Despite U.S. sanctions, Huawei has come “roaring back,” due to massive China government support and policies

On March 30th we wrote that Huawei Technologies was back, with its net profit more than doubled from the same period last year (2023). Today, a Wall Street Journal (WSJ) news story reaffirmed that with reasons which were really no surprise! Huawei’s profit more than doubled last year, the largest jump in at least two decades. Roughly two-thirds of its revenue comes from domestic (China) clients.

Five years ago, the U.S. sanctioned Huawei, cutting off the Chinese company’s access to advanced U.S. technologies like semiconductors and the Android OS for its smartphones. Initially, the company struggled. In 2021, its revenue dropped almost 30% from the year before. Its core telecom equipment business was suffering. Apple’s iPhone was taking over Huawei market share in smartphones.

Yet in the last year, Huawei has come roaring back, boosted by billions of dollars in China government support. Huawei has expanded into new businesses, boosted its profitability and found fresh ways to curb its dependence on U.S. suppliers. It has held on to its leading position in the global telecom-equipment market, despite American efforts to squeeze Huawei out of its allies’ networks. Also, it’s making a big comeback in high-end smartphones, using sophisticated new chips developed in-house, such that it has captured 15% market share in China (knocking Apple out of the top five smartphone brands).

“The U.S. government’s campaign against Huawei is inadvertently bolstering the company’s resilience, echoing the age-old adage that what doesn’t kill you makes you stronger,” said Sameh Boujelbene, an analyst at research firm Dell’Oro Group.

China state support has paid off big time! After the U.S. imposed restrictions, Huawei and China’s government grew closer. Soon, Huawei leaders declared that every product they made going forward should be able to rely entirely on components developed by Chinese companies. China government contracts and company registration records, as well as WSJ interviews with former and current employees, reveal that billions of dollars flowed from the Chinese government to Huawei through preferential buying contracts and subsidies. State-owned enterprises, government agencies and Communist Party bodies sought Huawei chips, smartphones, cloud services and software, with some procurement contracts calling for Huawei gear by name.

Local governments have bought Huawei businesses, providing cash injections. Once reliant on Google’s Android for its consumer devices, Huawei built its own operating system. It has even made a foray into electric vehicles, a task that Apple gave up on, and developed its own version of Bluetooth. Huawei still faces challenges. Its most advanced semiconductors remain a step behind industry leaders such as Nvidia, whose chips are made by TSMC in Taiwan, which Huawei no longer has access to due to U.S. sanctions. U.S. export restrictions, which effectively barred Huawei from using American technology anywhere along the chipmaking process, meant the Chinese company could no longer source its chips from TSMC. Some analysts believe it will be hard for Huawei to keep innovating without access to more advanced Western technologies, especially chip making equipment and software.

One current U.S. official said Washington is closely tracking Huawei’s efforts to make its own semiconductors, in case more actions are needed to block China from manufacturing artificial-intelligence-focused chips that can give Beijing a military edge.

On May 16, 2019, China’s local government in Shenzhen, where Huawei is based, registered an investment company Shenzhen Major Industry Investment Group (SMII), focused on semiconductors, investing in foundries, manufacturing equipment and materials that would help ensure Huawei was supplied with enough domestically made chips and other technologies. Two companies established by SMII, including a chip foundry, employed former Huawei executives, according to people familiar with the matter. One received around a dozen patented technologies transferred from Huawei. Huawei human-resources managers had asked company researchers if they would work at that entity, promising them they could keep their benefits if they moved, according to people familiar with the matter. Shenzhen’s imports of semiconductor manufacturing equipment surged after SMII’s inception, official data shows. Through various state-backed funds, the Chinese government has invested in more than two dozen chip-related startups, over the past five years, according to corporate database Tianyancha.

That’s in addition to government investments in Huawei’s HiSilicon chip unit (more below), which made the silicon used in the company’s popular Mate 60 Pro smartphone. HiSilicon became an independent, wholly owned Huawei subsidiary in 2004. It was founded in 1991 as Huawei’s ASIC Design Center.

A majority-owned Shenzhen company also bought Huawei’s Honor smartphone business, which was struggling because of the U.S. sanctions. The deal was worth several billions of dollars, a person familiar with the transaction said. The cash allowed Huawei to focus on other businesses, including its higher-end Mate series of phones.

“We’ve been through a lot over the past few years. But through one challenge after another, we’ve managed to grow,” Huawei said in a written statement, adding that the company owed its survival and development to the trust and support of global customers, partners and “all sectors of society.” Sustaining R&D investment will be crucial going forward, the company said.

“We’ve been through a lot over the past few years, but through one challenge after another, we’ve managed to grow,” Huawei said in a written statement, adding that the company owed its survival and development to the trust and support of global customers, partners and “all sectors of society.” Sustaining R&D investment will be crucial going forward, the company said.

Huawei focused on building out more of its own supply chain and expanding into new areas that could generate revenue to help keep the company going, including cloud computing and other services, according to Chris Peirera, a former Huawei senior director in public affairs. “In the past, we chased the ideal of globalization, determined to serve mankind. What are our goals now? It’s to survive. We will make money wherever we can,” Huawei founder Ren Zhengfei later told the company’s staff in an internal letter.

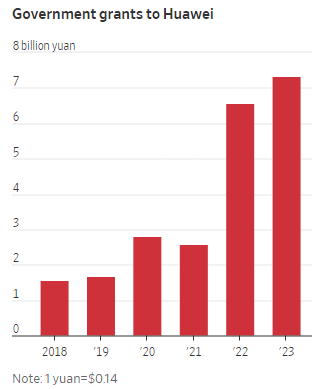

Huawei received over $1 billion in China government grants in 2023, more than quadruple the amount it received in 2019, according to Huawei’s financial reports. In all, Huawei received nearly $3 billion in the past five years, accounting for 3% of its total R&D expenses.

Source: Huawei via WSJ

China’s government directed state agencies to buy more of Huawei’s software, chips and mobile devices, a policy that boosted Huawei while reducing China’s reliance on American companies, including Apple, whose iPhones are no longer allowed in the workplace for many government employees. A Chinese government research unit named Huawei as one of four tech giants spearheading the nation’s push to wean itself off foreign technology, while another government body singled out Huawei as a preferred state supplier of AI chips, servers and other enterprise software.

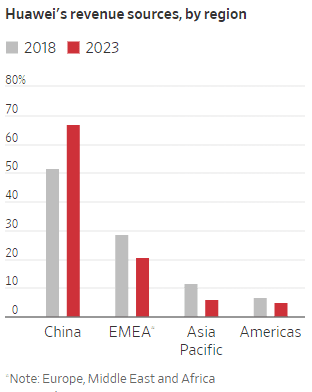

Though Huawei is still seeking to sell its products abroad in places such as Southeast Asia and Africa, it is more reliant on China’s market than ever, with 67% of revenue last year coming from domestic clients. The company often portrays itself as a national champion that gives priority to serving China.

Source: Huawei via WSJ

A WSJ investigation found more than 300 government procurement contracts worth around $5 billion specifically calling for the purchase of servers and other tech infrastructure powered by Huawei’s Kunpeng central processing units, or CPUs, in 2023. Other contracts listed Huawei CPUs among a handful of preferred local vendors. All of this was a sharp contrast to five years ago, when government agencies specifically requested products from U.S. chip makers Intel or AMD.

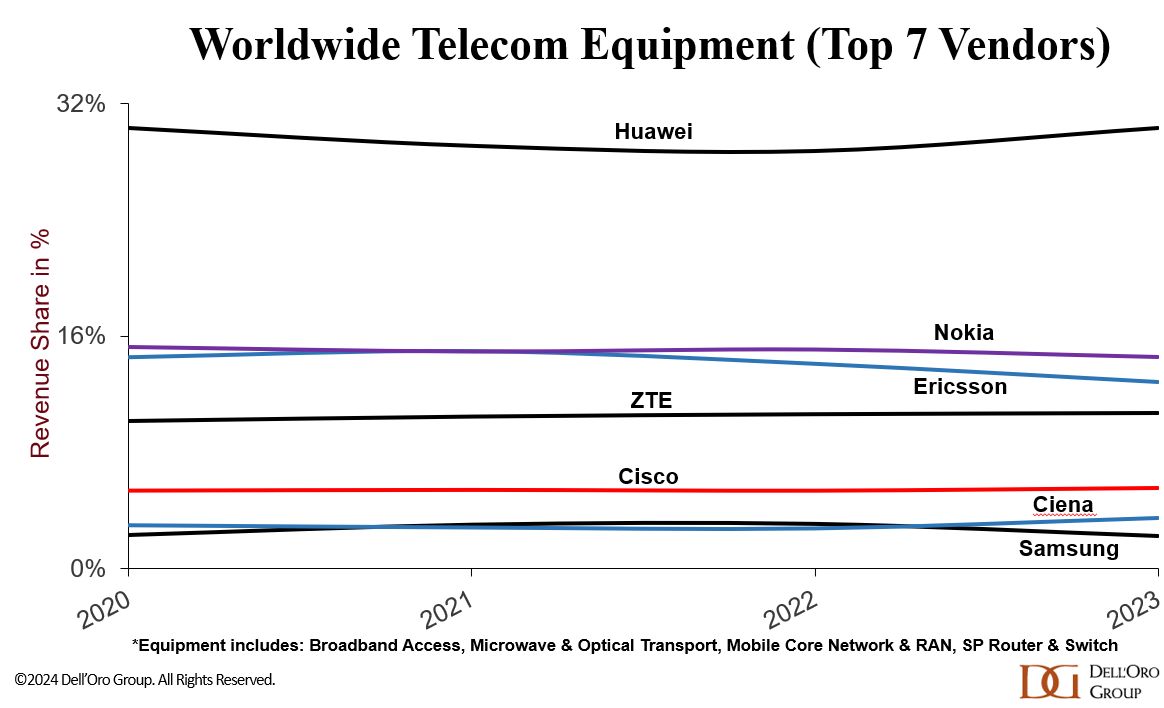

China’s buy-local policy is even more pronounced in the telecom-equipment space, Huawei’s largest revenue source. State-owned Chinese wireless carriers have largely stopped buying equipment from Huawei’s foreign rivals, Sweden’s Ericsson and Finland’s Nokia, even when one of them priced their contracts more cheaply than Chinese companies. The shift came while Sweden and other European countries indicated that they would cut Huawei and another Chinese equipment maker, ZTE, from their networks. Ericsson and Nokia held about 15% of China’s cellular network equipment market before 5G began rolling out in 2019. In China’s current 5G cellular-equipment market, Huawei holds about 4% to 5%, according to market research firm Dell’Oro.

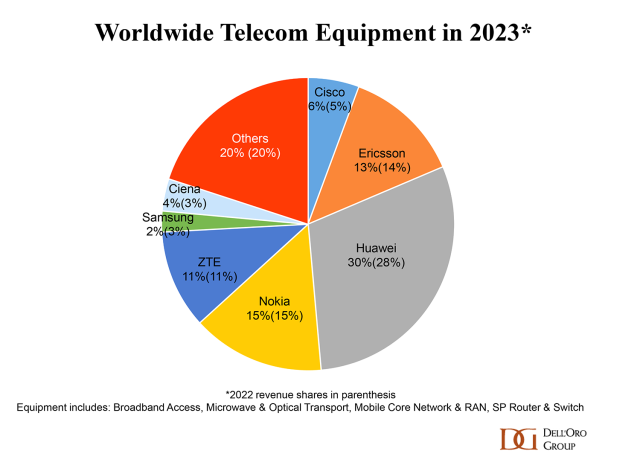

They peg Huawei’s 2023 global telecom market share (#1) at 30% – double that of #2 Nokia as per this pie chart:

With so much government support, Huawei was able to avoid massive job and spending cuts that would have gutted its R&D or led to a talent exodus. Huawei boosted R&D spending to almost 165 billion yuan, or $23 billion, last year, up from 102 billion yuan in 2018. More than half of Huawei’s 207,000 employees are in R&D.

Huawei is now at the vanguard of China’s push to develop cutting-edge chips to wean reliance on Nvidia and Intel, as the Biden administration seeks to curb China’s ability to develop advanced chips and technology that could aid its warfare and surveillance. U.S. chip juggernaut Nvidia singled out Huawei as a top competitor in February.

Huawei is leading a government-funded project to develop memory units for advanced AI chips, people familiar with the matter said, with at least 11 national AI data centers now using Huawei chips. WSJ reports that last summer, a group of Huawei researchers gathered at a barbecue restaurant on the outskirts of Beijing to congratulate engineers who worked on the Mate 60 Pro chip set at Huawei owned HiSilicon.

![]()

“You HiSilicon people kick ass,” one of the Huawei researchers said, according to a person who attended. “Managers tell us daily that our work helps the country fight against foreign oppression,” a HiSilicon engineer who was present responded. “We’re becoming more and more like a state-owned company, aren’t we?” another researcher chimed in.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

References:

https://www.wsj.com/business/telecom/huawei-china-technology-us-sanctions-76462031

Huawei is back – net profits more than doubled in 2023!

Dell’Oro: 2023 global telecom equipment revenues declined 5% YoY; Huawei increases its #1 position

Huawei to revolutionize network operations and maintenance

Huawei pushes 5.5G (aka 5G Advanced) but there are no completed 3GPP specs or ITU-R standards!

China’s mobile data consumption slumps; Apple’s market share shrinks-no longer among top 5 vendors

2 thoughts on “Despite U.S. sanctions, Huawei has come “roaring back,” due to massive China government support and policies”

Comments are closed.

Sanctions against Huawei fail, then birth “Delete America” campaign across China’s supply chains

Five years following strict technology exports bans aimed at Huawei, a Chinese electronics and telecommunications giant, the company is stronger and more profitable than ever. What’s more, Huawei and thousands of other companies across China have embraced a “Delete America” strategy from all their supply chains.

Some officials maintain that the bans on Huawei exports and contracting have been successful, however, and point to laws that require US government contractors, the Pentagon, and allied countries to “rip and replace” Huawei gear from communications networks.

However, almost no real progress there has been made, as only a small percentage of US government contractors have made the switch, the Pentagon has asked for and received waivers each year so they do not have to comply, and our allies have flatly refused to replace Huawei telecommunications equipment.

When surveyed, Americans report historic low levels of confidence in our institutions, with corresponding high levels of distrust. Officials promised that tariffs will not lead to higher prices, that national security concerns necessitate banning affordable Chinese electric cars, and that Huawei represents a grave threat to the country. American citizens seem to reject most of those positions, as they continue to buy Chinese-made products in high volumes, and express to pollsters their hope to buy Chinese vehicles. As to Huawei, even the Pentagon and our biggest contractors are sticking with Huawei gear, given more costly alternatives.

https://www.youtube.com/watch?v=ebGXnWA-EkU

WSJ: Huawei Readies New Chip to Challenge Nvidia, Surmounting U.S. Sanctions

Huawei Technologies is close to introducing a new chip for artificial intelligence (AI) in China, overcoming U.S. sanctions to challenge Nvidia. Chinese internet companies and telecommunications operators have been testing Huawei’s latest processor, called Ascend 910C, in recent weeks, according to people familiar with the matter. Huawei told potential clients that the new chip is comparable to Nvidia’s H100, which was introduced last year and isn’t directly available in China, the people said.

Huawei’s ability to keep advancing in chips is the latest sign of how the company has managed to break through U.S. erected obstacles and develop Chinese alternatives to products made by the U.S. and its allies. Aided by billions of dollars in state support, it has become a national champion in areas including AI and a key part of Beijing’s endeavor to “delete” American technologies.

Still, Huawei has run into production delays in its current chips, according to the people. It faces the prospect of further U.S. restrictions that could deprive it of machine components and the latest memory chips used in AI hardware.

Companies including TikTok parent ByteDance, search-engine giant Baidu and state-owned telecommunications carrier China Mobile are in early discussions about obtaining the 910C, the people said. Initial negotiations between Huawei and potential customers indicate that orders are likely to surpass 70,000 chips, with a total value of around $2 billion, they said.

Huawei aims to start shipping as soon as October, the people said. They cautioned that final purchases may differ from initial plans and the delivery schedule may change. A Huawei representative declined to comment.

China is stepping up support for semiconductor manufacturing and in May raised $48 billion in the third installment of a national investment fund for the industry.

Huawei’s new AI chip seeks to fill a void left by Nvidia after U.S. export controls beginning 2022 effectively prevented the Santa Clara, Calif.-based company from offering its most advanced chips to Chinese customers. Nvidia continues to create less-powerful variants for China that comply with the export rules, although some in China have found ways to obtain its more powerful chips through other means.

Chinese customers buying from Nvidia have to make do with the H20, a downgraded version of its AI chips, which Nvidia designed to clear Washington’s rules for selling to China and introduced this spring.

In the U.S., by contrast, Nvidia clients such as OpenAI, Amazon and Google will soon have access to the company’s latest Blackwell chips and the GB200 line of hardware powered by them, which Nvidia has described as several times more powerful than its existing hardware.

Nvidia is working on another China-oriented chip called B20, but the design might have trouble getting U.S. approval for China export if the White House tightens its rules, said people familiar with the matter.

Dylan Patel, an analyst at industry research firm SemiAnalysis, said he viewed Huawei’s 910C as an advance that could perform better than Nvidia’s B20. If Huawei can produce its new chip successfully and Nvidia is still blocked from offering advanced chips to Chinese customers, he said, “Nvidia would lose market share rapidly in China.” SemiAnalysis says Huawei could produce 1.3 million to 1.4 million 910C chips next year if it doesn’t face additional U.S. restrictions.

Initially Chinese customers weren’t enthusiastic about Nvidia’s H20 because they weren’t sure it was significantly better than Huawei’s latest offering, The Wall Street Journal reported. However, some clients ramped up H20 orders after tests of bigger H20 clusters produced favorable performance results and Nvidia cut prices, people familiar with the matter said. Huawei’s production bottlenecks also played a role.

SemiAnalysis estimated in July that Nvidia would sell over one million H20 chips in China this year, valued at some $12 billion. The number of chips sold would be almost twice as many as Huawei is expected to sell of its 910B, SemiAnalysis said.

The U.S. sanctions are behind some delays this year in shipments of the Ascend 910B, currently Huawei’s most advanced AI processor, people familiar with the matter said.

In recent weeks, Huawei has started stockpiling high-bandwidth memory chips, used for state-of-the-art AI processors, in response to potential U.S. curbs on China’s access to such chips, the people said. The U.S. Commerce Department frequently updates sanctions and export controls, and people in the industry expect further action this year.

Huawei has told its local contract manufacturer and suppliers to store more machine components, anticipating that production workarounds might shorten the life of some parts and it might have a harder time sourcing parts, the people said.

At a semiconductor industry conference in June, a Huawei executive said nearly half of China’s large language models were trained with Huawei’s chips. He said 910B’s performance has surpassed Nvidia’s A100 in training models.

A June analysis by the Center for Security and Emerging Technology, a Georgetown University policy research body, said the 910 series was competitive with the A100 but also faced significant problems including limited manufacturing capacity and low yield. It said the 910B chip has fewer active AI cores—key components for computation—compared with Huawei’s previous version, so it wasn’t a big improvement.

https://www.wsj.com/tech/ai/huawei-readies-new-chip-to-challenge-nvidia-surmounting-u-s-sanctions-e108187a