AT&T grows fiber revenue 19%, 261K net fiber adds and 29.5M locations passed by its fiber optic network

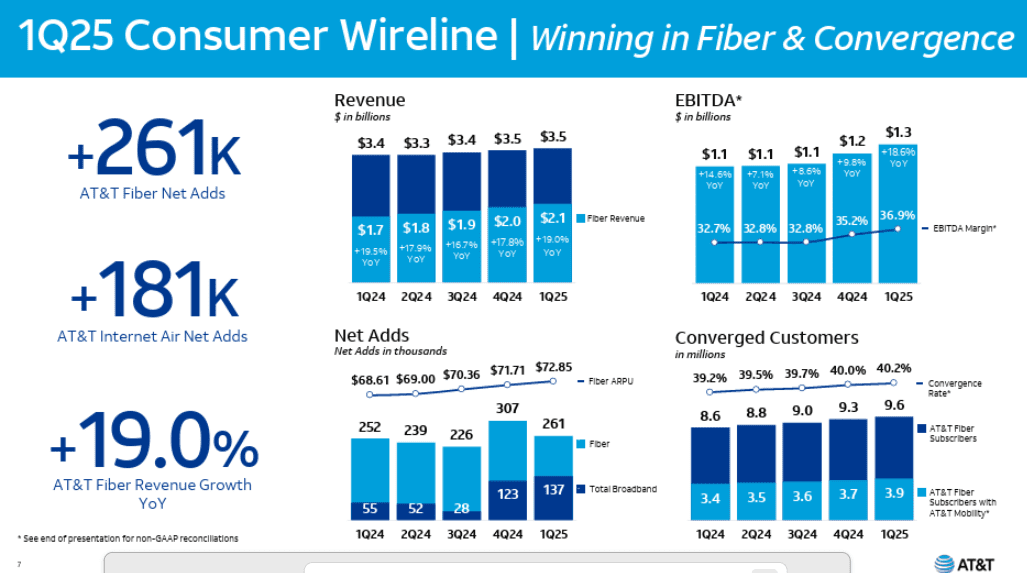

In the 1st quarter of 2025, AT&T’s fiber business showed strong performance, with fiber revenue growing by 19% year-over-year and 261,000 net fiber subscribers added. This growth helped drive overall wireline revenue and operating income, with fiber revenue contributing significantly to the 9.6% broadband revenue increase. AT&T’s fiber strategy is a key part of its broader plan for growth, including 5G wireless, and is expected to continue contributing to strong financial results. At the end of the 1Q2025, AT&T said that 29.5 million locations were passed with its fiber network. The company expects to surpass 30 million by midyear, months ahead of its original target. Consumer fiber broadband revenue was $2.1 billion in the quarter, up 19% year-over-year, as more customers upgraded to faster service tiers. Executives noted that more than 40% of AT&T Fiber households now also subscribe to AT&T wireless, part of a deliberate strategy to drive “converged” customer relationships.

AT&T continues to lead the Fiber-to-the-Home market, and has reportedly been in talks to acquire Lumen Technologies’ consumer fiber business in a deal valued at more than $5.5 billion, according to Bloomberg and Reuters

CFO Pascal Duroche on the 1Q2025 earnings call:

“We delivered 261,000 AT&T Fiber net adds, up from 252,000 in the first quarter of last year. This was driven by growth in our consumer locations served with fiber, which reached 23,800,000 at the end of 1Q and growing contribution of net adds in regions served with Giga Power Fiber. We love the return profile of fiber and the lift it provides our mobility business only makes investing in fiber more attractive. AT and T Internet Air net adds were 181,000 in the quarter, which is a significant improvement from a year ago, driven by broader availability across our distribution channels. Our combined success with these two services helped us deliver 137,000 total broadband net adds in the quarter.

This marks our seventh straight quarter of overall broadband subscriber growth and second consecutive quarter with more than 100,000 broadband net adds. We grew Consumer Wireline revenue by 5.1% versus the prior year. This was driven by fiber revenue growth of 19%, reflecting subscriber gains and solid fiber ARPU growth of 6.2%. Consumer wireline EBITDA grew 18.6% for the quarter. Our first quarter results benefited from vendor settlements that positively impacted our total wireline operating expenses by approximately $100,000,000 Roughly $55,000,000 of the impact was in Consumer Wireline with the rest in Business Wireline.”

AT&T is investing heavily in its fiber network which is reflected in the increase in its capital expenditures (CAPEX) which are expected to remain in the $22 billion range annually from 2025 through 2027.

AT&T logo on a building in Pasadena, California, U.S., January 24, 2018. REUTERS/Mario Anzuoni/File Photo Purchase Licensing Rights

………………………………………………………………………………………………………………………………………………………………………………………………………..

“Where we have fiber, we win,” said CEO John Stankey. “This dynamic continues to drive growth, shown by our increasing rate of convergence, customer penetration and significant wireless share gains within our fiber footprint.”

………………………………………………………………………………………………………………………………………………………………………………………………………….

References:

https://about.att.com/story/2025/1q-earnings.html

AT&T to Buy Lumen’s Consumer Fiber Business for $5.75 Billion. AT&T says deal will accelerate high-speed fiber internet access for millions of Americans. The deal is expected to close in the first half of 2026.

AT&T said the acquisition will create jobs in metro areas across 11 states and improve critical connectivity infrastructure. The transaction will allow AT&T to expand in areas including Denver, Las Vegas, Minneapolis-St. Paul, Phoenix, Salt Lake City and Seattle, among others.

The deal includes about 1 million Lumen fiber subscribers across more than 4 million locations, AT&T said. Those subscribers will transition to become AT&T Fiber customers.

AT&T now expects to reach 60 million total fiber locations by the end of 2030, roughly double the number of places it is available now.

https://www.wsj.com/business/telecom/at-t-to-buy-lumens-mass-markets-fiber-business-for-5-75-billion-4e363bc2