e-SIM

Kaleido Intelligence: eSIMs for smartphones and IoT at 21% CAGR from 2023-2028

A new report from Kaleido Intelligence predicts that 1.4 billion eSIMs will be shipped in 2028, while CAGR will rise 21% between now and then. The market research firm forecasts a robust average growth of 77% in smartphone eSIM activations between 2023 and 2028.

Market disruption will come in the form of ‘travel eSIM’ as well as increased ability to transfer an eSIM from one device to another, ‘forcing the market to take new shape.’

However, the most profound transformation is anticipated in the IoT space. An IoT specification for eSIMs will see ‘commercialization as pre-compliant solutions’ in 2024, and will lower the technical and investment burden of setting up IoT systems.

The press release also states: “Although many MNOs may not have a concrete strategy for IoT connectivity at retail, support for eSIM via the new specification will offer considerable opportunities at the wholesale level. With well over half of active IoT eSIMs using the new specification by 2028, demand for connectivity profiles will be greater than ever before.”

Kaleido’s research found that the combined migration towards ‘ijo,hudfwe4’ smartphones and the ability to offer a more seamless journey to travel SIM purchasing is likely to help accelerate travel SIM adoption and erode the existing physical travel SIM market.

Nitin Bhas, Chief of Strategy & Insights at Kaleido commented:

“High roaming costs, growing traveller awareness of eSIM, and the future ratification of GSMA eSIM specifications for smartphones in China will further drive this adoption surge for alternative eSIM solutions. Nevertheless, the market landscape presents mobile operators with the opportunity to reshape their traditional roaming strategies, attract new customers through similar travel eSIM services and to drive usage amongst existing customers with compelling roaming deals.”

500% Growth in Spend:

Travel eSIM retail spend predicted to rise 500% between 2023 and 2028, as leisure and business travellers embrace cheaper esim travel plans outside core rlah markets.

$10 billion in Retail Spend:

The global travel eSIM market will be worth close to $10 billion in 2028, accounting for over 80% of total travel SIM spend by then. ‘

$30 billion Travel Market:

Retail spend on travel connectivity services, including roaming packages and travel SIMs, to be worth over $30 billion by 2028.

“The eSIM market has seen several developments recently that smooth the path to adoption, and address many lingering ecosystem challenges,” said Steffen Sorrell, Chief of Research at Kaleido. “The effect of this will mean eSIM or iSIM form factors will gradually become a de facto requirement by 2028 for most cellular devices.”

A recent survey by Omdia would seem to back up this projection of growth for the IoT and eSIM sector – of the hundreds of enterprise professionals polled over 70% of said they are planning to use 5G connectivity for IoT, while, eSIM/iSIM technology has already been or will be adopted by nearly 90% over the next two years. 95% of them expected to see measurable benefits from IoT within two years of deployment, and 90% said existing IoT projects have met or exceeded their expectations.

References:

https://telecoms.com/523216/esim-shipments-will-grow-77-by-2028/

Counterpoint Research: eSIM adoption now entering high-growth phase; +11% YoY in 2022

Counterpoint Research: eSIM adoption now entering high-growth phase; +11% YoY in 2022

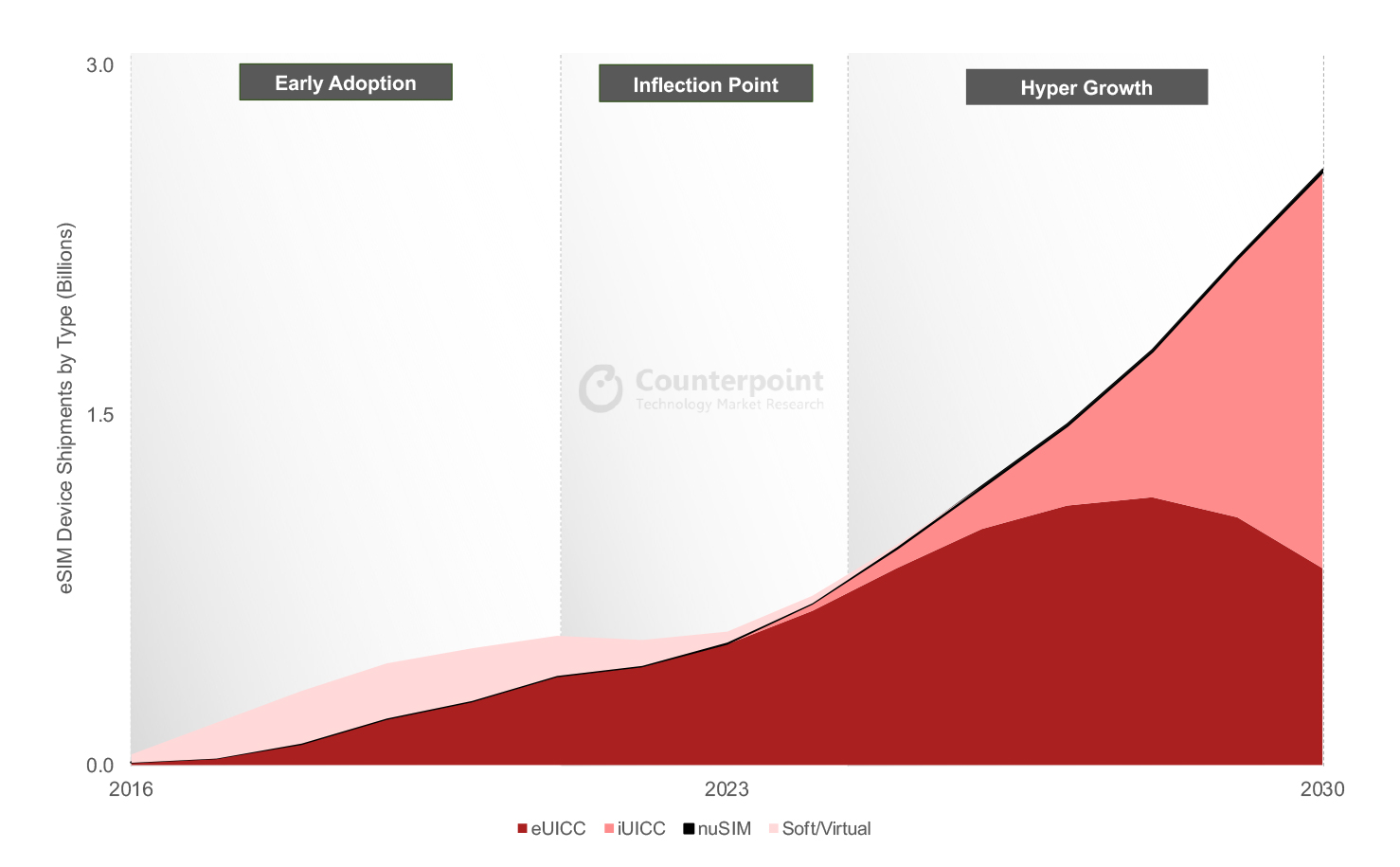

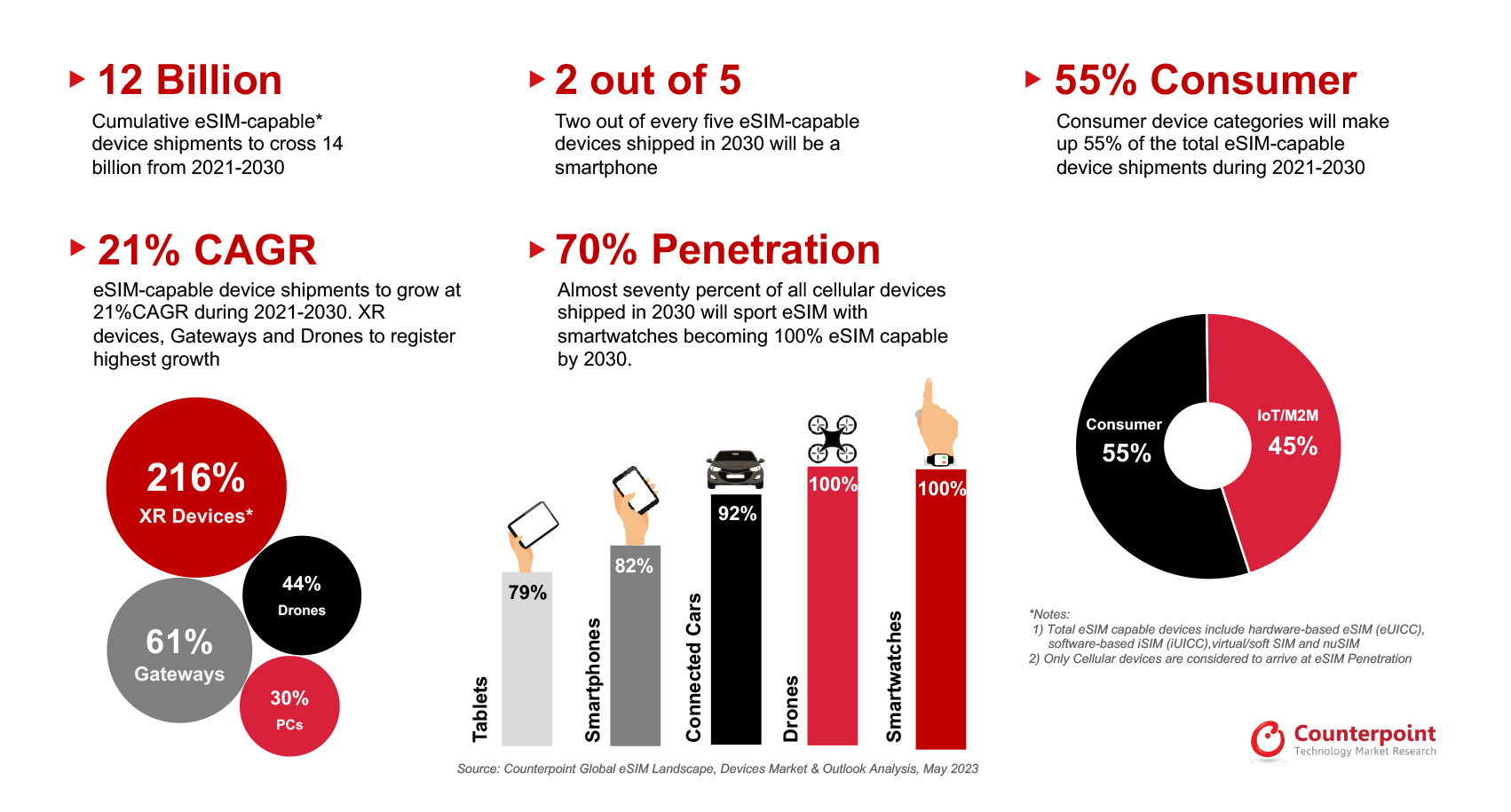

More than 6 billion xSIM (eSIM + iSIM) capable devices will be cumulatively shipped over the next five years, covering all form factors including hardware-based eSIM (eUICC), iSIM (iUICC), nuSIM and Soft SIM, according to Counterpoint’s latest eSIM Devices Market Outlook report.

Editor’s Note: An embedded SIM card – or eSIM – is pre-installed in a device and cannot be physically swapped. Instead, it is programmed remotely and can hold several SIMs at the same time. An integrated SIM (iSIM), meanwhile, is integrated in a device’s main processor, doing away with any form of dedicated hardware.

eSIM adoption has passed the inflection point and is now entering a high-growth phase, driven by the rising adoption of eSIM in smartphones, connected vehicles and cellular IoT applications. The next phase of growth will be driven by greater awareness of eSIM among mobile network operators (MNOs) and device manufacturers, facilitated by the flexibility, cost efficiency, security, cost savings and above all, the key role eSIM is playing in the digital transformation of MNOs.

In 2022, eSIM-capable device shipments grew 11% YoY to reach 424 million units despite a 3% YoY fall in overall cellular-connected device shipments due to weaker demand for smartphones. Globally, more than 275 MNOs support eSIM and provide connections to 30+ different eSIM-capable consumer device models on average. Furthermore, the number of cellular IoT modules and devices is continuously growing.

By 2030, 70% of all cellular devices are expected to support eSIM technology. Adoption will reach 100% in the smartwatch and drone segments; 92% for connected cars; 82% for smartphones; and 79% for tablets. Around 40% of eSIM devices will be smartphones, while 55% of eSIM devices shipped between 2021 and 2030 will be consumer devices.

Commenting on the outlook for xSIM-capable device shipments, Research Vice President Neil Shah said, “The physical MFF2/WLCSP form-factor soldered eSIM chip has been the go-to standard for eSIM implementation alongside the other niche alternative implementations such as soft SIM and nuSIM. Over the next five years, hardware-based eSIM (eUICC) will remain the dominant eSIM form factor and will account for more than half of all shipments.”

“The first wave of mainstream iSIM adoption will be seen across IoT applications driven by leading IoT chipset and module players such as Quectel, Telit, Sequans and Sony Semi (Altair) in partnership with leading xUICC players like Kigen, G+D and Thales. Other key stakeholders driving the adoption of iSIMs would include Qualcomm, IDEMIA, Truphone, Redtea Mobile, Oasis SmartSIM, Apple, Samsung and Nokia. Beyond 2028, iSIM is projected to take over as the dominant SIM form factor, with the shipments of iSIM-capable devices poised to climb to a cumulative 4 billion units by 2030.”

eSIM Has Reached an Inflection Point, Set to Enter a Period of Hyper-Growth

Source: Global eSIM Landscape – Market Outlook and Forecast

Commenting on eSIM adoption across different device categories, Senior Analyst Ankit Malhotra said, “Smartphones have been key in driving primary eSIM awareness among consumers and MNOs, and will continue to be the dominant eSIM-capable device category. Cellular connectivity in smartwatches is growing steadily which is also helping increase the penetration of eSIM-supported smartwatches. The adoption of entitlement servers by MNOs worldwide is a testament to the growing number of smartwatches and other companion devices powered by eSIM. Other cellular-capable consumer devices such as laptops and tablets will also see rapid eSIM adoption in the coming years.”

“The number of IoT/M2M devices equipped with eSIM is poised to grow faster than consumer device categories due to the natural cost, space and remote device management benefits that eSIM offers. The new eSIM IoT specifications SGP.31 by GSMA will accelerate eSIM adoption in the IoT segments potentially eradicating complexities of the existing eSIM Remote Service Provisioning (RSP) platform SM-DP/SM-SR for M2M/IoT segments.”

eSIM Devices Forecast and Analysis

Emerging device categories such as XR, drones and cellular gateways/FWA CPEs will be the fastest-growing categories. 5G-connected drones are another category that will benefit from eSIM technology and drive adoption across several use cases like last-mile delivery, disaster management, search and rescue, education, construction and agriculture. Regulation of beyond-visual-range drones in regions such as Europe will increase the adoption of eSIMs as well.

Automotive and smart mobility are huge growth areas as well. Connected cars are one of the largest and most obvious use cases for eSIMs. Consistent connectivity experience for mobility applications is becoming paramount, particularly for safety use cases such as eCall and the future rise of autonomous driving.

………………………………………………………………………………………………………………………………………………………………………………..

According to Omdia (owned by Informa), there is a compelling business case (subscription required) for eSIMs in the IoT market as they could help resolve connectivity issues plaguing enterprises. Some of the areas that could benefit include energy, healthcare and the financial sector, Omdia says.

Counterpoint forecasts iSIM will become the predominant type of SIM post-2028, with cumulative device shipments to reach 4 billion by 2030. Initial demand will come mainly from IoT applications, it says.

According to Omdia, the iSIM can alleviate issues such as chip shortages, energy and size constraints and increased security concerns. It also notes that cellular service providers such as AT&T, Vodafone and Deutsche Telekom have shown more enthusiasm for iSIMs than eSIMs.

References:

eSIM-Capable Devices Set for Hyper-Growth After Crossing Inflection Point

https://www.t-mobile.com/resources/what-is-an-esim-card

https://www.nytimes.com/2023/03/23/technology/personaltech/esim-sim-cards-travel.html