5G monetization

Rakuten Symphony exec: “5G is a failure; breaking the bank; to the extent 6G may not be affordable”

In a Linkedin post, Rakuten Symphony CMO Geoff Hollingworth says 5G has been a failure, that it will never achieve ubiquitous coverage and it’s time for the mobile industry to invest in customers rather than networks:

5G is a failure. We build technology to deliver a promise, the promise made was commercial. If that promise is not delivered then it has failed. If that promise is delivered but the cost of delivery is prohibitively expensive versus the return, then that technology is a failure. Currently the promise has not been delivered and there is no line of sight to delivery.

I do not believe the market is going to deliver on this promise further down the road, the networks do not work this way. 5G will never have ubiquitous coverage, and this is getting worse. We can get closer to ubiquitous coverage as a network of networks but then all the complexity embedded in 5G for advanced management of the network is a cost. There is never only one “G” in a market, there tend to be at least 3 at any moment. Each G takes time to retire, from a customer, device, and ROI point of view. APIs cannot get deployed universally and by the the time networks are universal the next G is starting to be rolled out. We are still waiting for “real 5G” but even when it shows what will it translate to commercially? Will it arrive before something labeled “6G” is starting to roll out?

“The current cost for 5G is breaking the bank, to the extent where 6G might not be affordable. None of this is good for an industry that is supposedly powering the global GDP and defining the future state of all countries.”

Of course, we agree as we’ve been pounding the table since the 3GPP Release 15 pre-standard version of 5GNR was introduced in 2018. The “real 5G” must include standardized 5G SA core network, URLLC that meets ITU-R M.2410 performance requirements and harmonized frequencies.

“We are already repeating the narrative into 6G with the same concept of ubiquitous coverage mindset. We are not segmenting for actual coverage and actual market reality when comparing to cost, time, and need,” Hollingworth warns. “We must embrace that there are other better ways to solve for coverage, depending [on] the use case and the coverage type required. We have less of a coverage problem and more of a seamless access problem, as one moves from indoor to outdoor city to outdoor suburb to rural.”

…………………………………………………………………………………………………………………………………………………………………………………….

Future Network Trends -AI native and cloud native operations:

To see future network needs, there is a need to understand future AI software design patterns. We now see these appearing and they are different from what we have seen before.

- They depend on large data streams where the data and interpretation has time sensitivity.

- Compute is distributing to where the data is rather than bringing the data to where the compute is.

- This forces distribution of models and software to where the data and compute is, and overhead must be kept to a minimum and automation must be maximized to be cost effective.

- There is need for rapid iteration and continuous fine tuning of the models and algorithms as more data is analyzed and performance improves.

The first applications with these design requirements are the 5G++ network architected functions. The test of the industry is whether the software can be adopted with true AI native, cloud native operations or whether they will be deployed traditionally. If we succeed in deploying a true hyperscale operation for our own software we can take our tooling and knowledge, and expand it to support any application and service.

Now there are many networks that devices can connect to, and 80% of the time traffic does not travel through cellular networks at all. In markets with high fiber penetration Wi-Fi connectivity and latency has higher performance than cellular, especially indoors, where higher frequency spectrum no longer travels inside buildings, especially those with reflective sustainability materials.

We previously solved as if cellular was the only way to solve all the problems. We must embrace that there are other better ways to solve for coverage, depending the use case and the coverage type required. We have less of a coverage problem and more of a seamless access problem, as one moves from indoor to outdoor city to outdoor suburb to rural.

References:

https://www.linkedin.com/pulse/cost-delusion-promise-reality-geoff-hollingworth-vt4xe/

https://www.itu.int/pub/R-REP-M.2410

https://www.lightreading.com/6g/jumping-off-the-g-train

WSJ: Has 5G Lived Up to Expectations?

Hundreds of billions of dollars have been invested worldwide in 5G. What was the return on that huge investment? As we forecasted five years ago and ever since then, 5G hasn’t revolutionized whole swaths of the economy the way past mobile technologies did.

…………………………………………………………………………………………………………………………….

Opinion: Network operators and 5G vendors promised too much and under delivered. 3GPP and ITU-R WP 5D are partially to blame for the commercial failure of 5G.

In particular, URLLC- the key 5G use case- could not be realized because 3GPP Release 16 spec for Enhancements for URLLC in the RAN wasn’t complete and so could not be implemented. Those enhancements were to enable URLLC end points to realize ITU-R M.2410 performance requirements, e.g. <1 ms latency in the data plane and <10 ms latency in the control plane.

Also, the 3GPP specs for 5G Architecture did not include implementation of 5G SA Core network, but instead provided many options. Hence, there are many versions of 5G SA Core networks, with many major network operators, e.g. AT&T and Verizon, still using 5G NSA (with LTE infrastructure for everything but the RAN).

ITU-R M2150, the terrestrial 5G RIT/SRIT recommendation, did not meet the M.2410 URLLC performance requirements (due to absence of 3GPP Rel 16 URLLC in the RAN spec), Also, it was not accompanied by the companion recommendation M.1036 issue 6 IMT Frequency Arrangements, which could not be agreed upon till a few months ago (it’s expected to be approved by ITU-R SG 5 meeting this November). As a result, there were no standard frequencies for 5G. That resulted in a “frequency free for all” where administrations like the FCC chose frequencies for 5G that were not agreed upon at WRC’19 and assigned to ITU-R WP 5D to specify the frequency arrangements.

For sure, the U.S. wireless carriers offering 5G service have not had anywhere near a good ROI. That’s indicative of the decline in their stock prices this year. Despite an 8.67% dividend, Verizon (VZ) stock has lost -16.39% YTD through Friday Oct 13th. AT&T (T) stock has performed slightly worse with a -16.74% YTD total return. The Dow Jones U.S. Telecommunications Index is -17.34% YTD through Friday.

…………………………………………………………………………………………………………………………….

In markets with widespread 5G, cellphone users often fail to notice a difference in service compared with 4G-LTE. This author has had a 5G Samsung Galaxy phone for over one year and does not notice any difference from 4G-LTE.

A key growth opportunity for 5G—businesses installing private networks in places such as manufacturing plants and arenas—has yet to take off.

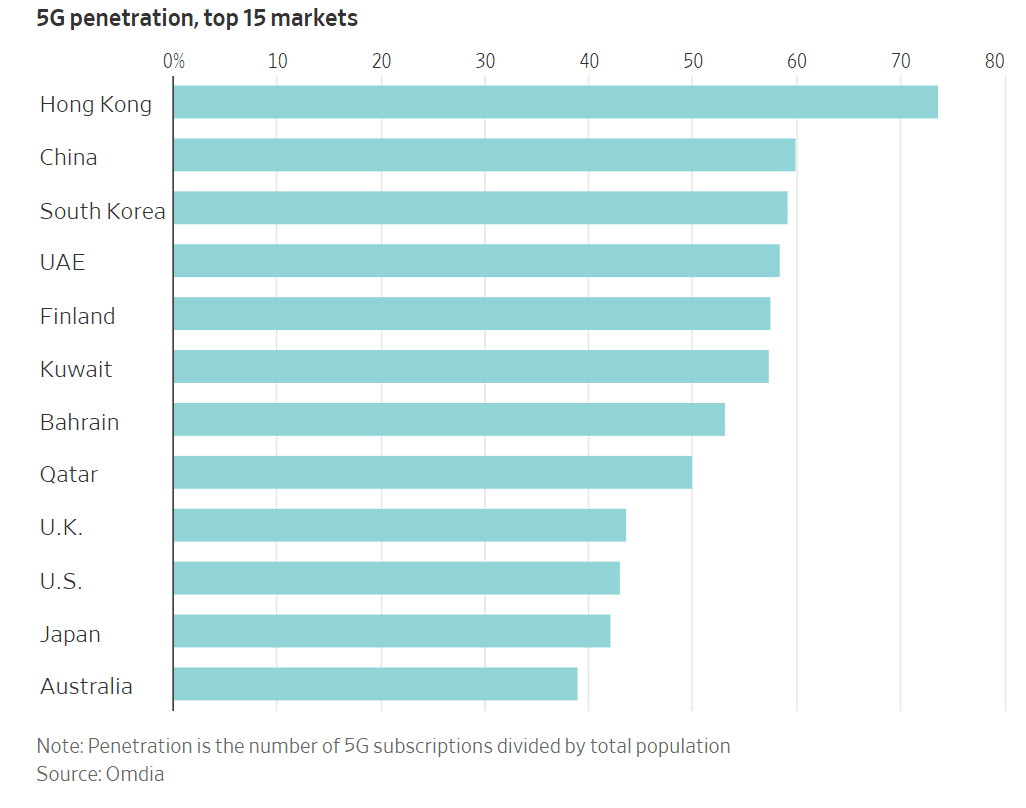

In the U.S., about 43% of people had 5G mobile subscriptions as of June, ranking 10th worldwide, according to estimates from research firm Omdia. Hong Kong had the world’s highest 5G penetration rate, with 74% of its population subscribed to the mobile service. Ranked second- and third-highest in the world were mainland China and South Korea, which registered 5G mobile-subscription rates of 60% and 59%, respectively.

The high uptake in China and its neighbors is no accident. Smartphone users in several Asian countries have benefited from affordable next-generation devices, strong fiber-optic infrastructure and government policies that encouraged broad 5G cellular coverage. China and South Korea also host technology giants like Huawei and Samsung that are spearheading the wireless technology’s advancement.

Finland had the highest 5G penetration rate in Europe, at 58%, while the United Arab Emirates led the Middle East, also with 58%.

Getting “4G for all, not 5G for few,” has been the mantra for the past two years at Veon, a network operator that serves cash-strapped markets from Ukraine to Bangladesh.

The Amsterdam-based company has already covered 90% of the six countries it serves with 4G signals. Some areas lack the fiber-optic-cable infrastructure to support 5G-capable cellphone towers, and roughly half of the population in those markets lacks even a smartphone, let alone one capable of picking up 5G connections. Some countries also impose high taxes on smartphones, which puts the devices out of reach for many consumers, says Veon Chief Executive Kaan Terzioğlu.

“This is really matching the needs of the markets with the technologies that are available,” Terzioğlu told the WSJ. Spending money on 5G infrastructure before the people it covers are ready to tap it “would be irresponsible,” he added.

Business owners and executives in many poorer countries say they wouldn’t plan around ultrafast wireless connections in places where 2010 technology is still the norm. “There’s not enough coverage or towers here,” says Nicholas Lutchmiah, retail manager at Topbet, a licensed gambling bookmaker and sports-betting company in South Africa, which has most of its shops in poorer townships and rural areas. “That’s the biggest problem that we face. In rural areas and townships, we get 3G, which is rather slow.”

Business owners and executives in many poorer countries say they wouldn’t plan around ultrafast wireless connections in places where 2010 technology is still the norm. “There’s not enough coverage or towers here,” says Nicholas Lutchmiah, retail manager at Topbet, a licensed gambling bookmaker and sports-betting company in South Africa, which has most of its shops in poorer townships and rural areas. “That’s the biggest problem that we face. In rural areas and townships, we get 3G, which is rather slow.”

Despite the limitations, some developing countries have invested heavily in 5G technology. Indian telecom companies have committed tens of billions of dollars to the latest network technology and making a push for ultracheap smartphones, for instance. Domestic conglomerate Reliance Industries has led much of its country’s aggressive telecom investments through its Jio brand, the spearhead of leader Mukesh Ambani’s ambition “to connect everyone and everything, everywhere.”

The wireless companies that invested in 5G technology early paid handsomely to refresh their networks. and they have the balance sheets to prove it. The world’s biggest wireless companies—excluding China’s state-backed operators—carried $1.211 trillion of corporate debt at the end of 2022, up from $1.072 trillion four years earlier, according to Moody’s Investors Service.

The credit-rating service said that those companies spent more than in past years building up their wireless networks and issued more debt to finance big spectrum purchases. The price of that spectrum has varied but generally risen. One auction raised $19 billion in India while another group of licenses fetched $81 billion in the U.S.

Debt is nothing new to big telephone networks. The capital-intensive companies have historically run through cycles of heavy upfront spending on new equipment and installation before paying down the tab over time through reliable subscription fees; phone and internet service is a modern necessity, after all.

But securing airwaves for new 5G signals has forced companies to speed up their borrowing. “There’s a lot of debt on these companies,” Moody’s analyst Emile El Nems says. “We’re not ringing the alarm bells, but we’re saying there’s limited flexibility for an accident.”

Executives at telecom companies that borrowed the most to amass 5G-friendly spectrum licenses have said that they made prudent investments to meet customers’ demand for mobile bandwidth, and that their biggest spending is behind them, at least in the near term.

China moved early to enhance its national infrastructure, blanketing the country with 5G base stations as soon as manufacturers started making them. The country’s three major mobile-phone carriers anchored those transmitters to a dense network of fiber-optic cables and encouraged a range of businesses from seaports to coal mines to use the ultrafast connections. It has also provided subsidies and regulatory support to telecom operators and tech companies, facilitating their growth and enabling them to compete on a global scale.

At the end of June, 5G base stations in the country connected 676 million 5G phones and more than 2.12 billion Internet of Things devices, China’s central-government officials said in a press conference in July.

U.S. officials offered their national cellphone carriers fewer direct subsidies than their Beijing counterparts, but policy makers granted many requests on the companies’ wish lists. Trump administration appointees fast-tracked auctions of 5G-capable wireless frequencies and consolidated the wireless sector by approving T-Mobile’s takeover of rival Sprint, a deal that the company and government leaders said would accelerate long-planned network upgrades.

At the same time, the U.S. has tried to persuade other countries to not buy Chinese gear—an effort that prompted some governments to ban its telecom equipment. But China’s homegrown supplier, Huawei, has weathered the U.S. efforts and played a pivotal role in both the domestic and global 5G markets. At the same time, they have turned away from Western suppliers like Qualcomm for some components and are now relying on domestic suppliers.

Huawei remains the world’s largest seller of telecom equipment, commanding about a third of the global market, with sales about twice those of the second- and third-ranked suppliers, Nokia and Ericsson, according to market-research firm Dell’Oro Group.

What happened to businesses being big 5G consumers?

One of 5G’s most alluring promises remains the private network: a system built to the same standard as a high-speed cellphone service but tailored for a business operating in a smaller area like an office, farm or factory. Those networks can connect a range of computers, sensors and robotics without the hassle and cost of hooking them up with wires.

For now, though, companies have been slow to adopt private networks. Consider “the factory of the future” that Ford and Vodafone previewed outside London in 2020. The companies detailed plans for a swarm of mobile robot welders receiving orders over superfast 5G connections, so they could assemble electric cars more quickly and precisely than traditional equipment.

Three years later, the factory of the future is still just a concept. Ford doesn’t use the high-tech wireless standard on its production line, and Vodafone says it ended its proof-of-concept project with the American automaker. A Ford spokesman didn’t respond to a request for comment.

In total, organizations have built more than 750 private cellular networks around the world, according to Besen Group, a private-network consultancy. Installations run the gamut from college campuses to open-pit mines, though many of them use less-advanced 4G gear instead of the latest-generation electronics.

That is partly because of a chicken-or-the-egg problem with private networks. A device maker might not want to create 5G gear for factories until more factories have installed cellular networks. But factory owners don’t want to invest in those networks unless there are enough 5G-ready devices on the market to justify the upgrade.

“This is actually fairly typical for new network equipment,” says Vodafone cloud and private-network chief Jenn Didoni. “The devices will certainly come, but there aren’t as many as in 4G, and they aren’t as tested and understood.”

Dell’Oro estimates that private networks make up less than 1% of the market for the relevant 5G equipment, but the research firm predicts that early revenue will grow, on average, at a 25% annual rate over the next five years as more connected gadgets hit the market.

“In the beginning, a lot of the conversations used to be about feasibility,” says Durga Malladi, a senior vice president at chip maker Qualcomm. “If I am interested in moving robots and overhead cranes using 5G, can I even get the same level of reliability and latency that I have expected from just wired? And the answer to that is, in almost all instances, absolutely yes.”

Many industries have yet to experience the market disruption that 5G’s boosters promised. A notable exception: Some telecom companies are enjoying a windfall from wireless bandwidth improvements at the expense of their cable-internet rivals.

Mobile network carriers like T-Mobile and Verizon have used new high-speed wireless equipment to beam internet service straight into customers’ homes, racking up more than five million new subscriptions altogether in under three years. The over-the-air service has dented cable-industry revenue and forced companies to compete in areas where they were once the only game in town.

Telecom companies have long known how to beam internet connections into people’s homes without the considerable expense of new wires and equipment. But wireless companies faced an uphill fight against their hard-wired competitors until 5G improvements brought advances such as more-efficient signals that could run through the same cell-tower antennas that companies were already installing to connect cellphones.

That helped mobile-network operators quickly rack up home-internet customers at much lower variable costs, especially in America, where cable companies’ dissatisfied customers offer a juicy target.

“The U.S. is very unusual because we pay so much for home broadband,” says Jeff Heynen, an analyst for Dell’Oro. “The way T-Mobile and Verizon are addressing the service, clearly you know who they’re going after.”

Markets with many far-flung customers, like Australia and Saudi Arabia, could soon follow the U.S. lead in 5G home-internet service, Heynen adds. Industry experts warn that the booming wireless-broadband business isn’t going to replace cable soon, however.

Capacity is the main factor holding back wireless internet services. A single cellular tower can only handle so many videogames, TV streams and Zoom calls at once, even after 5G upgrades offer those towers more bandwidth to go around.

T-Mobile CEO Mike Sievert has even played down his company’s booming home-internet business, telling investors at a Goldman Sachs conference in September that the service would eventually reach a customer base in the single-digit millions. That is a sliver of the more than 100 million U.S. households that could use broadband service. “It’s a very mainstream offer, but we don’t think it’s going to take over cable and fiber,” Sievert said.

Omdia forecasts weaker 5G market growth in near term, 4G to remain dominant

5G is a big letdown and took a “back seat” at CES 2023; U.S. national spectrum policy in the works

Another Opinion: 5G Fails to Deliver on Promises and Potential

3GPP Release 16 5G NR Enhancements for URLLC in the RAN & URLLC in the 5G Core network

U.S. Network Operators and Equipment Companies Agree: 5G CAPEX slowing more than expected

We noted in a recent IEEE Techblog post that the 5G spending slowdown in the U.S. is broader than many analysts and executives expected. Well, it’s worse than that! The previously referenced negative comments from the CEO of Crown Castle, were corroborated by American Tower last week:

“The recent pullback was more abrupt than our initial expectations,” said Rod Smith, the CFO for cell tower firm American Tower, during his company’s quarterly conference call last week, according to Seeking Alpha. Smith was discussing the reduction in US operator spending on 5G, a situation that is now cutting $40 million out of American Tower’s margin expectations. “The initial burst of 5G activity has slowed down,” agreed the financial analysts at Raymond James in a note to investors following the release of American Tower’s earnings.

Cell tower giant SBA Communications said it too is seeing the broad pullback in spending that has affected its cell tower competitors (i.e. American Tower and Crown Castle). But the company’s management sought to reassure investors with promises of continued growth over the long term. During their earnings call, SBA executives said they expect activity to increase next year as T-Mobile looks to add 3.45GHz and C-band spectrum to its network, and as Dish Network restarts its network buildout.

The two largest 5G network equipment vendors that sell gear in the U.S. are seeing similar CAPEX cutbacks. “We see some recovery in the second half of the year but it will be slower than previously expected,” Nokia CEO Pekka Lundmark said earlier this month during his company’s quarterly conference call, in response to a question about the company’s sales in North America. His comments were transcribed by Seeking Alpha. Ericsson’s CEO, Borje Ekholm, is experiencing similar trends: “We see the buildout pace being moderated,” he said of the North American market, according to a Seeking Alpha transcript

AT&T’s CFO Pascal Desroches confirmed the #1 U.S. network operator is slowing its network spending. “We expect to move past peak capital investment levels as we exit the year,” he said during AT&T’s quarterly conference call, as per a Seeking Alpha transcript. AT&T’s overall CAPEX would be $1 billion lower in the second half of 2023 when compared with the first half of this year due to greatly reduced 5G network build-outs.

“This implies full year capex of ~$23.7 billion, which management believes is consistent with their prior full year 2023 capex guidance of ‘~$24 billion, near consistent with 2022 levels’ and includes vendor financing payments,” wrote the financial analysts at Raymond James in their assessment of AT&T’s second quarter results, citing prior AT&T guidance.

“Although management declined to guide its 2024 outlook, it has suggested that it expects capital investments to come down as it progresses past the peak of its 5G investment and deployments. We believe the trends present largely known CY23 [calendar year 2023] headwinds for direct 5G plays CommScope, Ericsson and Nokia. Opportunities from FWA [fixed wireless access] might provide modest offsets and validate Cambium’s business. AT&T’s focus on meeting its FCF [free cash flow] targets challenge all of its exposed suppliers, which also include Ciena, Infinera and Juniper,” the financial services firm added.

Verizon CEO Hans Vestberg told a Citi investor conference in January that CAPEX would drop to about $17bn in 2024, down from $22bn in 2022″ “We continue to expect 2023 capital spending to be within our guidance of $18.25 billion to $19.25 billion. Our peak capital spend is behind us, and we are now at a business-as-usual run rate for capex, which we expect will continue into 2024,” explained Verizon CFO Tony Skiadas during his company’s quarterly conference call last week, according to Seeking Alpha.

“After years of underperformance, perhaps the best argument for Verizon equity is that expectations are very low. They are coming into a phase where capex will fall now that they’ve largely completed their 5G network augmentation. Higher free cash flow will flatter valuations, but it will also, more importantly, lead to de-levering first, and potentially even to share repurchases down the road,” speculated the analysts at MoffettNathanson in a research note to investors following the release of Verizon’s earnings.

T-Mobile USA had previously said its expansive 5G build-out had achieved a high degree of scale and it would reduce its capex sharply starting in 2023.”We expect capex to taper in Q3 and then further in Q4,” said T-Mobile USA’s CFO Peter Osvaldik during his company’s quarterly conference call last week, according to Seeking Alpha. He said T-Mobile’s capex for 2023 would total just under $10 billion. T-Mobile hopes to cover around 300 million people with its 2.5GHz midband network by the end of this year. Afterward, it plans to invest in its network only in locations where such investments are necessary.

Similarly, Verizon and AT&T are completing deployments of their midband C-band 5G networks, and will slow spending after doing so. That’s even though neither telco has deployed a 5G SA core network which involves major expenses to build, operate and maintain.

Dish Network managed to meet a federal deadline to cover 70% of the U.S. population with it’s 5G OpenRAN in June. As a result, the company said it would pause its spending until next year at the earliest.

American Tower was a bit more hopeful that CAPEX would pick up in the future:

- “Moderation in carrier spend following the recent historic levels of activity we’ve seen in the industry isn’t unexpected and is consistent with past network generation investment cycles,” explained CFO Rod Smith.

- “The cycles typically progress as there’s a coverage cycle. It’s what we’ve seen in past cycles, including 3G and 4G. It’s an initial multiyear period of elevated coverage capex, and it’s tied to new G spectrum aimed at upgrading the existing infrastructure,” said American Tower’s CEO Tom Bartlett. “And then later in the cycle, it will fill back into a capacity stage where we’ll start to see more densification going on. So I’m hopeful that our investor base doesn’t get spooked by the fact that this is a pullback. It’s very consistent. The cadence is really spot on with what we’ve seen with other technologies.”

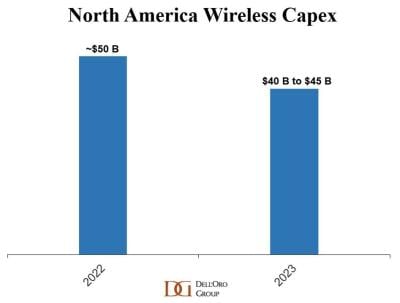

In April, Dell’Oro Group analyst Stefan Pongratz forecast global telecom capex is projected to decline at a 2% to 3% CAGR over the next 3 years, as positive growth in India will not be enough to offset sharp capex cuts in North America. He also predicted that wireless CAPEX in the North America (NA) region would decline 10% to 20% in 2023 as per this chart:

Now, that NA CAPEX decline seems more like 30% this year!

……………………………………………………………………………………………………………………………………………

References:

U.S. 5G spending slowdown continues; RAN revenues set to decline for years!

USA’s 5G capex bubble will burst this year as three main operators cut back

GSM 5G-Market Snapshot Highlights – July 2023 (includes 5G SA status)

Worldwide Telecom Capex to Decline in 2023, According to Dell’Oro Group

https://www.fiercewireless.com/wireless/wireless-capex-north-america-expected-decline-10-20-2023

Dell’Oro: Telecom Capex Growth to Slow in calendar years 2022-2024

U.S. 5G spending slowdown continues; RAN revenues set to decline for years!

The 5G spending slowdown in the U.S. is broader than many analysts and executives expected. Dell’Oro’s Stefan Pongratz recently wrote:

“Even if it is early days in the broader 5G journey, the challenge now is the comparisons are becoming more challenging in the more mature 5G markets and the upside with the slower-to-adopt 5G regions is not enough to extend the growth streak. Meanwhile, growth from new revenue streams including Fixed Wireless Access and enterprise LTE/5G is not ramping fast enough to change the trajectory. With 5G-Advanced not expected to trigger a new capex cycle, the question now is no longer whether RAN will grow. The question now is, rather, how much will the RAN market decline before 6G comes along?”

AT&T, Verizon, T-Mobile and Dish Network broadly spent 50% less on their 5G network build-outs than Crown Castle [1.] CEO Jay Brown expected. As a result, Crown Castle cut $90 million in expected services revenues from its full year 2023 financial forecast.

……………………………………………………………………………………………………………………………………

Note 1. Crown Castle offers services including new cell site development and equipment installation. The company has a nationwide footprint of 40K+ cell towers, ~115K small cell nodes on air or under contract and more than 80K route miles of fiber optic cable.

…………………………………………………………………………………………………………………………………….

“So the back half of 2023, we did see a change relative to what we previously expected,” Brown said last week during his company’s quarterly conference call, as per a Seeking Alpha transcript. “The first half of 2023 came in exactly where we thought it was going to, and we saw the change in activity during the quarter. And that’s what affected our second half of the year, the activity that we’ll see in the – we believe we’ll see in the third and the fourth quarter.”

“I believe this initial surge in tower activity [among U.S. network operators] has ended,” Brown said, arguing that early 5G network buildout programs are coming to an end. “In the second quarter, we saw tower activity levels slowed significantly. As a result, we are decreasing our 2023 outlook primarily as a result of lower tower services margin.”

“From our perspective, this new guidance is as close to a disaster as it gets,” wrote the financial analysts at KeyBanc Capital Markets in a note to investors last week. The analysts said the cell tower industry broadly is very stable, and warnings like those from Crown Castle are few and far between. “We struggle to understand how the … trajectory could change so materially.”

…………………………………………………………………………………………………………………………….

Nokia and Ericsson take a hit:

5G network equipment vendor Nokia experienced a huge revenue drop of 40% from the North America market. Nokia CFO Marco Wiren stated that was “a result of declines across all business groups as inventory digestion continued and [communication service providers] reevaluated their spending plans.”

“The weakness was clearly visible,” Nokia CEO Pekka Lundmark said earlier this month, according to Seeking Alpha.

Nokia’s 5G FWA business has run into some market challenges, specifically tied to the vendor being “highly sensitive to a very small number of customers.” “Especially in North America, now when those deployments are significantly more slow, there is inherently some volatility here,” Lundmark explained.

Likewise, Ericsson’s CEO Borje Ekholm said the vendor’s quarterly sales in North America represented “one of the lowest shares we’ve seen in many years. But on the other hand, we see India growing very, very fast.”

…………………………………………………………………………………………………………………………….

“We believe AT&T is a primary culprit with slow spending, but inventory absorption is occurring with other operators too,” wrote the financial analysts at Raymond James in a recent note to investors. “CommScope has exposure to the same mobile and fixed access projects as well as an operator bias to its business. Ciena has high exposure to the North American operators (fiber backhaul from cell sites), but we think guidance it offered in early June reflected AT&T absorbing inventory. Ciena, Infinera, and Juniper have material cloud exposure that we believe is improving as an offset to slower telcos.”

References:

https://www.sdxcentral.com/articles/analysis/open-ran-growth-slows-to-a-crawl/2023/07/

Kearney’s “5G Readiness Index 2022” and How to Monetize 5G

A new report from management consultancy Kearney analyzes a year of 5G progress across 33 countries around the world. The Kearney “5G Readiness Index 2022” assesses 5G and how close countries are to realizing all the potential and benefits of widespread 5G in the context of the overall maturity of a country’s telecoms market and its socio-economic position. The report covers 33 countries, all of which had launched 5G by the third quarter of 2022. To be included, countries must have launched 5G by the fourth quarter of 2021.

“Europe is falling behind on 5G!” is a cry we heard at the latest Mobile World Congress. The Kearney 5G Readiness Index 2021 reflected it, and our 2022 Index confirms it, at least for now (see Figure 1).

11 out of 28 countries tracked have at least one operator with a standalone 5G core network launched. Asia leads with seven countries, while Europe trails with just Finland and Germany reaching this point. Only in two countries have all operators launched standalone cores—Singapore and China—opening up their markets for a 5G transformation.

This year’s Index reveals that only 10 countries have made high band spectrum available, and operators in just five of them (the United States, Australia, South Korea, Thailand, and Japan) have launched full commercial services within it. So far, no European countries have gotten this far, although select services have been launched on limited mmWave licenses, including in Germany. The lack of availability of mmWave spectrum is disappointing because its advantages are the cornerstone of new, high speed 5G-enabled services.

The Index identified more key developments during the past year:

- The United States continues to push ahead of other countries. Its regulator has provided spectrum in all three band classes, and national operators have made the most of it by launching services. One operator has launched a standalone 5G core. Canada also has an operator offering 5G services via its new standalone core.

- South Korea, which ranked second in the 2021 Index, has dropped to fifth because it has not made low band spectrum available, despite high subscriber penetration.

- Most Nordic countries are pulling ahead, thanks to wider spectrum availability and broader deployment across bands, but Sweden is held back by the lack of mmWave spectrum as full availability of 26 GHz isn’t planned before 2025. This slows Sweden down and risks muting consumer excitement.

- Germany moved from laggard to leader of the EU4 (France, Germany, Italy, and Spain) plus the United Kingdom, thanks to operators launching 5G in multiple bands. Only one operator has launched a 5G standalone core.

- France now trails other larger European countries because of its late launch of 5G (November 2020) and customers’ apparent limited interest in it.

- A strong showing in the Middle East (Saudi Arabia, United Arab Emirates, and Qatar) is a testament to their networks’ quality and strong rollouts. Penetration is 9 to 11 percent. A Saudi operator has launched a standalone 5G core.

- Australia was one of the first countries to launch 5G, has continuously expanded spectrum access across all bands, and enjoys successful commercialization. It has 18 percent 5G penetration, the second highest in the Index.

Kearney also uncovered the following findings:

- Take-up (as a percentage of total subscribers in the first quarter, 2022) is paltry across Europe. Switzerland is the best with 13 percent but launched in April 2019. Belgium is the worst offender at 1.7 percent of connections. Take-up is 31 percent in South Korea.

- In South Korea, the government has announced a push for creating an ecosystem of companies that innovate and leverage 5G (aiming for 1,800 5G service firms by 2026). They understand operators won’t be solo drivers but enablers.

- Rollout of new capacity in the United States allows operators to launch impactful services, such as 5G fixed wireless access (FWA). One operator is using

- 5G to equip ambulances with high-quality video feeds that medical professionals can view while patients are en route.

Europe is behind, but not irreparably so. Vigilance and focus are required, together with operators’ preparation to win with 5G when their countries have reached ready status.

Monetize 5G step-by-step, building up to an ecosystem of products, services, and partners:

Currently, 5G lacks killer uses cases to drive customer uptake. Without seductive 5G products or services, people won’t see its benefits. Yet, operators wonder whether advancing investment in 5G is wise. It’s classic chicken-and-egg, but it will start somewhere, spearheaded by first-mover operators along with third-party providers that will figure out what will make everyone want 5G. Plan monetization first with small steps, and then plan the ecosystem to realize its potential.

It still may seem like early days in the 5G journey, but time grows shorter for European telcos to catch up with the United States and other markets. Getting your strategy rolling now is the only way to take advantage of the European market when it becomes fully 5G ready.

References:

Ericsson Mobility Report: 5G monetization depends on network performance

Moody’s skeptical on 5G monetization; Heavy Reading: hyperscalers role in MEC and telecom infrastructure

ABI Research: Expansion of 5G SA Core Networks key to 5G subscription growth

PwC report on Monetizing 5G should be a wake up call to network operators!

How 5G network operators can stay competitive and grow their business

ABI Research: Expansion of 5G SA Core Networks key to 5G subscription growth

The number of 5G subscriptions will surge from 934 million in 2022 to 3.1 billion in 2027 -a Compound Annual Growth Rate (CAGR) of 27% – according to a study from ABI Research. Further, 5G traffic is forecast to increase from 293 Exabytes (EB) in 2022 to 2,515 EB in 2027, at a CAGR of 54%.

ABI’s forecast is largely based on an increase in 5G Core (5GC) networks. To date, more than 35 5GC networks are operating in 5G standalone (SA) mode. 5GC is expected to lead to a growth in devices connected to the network and the traffic routed through it.

“5GC holds potential for operators to monetize further existing cellular connectivity for traditional mobile broadband (MBB) use cases but also offers scope for operators to expand cellular capabilities in new domains. Additionally, 5GC also offers innovation potential for committed telcos to establish new operating models for growth outside of the consumer domain,” explains Don Alusha, Senior Analyst, 5G Core and Edge Networks, at ABI Research.

5GC presents Communications Service Providers (CSPs) with a fluid and dynamic landscape. In this landscape, there is no static offering (requirements constantly change), no uniform offering (one shoe does not fit all), and no singular endpoint (one terminal with multiple applications). 5GC guides the industry into edge deployments and topologies. CSPs step out of the four walls of either their virtual Data Center (DC) or physical DC to place network functionality and compute as close to their customers as possible. This constitutes decentralization, a horizontal spread of network assets and technology estate that calls for a ‘spread’ in the operating model.

The shift from a centralized business (e.g. with 4G EPC) to a decentralized business (5G SA core network) stands to be a significant trend in the coming years for the telecoms industry. Against that backdrop, the market will demand that CSPs learn to drive value bottom-up. “What customers need” is the starting point for companies like AT&T, BT, Deutsche Telekom, Orange, and Vodafone. In other words, in this emerging landscape, there will be enterprise-specific, value-based, and niche engagements where the business strategy sets the technology agenda. So, it is rational to conclude that a “bottom-up” approach may be required to deliver unique value and expand business scope. That said, CSPs may be better equipped to drive sustained value creation if they learn to build their value proposition, starting from enterprise and industrial edge and extending to core networks.

“A 5G cloud packet core can potentially unlock new transactions that supplement existing volume-centered modus operandi with a local, bottom-up value play for discrete engagements. But the power of a bottom-up model is not enough. To monetize a 5G cloud packet core at scale, some of the existing top-down intelligence is needed too. Learning how to operate in this hybrid top-down and the emerging bottom-up, horizontally stratified ecosystem is a journey for NTT Docomo, Rakuten Mobile, Singtel, Softbank, and Telstra, among other CSPs. In the impending cellular market, an effective and efficient operating model must contain both control and lack of control, both centralization and decentralization and a hybrid of bottom-up plus some of the ‘standard’ top-down intelligence. The idea is that CSPs’ operating model should flexibly fit and change in line with new growing market requirements, or new growth forays may hit a roadblock,” Alusha concludes.

Editor’s Note:

It’s critically important to understand that the 3GPP defined 5G core network protocols and network interfaces enable the entire mobile system. Those include call and session control, mobility management, service provisioning, etc. Moreover, the 3GPP defined 5G features can ONLY be realized with a 5G SA core network. Those include: Network Automation, Network Function Virtualization, 5G Security, Network Slicing, Edge Computing (MEC), Policy Control, Network Data Analytics, etc

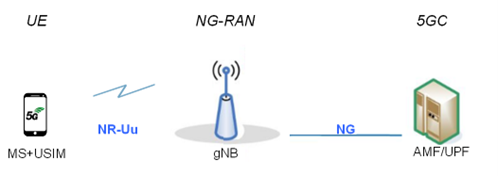

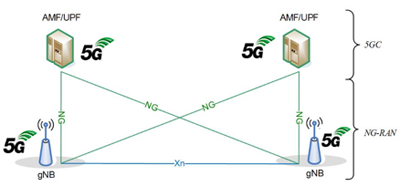

Figure 1: Overview of the 5G system

The 5GC architecture relies on a “Service-Based Architecture” (SBA) framework, where the architecture elements are defined in terms of “Network Functions” (NFs) rather than by “traditional” Network Entities. Via interfaces of a common framework, any given NF offers its services to all the other authorized NFs and/or to any “consumers” that are permitted to make use of these provided services. Such an SBA approach offers modularity and reusability.

Figure 2: 5G SA Core Network Architecture

The 5G SA architecture can be seen as the “full 5G deployment,” not needing any part of a 4G network to operate.

Finally, 3GPP has not liased their 5G system architecture specifications to ITU-T so there are no ITU-T standards for 5G SA Core Network or any other 5G non-radio specification. Instead, 3GPP sends their specs to ETSI which rubber stamps them as “ETSI standards.”

……………………………………………………………………………………………………………………………………………………….

These findings are from ABI Research’s 5G Core Market Status and Migration Analysis report. This report is part of the company’s 5G Core & Edge Networks research service, which includes research, data, and analyst insights. Based on extensive primary interviews, Application Analysis reports present an in-depth analysis of key market trends and factors for a specific technology.

About ABI Research

ABI Research is a global technology intelligence firm delivering actionable research and strategic guidance to technology leaders, innovators, and decision makers around the world. Our research focuses on the transformative technologies that are dramatically reshaping industries, economies, and workforces today.

References:

https://www.3gpp.org/technologies/5g-system-overview#

https://www.nokia.com/networks/core/5g-core/

A few key 3GPP Technical Specifications (TSs) are listed here:

- TS 22.261, “Service requirements for the 5G system”.

- TS 23.501, “System architecture for the 5G System (5GS)”

- TS 23.502 “Procedures for the 5G System (5GS)

- TS 32.240 “Charging management; Charging architecture and principles”.

- TS 24.501 “Non-Access-Stratum (NAS) protocol for 5G System (5GS); Stage 3”

- TS 38.300 “NR; NR and NG-RAN Overall description; Stage-2”

PwC report on Monetizing 5G should be a wake up call to network operators!

A PwC report titled, “The challenge of monetizing 5G,” states that capital expenditures and operating expenses will likely be very high with the deployment of 5G standalone networks and their fully virtualized, cloud-native architectures. Yet returns have been anemic across all generations, ranging from 1.5% to 4.5% of return on assets.

PwC’s 26th Annual Global CEO Survey found that 46% of telco CEOs believe that if their companies continue on their current paths, their businesses would not be economically viable in 10 years.

Source: PwC

As 5G becomes an everyday reality for both investors and consumers, carriers are going to face increasing pressure on two fronts:

1. Improve return on assets

As capital markets and stakeholders begin to focus on investment returns in a high-inflation environment, there will be growing scrutiny on telcos and wireless carriers, especially in comparison to other capital-intensive investment opportunities. An exemplar cloud services provider (CSP) has demonstrated ROA of 17% to 20%+ over the past five years, which compares to the 2% to 3% ROA range of MNOs. The ROA of MNOs approximates that of regulated entities like utilities, which explains investor angst.

2. Deliver on demanding service-level agreements to support 5G “killer apps,” such as metaverse applications (really?)

Improving ROA is intrinsically tied to successfully managing the costs and revenues of 5G applications. Many operators face a growing clamor from application providers and up-stack players to create “metaverse-capable networks,” without much clarity on how application revenue will be shared with them. Network operators risk becoming trapped in a “give more, get less” scenario of providing pure-play connectivity, while up-stack companies monetize the 5G applications.

……………………………………………………………………………………………………………………………………………………………………

For those who believe 5G FWA is the way to monetize 5G, PwC warned that’s not likely. The market research firm’s analysis showed FWA services could cost more than 22-times as much as mobile connectivity services. That’s due to costs associated with delivering data tied to specific latency or QoS service-level agreements (SLAs). Immersive and augmented experiences — such as virtual-reality apps, mobile metaverse and gaming — could cost three to four times as much. Network costs related to the Internet of Things (IoT) are even more challenging to estimate and track, primarily because of the extremely wide range of connected devices and applications available.

The report also found that FWA services could have up to 40-times less revenue potential. This is due to FWA services being price limited by competing fiber or cable internet options.

“Most FWA subscribers are willing to pay only as much as wireline plans cost, yet they expect a similar quality of service for internet connectivity,” the report notes.

PwC Partner Dan Hays explained during an interview with SDx Central at the MWC Barcelona 2023 event that operators should approach FWA and other alternative 5G connection services like IoT with reasonable financial and operational expectations. “Fixed-wireless access is a great way to fill out excess capacity, if you have it,” Hays said. “You see some of the carriers making that play.”

“It’s not a cure all by any means,” Hays said, explaining, “we look at it as not a business model but really a technology. It’s a technology choice that you can use.”

Hays said that operators are indeed being “really thoughtful” in managing capacity to serve FWA customers, but that can potentially run into a problem down the road where a particular site can no longer support a high-bandwidth FWA connection. “Do they fire you as a customer at some point,” he said.

In conclusion, PwC states:

Carriers will be increasingly challenged to demonstrate better returns on invested capital for massive 5G capital outlays, while simultaneously meeting the demanding service-level agreements of future 5G applications. Network costs are likely higher — and revenue potential is likely lower — than carriers understand for these applications. Critical strategies for improving ROA and monetizing 5G successfully involve accurately valuing network features, quantifying network costs and communicating them to all stakeholders, as well as improving 5G offer management, pricing and service evolution.

References:

https://www.pwc.com/us/en/tech-effect/emerging-tech/5g-monetization.html

Juniper Research: 5G to Account for 80% of Operator Revenue by 2027; 6G Requires Innovative Technologies

5G to Account for 80% of Operator Revenue by 2027:

Juniper Research has forecast that communications operators are likely to generate $625B from 5G services globally by 2027, a substantial rise from the $310bn predicted for the end of 2023. The new report, Operator revenue strategies: Business models, emerging technologies & market forecasts 2023-2027, forecasts that 80% of global operator-billed service revenue will be attributable to 5G by 2027; allowing operators to secure a return on investment into their 5G networks. However, the increasing implementation of eSIMs into new devices will drive global cellular data traffic to grow by over 180% between 2023 and 2027, as data traffic is offloaded from fixed and Wi-Fi networks to 5G.

Juniper Research noted that the increasing implementation of embedded subscriber identity modules (eSIMs) into new devices would drive global cellular data traffic to grow by over 180% between 2023 and 2027, as data traffic is offloaded from fixed and Wi-Fi networks to 5G. Previous Juniper studies have observed that after spending more than a decade offering a potential breakthrough in mobile communications, embedded eSIM technology has enjoyed noticeable growth in the past 12 months, making its way from smartphones to smart devices. The report also calculated that, driven by Apple’s innovation disrupting the smartphone sector, the value of the global eSIM market was expected increase from $4.7bn in 2023 to $16.3bn by 2027.

Juniper Research author Frederick Savage commented: “eSIM-capable devices will drive significant growth in cellular data, as consumers leverage cellular networks for use cases that have historically used fixed networks. Operators must ensure that networks, including 5G and upcoming 6G networks, are future‑proofed by implementing new technologies across the entirety of networks.”

6G Development Necessitates Innovative Technologies:

To prepare for this increasing demand in cellular data, the report predicts that 6G standards must adopt innovative technologies that are not currently used in 5G standards. It identified NTNs (Non‑terrestrial Networks) and sub-1THz frequency bands as key technologies that must be at the center of initial trials and tests of 6G networks, to provide increased data capabilities over existing 5G networks.

However, the research cautions that the increased cost generated by the use of satellites for NTNs and the acquisition costs of high-frequency spectrum will create longer timelines for securing return on 6G investment for operators. As a result, it urges the telecommunications industry to form partnerships with specialists in non-terrestrial connectivity; thus benefitting from lower investment costs into 6G networks.

………………………………………………………………………………………………………………………………………………………………………………………………………..

References:

https://www.juniperresearch.com/pressreleases/operator-5g-revenue-to-reach-$625bn-by-2027

Juniper Research: CPaaS Gobal Market to Reach $29 Billion by 2025

Juniper Research: 5G connectivity opportunity for the connected car market

Juniper Research: 5G Fixed Wireless Access to Generate $2.5 Billion in Operator Revenue by 2023

Ericsson Mobility Report: 5G monetization depends on network performance

A special Ericsson Mobility Report – called the Business Review edition – addresses monetization opportunities as they relate to 5G. Flattening revenues have been a challenge for service providers in all parts of the world, often impacting network investment decisions as part of their business growth strategies, known as ‘monetization’ in the industry.

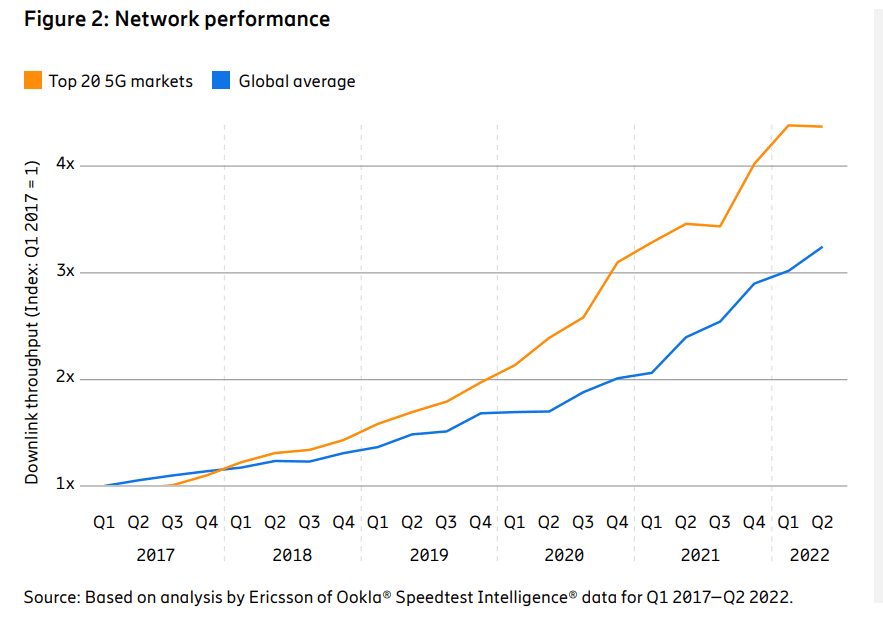

The report highlights a positive revenue growth trend since the beginning of 2020 in the top 20* 5G markets – accounting for about 85 percent of all 5G subscriptions globally – that correlates with increasing 5G subscription penetration in these markets.

The report finds:

- Tiered pricing models are key for service providers, both for effectively addressing the individual needs of each customer and for continuing to drive long-term revenue growth.

- The top 20 5G markets have seen a significant network performance boost following the introduction of 5G services.

- After a period of slow or no growth, wireless service revenue curves are again pointing upwards in these leading markets. This correlate with 5G subscription penetration growth.

- In the top 20 5G markets, the average downlink throughput has increased by 4.3 times over the past 5 years. This is 32 percent more than other markets on a global level, showing the positive impact 5G has had on network performance and user experience. The most significant network performance improvement in the top 20 5G markets was in 2020, following the introduction of 5G NSA network services.

- In the top 20 5G markets, the median downlink throughput of 5G is 5.8 times higher than the throughput of 4G (187 Mbps vs. 32 Mbps) in Q3 2022. This performance boost is what service providers could offer to consumers as an immediate benefit of upgrading to 5G.

Fredrik Jejdling, Executive Vice President and Head of Networks, Ericsson, says: “Meeting our customers’ challenges is at the heart of our R&D efforts and every resulting product we develop. The link between 5G uptake and revenue growth in the top 20 5G markets underlines that not only is 5G a game changer, but that early adopters benefit. What is particularly encouraging about this is that while 5G is still at a relatively early phase, it is growing fast with proven early use cases and a clear path to medium and long-term use cases.”

As expected, Enhanced Mobile Broadband (eMBB) is the main early use case for 5G, driven by increasing geographical coverage and differentiated offerings. More than one billion 5G subscriptions are currently active across some 230 live commercial networks globally. 5G eMBB offers the fastest revenue opportunities for 5G, as it is an extension of service providers’ existing business, relying on the same business models and processes. Even in the top 20 5G markets, about 80 percent of consumers have yet to move to 5G subscriptions – one pointer to the potential for revenue growth.

As highlighted in the November 2022 Ericsson Mobility Report, Fixed Wireless Access (FWA) is the second biggest early 5G use case, particularly in regions with unserved or underserved broadband markets. FWA offers attractive revenue growth potential for CSPs as it largely utilizes mobile broadband assets. FWA connections are forecast to top 300 million within six years.

Beyond consumer subscribers, there are growing opportunities in enterprise and public sector applications across the world. Ericsson sas that 5G enables significant value for enterprises, with private 5G networks and wireless wide area networks being deployed for enterprise and industrial use.

Upgrading existing 4G sites to 5G has the potential to realize increases of 10 times in capacity and reduce energy consumption by more than 30 percent, offering the possibility of growing revenue and lowering costs, while addressing sustainability.

Jejdling adds: “Revenue growth and sustainability are recurring themes in my discussions with customers. In this special Ericsson Mobility Report edition, we have explored how service providers are tapping 5G opportunities. We see initial signs of revenue growth in advanced 5G markets with extensive coverage build-out and differentiated service offerings. An equally crucial aspect of 5G is that it brings cost advantages and helps service providers handle the data growth needed to drive future revenue. This can make 5G the growth catalyst that the market has been waiting for.”

Read the full Ericsson Mobility Report Business Review Edition report here.

*Note: The markets categorized as the Top 20 5G markets in the report are: Australia, Bahrain, China, Denmark, Finland, Hong Kong, Ireland, Japan, Kuwait, Monaco, Norway, Qatar, Saudi Arabia, Singapore, South Korea, Switzerland, Taiwan, the UAE, the UK and the US.

They were selected on the basis of 5G subscription penetration. These markets represent 85 percent of all 5G subscriptions globally – with each market having 5G penetration above 15 percent.

Related links:

Ericsson Mobility Report site

Ericsson 5G

Ericsson 4G and 5G Fixed Wireless Access

Breaking the energy curve

5G the next wave – what does consumers want

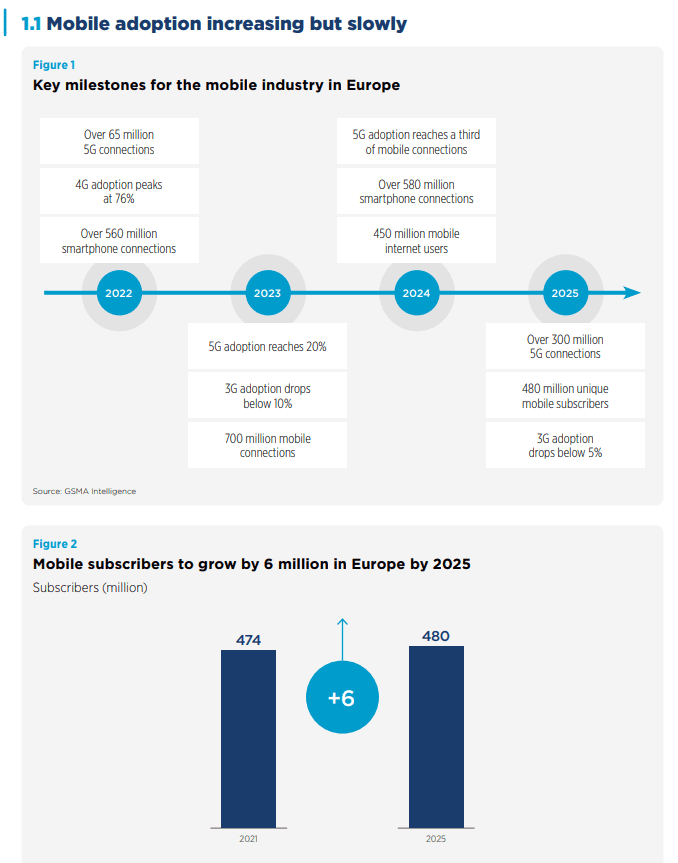

GSMA: Europe’s 5G rollout is too slow at 6% of mobile customer base

GSMA says in order to stay competitive European economies must ‘digitalize’ themselves through faster 5G rollouts and make a fair contribution. The telco trade body and owner of MWC event has released its 2022 Mobile Economy Report for Europe, in which it states the EU will not meet its ‘digital decade goals’ unless it starts rolling out 5G faster across the continent.

In 2021, 474 million people in Europe (86% of the population) were subscribed to mobile services, and this is expected to grow to 480 million by 2025.

The majority of countries in Europe have now deployed commercial 5G services, and nearly two thirds of wireless network operators in the region have launched 5G networks. At the end of June 2022, 108 operators in 34 markets across Europe had launched commercial 5G services, while consumer uptake was at 6% of the mobile customer base. Norway trended above this with 16% of its citizens using 5G, followed by Switzerland (14%), Finland (13%), the UK (11%) and Germany (10%).

GSMA forecasts that by 2025, there will be 311 million 5G connections across Europe, a 44% adoption rate. However, European markets still lag behind global peers such as Japan, South Korea and the U.S. in the adoption of 5G technology. In 2025, the UK and Germany will have the highest 5G adoption rates in Europe at 61% and 59% respectively, compared to 73% in South Korea and 68% in Japan and the U.S. 4G adoption in Europe will peak in 2022 and then decline. However, it is set to remain the dominant technology across the region, accounting for just over half of total connections by 2025.

The pace of 5G coverage expansion across Europe will be a key factor in the transition from 4G to 5G. Although 5G network coverage in Europe will rise to 70% in 2025 (from 47% in 2021), nearly a third of the population will remain without 5G coverage. This compares to 2% or less in South Korea and the U.S.

SOURCE: GSMA

“Europe is adopting 5G faster than ever before, but greater focus on creating the right market conditions for infrastructure investment is needed to keep pace with other world markets. This should include the implementation of the principle of fair contribution to network costs,” said Daniel Pataki, GSMA Vice President for Policy & Regulation, and Head of Europe.

Which of course is a reference to the ‘fair contribution’ argument that telcos and now the GSMA itself has been making for some time now, which in a nutshell says that since internet firms like Netflix and Facebook make tons of money, they should contribute to the building of physical network infrastructure because it is expensive and telcos don’t make as much cash as they used to.

This announcement from the GSMA goes a bit further than saying it’s unfair that content providers make much more margin streaming TV shows that telcos do on digging holes and dragging up cell towers, and seems to be asserting that unless something is done about all this then the entire continent of Europe will become uncompetitive on the world stage.

As economies and societies around the world digitalize, the acceleration of 5G in Europe is necessary to ensure that traditional industrial and manufacturing strengths are not dragged down by weaknesses in the ICT sector. To achieve this, it is vital to create the right conditions for private infrastructure investment, network modernization and digital innovation. A financially sustainable mobile sector is key to the delivery of innovative services and the deployment of new networks.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

References:

https://www.gsma.com/mobileeconomy/wp-content/uploads/2022/10/051022-Mobile-Economy-Europe-2022.pdf