Uncategorized

451 Alliance Report: Corporate Cloud Computing Trends Multi-Cloud UPDATE

by 451 Alliance Staff

Update by the Editor on Multi-Cloud Adoption (April 2, 2017):

In the search for higher “fault tolerance,” few companies rely on a single cloud service provider. According to a recent study by Microsoft and 451 Research, nearly a third of organizations work with four or more cloud service providers (CSPs). By using multiple cloud services, enterprises increase their agility and automation. More and more companies are now re-strategizing and adopting a multicloud system.

“In computing, redundancy is a good thing,” says Mart van de Ven, director and consultant at Droste, a data consultancy. “If one provider is ‘nuked’, our services would not be affected because [as a company using multiple providers] we are also running our services on another provider.”

A study conducted by International Data Corporation (IDC) last year found that 86 per cent of enterprises predict they will require a multi-cloud strategy to support their business goals within the next two years.

A recent example of a company adopting a multi-cloud strategy is SNAP, the company with the popular Snapchat messaging and photo-sharing app that recently had a very successful IPO. It has agreed to buy $1 billion worth of Amazon cloud services over the next five years, according to its filing to the SEC in February 2017. This comes just days after SNAP revealed in another document related to its IPO that it has committed to buying $2 billion worth of Google Cloud services over the same five-year timeframe.

Other than serving as a back-up plan, the multi-cloud strategy means that different clouds from different providers can be used for separate tasks. It also enables companies to avoid vendor lock-in, so they can take advantage of price fluctuations and new offerings.

Lack of expertise in multiple clouds makes data management a challenge that businesses face as they grow in size and go global.

Last year, a survey of IT managers in Hong Kong, India and Singapore, by IDG, Connect and Rackspace, showed that over half of overall survey respondents found monitoring and managing multiple and/or complex workloads their biggest multi-cloud challenge.

Choosing cloud vendors with global networks and strong cloud security capability has become essential for companies when they adopt different cloud vendors. For example, many multinational companies with businesses in China are using services from Alibaba Cloud, the cloud computing arm of Alibaba Group, to help manage their global IT infrastructure from one single account, and to gain full-fledged anti-distributed denial-of-service (anti-DDoS) support, with the company’s server on premises or on cloud.

“Companies are adopting multi-cloud by necessity,” van de Ven says.

Both the number of companies using multiple clouds and the number of clouds they’re using are growing. Finding the right expertise to manage clouds is a key concern, according to the 1,002 IT professionals surveyed by RightScale, a cloud management platform. No wonder multi-cloud management is already a fast-growing market.

According to global market research and consulting company MarketsandMarkets, the multi-cloud management market size is expected to grow from US$939.3 million last year to US$3.4 billion by 2021, at a compound annual growth rate of 29.6 per cent.

………………………………………………………………………………………………

Reliability and Cost are Most Important in Choosing a Cloud Computing Vendor

A December 2016 survey of 911 members of the 451 Global Digital Infrastructure Alliance focused on cloud computing trends, including overall spending, levels of adoption and key attributes. These are summarized below:

By Tracy Corbo Overall IT Spending – Next 90 DaysWe asked respondents about their organizations’ overall IT spending and found 38% expect it to increase over the next 90 days – unchanged from the October 2016 survey. Another 11% expect a decrease (up 2-pts from previously).

Cloud Spending – Next 90 DaysCloud vs Overall IT Spending. Cloud spending continues to outpace overall IT spending over the next 90 days, with cloud spending increases 6-pts stronger than overall IT.

Last 12+ Months. Focusing specifically on cloud spending, 44% of respondents expect their organizations’ cloud spending to increase over the next 90 days (down 2-pts from previous), compared with only 4% who expect a decrease. As the following chart shows, the level of cloud spending growth has remained extremely strong over the past year.

Cloud AdoptionSaaS (64%, up 1-pt) remains the most popular type of cloud computing in use, followed by Infrastructure as a Service (43%, up 4-pts) and On-Premises Private Cloud (34%, down 2-pts).

Level of Adoption. Respondents using cloud services were asked to describe the level of cloud adoption in their organizations. Overall adoption remains strong, with three in five respondents indicating broad or initial implementations of production applications. Broad Implementation of Production Applications (31%) is up 2-pts from the previous survey. Initial Implementations of Production Applications (31%) and Running Trials/Pilot Projects (15%) are both up 1-pt.

In contrast, Discovery and Evaluation (15%, down 2-pts) and Used for Test and Development Environments (9%) are down slightly. Clouds Running Mission Critical Applications. Respondents were asked to describe the criticality of the majority of applications running on various cloud environments. More applications critical to business are running on On-Premises Private Cloud (70%) than on IaaS/Public Cloud (59%).

Cloud VendorsThis section looks at the vendors respondents are using across the different types of cloud. On-Premises Private Cloud. The most popular vendor for on-premises private cloud is VMware vCloud (65%), with Cisco (33%) and Microsoft Cloud OS (30%) a more distant second and third.

IaaS. In terms of which vendors respondents are using to meet their IaaS needs, Amazon Web Services (56%) was the most popular choice, followed closely by Microsoft Azure

Key Vendor AttributesRespondents were asked about the most important attributes they look for in a cloud provider. For on-premises private cloud vendors, Platform Reliability (66%) topped the list, followed by Value for Money/Cost (47%) and Technical Expertise (36%).

IaaS/Public Cloud Vendor Attributes. In a similar fashion, Service Reliability (60%) and Value for Money/Cost (55%) top the list, but Secure Services (45%) is third.

Cloud Usage Next Two YearsLooking ahead, respondents were asked to select which of the following best describes how their organization will use different on-premises and off-premises cloud environments over the next two years. Overall, 34% of respondents said they will focus primarily on a single cloud environment. Another 29% said they will have multiple cloud environments with little or no interoperability, and 25% said they will have multiple cloud environments that will migrate workloads or data between different cloud environments.

Company Size. A closer look at the 34% who selected single cloud environments shows clear differences by company size. That number is higher among smaller companies (40% for companies with 1-249 employees; 38% for companies with 250-999 employees) compared to just 26% among companies with 10,000+ employees.

Larger organizations favor multiple cloud environments. Companies with 1,000 to 9,999 employees (36%) will have multiple clouds with little or no interoperability, while 29% of very large organizations (more than 10,000 employees) plan to migrate data between multiple cloud environments. |

FCC seeks $10B in Spectrum Auction; Trump Team Plans to Restructure FCC Bureaus; Pai new FCC Chairman

FCC Forward Auction:

The Federal Communications Commission (FCC) now has a benchmark price of $10,054,676,822 for the forward portion of its wireless spectrum auction [1].

Note 1: In the reverse auction, TV broadcasters sold spectrum which is to be sold in the forward portion of the FCC auction. More at https://www.fcc.gov/general/learn-everything-about-reverse-auctions-now-learn-%E2%80%93-faqs

………………………………………………………………………………………………………

That’s a huge drop from the previous round. It appears a number wireless operators might be able to meet the lowered benchmark price, especially if the average price in the top markets also meets the second condition for closing the auction successfully. It is a far cry from the $86 billion broadcaster asking price when the auction began, though that was for much more spectrum. One low-power TV advocate called it a “fire sale.”

The $10,054,676,822 is how much the government will have to pay—actually it will be wireless companies if/when the auction finally closes for good—to move broadcasters off 84 MHz of spectrum so it can offer it to forward auction bidders for wireless broadband. That is down from the $43 billion broadcasters wanted for 108 MHz in stage 3.

More info at: http://www.broadcastingcable.com/news/washington/spectrum-auction-tvs-new-exit-price-plummets-10b/162451

………………………………………………………………………………………………………

Trump Team Plots to Revamp FCC:

President-elect Donald Trump’s incoming administration reportedly has signed off on a plan to restructure and streamline the bureaus of the Federal Communications Commission.

“There is an opportunity now, not to be wasted, to make some fundamental changes in the FCC’s structure and the way it operates,” said Randolph May of the Free State Foundation.

To read more: http://www.broadcastingcable.com/news/washington/exclusive-trump-team-embraces-fcc-remake-blueprint/162479

Pai expected to be named FCC interim chairman:

Ajit Pai is expected to be named interim FCC chairman on Friday after Chairman Tom Wheeler’s departure, which is coincident with Donald J Trump’s presidential inauguration. White House spokesman Sean Spicer confirmed a meeting between Pai and President-elect Trump and referred to Mr. Pai as the current FCC chairman.

Pai is predicting a “more sober” regulatory approach after President-elect Donald Trump is sworn in, saying in a recent speech that the FCC will be “guided by evidence, sound economic analysis, and a good dose of humility” under its new leadership.

While undoing some of the actions taken by the FCC during the past eight years is likely to be the initial focus of the Trump administration in the coming months, Pai said when attention is turned to new regulations the bar will be set high. “Proof of market failure should guide the next Commission’s consideration of new regulations,” he told the Free State Foundation. “And the FCC should only adopt a regulation if it determines that its benefits outweigh its costs.”

Having served as a Republican commissioner since 2012, Pai has won near-universal praise from broadcasters for his efforts to revitalize the AM band and a willingness to devote resources to radio-related issues. One Washington insider tells Inside Radio he believes the Commission—with Pai and fellow Republican Michael O’Rielly and Democrat Mignon Clyburn—could prove to be highly productive in the coming months. The first item up for a vote is doing away with a regulation mandating broadcasters to keep hard copies of emails and letters sent to the station in their public inspection file. The FCC is scheduled to vote on the change on Jan. 31.

AT&T CEO Stephenson Meets Trump With Time Warner Deal in Background

AT&T CEO Randall Stephenson recently met with President-elect Donald Trump at Trump Tower. AT&T’s proposed $85.4 billion acquisition of Time Warner was not a topic of discussion during the meeting, which centered primarily on job creation, wage increases and “the policies and the regulations that stand in the way of them creating further jobs,” said incoming White House press secretary Sean Spicer.

Even so, the Time Warner deal loomed large. “The No. 1 thing for AT&T right now is the merger, so it is obviously in the background and coloring every single one of these discussions,” said Gigi Sohn, a former senior adviser to Tom Wheeler, the chairman of the Federal Communications Commission. “The Trump people are smart enough to know that.”

The careful positioning of Thursday’s meeting illustrates the difficulties AT&T faces in pushing through the Time Warner deal. The acquisition, announced last October, is the first test for huge mergers in the new administration, which was voted in on a populist wave that is skeptical of such deals because of the job losses that often follow.

But beyond a barometer of antitrust, the deal is also being closely watched for Mr. Trump’s strong-arm approach to media — particularly to organizations whose coverage he dislikes. Mr. Trump repeatedly targeted CNN during the presidential campaign. This week, he criticized the network for reporting on a briefing by intelligence officials to the president and the president-elect about an unverified report linking him to a Russian campaign to influence the election.

The meeting between Mr. Trump and Mr. Stephenson, which included Bob Quinn, AT&T’s head of lobbying and regulatory affairs, appeared to do little to defuse tension. Right after the meeting, Mr. Trump took to Twitter to again attack CNN, which he said is in a “meltdown” and suffering from declining ratings.

The proposed AT&T-Time Warner deal also is set to face fewer regulatory eyes than originally thought. While the Justice Department is reviewing it, AT&T and Time Warner said last week that they did not plan to submit an application to the F.C.C. Time Warner said that after reviewing the satellite and other telecommunications licenses for its television networks, it concluded they did not merit F.C.C. scrutiny, Time Warner said in filings.

References:

Verizon Trial of NG-PON2 Demonstrates Multi-Vendor Interoperability

Verizon Communications says it has reached a breakthrough in lab trials of NG-PON2 technology that will allow various vendors to supply NG-PON2 components to service providers. NG-PON2 can support 40 gigabits per second of network capacity. Verizon called the interop test a “breakthrough,” because it represents a significant step in creating a platform that will enabling the mixing and matching of vendors for various components for NG-PON2, an emerging standard (ITU-T approved the NG-PON2 specs in 2015) that enables up to 40 Gbps of capacity and symmetrical speeds of up 10 Gbps per customer.

In current PON deployments, operators have to use the same company for both optical line terminals (OLTs), the termination point on the service provider side, and optical network terminals (ONTs), the termination point at the end user location. Verizon is determined to change that paradigm. The company plans to publish the open OMCI (ONT Management and Control Interface) specifications that define its new OLT-to-ONT interface in the coming months. The Verizon OMCI spec is being developed as part of the ITU–T G.988 standard.

“We would like NG-PON2 to be the first PON system which is interoperable from day one, and that’s very important for us,” Verizon’s lead engineer on the trial, Dr. Denis Khotimsky, told Light Reading. He said it’s too early to speculate on when NG-PON2 will be ready for commercial deployments. “We’ll proceed with deployment once we see the technology to be mature, cost efficient and when we see the customer demand for the services it provides,” he told MultiChannel News (see reference below).

Unlike when Verizon upgraded from BPON to GPON more than a decade ago, Verizon is hoping to create a more flexible ecosystem of vendors for the migration to NG-PON2. Verizon’s current FTTP networks for FiOS use both the BPON and GPON, but the technologies used for them are not interoperable, so those systems are partitioned geographically while also requiring Verizon to use the same vendor for each end-point of those systems.

The mega telco’s first interop test for NG-PON2 included Adtran Inc, Broadcom Corp, Cortina Access, and Ericsson AB (in partnership with Calix Networks Inc). If Verizon can ultimately depend on interoperable gear from a wider group of vendors, it may be able to exert pricing pressure more effectively and help drive the cost of NG-PON2 deployments down. For now, Verizon isn’t willing to share if it’s working with other companies on NG-PON2 in addition to those listed in the trial.

Nokia Corp would be an obvious bet as an additional equipment partner, but so far that vendor has been left out in the cold. (See Verizon Readies Landmark NG-PON2 Trial.)

NG-PON2 is important for several reasons. It increases total capacity in the access network to 40 Gbit/s, with symmetrical 10-gig speeds possible for each individual customer. NG-PON2 is also resilient in a way that current GPON technology can’t match. Telcos will be able to use NG-PON2 to deliver services over multiple wavelengths on each fiber, making it easy to fail over from one wavelength to another as needed.

In particular, NG-PON2 is believed to be an important foundation for the future growth of 5G wireless technologies. One of the major use cases cited for the PON upgrade is the ability to provide both backhaul and fronthaul support for 5G deployments.

Despite the advantages of NG-PON2, however, several operators are considering an interim step on the road to next-generation PON. Companies like AT&T Inc. (NYSE: T) and Vodafone Group plc (NYSE: VOD) are evaluating XGS-PON technology for the near term as a less expensive alternative to NG-PON2.

For more information:

http://www.lightreading.com/gigabit/fttx/verizon-proves-ng-pon2-interoperability/d/d-id/729487 and

http://www.multichannel.com/news/technology/verizon-touts-progress-next-gen-fttp/410105

In Pursuit of Next Generation FTTP, Verizon OMCI Specs Seek NG-PON2 Interoperability

IHS Markit: Mobile Infrastructure & CAPEX Stuck in a Funk; Project CORD Gains Traction

by

The mobile infrastructure market outlook remains cloudy as 2017 brings us 2 years past the LTE peak, with fewer and fewer potential 2G/3G mobile networks that need to be upgraded to LTE. In the Q4 edition of our Mobile Infrastructure Market Tracker – Regional, released 1 December 2016, we had 537 live commercial LTE networks and a total of 560 in the forecast for the full year. As we believe there are roughly 750+ mobile networks worldwide and those left with no LTE have small footprints in the range of fewer than 1,000+ nodes, the LTE infrastructure hardware market is poised for steep decline this year.

Telecom spending (CAPEX) appears to be very flat at best! Little has changed since last year, and in our most recent biannual Service Provider Capex, Revenue, and Opex Market Tracker – Regional report, released in November 2016, we still expect worldwide capex to barely budge from $341.5B last year to 342.8B by year end—just 0.4% YoY growth.

For an update, please visit https://techblog.comsoc.org/2017/06/05/sk-telecom-rolls-out-4-5g-service-in-south-korea-plans-1g-bsec-service-in-2018/

……………………………………………………………………………………………………………………

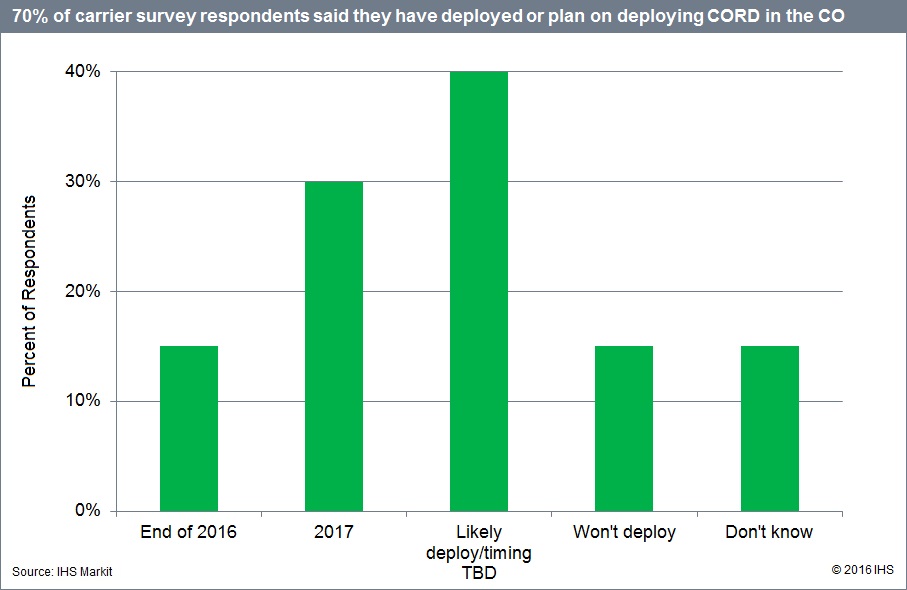

Separately, IHS-Markit’s Michael Howard writes that 70 percent of respondents to an IHS Markit survey plan to deploy CORD in their central offices — 30 percent by the end of 2017 and an additional 40 percent in 2018 or later.

The Central Office Re-Architected as a Data Center (CORD) combines network functions virtualization (NFV) and software-defined networking (SDN) to bring data center economics and cloud agility to the telco central office. CORD garnered so much attention in 2016 that its originator — On.Lab‘s Open Network Operating System (ONOS) — established CORD as a separate open source entity. And non-telcos have joined the open source group, including Google and Comcast.

IHS Markit found that 95 percent of operators surveyed are using or planning to deploy servers and storage in selected central offices to create mini data centers to offer cloud services. And they will use them as the NFV infrastructure on which to run virtual network functions (VNFs).

The survey results are based on interviews with router purchase decision-makers at 20 global service providers that control 36 percent of worldwide telecom capex and a third of revenue.

In other survey findings, operator respondents indicated that 100-Gb/s Ethernet is the wave of the future. They said that it will make up 38 percent of their 10-, 40- and 100-Gb/s Ethernet port purchases during 2018, which is more than two times that of 2016.

In addition, 70 percent of operators surveyed are deploying packet-optical transport systems (P-OTS) or plan to do so by 2018. Between 2016 and 2018, the percentage of nodes with P-OTS is anticipated to grow six-fold in core/long haul and almost double in access, aggregation, metro core, and regional.

“We believe these plans will keep a damper on router sales,” writes IHS Markit senior research director Michael Howard in a summary of the report. “And despite much industry talk, respondents have little current demand for a multilayer data/transport control plane.”

IHS Markit: 100GE Router Port Purchases to More Than Double from 2016 to 2018

By Michael Howard, senior research director and advisor, carrier networks, IHS Markit

Highlights:

- IHS Markit’s operator respondents say that 100GE will make up 38 percent of their 10/40/100GE port purchases during 2018—more than two times that of 2016

- 70 percent of operators surveyed are deploying packet-optical transport systems (P-OTS) or plan to do so by 2018

- 70 percent of respondents plan to deploy central office re-architected as a data center (CORD) in their smart central offices (COs)

IHS Markit Analysis:

Our routing, network functions virtualization (NFV) and packet-optical study covers hot and emerging topics in the carrier Ethernet, routing and switching space, with a focus on the IP edge—the area where architectural changes are occurring closer to the customer. The survey looks at operator deployment plans and strategies, deployment locations, router bypass, port mix, expected price per port, and more.

What’s clear from this latest survey is that telecom is moving to 100G now. Sixteen percent of the 10/40/100GE router ports our survey participants purchased in 2016 were 100GE on average, and these service providers expect their 100GE port purchases to more than double to 38 percent in 2018.

In 2017, almost all operator respondents (88 to 96 percent) expect to be paying “10GE parity” or less in three main areas of their networks. “Parity” means that a 100GE port is priced at ten times the price of a 10GE port.

P-OTS remains an integral part of carrier network architecture. Seventy percent of respondents are deploying P-OTS or plan to do so by 2018. Between 2016 and 2018, the percentage of nodes with P-OTS is anticipated to grow six-fold in core/long haul and almost double in access, aggregation, metro core and regional. We believe these plans will keep a damper on router sales. And despite much industry talk, respondents have little current demand for a multi-layer data/transport control plane.

95 percent of operators surveyed are using or planning to use smart COs by deploying servers and storage in selected COs to create mini data centers to offer cloud services and to use them as the NFV infrastructure on which to run virtual network functions (VNFs).

……………………………………………………………………………………………………………………………………………..

For this year’s survey we added questions about CORD. CORD combines NFV and software-defined networking (SDN) software to improve elasticity and bring data center economics and cloud agility to the telco CO. Seventy percent of respondents plan to deploy CORD in their smart COs—30 percent by the end of 2017 and an additional 40 percent in 2018 or later.

Routing, NFV and Packet-Optical Survey Synopsis:

The 25-page 2016 IHS Markit routing, NFV, and packet-optical strategies survey is based on interviews with router/CES purchase decision-makers at 20 global service providers that control 36 percent of worldwide telecom capex and a third of revenue. The survey provides insights into plans for moving router functions from physical routers to software vRouters and VNFs; 100GE adoption and use of IPoDWDM; router and CES protocols; planned uses of vRouters; plans to deploy P-OTS versus routers; and metro architectural changes and deployment of CORD in smart COs.

For information about purchasing this report, contact the sales department at IHS Markit in the Americas at (844) 301-7334 or[email protected]; in Europe, Middle East and Africa (EMEA) at +44 1344 328 300 or [email protected]; or Asia-Pacific (APAC) at +604 291 3600 or [email protected]

FBR: 2017 Technology, Media & Telecom Outlook – Kumbaya?

by FBR Media & Telecom Staff

Summary

We see 2017 as the year when telecom and media sing “kumbaya.” We see the regulatory stance under the Trump Administration as supportive of M&A, causing investors to increasingly discount the possibility of more combinations. We see this becoming a meaningful, investable, multiyear theme for the group—helpful for potential targets, and possibly threatening for those left single.

■ TMT outlook: kumbaya. We see AT&T’s (T) acquisition of Time Warner (TWX) closing and setting a template for future deals. While investors have reasonably pushed back on the merits of content/pipe combinations by citing a dearth of synergy at CMCSA/NBCU, they forget synergies were constrained by regulations that we see going away in a Republican FCC. So we see potential for cable companies to gain more freedom to use their own backhaul facilities to favor in-house 5G services, driving more cable/wireless mergers. We also see wireless/wired operators gaining freedom to favor in-house content, with such things as 0-based data service and performance advantaged private nets, or by charging rivals more for data access/performance. That should drive more telecom/content mergers, like T/TWX and Sky/Fox, helpful for big content brands that could be seen as in the cross-hairs for the next big deal, such as CBS. Internet video services unattached to a physical plant, like NFLX, Google/YouTube, and AMZN Prime Video, could face new competitive hurdles. The environment also seems poised for a loosening of constraints on local media combinations, which could spark more duopoly-driven asset swaps by TV station owners or expansion of national TV station footprints by broadcast nets, helpful for TV station equities like TGNA.

■ Media & leisure outlook: fundamentals improving. The entire media group would benefit from what seems to be the most likely tax reform, as outlined in our report published on December 16. We see the currently modest pressure on affiliate fees potentially easing slightly, driven by cord-cutting moving toward “app-shaving.” We see income-challenged millennial cohorts migrating away from dropping pay TV altogether and toward embracing the new, low cost virtual bundles, like DirecTV Now. TV advertising will have to comp recurring lifts in 2016 from political and Olympics but should benefit from a stronger economy. Normal weather would be positive for theme parks after a tough summer 2016. Regional ski resorts also have easy comps versus a historically bad season in the Northeast/Midwest last year.

■ Telecom services outlook. We increase our view on the telecom services sector from Underweight to Overweight for 2017 driven by potential valuation upside from regulatory relief, tax reform, and M&A activity under a Republican Administration. We see higher likelihood of an Sprint/T-Mobile combination but less likelihood of a wireless acquisition by a cable company in the near term as their in-house services can be disruptive to wireless valuations ahead of a deal. A politically influenced DOJ may be necessary given the extensive public record justifying four nationwide wireless providers and a limited economic versus legal admin skill set. The ongoing broadcast incentive auction will likely wrap up in early 2017, with final proceeds likely much lower than expectations as the industry continues the shift to higher bands, leveraging a lower-cost, software-centric technology cycle, which we believe will drive up spectrum reuse and drive down valuations for high-band spectrum. We expect a capex investment shift from efficiency-driven automation to edge security and analytics engines that evaluate unstructured data from the device to the application server. Legacy capex trends will again be ugly as telecom network returns on incremental capital investment remain negative, which is driving a change in investment strategy across the industry.

……………………………………………………………………………….

Will cable enter the wireless space in the near term?

The combination of an intensely competitive wireless environment, negative incremental returns on invested capital, and organic disruption from cable companies to the wireless sector should discourage a near-term wireless acquisition by cable companies, in our view. However, we believe cable will gain greater leverage over the wireless sector over time, and a wireless asset or partnership is likely in the medium to longer term to augment delivery of profitable content to customers beyond their footprints. In the short term, we think cable companies prefer to better understand their impact on the wireless business model. Ahead of an acquisition, we think they will focus on testing the disruptive capabilities of their in-home and in-building assets as they incorporate LTE on commodity spectrum bands into their hardware. In the meantime, Verizon and AT&T continue to diversify away from a fiercely competitive wireless access market into content and are positioning their respective companies to manage the next wave of wireless network usage by pivoting to a lower-cost dark fiber–rich distributed compute platform. We expect additional M&A activity in both content and dark fiber in 2017. Sprint’s firmer footing suggests there is potential to make another attempt at a merger with T-Mobile US. We believe a second merger attempt could pass regulatory muster under a business-friendly Republican-led Administration.

Will a rollback of regulatory restraints under the new Trump Administration spark more M&A over time?

We believe so. Trump’s early FCC brain trust is populated by free market enthusiasts who seem diametrically opposed to the Obama Administration’s embrace of constraints like net neutrality and the threat of Title II–backed rate regulation. To us, this suggests that wireless and cable companies will gain new freedoms to leverage their investments in wired, wireless, and content assets for their own benefit. We see this favoring more mergers of wireless companies with those owning physical plants, such as cable companies, and more mergers of wireless and cable companies with content companies.

………………………………………………………………………………………………………..

Editor’s Note: We strongly disagree with many points made above by FBR, especially related to M&A, which we feel is incredibly destructive to the telecom industry, results in less competition and higher prices for consumers and concentrates too much power in the acquiring company, e.g. AT&T if they take over Time Warner.

According to a January 5th Bloomberg article:

Donald Trump remains opposed to the megamerger between AT&T Inc. and Time Warner Inc. because he believes it would concentrate too much power in the media industry, according to people close to the president-elect, who has been publicly silent about the transaction for months.

Trump told a friend in the last few weeks that he still considers the merger to be a bad deal, said one of the people, who asked not to be identified because the conversation was private. Trump’s chief strategist, Steve Bannon, is also opposed to the deal, another person said.

It remains unclear whether Trump would try to influence the regulatory review of the merger, either by pushing officials to impose conditions or to block the deal entirely. The transaction, which would combine the biggest U.S. pay-TV and internet provider with one of the largest creators of TV programming, will be reviewed by the Justice Department and possibly by the Federal Communications Commission.

Trump, who takes office Jan. 20, has nominated Senator Jeff Sessions, an Alabama Republican, to lead the Justice Department, and hasn’t named a successor to departing FCC Chairman Tom Wheeler.

In October, before the election, Trump said his administration wouldn’t approve the merger, saying, “It’s too much concentration of power in the hands of too few.” He cited the deal as “an example of the power structure I’m fighting.”

AT&T to Deliver “DirecTV Now” Internet Video Service via mm wave in 2018

AT&T hopes to begin using “5G”-based millimeter wave spectrum technology to wirelessly deliver its “DIRECTV Now” (Internet TV) service to homes. The company has achieved speeds of 14 gigabits per second in lab tests with several partners that include Intel, Ericsson and Qualcomm. AT&T’s goal is to see how millimeter wave “last mile” technology handles high volume video traffic.

AT&T’s John Donovan says the mega carrier plans to offer commercial point-to-point “5G” next year (2018), which is two years before ITU-R completes the first round of true 5G standards. Nonetheless, AT&T says its mobile 5G service should be commercially available in 2019, according to Mr. Donovan who has led AT&T’s network upgrades over the past nine years from 2G to 3G to 4G. He now says 5G will have a bigger impact by enabling things like driverless cars, live maps and virtual reality.

“Five G is a bigger thing than I have ever been involved in my career because it opens up whole new worlds,” he said.

To read more:

http://www.prnewswire.com/news-releases/att-details-5g-evolution-300385196.html

https://www.engadget.com/2017/01/04/atandt-to-conduct-5g-streaming-tests-with-directv-now/

IHS Markit Router & Switch Survey: Cisco, Juniper, Huawei & Nokia form Top Tier

By Michael Howard, senior research director and advisor, carrier networks, IHS Markit

Highlights:

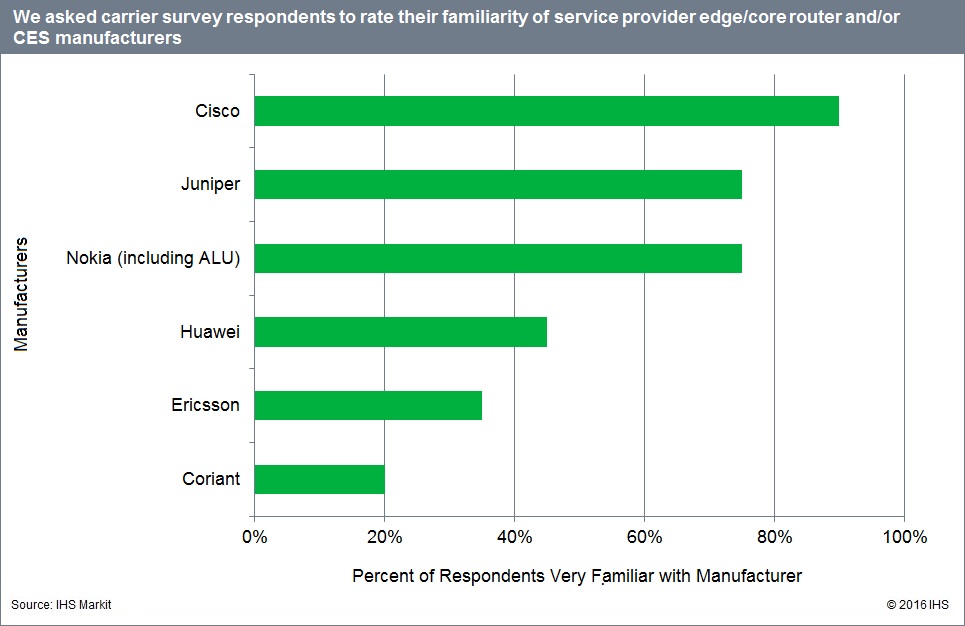

- Among IHS Markit’s service provider respondents, Cisco, Juniper, Huawei and Nokia form a top tier separated by a wide margin from other router and switch vendors

- Cisco was the top-scoring company in edge/core router and Carrier Ethernet Switch (CES) leadership

- All four vendors—Cisco, Juniper, Huawei and Nokia—were named by respondents as leaders in next-generation routing technologies such as 100GE, vRouter and IP data center interconnect (DCI)

IHS Markit Analysis:

The IHS Markit router and switch vendor leadership survey measures service provider attitudes toward and perceptions of edge router, core router and CES manufacturers. The 20 responding operators to our study control 36 percent of worldwide telecom capex and one-third of revenue.

In the 2016 study, Cisco was at the top of respondent edge/core router and CES manufacturer leadership scores. Cisco—along with Juniper, Huawei and Nokia (including Alcatel-Lucent)—form a top tier clearly separated by a wide margin from the other manufacturers. Together, these four manufacturers account for about 86 percent of worldwide revenue market share for routers and CES.

Cisco, Juniper, Huawei and Nokia were the leaders in all five of the carriers’ top manufacturer selection criteria: price-to-performance ratio, product reliability, service and support, technology innovation and product roadmap. There was a big gap between these four and their competitors, with the sole exception being price-to-performance ratio.

Looking at the individual manufacturer selection criteria, when it comes to product reliability and service and support, Nokia was tops among respondents, followed by Cisco and Juniper. For technology innovation and product roadmap, Cisco and Nokia were numbers one and two, respectively. And for price-to-performance ratio, the Chinese vendors led with Huawei at number one and ZTE at number two.

Cisco, Juniper, Huawei and Nokia also led in other measures including unaided awareness, familiarity (or aided awareness), and equipment installed and under evaluation. The vendors likewise ranked at the top when survey respondents named leaders in next-gen routing technologies including 100GE, vRouter and IP DCI.

Router and Switch Survey Synopsis:

The 15-page 2016 IHS Markit switch and router vendor leadership survey sheds light on how global service providers select router and CES manufacturers, whose equipment they have installed and will evaluate for future purchases, and which manufacturers they consider to be leaders in key manufacturer selection criteria. The study features operator ratings of 11 vendors (Brocade, Cisco, Coriant, ECI, Ericsson, Fujitsu, Huawei, Juniper, NEC, Nokia [including Alcatel-Lucent] and ZTE) on 9 criteria.

For information about purchasing this report, contact the sales department at IHS Markit in the Americas at (844) 301-7334 or[email protected]; in Europe, Middle East and Africa (EMEA) at +44 1344 328 300 or [email protected]; or Asia-Pacific (APAC) at +604 291 3600 or [email protected]

Networking Startups Out of Stealth Mode in 2016- Will Any Succeed?

Several networking startups, most of which are actually software companies, launched products claiming to transform networking with SD-WAN, SD-Security, wireless networking with machine learning, guest WiFi services, and various new twists on network virtualization and virtualized routers. Many of these startups are focused on the SD-WAN market, which IDC forecasts will reach $6 billion by 2020.

The new age networking companies included: Barefoot Networks, 128 Technology, Apstra, Cloud4Wi, Mist Systems, CloudGenix, and SnapRoute. In November, Forward Networks launched out of stealth using formal verification to model network behavior and help prevent outages.

………………………………………………………………………………………………………………………………………………………………..

We believe that Barefoot Networks, headed up by South African Martin Izzard, is the most promising of the bunch and very well funded. The company announced it’s programmable switch platform in June – touting it as the world’s fastest and most programmable series of switches. Barefoot’s Tofino switch chip can fit inside hardware devices to direct the flow of data traffic across networks, and the company plans to advance SDN though its software suite of tools for programming Tofino. The startup also built a programming language, P4 — Programming Protocol-Independent Packet Processors – to allow developers to differentiate their networks and solutions.

In November, Chinese web goliaths Alibaba and Tencent led a $23 million funding round for Barefoot. Since it emerged from stealth in June, the company has raised more than $150 million, backed by venerable and respected companies like Hewlett Packard Enterprise, Google and Goldman Sachs.

………………………………………………………………………………………………………………………………………………………………..

Viptela is a four year old startup that specializes in network virtualization and SD-WAN. 90% of Viptela’s customers are hosted on Amazon Web Services. The others are giant enterprises that use its services in their own data centers. The company recently named Praveen Akkiraju as CEO. More details at: http://www.bizjournals.com/sanjose/news/2017/01/12/cisco-veteran-takes-reins-at-san-jose-competitor.html

…………………………………………………………………………………………………………………………………………………………………

Conclusion:

The startups boast impressive leadership and funding, but we believe very few, if any, will actually survive and gain critical market mass to challenge incumbent network equipment companies left, e.g. Nokia, Ericsson, Huawei, Cisco, ZTE, Ciena, etc.