LightCounting: Sales of Optical Transceivers will decline in 2023

|

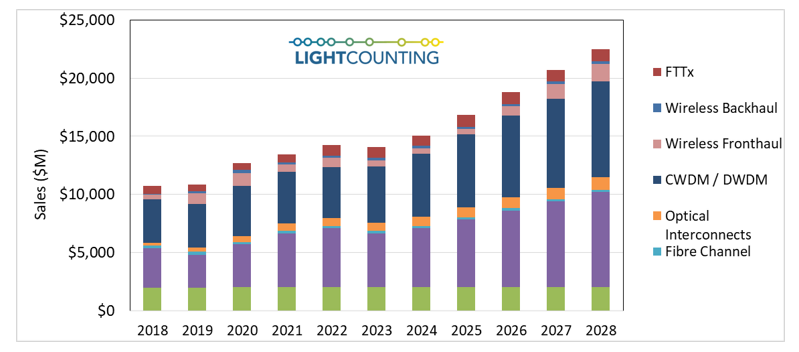

The optical communications industry entered 2020 with very strong momentum. Demand for DWDM, Ethernet, and wireless fronthaul connectivity surged at the end of 2019, and major shifts to work-at-home and school-at-home in 2020 and 2021 due to the COVID-19 pandemic created even stronger demand for faster, more ubiquitous, higher reliability networks. While supply chain disruptions continued, the industry was able to largely overcome them, and the market for optical components and modules saw strong growth in 2020-2022, as shown the figure in below.

We believe the optical transceiver market will be down slightly (1% or so) in 2023 due to declines in the sales of Ethernet and wireless fronthaul transceivers of 10% and 30%, respectively, offsetting growth in all other market segments in 2023.

|

|

|

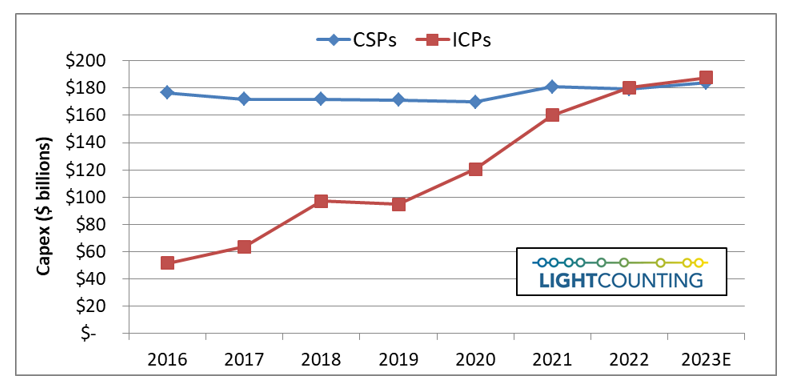

Amazon and other cloud companies plan to moderate their investments in 2023 and beyond, even if there is no economic recession. The Cloud companies benefited from the COVID-19 pandemic, but they were forced to reassess their plans at the end of 2022, as growth slowed. Their capex almost doubled between 2019 and 2022 but future investments will be more conservative. We expect the Top 15 ICP’s capex to be up only 4% in 2023, essentially flat, after several years of double-digit growth. Investments in AI infrastructure will remain a priority.

Telecom service providers plan to reduce their capex in 2023 also but they will continue to upgrade access networks. Connecting business and consumers to the Cloud is a priority now. Their customers are willing to pay more for secure and low-latency broadband services and it is a great opportunity for revenue growth. Telecom service providers plan to digitize their operations and offer Network-as-a-Service (NaaS) to an increasing number of end users, not just a few of their largest customers.

|

|

|

Despite a slower than expected growth in revenues of the leading Cloud companies, AI infrastructure remains a priority. This new focus will sustain the market for high bandwidth and low latency Ethernet and InfiniBand switches in the next 5 years. We also expect the deployments of optical circuit switches in AI clusters to expand beyond Google’s datacenters.

Other notable forecast changes include increased sales of 50G and 100G fronthaul transceivers in the 2026-2028 timeframe, as we believe they will be needed for early 6G deployments, and increased sales of PON optics as deployments of FTTx are increasing due to government stimulus in the US and elsewhere.

LightCounting’s Market Forecast Report presents our forecast for optical transceivers used in the telecom and datacom sectors, and includes chapters reviewing the health and spending outlook for both CSPs and ICPs, as well as explanations of forecast drivers and assumptions for each of the six product segments covered: Ethernet, WDM, Fronthaul, Backhaul, FTTX, and Optical Interconnects. The accompanying Excel database includes unit and sales forecasts for over 200 product categories.

More information on the report is available at ttps://www.lightcounting.com

|