Frontier Communications fiber growth accelerates in Q1 2025

Frontier Communications reported record fiber subscriber net adds in Q1-2025. However, the “fiber first” carrier had a loss of $0.26 per share, compared to break-even earnings per share a year ago. The telco posted revenues of $1.51 billion for the quarter ended March 2025, compared to year-ago revenues of $1.46 billion.

“We had the strongest start to a year yet, led by continued strength in our fiber business,” said Nick Jeffery, President and Chief Executive Officer of Frontier. “Consumers, business owners and technology companies are increasingly relying on fiber to power networks and connect to the digital economy – and that trend is shining through in our results. The team delivered 19% growth in fiber broadband customers and 24% growth in fiber broadband revenues this quarter, which taken together drove record first-quarter growth in both revenue and Adjusted EBITDA.”

Jeffery continued, “We also hit a milestone in the first quarter, growing our fiber network to reach more than 8 million passings. We started this turnaround journey with a goal of 10 million fiber passings and four years later, I’m proud to say that we’re nearly there. As we scale our network, we’re expanding access for millions of Americans and building a legacy that will continue to endure long after our planned combination with Verizon.”

First-Quarter 2025 Highlights

- Added 321,000 fiber passings to reach 8.1 million total locations passed with fiber

- Added 107,000 fiber broadband customers, resulting in fiber broadband customer growth of 19.3% year-over-year

- Consumer fiber broadband ARPU of $68.21 increased 4.7% year-over-year

- Revenue of $1.51 billion increased 3.4% year-over-year as growth in fiber-based products was partly offset by declines in copper-based products

- Operating income of $76 million and net loss of $64 million

- Adjusted EBITDA of $583 million increased 6.6% year-over-year driven by revenue growth and lower content expense, partially offset by higher customer acquisition costs1

- Cash capital expenditures of $757 million plus $16 million of vendor financing payments resulted in total cash capital investment of $773 million2

- Generated net cash from operations of $519 million

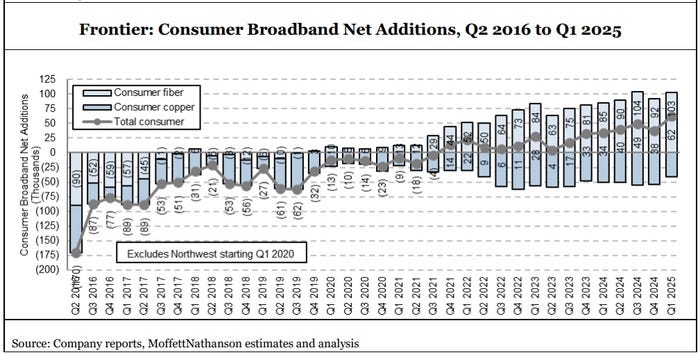

Frontier added 103,000 residential fiber broadband customers in Q1 2025, beating the 95,000 expected by MoffettNathanson (see graph below). Frontier’s residential fiber additions in the quarter were just shy of the record 104,000 it added in Q3-2024. The fiber facilities based carrier gained a record 59,000 net broadband customers in the period, which included losses of legacy copper subscribers.

Frontier built another 321,000 fiber passings in Q1-2025, pushing its total past the 8 million mark. Alongside subscriber growth, Frontier’s consumer fiber broadband average revenue per unit (ARPU) also climbed – to $68.21, up 4.7% versus the year-ago period.

Frontier said the “vast majority” of new fiber subs are now taking multi-gigabit speeds. A specific number wasn’t shared, but back in Q2 2024 more than 60% of new Frontier fiber customers took speeds of 1 Gbit/s or more.

CEO Jeffery said Frontier is sticking with its plan to build fiber to 1.3 million locations in 2025. The current pace puts Frontier on a path to reach its 10 million fiber passing goal around the third quarter of 2026, New Street Research analyst Jonathan Chaplin said in a research note.

Jeffery said Frontier’s “fiber build machine” is capable of going faster, but he stressed that the current pace gives the company the time it needs to also sell, service and support fiber broadband as it builds. “The whole company needs to be in balance. We want more customers and higher ARPU, and we’ve demonstrated that it’s doable,” Jeffery said.

He attributed ARPU growth to multiple factors, including customers taking higher-level speed tiers and subscribing to additional, premium services. Frontier estimates that more than 50% of new customers take some type of add-on, including whole-home Wi-Fi and YouTube TV.

Jeffery said Frontier is seeing good adoption of “Unbreakable Wi-Fi,” a $25 per month add-on that flips to 4G cellular backup (with 130 gigabytes of data per billing cycle) when the primary fiber connection is down. Those customers can also opt for a battery backup that provides up to four hours of backup power.

Frontier’s Q1 results come as it moves ahead with its proposed acquisition by Verizon which is currently expected to close by the first quarter of 2026. Jeffery would only say that the deal process is going smoothly at the state and federal levels.

“My job is now very much to deliver this asset in the best possible shape it can be to its future owner, Verizon,” he said. “I’m delighted to say that that’s really been evident in our first quarter results.”

References:

https://www.businesswire.com/news/home/20250429128668/en/Frontier-Reports-First-Quarter-2025-Results

Verizon to buy Frontier Communications

Frontier Communications recovering from unknown cyberattack!

Building out Frontier Communications fiber network via $1.05 B securitized debt offering

Frontier Communications fiber build-out boom continues: record number of fiber subscribers added in the 1st quarter of 2023

Frontier Communications offers first network-wide symmetrical 5 Gig fiber internet service

Fiber builds propels Frontier Communication’s record 4th Quarter; unveils Fiber Innovation Labs

AT&T to use Frontier’s fiber infrastructure for 4G/5G backhaul in 25 states

Strong resilience from Frontier—with 107K new fiber subs and 321K new passings in Q1. It’s clear their fiber-first strategy is paying off. Revenue and ARPU growth reflect real momentum ahead of the Verizon acquisition.

It is impressive that Frontier continues to push forward with its fiber-first strategy, with 19% growth in fiber broadband customers and 24% revenue growth year-over-year. Reaching the 8 million fiber connection milestone and targeting 10 million by the end of 2026 shows the company’s strong commitment to expanding its infrastructure and serving the community. This is a positive sign for the telecommunications industry in promoting high-speed broadband connectivity.