Ericsson Mobility Report: 5G monetization depends on network performance

A special Ericsson Mobility Report – called the Business Review edition – addresses monetization opportunities as they relate to 5G. Flattening revenues have been a challenge for service providers in all parts of the world, often impacting network investment decisions as part of their business growth strategies, known as ‘monetization’ in the industry.

The report highlights a positive revenue growth trend since the beginning of 2020 in the top 20* 5G markets – accounting for about 85 percent of all 5G subscriptions globally – that correlates with increasing 5G subscription penetration in these markets.

The report finds:

- Tiered pricing models are key for service providers, both for effectively addressing the individual needs of each customer and for continuing to drive long-term revenue growth.

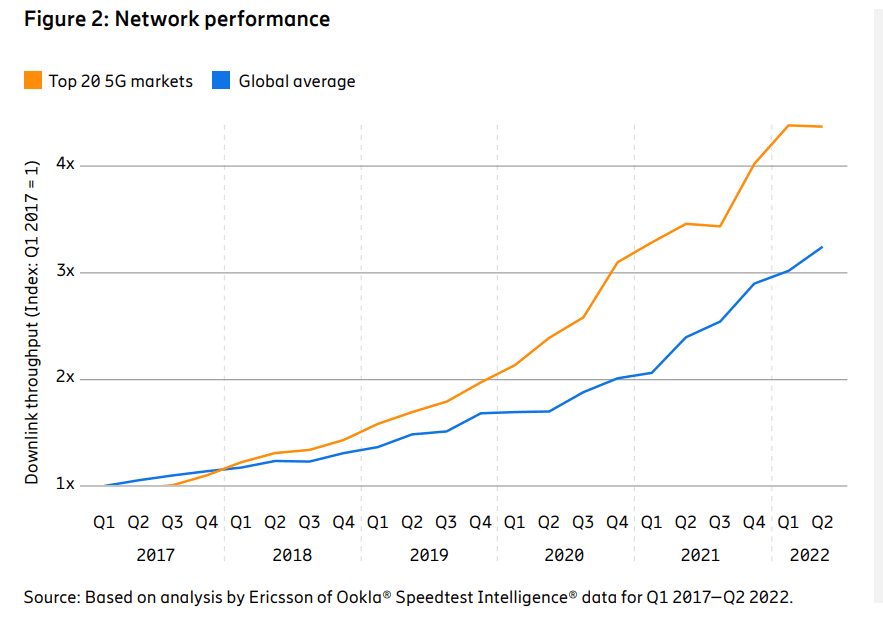

- The top 20 5G markets have seen a significant network performance boost following the introduction of 5G services.

- After a period of slow or no growth, wireless service revenue curves are again pointing upwards in these leading markets. This correlate with 5G subscription penetration growth.

- In the top 20 5G markets, the average downlink throughput has increased by 4.3 times over the past 5 years. This is 32 percent more than other markets on a global level, showing the positive impact 5G has had on network performance and user experience. The most significant network performance improvement in the top 20 5G markets was in 2020, following the introduction of 5G NSA network services.

- In the top 20 5G markets, the median downlink throughput of 5G is 5.8 times higher than the throughput of 4G (187 Mbps vs. 32 Mbps) in Q3 2022. This performance boost is what service providers could offer to consumers as an immediate benefit of upgrading to 5G.

Fredrik Jejdling, Executive Vice President and Head of Networks, Ericsson, says: “Meeting our customers’ challenges is at the heart of our R&D efforts and every resulting product we develop. The link between 5G uptake and revenue growth in the top 20 5G markets underlines that not only is 5G a game changer, but that early adopters benefit. What is particularly encouraging about this is that while 5G is still at a relatively early phase, it is growing fast with proven early use cases and a clear path to medium and long-term use cases.”

As expected, Enhanced Mobile Broadband (eMBB) is the main early use case for 5G, driven by increasing geographical coverage and differentiated offerings. More than one billion 5G subscriptions are currently active across some 230 live commercial networks globally. 5G eMBB offers the fastest revenue opportunities for 5G, as it is an extension of service providers’ existing business, relying on the same business models and processes. Even in the top 20 5G markets, about 80 percent of consumers have yet to move to 5G subscriptions – one pointer to the potential for revenue growth.

As highlighted in the November 2022 Ericsson Mobility Report, Fixed Wireless Access (FWA) is the second biggest early 5G use case, particularly in regions with unserved or underserved broadband markets. FWA offers attractive revenue growth potential for CSPs as it largely utilizes mobile broadband assets. FWA connections are forecast to top 300 million within six years.

Beyond consumer subscribers, there are growing opportunities in enterprise and public sector applications across the world. Ericsson sas that 5G enables significant value for enterprises, with private 5G networks and wireless wide area networks being deployed for enterprise and industrial use.

Upgrading existing 4G sites to 5G has the potential to realize increases of 10 times in capacity and reduce energy consumption by more than 30 percent, offering the possibility of growing revenue and lowering costs, while addressing sustainability.

Jejdling adds: “Revenue growth and sustainability are recurring themes in my discussions with customers. In this special Ericsson Mobility Report edition, we have explored how service providers are tapping 5G opportunities. We see initial signs of revenue growth in advanced 5G markets with extensive coverage build-out and differentiated service offerings. An equally crucial aspect of 5G is that it brings cost advantages and helps service providers handle the data growth needed to drive future revenue. This can make 5G the growth catalyst that the market has been waiting for.”

Read the full Ericsson Mobility Report Business Review Edition report here.

*Note: The markets categorized as the Top 20 5G markets in the report are: Australia, Bahrain, China, Denmark, Finland, Hong Kong, Ireland, Japan, Kuwait, Monaco, Norway, Qatar, Saudi Arabia, Singapore, South Korea, Switzerland, Taiwan, the UAE, the UK and the US.

They were selected on the basis of 5G subscription penetration. These markets represent 85 percent of all 5G subscriptions globally – with each market having 5G penetration above 15 percent.

Related links:

Ericsson Mobility Report site

Ericsson 5G

Ericsson 4G and 5G Fixed Wireless Access

Breaking the energy curve

5G the next wave – what does consumers want

2 thoughts on “Ericsson Mobility Report: 5G monetization depends on network performance”

Comments are closed.

From Mike Dano of Light Reading:

Niklas Heuveldop, the head of Ericsson’s North American business, said he’s preparing to cut 5-7% of his company’s workforce in the area. The cuts are part of Ericsson’s global round of layoffs that will see a total of 8,500 employees leave the company.

Ericsson employs roughly 105,000 people across the world, and 12,000 of those are in North America. In the US specifically, Ericsson counts 9,000 employees.

“I think the leadership has been wise about keeping a tight ship,” Heuveldop told Light Reading, arguing that the company’s current round of layoffs are relatively light, given the slowdown in operator spending. He attributed the situation to Ericsson’s moderate rate of growth while supporting early 5G demand. “We’re coming off an exceptional period of acceleration,” he said.

Ericsson’s Networks division is the company’s biggest, and North America is the company’s biggest region by sales. Heuveldop said AT&T, Verizon and T-Mobile in the US have all been furiously buying Ericsson equipment (alongside equipment from the likes of Samsung and Nokia) to add midband spectrum to their 5G networks. Now, he said, that spending is slowing as the operators finish their early network buildout efforts.

However, “we’re not done yet,” Heuveldop said.

Heuveldop argued that Ericsson expects mobile traffic volumes to grow 4x through 2028, and he said operators will need to further invest in their networks to keep pace with that growth. Additionally, he pointed to the new fixed wireless offerings from T-Mobile and Verizon as another catalyst for growth.

Specifically, he said that network operators throughout North America will continue to purchase Ericsson equipment to expand their 5G networks into rural areas, and to then reinforce those networks with small cells and indoor networking equipment.

But big mobile network operators aren’t Ericsson’s only potential customers. The company is also pursuing enterprise customers through the sale of private wireless networking equipment, an effort underscored by Ericsson’s recent $1.1 billion purchase of Cradlepoint.

“We see a lot of enterprises ‘cutting the cord,'” Heuveldop said. He said such customers are shifting all of their operations onto 5G, essentially removing the need for wired enterprise connections.

However, Heuveldop said enterprise equipment suppliers – those that build robots, sensors, manufacturing machinery and mixed reality devices – need to support 5G more broadly. “The device ecosystem is not where it needs to be,” he said. “We need the ecosystem to start maturing.”

Finally, Heuveldop nodded to the GSMA’s new “Open Gateway” initiative, under which more than a dozen big mobile network operators around the globe are pledging to develop standardized application programming interfaces (APIs) into their respective networks. He described that announcement as a “breakthrough” because it could position operators (Ericsson’s main customers) to develop new ways to make more money.

https://www.lightreading.com/5g-and-beyond/ericssons-heuveldop-prepares-to-cut-jobs-but-stays-upbeat/d/d-id/783488?

In November 2023, Ericsson predicted there would be 5 billion 5G subscriptions in the world by the end of 2028, as operators took advantage of new spectrum licenses and built out their networks. This would mean 5G accounting for about 55% of all mobile subscriptions that year. By June, however, Ericsson had made a rather dramatic downward revision. The forecast of 5 billion subscriptions had been lowered by a whopping 400 million, or 8%, to 4.6 billion instead. Putting a dent of 100 million subscribers in Ericsson’s forecast of total mobile subscriptions, this change cuts 5G’s share of that total to about 50.5%.

This is all rather alarming for Ericsson. Although it is branching into software and pitching its wares at carmakers, factory owners and other companies that have never previously bought network products, it still generates most of its income by selling 5G equipment to operators. If those operators aren’t building networks because they can’t afford it or don’t have the spectrum, Ericsson isn’t making money.

A 400 million difference in subscriber numbers might affect Ericsson’s customers more than it hurts Ericsson. One scenario is that cash-strapped consumers refuse to upgrade to the 5G networks operators have built. Something like that could be blamed on the “difficult macroeconomic conditions” Ericsson refers to in its latest mobility report.

But operators in many countries don’t even attempt a 5G upsell – they simply provide it to subscribers with compatible gadgets at the same low rates previously charged for older network services. A likelier explanation for the missing 400 million is that 5G networks don’t exist. And auction delays – the other reason Ericsson gives for its adjustment – would obviously hinder their rollout, directly harming Ericsson. This is why the Swedish company routinely complains about authorities that take ages to release spectrum to the telecom sector.

Ericsson’s downgrade implies there will be 73 million fewer 5G subscribers each year over the forecast period than it previously expected, a figure that represents nearly 7% of subscriber numbers at the end of March. To put it in another context, it is roughly equal to the sum of customers served by all four mobile networks in France.

A big concern for Ericsson right now is some of the negative publicity surrounding 5G. It is frequently made out to be a disappointment that has brought no obvious benefits for consumers while driving up capital expenditure for telcos. To counter that, Ericsson is now trying to convince operators that 5G has already fueled sales growth.

But its case is relatively weak. In countries ranked as the “top 20 5G markets,” where average smartphone penetration has risen to about 20% since 2020, telco revenues today are only about 4% higher than they were in 2017, a chart included in Ericsson’s latest mobility report appears to show. Desperate times.

https://www.lightreading.com/5g-and-beyond/ericsson-slashes-5g-outlook-by-400m-subscribers/a/d-id/785418?