LightCounting: Q1 2024 Optical Network Equipment market split between telecoms (-) and hyperscalers (+)

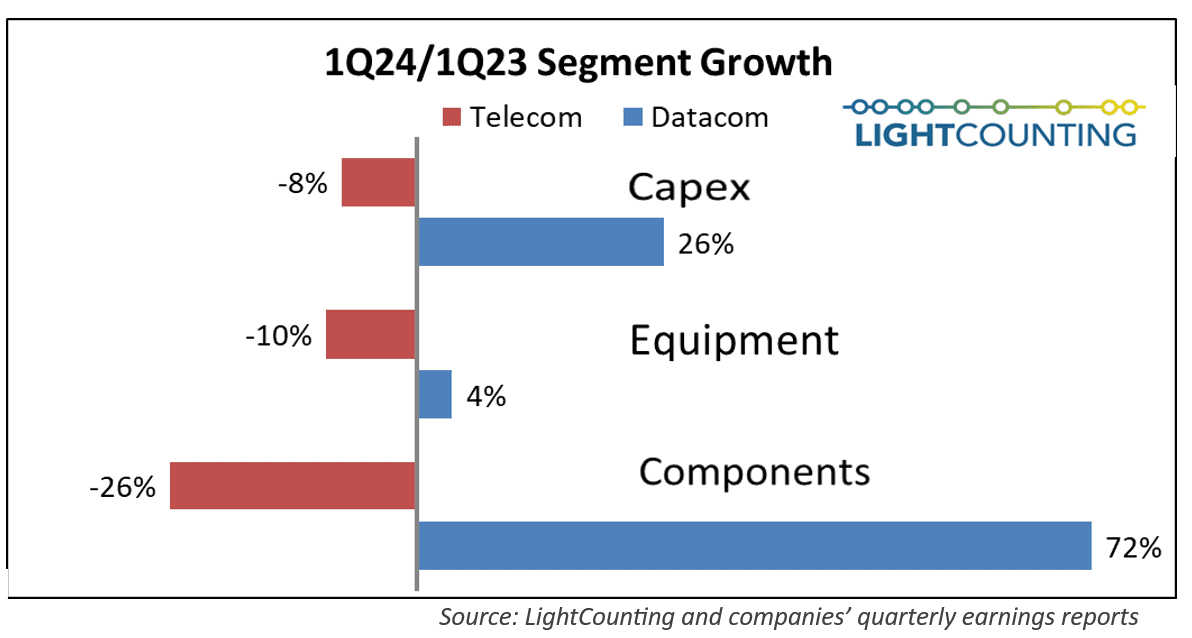

As has been the trend for the past several quarters, Q1 2024 results for the optical communications market were sharply split between very weak sales in the telecom segment (Communications Service Providers or CSPs) and continued strong demand by the hyperscalers (cloud giants). The combined capex of the Top 15 CSPs declined year-over-year for the sixth quarter in a row, while the Top 15 ICPs spending grew for the second quarter in a row, paced by Alphabet (+91%) and Microsoft (+66%). Chinese ICPs spending also increased dramatically, suggesting the AI boom is hitting China too.

Equipment makers may have felt like passengers in an airplane hitting an air pocket, with networking and optical transport gear sales down 10% y-o-y, and server and switch maker sales up just 4%. Even the smaller and more focused suppliers like Ciena and Infinera were uniformly down compared to Q1 2023.

The stark contrast between telecom and datacom (hyperscalers) is shown in this chart:

Sales of 400G and 800G Ethernet optical transceivers for deployments in AI clusters were in line with our expectations. Although the recovery in demand for DWDM started in Q4 2023, Q1 2024 was slow. No recovery is expected in demand for FTTx and WFH transceivers until 2025-2026. Despite weakness in several segments, cloud demand is expected to lift annual sales of Ethernet transceivers by 40% in 2024, pushing the overall transceiver market to a new high of more than $2.6 in Q2 2024. Innolight continued to report above average results, with record sales for the third quarter in a row.

The semiconductor segment grew 61% y-o-y driven almost solely by Nvidia (up 262%), again highlighting the dichotomy between those feeding the ICPs AI ambitions, and those supporting the traditional communications providers. Broadcom deserves honorable mention (up 43% y-o-y), as its booming datacenter sales suggest that the impact of the AI arms race is starting to expand beyond Nvidia.

Looking ahead we expect continued spending growth by ICPs this year, benefiting the better-positioned suppliers like Nvidia, Broadcom, and Innolight. CSP spending on the other hand will languish for another quarter or two at least, putting a drag on the larger NEMs like Ericsson and Nokia especially.

LightCounting’s Quarterly Market Update consists of a PowerPoint slide deck and a data-packed spreadsheet, with both vendor survey results and publicly reported financial results across six market segments.

References: