Optical Components

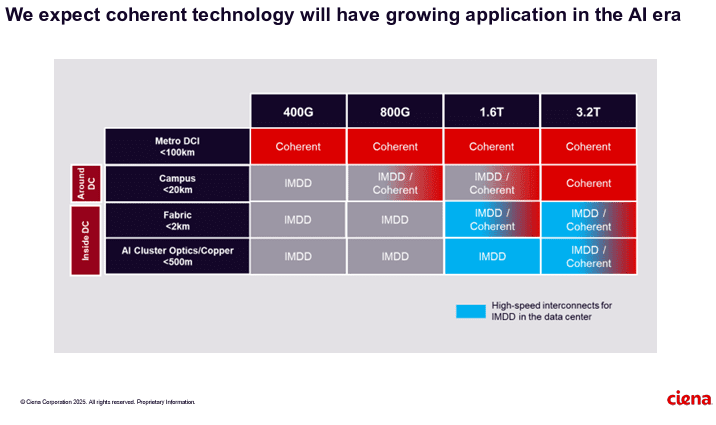

AI infrastructure investments drive demand for Ciena’s products including 800G coherent optics

Artificial Intelligence (AI) infrastructure investments are starting to shift toward networks needed to support the technology, rather than focusing exclusively on computing and power, according to Ciena Chief Executive Gary Smith. The trends helped Ciena swing to a profit and post a 24% jump in sales in the recent quarter.

The company enables high-speed fiber optic connectivity for telecommunications and data centers, helping hyper-scalers such as Amazon and Microsoft support AI initiatives via data center interconnects and intra-data center networking. Currently, the company is ramping up production to meet surging demand fueled by cloud and AI investments.

“There’s no point in investing in these massive amounts of GPUs if we’re going to strand it because we didn’t invest in the network,” Smith said Thursday.

……………………………………………………………………………………………………………………………………………………..

Ciena sees a bright future in 800G coherent optics that can accommodate AI traffic. Smith said a global cloud provider has selected Ciena’s coherent 800-gig pluggable modules and Reconfigurable Line System (RLS) photonics for investing in geographically distributed, regional GPU clusters. “With our coherent optical technology ideally suited for this type of connectivity, we expect to see more of these opportunities emerge as cloud providers evolve their data center network architectures to support their AI strategies,” he added.

It’s still early innings for 800G adoption, but demand is climbing due to AI and cloud connectivity. Vertical Systems Group expects to see “a measurable increase” in 800G installations this year. Dell’Oro optical networking analyst Jimmy Yu noted on LinkedIn Ciena’s data center interconnect win is the first he’s heard of that involves connecting GPU clusters across 100+ kilometer spans. “It was a hot topic of discussion for nearly 2 years. It is now going to start,” Yu said.

……………………………………………………………………………………………………………………………………………………

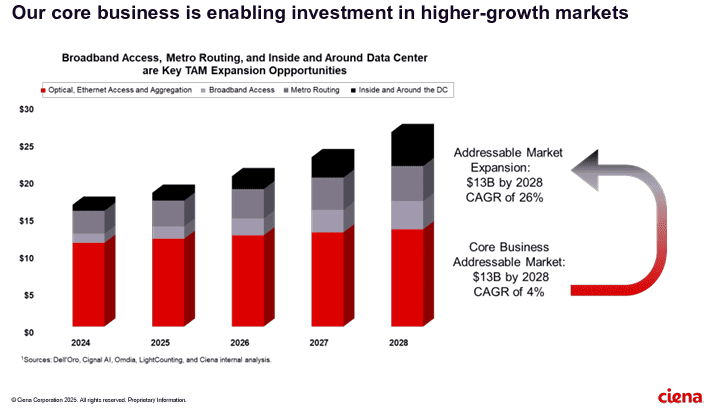

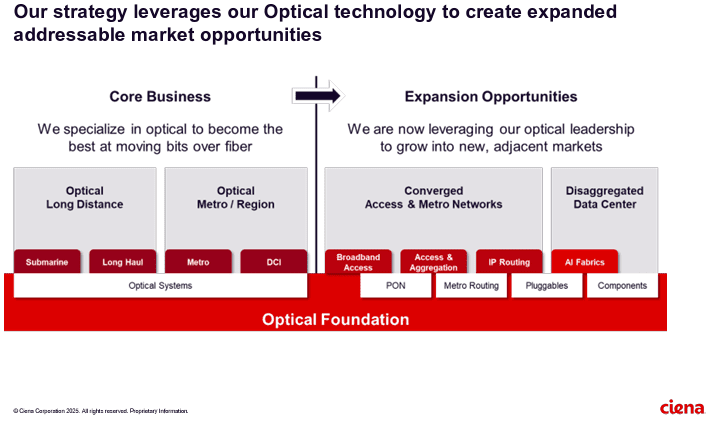

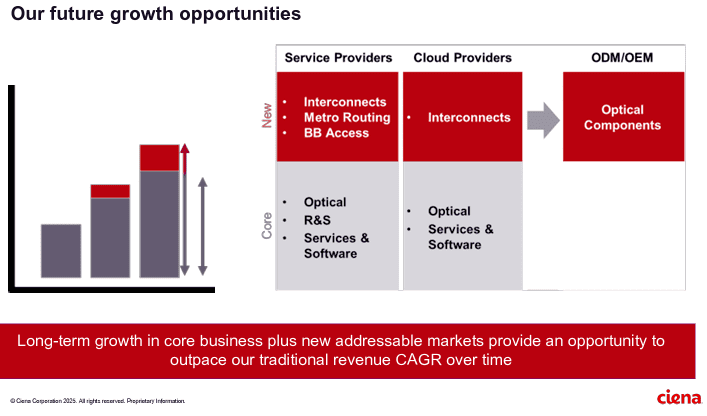

Ciena’s future growth opportunities include network service and cloud service providers as well as ODM/OEM sales of optical components.

References:

https://www.wsj.com/business/earnings/ciena-swings-to-profit-as-ai-investments-drive-demand-0195f30c

https://investor.ciena.com/static-files/d964ccac-74b3-43d9-a73e-ecf67fab6060

https://www.fierce-network.com/broadband/ciena-now-expects-tariff-costs-10m-quarter

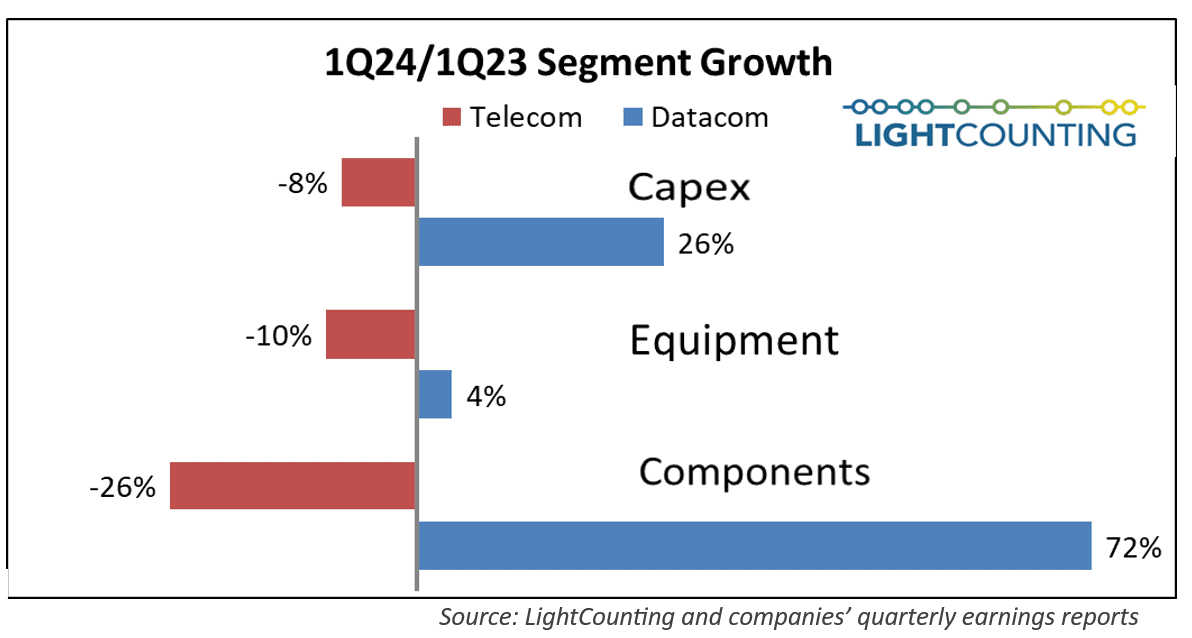

LightCounting: Q1 2024 Optical Network Equipment market split between telecoms (-) and hyperscalers (+)

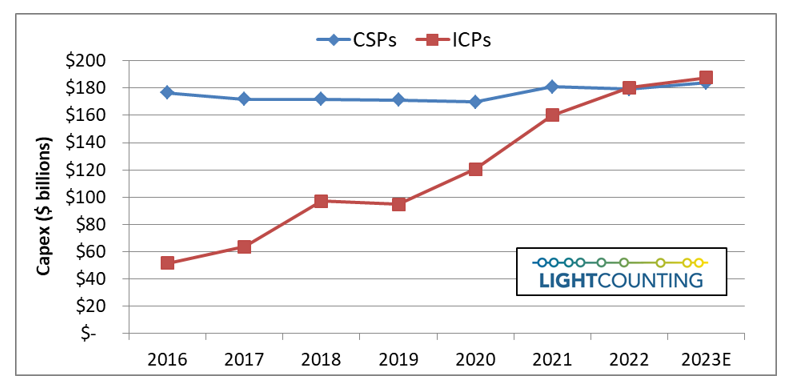

As has been the trend for the past several quarters, Q1 2024 results for the optical communications market were sharply split between very weak sales in the telecom segment (Communications Service Providers or CSPs) and continued strong demand by the hyperscalers (cloud giants). The combined capex of the Top 15 CSPs declined year-over-year for the sixth quarter in a row, while the Top 15 ICPs spending grew for the second quarter in a row, paced by Alphabet (+91%) and Microsoft (+66%). Chinese ICPs spending also increased dramatically, suggesting the AI boom is hitting China too.

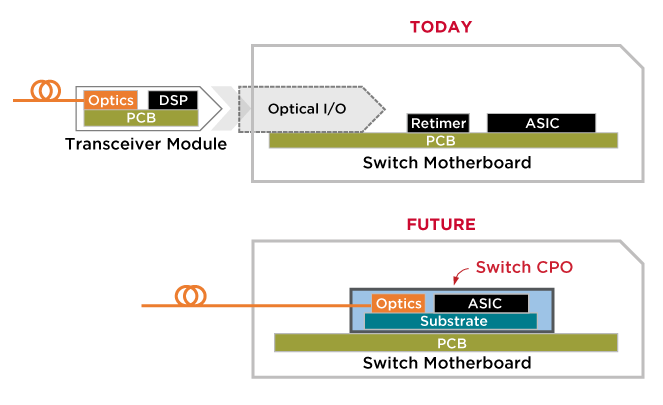

Co-Packaged Optics to play an important role in data center switches

The commercialization of co-packaged optics (CPO) has been long anticipated but is becoming increasingly desirable as data needs accelerate. Co-Packaged Optics are an advanced heterogeneous integration of optics and silicon on a single packaged substrate aimed at addressing next generation bandwidth and power challenges.

As the bandwidth of data center switches increases, a disproportionate amount of power is becoming dedicated to the switch – optics interface. Reducing the physical separation between these two components by co-packaging enables system power savings which is essential to continued bandwidth scaling.

CPO brings together a wide range of expertise in fiber optics, digital signal processing (DSP), switch ASICs, and state-of-the-art packaging and test to provide disruptive system value for the data center and cloud infrastructure.

The companies and institutions working on CPO have made great strides in developing suitable electronic components. But hundreds of meters of fiber will be packed into the switch box for the first time, and faceplate connections will have unprecedented densities. As a result, the design and development of optical system solutions will also be critical elements in the success of CPO. Optical components with performance tailored to the CPO application and effective solutions for managing the fiber in the switch box are vital in optimizing the complete optical system. Three aspects of CPO deployment, in particular, hinge on the properties of the fiber and the optical interfaces: optical power loss, the trade-off between minimizing bend loss and controlling for MPI and maintaining the polarization state if external lasers are used.

Image Courtesy of Broadcom

……………………………………………………………………………………………………………………………………….

Data centers face substantial challenges as they scale, particularly in reducing power dissipation and cost per bit. CPO will play a significant role in helping to meet those challenges. In today’s data center switches, external fiber optic connections that carry data terminate on pluggable transceivers on the housing faceplate. The optical data stream is coupled to the electrical signals at that interface.

With a CPO realization of a 51.2 Tbps switch, the substrate connects a central regulator ASIC to 16 optoelectronic (O/E) tiles on the substrate perimeter. These tiles are connected to optical fiber signal cables that run to the switch box faceplate and receive power from external lasers that they modulate to produce the outgoing optical signal stream.

They communicate between the transceiver and the switch application-specific integrated circuit (ASIC) via copper traces on printed circuit boards. Under the CPO paradigm, as the optoelectronic conversion is pushed back from the faceplate to the switch substrate, long electrical traces are replaced with virtually loss-free optical fiber.

With CPO, the fiber path continues past a connector at the faceplate and into the switch box, ending at photonic integrated circuits (PICs) on optical tiles attached to the switch substrate. This shift presents the novel challenge of routing and connecting hundreds of optical fibers within a compact and crowded space, creating a need to minimize the footprint of the optics while still achieving performance and reliability targets.

CPO will soon be a reality that relies on a system of complex, interconnected components working well together. For optimum overall performance, these components must be designed with the specific requirements of CPO in mind, which for the optical subsystem include efficient and unobtrusive deployment within a crowded switch box, low power losses, absence of MPI impairments, and good reliability. Some CPO realizations also need optical polarization state control.

The familiar fiber and connectivity products, while having impressive attributes, are not optimum for the CPO application, and there is great scope for enhancing the performance of the optics by moving beyond default solutions to those specifically designed for the role.

References:

https://www.broadcom.com/info/optics/cpo

Coherent Optics: Synergistic for telecom, Data Center Interconnect (DCI) and inter-satellite Networks

Heavy Reading: Coherent Optics for 400G transport and 100G metro edge

Precision Optical Technologies (OT) in multi-year “strategic partnership” to upgrade Charter Communications optical network

Rochester, N.Y., based Precision Optical Technologies (OT) has struck a multi-year “strategic partnership” with Charter Communications to upgrade the latter’s optical network. In alignment with Charter’s Distributed Access Architecture (DAA) network expansion and operational enhancement initiatives, this collaboration will see the deployment of nearly all of Precision OT’s active and passive portfolio of solutions; to include 10G DWDM tunable optics, 100G and 400G optics, Bluetooth® DWDM tuning modules, passive connectivity solutions and more. Precision OT didn’t announce the financial terms of the agreement.

Charter plans to upgrade about 85% of its HFC plant using a distributed architecture paired with a virtual cable modem termination system (vCMTS) and “high-split’ upgrades that dedicate more spectrum to the DOCSIS upstream. About 50% of Charter’s HFC plant will be upgraded to 1.2GHz of capacity and 35% will upgrade to 1.8GHz and a full deployment of DOCSIS 4.0. The remaining 15% of Charter’s footprint will be moved to 1.2GHz with a high-split but forgo DAA and a vCMTS.

Greg Mott, SVP Field Operations Engineering at Charter Communications said of the partnership, saying: “The team at Precision OT has a clear understanding of Charter’s broadband network evolution — cost, scale, and speed — and their mix of solutions will help us deliver on our commitments across our 41-state service area.”

Charter has also tapped Harmonic for the vCMTS component and selected Vecima Networks’ DAA platform, including remote PHY nodes. ATX Networks, which recently introduced a 1.8GHz platform that can be used to upgrade legacy Cisco nodes, is also expected to be in the mix at Charter. Teleste, a Finnish supplier that is boosting its investment in the North American cable market as operators push ahead with DAA and D4.0 upgrades, also has projects underway with Charter, according to industry sources.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

With a global footprint, Precision OT currently serves a diverse range of customers across various industries worldwide. Among its clientele are leading broadband service providers in North America, Europe, Latin America, and beyond. This partnership further solidifies Precision OT’s reputation as a trusted partner and solutions provider in the telecommunications and optical technology sectors.

“We are pleased that Charter Communications has chosen Precision OT as a trusted technology partner to deploy cutting-edge optical networking solutions,” said Keith Habberfield, SVP of Sales & Marketing at Precision OT. “Optics and their components are the integration point that enables networks to communicate. We provide a suite of solutions that work in all of Charter’s identified use-cases; this drives measurable operational simplicity and speeds deployments for their project.”

About Charter Communications:

Charter Communications, Inc. (NASDAQ:CHTR) is a leading broadband connectivity company and cable operator serving more than 32 million customers in 41 states through its Spectrum brand. Over an advanced communications network, the Company offers a full range of state-of-the-art residential and business services including Spectrum Internet®, TV, Mobile and Voice.

For small and medium-sized companies, Spectrum Business® delivers the same suite of broadband products and services coupled with special features and applications to enhance productivity, while for larger businesses and government entities, Spectrum Enterprise® provides highly customized, fiber-based solutions. Spectrum Reach® delivers tailored advertising and production for the modern media landscape. The Company also distributes award-winning news coverage and sports programming to its customers through Spectrum Networks. More information about Charter can be found at corporate.charter.com.

About Precision OT:

Precision OT is a systems integration company focused on end-to-end optical networking solutions, network design services and cutting-edge product development advancements. Backed by our extensive experience and robust R&D efforts, we play an integral role in enabling next-generation optical networks worldwide. For more information, visit www.precisionot.com.

References:

https://www.fiercetelecom.com/broadband/charter-plots-3-year-upgrade-deploy-docsis-40-2025

Charter Communications selects Nokia AirScale to support 5G connectivity for Spectrum Mobile™ customers

T-Mobile and Charter propose 5G spectrum sharing in 42GHz band

Comcast Xfinity Communities Wi-Fi vs Charter’s Advanced Wi-Fi for Spectrum Business customers

Coherent Optics: Synergistic for telecom, Data Center Interconnect (DCI) and inter-satellite Networks

by Kalar Rajendiran, Alphawave Semi (edited by Alan J Weissberger)

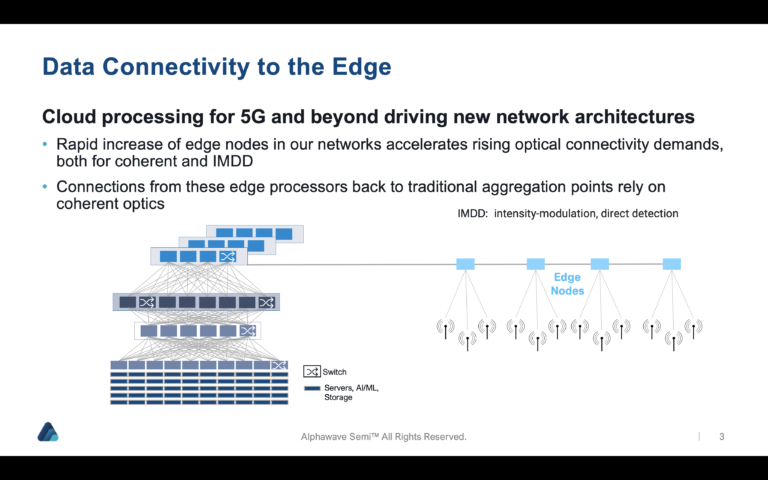

The telecommunications industry has experienced significant growth in recent years, driven by the increasing demand for high-speed internet and data services. This growth has created a surge in traffic on optical networks, leading to the development of new telecom network architectures that can support the increasing demand for bandwidth.

Optical networking technologies, such as coherent optics, have traditionally been developed for telecom applications. However, with the growth of hyperscale data centers and the increasing demand for high-speed networking, these technologies are now also being adopted in data center applications. Traditionally, data centers have used copper or short-range optical cables to connect servers and storage devices within the same data center. However, as data volumes continue to grow and data center interconnect (DCI) requirements increase, coherent optical networking is becoming an attractive option for data centers. With coherent optical networking, data centers can achieve higher data transmission rates over longer distances, resulting in increased data capacity and lower latency. 400G was the first data rate where hyperscale data center applications outpaced telecom applications in the use of coherent optics.

Coherent optics enables the transmission of high-speed data over long distances by using advanced signal processing techniques to mitigate the effects of signal distortion and noise. This technology is essential for supporting the growing demand for high-speed internet and data services, particularly in areas where traditional copper-based networks are not feasible. This trend is likely to continue and proliferate further going forward, driven by the ongoing growth of cloud computing, big data, AI/ML workloads and other data-intensive applications.

Another driver of the shift towards optical interconnects has been the increasing complexity of satellite networks. As satellite networks become more complex, the need for high-speed, low-latency communication between satellites becomes more important. Optical interconnects are ideal for this type of communication, as they offer very low latency and can support high-speed data transfer between satellites.

Optical telecom synergies have played a significant role in the evolution of inter-satellite communication. Many of the technologies and techniques used in optical telecom networks have been adapted for use in inter-satellite communication. Innovations in optical digital signal processing (DSP) and system automation also offer several optimization opportunities with inter-satellite interconnects. Benefits include:

- Improved Signal Quality: Optical DSP can be used to compensate for impairments in the optical signal, such as chromatic dispersion and polarization mode dispersion. This can improve the quality of the signal and reduce the bit error rate (BER), enabling high-quality communications over long distances.

- Reduced Latency: System automation can also be used to optimize the routing of data between satellites, minimizing the number of hops and reducing latency. This can improve the responsiveness of the system and enhance the user experience.

- Power-efficient Modulation Formats: Optical DSP can enable the use of power-efficient modulation formats, such as pulse-amplitude modulation (PAM), which can reduce the power consumption of the inter-satellite links while maintaining high data rates.

- Energy-efficient Signal Processing: Optical DSP can also be optimized to perform signal processing operations more energy-efficiently. For example, parallel processing and low-power digital signal processing techniques can reduce the power consumption of the signal processing circuitry.

At the recent Optical Fiber Communication (OFC) conference, Alphawave Semi (located in London, UK) showcased its ZeusCORE XLR test chip during the interoperability demonstration organized by the Optical Internetworking Forum (OIF). Alphawave Semi executives Loukas Paraschis, VP of Business Development and Tony Chan Carusone, CTO, presented on high-speed connectivity leadership. Their presentations touched on the growing synergies and optimization opportunities of inter-satellite interconnects and optical telecom through innovations in optical DSP and system automation.

As the volume of data traffic on optical networks continues to increase, it is essential to ensure that the cost of implementing and maintaining these networks remains affordable. This requires a delicate balance between increasing volume and decreasing costs, which can only be achieved through innovation and the development of highly-integrated co-designed solutions. These solutions combine multiple technologies and functions into a single device, reducing the complexity and cost of optical network infrastructure. This approach enables the development of more efficient, cost-effective optical networks that can meet the growing demand for bandwidth and high-speed data transmission.

To learn more about the ZeusCORE, visit the product page.

References:

Alphawave Semi at the Chiplet Summit

Alphawave IP is now Alphawave Semi for a very good reason!

Heavy Reading: Coherent Optics for 400G transport and 100G metro edge

Cable Labs: Interoperable 200-Gig coherent optics via Point-to-Point Coherent Optics (P2PCO) 2.0 specs

Adtran showcases coherent innovation at OFC 2023: FSP 3000 open line system & coherent 100ZR

Microchip and Cisco-Acacia Collaborate to Progress 400G Pluggable Coherent Optics

Cignal AI: Metro WDM forecast cut; IP-over-DWDM and Coherent Pluggables to impact market

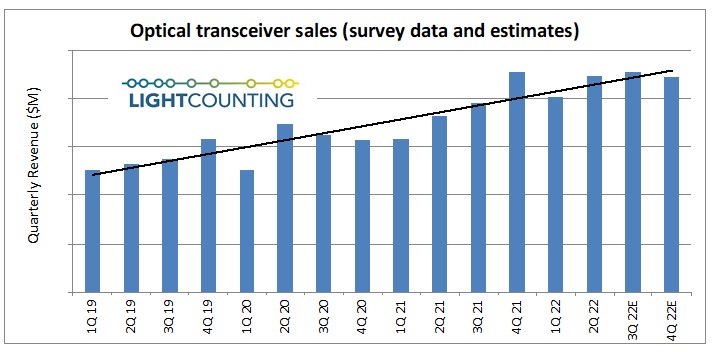

LightCounting: Sales of Optical Transceivers will decline in 2023

|

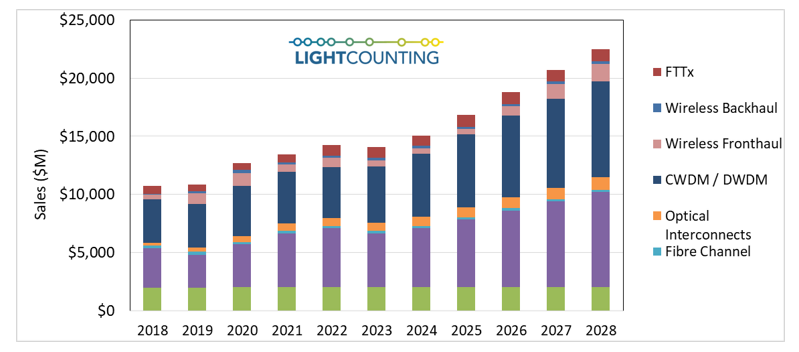

The optical communications industry entered 2020 with very strong momentum. Demand for DWDM, Ethernet, and wireless fronthaul connectivity surged at the end of 2019, and major shifts to work-at-home and school-at-home in 2020 and 2021 due to the COVID-19 pandemic created even stronger demand for faster, more ubiquitous, higher reliability networks. While supply chain disruptions continued, the industry was able to largely overcome them, and the market for optical components and modules saw strong growth in 2020-2022, as shown the figure in below.

We believe the optical transceiver market will be down slightly (1% or so) in 2023 due to declines in the sales of Ethernet and wireless fronthaul transceivers of 10% and 30%, respectively, offsetting growth in all other market segments in 2023.

|

|

|

Amazon and other cloud companies plan to moderate their investments in 2023 and beyond, even if there is no economic recession. The Cloud companies benefited from the COVID-19 pandemic, but they were forced to reassess their plans at the end of 2022, as growth slowed. Their capex almost doubled between 2019 and 2022 but future investments will be more conservative. We expect the Top 15 ICP’s capex to be up only 4% in 2023, essentially flat, after several years of double-digit growth. Investments in AI infrastructure will remain a priority.

Telecom service providers plan to reduce their capex in 2023 also but they will continue to upgrade access networks. Connecting business and consumers to the Cloud is a priority now. Their customers are willing to pay more for secure and low-latency broadband services and it is a great opportunity for revenue growth. Telecom service providers plan to digitize their operations and offer Network-as-a-Service (NaaS) to an increasing number of end users, not just a few of their largest customers.

|

|

|

Despite a slower than expected growth in revenues of the leading Cloud companies, AI infrastructure remains a priority. This new focus will sustain the market for high bandwidth and low latency Ethernet and InfiniBand switches in the next 5 years. We also expect the deployments of optical circuit switches in AI clusters to expand beyond Google’s datacenters.

Other notable forecast changes include increased sales of 50G and 100G fronthaul transceivers in the 2026-2028 timeframe, as we believe they will be needed for early 6G deployments, and increased sales of PON optics as deployments of FTTx are increasing due to government stimulus in the US and elsewhere.

LightCounting’s Market Forecast Report presents our forecast for optical transceivers used in the telecom and datacom sectors, and includes chapters reviewing the health and spending outlook for both CSPs and ICPs, as well as explanations of forecast drivers and assumptions for each of the six product segments covered: Ethernet, WDM, Fronthaul, Backhaul, FTTX, and Optical Interconnects. The accompanying Excel database includes unit and sales forecasts for over 200 product categories.

More information on the report is available at ttps://www.lightcounting.com

|

Ranovus Monolithic 100G Optical I/O Cores for Next-Generation Data Centers

Ranovus Inc. (“RANOVUS”) [1.] has announced the availability of its protocol-agnostic Odin™ 100G optical I/O cores based on GF Fotonix™, GlobalFoundries’ recently announced next generation, monolithic platform. GF Fotonix™ is the first in the industry to combine its differentiated 300mm photonics and RF-CMOS features on a silicon wafer, delivering best-in-class performance at scale. The announcement was made at OFC 2023 in San Diego.

Note 1. RANOVUS, founded in 2012, develops and manufactures advanced photonics interconnect solutions to support the next generation of AI/ML workloads in data centers and communication networks. Its current portfolio includes Multi-Wavelength Quantum Dot Laser technology and advanced digital and silicon photonics integrated circuit technologies that set a new industry benchmark for the lowest power dissipation, size, and cost for the next generation of optical interconnect solutions. RANOVUS’ Odin™ platform is claimed to be the enabling technology for a new data center architecture optimized for AI/ML workloads.

………………………………………………………………………………………………………………………………………………………………….

Odin 100G optical I/O chiplets and IP cores can be integrated with processors, switches, and memory appliances to enable new data centre architectures for machine learning, artificial intelligence, metaverse, cloud, 5G communications, and defence and aerospace. Data centres are increasingly demanding efficient and cost-effective high-capacity interconnect solutions to meet the exponential growth in data-driven applications like ML/AI and metaverse. Odin 100Gbps optical I/O scales from 8- to 32-cores in the same footprint by combining RANOVUS’ 100G bps per wavelength monolithic EPIC (Electro-Photonic Integrated Circuit) cores with its proprietary laser and advanced packaging technologies.

“We are delighted to share our multi-disciplinary silicon-photonics IP cores and chiplets, and advanced packaging solutions with our customers who are driving the adoption of novel data centre architectures based on integrating best-in-class chiplets and co-packaged optics”, said Hojjat Salemi, Chief Business Development Officer of RANOVUS. “Our close collaboration with GlobalFoundries underlines our joint commitment to deliver a fully featured set of qualified IP cores and chiplets with OSAT-ready high-volume manufacturing flows and supporting ecosystem to enable the huge potential of monolithic silicon photonics.”

As previously announced, RANOVUS has developed a highly flexible co-packaged optics architecture (Analog-Drive CPO 2.0) together with a Tier 1 ecosystem for high volume manufacturing of Odin chiplets. The first customer co-packaged solution with 800Gbps Odin optical I/O is also being demonstrated at OFC 2022 with samples based on the GF Fotonix platform shipping now.

“Data centers, computing and sensing applications require incredible processing, transmission and power efficiency as the world’s data needs soar dramatically.” Ranovus’ IP cores, chiplets and advanced packaging solutions, combined with GF Fotonix, provide customers a complete solution to develop the chips needed solve some of the biggest challenges facing data centers today,” commented Anthony Yu, vice president, Computing and Wired Infrastructure Strategic Business Unit at GF.

Image Credit: RANOVOUS

Previously at OFC 2023, RANOVUS announced interoperability of AMD Versal adaptive SoCs with the co-packaged Odin® 800G direct-drive optical engine and third party 800G DR8+ retimed pluggable modules. The interoperability demonstration is part of OFC 2023, the leading optical networking event in North America, and highlights the versatility of RANOVUS’s Odin® portfolio for AI/ML and communications applications.

“We announced the first generation of our Odin® optical interconnect at OFC 2022 for proprietary AI/ML applications. We are thrilled to showcase our standards-based Odin® optical interconnect product with 5pJ/bit for a direct-drive CPO solution,” said Dr. Christoph Schulien, head of Systems and High-Speed IC R&D of RANOVUS. “Its inherent versatility enables hyperscale data center providers to drastically reduce power consumption and optimize density and cost as they deploy novel hybrid data center architectures in response to the insatiable growth in AI/ML workloads.”

“RANOVUS’ demonstration of interoperability between our Versal™ adaptive SoCs co-packaged with Odin® 800G direct-drive CPO 2.0 and third party 800G DR8+ retimed pluggable modules underlines the flexibility and scalability of RANOVUS’ technology,” said Yohan Frans, vice president, Engineering at AMD. “We are proud of our collaboration with RANOVUS in demonstrating the performance and versatility of monolithic silicon photonics interconnects as data center and 5G customers deploy highly efficient and cost-effective systems for next generation workloads.”

“RANOVUS’ demonstration of interoperability between CPO and pluggable modules is a key proof point that their interconnect technology supports the flexibility and scalability with the lowest power consumption sought by hyperscalers as they optimize their data centers for AI/ML workloads,” said Vladimir Kozlov the founder and CEO of LIGHT COUNTING.

About Ranovus

RANOVUS, with operations in Ottawa, Canada (headquarters), Nuremberg, Germany and Sunnyvale, CA, develops and manufactures advanced photonics interconnect solutions to support the next generation of AI/ML workloads in data centers and communication networks. Our team has extensive experience in product development and commercialization of optoelectronics subsystems for the information technology industry. RANOVUS’ current disruptive portfolio of IP cores includes multi-wavelength quantum dot laser technology and advanced digital and silicon photonics integrated circuit technologies that set a new industry benchmark for the lowest power dissipation, size, and cost for the next generation of optical interconnect solutions. RANOVUS’ Odin™ platform is the enabling technology for a new data center architecture optimized for AI/ML, metaverse, cloud and 5G communications workloads. The company has received funding from leading venture capital firms, strategic investors, Sustainable Development Technology Canada, and Strategic Innovation Fund of Canada.

References:

Adtran showcases coherent innovation at OFC 2023: FSP 3000 open line system & coherent 100ZR

Adtran®, Inc., a leading provider of open and disaggregated networking solutions, today announced that its latest coherent innovation is being showcased at OFC 2023, as part of OFCnet. The demo reveals how the Adtran FSP 3000 open line system (OLS) can bring new levels of flexibility to optical networks by enabling optimized, tailored spectrum services. In collaboration with Acacia, Cisco, Coherent Corp., Corning, EXFO, Nokia and VIAVI Solutions, Adtran will showcase 100ZR, 200Gbit/s, 400Gbit/s OpenZR+ and 800Gbit/s connectivity. The FSP 3000 DCI OLS is also playing a key role in the OIF 400ZR demo at OFC.

“Our demo shows how the spectrum-as-a-service concept has the potential to revolutionize the way operators utilize their fiber resources. It highlights how it’s possible to slice up the network even in a metro environment. With fully flexible spectrum allocation, operators can provide a wide variety of differentiated services and ensure they leverage the full capacity of their infrastructure. Not only will this help tackle ever-increasing data demand, but it also offers a new route to revenue growth. Our compact FSP 3000 OLS is the key to realizing the full benefits of this open and flexible approach. It removes the limits of fixed channel grids so that untapped spectrum can be put to work,” said Jörg-Peter Elbers, head of advanced technology at Adtran.

…………………………………………………………………………………………………………………………..

Adtran also demonstrated its QSFP28 pluggable Coherent 100ZR [1.], which provides 100G coherent edge network connectivity. There was a live display of a 100ZR QSFP28 pluggable operating over a DWDM metro ring. The objective was to show how fiber based network operators can benefit from efficient and cost-effective deployment of coherent 100Gbit/s services with minimal power consumption and low footprint increase. The trial uses the multi-vendor OFCnet network setup with equipment at the Adtran booth as well as the Coherent and OFCnet booths.

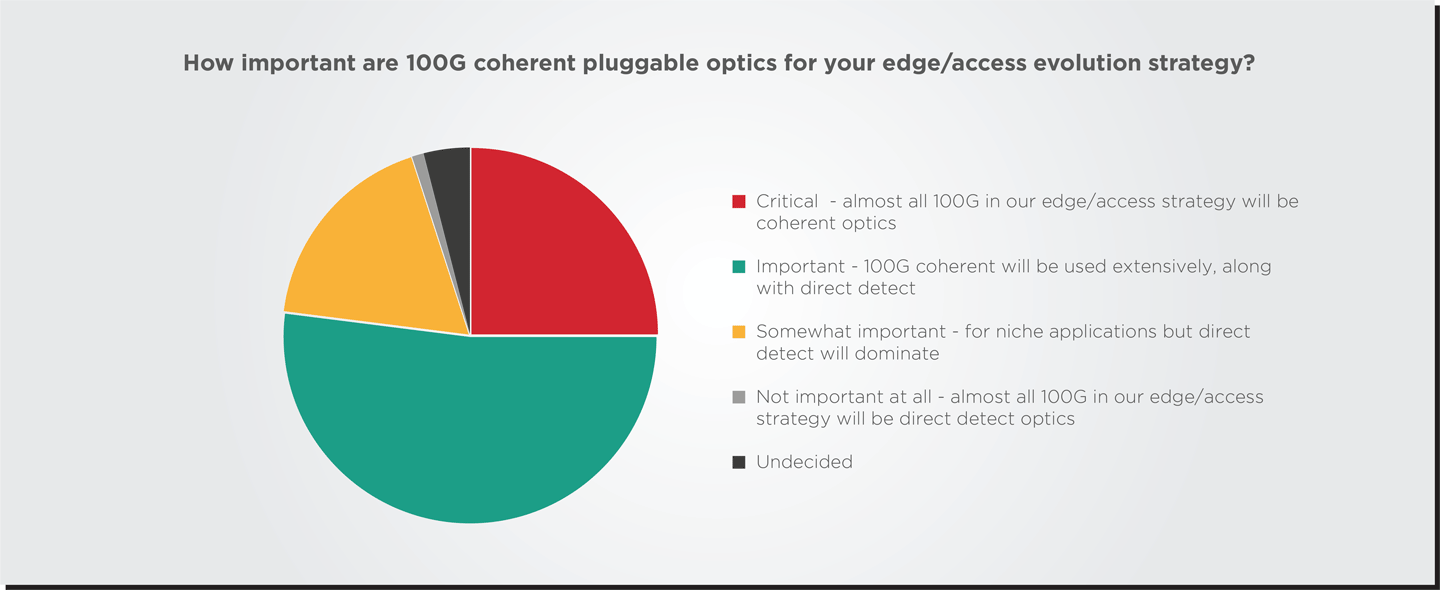

Note 1. In June 2022, transceiver developer II‐VI Incorporated (now Coherent Corp.) and optical networking solutions provider ADVA (now owned by Adtran) announced the launch of the industry’s first 100ZR pluggable coherent transceiver. A recently released Heavy Reading survey (see pie chart below) revealed that over 75% of network operators surveyed believe that 100G coherent pluggable optics will be used extensively in their edge and access evolution strategy. However, this interest had not really materialized into a 100ZR market because no affordable or power-efficient products were available. The most the industry could offer was 400ZR pluggables that were “powered-down” for 100G capacity.

……………………………………………………………………………………………………………………………………………………………………………………………………..

Adtran’s Coherent 100ZR is purpose-built for the optical network edge. With its QSFP28 form factor and power specification, it enables easy and cost-effective upgrades to 100Gb/s data rates by plugging directly into existing head-ends, switches and routers. Co-developed by Adtran and Coherent, the DSP offers a range of deployment options, from local exchanges and central offices to harsh outdoor conditions such as street cabinets. These benefits are achieved thanks to the transceiver‘s features, which include a cost-, space- and power-optimized DSP specifically engineered for 100ZR. Adtran is also developing low-power silicon photonics integrated circuits that will enable faster and more energy-efficient solutions across a wide range of applications.

Quotes:

Saeid Aramideh, VP of Business Development at Optical Engines, Adtran said: “This demo is a significant milestone for network operators looking to expand their business capabilities. It highlights how our Coherent 100ZR can be easily and affordably integrated into a metro aggregation network, eliminating the need for costly infrastructure changes. This showcase reveals a valuable solution for operators seeking to support higher data rates at the network edge and highlights the potential for widespread adoption of 100Gbit/s coherent technology. We can’t wait to bring these benefits to our customers.”

Ross Saunders, GM of Optical Engines, Adtran said: “The technology we’re showcasing here will be a game-changer for service providers. It offers the ability to easily deploy coherent 100Gbit/s connectivity with compact footprint and lowest power consumption. By bringing coherent technology to the optical edge, we’re providing operators with a cost-efficient solution to upgrade edge aggregation networks to 100Gbit/s. Our Coherent 100ZR will also boost sustainability by lowering our customers’ carbon footprint. What’s more, it offers a way to deliver an improved experience for end-users by supporting higher data rates and improved service reliability.”

…………………………………………………………………………………………………………………………………………….

According to a recent Heavy Reading survey, 75% of operators believe that 100G coherent pluggable optics will be used extensively in their edge and access evolution strategy. However, market adoption has yet to materialize since affordable and power-efficient 100ZR-based products are currently not available due to stringent size and power consumption requirements that cannot be fulfilled by today’s tunable laser solutions.

Distribution of responses to a Heavy Reading survey question: How important are 100G coherent pluggable optics for your edge/access evolution strategy? The sample was composed of 87 people who work for network operators worldwide and are involved in network planning or purchasing network equipment.

Source: Heavy Reading

References:

https://www.fibre-systems.com/news/ofc-2023-adtran-demonstrates-coherent-100zr-qsfp28

Broadcom: 5nm 100G/lane Optical PAM-4 DSP PHY; 200G Optical Link with Semtech

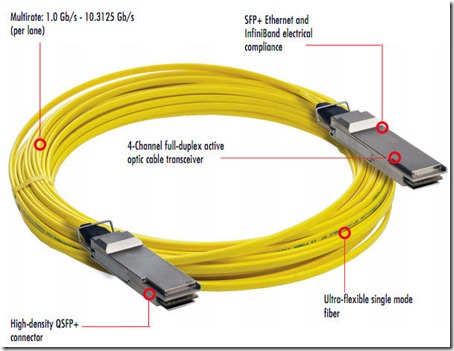

Broadcom Inc. today announced the availability of its 5nm 100G/lane optical PAM-4 DSP PHY with integrated transimpedance amplifier (TIA) and laser driver, the BCM85812, optimized for 800G DR8, 2x400G FR4 and 800G Active Optical Cable (AOC) [1.] module applications. Built on Broadcom’s proven 5nm 112G PAM-4 DSP platform, this fully integrated DSP PHY delivers superior performance and efficiency and drives the overall system power down to unprecedented levels for hyperscale data center and cloud providers.

Note 1. Active Optical Cable (AOC) is a cabling technology that accepts same electrical inputs as a traditional copper cable, but uses optical fiber “between the connectors.” AOC uses electrical-to-optical conversion on the cable ends to improve speed and distance performance of the cable without sacrificing compatibility with standard electrical interfaces.

BCM85812 Product Highlights:

- Monolithic 5nm 800G PAM-4 PHY with integrated TIA and high-swing laser driver

- Delivers best-in-class module performance in BER and power consumption.

- Drives down 800G module power for SMF solutions to sub 11W and MMF solutions to sub 10W.

- Compliant to all applicable IEEE and OIF standards, capable of supporting MR links on the chip to module interface.

- Fully compliant with OIF 3.2T Co-Packaged Optical Module Specs

- Capable of supporting optical modules from 800G to 3.2T

Demo Showcases at OFC 2023:

Broadcom will demonstrate the BCM85812 in an end-to-end link connecting two Tomahawk 5 (TH5) switches using Eoptolink’s 800G DR8 optical modules. Attendees will see live traffic stream of 800GbE data running between two TH5 switches. Broadcom will showcase various 800G DR8, 2x400G FR4, 2x400G DR4, 800G SR8, and 800G AOC solutions from third party transceiver vendors that interoperate with each other, all using Broadcom’s DSP solutions. Following are module vendors that will be participating in a multi-vendor interop plug-fest on the latest Tomahawk 5 switch platform: Eoptolink, Intel, Molex, Innolight, Source Photonics, Cloud Light Technology Limited and Hisense Broadband.

Additionally, Broadcom in collaboration with Semtech and Keysight will demonstrate a 200G per lane (200G/lane) optical transmission link leveraging Broadcom’s latest SerDes, DSP and laser technology. These demonstrations will be in Broadcom Booth 6425 at the Optical Fiber Communication (OFC) 2023 exhibition in San Diego, California from March 7th to 9th.

“This first-to-market highly integrated 5nm 100G/lane DSP PHY extends Broadcom’s optical PHY leadership and demonstrates our commitment to addressing the stringent low power requirements from hyperscale data center and cloud providers,” said Vijay Janapaty, vice president and general manager of the Physical Layer Products Division at Broadcom. “With our advancement in 200G/lane, Broadcom continues to lead the industry in developing next generation solutions for 51.2T and 102.T switch platforms.”

“By 2028, optical transceivers are projected to account for up to 8% of total power consumption in cloud data centers,” said Bob Wheeler, principal analyst at Wheeler’s Network. “The integration of TIA and driver functions in DSP PHYs is an important step in reducing this energy consumption, and Broadcom is leading the innovation charge in next-generation 51.2T cloud switching platforms while also demonstrating a strong commitment to Capex savings.”

Availability:

Broadcom has begun shipping samples of the BCM85812 to its early access customers and partners. Please contact your local Broadcom sales representative for samples and pricing.

……………………………………………………………………………………………………………………………………….

Separately, Semtech Corp. with Broadcom will demonstrate a 200G per lane optical transmission link that leverages Semtech’s latest FiberEdge 200G PAM4 PMDs and Broadcom’s latest DSP PHY. The two companies plan to recreate the demonstration this week at OFC 2023 in San Diego in their respective booths. Such a capability will be useful to enable 3.2-Tbps optical modules to support 51.2- and 102.4-Tbps switch platforms, Semtech points out.

The two demonstrations will leverage Semtech’s FiberEdge 200G PAM4 EML driver and TIA and Broadcom’s 5-nm 112-Gbaud PAM4 DSP platform. Instrumentation from Keysight Technologies Inc. will verify the performance of the links.

“We are very excited to collaborate with Broadcom and Keysight in this joint demonstration that showcases Semtech’s 200G PMDs and their interoperability with Broadcom’s cutting-edge 200G/lane DSP and Keysight’s latest 200G equipment,” said Nicola Bramante, senior product line manager for Semtech’s Signal Integrity Products Group. “The demonstration proves the performance of a 200G/lane ecosystem, paving the way for the deployment of next-generation terabit optical transceivers in data centers.”

“This collaboration with Semtech and Keysight, two of the primary ecosystem enablers, is key to the next generation of optical modules that will deliver increased bandwidth in hyperscale cloud networks. This achievement demonstrates our commitment to pushing the boundaries of high-speed connectivity, and we are excited to continue working with industry leaders to drive innovation and deliver cutting-edge solutions to our customers,” added Khushrow Machhi, senior director of marketing of the Physical Layer Products Division at Broadcom.

“Semtech’s and Broadcom’s successful demonstration of the 200-Gbps optical link is another important milestone for the industry towards ubiquitous future 800G and 1.6T networks. Keysight’s early engagement with leading customers and continuous investments in technology and tools deliver the needed insights that enable these milestones,” said Dr. Joachim Peerlings, vice president and general manager of Keysight’s Network and Data Center Solutions Group.

…………………………………………………………………………………………………………………………………………………………………….

About Broadcom:

Broadcom Inc. is a global technology leader that designs, develops and supplies a broad range of semiconductor and infrastructure software solutions. Broadcom’s category-leading product portfolio serves critical markets including data center, networking, enterprise software, broadband, wireless, storage and industrial. Our solutions include data center networking and storage, enterprise, mainframe and cyber security software focused on automation, monitoring and security, smartphone components, telecoms and factory automation. For more information, go to https://www.broadcom.com.

Broadcom, the pulse logo, and Connecting everything are among the trademarks of Broadcom. The term “Broadcom” refers to Broadcom Inc., and/or its subsidiaries. Other trademarks are the property of their respective owners.

About Semtech:

Semtech Corporation is a high-performance semiconductor, IoT systems and Cloud connectivity service provider dedicated to delivering high quality technology solutions that enable a smarter, more connected and sustainable planet. Our global teams are dedicated to empowering solution architects and application developers to develop breakthrough products for the infrastructure, industrial and consumer markets.

References:

https://www.broadcom.com/company/news/product-releases/60996

https://www.fiberoptics4sale.com/blogs/archive-posts/95047430-active-optical-cable-aoc-explained-in-details

Industry Analysts: Important Optical Networking Trends for 2023

Optical Transceivers:

Optical transceivers save space and reduce the need for additional transmitting and receiving devices because they transmit and receive information all in one device! Additionally, they are an economical, compact tool to enable networks to send information over larger distances, come in a variety of Ethernet speeds from Fast Ethernet to 100 Gigabit Ethernet, and offer great flexibility to grow your network while leveraging existing network devices and infrastructure.

Many newer, high quality Small Form-factor Pluggable (SFP) modules have Diagnostic Monitoring Interface (DMI), which automatically monitors SFP operations such as output and input power, temperature, and supply voltage in addition to providing multimode, single mode, and multi-rate SFP options for more flexibility.

Market Research Future® (MRFR) predicts that the global optical transceiver market will rise to 8 billion in the U.S. by 2023.

Pluggable optics:

400ZR coherent pluggable optics emerged as a connectivity tool for metro-distributed data center connectivity. In 2023, look for three additional innovations to enable even more opportunities for coherent pluggables.

High-performance pluggables with 0 dBm transmit power and low out-of-band noise will enable coherent pluggable transceivers to cover a richer set of use cases, including deployment in metro networks with multiple cascaded ROADMs. This increased transceiver performance will also push some pluggables beyond the 600-km metro threshold and into a portion of the long-haul network.

Advances in intelligent pluggables management, as being defined in the 28-member Open XR Forum and with inputs to other organizations like the OIF, will ease deployment complexity and enable operational support for advanced functionality like remote diagnostics, auto-discovery, spectrum analysis, and streaming telemetry in all types of non-optical hosts, including switches and routers.

A new class of coherent pluggables, such as Infinera’s ICE-XR with digital subcarrier technology, will enable commercial deployment of point-to-multipoint architectures, where a single high-speed (e.g., 400G) hub optic can communicate with multiple lower-speed (e.g., 25G to 100G in 25G increments) optics without requiring intermediate electrical aggregation – thus reducing the amount of equipment, space, and power utilized and the total cost of network ownership by up to 70% over multiple years.

Heavy Reading’s optical networking analyst Sterling Perrin sees “pluggable optics everywhere” being a dominant theme. “This includes the continuing trends in 400ZR and ZR+ but also a big focus on migrating down to small coherent 100G pluggables, pluggables across 5G XHaul networks, and pluggables in PON,” he writes in a note to Light Reading.

Data center transmission:

In 2023, look for modular, distributed data center deployments to accelerate, along with 400 Gb/s, 600 Gb/s, and 800 Gb/s per wavelength coherent optical connectivity to support their interconnection

Modular data centers, where construction and integration tasks are moved offsite and then shipped and assembled onsite, are becoming mainstream and enabling compute and storage to be quickly and reliably deployed in all types of settings – from just a few racks in a small hut to megawatts of equipment in a multi-story configuration. In 2023, look for modular, distributed data center deployments to accelerate, along with 400 Gb/s, 600 Gb/s, and 800 Gb/s per wavelength coherent optical connectivity to support their interconnection.

Lisa Huff, Omdia’s senior principal analyst covering optical components will keep an eye out for whether 800G and 1.6T transmission will show up next in data centers. “We are in the middle of 400G deployment inside the data center and, as always, there is much hype around what the next data rate will be,” she writes.

“Omdia expects to see 2x400G and 8x100G solutions start to be deployed inside the data center in 2023, but we will not see high-volume deployment until about 2025 when DR4 and FR4 variants mature and 400G starts to slow down,” she writes. Deployments of 1.6T may start in 2026, but Huff said it might be 2027 or later before we see significant volume.

Coherent routing:

Omdia Senior Principal Analyst Timothy Munks said that with data traffic growing at the network’s edge, network operators are looking for better solutions to collect and move that data into metro and core networks.

“The convergence of IP and optical, or coherent routing, provides cost effective aggregation and transport of diverse traffic streams and offers network operators a pure pay-as-you-grow business model for adding capacity,” he writes.

In this video, Cisco’s Bill Gartner, SVP/GM Optical Systems & Optics, chats with Phil Harvey to discuss their Leading Lights Award and how Routed Optical Networking is transforming infrastructure and the economics of the network.

References: