Spectrum Sharing

Sharing of lower 3 GHz band in U.S. is unclear after DoD redacted report

The U.S. wireless industry would like to use the lower 3 GHz band, but it’s currently occupied by the military. The DoD says sharing between federal and commercial systems is not feasible unless certain conditions are met. Sharing between federal radar and mobile systems presents unique challenges, especially for airborne operations.

The DoD acknowledges the potential of freeing up some of the spectrum for 5G use, emphasizing that in order to make the lower 3 GHz band available for commercial use a “coordination framework must facilitate spectrum sharing in the time, frequency, and geography domains,” notes Broadband Breakfast.

5G already coexists with U.S. military systems in the lower 3 GHz band in more than 30 countries, said Umair Javed, CTIA senior vice president-spectrum. However, the future of the lower 3 GHz band in the U.S. is unsettled following DoD’s public release last week of a redacted version of its Emerging Mid-Band Radar Spectrum Sharing Feasibility Assessment [1.].

Note 1. Emerging Mid-Band Radar Spectrum Sharing Feasibility Assessment report

This redacted DoD report examines military systems located in lower 3 GHz spectrum, with an eye on potential sharing but not on clearing as sought by CTIA and carriers. It concludes that sharing the 3.1-3.45 GHz band between federal and commercial systems is not currently feasible “unless certain regulatory, technological, and resourcing conditions are proven and implemented.” The report originally came out in September 2023.

…………………………………………………………………………………………………………………..

DoD Chief Information Officer John Sherman said in February the department is willing to consider clearing part of the band “perhaps for future airborne radars,” which wasn’t part of EMBRSS. The spectrum is home to the Airborne Warning and Control System (AWACS), which DOD is upgrading. Airborne radars are considered the most difficult to address in a sharing regime because they are so mobile.

The lower 3 GHz is one of a few bands allowing for military radars “with small enough antenna apertures” to be mobile, with “sufficient range capabilities to serve as medium and long-range radars,” the study says. It notes the propagation characteristics of mid-band spectrum, which also make it a top target of carriers. “A complicating factor … has been the increased packing of federal systems relocated from other bands, including those as a result of repurposing from previous auctions,” the study says.

DoD found that more than 120 different ground-based, ship-borne and airborne radars use the band. While details are redacted, the report offers basic information on how the bands are used, for everything from land-based radar for tracking threats to Coast Guard and Navy search and rescue missions to air-traffic control to tracking bird migrations with an eye toward avoiding collisions. It also discusses the Department of Homeland Security’s uses.

But EMBRSS says sharing is possible using a dynamic spectrum management system (DSMS). It cites sharing in the citizens broadband radio service band. A DSMS, which “evolves the CBRS framework … with advanced interference mitigation features” addressing the unique needs of airborne systems, “provides a feasible path forward for spectrum sharing between the Federal and commercial systems,” EMBRSS said.

Blair Levin wrote Wednesday in a note to New Street clients.:

“The report’s most significant implications for investors involve what the DOD report did not do. It did not resolve any issues or provide a timetable for doing so. Thus, we remain far from resolving the question of where the spectrum that the wireless carriers argue they will need by 2027 will come from. While some advocate exclusive licensing of the band, and others sharing, DOD “almost certainly retains a veto power over any potential outcome,” he said.

DoD leaders, including John Sherman, the Pentagon’s top IT official, met Monday with the National Spectrum Consortium, a group of more than 350 members of academia and industry who work with the electromagnetic spectrum, to take the first steps to outline a framework to share the bandwidth with industry and to kickstart a discussion on a spectrum management program.

“No surprise. We know that spectrum will be challenging,” said Kevin Mulvihill, the Pentagon’s deputy chief information officer for command, control and communications. “But we need to work together across industry, government and academia to explore potential ways to achieve spectrum coexistence for the benefit of the entire nation while ensuring that the spectrum sharing that we choose does not negatively affect the primary mission of the Department of Defense.”

References:

https://dodcio.defense.gov/Portals/0/Documents/Library/DoD-EMBRSS-FeasabilityAssessmentRedacted.pdf

https://www.fierce-network.com/5g/dod-releases-long-awaited-report-lower-3-ghz

If the Pentagon has to share 5G spectrum, it wants some new ground rules – Breaking Defense

Could Transpositional Modulation be used to solve the “spectrum crunch” problem

Transpositional Modulation (TM) permits a single carrier wave to simultaneously transmit two or more signals, unlike other modulation methods. It does this without destroying the integrity of the individual bit streams.

TM Technologies (TMT) is a wireless technology company offering dramatic data throughput increases for existing wireless and wired networks, using TM.

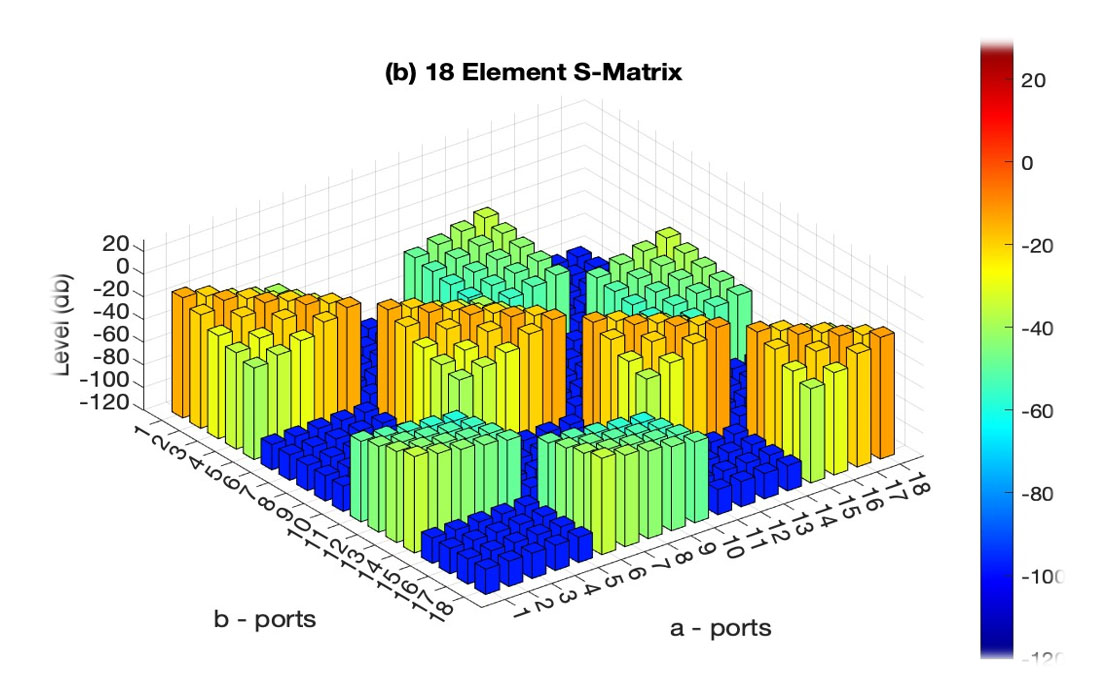

TMT’s In Band Full Duplex (IBFD) is a MIMO-compatible antenna and software technology providing signal interference cancellation via its Adaptive-Array Antenna which allows simultaneous transmit and Receive = Doubling Data Rates. TM-IBFD development has shown a combined 120 db noise reduction in two-way communications, which provides up to a 100% gain in wireless data transport efficiency.

TMT believes that the use of its patented methods can prevent or delay the onset of a wireless “bandwidth crunch” and focuses on developing products for a range of applications. These products will use core technology to provide solutions and create value for customers, the economy, and the global wireless infrastructure. The company says that the TM-IBFD is backwards compatible and complimentary with existing beam forming or beam shaping installations.

Image Courtesy of TM Technologies (TMT)

……………………………………………………………………………………………………………………………………..

Using the latest Xilinx RFSoC devices, TMT has produced a Software Defined Radio (SDR) format with OFDM as primary modulation with multiple TM channel overlays. This is applicable to nearly any access or backhaul radio device with adequate head-space and operating within the 3GPP Rel 16 specifications.

Industry analyst Jeff Kagan wrote: “Spectrum shortage remains a problem that is not going to solve itself. That’s why new solutions like this are necessary….In the case of solving this spectrum crisis, there are two different groups to focus on. One, is the wireless carriers. Two, are wireless network builders. Either, the customer, which is the wireless network needs to demand this from their network builders. Or the network builders need to embrace this as a competitive advantage and as a solution to their customers.”

Jeff Kagan

References:

Kagan: Could TM Technologies help solve wireless spectrum shortage?

U.S. Launches National Spectrum Strategy and Industry Reacts

The U.S. Dept of Commerce has finally published a National Spectrum Strategy that could pave the way for 2,786MHz of frequencies to be repurposed for new use. That is nearly double NTIA’s initial target of 1,500 megahertz.

The frequencies in question, across five bands, will be studied for potential new uses, and the study could go either way. The next step will see the Biden-Harris administration develop and publish an Implementation Plan.

The spectrum target includes more than 1,600 megahertz of midband spectrum – a frequency range in high demand by the wireless industry for next-generation services.

As required by the Presidential Memorandum titled Modernizing United States Spectrum Policy and Establishing a National Spectrum Strategy, the Secretary of Commerce, through the National Telecommunications and Information Administration (NTIA), prepared this National Spectrum Strategy to both promote private-sector innovation and further the missions of federal departments and agencies, submitting it to the President through the Assistant to the President for National Security Affairs, the Assistant to the President for Economic Policy, and the Director of the Office of Science and Technology Policy.

The Strategy reflects collaboration with the Federal Communications Commission (FCC), recognizing the FCC’s unique responsibilities with respect to non-Federal uses of spectrum, and coordination with other Federal departments and agencies (referred to collectively here as “agencies”).

The NTIA will study the following bands in the next two years, noting that the spectrum could support a range of uses, including mobile broadband (IMT), drones and satellite operations:

- 3.1 GHz-3.45 GHz

- 5.03 GHz-5.091 GHz

- 7.125 GHz-8.4 GHz

- 18.1 GHz-18.6 GHz

- 37.0 GHz-37.6 GHz

Note that for terrestrial IMT (3G, 4G, 5G), the only one of the above frequencies approved by ITU-R Radio Regulations in ITU-R M.1036 is 3.3 GHz-to-3.7 GHz frequency range. Please refer to my Comment in the box below this post.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

The goals of the Spectrum Strategy are to: drive technological innovation (including innovative spectrum sharing technologies); boost U.S. industrial competitiveness; protect the security of the American people; foster scientific advancements; promote digital equity and inclusion; and maintain U.S. leadership in global markets for wireless equipment and services, as well as innovative spectrum-sharing technologies. Dynamic spectrum sharing will be part of the plan.

…………………………………………………………………………………………………………….

Industry Reactions to the Strategy:

“It is a critical first step, and we fully support their goal of making the 7/8 GHz band available for 5G wireless broadband and their decision to re-study all options for future full-power commercial access to the lower 3 GHz band,” said Meredith Attwell Baker, president and CEO of industry body the CTIA. “In order to meet growing consumer demand for 5G, close America’s widening 5G spectrum deficit and counter China’s global ambitions, America’s wireless networks need 1500 MHz of additional full power, licensed spectrum within the next ten years. Failure to make this spectrum available risks America’s economic competitiveness and national security,” Attwell Baker added.

“The plan released today will secure our digital future by eliminating the structural problems that hold back U.S. wireless innovation,” added Harold Feld, senior vice president of consumer advocacy group Public Knowledge.

“For six years, the United States has lacked a comprehensive spectrum strategy,” he said. “This lack of a national plan has created increasing tensions between the FCC’s efforts to meet our ever-expanding need for wireless capacity and federal agencies trying to carry out vital missions from weather forecasting to national security. These tensions, in turn, have compromised our ability to develop new wireless technologies and undermined our ability to maintain global leadership.”

“We hope this reallocation will help correct the midband spectrum imbalance that currently prioritizes unlicensed and federal uses – a disparity that fails to meet Americans’ ever-accelerating demand for mobile connectivity and neglects licensed spectrum’s place as the foundation of our wireless ecosystem,” AT&T’s Rhonda Johnson, EVP of federal regulatory relations, said.

“We don’t think the events of today should be thought of as anyone scoring a touchdown, but rather, moving the ball from one’s own 20-yard line to the opponents’ 40,” summarized the financial analysts at New Street Research in a note to investors Monday.

…………………………………………………………………………………………………………………………..

Light Reading’s Mike Dano had 5 takeaways from NTIA’s Spectrum plan:

1. It’s evolutionary, not revolutionary.

2. It’s pretty boring.

3. It makes no clear decision on the lower 3GHz band.

4. Sharing, and other spectrum management technologies, are encouraged.

5. 6G is mentioned, but only obliquely.

References:

https://www.ntia.gov/issues/national-spectrum-strategy

https://telecoms.com/524821/us-spectrum-plan-eases-frequency-frustrations-to-an-extent/

https://www.lightreading.com/5g/five-takeaways-from-biden-s-new-national-spectrum-strategy

https://www.itu.int/en/ITU-R/information/Pages/emergency-bands.aspx

Highlights of FCC Notice of Inquiry (NOI) on radio spectrum usage & how AI might be used

The U.S. Federal Communications Commission (FCC) is requesting input from the public on new technological approaches to assessing “real-time, non-Federal (government) spectrum usage, so that it has better insights into current technologies that might help the agency to manage spectrum and identify opportunities for spectrum sharing—including how artificial intelligence (AI) might be used.

This FCC Notice of Inquiry (NOI) was approved by all four members of the Commission. It states:

“Spectrum usage information is generally non-public and made available infrequently. As the radiofrequency (RF) environment grows more congested, however, we anticipate a greater need to consider such data to improve spectrum management. That is especially true as the burgeoning growth of machine learning (ML) and artificial intelligence (AI) offer revolutionary insights into large and complex datasets. Leveraging today’s tools to understand tomorrow’s commercial spectrum usage can help identify new opportunities to facilitate more efficient spectrum use, including

new spectrum sharing techniques and approaches to enable co-existence among users and services.”

Spectrum usage has been defined in various ways. In one technical paper, for instance, NTIA and NIST defined “band occupancy” as “the percentage of frequencies or channels in the band with a detected signal level that exceeds a default or user-defined threshold.”

“Right now, so many of our commercial spectrum bands are growing crowded,” said FCC Chairwoman Jessica Rosenworcel. “Hundreds of millions of wireless connections—from smartphones to medical sensors—are using this invisible infrastructure. And that number is growing fast. But congestion can make it harder to make room in our skies for new technologies and new services. Yet we have to find a way, because no one wants innovation to grind to a halt. To do this we need smarter policies, like efforts that facilitate more efficient use of this scarce resource. … Now enter AI. A large wireless provider’s network can generate several million performance measurements every minute. Using those measurements, machine learning can provide insights that help better understand network usage, support greater spectrum efficiency, and improve resiliency by making it possible to heal networks on their own.”

“[This] inquiry is a way to understand this kind of potential and help ensure it develops here in the United States first. “I believe we can do more to increase our understanding of spectrum utilization and support the development of AI tools in wireless networks,” she added.

Rosenworcel noted that some pioneering work on dynamic, cognitive radios was kick-started with the Defense Advanced Research Project’s three-year Spectrum Collaboration Challenge, which sought to develop software-defined radios’ capability to dynamically detect other spectrum users and work around them in a congested radio frequency environment.

The FCC pointed out in a statement that it generally doesn’t collect information on spectrum usage, and instead relies on intermittent data from third-party sources.

“As the radiofrequency environment becomes more congested, leveraging technologies such as artificial intelligence to understand spectrum usage and draw insights from large and complex datasets can help facilitate more efficient spectrum use, including new spectrum sharing techniques and approaches to enable co-existence among users and services,” the agency said, adding that the inquiry will explore the “feasibility, benefits, and limitations” of various ways to understand non-federal spectrum usage, as well as band- or service-specific considerations and various technical, practical or legal aspects that should be considered.

References:

https://www.fcc.gov/document/spectrum-usage-noi

https://docs.fcc.gov/public/attachments/FCC-23-63A1.pdf

Big 5G Conference: 6G spectrum sharing should learn from CBRS experiences

Spectrum sharing is a methodology that allows multiple wireless networks to access the same frequency band dynamically and efficiently. It can reduce the spectrum scarcity issue and enable more wireless applications and services, but also requires careful coordination and management to avoid interference and ensure fair access.

Examples of spectrum sharing techniques include Licensed Shared Access (LSA), which uses a regulatory framework to permit licensed users to share spectrum with incumbent users, Dynamic Spectrum Access (DSA), which enables wireless networks to sense and adapt to the spectrum environment, and Spectrum Aggregation, which combines multiple spectrum bands or channels into a larger bandwidth. LSA can be used by mobile operators to access spectrum that is not used by TV broadcasters, DSA can be employed by cognitive radio networks to detect and avoid channels occupied by primary users, Spectrum Aggregation can be used by 5G networks for coverage and speed.

The wireless telecom industry has to take a “concerted look at revolutionizing spectrum sharing” and to take a closer look at the lessons learned from CBRS spectrum sharing [1.], which took about a decade to be successfully implemented, according to Andrew Thiessen, chair of the spectrum working group at the Next G Alliance who was speaking at the Informa Big 5G conference panel session in Austin, TX. He opined that the industry needs to be pushing ahead with spectrum sharing technologies and techniques at speeds similar to the innovations that are being applied to smartphones.

Note 1. Citizens Broadband Radio Service (CBRS), which allows for dynamic spectrum sharing between the Department of Defense and commercial spectrum users. The DOD users have protected, prioritized use of the spectrum. When the government isn’t using the airwaves, companies and the public can gain access through a tiered licensing arrangement. This means the DOD can use the same spectrum for its critical missions while companies can use it for 5G and high-speed Internet deployment.

“Innovative spectrum sharing frameworks are key to unlocking additional bandwidth for wireless connectivity across the country,” Deputy Assistant Secretary of Commerce for Communications and Information April McClain-Delaney said. “The success and growth of the CBRS band shows the promise of dynamic spectrum sharing to make more efficient use of this finite resource.”

………………………………………………………………………………………………………………………………………………..

Joe Kochan, executive director of the National Spectrum Consortium, agreed that spectrum sharing for 6G does present challenges as it faces a wide range of commercial users, federal users and non-federal users, as well as different types of technologies, such as radar. That elicits a need for the industry to build new tools and to get more creative about how that spectrum can be shared.

The Biden administration’s National Spectrum Strategy will “lay the framework” to get everything moving, said Derek Khlopin, deputy associate administrator, spectrum planning policy, at the NTIA. “We’re tech and application-neutral. But the better we understand, the better we can plan.” he explained.

“We’ve started listening, to be frank,” Khlopin said. “But it’s not necessarily the role of the government to figure all of this out. We need help, so we’re working closely with industry, with academia and others. Spectrum sharing is here to stay between federal and non-federal users,” he added.

Khlopin was asked about NTIA’s exploration of the 7GHz band and its potential for 6G. “It’s a very complicated band,” he said. “There’s a lot there … We’re aware of the industry interest there.”

Thiessen said one challenge for 6G will be a lack of contiguous spectrum. He believes that 6G will likely be made up of a lot of pieces of spectrum, and those pieces will likely need to be targeted to specific use cases. However, that presumption is premature as neither 3GPP or ITU-R WP5D has started any serious work on defining 6G specifications. That is why all the buzz about 6G is irrelevant at this time.

References:

https://www.linkedin.com/advice/1/how-can-wireless-network-coexistence-interference

https://ntia.gov/blog/2023/innovative-spectrum-sharing-framework-connecting-americans-across-country

https://www.lightreading.com/6g/spectrum-sharing-will-be-key-to-unlocking-6g/d/d-id/784884?

Vodafone tests 5G Dynamic Spectrum Sharing (DSS) in its Dusseldorf lab

SNS Telecom & IT: Shared Spectrum to Boost 5G NR & LTE Small Cell RAN Market

SNS Telecom & IT‘s latest research report indicates that annual spending on (3GPP specified) 5G NR and LTE small cell RAN (Radio Access Network) infrastructure operating in shared spectrum [1.] will reach nearly $4 Billion by 2024 to support a variety of uses including private cellular networks for enterprises and vertical industries, densification of mobile operator networks, FWA (Fixed Wireless Access), and neutral host connectivity.

Note 1. Spectrum sharing is the simultaneous usage of a specific radio frequency band, in a specific geographical area, by a number of independent entities (usually wireless telcos). In other words, it is the “cooperative use of common spectrum” by multiple users. Spectrum sharing also can take many forms, coordinated and uncoordinated.

Release Date: January 2021 Number of Pages: 592 Number of Tables and Figures: 94

………………………………………………………………………………………………………………………………………………………………………………………………………….

As the 5G era advances, the cellular communications industry is undergoing a revolutionary paradigm shift, driven by technological innovations, liberal regulatory policies and disruptive business models. One important aspect of this radical transformation is the growing adoption of shared and unlicensed spectrum – frequencies that are not exclusively licensed to a single mobile operator.

Telecommunications regulatory authorities across the globe have launched innovative frameworks to facilitate the coordinated sharing of licensed spectrum, most notably the United States’ three-tiered CBRS scheme for dynamic sharing of 3.5 GHz spectrum, Germany’s 3.7-3.8 GHz licenses for private 5G networks, the United Kingdom’s shared and local access licensing model, France’s 2.6 GHz licenses for industrial LTE/5G networks, the Netherlands’ local mid-band spectrum permits, Japan’s local 5G network licenses, Hong Kong’s geographically-shared licenses, and Australia’s 26/28 GHz area-wide apparatus licenses. Collectively, these ground-breaking initiatives are catalyzing the rollout of shared spectrum LTE and 5G NR networks for a diverse array of use cases ranging from private cellular networks for enterprises and vertical industries to mobile network densification, FWA and neutral host infrastructure.

In addition, the 3GPP cellular wireless ecosystem is also accelerating its foray into vast swaths of globally and regionally harmonized unlicensed spectrum bands. Although existing commercial activity is largely centered around LTE-based LAA (Licensed Assisted Access) technology whereby license-exempt frequencies are used in tandem with licensed anchors to expand mobile network capacity and deliver higher data rates, the introduction of 5G NR-U in 3GPP’s Release 16 specifications paves the way for 5G NR deployments in unlicensed spectrum for both licensed assisted and standalone modes of operation.

Even with ongoing challenges such as the COVID-19 pandemic-induced economic slowdown, SNS Telecom & IT estimates that global investments in 5G NR and LTE small cell RAN infrastructure operating in shared and unlicensed spectrum will account for more than $1.3 Billion by the end of 2021. The market is expected to continue its upward trajectory beyond 2021, growing at CAGR of approximately 44% between 2021 and 2024 to reach nearly $4 Billion in annual spending by 2024.

The “Shared & Unlicensed Spectrum LTE/5G Network Ecosystem: 2021 – 2030 – Opportunities, Challenges, Strategies & Forecasts” report presents a detailed assessment of the shared and unlicensed spectrum LTE/5G network ecosystem including the value chain, market drivers, barriers to uptake, enabling technologies, key trends, future roadmap, business models, use cases, application scenarios, standardization, spectrum availability/allocation, regulatory landscape, case studies, ecosystem player profiles and strategies. The report also provides global and regional forecasts for shared and unlicensed spectrum LTE/5G RAN infrastructure from 2021 till 2030. The forecasts cover two air interface technologies, two cell type categories, two spectrum licensing models, 12 frequency band ranges, seven use cases and five regional markets.

Important research findings from the report include the following:

- Even with ongoing challenges such as the COVID-19 pandemic-induced economic slowdown, SNS Telecom & IT estimates that global investments in LTE and 5G NR RAN infrastructure operating in shared and unlicensed spectrum will account for more than $1.3 Billion by the end of 2021. The market is expected to continue its upward trajectory beyond 2021, growing at CAGR of approximately 44% between 2021 and 2024 to reach nearly $4 Billion in annual spending by 2024.

- Breaking away from traditional practices of spectrum assignment for mobile services that predominantly focused on exclusive-use national licenses, telecommunications regulatory authorities across the globe have launched innovative frameworks to facilitate the coordinated sharing of licensed spectrum.

- Notable examples include the United States’ three-tiered CBRS scheme for dynamic sharing of 3.5 GHz spectrum, Germany’s 3.7-3.8 GHz licenses for private 5G networks, the United Kingdom’s shared and local access licensing model, France’s 2.6 GHz licenses for industrial LTE/5G networks, the Netherlands’ local mid-band spectrum permits, Japan’s local 5G network licenses, Hong Kong’s geographically-shared licenses, and Australia’s 26/28 GHz area-wide apparatus licenses.

- Collectively, these ground-breaking initiatives are catalyzing the rollout of shared spectrum LTE and 5G NR networks for a diverse array of use cases ranging from private cellular networks for enterprises and vertical industries to mobile network densification, FWA and neutral host infrastructure.

- In particular, private LTE and 5G networks operating in shared spectrum are becoming an increasingly common theme. For example, Germany’s national telecommunications regulator BNetzA (Federal Network Agency) has received more than a hundred applications for private 5G licenses in 2020 alone. Dozens of purpose-built 5G networks are already in operational use by the likes of aircraft maintenance specialist Lufthansa Technik, industrial conglomerate Bosch, automakers and other manufacturing giants.

- Since the commencement of its local 5G spectrum licensing scheme, Japan has been showing a similar appetite for industrial-grade 5G networks, with initial field trials and deployments being spearheaded by many of the country’s largest industrial players including Fujitsu, Mitsubishi Electric, Sumitomo Corporation and Kawasaki Heavy Industries.

- Among other examples, the 3.5 GHz CBRS shared spectrum band is being utilized to set up private LTE networks across the United States for applications as diverse as remote learning and COVID-19 response efforts in healthcare facilities. 5G NR-based CBRS implementations are also expected to emerge between 2021 and 2022 to better support industrial IoT requirements. Multiple companies including agriculture and construction equipment manufacturer John Deere have already made commitments to deploy private 5G networks in CBRS spectrum.

- Mobile operators and other cellular ecosystem stakeholders are also seeking to tap into vast swaths of globally and regionally harmonized unlicensed spectrum bands for the operation of 3GPP technologies. Although existing deployments are largely based on LTE-LAA technology whereby license-exempt frequencies are used in tandem with licensed anchors to expand mobile network capacity and deliver higher data rates, standalone cellular networks that can operate solely in unlicensed spectrum – without requiring an anchor carrier in licensed spectrum – are beginning to emerge as well.

- In the coming years, with the commercial maturity of 5G NR-U technology, we also anticipate to see 5G NR deployments in unlicensed spectrum for both licensed assisted and standalone modes of operation using the 5 GHz and 6 GHz bands as well as higher frequencies in the millimeter wave range – for example, Australia’s 24.25-25.1 GHz band that is being made available for uncoordinated deployments of private 5G networks servicing locations such as factories, mining sites, hospitals and educational institutions.

The report will be of value to current and future potential investors into the shared and unlicensed spectrum LTE/5G network market, as well as LTE/5G equipment suppliers, mobile operators, MVNOs, fixed-line service providers, neutral hosts, private network operators, vertical domain specialists and other ecosystem players who wish to broaden their knowledge of the ecosystem.

For further information concerning the SNS Telecom & IT publication “The Shared & Unlicensed Spectrum LTE/5G Network Ecosystem: 2021 – 2030 – Opportunities, Challenges, Strategies & Forecasts” please visit: https://www.snstelecom.com/shared-spectrum

For a sample please contact: [email protected]

About SNS Telecom & IT:

Part of the SNS Worldwide group, SNS Telecom & IT is a global market intelligence and consulting firm with a primary focus on the telecommunications and information technology industries. Developed by in-house subject matter experts, our market intelligence and research reports provide unique insights on both established and emerging technologies. Our areas of coverage include but are not limited to wireless networks, 5G, LTE, SDN (Software Defined Networking), NFV (Network Functions Virtualization), IoT (Internet of Things), critical communications, big data, smart cities, smart homes, consumer electronics, wearable technologies, and vertical applications.

References: