Open AI raises $8.3B and is valued at $300B; AI speculative mania rivals Dot-com bubble

According to the Financial Times (FT), OpenAI (the inventor of Chat GPT) has raised another $8.3 billion in a massively over-subscribed funding round, including $2.8 billion from Dragoneer Investment Group, a San Francisco-based technology-focused fund. Leading VCs that also participated in the funding round included Founders Fund, Sequoia Capital, Andreessen Horowitz, Coatue Management, Altimeter Capital, D1 Capital Partners, Tiger Global and Thrive Capital, according to the people with knowledge of the deal.

The oversubscribed funding round came months ahead of schedule. OpenAI initially raised $2.5 billion from VC firms in March when it announced its intention to raise $40 billion in a round spearheaded by SoftBank. The Chat GPT maker is now valued at $300 billion.

OpenAI’s annual recurring revenue has surged to $12bn, according to a person with knowledge of OpenAI’s finances, and the group is set to release its latest model, GPT-5, this month.

OpenAI is in the midst of complex negotiations with Microsoft that will determine its corporate structure. Rewriting the terms of the pair’s current contract, which runs until 2030, is seen as a prerequisite to OpenAI simplifying its structure and eventually going public. The two companies have yet to agree on key issues such as how long Microsoft will have access to OpenAI’s intellectual property. Another sticking point is the future of an “AGI clause”, which allows OpenAI’s board to declare that the company has achieved a breakthrough in capability called “artificial general intelligence,” which would then end Microsoft’s access to new models.

An additional risk is the increasing competition from rivals such as Anthropic — which is itself in talks for a multibillion-dollar fundraising — and is also in a continuing legal battle with Elon Musk. The FT also reported that Amazon is set to increase its already massive investment in Anthropic.

OpenAI CEO Sam Altman. The funding forms part of a round announced in March that values the ChatGPT maker at $300bn © Yuichi Yamazaki/AFP via Getty Images

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

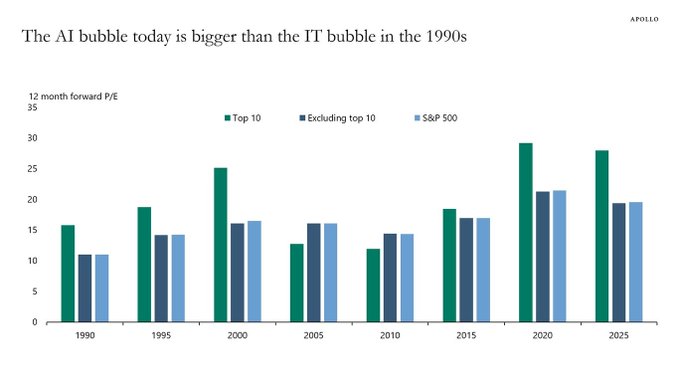

While AI is the transformative technology of this generation, comparisons are increasingly being made with the Dot-com bubble. 1999 saw such a speculative frenzy for anything with a ‘.com’ at the end that valuations and stock markets reached unrealistic and clearly unsustainable levels. When that speculative bubble burst, the global economy fell into an extended recession in 2001-2002. As a result, analysts are now questioning the wisdom of the current AI speculative bubble and fearing dire consequences when it eventually bursts. Just as with the Dot-com bubble, AI revenues are nowhere near justifying AI company valuations, especially for private AI companies that are losing tons of money (see Open AI losses detailed below).

Torsten Slok, Partner and Chief Economist at Apollo Global Management via ZERO HEDGE on X: “The difference between the IT bubble in the 1990s and the AI bubble today is that the top 10 companies in the S&P 500 today (including Nvidia, Microsoft, Amazon, Google, and Meta) are more overvalued than the IT companies were in the 1990s.”

AI private companies may take a lot longer to reach the lofty profit projections institutional investors have assumed. Their reliance on projected future profits over current fundamentals is a dire warning sign to this author. OpenAI, for example, faces significant losses and aggressive revenue targets to become profitable. OpenAI reported an estimated loss of $5 billion in 2024, despite generating $3.7 billion in revenue. The company is projected to lose $14 billion in 2026 while total projected losses from 2023 to 2028 are expected to reach $44 billion.

Other AI bubble data points (publicly traded stocks):

- The proportion of the S&P 500 represented by the 10 largest companies is significantly higher now (almost 40%) compared to 25% in 1999. This indicates a more concentrated market driven by a few large technology companies deeply involved in AI development and adoption.

- Investment in AI infrastructure has reportedly exceeded the spending on telecom and internet infrastructure during the dot-com boom and continues to grow, suggesting a potentially larger scale of investment in AI relative to the prior period.

- Some indices tracking AI stocks have demonstrated exceptionally high gains in a short period, potentially surpassing the rates of the dot-com era, suggesting a faster build-up in valuations.

- The leading hyperscalers, such as Amazon, Microsoft, Google, and Meta, are investing vast sums in AI infrastructure to capitalize on the burgeoning AI market. Forecasts suggest these companies will collectively spend $381 billion in 2025 on AI-ready infrastructure, a significant increase from an estimated $270 billion in 2024.

Check out this YouTube video: “How AI Became the New Dot-Com Bubble”

References:

https://www.ft.com/content/76dd6aed-f60e-487b-be1b-e3ec92168c11

https://www.telecoms.com/ai/openai-funding-frenzy-inflates-the-ai-bubble-even-further

https://x.com/zerohedge/status/1945450061334216905

SoftBank races to fulfill $22.5 billion funding commitment to OpenAI by year-end, sources say

Japan’s SoftBank Group is racing to close a $22.5 billion funding commitment to OpenAI by year-end through an array of cash-raising schemes, including a sale of some investments, and could tap its undrawn margin loans borrowed against its valuable ownership in chip firm Arm Holdings , sources said.

The “all-in” bet on OpenAI is among the biggest yet by SoftBank CEO Masayoshi Son, as the Japanese billionaire seeks to improve his firm’s position in the race for artificial intelligence. To come up with the money, Son has already sold SoftBank’s entire $5.8 billion stake in AI chip leader Nvidia (NVDA.O), opens new tab, offloaded $4.8 billion of its T-Mobile US.

Son has slowed most other dealmaking at SoftBank’s Vision Fund to a crawl, and any deal above $50 million now requires his explicit approval, two of the sources told Reuters.

Son’s firm is working to take public its payments app operator, PayPay. The initial public offering, originally expected this month, was pushed back due to the 43-day-long U.S. government shutdown, which ended in November. PayPay’s market debut, likely to raise more than $20 billion, is now expected in the first quarter of next year, according to one direct source and another person familiar with the efforts.

The Japanese conglomerate is also looking to cash out some of its holdings in Didi Global (92Sy.D), opens new tab, the operator of China’s dominant ride-hailing platform, which is looking to list its shares in Hong Kong after a regulatory crackdown forced it to delist in the U.S. in 2021, a source with direct knowledge said. Investment managers at SoftBank’s Vision Fund are being directed toward the OpenAI deal, two of the above sources said.

https://www.reuters.com/business/media-telecom/softbank-races-fulfill-225-billion-funding-commitment-openai-by-year-end-sources-2025-12-19/