Satellite Monitoring

Starlink doubles subscriber base; expands to to 42 new countries, territories & markets

Starlink, the satellite internet service by SpaceX, has nearly doubled its internet subscriber base in 2025 to over 9 million global customers. This rapid expansion from approximately 4.6 million subscribers at the end of 2024 has been driven by new service launches in 42 countries and territories, new subscription options, and the company’s focus on bridging the digital divide in remote and underserved areas.

- Total Subscribers: As of December 2025, Starlink connects over 9 million active customers across 155 countries.

- Growth Rate: The company added its most recent million users in just under seven weeks, a record pace of over 20,000 new users daily. Overall internet traffic from users more than doubled in 2025.

- Geographic Expansion: Starlink’s growth is heavily fueled by international markets where traditional broadband is limited. The U.S. subscriber base alone reached over 2 million by mid-2025.

- Infrastructure: SpaceX has focused heavily on scaling its network capacity, operating more than 9,000 active satellites in orbit and investing heavily in ground infrastructure.

Starlink’s Ground Network:

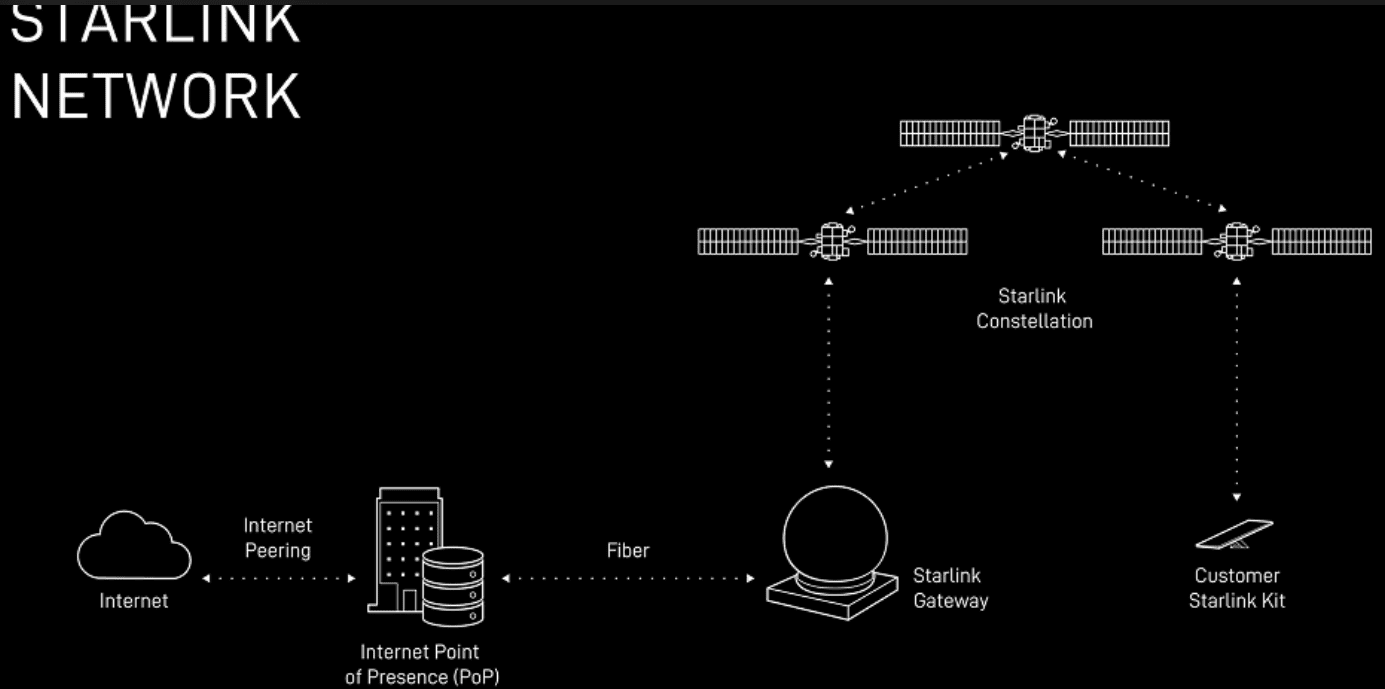

Starlink has also deployed the largest satellite ground network with more than 100 gateway sites in the United States alone – comprising a total of over 1,500 antennas – are strategically placed to deliver the lowest possible latency, especially for those who live in rural and remote areas.

Starlink produces these gateway antennas at our factory in Redmond, Washington where they rapidly scaled production to match satellite production and launch rate.

Network Resilience:

With more than 7,800 satellites in orbit, Starlink customers always have multiple satellites in view, as well as multiple gateway sites and internet points-of-presence locations (PoPs). As a result, Starlink customers benefit from continuous service even when terrestrial broadband is suffering from fiber cuts, subsea cable damage, and power outages that can deny service to millions of individuals for days.

Additionally, each Starlink satellite is equipped with cutting-edge optical links that ensure they can relay hundreds of gigabits of traffic directly with each other, no matter what happens on the ground. This laser network enables Starlink satellites to consistently and reliably deliver data around the world and route traffic around any ground conditions that affect terrestrial service at speeds that are physically impossible on Earth.

Starlink’s Latency:

To measure Starlink’s latency, the company collects anonymized measurements from millions of Starlink routers every 15 seconds. In the U.S., Starlink routers perform hundreds of thousands of speed test measurements and hundreds of billions of latency measurements every day. This high-frequency automated measurement assures consistent data quality, with minimal sampling bias, interference from Wi-Fi conditions, or bottlenecks from third-party hardware.

As of June 2025, Starlink is delivering median peak-hour latency of 25.7 milliseconds (ms) across all customers in the United States. In the US, fewer than one percent of measurements exceed 55 ms, significantly better than even some terrestrial operators.

- Addressing the Digital Divide: Starlink has positioned itself as a critical solution for rural and remote communities, offering high-speed, low-latency internet where fiber or cable is unfeasible.

- New Services: The company is expanding beyond individual households to include services for airlines, maritime operators, and businesses. There are also plans for a direct-to-cell service in partnership with mobile carriers like T-Mobile.

- Next-Generation Satellites: To manage the growing user base and increasing congestion, SpaceX plans to launch its larger, next-generation V3 satellites in 2026, which are designed to offer gigabit-class connectivity and dramatically increase network capacity.

- IPO Considerations: Starlink’s significant growth and role as SpaceX’s primary revenue driver have positioned the parent company for a potential initial public offering (IPO) in 2026.

Competition:

Starlink’s main LEO competitors are Amazon Leo (Project Kuiper) and OneWeb (Eutelsat), aiming for similar high-speed, low-latency service, while established providers Hughesnet and Viasat (mostly GEO) offer more traditional, affordable satellite options but with higher lag, though they’re adapting. Starlink leads in consumer availability and speed currently, but Amazon and OneWeb are rapidly scaling to challenge its dominance with LEO constellations, offering faster speeds and lower latency than older satellite tech.

……………………………………………………………………………………………………………..

References:

https://starlink.com/updates/network-update

Elon Musk: Starlink could become a global mobile carrier; 2 year timeframe for new smartphones

Amazon Leo (formerly Project Kuiper) unveils satellite broadband for enterprises; Competitive analysis with Starlink

NBN selects Amazon Project Kuiper over Starlink for LEO satellite internet service in Australia

GEO satellite internet from HughesNet and Viasat can’t compete with LEO Starlink in speed or latency

KDDI unveils AU Starlink direct-to-cell satellite service

Telstra selects SpaceX’s Starlink to bring Satellite-to-Mobile text messaging to its customers in Australia

U.S. BEAD overhaul to benefit Starlink/SpaceX at the expense of fiber broadband providers

One NZ launches commercial Satellite TXT service using Starlink LEO satellites

Reliance Jio vs Starlink: administrative process or auction for satellite broadband services in India?

FCC: More competition for Starlink; freeing up spectrum for satellite broadband service

SpaceX launches first set of Starlink satellites with direct-to-cell capabilities

Starlink Direct to Cell service (via Entel) is coming to Chile and Peru be end of 2024

Hellas Sat and Space Compass sign MoU for optical inter-satellite connectivity for cross-operator interoperability

Hellas Sat (Greece) and Space Compass (Japan) have executed a Memorandum of Understanding (MoU) to establish a strategic technical and commercial framework for optical inter-satellite connectivity. The collaboration focuses on integrating the forthcoming Hellas Sat 5 geostationary (GEO) satellite with Space Compass’s planned GEO optical data-relay system to enable seamless, cross-operator interoperability.

Strategic Objectives and Infrastructure Integration Inter-Satellite Interoperability:

The partners identify cross-operator optical compatibility as a critical prerequisite for deploying next-generation, high-capacity space communications.

Hellas Sat 5 (HS5) Architecture:

The HS5 satellite is expected to play an important role in advancing space-based optical communications. Currently in the design phase, HS5 will be positioned at 39° East. It is engineered to host the European Space Agency (ESA) HydRON (High Throughput Optical Network) payload. Data Relay Capabilities: The partnership aims to validate ultra-fast laser links and ground connectivity, bridging GEO and Low Earth Orbit (LEO) systems to provide near-real-time data delivery for Earth observation missions. By integrating the optical payload, HS5 will bridge geostationary and low earth orbit systems, enable seamless optical data relay.

Expanded Ecosystem Collaboration Regulatory & Research Alignment: Space Compass is concurrently working with ESA under a separate Memorandum of Intent to conduct feasibility studies on optical communication interoperability between their respective in-orbit demonstration programs.

Advanced Optical Payload:

In partnership with Thales Alenia Space, Hellas Sat 5 is designed to support capacities reaching the Terabit-per-second scale, a significant leap over current gigabit-scale radio frequency systems. This collaboration reinforces the transition toward a standardized, high-speed optical space network, essential for securing global digital infrastructure throughout the 2030s.

……………………………………………………………………………………………………………………………………………………………………..

This project is one of the initiatives of space business brand under NTT Group’s “NTT C89” and SKY Perfect JSAT.

About Space Compass:

Space Compass is a joint venture between NTT, a global Information and Communications Technology (ICT) company, and SKY Perfect JSAT Corporation, Asia’s largest satellite operator. The company was established to develop the Space Integrated Computing Network, a new multi-orbital, optical communication-based independent space infrastructure designed to address social challenges. For more information, please visit: https://space-compass.com/en/

………………………………………………………………………………………………………………………………………………………………….

- SDA’s Role: The Space Development Agency is a major driver, releasing Optical Communication Terminal (OCT) Standards (covering physical & data link layers) to ensure different systems can connect.

- Kepler Network: Demonstrated Optical ISLs between its satellites using SDA-compatible terminals, forming mesh networks for data relay.

- SpaceX Starlink: Added optical links for global coverage and resiliency, testing crosslinks with other partners like York.

- Project Kuiper: Amazon’s project also successfully tested end-to-end optical links for its constellation.

- Collaborative Efforts: Companies like Space Compass, Axelspace, NEC, and ESA are working on R&D for interoperable optical networks.

- Seamless Networks: Enables complex multi-platform, multi-orbit networks.

- Data Relay: Allows satellites to relay data for others, reducing ground station reliance.

- Standardization: Essential for different companies’ satellites to talk to each other.

References:

https://www.skyperfectjsat.space/en/news/20251211

https://space-compass.com/en/news/000080.html

Coherent Optics: Synergistic for telecom, Data Center Interconnect (DCI) and inter-satellite Networks

Important satellite network services to be discussed at WRC 23

SatCom market services, ITU-R WP 4B, 3GPP Release 18 and ABI Research Market Forecasts

Muon Space in deal with Hubble Network to deploy world’s first satellite-powered Bluetooth network

Important satellite network services to be discussed at WRC 23

Several agenda items for WRC‑23 include fixed, mobile, broadcasting, and radio determination satellite services. Study Group 4 ITU–R is responsible for preparing these agenda items, aiming to ensure efficient use of the radio spectrum and satellite orbit systems and networks.

Non‑geostationary satellite orbit (non‑GSO) systems are one of the top priorities on the WRC‑23 agenda.

First, coexistence must be ensured between non‑GSO and geostationary satellite orbit (GSO) systems, with protection being ensured for both kinds of satellites. This requires accurate calculations of potential interference to and from non‑GSOs, allowing possible modifications to non‑GSO systems to be considered where needed.Improved rules for non‑GSOs should also cover those on orbital tolerances. These will be treated under the conference’s agenda items for satellite services (7A), milestone reporting (7B), and aggregate interference to GSOs (7J), along with a functional description for software tools to determine non‑GSO fixed-satellite service (FSS) system or network conformity (ITU–R Recommendation S.1503).

Satellite operators expect decisions at WRC‑23 to provide maximum flexibility in the use of spectrum allocations for certain purposes.

These include: earth stations in motion (ESIM) in the FSS, under agenda items 1.15 and 1.16; inter-satellite communications in the FSS, item 1.17; and FSS in the existing broadcasting-satellite service (BSS), item 1.19.

WRC‑23 discussions on these topics will aim to allow for more efficient spectrum use than is currently the case.

Amid rapid satellite development in recent years, non‑GSO systems have been deployed on a large scale. At the same time, new high-capacity satellites have gone into geostationary orbit.

On the regulatory side, the addition of a satellite component to the International Mobile Telecommunications (IMT‑2020) ecosystem has enabled satellite usage in cellular networks, along with new satellite services and other innovations.

Member States of the International Telecommunication Union (ITU) are increasingly raising the issue of sustainability, equitable access, and the rational use of GSO and non‑GSO spectrum resources. Resolution 219 of the ITU Plenipotentiary Conference (Bucharest, 2022) reflects these concerns.

WRC‑23 needs to continue giving high priority to establishing equitable access to satellite orbits. This means recognizing the special needs of developing countries, often including geographical challenges.

The development of innovative satellite technologies has now moved significantly ahead of regulations in the use of radio-frequency spectrum and satellite orbits. As this gap continues widening, ITU must find new approaches to keep international satellite regulation timely and relevant for the industry.

Technology is advancing so rapidly that some operators have begun to introduce new satellite technologies using GSO and non‑GSO satellites without waiting for conference decisions to regulate such use. Moreover, national administrations sometimes grant authorization for such uses in the absence of internationally agreed rules.

Concerns are growing about derogations from the ITU Radio Regulations, particularly under 4.4 of Article 4 — which allows national administrations to assign frequencies exceptionally, outside the Table of Frequency Allocations and other treaty requirements, as long as such assignments do not cause harmful interference to any existing radio services.

The conference will consider how to deal with the widespread use of 4.4, for non‑coordinated satellite networks. It should also clarify whether the derogation option under 4.4 should be available for all radio systems, or only non‑commercial systems.

Overall, WRC‑23 must clarify how administrations use the provision, when they have the right to invoke it, and which specific circumstances justify exceptional use of 4.4 on a temporary basis.

The Radio Regulations, containing the rules and regulations for the use of the radio-frequency spectrum and satellite orbits, are updated approximately every four years, in line with ITU’s associated conference cycle.

Perhaps the time has come to think about reducing the number of years between World Radiocommunication Conferences and simplifying the preparatory cycle and associated documentation. One way forward could be to reassess the current Conference Preparatory Meeting (CPM) format and to consider merging the two CPM sessions into one.

Given the rapid growth, transformation and innovation phase the satellite industry is now going through, WRC‑23 should instruct the ITU Radiocommunication Sector to conduct urgent studies on the potential for reusing frequency bands allocated to mobile services for non‑GSO satellite systems.

National administrations, as well as companies and organizations taking part as ITU Sector Members, need to jointly address these new issues, strengthen the ITU–R framework, and pursue global solutions for the benefit of all.

References:

Amazon launches first Project Kuiper satellites in direct competition with SpaceX/Starlink

Juniper Research: 5G Satellite Networks are a $17B Operator Opportunity

New developments from satellite internet companies challenging SpaceX and Amazon Kuiper

SatCom market services, ITU-R WP 4G, 3GPP Release 18 and ABI Research Market Forecasts

KDDI Partners With SpaceX to Bring Satellite-to-Cellular Service to Japan

European Union plan for LEO satellite internet system

GSMA- ESA to collaborate on on new satellite and terrestrial network technologies

ABI Research and CCS Insight: Strong growth for satellite to mobile device connectivity (messaging and broadband internet access)

Telstra partners with Starlink for home phone service and LEO satellite broadband services

FT: A global satellite blackout is a real threat; how to counter a cyber-attack?

Spark New Zealand partnering with Lynk Global to offer a satellite-to-mobile service

European Space Agency & UK Space Agency chose EnSilica to develop satellite communications chip for terminals

UK based EnSilica, a fabless ASIC and mixed signal chip maker, has announced a contract to develop a new chip to address the next generation of mass market satellite broadband user terminals.

The contract has been awarded through the European Space Agency’s (ESA) Advanced Research in Telecommunications Systems Core Competitiveness program (“ARTES CC”), through the support of the UK Space Agency.

The chip in development will enable a new generation of lower-cost, low-power satellite broadband user terminals, which track the relative movement of low-earth orbit satellites and allow users to access high bandwidth connectivity when out of reach of terrestrial networks.

Use cases include satellite communication-on-the-move (SOTM) for automotive, maritime, and aerospace connectivity as well as extending broadband access to users without internet access.

Dietmar Schmitt, Head of Technologies & Products Division at ESA, said “ESA is pleased to continue our collaboration with EnSilica through the ARTES Core Competitiveness programme and to support this important technology development, which will facilitate the provision of high capacity connectivity across a wide range of use cases.”

Henny Sands, Head of Telecoms at the UK Space Agency, described EnSilica’s satellite broadband user terminals chip as “a brilliant example of the diversity of expertise in the UK’s leading satellite communications sector.”

Henny added: “Through the ARTES CC programme the UK Space Agency aims to champion UK companies that have the right expertise and ambition to become global players in this market and lead on ground-breaking technologies that will enhance the wider UK space sector, create jobs and generate further investment. That’s why we recently announced £50 million of funding for ambitious and innovative projects that will supercharge the UK’s satellite communications industry.”

Paul Morris, VP RF and Communications BU, commented: “We are delighted to be continuing our successful partnerships with both UKSA and ESA to further develop innovative semiconductor solutions for the next generation of satellite broadband user terminals.”

…………………………………………………………………………………………………………………………………………………………………

About EnSilica:

EnSilica is a leading fabless design house focused on custom ASIC design and supply for OEMs and system houses, as well as IC design services for companies with their own design teams. The company has world-class expertise in supplying custom RF, mmWave, mixed signal and digital ICs to its international customers in the automotive, industrial, healthcare and communications markets. The company also offers a broad portfolio of core IP covering cryptography, radar, and communications systems. EnSilica has a track record in delivering high quality solutions to demanding industry standards. The company is headquartered near Oxford, UK and has design centres across the UK and in India and Brazil.

Recent ASICs and Case Studies:

- 40nm Ka-band transceiver and beamformer for satellite terminals

- 180nm BCD H-bridge controller for automotive chassis control

- 55nm low-power mobile phone sensor interface

- 180nm BCD industrial MCU for safety critical applications

- 180nm BCD multi-channel 2GHz phase controller 600nm gyro sensor amplifier

- 28nm audio processor for smart microphone

- 28nm multi-standard GNSS receiver

- 40nm multi-standard analog and digital broadcast receiver

- 40nm 60GHz Radar sensor 65nm medical vital signs sensor with 2.4GHz radio

- 40nm NFC energy harvesting processor

About ESA’S ARTES Core Competitiveness Program:

ESA’s ARTES (Advanced Research in Telecommunications Systems)

program is unique in Europe and aims to support the competitiveness of European and Canadian industry on the world market. Core Competitiveness is dedicated to the development, qualification and demonstration of products (“Competitiveness and Growth”), or long-term technology development (“Advanced Technology”). Products in this context can be equipment for the platform or payload of a satellite, a user terminal, or a full telecom system integrating a network with its space segment.

China to build ground stations in Antartica to support ocean monitoring satellites

China, only the third country to put a man in space after the Soviet Union and United States, is to build ground stations on Antarctica to back its network of ocean monitoring satellites, state media said on Thursday.

Renders of the 43.95 million yuan ($6.52 million) project show four radome-covered antennas at China’s Zhongshan research base in East Antarctica. It is unknown if these are new and additional to antennas already established at the base.

The antennas will assist data acquisition from Chinese satellites that orbit in polar and near-polar orbits. Satellites in these orbits are visible near the poles multiple times a day, allowing more frequent opportunities for downlink than with stations at lower latitudes.

China has already launched eight Haiyang series ocean observation satellites into sun-synchronous orbits between 2002 and 2021, and plans more in the coming years. The first new-generation Haiyang-3 satellite is scheduled for launch this year, according the China’s main space contractor, CASC.

………………………………………………………………………………………………………………………………………………………………….

China Satellites and Balloons used for Espionage?

China’s global network of ground stations to support a growing number of satellites and outer space ambitions has drawn concern from some nations that it could be used for espionage, a suggestion China rejects.

In 2020, Sweden’s state-owned space company, which had provided ground stations that helped fly Chinese spacecraft and transmit data, declined to renew contracts with China or accept new Chinese business due to “changes” in geopolitics.

The United States military shot down a Chinese spy balloon on Saturday that had spent the last week traversing the country. The balloon, which spent five days traveling in a diagonal southeast route from Idaho to the Carolinas, had moved off the coast by midday Saturday and was shot down within moments of its arrival over the Atlantic Ocean.

One of two F-22 fighter jets from Langley Air Force Base fired a Sidewinder air-to-air missile, downing the balloon, which was flying at an altitude of 60,000 to 65,000 feet. The F-22s were at 58,000 feet, with other American fighters in support.

In announcing the cancellation of his trip to China, U.S. Secretary of State, Antony J. Blinken said the entry of the spy balloon was a “clear violation of U.S. sovereignty and international law.”

………………………………………………………………………………………………………………………………………………………………….

China Aerospace Science and Technology Group Co. is to build the stations at the Zhongshan research base, one of two permanent Chinese research stations on Antarctica, after winning the tender with its 43.95 million yuan ($6.53 million) bid, state-controlled China Space News reported.

Liftoff of a Long March 2C from Taiyuan carrying the Haiyang-1D ocean observation satellite on June 10, 2020. Image Credit: CASC

No technical details of the project were given in the report, though China Space News published two accompanying illustrations of an artist’s rendering that shows four ground stations at Zhongshan, located by Prydz Bay in East Antarctica, south of the Indian Ocean.

The project was part of broader initiatives aimed at building China’s marine economy and turning China into a marine power, according to China Space News.

References: