Uncategorized

Google Fiber Growth down sharply in 2016!

Google Fiber’s video growth dropped to 57.8% in 2016 from 78.8% the previous year, as per a Moffett-Nathanson analysis based on fresh data from the U.S. Copyright Office. Google Fiber ended 2016 with 84,232 pay TV subs, marking a sharp decline in the rate of growth, Moffett-Nathanson found in an analysis

Across all Google Fiber U.S. markets, year-on-year growth declined to 57.8%, from 78.8% a year ago, the market research firm found. But Google Fiber’s video business is still growing amid a rising cord-cutting trend that is affecting most major U.S. pay TV providers.

Update: Google Fiber hasn’t released sub numbers, but a person familiar with its business noted that the unit did double its Internet subs in 2016 compared to all previous years combined that Google Fiber has been in business, and that Google Fiber has generally been seeing strong growth for Internet-only subs, including those that are coming way of Webpass, which is being offered in markets such as San Francisco, San Diego, Chicago, Miami and Boston. Webpass does not provide video service alongside its baseline high-speed Internet offering.

Even without any specific broadband subscriber results provided by either the U.S. Copyright Office or Google parent Alphabet, Moffett said Google Fiber’s video numbers speak volumes about its efforts to make a mark in the broader pay TV industry. It’s not succeeding.

“Seven years after breaking ground in their first broadband market, Google Fiber still accounts for only 0.1% of the U.S. Pay TV industry,” Moffett explained.

Among Google Fiber’s largest individual markets, MoffettNathanson found that the company ended 2016 with 45,096 video subs in its largest market, Kansas City, MO, compared to 28,941 in Kansas City, KS; 5,889 in Austin, Texas; and 2,914 in Provo, Utah.

References:

http://www.multichannel.com/news/content/google-fiber-ended-2016-84232-pay-tv-subs-study/411758

Google Fiber Proposed for Santa Clara; AT&T bids to build CityLinkLA

http://www.mysanantonio.com/news/local/article/Construction-on-backbone-of-Google-Fiber-10851778.php

Google Wants India Telecom Operators to use its “SDN Platform”

Source: Economic Times Telecom

Google Inc is looking to bring more Indian telecom operators on board its software defined networking (SDN)-based platform. The internet search giant says its SDN-based platform enables telecom networks adapt to new services and traffic patterns efficiently.

The company has already teamed up with Bharti Airtel and South Korea’s SK Telecom to pursue this networking initiative.

“We are happy to share our knowledge and capabilities with operators. We are very open to talking about our capabilities on both client and application sides and cloud technologies to carriers across the spectrum,” Gulzar Azad, country head for connectivity at Google India, told ET. “We believe there will be more engagements as we move forward in India as well.”

Google’s (proprietary) SDN-based platform comes at a time when telecom networks are dealing with a huge upsurge in data consumption. The platform also aims to create richer APIs that will enable new operational models and help operators bring new features (such as Smart Offline) to consumers.

“Information on the Android side or devices side and information on app side need to come together with all the data availability on the carrier side to make smarter and intelligent networks in India,” Azad said.

“That’s the future we see where two worlds are coming together and make better experience for users and make much productive data consumption by the users,” he added.

According to Azad, more industry players need to contribute for network infrastructure and optimisation to ensure efficient running of applications and client devices, besides ensuring existence of public WiFi.

“This needs to be there to fulfill the government’s vision and create an environment where data revolution is fulfilled by way of consumption, which is 10 times higher than it is today,” Azad said, adding that the industry is moving towards a data revolution.

Meanwhile, Google is on track to equip another 400 railway stations in India with high-speed WiFi network. With the help of RailTel and Indian Railways, it is currently providing WiFi services at 115 stations.

The company recently won its first city Google Station WiFi deal from Pune Smart City Development Corporation Limited, a special purpose vehicle formed for the smart city mission in the city. The project will be executed in collaboration with companies like IBM, Larsen & Toubro and RailTel.

References:

Google’s Internet Access for Emerging Markets – Managed WiFi Network for India Railways

CenturyLink Delivers Broadband Services on CORD Platform

Less than one year after AT&T took its Central Office Re-architected as a Data center (CORD) to the Linux Foundation, which then produced a reference design, CenturyLink, Inc. says it is the first carrier to use its own virtualized Broadband Network Gateway (vBNG) to support broadband services using the a CORD based design.

This key step in CenturyLink’s efforts to virtualize its infrastructure within the central office is part of the company’s commitment to have full global virtualization coverage in its IP core network by the end of 2019.

Through CORD, CenturyLink is using some version (????) of software-defined networking (SDN) and network functions virtualization (NFV) to bring data center economics and cloud agility to its central offices for fast and efficient delivery of new network services to residential and business customers.

“Our CORD deployment is a significant milestone on our path to achieve full network virtualization,” said Aamir Hussain, CenturyLink’s executive vice president and chief technology officer. “This is a key component in our strategy to bring virtual network services to our customers while driving virtualization into our last-mile network, allowing us to quickly and efficiently deliver new technologies that meet our customers’ rapidly changing needs,” he added.

CenturyLink’s SDN access controller is an OpenDaylight-based controller stack that integrates its legacy operations support systems (OSS) and latest generation orchestration platforms. In addition to virtualizing its infrastructure, CenturyLink continues to develop and implement virtualized services, including a virtual firewall, data center interconnection and software-defined wide area networking (SD-WAN) for enterprise customers. Through these virtualization efforts, CenturyLink is enhancing the customer experience by providing them with more control of their services.

The carrier said it’s also continuing to create and implement virtualized services along with virtualizing its own infrastructure spread out over 55 global data centers. These virtualized services include a virtual firewall, datacenter interconnection and software-defined wide area networking (SD-WAN) targeting enterprises.

Author’s Notes:

There are no implementation standards/interface specs for SD-WAN so there’s no vendor interoperability and hence, it’s a turnkey single vendor solution for a carrier.

While same is true for NFV, but the OPEN NFV (OPNFV) open source group is effectively creating a defacto standard by agreeing to a spec prior to generating open source code.

References:

https://virtualizationreview.com/articles/2017/03/23/centurylink-cord.aspx

AT&T & IBM Partner for New IoT Analytics Tool

AT&T and IBM have teamed up to give enterprise developers a cloud-based tool to analyze data coming from internet of things (IoT) devices. The companies hope to “leverage the data that’s coming off of these devices and create an analytics-as-a-service solution combining the IBM Watson capability sets with our capability sets at AT&T to provide those real meaningful insights across a number of vertical solutions,” said Chris Penrose president of IoT Solutions at AT&T Inc, in an interview with Light Reading. (See IBM to Use AT&T Flexware.)

The impetus behind the development of this new technology stemmed from business customers’ demand for faster data generation from IoT devices as well as rapid, meaningful analysis to make near real-time decisions for process improvements. (See AT&T Introduces IoT Solution Powered by IBM Watson on the Cloud.)

AT&T has connected over 30 million IoT devices globally on its network, and with the new IoT analytics solution, customers can not only connect devices, but also take action and gain insight on transforming their business, reduce costs and create new revenue opportunities, said Penrose.

Customers from a variety of verticals can utilize the technology for uses like detecting anomalies and predicting potential malfunctions in oil and gas wells, analyzing error codes in connected vending machines and determining if the machine is in an ideal location, and monitoring pallet and product location in real-time. The technology isn’t limited to industrial IoT applications, and can be utilized in other verticals such as healthcare, said Penrose.

“A lot of this, whether it’s in heavy equipment machinery or asset tracking, all of these spaces where you get can information off the machine to know if it is operating effectively, potentially diagnose the issue and predict future issues, are great areas of opportunity and we’re mining that data to make it a better solution,” said Penrose.

According to the release, the new analytics technology uses AT&T’s M2X, Flow Designer and Control Center; the IBM Watson IoT portfolio and Data Platform; and IBM’s Machine Learning Service.

References:

IHS Markit: Cloud Service Providers & Telcos to Reign Supreme in Data Center Switching by 2021

By Cliff Grossner, Ph.D., senior research director and advisor, cloud and data center research practice, IHS Markit

Highlights:

- Growth continues for the data center network equipment market, which grew both sequentially and for the full-year 2016

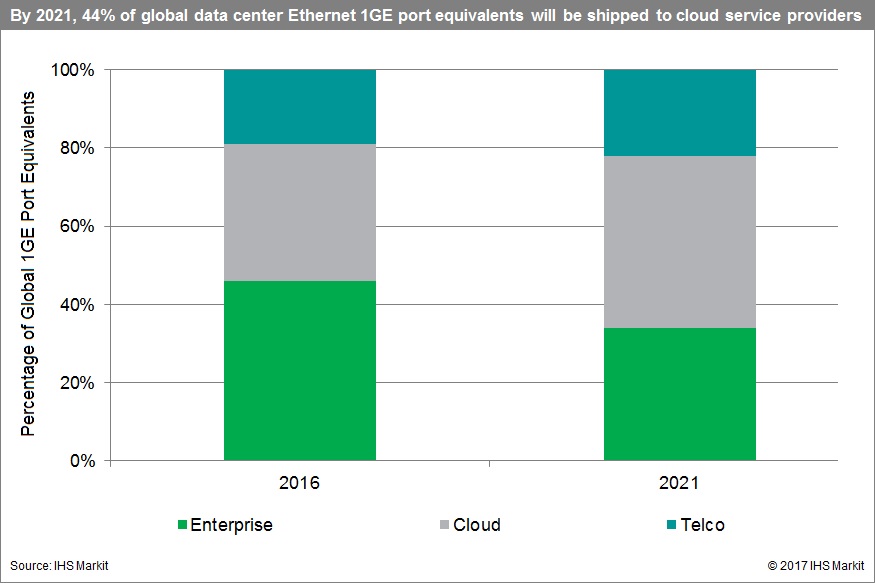

- By 2021, the cloud service provider (CSP) and telco market segments will squeeze the enterprise in data center switching revenue and transmission capacity

- Software-defined enterprise wide area network (SD-WAN) revenue is anticipated to reach $2.9 billion by 2021

IHS Markit Analysis:

Worldwide data center network equipment revenue—including data center Ethernet switches, application delivery controllers (ADCs), SD-WAN and WAN optimization appliances (WOA)—totaled $3.5 billion in Q4 2016, gaining 4 percent from Q3 2016. For the full-year 2016, revenue grew 10 percent to $12.9 billion. Revenue was up in all regions except the Caribbean and Latin America (CALA).

Some results by segment:

- Data center Ethernet switch revenue rose 8 percent in Q4 2016 from the year-ago quarter

- SD-WAN revenue was $31 million in Q4 2016 and hit $87 million for the full-year 2016

- Bare metal switch revenue was up 27 percent year over year in Q4 2016

- ADC revenue was down 3 percent sequentially in 4Q 2016 and down 8 percent year over year

- WAN optimization appliance revenue declined 9 percent in Q4 2016 and fell 20 percent from a year ago

We look for long-term growth in the data center network equipment market to slow to 2018 and then increase out to 2021 as SD-WAN reaches $2.9 billion.

Ethernet switch analysis by market segment:

For this latest edition of our data center network report, we added Ethernet switch analysis by market segment: CSP, telco and enterprise—by revenue and port speed (1GE, 10GE, 25GE, 40GE and 100GE).

The CSP and telco segments are expected to squeeze out the enterprise in data center switching by 2021 as Ethernet capacity measured in 1GE port equivalents shipped to CSPs reaches 44 percent of total capacity (up from 25 percent in 2016), to telcos reaches 22 percent (up from 19 percent) and to the enterprise drops to 34 percent.

Barefoot Networks’ Tofino is now available in switches from Taiwan-based Edgecore Networks and WNC. Cavium’s Xpliant-based Wedge 100C switch design contributed to the Open Computer Project (OCP) targeting CSP and telco network virtual function (NVF) markets. Cumulus Networks announced the availability of its operating system for Backpack, Facebook’s white box bare metal chassis, and is partnering with Celestica to make Backpack available for preorder with Cumulus Linux. And Huawei is challenging Arista for the number-two spot in data center Ethernet switching.

Data Center Report Synopsis

The quarterly IHS Markit data center network report provides market size, vendor market share, forecasts through 2021, analysis and trends for data center Ethernet switches, bare metal Ethernet switches, Ethernet switches sold in bundles, application delivery controllers, software-defined enterprise WAN and WAN optimization appliances.

For information about purchasing this report, contact the sales department at IHS Markit in the Americas at (844) 301-7334 or[email protected]; in Europe, Middle East and Africa (EMEA) at +44 1344 328 300 or[email protected]; or Asia-Pacific (APAC) at +604 291 3600 or [email protected]

Century Link Enhances TV Service with 4 Epix Channels; Pay TV Subs Decline

CenturyLink will begin carrying Epix premium TV channels on its Prism TV platform, having reached a deal that includes four Epix channels. Subscribers will also gain access to Epix’s TV Everywhere app, which offers more than 3,000 titles.

Financial terms were not disclosed, but the multi-platform deal does include TV Everywhere access to more than 3,000 titles available from the premium programmer on Epix.com and via the Epix app.

Epix said the deal with CenturyLink marks the third to involve the top ten from NCTC (National Cable Television Cooperative) members within the last year.

It also comes amid some changes to CenturyLink’s video strategy that are well underway.

Multi-Channel News wrote that CenturyLink has already said it is de-emphasizing Prism TV, its current full-freight IPTV service that’s powered by the Ericsson Media room platform, as it moves ahead with a new slimmed-down OTT TV package that, it believes, will be more economically attractive.

Epix is a premium TV service which is a joint venture between Viacom, its Paramount Pictures unit, Lionsgate and Metro-Goldwyn-Mayer Studios Inc. (MGM), is available in more than 50 million homes. It carries block buster movies, a few original content programs, and occasional sports documentaries. Reuters recently reported that MGM is in talks with Viacom and Lionsgate to purchase their stakes in Epix.

Read more at:

http://www.multichannel.com/news/content/epix-centurylink-carve-out-carriage-deal/411616

See the new Epix channel content at:

http://watch.centurylink.net/networks/73083313

………………………………………………………………………..

Addendum: Pay TV Subscribers Decrease

Leichtman Research Group (LRG) noted that Cable TV firms (cablecos or MSOs) lost 278,000 pay-TV video subscribers in 2016. Comcast added 161,000, while telcos (like Century Link) lost 1.5 million, according to LRG. AT&T’s U-verse service accounted for 1.36 million subscriber losses as AT&T shifted marketing toward its DirecTV satellite TV service. DirecTV added 1.2 million customers last year, but Dish Network lost just over 1 million, said LRG.

Analyst say pay-TV industry subscribers could fall further. As cord-cutting goes on and the traditional video business for cable providers shrinks, their No. 1 product will be broadband and internet access. So even if internet video takes off, they still have broadband dominance.

Google-parent Alphabet (GOOGL) has announced YouTube TV, a $35 monthly paid subscription service. Hulu — a joint venture of Walt Disney (DIS), Fox-parent 21st Century Fox Entertainment (FOXA) and Comcast’s NBC Universal — is set to launch yet another live TV streaming service in the spring. And, Amazon.com (AMZN) could follow in 2018. Entertainment (FOXA) and Comcast’s NBCUniversal — is set to launch yet another live TV streaming service in the spring. And, Amazon.com (AMZN) could follow in 2018.

They’ll join AT&T’s DirecTV Now and Dish Network’s (DISH) Sling streaming services.

Reference:

http://www.investors.com/news/technology/comcast-charter-morphing-into-broadband-first-providers/

Highlights of ISQED Conference: March 14-15, 2017 Santa Clara, CA

ISQED Conference Backgrounder:

The 18th International Symposium on Quality Electronic Design (ISQED 2017) is the premier interdisciplinary and multidisciplinary Electronic Design conference—bridges the gap among Electronic/Semiconductor ecosystem members providing electronic design tools, integrated circuit technologies, semiconductor technology,packaging, assembly & test to achieve total design quality.

The ISQED 2017 event is held with the technical sponsorship of IEEE CASS, IEEE EDS, and IEEE Reliability Society.

Highlights of Two Sessions:

1. Terrific panel session on Cybersecurity Challenges for the Automotive Industry at the ISQED conference on Tuesday March 14th.

Abstract: In the past couple of years, we have witnessed one of the most dramatic transformations in automotive industry: vehicles are becoming intelligent and connected. They are not only a tool controlled by the so-called “drivers” to transport people and goods from one place to another. They are “talking” to each other as well as roadside infrastructure, making themselves autonomous or “driverless”. In this panel, we have invited experts to share their views on cybersecurity challenges such as safety, security, and privacy that the automotive industry are facing. Our panelists will also discuss how our life will be changed (again) by the next generation vehicles.

Chair & Moderator:

Professor Gang Qu – University of Maryland

Panelists:

Anuja Sonalker – STEER Tech

Gaurav Bansal – Toyota InfoTechnology Center

Navraj Nandra – Senior Director of Interface IP – Synopsys

………………………………………………………………………………..

2. Session on Design for Smart Sensors and Internet of Things (IoT): Low Power MEMS based Sensors

Author’s Notes:

In an enlightening and stimulating presentation on Low Power MEMS based Sensors, David Horsley, PhD described his research in this field along with commercially available piezo-electronics MEMS based sensors from ST Micro, Avago, and Vesper. He noted that low cost, low power and small footprint size sensors are needed for many IoT applications.

Another very real application of ultrasonic sensors (in a matrix configuration) is a fingerprint reader (and validator) for a smart phone. That would eliminate the need for a password to unlock the phone. Current ultra sonic sensors are too big for that application and also require a lot of external electronics.

David is the CTO of Chirp Microsystems which designs, develops, and manufactures a line of extremely low power, ultrasonic 3D-sensing solutions for consumer electronics, smart homes, industrial automation, and much more. Chirp’s technology was originally developed at the Berkeley Sensor and Actuator Center (BSAC) at UC Berkeley and UC Davis. Horsley showed the audience various functional block diagrams of those sensors used in the fingerprint reader application. The company says that their technology is an enabler for high volume, pervasive computing applications for the Internet of Things (IoT).

………………………………………………………………………………………….

AT&T Extends Akamai Partnership Thru 2019

AT&T and Akamai have extended their global partnership through 2019, allowing continued access to Akamai’s cloud and web security services technologies for AT&T business customers. The partnership was initially made in 2012.

Akamai is also expanding its global server footprint located at the edge of AT&T’s IP network. Akamai says the expansion of the server footprint can help deliver higher-quality experiences to AT&T customers through more efficient content routing and improved delivery of digital content, video and Web applications.

“The use of AT&T IP networks and AT&T Security Services along with Akamai CDN and related web security services is a powerful one,” said Mo Katibeh, SVP of AT&T advanced solutions, in a release. “Collectively, they form the underpinnings of the secure infrastructure that can help enterprises thrive in today’s massively connected and distributed world.”

“Our expanded agreement with AT&T is a testament to the strong and trusted relationship our organizations have forged with businesses around the world,” said Tom Leighton, CEO and co-founder, Akamai. “Together, we’ve demonstrated the value and efficiencies of having Akamai’s content delivery capabilities deployed deep into the AT&T IP network. We’re excited to add DDoS protection to the suite of available solutions, addressing a critical customer concern as the size and frequency of cyber attacks continues to rise.”

Fierce Telecom says that “alliances with companies like Akamai are important for AT&T, particularly as it looks to enhance its strategic business set, which represents a growing segment.”

References:

https://www.akamai.com/us/en/about/news/press/2017-press/akamai-and-att-renew-global-alliance.jsp

https://www.business.att.com/enterprise/Service/hosting-services/content-delivery/distribution/

FBR: MWC Conference part II: Implications for US Telcos & Wireless Telecom Equipment Industry

by David Dixon, FBR Technology, Media & Telecom group (edited by Alan J Weissberger, IEEE ComSoc Content Manger)

Editor’s Note:

U.S. wireless telcos + DISH Network are covered in this detailed FBR report along with Nokia and several smaller network/ telecom equipment vendors.

Takeaways for AT&T, Verizon & Nokia:

AT&T is poised to win the FirstNet contract to build a nationwide public safety network, with a Court decision expected as early as next week. We think this will drive an AT&T capex mix shift to wireless as parallel deployment of 700 MHz, AWS-3, AWS-1, and WCS spectrum gets underway in 1H17. AT&T sees a relative industry spectrum advantage.

Verizon is likely to accelerate its spectrum plans as well, and the industry may benefit from more sub-6 GHz access spectrum coming down the pipeline. Meanwhile, in the short run, Verizon is making a tactical shift from small cells to macro densification.

Nokia has created a wireless network wrinkle for Verizon, AT&T, and T-Mobile to a lesser extent, by discontinuing support for Alcatel equipment forcing a costly swap.

If AT&T deploys on schedule, a spectrum advantage is possible if 3.5 GHz industry momentum slows. However, our checks suggest that this is not occurring, a negative for DISH, in our view.

From a derivative perspective, we think AT&T’s wireless push and Verizon’s macro densification push are positive for tower, radio equipment, and antenna equipment providers.

Companies in these sectors include: American Tower, Crown Castle, SBA Communications, Nokia, Commscope, and ARRIS.

Conclusions for AT&T:

■ We view AT&T as likely to be the imminent beneficiary of $6.5B in federal funds to build a nationwide public safety network on behalf of FirstNet. This front-end-loaded network is scheduled to be completed over the next five years. A lawsuit between FirstNet and AT&T’s competing bidder, Rivada Networks, has delayed deployment but is quickly drawing to a close.

Our industry checks indicate:

(1) Oral arguments of two hours each were provided to a very engaged Judge, who clearly understood the legal basis and arguments;

(2) a decision could come as early as the end of this week or, more conservatively, by the end of March.

–>We think AT&T is the likely winner of the FirstNet contract, even in the unlikely event that Rivada wins the lawsuit and is readmitted to the bidding process because, we believe, AT&T is using its balance sheet (if necessary) to ensure bidding victory.

Importantly, certain major states have opted out of the FirstNet network build, (including Florida, New York, California, Texas). AT&T may need to work harder to provide option incentives. These markets will be targeted by Rivada Networks, in our view, should its bid be unsuccessful.

■ AT&T capex mix shift to wireless as ramp in 1st half of 2017 gets underway. AT&T capex has recently been weighted to the wireline segment. For months, AT&T has been waiting for the FirstNet contract to be awarded, frustrated by the Rivada lawsuit. At the conclusion of the lawsuit, assuming AT&T is declared the winner, we believe the company will commence adding substantial wireless network capacity. AT&T has delayed adding capacity using the combination of its non-utilized AWS-3, AWS-1, and WCS spectrum due to the costly nature of the upgrade. It planned, instead, to wait for the FirstNet contract to be awarded and piggyback the 700 MHz buildout program.

■ Assuming a win, AT&T gains access to 2×10 MHz of 700 MHz spectrum to be deployed on 20,000 cell sites, complementing deployment of 40 MHz of non-utilized spectrum in the AWS-3, AWS-1, WCS bands (recently proposed as a lease to utilities as a shared priority-access network). If it deploys on schedule, there is a potential spectrum advantage; we think this could occur in the event that 3.5 GHz industry momentum slows, either through FCC approval delay, denial for license changes to be requested by Verizon, or delayed FCC certification of Spectrum Access System.

Verizon Also About to Move Fast on Spectrum:

At the conclusion of the broadcast incentive auction, we expect Verizon to seek FCC approval for license changes to the 3.5GHz band; 150 MHz of this band was approved by the FCC for indoor and outdoor use, with 80 MHz reserved for general access and 70 MHz reserved for priority access licenses. These priority access licenses are currently based on 70,000 census blocks across the U.S. and for three-year license terms. We think Verizon will seek approval to have this changed to only 400 market areas and license terms extended to 10 years. This should mitigate interference challenges in adjacent areas because interference protection contours were impossible to manage in such small areas. Once approved we see Verizon and T-Mobile moving fast to endorse and deploy low-cost 3.5 GHz spectrum and see device support in 2018 and 2019. This is significant because investors rightly point out that 3.5 GHz spectrum is not a differentiated spectrum band since all market participants and new entrants can access this spectrum. However, once the spectrum is fully utilized and congested, priority-access licenses can create differentiation.

Much More Sub-6 GHz Access Spectrum Coming Down Pipeline:

We point out potential for: (1) an additional 500 MHz of spectrum in the 3.7 GHz to 4.2 GHz band, which may be utilized for both 4G and 5G; (2) as a TDD spectrum, operators that deploy could benefit from a change to High Performance User Equipment (HPUE), first approved for Sprint’s 2.6 GHz band, but could be applied to any TDD spectrum band globally. This would substantially lower network deployment costs by increasing the cell-site area when using higher-power devices.

We maintain that Verizon and T-Mobile are not likely to pursue DISH spectrum, and Verizon is less spectrum challenged strategically than the market assumes.

Verizon Tactical Shift to Macro Densification in Short Term:

Verizon recently issued an RFP to build fiber in 20 to 30 cities, where it plans to deploy additional wireless network capacity using its fiber based Cloud-Radio Access Network architecture.

Our industry checks indicate Verizon recently made a tactical switch from small cell to macro densification to alleviate capacity constraints in certain areas. We think this is due in part to Mobilitie (a Sprint partner) having created zoning approval havoc in many markets. Our checks indicate that the small cell zoning approval time frame has lengthened from six months to two years.

T-Mobile Focused on 600 MHz Deployment ahead of 3.5 GHz:

From a T Mobile perspective, vendor checks indicate that T Mobile is doing OK on the network front but is being pushed very hard to get 600MHz spectrum deployed in every market where they do not have 700MHz coverage.

T Mobile’s network remains the fastest network in many metro markets (and is the surprising roaming partner of choice for international carriers we spoke with in many more markets than we had assumed). However, its Achilles heel is that they still do not have good coverage away from urban markets in areas where there is less competition.

Nokia Creates a Wireless Network Wrinkle for Verizon, AT&T, and T- Mobile to a Lesser Extent:

Following the merger of Nokia and Alcatel, Nokia mandated the sunset of Alcatel network equipment, deployed on approximately half the AT&T and Verizon networks. T-Mobile is also affected to a lesser extent because certain Nokia equipment is also being discontinued. This equipment will have to be replaced on each network because software features will no longer be supported. At a minimum, this will be a costly, unexpected capital outlay. All operators are frustrated because they do not have a choice. Nokia is the only vendor option and will likely dictate pricing.

Although we expect the migration to be well managed (this is not a network rip-and-replace) this could create network performance challenges.

Implications for AT&T, Verizon, and DISH:

If AT&T wins the FirstNet bid and deploys on schedule, there is a potential spectrum advantage. We think this could occur in the event that 3.5 GHz industry momentum slows, either through FCC approval delay, denial for license changes to be requested by Verizon, or a delay in FCC certification of the Spectrum Access System.

However, our Mobile World Congress (MWC) checks suggest this is not likely. On the contrary, we see 3.5 GHz momentum accelerating across the industry, including from the cable sector. This has negative implications for DISH, in our view.

From a derivative perspective, we think AT&T’s wireless push and Verizon’s macro densification push are positive for tower, radio equipment, and antenna equipment providers. Companies in these sectors include: American Tower, Crown Castle, SBA Communications, Nokia, Commscope, and ARRIS.

………………………………………………………………………………………………..

Company-Specific Disclosures:

FBR acts as a market maker or liquidity provider for the company’s securities: AT&T Inc., DISH Network Corporation and TMobile US, Inc.

For up-to-date company disclosures including price charts, please click on the following link or paste URL in a web browser: www.fbr.com/disclosures.

General Disclosures Information about the Research Analyst Responsible for this report:

The primary analyst(s) covering the issuer(s), David Dixon, certifies (certify) that the views expressed herein accurately reflect the analyst’s personal views as to the subject securities and issuers and further certifies that no part of such analyst’s compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed by the analyst in the report. The analyst(s) responsible for this research report has received and is eligible to receive compensation, including bonus compensation, based on FBR’s overall operating revenues, including revenues generated by its investment banking activities.

Highlights of OCP Summit: Mar 8-9, 2017, Santa Clara CA

Key Takeaways:

- Microsoft was everywhere- presenting at the Wednesday morning keynotes, announcing partnerships and new initiatives during Thursday engineering workshops. Progress on the SONIC protocol stack (announced last year) and the new Project Olympus were described in detail.

- Facebook revealed details of it’s “server refresh” and 100GE fiber optic switch-to-switch Data Center network (see section below).

- Yahoo – Japan explained that lower electricity cost was the reason the company has a Data Center in Washington state. They showed a video demonstrating how simple and quick it was to swap out an OCP hardware module in their Washington Data Center.

- Nokia talked about its vision for Telco Cloud, which is actually quite mature. In a different session, they discussed the company’s experience with OCP hardware, including backgrounds and incentives, what choices were made and why. Hardware management interfaces and related improvement needs were disclosed.

- SK Telecom shared its experiences in a trial deployment and maintenance of OCP gear, while also stating its future directions. They conducted an OCP trial for telco infrastructure with three objectives in mind: (1) Analysis of OCP System Deployment Environment, (2) Evaluation of Efficiency, Serviceability, and Performance, (3) Application Test. The company says that the OCP ecosystem in Korea is not mature and has a relatively small market. To minimize risk, SK Telecom would very much like to collaborate with other OCP telco members on practical issues like: vendor selection, existing data center deployments, technical support, compatibility, etc.

- AT&T provided status and updates on several specifications AT&T has or will share with OCP. These include the XGS-PON specs as well as the new G.Fast specs. [Both specs are part of Project CORD which is hosted by the Linux Foundation. Much of the open source code done for Cord is done at ON.Lab.] It was interesting to learn that G.Fast will operate on both low grade copper twisted pairs as well as coax.

- AT&T also revealed its future direction in disaggregated Line Termination Equipment (LTE): remove the processor from the box and replace it with redundant communications links (for failover) to a compute server. That would enable one compute server to control and manage many LTEs. AT&T favors dis-aggregation of network elements, which permits cloud software strategies to be used in place of firmware type applications in telecom equipment. By creating more flexible relationships between hardware and software, new availability and management models are possible.

- EdgeCore highlighted the achievements made in the OCP networking group over the last four years, overview of that latest advancements in Open Networking, and a glimpse into the future of Open Networking. The company is one of two 100GE CWDM-4 optical switch suppliers for Facebook’s 100G Data Center network, as described in the section below.

- HPE talked about the challenges and risks of moving to an open source environment. Citing Gartner Group market research, the company claimed it was the #1 brand for compute and storage servers and #2 in networking.

- Intel presented Rack Scale Design (Intel® RSD) – a logical architecture whose open standard APIs offer infrastructure manageability that is compatible with the hardware designs being contributed and adopted by OCP members.

- Radisys described the OCP Carrier Grade OpenRack-19 specification for the telco data center. It’s a scalable carrier-grade rack level system that integrates high performance compute, storage and networking in a standard rack. Key points covered included:

(1) The telecom industry’s transformation from the traditional Central Office (CO) to virtualized Data Centers and how this transition is driving demand for open hardware solutions from OCP.

(2) Why adapting the OCP base model to the telecom environment must take into account new requirements to accommodate existing Central Offices.

(3) The specific requirements for carrier-grade OCP, including Physical, Content/Workload, Management, and Networking/Interconnect.

(4) How the CG-OpenRack-19 specification aligns with the principles of OCP. Panelists will discuss in-depth how the spec meets requirements for efficient design, scale-out ready architecture, open source and creating a meaningful positive impact.

(5) A real-world example of a CG-OpenRack-19 based hardware solution being deployed in a live network.

Verizon said they will use the OCP Carrier Grade-OpenRack-19 specification to simplify data center deployments and speed up failed equipment replacement time.

- Ericsson discussed their collaboration in open source software projects in order to provide a common management agent framework and sample agent for Ericsson’s hyperscale data center solutions. In a different session, the company discussed solutions for hardware that needs to remain operational in telco data centers which may be deployed in high-temperature (up to 50 degrees centigrade = 122 degrees fahrenheit) situations. A few examples based on Ericsson’s BSP 8100 telco-grade blade servers were presented.

- Google was present, but kept a very low profile, with no keynote presentation(s) or exhibit hall booth. OCP Operations Director & Community Manager Amber Graner wrote in an email to this author:

“Google was there. They were presenting in the Engineering Workshops for the 48v rack standard as part of the Rack and Power Group. They engaged and involved in the community.”

Personally, the best session for me was saved for end of the conference. The very last session on the last day (Thursday):

100G Optics Deployed in Facebook’s Data Centers