SATCOM as a Service

KDDI unveils AU Starlink direct-to-cell satellite service

KDDI-owned AU [1.] launched Japan’s first direct satellite service, connecting 40% of remote island and mountain populations in Japan that terrestrial networks cannot now reach. The new service, called AU Starlink Direct, is also available to subscribers of Okinawa Cellular, a KDDI-owned company serving the group of islands located in southern Japan. KDDI and Okinawa Cellular will start providing AU Starlink Direct, a direct to cell service between satellites and AU smartphones, on April 10, 2025. This is the first Direct to Cell satellite service in Japan.

Note 1. AU is a brand marketed by KDDI in the main islands of Japan and by Okinawa Cellular in Okinawa for their mobile cellular services. acquired au in 2001, initially through a merger of DDI, KDD, and IDO, and subsequently absorbing au’s parent company. KDDI continues to operate the AU brand for its mobile services.

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

The service is compatible with 50 smartphone models and is available free of charge to au users from today for the time being without the need to apply. Subscribers of AU and Okinawa Cellular whose iPhone and Android devices support satellite mode can try the service.

Source: Sean Prior/Alamy Stock Photo

Although AU has nearly 100% population coverage, mobile operators’ 4G and 5G networks effectively serve only about 60% of the population because mobile signal cannot reach remote islands and mountainous areas. The new AU Starlink Direct service allows the operator to bridge this digital divide by enabling customers in these dead zones to connect directly to a Starlink satellite using compatible smartphones.

The service can be used to communicate with family members and friends, in emergencies, etc., even in mountainous areas, island areas, and campgrounds and at sea where it is difficult to provide a telecommunications environment. KDDI is expanding the AU coverage area to all of Japan to bring the experience of “Connecting the Unconnected. wherever you see the sky.”

Gwynne Shotwell, President & COO of SpaceX, said: “I’m very excited to bring direct-to-cell phone connectivity to Japan through KDDI, the first in Asia and one of the first in the world. Both Starlink and direct-to-cell are game-changing technologies, making connecting the unconnected simple and bringing potentially life-saving capability to the people of Japan for disaster and other emergency responses.”

KDDI conducted a successful field test of AU Starlink Direct in Kumejima, Okinawa Prefecture, nearly six months ago.

References:

https://newsroom.kddi.com/english/news/detail/kddi_nr-533_3818.html

https://newsroom.kddi.com/english/news/detail/kddi_nr-299_3557.html

KDDI Partners With SpaceX to Bring Satellite-to-Cellular Service to Japan

SpaceX and KDDI to test Satellite Internet in Japan

KDDI Deploys DriveNets Network Cloud: The 1st Disaggregated, Cloud-Native IP Infrastructure Deployed in Japan

AWS Integrated Private Wireless with Deutsche Telekom, KDDI, Orange, T-Mobile US, and Telefónica partners

Samsung and KDDI complete SLA network slicing field trial on 5G SA network in Japan

KDDI claims world’s first 5G Standalone (SA) Open RAN site using Samsung vRAN and Fujitsu radio units

Samsung vRAN to power KDDI 5G network in Japan

Standards are the key requirement for telco/satellite integration: D2D and satellite-based mobile backhaul

At the Satellite 2025 conference in Washington DC, Analysys Mason Research Director Lluc Palerm moderated a panel session discussing Direct to Device (D2D) and satellite mobile backhaul. Market forecasts have been impressive. Analysys Mason says investments in the satellite communications industry from AT&T, Google, Vodafone, Apple “could well surpass $20 billion in 2025.” The market research firm believes annual satellite telecoms service revenue will reach $165 billion by 2033.

Indeed, many analysts believe that the 3GPP non-terrestrial networks (NTN) specification work will facilitate new markets and opportunities, lowers costs, and provides seamless mobility sought by certain markets, such as first responders, military and aviation. Airbus is leading by example, as demonstrated in its deployment of 5G NTN over OneWeb LEO satellites and chips from MediaTek.

- Amina Boubendir, PhD, head of research and standardization for Airbus Defense and Space, shared an update on related 3GPP specification work during the session. She pointed out that in 3GPP Releases 17, 18 and (forthcoming) 19 and 20, the work has progressed from IoT to broadband to low-earth orbit (LEO) satellites. “LEO comes into the integration between terrestrial and non-terrestrial network (NTN) in Release 19, and both IoT and broadband are being covered as we move with the community into Release 20,” Boubendir said.

- Jean-Philippe Gillet, Vice President and General Manager, Networks Intelsat US, said that telcos and their suppliers are also pushing to integrate 5G NTN into future deployments, according to JP Gillet, SVP Intelsat. He said it’s not if but when. “The reality is mobile network operators are under tremendous pressure,” he said. “They need to drive innovation to stay relevant.”

- Telesat CMO Glenn Katz said the mobile backhaul market will reach $600 billion in the mid-2030s and that Telesat expects to capture its share of that total by continuing to focus on carrier applications in the enterprise, maritime, aviation and government markets. Telesat has already run Release 19 on its test LEO satellite – Katz said where these efforts lead commercially remains an open question. “We can’t close the business case on how much it’s going to cost to put those specific types of technologies on a satellite,” he added. “We’re a carrier’s carrier. I think some of us in the industry need to continue to think that way. Those telcos are giant. We’re not going to take business from them. We have to be complimentary.”

- Nikola Kromer, VP Product Marketing, ST Engineering iDirect said there are other requirements. “So, it’s not just the 5G NTN standard that we need,” she said. In particular, she mentioned the Digital Intermediate Frequency Interoperability (DIFI) Consortium and the Waveform Architecture for Virtualized Ecosystems (WAVE) Consortium. ST Engineering iDirect announced a subscription-based model, Intuition Unbound, offering operations as a service (OaaS) and platform as a service (PaaS). According to ST Engineering, the selling point is that satellite providers and telcos can subscribe to a ground network service and turn a massive capital spending outlay into smaller, more digestible monthly payments.

Standardization efforts such as DIFI are important to accelerate innovation, Boubendir said. “Telcos have already gone through this digitalization process. The space industry, I would say, has to catch up.” Building out new systems in cloud-native environments is a challenge, especially if you want to be efficient and fast.

Illustration of the classes of orbits of satellites [source: 3GPP TR 22.822]

………………………………………………………………………………………………………………………………………………………………………………………………

5G NTN and Status in ITU-R WP 4B:

ITU-R Working Party 4B (WP 4B) is responsible for recommendations related to: systems, air interfaces, performance and availability objectives for FSS, BSS and MSS, including IP-based applications and satellite news gathering. Many analysts believe NTNs will be an essential component of 6G/IMT-2030. ITU-R, the official standards body for IMT (all the Gs) envisions 6G networks to deliver intelligent, seamless connectivity that supports reliable, sustainable, and resilient communications. To achieve this vision, NTNs represent a significant advancement by extending connectivity beyond the Earth’s surface. These networks integrate advanced communication technologies that go beyond conventional terrestrial infrastructure, enabling comprehensive global connectivity across domains such as the Internet, Internet of Things (IoT), navigation, disaster recovery, remote access, Earth observation, and even scientific initiatives like interplanetary communication.

An October 28, 2024 4B Working document is a related preliminary draft new Report ITU-R M.[SAT IOT] – Technical and operational aspects of satellite Internet of Things (IoT) applications. This document is intended as a snapshot of evolving satellite IoT technologies and practices. Satellite IoT encompasses a variety of technologies that have been in use for decades, yet continue to evolve rapidly. The information presented reflects the state of the industry as of the date of this Report and is subject to change. The purpose of this report is to provide an overview of the current and emerging satellite IoT applications and their technical and operational aspects. It is also noted that the implementation of [current and emerging] satellite IoT does not require specific regulatory provisions in the Radio Regulations, and this Report does not address any spectrum requirements and technical requirements for satellite IoT applications, and does not preclude future technologies.

At it’s October 2024 meeting, Sub-Working Group (SWG) 4B1 dealt with satellites in Next Generation Access Technologies. 4B1 started work on a preliminary draft new Recommendation ITU-R M.[IMT 2020-SAT.SPECS]. That proposed ITU-R Recommendation will identify satellite radio interface technologies of International Mobile Telecommunications-2020 (IMT-2020) and provides the detailed radio interface specifications. SWG 4B1 first focused on reviewing the Final Evaluation Reports on the proposed candidate IMT-2020 satellite radio interface technologies and preparing responses back to 3GPP and feedback to the Independent Expert Groups as well as other IMT-2020 matters.

At 4B’s Shanghai, China 30 April – 6 May, 2025 meeting, received contributions will be considered in an attempt to finalize the working document, elevate it to Draft New Recommendation and send it to SG 4 plenary for approval. It is highly unlikely all that can be done in a single ITU-R WP meeting so that objective is unrealistic in this author’s opinion!

Separately, a proposed work plan for the future development of satellite IMT-2030 – Work plan, timeline, process and deliverables for the future development of satellite IMT-2030 was started. These are necessary to provide the expected ITU-R outcomes of evolved satellite IMT in support of the next generation of mobile communications systems beyond IMT-2020, around the 2030 timeframe. Circular Letter(s) are expected to be issued at the appropriate time(s) to announce the invitation for submitting formal proposals and other relevant information. The deliverable backgrounds and processes together with the Circular Letter(s) will describe the comprehensive methodology for developing technology proposals for satellite IMT-2030. WP 4B plans to hold a workshop on IMT‑2030, focusing on satellite radio interfaces.

In summary, it appears the NTN specification work is ONLY being done in 3GPP which will liase relevant documents to 4B in preparation for their ITU-R NTN 5G and 6G Recommendations.

References:

https://www.analysysmason.com/events-and-webinars/events/satellite-2025/

https://www.analysysmason.com/about-us/news/predictions-2025/telco-investment-space/

https://www.3gpp.org/technologies/ntn-overview

Momentum builds for wireless telco- satellite operator engagements

5G connectivity from space: Exolaunch contract with Sateliot for launch and deployment of LEO satellites

Satellite 2024 conference: Are Satellite and Cellular Worlds Converging or Colliding?

China Telecom and China Mobile invest in LEO satellite companies

5G connectivity from space: Exolaunch contract with Sateliot for launch and deployment of LEO satellites

SatCom market services, ITU-R WP 4G, 3GPP Release 18 and ABI Research Market Forecasts

FCC: More competition for Starlink; freeing up spectrum for satellite broadband service

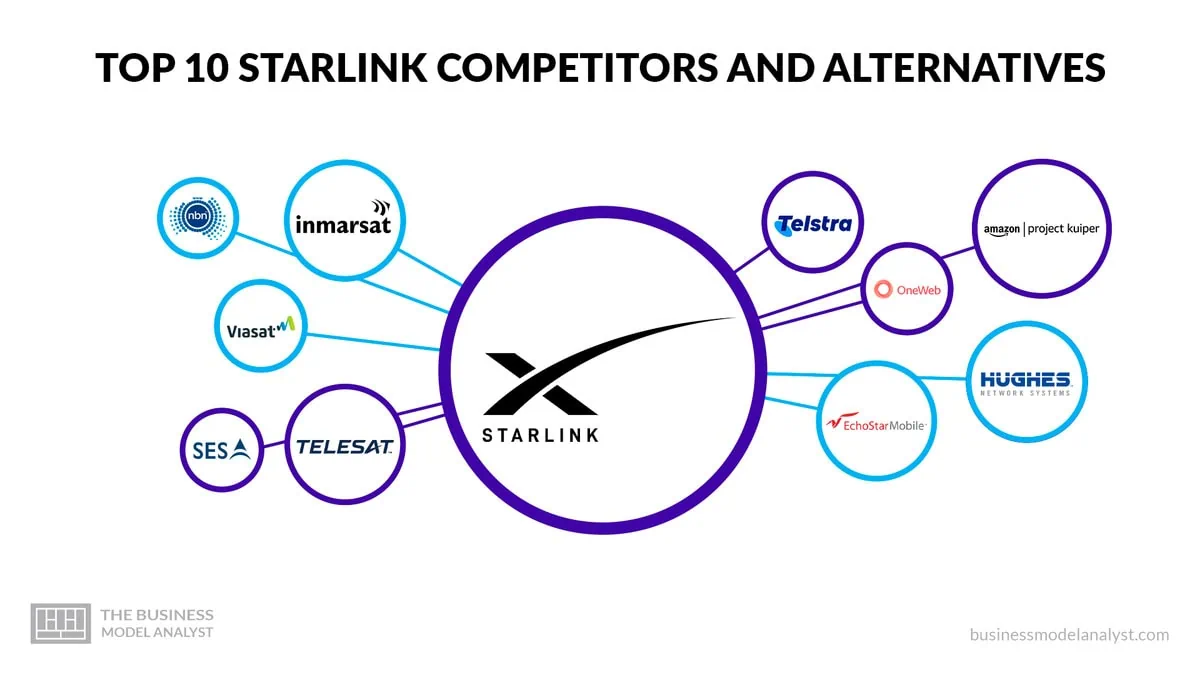

More Competition for Starlink Needed:

FCC chairwoman Jessica Rosenworcel said Wednesday that she wants to see more competition for SpaceX‘s internet satellite constellation Starlink. Starlink (owned by SpaceX, which provides launch services) controls nearly two thirds of all active satellites and has launched about 7,000 satellites since 2018. Rosenworcel said at a conference Wednesday that Starlink has “almost two-thirds of the satellites that are in space right now and has a very high portion of (satellite)) internet traffic… Our economy doesn’t benefit from monopolies. So we’ve got to invite many more space actors in, many more companies that can develop constellations and innovations in space.”

Starlink competitors include:

OneWeb is a solid alternative to Starlink’s satellite internet service by offering similar capabilities and coverage. The company plans to launch a constellation of approximately 650 satellites to provide seamless broadband connectivity to users worldwide, including remote and underserved areas. By operating in low-earth orbits (LEO), OneWeb’s satellites can offer low latency and high-speed internet access, suitable for a wide range of commercial, residential, and governmental applications. OneWeb’s satellites will be deployed in polar orbit, allowing them to cover even the Earth’s most remote regions. This global coverage makes OneWeb an attractive option for users who require internet connectivity in areas where traditional terrestrial infrastructure is limited or unavailable.

Viasat has a fleet of satellites in geostationary orbit, allowing it to provide internet services to customers in remote and rural areas. This coverage is essential for customers living in areas with limited terrestrial internet options. In addition to its satellite coverage, Viasat also offers competitive internet speeds. The company’s satellite technology allows fast and reliable internet connections, making it a viable alternative to traditional wired internet providers. This is especially beneficial for customers who require high-speed internet for activities such as streaming, online gaming, or remote work.

Telesat offers a wide range of satellite services tailored to different industries and applications. Telesat’s satellite fleet includes geostationary satellites, low-earth orbit (LEO) satellites, and high-throughput satellites (HTS), allowing it to deliver high-speed internet connectivity, broadcast services, and backhaul solutions to customers in remote and underserved areas. Telesat has extensive coverage and capacity in terms of satellite internet services. They have a strong presence in North America, South America, Europe, the Middle East, and Africa, making their services accessible to millions of users.

Telstra’s extensive network infrastructure and coverage make it a strong competitor to Starlink. The company operates a vast network of undersea cables, satellites, and terrestrial infrastructure, which enables it to provide reliable and high-speed connectivity across Australia and beyond. Telstra also has a solid customer base and brand recognition in the telecommunications industry, which gives it a competitive advantage. One of the critical business challenges that Telstra poses to Starlink is its established presence and dominance in the Australian market. Telstra has a significant market share and customer base in Australia, which gives it a strong foothold in the telecommunications industry. This makes it more difficult for Starlink to penetrate the market and attract customers away from Telstra. In addition, Telstra’s network coverage and infrastructure in remote and rural areas of Australia are competitive advantages.

Project Kuiper is backed by Amazon’s vast resources and infrastructure. Amazon’s deep pockets and logistics and cloud services expertise give Project Kuiper a decisive advantage in deploying and scaling its satellite network. By providing affordable and accessible broadband services, Project Kuiper intends to empower individuals, businesses, and communities with the opportunities and resources that come with internet access. With a constellation of low-earth orbit (LEO) satellites, Project Kuiper plans to deliver high-speed internet connectivity to areas with limited traditional terrestrial infrastructure.

Hughes Network System has a strong foothold in the market, particularly in rural areas with limited terrestrial broadband options. The company’s HughesNet service utilizes geostationary satellites to provide internet connectivity, offering up to 100 Mbps for downloads.

Inmarsat offers a range of satellite-based communication solutions that cater to its customers’ diverse needs. One key area where Inmarsat differentiates itself is its focus on mission-critical applications. The company’s satellite network is designed to provide uninterrupted and reliable connectivity, even in the most remote and challenging environments. Inmarsat’s portfolio includes services such as voice and data communications, machine-to-machine connectivity, and Internet of Things (IoT) solutions. The company’s satellite network covers most of the Earth’s surface, ensuring its customers can stay connected wherever they are.

Freeing Up Spectrum to Support Satellite Broadband Service:

At the FCC’s September 26th Open Commission Meeting, the Commission will consider a Report and Order that will provide 1300 megahertz of spectrum in the 17 GHz band for non-geostationary satellite orbit (NGSO) space stations in the fixed-satellite service (FSS) while also protecting incumbent operations. The Order provides a more cohesive global framework for FSS operators and maximizes the efficient use of the 17 GHz band spectrum. (IB Docket No. 22-273).

………………………………………………………………………………………………………………………………….

References:

https://www.fcc.gov/september-2024-open-commission-meeting

https://businessmodelanalyst.com/starlink-competitors/

SpaceX launches first set of Starlink satellites with direct-to-cell capabilities

Starlink Direct to Cell service (via Entel) is coming to Chile and Peru be end of 2024

SpaceX has majority of all satellites in orbit; Starlink achieves cash-flow breakeven

Starlink’s Direct to Cell service for existing LTE phones “wherever you can see the sky”

Amazon launches first Project Kuiper satellites in direct competition with SpaceX/Starlink

Momentum builds for wireless telco- satellite operator engagements

Over the past two years, the wireless telco-satellite market has seen significant industry-wide growth, driven by the integration of Non-Terrestrial Networks (NTN) in 5G New Radio as part of 3GPP Release 17. GSMA Intelligence reports that 91 network operators, representing about 5 billion global connections (60% of the total mobile market), have partnered with satellite operators. Although the regulatory landscape and policy will influence the commercial launch of these services in various regions, the primary objective is to achieve ubiquitous connectivity through a blend of terrestrial and non-terrestrial networks.

Recent developments include:

- AT&T and AST SpaceMobile have signed a definitive agreement extending until 2030 to create the first fully space-based broadband network for mobile phones. This summer, AST SpaceMobile plans to deliver its first commercial satellites to Cape Canaveral for launch into low Earth orbit. These initial five satellites will help enable commercial service that was previously demonstrated with several key milestones. These industry first moments during 2023 include the first voice call, text and video call via space between everyday smartphones. The two companies have been on this path together since 2018. AT&T will continue to be a critical collaborator in this innovative connectivity solution. Chris Sambar, Head of Network for AT&T, will soon be appointed to AST SpaceMobile’s board of directors. AT&T will continue to work directly with AST SpaceMobile on developing, testing, and troubleshooting this technology to help make continental U.S. satellite coverage possible.

- SpaceX owned Starlink has officially launched its commercial satellite-based internet service in Indonesia and received approvals to offer the service in Malaysia and the Philippines. Starlink is already available in Southeast Asia in Malaysia and the Philippines. Indonesia, the world’s largest archipelago with more than 17,000 islands, faces an urban-rural connectivity divide where millions of people living in rural areas have limited or no access to internet services. Starlink secured VSAT and ISP business permits earlier in May, first targeting underdeveloped regions in remote locations.Jakarta Globe reported the service costs IDR750,000 ($46.95) per month, twice the average spent in the country on internet service. Customers need a VSAT (very small aperture terminal) device or signal receiver station to use the solution.Internet penetration in Indonesia neared 80% at the end of 2023, data from Indonesian Internet Service Providers Association showed. With about 277 million people, Indonesia has the fourth largest population in the world. The nation is made up of 17,000 islands, which creates challenges in deploying mobile and fixed-line internet nationwide.Starlink also in received approvals to offer the service in Malaysia and the Philippines. The company aims to enable SMS messaging directly from a network of low Earth orbit satellites this year followed by voice and data starting in 2025. In early January, parent SpaceX launched the first of six satellites to deliver mobile coverage.

- Space X filed a petition with the FCC stating that it “looks forward to launching commercial direct-to-cellular service in the United States this fall.” That will presumably be only for text messages, because the company has stated that ONLY text will available in 2024 via Starlink. Voice and data won’t be operational until 2025. Importantly, SpaceX did not identify the telco who would provide Direct-to Cell satellite service this fall.

In August 2022, T-Mobile and SpaceX announced their plans to expand cellular service in the US using low-orbit satellites. The service aims to provide direct-to-cell services in hard-to-reach and underserved areas such as national parks, uninhabited areas such as deserts and mountain ranges, and even territorial waters. Traditional land-based cell towers cannot cover most of these regions.

- SpaceX said that “supplemental coverage from space (“SCS”) will enable ubiquitous mobile coverage for consumers and first responders and will set a strong example for other countries to follow.” Furthermore, SpaceX said the “FCC should reconsider a single number in the SCS Order—namely, the one-size-fits-all aggregate out-of-band power flux-density (“PFD”) limit of -120 dBW/m2 /MHz that it adopted in the new Section 25.202(k) for all supplemental coverage operations regardless of frequency band.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………

References:

https://about.att.com/story/2024/ast-spacemobile-commercial-agreement.html

AT&T, AST SpaceMobile draw closer to sat-to-phone launch

Starlink sat-service launches in Indonesia

Space X “direct-to-cell” service to start in the U.S. this fall, but with what wireless carrier?

AT&T deal with AST SpaceMobile to provide wireless service from space

AT&T and satellite network provider AST SpaceMobile are teaming up to provide wireless service from space — a challenge to Elon Musk’s SpaceX, which struck a similar deal two years ago with T-Mobile US. AT&T and AST SpaceMobile formalized the partnership following an earlier testing period. They said on Wednesday that their agreement to build a space-based broadband network will run through 2030.

AT&T head of network Chris Sambar will join the AST SpaceMobile board, deepening a relationship that dates back to at least 2018. Sambar said in an interview that his team is confident in AST SpaceMobile’s technology, as demonstrated by the performance of the BlueWalker 3 test satellite. The relationship is moving from “loose partner to a strategic partner,” he said.

Wireless providers are in a race to offer connections for the world’s estimated 5 billion mobile phones when those devices are in remote areas beyond the reach of cell towers. For consumers, these services hold the promise of connectivity along rural roads and in places likes national parks. The service is typically marketed as a supplement to standard wireless coverage.

The new satellite network will work with ordinary mobile phones, offering a level of convenience that’s lacking in current call-via-satellite services, which require the assistance of bulky specialized equipment.

“Space-based direct-to-mobile technology is designed to provide customers connectivity by complementing and integrating with our existing mobile network,” said Jeff McElfresh, Chief Operating Officer, AT&T. “This agreement is the next step in our industry leadership to use emerging satellite technologies to provide services to consumers and in locations where connectivity was not previously feasible.”

“Working together with AT&T has paved the way to unlock the potential of space-based cellular broadband directly to everyday smartphones. We are thrilled to solidify our collaboration through this landmark agreement,” said Abel Avellan, AST SpaceMobile Founder, Chairman, and CEO. “We aim to bring seamless, reliable service to consumers and businesses across the continental U.S., transforming the way people connect and access information.”

AST SpaceMobile this summer will send five satellites to Cape Canaveral, Florida, for launch into low Earth orbit. AT&T’s Sambar didn’t say when service to customers might begin. “This will be a full data service, unlike anything you can get today from a low-Earth orbit constellation,” Sambar said.

T-Mobile is working with the low-Earth orbiting Starlink service from Musk’s Space Exploration Technologies Corp. The mobile carrier earlier said that its calling-via-satellite service could begin this year.

SpaceX has roughly 6,000 satellites aloft in low-Earth orbit — far more than any other company. The trajectory, with satellites circling near the Earth’s surface, allows communications signals to travel quickly between spacecraft and a terrestrial user.

SpaceX in January launched its first set of satellites capable of offering mobile phone service. The service “will allow for mobile phone connectivity anywhere on Earth,” Musk said in a post on X, the social network formerly known as Twitter, though he added that technical limitations mean “it is not meaningfully competitive with existing terrestrial cellular networks.”

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………

About AST SpaceMobile

AST SpaceMobile, Inc. is building the first and only global cellular broadband network in space to operate directly with standard, unmodified mobile devices based on our extensive IP and patent portfolio, and designed for both commercial and government applications. Our engineers and space scientists are on a mission to eliminate the connectivity gaps faced by today’s five billion mobile subscribers and finally bring broadband to the billions who remain unconnected. For more information, follow AST SpaceMobile on YouTube, X (formerly Twitter), LinkedIn and Facebook. Watch this video for an overview of the SpaceMobile mission.

References:

https://about.att.com/story/2024/ast-spacemobile-commercial-agreement.html

AST SpaceMobile: “5G” Connectivity from Space to Everyday Smartphones

AST SpaceMobile achieves 4G LTE download speeds >10 Mbps during test in Hawaii

AST SpaceMobile completes 1st ever LEO satellite voice call using AT&T spectrum and unmodified Samsung and Apple smartphones

AST SpaceMobile Deploys Largest-Ever LEO Satellite Communications Array

Satellite 2024 conference: Are Satellite and Cellular Worlds Converging or Colliding?

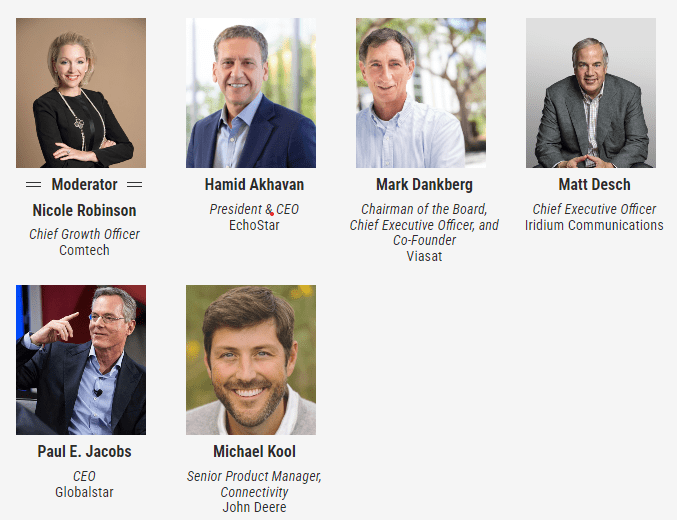

Converged terrestrial and satellite connectivity is a given, but the path is strewn with unknowns and sizable technological and business challengers, according to satellite operator CEOs. Hopefully, 3GPP Release 18 will contain the necessary specifications for it to be implemented as we explained in this IEEE Techblog post.

During Access Intelligence’s Satellite 2024 conference in Washington DC this week, Viasat CEO Mark Dankberg said satellite operators must start thinking and acting like mobile network operators, creating an ecosystem that allows seamless roaming among them. Terrestrial/non-terrestrial network (NTN) convergence requires “a complete rethinking” of space and ground segments, as well as two to three orders of magnitude improvement in data pricing, Dankberg said. Standards will help get satellite and terrestrial to fit together, but that evolution will happen slowly, taking 10 to 15 years, Iridium CEO Matt Desch said. It remains to be seen how direct-to-device services will make money, he added. Satellite-enabled SOS messaging on smartphones “is becoming free, and our satellites are not free — we need to make money on it some way,” Desch added.

The regulatory environment around satellite has changed tremendously during the past decade, with the FCC very oriented toward mobile networks’ spectrum needs and now satellite matters making up most of the agenda for the 2027 World Radiocommunication Conference, Desch said. However, there will be regulatory challenges to resolve in satellite/terrestrial convergence, he predicted. There are significant synergies in having a 5G terrestrial network and satcom assets under one roof, he said. Blurring the lines between terrestrial and non-terrestrial makes it easier for manufacturers to build affordable equipment that operates in both modes, Desch concluded.

That inevitable convergence is being driven by declining launch costs, maturing technologies and improved manufacturing, all of which make non-terrestrial network connectivity more economically competitive, said EchoStar CEO Hamid Akhavan. He said the EchoStar/Dish Network combination (see 2401020003) was driven in part by that convergence, consolidating EchoStar’s S-band spectrum holdings outside the U.S. with Dish’s S-band holdings inside the country. The deal also melds Dish’s network operator expertise with Hughes’ satellite expertise.

Wednesday Opening General Session: Are Satellite and Cellular Worlds Converging or Colliding?

To ensure space’s sustainability, missions must follow the mantra of “leave nothing behind,” sustainability advocates said. Space operators should have more universal protocols and vocabulary when exchanging space situational awareness data, as well as more uniformity in what content gets exchanged, said Space Data Association Executive Director Joe Chan. When it comes to space sustainability, clutter isn’t necessarily dangerous, and any rules fostering sustainability should avoid restricting the use of space, he said. Space lawyer Stephanie Roy of Perkins Coie said a mission authorization framework covering space operations that fall outside the regulatory domain of the FCC, FAA and NOAA is needed. Space operators and investors see sustainability rules as inevitable and want to ensure they allow flexibility and don’t mandate use of any particular technology, she added. Many speakers called for a “circular economy” in space, with more reuse of materials via refueling, reuse or life extension.

Separately, space sustainability advocates urged a mission authorization regulatory framework and universal use of design features such as docking plates enabling on-orbit serving or towing. Meanwhile, conference organizers said event attendance reached 14,000.

Also, ITU Secretary-General Doreen Bogdan-Martin urged the satellite industry to join ITU’s Partner2Connect digital coalition aimed at addressing digital divide issues, particularly in the least-developed nations and in landlocked and small island developing countries. The digital divide “is right up there” with climate change as a pressing issue for humanity, said Bogdan-Martin. She noted the coalition has received $46 billion in commitments, with a target of $100 billion by 2026.

References:

https://communicationsdaily.com/article/view?BC=bc_65fb60473d5de&search_id=836928&id=1911572

ABI Research and CCS Insight: Strong growth for satellite to mobile device connectivity (messaging and broadband internet access)

SatCom market services, ITU-R WP 4G, 3GPP Release 18 and ABI Research Market Forecasts

https://www.3gpp.org/specifications-technologies/releases/release-18

Orange France satellite Internet based on Eutelsat Konnect VHTS satellite

Orange France has expanded its range of connectivity offerings to include satellite Internet in its technology mix, alongside fiber, ADSL, 4G and 5G Home FWA. This new Satellite offering from Orange is aimed at customers who are not eligible for fiber and those with ADSL speeds of less than 8 Mbps. It is marketed through Orange’s distribution channels and operated by Nordnet, an Orange subsidiary company that has been specializing in satellite Internet for 15 years.

This offer is part of the French government’s Cohésion Numérique des Territoires (Digital Cohesion of Regions) program, and meets the government’s objective of guaranteeing access to superfast broadband (greater than 30 Mbps) for all by 2025.

Homes without good wired broadband can benefit from a subsidy to access a better connection via wireless technology.

An offer based on the expertise of the French and European space industry:

This offer is based on the Eutelsat Konnect VHTS satellite, designed by Thalès Alenia Space in Cannes and launched by on Ariane 5 in September 2022. Weighing 6.5 tons and measuring 9 meters in height, Eutelsat Konnect VHTS is the largest European satellite ever designed. It is part of the new generation of electric propulsion satellites [3] launched from the all-electric platform built by Spacebus NEO, with the financial support of the European Space Agency and the Centre National d’Etudes Spatiales (French Space Agency).

Konnect VHTS | Broadband Satellites | Eutelsat

……………………………………………………………………………………………………………………….

For €49.99 per month (with the first month free), customers of this satellite offer can enjoy unlimited superfast broadband with a connection speed of up to 200 Mbps downstream and 15 Mbps upstream [1]. This offer requires no change of phone number and includes unlimited calls to landlines in mainland France and 50 other destinations [2] as well as calls to mobiles in mainland France and eight other destinations.

After subscribing, customers will receive a Satellite Kit, which they can install by themselves or with the help of Nordnet and its network of specialist installation partners. The Satellite Kit can be purchased for €299 or rented for €8/month. Nordnet’s installation kit option costs €299, with a one-year warranty.

Jean-François Fallacher, Executive Vice President, CEO Orange France: “The launch of Orange Satellite with Nordnet is another step towards the deployment of superfast broadband for everyone, everywhere in mainland France. At Orange, we’re proud to be able to offer all our customers a superfast broadband access solution thanks to our technology mix. Our range of connectivity offers now includes satellite, in addition to 4G and 5G Home, fiber and ADSL. This new offer responds to the needs of the French population, whatever their connectivity requirements, even in the most remote areas.”

NOTES:

[1] Offer in mainland France subject to eligibility. 12-month commitment. Maximum theoretical speeds. Details on orange.fr. €35 set-up fee & €15 equipment delivery fee

[2] List of destinations on nordnet.com

[3] The satellite’s environmental footprint is reduced thanks to its 100% electric propulsion, which is less polluting than previous propulsion systems using chemicals.

References:

https://newsroom.orange.com/orange-launches-its-satellite-offer/?lang=fr

https://www.eutelsat.com/en/satellites/2-7-east.html

Orange Business tests new 5G hybrid network service in France

AWS Integrated Private Wireless with Deutsche Telekom, KDDI, Orange, T-Mobile US, and Telefónica partners

Economic Times: Qualcomm, MediaTek developing chipsets for Satcom services

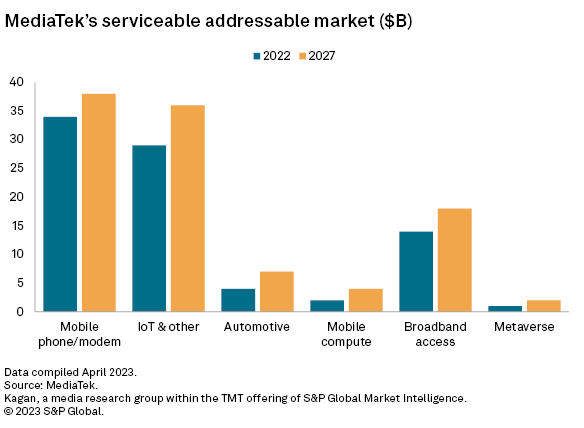

Over the next few years,, consumers can expect to use their mobile phones for satellite communications, including for calls, messages and broadband data, as the broadband from-space service gains pace.

Currently, satcom through mobile devices is primarily used for coverage in emergency text messages. However, it’s expected that in a few years, both phone calls and broadband internet will be available with new mobile phones. There are now 5-6 devices available in the market globally, including the iPhone 14 and 15 models, that support satellite connectivity. Going forward, more OEMs are expected to incorporate Satcom technology.

Leading chipmakers Qualcomm and MediaTek said they have already developed chipsets supporting satellite connectivity.

“Right now, it’s catering to the niche market, but we expect that eventually it will cater to the mainstream consumers and businesses,” MediaTek India managing director Anku Jain told Economic Times. MediaTek has adhered to the 3GPP specs for designing satcom chipsets so that there is interoperability in the long run, he said. “For the technology to become mainstream, more and more OEMs (original equipment manufacturers) need to adopt it and we will see how that happens. “From MediaTek point of view, we are ready with the solution,” Jain added.

……………………………………………………………………………………………………………………………………………………………………………………………………………………………….

“The technology is already there, and we have the chips to support direct-to-device satcom services,” Qualcomm India president Savi Soin told ET.

Asked about the opportunity in India, Soin said while the technology is available, standards are the key. “The question is who will provide the (satellite) constellation and is that constellation compliant with India,” he said. NOTE THAT THERE IS NO CURRENT WORK IN ITU-R TO STANDARDIZE SATCOM SERVICES- ALL THE WORK IS BEING DONE BY 3GPP!

In January, Qualcomm and Iridium entered into an agreement to bring satellite-based connectivity to next-generation premium Android smartphones. Garmin looks forward to collaborating with support for emergency messaging.

If the majority of satellite operators and OEM makers adopt global open standards, there would be better interoperability. But if players adopt propriety standards, it would be difficult to predict how the market would shape up, experts said.

Currently, satellite constellation providers like Starlink, Amazon Kuiper, OneWeb, etc. are pushing for their standards and it all depends on how the market evolves as satellite constellations deployment by the satellite internet providers are completed.

–>Please refer to references below.

References:

SatCom market services, ITU-R WP 4G, 3GPP Release 18 and ABI Research Market Forecasts

Juniper Research: 5G Satellite Networks are a $17B Operator Opportunity

Starlink’s Direct to Cell service for existing LTE phones “wherever you can see the sky”

Samsung announces 5G NTN modem technology for Exynos chip set; Omnispace and Ligado Networks MoU

Starlink’s Direct to Cell service for existing LTE phones “wherever you can see the sky”

Satellite internet provider Starlink, owned by SpaceX, has quietly started advertising its “Direct to Cell” service on its website, promising connectivity to existing LTE phones “wherever you can see the sky.”

No changes to hardware, firmware, or special apps are required, providing seamless access to text, voice, and data. Starlink will offer text services in 2024, followed by voice, data and IoT connectivity in 2025.

Subscribers will be able to use their existing LTE phone to tap into the satellite service, the obvious benefit being if you are out in the wilderness somewhere without terrestrial coverage.

Source: Starlink

…………………………………………………………………………………………………………………………………………………………………………

Direct to Cell satellites will initially be launched on SpaceX’s Falcon 9 rocket and then Starship. On orbit the satellites will immediately connect over laser backhaul to the Starlink constellation to provide global connectivity.

Starlink satellites with Direct to Cell capability are loaded with an eNodeB modem that acts like a cellphone tower in space, ‘allowing network integration similar to a standard roaming partner.’

In August last year, at SpaceX’s launch facility, Elon Musk and T-Mobile CEO Mike Sievert announced ‘Coverage Above and Beyond’ a joint project which promised to ‘bring cell phone connectivity everywhere.’

The project appears to have experienced a name change in the intervening time, and additional operator partners are now listed on the new webpage as Optus in Australia, Rogers in Canada, One NZ in New Zealand, KDDI in Japan, and Salt in Switzerland.

As was the case with that initial launch, the details of what level of connectivity might be possible using this method remains vague – there was no actual announcement or press release for service which might have yielded such specifics.

Peter Kibutu, Advanced Technology Lead – NTNs at TTP told Telecoms.com: “Starlink continues to set ambitious targets for its satellite network, however, its plans to deliver a direct-to-cell service requires scrutiny. Offering connectivity supported by unmodified 4G handsets might only result in low-bandwidth data and voice services, falling short of contemporary data demands and user experience.

“Delivering satellite connectivity akin to what we can experience today on 4G and 5G devices will require the 3GPP-compliant 5G NR NTN waveform, which is continuously optimised to maximise the performance of direct to handset services over LEO satellite constellations. Starlink has made it clear that it will continue to use its own proprietary technology which, while providing it with speed to market, could present roadblocks in years to come as it struggles to support high-performance connectivity services and use cases that will be readily available via other satellite operator’s 5G NTN networks. It will be interesting to see if Starlink will also be looking to develop services that leverage industry best practices and incorporate a wider ecosystem.”

There are no details on pricing or any other details, so we really don’t know exactly what Starlink Direct to Satellite service entails and how it compares to rival satellite connectivity ventures.

References:

https://telecoms.com/524273/starlink-indicates-its-satellite-to-phone-service-will-drop-next-year/

https://www.starlink.com/business/direct-to-cell

Important satellite network services to be discussed at WRC 23

Several agenda items for WRC‑23 include fixed, mobile, broadcasting, and radio determination satellite services. Study Group 4 ITU–R is responsible for preparing these agenda items, aiming to ensure efficient use of the radio spectrum and satellite orbit systems and networks.

Non‑geostationary satellite orbit (non‑GSO) systems are one of the top priorities on the WRC‑23 agenda.

First, coexistence must be ensured between non‑GSO and geostationary satellite orbit (GSO) systems, with protection being ensured for both kinds of satellites. This requires accurate calculations of potential interference to and from non‑GSOs, allowing possible modifications to non‑GSO systems to be considered where needed.Improved rules for non‑GSOs should also cover those on orbital tolerances. These will be treated under the conference’s agenda items for satellite services (7A), milestone reporting (7B), and aggregate interference to GSOs (7J), along with a functional description for software tools to determine non‑GSO fixed-satellite service (FSS) system or network conformity (ITU–R Recommendation S.1503).

Satellite operators expect decisions at WRC‑23 to provide maximum flexibility in the use of spectrum allocations for certain purposes.

These include: earth stations in motion (ESIM) in the FSS, under agenda items 1.15 and 1.16; inter-satellite communications in the FSS, item 1.17; and FSS in the existing broadcasting-satellite service (BSS), item 1.19.

WRC‑23 discussions on these topics will aim to allow for more efficient spectrum use than is currently the case.

Amid rapid satellite development in recent years, non‑GSO systems have been deployed on a large scale. At the same time, new high-capacity satellites have gone into geostationary orbit.

On the regulatory side, the addition of a satellite component to the International Mobile Telecommunications (IMT‑2020) ecosystem has enabled satellite usage in cellular networks, along with new satellite services and other innovations.

Member States of the International Telecommunication Union (ITU) are increasingly raising the issue of sustainability, equitable access, and the rational use of GSO and non‑GSO spectrum resources. Resolution 219 of the ITU Plenipotentiary Conference (Bucharest, 2022) reflects these concerns.

WRC‑23 needs to continue giving high priority to establishing equitable access to satellite orbits. This means recognizing the special needs of developing countries, often including geographical challenges.

The development of innovative satellite technologies has now moved significantly ahead of regulations in the use of radio-frequency spectrum and satellite orbits. As this gap continues widening, ITU must find new approaches to keep international satellite regulation timely and relevant for the industry.

Technology is advancing so rapidly that some operators have begun to introduce new satellite technologies using GSO and non‑GSO satellites without waiting for conference decisions to regulate such use. Moreover, national administrations sometimes grant authorization for such uses in the absence of internationally agreed rules.

Concerns are growing about derogations from the ITU Radio Regulations, particularly under 4.4 of Article 4 — which allows national administrations to assign frequencies exceptionally, outside the Table of Frequency Allocations and other treaty requirements, as long as such assignments do not cause harmful interference to any existing radio services.

The conference will consider how to deal with the widespread use of 4.4, for non‑coordinated satellite networks. It should also clarify whether the derogation option under 4.4 should be available for all radio systems, or only non‑commercial systems.

Overall, WRC‑23 must clarify how administrations use the provision, when they have the right to invoke it, and which specific circumstances justify exceptional use of 4.4 on a temporary basis.

The Radio Regulations, containing the rules and regulations for the use of the radio-frequency spectrum and satellite orbits, are updated approximately every four years, in line with ITU’s associated conference cycle.

Perhaps the time has come to think about reducing the number of years between World Radiocommunication Conferences and simplifying the preparatory cycle and associated documentation. One way forward could be to reassess the current Conference Preparatory Meeting (CPM) format and to consider merging the two CPM sessions into one.

Given the rapid growth, transformation and innovation phase the satellite industry is now going through, WRC‑23 should instruct the ITU Radiocommunication Sector to conduct urgent studies on the potential for reusing frequency bands allocated to mobile services for non‑GSO satellite systems.

National administrations, as well as companies and organizations taking part as ITU Sector Members, need to jointly address these new issues, strengthen the ITU–R framework, and pursue global solutions for the benefit of all.

References:

Amazon launches first Project Kuiper satellites in direct competition with SpaceX/Starlink

Juniper Research: 5G Satellite Networks are a $17B Operator Opportunity

New developments from satellite internet companies challenging SpaceX and Amazon Kuiper

SatCom market services, ITU-R WP 4G, 3GPP Release 18 and ABI Research Market Forecasts

KDDI Partners With SpaceX to Bring Satellite-to-Cellular Service to Japan

European Union plan for LEO satellite internet system

GSMA- ESA to collaborate on on new satellite and terrestrial network technologies

ABI Research and CCS Insight: Strong growth for satellite to mobile device connectivity (messaging and broadband internet access)

Telstra partners with Starlink for home phone service and LEO satellite broadband services

FT: A global satellite blackout is a real threat; how to counter a cyber-attack?

Spark New Zealand partnering with Lynk Global to offer a satellite-to-mobile service