Update on 5G Stand-Alone (SA) Core Networks

Statista:

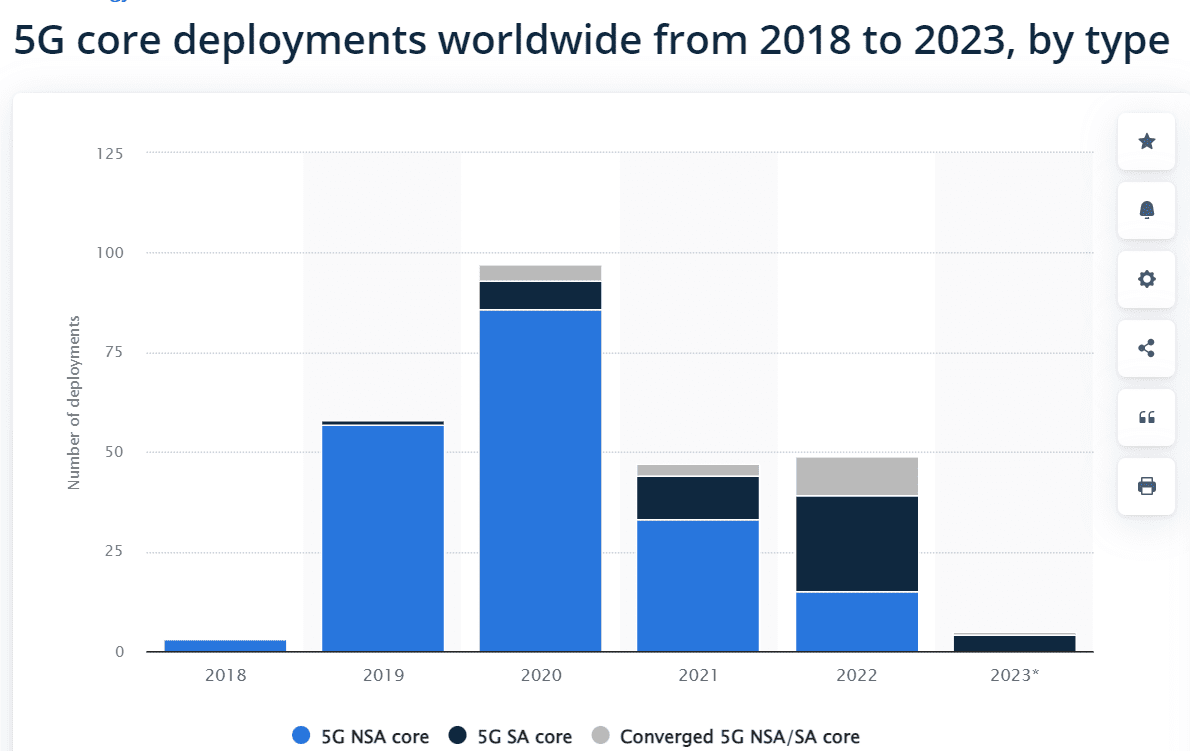

The type of 5G cores currently deployed remains dominated with about 75% of non-standalone (NSA) cores, or cores using the preexisting 4G network infrastructure. However, 5G standalone (SA) cores, which require more up-front costs and development yet may provide faster and more scalable connection, are forecast to outstrip NSAs and consist of 24 of the 49 5G core launches in 2022. All but one of the 5G launches announced for 2023 are standalone.

GSA:

Network Operators are increasingly experimenting with and deploying 5G standalone (SA) networks. With a totally new, cloud-based, virtualized, microservices-based core infrastructure, some of the anticipated benefits of introducing 5G SA technologies include faster connection times (lower latency), support for massive numbers of devices, programmable systems enabling faster and more-agile creation of services and network slices, with improved support for management of service-level agreements within those slices, and the advent of voice over New Radio (VoNR) technology. The introduction of 5G SA is expected to facilitate simplification of architectures, improve security and reduce costs.

The 5G SA technology is expected to enable customisation and open up new service and revenue opportunities tailored to enterprise, industrial and government customers.

GSA is tracking the emergence of the 5G SA system, including the availability of chipsets and devices for customers, plus the testing and deployment of 5G SA networks by public mobile network operators as well as private network operators. This report is the latest in an ongoing series summarizing market trends, drawing on data collected in GSA’s various databases covering chipsets, devices, spectrum and networks.

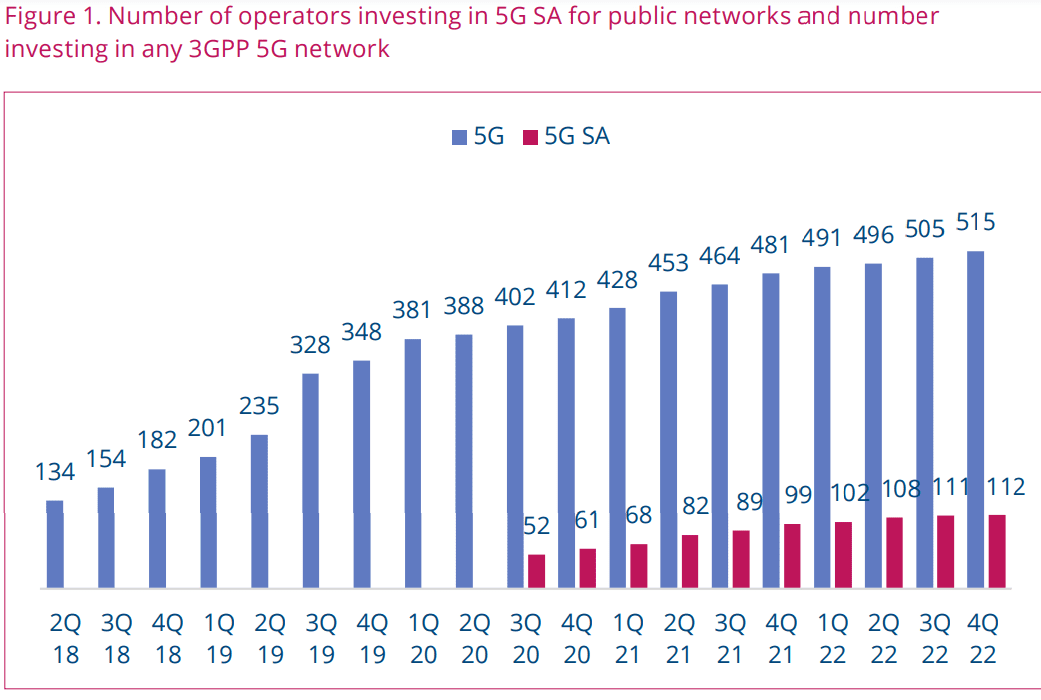

GSA has identified 112 operators in 52 countries and territories worldwide that have been investing in public 5G SA networks in the form of trials, planned or actual deployments . This equates to almost 21.7% of the 515 operators known to be investing in 5G licences, trials or deployments of any type.

At least 32 operators in 21 countries and territories are now understood to have launched public 5G SA networks, two of which have only soft-launched their 5G SA networks. In addition to these, 21 operators have been catalogued as deploying or piloting 5G SA for public networks, and 31 as planning to deploy the technology, showing that launches of 5G SA look set to continue apace. GSA has also recorded 19 operators as being involved in evaluations, tests or trials of 5G SA.

As of the last update in December 2022, GSA had collated information about 955 organisations known to be deploying LTE or 5G private mobile networks.

Countries and territories with operators identified as investing in public 5G SA networks have been granted a licence suitable for the deployment of a private LTE or 5G network so far. Of those, 391 are known to be using 5G networks (excluding those labelled as 5G-ready) for private mobile network pilots or deployments. Of those, 41 (slightly more than 10% of them) are known to be working with 5G SA already. They include manufacturers, academic organizations, commercial research institutes, construction, communications and IT services, rail and aviation organizations.

Dell’Oro Group:

At the close of 2022, we identified 39 mobile network operators that have commercially launched 5G SA eMMB networks.

References:

https://www.statista.com/statistics/1330511/5g-core-deployments-worldwide-by-type/

Mobile Core Network (MCN) growth to slow due to slow roll-out of 5G SA networks

https://www.3gpp.org/technologies/5g-system-overview

https://www.ericsson.com/en/core-network/5g-core