Open source software

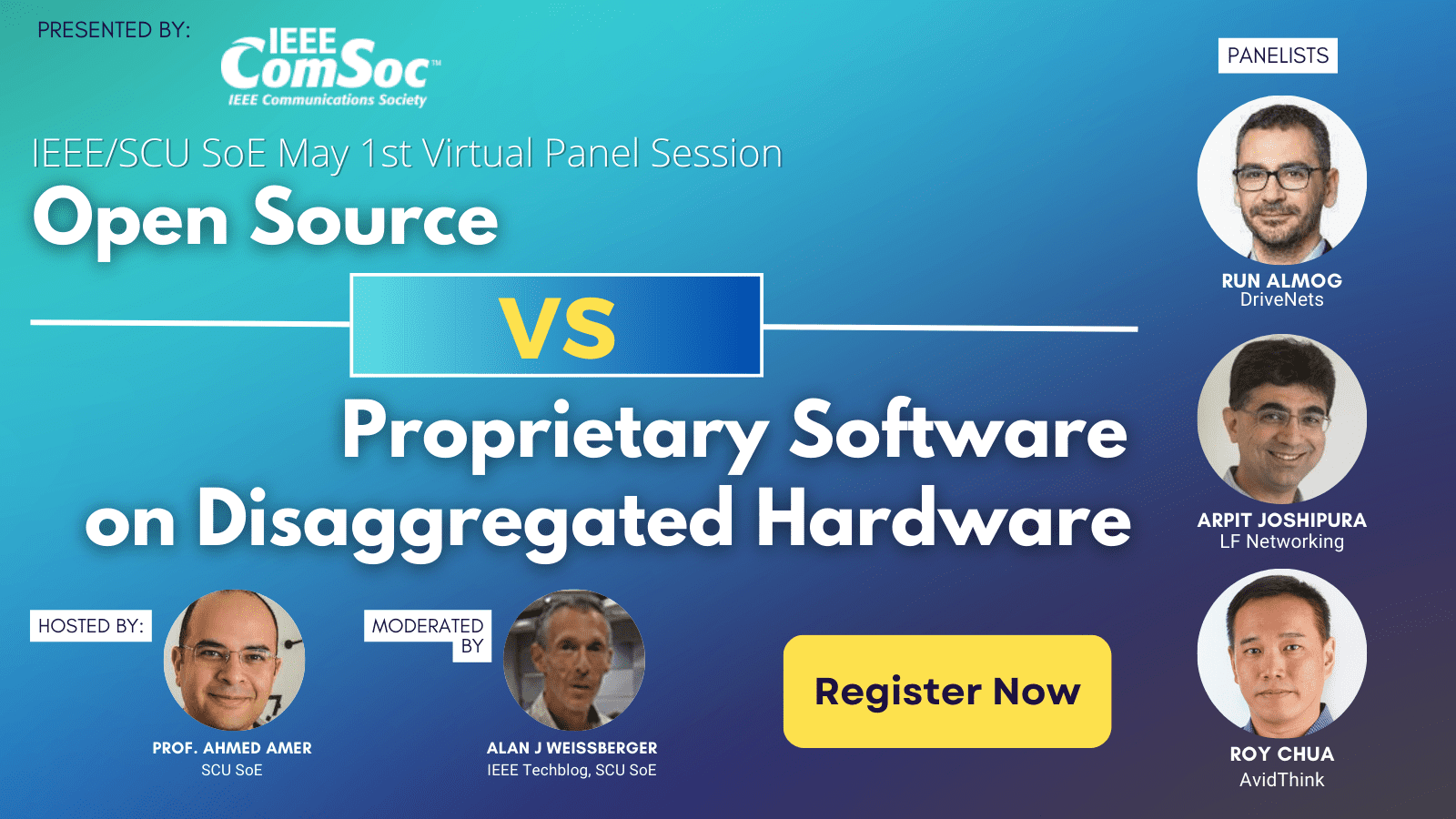

IEEE/SCU SoE May 1st Virtual Panel Session: Open Source vs Proprietary Software Running on Disaggregated Hardware

Complete Event Description at:

https://scv.chapters.comsoc.org/event/open-source-vs-proprietary-software-running-on-disaggregated-hardware/

The video recording is now publicly available:

https://www.youtube.com/watch?v=RWS39lyvCPI

……………………………………………………………………………………………………………………………………………….

Backgrounder – Open Networking vs. Open Source Network Software

Open Networking was promised to be a new paradigm for the telecom, cloud and enterprise networking industries when it was introduced in 2011 by the Open Networking Foundation (ONF). This “new epoch” in networking was based on Software Defined Networking (SDN), which dictated a strict separation of the Control and Data planes with OpenFlow as the API/protocol between them. A SDN controller running on a compute server was responsible for hierarchical routing within a given physical network domain, with “packet forwarding engines” replacing hop by hop IP routers in the wide area network. Virtual networks via an overlay model were not permitted and were referred to as “SDN Washing” by Guru Parulkar, who ran the Open Networking Summit’s for many years.

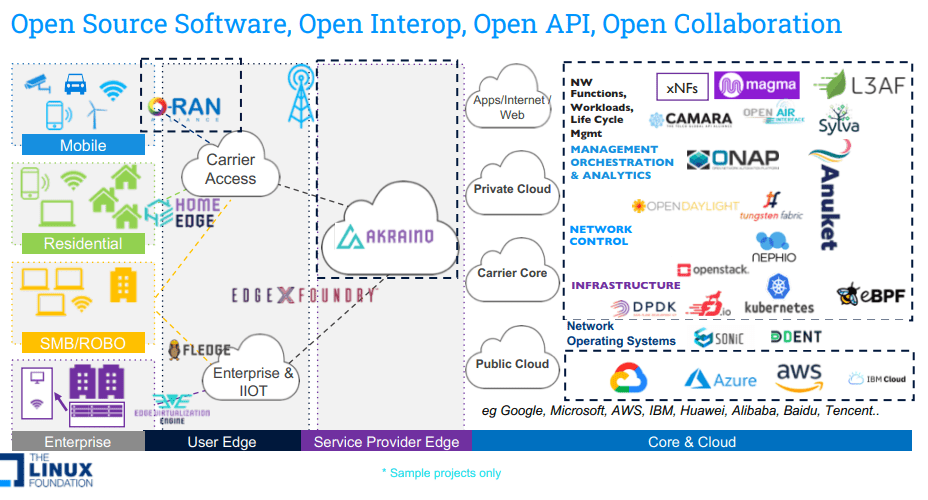

Today, the term Open Networking encompasses three important vectors:

A) Beyond the disaggregation of hardware and software, it also includes: Open Source Software, Open API, Open Interoperability, Open Governance and Open collaboration across global organizations that focus on standards, specification and Open Source software.

B) Beyond the original Data/Control plane definition, today Open Networking covers entire software stack (Data plane, control plane, management, orchestration and applications).

C) Beyond just the Data Center use case, it currently covers all networking markets (Service Provider, Enterprise and Cloud) and also includes all aspects of architecture (from Core to Edge to Access – residential and enterprise).

Open Source Networking Software refers to any network related program whose source code is made available for use or modification by users or other developers. Unlike proprietary software, open source software is computer software that is developed as a public, open collaboration and made freely available to the public. There are several organizations that develop open source networking software, such as the Linux Foundation, ONF, OCP, and TIP.

Currently, it seems the most important open networking and open source network software projects are being developed in the Linux Foundation (LF) Networking activity. Now in its fifth year as an umbrella organization, LF Networking software and projects provide the foundations for network infrastructure and services across service providers, cloud providers, enterprises, vendors, and system integrators that enable rapid interoperability, deployment and adoption.

Event Description:

In this virtual panel session, our distinguished panelists will discuss the current state and future directions of open networking and open source network software. Most importantly, we will compare open source vs. proprietary software running on disaggregated hardware (white box compute servers and/or bare metal switches).

With so many consortiums producing so much open source code, the open source networking community is considered by many to be a trailblazer in terms of creating new features, architectures and functions. Others disagree, maintaining that only the large cloud service providers/hyperscalers (Amazon, Microsoft, Google, Facebook) are using open source software, but it’s their own versions (e.g. Microsoft SONIC which they contributed to the OCP).

We will compare and contrast open source vs proprietary networking software running on disaggregated hardware and debate whether open networking has lived up to its potential.

Panelists:

- Roy Chua, AvidThink

- Arpit Joshipura, LF Networking

- Run Almog, DriveNets

Moderator: Alan J Weissberger, IEEE Techblog, SCU SoE

Host: Prof. Ahmed Amer, SCU SoE

Co-Sponsor: Ashutosh Dutta, IEEE Future Networks

Co-Sponsor: IEEE Communications Society-SCV

Agenda:

- Opening remarks by Moderator and IEEE Future Networks – 8 to 10 minutes

- Panelist’s Position Presentations – 55 minutes

- Pre-determined issues/questions for the 3 panelists to discuss and debate -30 minutes

- Issues/questions that arise from the presentations/discussion-from Moderator & Host -8 to 10 minutes

- Audience Q &A via ZOOM Chat box or Question box (TBD) -15 minutes

- Wrap-up and Thanks (Moderator) – 2 minutes

Panelist Position Statements:

1. Roy will examine the open networking landscape, tracing its roots back to the emergence of Software Defined Networking (SDN) in 2011. He will offer some historical context while discussing the main achievements and challenges faced by open networking over the years, as well as the factors that contributed to these outcomes. Also covered will be the development of open networking and open-source networking, touching on essential topics such as white box switching, disaggregation, OpenFlow, P4, and the related Network Function Virtualization (NFV) movement.

Roy will also provide insight into the ongoing importance of open networking and open-source networking in a dynamic market shaped by 5G, distributed clouds and edge computing, private wireless, fiber build-outs, satellite launches, and subsea-cable installations. Finally, Roy will explore how open networking aims to address the rising demand for greater bandwidth, improved control, and strengthened security across various environments, including data centers, transport networks, mobile networks, campuses, branches, and homes.

2. Arpit will cover the state of open source networking software, specifications, and related standards. He will describe how far we have come in the last few years exemplified by a few success stories. While the emphasis will be on the Linux Foundation projects, relevant networking activity from other open source consortiums (e.g. ONS, OCP, TIP, and O-RAN) will also be noted. Key challenges for 2023 will be identified, including all the markets of telecom, cloud computing, and enterprise networking.

3. Run will provide an overview of Israel based DriveNets “network cloud” software and cover the path DriveNets took before deciding on a Distributed Disaggregated Chassis (DDC) architecture for its proprietary software. He will describe the reasoning behind the major turns DriveNets took during this long and winding road. It will be a real life example with an emphasis on what didn’t work as well as what did.

……………………………………………………………………………………………………………….

References:

https://lfnetworking.org/

https://lfnetworking.org/how-

https://lfnetworking.org/

https://lfnetworking.org/open-

LF Networking 5G Super Blue Print project gets 7 new members

Overview:

LF Networking (LFN), which facilitates collaboration and operational excellence across open source networking projects, today announced seven new member organizations and one associate member have joined the community to collaborate on the 5G Super Blue Print initiative.

The 5G Super Blueprint project covers RAN, Edge, and Core and enables solutions for enterprises and verticals, large institutional organizations, and more. While Networking provides platforms and building blocks across the networking industry that enable rapid interoperability, deployment, and adoption. Participation in this nexus for 5G innovation and integration is open to anyone.

The new members are:

AQSACOM, a leader in Cyber Intelligence software solutions for communications service providers (CSPs) and law enforcement agencies (LEAs);

Radtronics, which provides secure and powerful private wireless network for Maximum Productivity with new applications and services, through Outcome based and cost efficient solutions enabled by strong innovation;

Turnuium, which enables channel partners to connect people, data, and applications through its turnkey multi-carrier managed SD-WAN;

SEMPRE, which secures 5G for critical infrastructure by moving compute to the edge and leveraging military-grade technology—the only HEMP-hardened 5G gNODEB with Edge; and

Wavelabs, a new-age technology company for the Digital, Cognitive & Industry 4.0 Era have joined LFN at the Silver level. New Associate members include: the Oman government’s Ministry of Transportation, Communications & Information Technology;

ICE Group’s (state telecommunications and energy operator of Costa Rica)

ANTTEC (ICE Group’s main union of technicians and engineers); and

High School Technology Services, which offers coding and technology training to students and adults, have joined as Associate members.

“As the center platform for enabling open source 5G building blocks, collaboration and integration is more important than ever for LFN, amplified by our recent developer event in early June,” said Arpit Joshipura, general manager, Networking, Edge and IoT, the Linux Foundation. “This impressive roster of new members across intelligence, government, enterprise and more are welcome additions to the LFN community. We look forward to continued collaboration that enables rapid interoperability, deployment, and adoption of 5G across the ecosystem.”

Leveraging the convergence of major initiatives in the 5G space, and building on a long-running 5G Cloud Native Network demo work stream, LF Networking is leading a community-driven integration and proof of concept involving multiple open source initiatives in order to show end-to-end use cases demonstrating implementation architectures for end users.

In April, the Linux Foundation and the World Bank launched an online course: 5G and Emerging Technologies for Public Service Delivery & Digital Economy Operations – Fundamentals of 5G Networks: Implications for Practitioners. The course is now available on the World Bank’s Open Learning Campus here. Aimed at decision makers and development practitioners, the course provides an introduction to open source and the critical role it plays in today’s networks.

ONE Summit:

Learn more about the 5G Super Blue Print during the Open Networking & Edge (ONE) Summit, the ONE event for end to end connectivity solutions powered by open source and enables the collaborative development necessary to shape the future of networking and edge computing. Taking place October 11-12, 2021 in Los Angeles, Calif., Registration will open soon.

New Member Support:

“With the dramatic growth of Private Wireless LTE and 5G networks over the coming years, the Open Source community will play a transformational role, which is the reason we’re joining the Linux Foundation Networking,” said Peter Lejon, co-founder of RADTONICS AB. “5G technology will have a huge impact on our future, driving positive changes for all of us. With enterprise and regional operators procuring solutions direct from the solutions providers, initiatives like 5G Super Blueprint and Magma Packet Core will be instrumental in serving a rapidly developing market that will include the next billion users on their journey of capturing value through digitalization. We believe that through Open Source and by working together, we can further accelerate the current pace of innovation and development. Change will never be this slow again,” added Lejon.

Marcus Owenby, SEMPRE’s Global CTO, affirmed “SEMPRE’s support for 5G Super Blueprint will enable enterprise and government organizations to leverage open source technology, while also securing 5G using military-grade technology purpose-built to protect critical infrastructure.”

“Wavelabs.ai is an ardent proponent of the ‘OPEN X’ network vision. We work with the entire ecosystems of clients & partners as an engaged, committed, and collaborative partner to realize 5G open and disaggregated ‘White Box’ network as a reality” said Mansoor Khan, CEO of Wavelabs. “LF Networking open-source 5G initiatives address major opportunities today and tomorrow. We believe this partnership will strengthen Wavelabs mission in accelerating the Journey to Future Connectivity by offering the unique blend of next-generation Digital, Cognitive, and Network technology services and solutions”

Resources

Deutsche Telekom: Access 4.0 in Production Leveraging ONF VOLTHA and SEBA open source software

Deutsche Telekom (DT) recently announced its Access 4.0 (A4) platform began providing services to customers in Stuttgart in December 2020. This marks a major milestone in DT’s efforts building a state-of-the-art disaggregated broadband solution that blends open source and vendor proprietary components into a production-grade highly optimized solution for providing FTTx services.

Deutsche Telekom’s Access 4.0 is the next generation of software-defined access networking. The program constitutes a true paradigm shift, not only in terms of technology but also ecosystem, collaboration, and agility. By leveraging an edge cloud approach, we create a cost-efficient, lean-to-operate, and scalable access platform to deliver gigabit products. It works in our labs and in an early field trial.

A key foundational building block of A4 is ONF’s Virtual OLT Hardware Abstraction (VOLTHA) open source software controlled by the ONF’s ONOS SDN Controller and a set of ONOS Apps. This VOLTHA stack enables operators to extend software defined programming to the fixed access network, and makes it possible to embrace a best-of-breed approach to selection of white box network equipment. In addition to this open source stack, ONF’s SDN-Enabled Broadband Access (SEBA) Reference Design documents the architecture and framework used to assemble open solutions such as DT’s.

VOLTHA™ is an open source project to create a hardware abstraction for broadband access equipment. It supports the principle of multi-vendor, disaggregated, “any broadband access as a service” for the Central Office. VOLTHA currently provides a common, vendor agnostic, GPON control and management system, for a set of white-box and vendor-specific PON hardware devices. With the upcoming introduction of access Technology Profiles, VOLTHA will support other access technologies like EPON, NG-PON2 and G.Fast as well.

VOLTHA, operational in the A4 network, has been developed as a joint effort between ONF, ONF operator partners (particularly AT&T, Deutsche Telekom and Turk Telekom), and additional members and vendors in the VOLTHA ecosystem. The role of the operators is key in shaping the architecture and requirements for VOLTHA and SEBA with their sharing of insight learned in field trials and early commercial deployments. This collaboration has helped to improve, harden and scale VOLTHA and SEBA.

SEBA™ is a lightweight platform based on a variant of R-CORD. It supports a multitude of virtualized access technologies at the edge of the carrier network, including PON, G.Fast, and eventually DOCSIS and more. SEBA supports both residential access and wireless backhaul and is optimized such that traffic can run ‘fastpath’ straight through to the backbone without requiring VNF processing on a server.

- Kubernetes based

- High Speed

- Operationalized with FCAPS and OSS Integration

“Deutsche Telekom is reaching an important milestone in its transformation into a software-based telecommunications provider,” explains Walter Goldenits, CTO Telekom Deutschland, adding, “We are thus consistently shaping the path taken by the industry toward solutions based on open and disaggregated components in the fixed network area as well.”

Abdurazak Mudesir, head of Services & Platforms and Access Disaggregation at Deutsche Telekom Technik, adds: “Disaggregation is now a reality. For the first time we’re producing a BNG on Whitebox hardware and are using software-defined networking technology to control that gateway. That’s a hugely important step toward our broadband network’s future structure. With the software-defined approach of Access 4.0 we’re driving forward automation and can implement lean processes ourselves in combination with our OSS platforms.”

Access 4.0 is primarily tailored to Deutsche Telekom’s broadband internet access for FTTH/B. This use case marks, however, just the start of the transformation. The underlying A4 platform technology should in future be able to support other applications at the network edge, especially in the 5G and Open RAN environment. The next step will see the project team focus on honing the platform for rollout in other regions.

……………………………………………………………………………………………..

References:

https://www.telekom.com/en/company/details/access-4-0-563612

Opinion: How virtualization and open source are upending the entire telecom industry

Article below written by Liliane Offredo-Zreik and Dr. Mark H Mortensen of ACG Research

[Note that the IEEE Techblog content manager (since April 2009) does not agree with the theme of this article. We believe that the only really big customers of virtualization and open source hardware/software are the largest tier 1 telcos (like AT&T, Telefonica, etc) and the big cloud companies (like Amazon, Google, Microsoft, Facebook, Alibaba, Tencent, etc).

- One of the big problems with network virtualization is that you have a single point of failure (the server running virtual network functions) and also a much larger attack surface for cyber attacks.

- The biggest obstacles to using open source hardware and software are systems integration, multi-vendor interoperability and compatibility and tech support, especially related to failure isolation and recovery. Other issues with deploying open source include performance (vs purpose built hardware/firmware/software) and OPEX associated with integrating and maintaining hardware/software from multiple vendors.

However, we like to present different views and provide balanced coverage of telecom tech topics like open networking and open source hardware/software. So please enjoy the below article and comment in the Comment box below it.]

………………………………………………………………………………………………………………………………………………..

Posted by: Anasia D’mello. Article written by Liliane Offredo-Zreik and Dr. Mark H Mortensen of ACG Research.

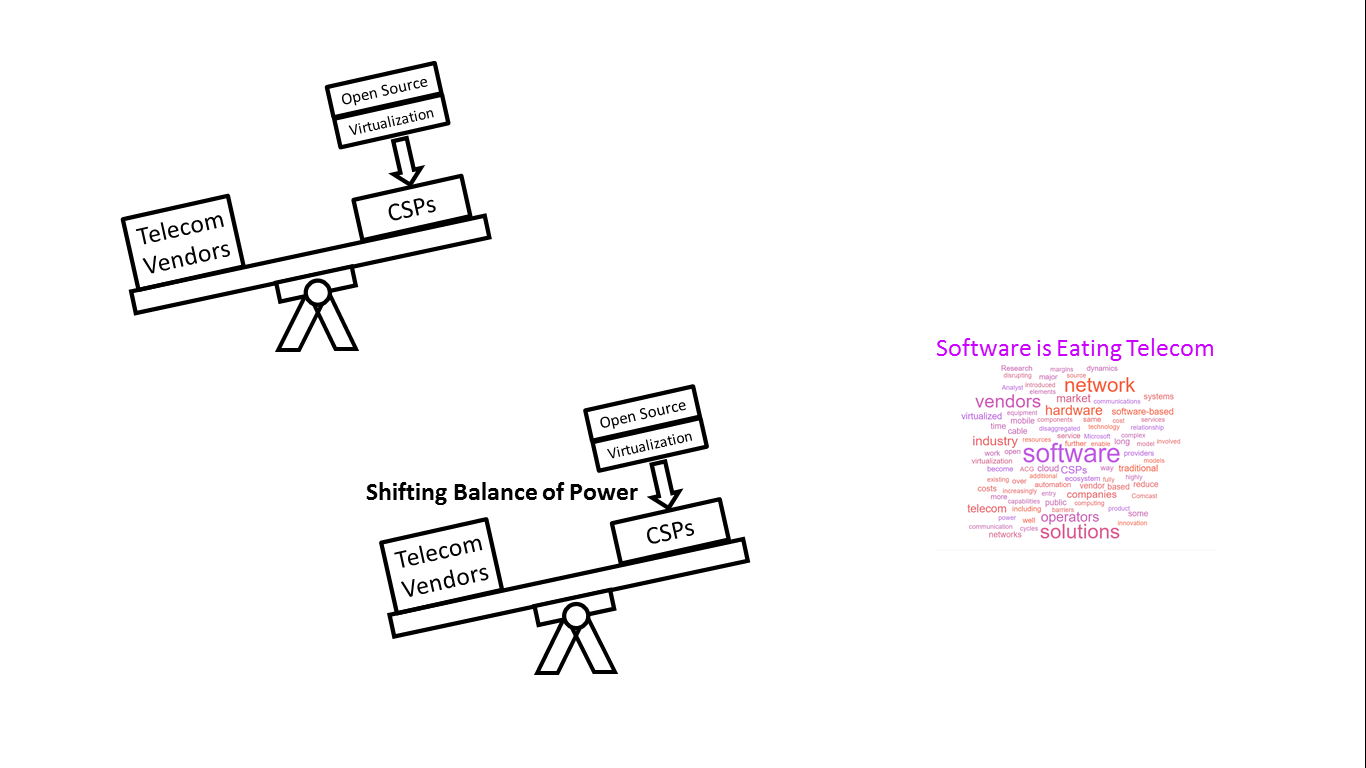

Until recently, network technology vendors to communication service providers (CSPs) had a well-established competitive market position with brand loyalty, long-standing customer relationships, and well entrenched proprietary solutions. However, an inexorable move to software-based (virtualised) solutions, combined with the increasing prevalence of open-source resources, is disrupting the market dynamics and will have profound implications for the industry structure.

Traditionally, telecom network technology vendors supplied bespoke solutions, typically consisting of hardware racks populated with purpose-built circuit boards that performed highly specialised tasks, complemented by highly customised software, with complex back office systems to manage these systems and the applications that run on them. These solutions were supplemented by extensive professional services resources, and typically involved regular software upgrades, and, less frequently hardware ones.

This, combined with the long cycles involved in introducing new solutions, or in upgrading existing ones due to long testing cycles, created a relatively closed ecosystem with high barriers to entry and high switching costs. It also drove costs up, as it increased the bargaining power of suppliers; it limited the number of competitors and stifled innovation because younger companies with fewer resources found it difficult to penetrate the ecosystem.

The disruptive nature of virtualization

The inexorable migration to software-based, virtualized solutions is disrupting this ecosystem, with profound long-term consequences. Increasingly, telecom operators are introducing virtualized software solutions in their operating environments. Their long-term goal is of a fully software-driven ecosystem with software-only network elements running on commodity off-the-shelf servers (COTS) or open source hardware, hosted in local offices, in distributed data centres or in a cloud-compute environment.

The software-based systems are not less complex, and the incumbent vendors are rushing to either port their existing solutions on COTS or redeveloping parts of those systems to become software based. It also allows new software vendors to enter the market without the long design, manufacturing, and logistics supply chains of traditional hardware.

At the same time, the CSP traditional development/deployment paradigm, which was largely based on the waterfall model and involved protracted cycles, is slowly making way to an agile framework, based on the Continuous Integration/Continuous Deployment model where incremental changes are introduced on an on-going basis, enabled by a microservices-based, modularised architecture.

This paradigm allows minimally viable products to be introduced and then rapidly enhanced, reducing the entrenched foothold of existing suppliers and opening the way for new entrants, further transforming the market dynamics.

By reducing the barriers to entry, virtualization is adding new vendors and new delivery mechanisms that bypass the traditional supply chains: New virtual network software companies, public cloud companies, and the network operators themselves.

- New virtual network software companies: New software-centric companies have entered the market over the last several years. Examples include Affirmed Networks, Altiostar and Parallel Wireless that offer a software-based mobile core solution, Etiya that provides a nearly fully virtualised mobile solution (running on an AWS public cloud infrastructure), and Metaswitch that offers a wide range of mobile and fixed network software-based network technologies. Other traditional software vendors to operators, such as HPE, are also entering the virtualised network equipment market.

- Public cloud companies: Cloud providers are increasingly tapping into the convergence of cloud and communication networks. Recently, Microsoft bought Affirmed Networks, which offers fully virtualized, cloud-native mobile network solutions for telecom operators. This acquisition will enable Microsoft to become a major telecom vendor in the mobile and nascent private 5G markets. In days past, communication service providers (CSP) used to build their own data centres, but virtualisation technologies enable cloud providers, such as Microsoft, to offer the same capabilities, mostly as services, on their public computing and storage infrastructure at much lower initial cost and with more flexibility.

- DIY: Some CSPs are hiring software developers in droves and are beginning to develop their own solutions. Not only that, but some operators are also transforming themselves into vendors, offering their solutions to their peer operators. A case in point is Comcast Corp. The company’s mantra has become “software eats the world.” Its newly opened Comcast Technology Center serves as “the dedicated home for our company’s growing workforce of more than 4,000 technologists, engineers and software architects.” Comcast has developed its Xfinity X1 entertainment service in-house; it is also syndicating it to cable operators, including Cox and Shaw and Rogers of Canada. At the same time, the company has developed a software-defined platform (ActiveCore) to power its business services, and it is not unfathomable that it would look to syndicate it at some point in the future.

Others CSPs are expanding their software capabilities for internal, and external, use. Reliance Jio’s parent company, Reliance Industries, bought Radisys, a US-based provider of open telecom solutions, while AT&T’s expansion of its software capabilities is well-known in the industry.

The role of open-source collaboration

Most operators do not have the capacity nor the ability to undertake massive development efforts, particularly because some of the solutions they need are highly complex. However, open-source hardware and software and disaggregated network elements go a long way to alleviate the need to undertake end to end developments.

Recent disaggregated network element (DNE) projects, some including open-source hardware and software, have been created by CSPs throughout the various telecom equipment domains, from radio backhaul to the core networks, optical access and transport equipment, and edge computing environments, among many others. DNEs are essentially public open source Lego-like building blocks that run on standard computing and storage hardware or programmable ASICs that standardise designs and that can be used to create solutions. They enable CSPs to select the best combination of commoditised hardware and specialised software components. DNEs are designed to reduce vendor lock-ins and further lower the barriers to entry for new vendors, increasing competition in sales and support.

The operator–vendor new relationship framework

New engagement models are emerging. The traditional supplier/customer relationship is making way to a cooperative engagement model, where the operator and the vendor work hand in hand on developing solutions. Furthermore, unlike traditional models where the vendor is paid upfront and is further compensated for on-going support, new frameworks are emerging where the vendor is compensated based on the success of the operator. One such arrangement was the Infinite Broadband Unlocked that Cisco introduced in 2018 where it charged cable operators based on broadband consumption over their networks, rather than upfront licenses. Such arrangements are facilitated by software-based solutions and are likely to become more prevalent over time, further disrupting market dynamics.

Toward the future

The commoditisation of the hardware components of the network will reduce the vendors’ margins and potentially reduce overall CSPs’ costs. However, the CSPs will have to bear the additional costs of testing multivendor arrangements, configuring, and managing the larger number of network components, as well as securing the entire network.

These additional costs will eat into the potential savings and are expected to require a hefty dose of automation. Such automation will come from vendors, systems integrators, as well as from additional open-source initiatives such as the ONAP program, the open-source version of the AT&T ECOMP home-grown system that seeks to provide real-time, policy-driven software automation of AT&T’s network management functions.

It is too early in the game to scope the full impact of this unfolding transformation. It is likely that it will increase the speed of innovation and improve the cost structure for operators. At the same time, intense competition may reduce vendors’ margins, decreasing their ability to invest in R&D. However, an increasingly symbiotic relationship between operators and vendors will improve industry dynamics, overall, as it will lead to better targeted solutions, more cost efficiency and improved customer experience.

Conclusion

Technological changes and industry realignment are enabling CSPs to gain greater market control and to reap larger efficiencies by replacing monolithic hardware and software solutions from major vendors with disaggregated networking elements with open-source software on commoditised, standardised hardware, and by adopting co-development models. This will reduce the pricing power of major vendors and compress their margins but may lead to greater innovation in the industry.

The authors are Liliane Offredo-Zreik and Dr. Mark H Mortensen of ACG Research.

Liliane Offredo-Zreik

Dr. Mark H Mortensen

About the authors

Liliane Offredo-Zreik ([email protected] @offredo) is a principal analyst with ACG Research. Her areas of coverage include the cable industry, SD-WAN, and communications service provider digital transformation. Prior to her analyst work, she held senior roles in major telecom and cable companies, including Verizon and Time Warner Cable (now Charter) as well as with industry vendors and has been an industry advisor in areas including marketing, strategy, product development and M&A due diligence.

Dr. Mark H Mortensen ([email protected] @DrMarkHM) is an acknowledged industry expert in communications software for the TMT sector, with over 40 years of experience in OSS and BSS specifications, network operations, software architecture, product marketing, and sales enablement. His work has spanned the gamut of technical work at Bell Labs, strategic product evolution at Telcordia, CMO positions at several software vendors, and as a research director at Analysys Mason. He is currently the Communications Software Principal Analyst at ACG Research focusing on network and business automation.

……………………………………………………………………………………………………………………………………………….