially explain steep declines in wireless-based investments. This capex deceleration was not confined to the RAN and MCN segments. Following a couple of years of robust PON investments, operators were able to curtail their home broadband capex as well. This reduction was more than enough to offset positive developments with optical transport and Service Provider routers.

The North America telecom equipment market declined faster than expected. Initial readings show that the aggregate telecom equipment market dropped by roughly a fifth in the North America region, underpinned by weak activity in both RAN and Broadband Access. On the bright side, regional dynamics were more favorable outside of the US. Our assessment is that worldwide revenues excluding North America advanced in 2023, as positive developments in the Asia Pacific region were mostly sufficient to offset weaker growth across Europe.

Also contributing to the regional and technology trends is the disruption caused by Covid hoarding and the supply chain crisis. Although this inventory correction was not felt everywhere and varied across the telecom segments, it was more notable in the RAN this past year.

Renewed concerns about macroeconomic conditions, Forex, and higher borrowing costs are also weighing down prospects for growth. The gains in the USD against the Yuan and the Yen are impacting USD-based equipment revenue estimates in China and Japan.

………………………………………………………………………………………………………………………………………………………………………………………………

Dell’Oro says that Huawei maintained its lead as the top global telecom equipment company by revenue in 2023, despite efforts by the U.S. government and other countries to limit its addressable market and access to Android and the latest chips and semiconductor technology from TSMC. In fact, Dell’Oro’s assessment is that Huawei’s lead widened in 2023, in part because its limited exposure to the North America region was a benefit in 2023 on a relative basis.

Supplier rankings were mostly unchanged. However, vendor revenue shares shifted slightly in 2023. Still, the overall concentration has not changed – the top seven suppliers accounted for around 80% of the overall market.

Market conditions are expected to remain challenging in 2024, though the decline is projected to be less severe than in 2023. The analyst team is collectively forecasting global telecom equipment revenues to contract 0 to -5% in 2024. Risks are broadly balanced. In addition to currency fluctuations, economic uncertainty, and inventory normalization, there are multiple regions/technology segments that are operating in a non-steady state.

References:

Dell’Oro & Omdia: Global RAN market declined in 2023 and again in 2024

Dell’Oro: Broadband access equipment sales to increase in 2025 led by XGS-PON deployments

Global 5G Market Snapshot; Dell’Oro and GSA Updates on 5G SA networks and devices

Dell’Oro: Broadband network equipment spending to drop again in 2024 to ~$16.5 B

Dell’Oro: Mobile Core Network market has lowest growth rate since 4Q 2017

Dell’Oro: U.S. suppliers ~20% of global telecom equipment market; struggling in RAN business

Dell’Oro & Omdia: Global RAN market declined in 2023 and again in 2024

A new report from the Dell’Oro Group reveals that the global Radio Access Network (RAN) market concluded the year with another difficult quarter, resulting in a global decrease of nearly $4 billion in RAN revenues for the full year of 2023. However, despite these challenges, the results for the quarter exceeded expectations, partly due to robust 5G deployments in China.

“Following the intense rise between 2017 and 2021, it’s clear that the broader RAN market is now experiencing a setback, as two out of the six tracked regions are facing notable declines,” said Stefan Pongratz, Vice President for RAN market research at the Dell’Oro Group. “In addition to challenging conditions in North America and Europe, the narrowing gap between advanced and less advanced operators (e.g. India) in this first 5G wave, compared to previous technology cycles, initially had a positive impact but is now constraining global 5G and broader RAN growth prospects,” Pongratz added.

Additional highlights from the 4Q 2023 RAN report:

- Overall concentration in the RAN market showed signs of improvement in 2021 and 2022, but this progress slowed down in 2023.

- While full-year RAN rankings remained mostly unchanged for major suppliers, revenue shares within the RAN market showed more variability, with Huawei and ZTE enhancing their global revenue shares. Similarly, Huawei and Nokia saw improvements in their revenue shares outside of China.

- The top 5 RAN suppliers based on worldwide revenues are Huawei, Ericsson, Nokia, ZTE, and Samsung.

- Regional projections are mostly unchanged, with market conditions expected to remain tough in 2024 due to difficult comparisons in India. Nevertheless, the base-case scenario anticipates a more moderate pace of decline this year.

…………………………………………………………………………………………………………………………

Source: Dell’Oro Group

…………………………………………………………………………………………………………………………

Separately, Rémy Pascal of Omdia says that global RAN revenues (including both hardware and software) declined by 11% last year to just over $40 billion. The worst performing region by far was North America, which almost halved, but this should be viewed in the context of a relatively strong 2022.

India and China were been the best performing countries for new RAN deployments. This partly explains why Huawei continues to be the top RAN vendor despite attempts by the U.S. and its allies to prevent that, but as the Omdia table below shows, the Chinese vendor is still doing well in many other regions too. We’re told this table looked pretty much the same last year.

Top RAN vendors by region, full year 2023:

|

North America |

Asia & Oceania |

Europe, Middle East and Africa |

Latin America & the Caribbean |

|

Ericsson |

Huawei |

Ericsson |

Huawei |

|

Nokia |

ZTE |

Nokia |

Ericsson |

|

Samsung |

Ericsson |

Huawei |

Nokia |

Source: Omdia

Omdia expects the RAN market size to decrease by around 5% compared to 2023. That’s an improvement on the 11% 2022-23 decline but still not good news for the RAN industry.

For all the talk of Open RAN, it clearly has yet to inspire significant capex from operators. The same goes for private 5G or programmable networks. Less than halfway through the presumed 5G cycle, spending has stalled and it’s not at all clear what will restart it.

Dell’Oro Group’s RAN Quarterly Report offers a complete overview of the RAN industry, with tables covering manufacturers’ and market revenue for multiple RAN segments including 5G NR Sub-7 GHz, 5G NR mmWave, LTE, macro base stations and radios, small cells, Massive MIMO, Open RAN, and vRAN. The report also tracks the RAN market by region and includes a four-quarter outlook. To purchase this report, please contact us by email at [email protected].

References:

RAN Market Shows Faint Signals of Life in 4Q 2023, According to Dell’Oro Group

https://www.telecoms.com/wireless-networking/global-ran-market-declined-by-11-in-2023

Dell’Oro: RAN market declines at very fast pace while Mobile Core Network returns to growth in Q2-2023

Dell’Oro: RAN Market to Decline 1% CAGR; Mobile Core Network growth reduced to 1% CAGR

https://www.silverliningsinfo.com/5g/ericsson-nokia-and-state-global-ran-2024

LightCounting: Open RAN/vRAN market is pausing and regrouping