Uncategorized

IHS: Most Service Providers Will Deploy NFV by 2017; Light Reading: 4 Top NFV Carriers

By Michael Howard, Senior Research Director Carrier Networks, IHS Markit

Key Points:

- 100 percent of service providers participating in the IHS Markit NFV strategies survey say they will deploy network functions virtualization (NFV) at some point, with 81 percent expecting to do so by 2017

- Moreover, 59 percent of operator respondents have deployed or will deploy NFV this year

- Integrating NFV into existing networks is an issue for a majority of survey respondents, as is the lack of carrier-grade products

IHS Analysis:

Service providers around the globe are moving toward NFV, which the latest NFV strategies study by IHS Markit bears out. These carriers believe that NFV and its software-defined networking (SDN) companion are a fundamental change in telecom network architecture that will deliver benefits in automation; new, more agile services and revenue; operational efficiency; and capex savings.

Many carriers in 2016 are moving from their NFV proof-of-concept (PoC) tests and lab investigations and evaluations to working with vendors that are developing and productizing the software, which is being deployed commercially.

The carrier mind-set toward NFV is changing quickly. In 2014, there was one standout barrier: operations and business support systems (OSS/BSS). In 2015 and 2016, the top barriers—integrating NFV into existing networks and non-carrier-grade products—show that carriers are very serious about deploying NFV.

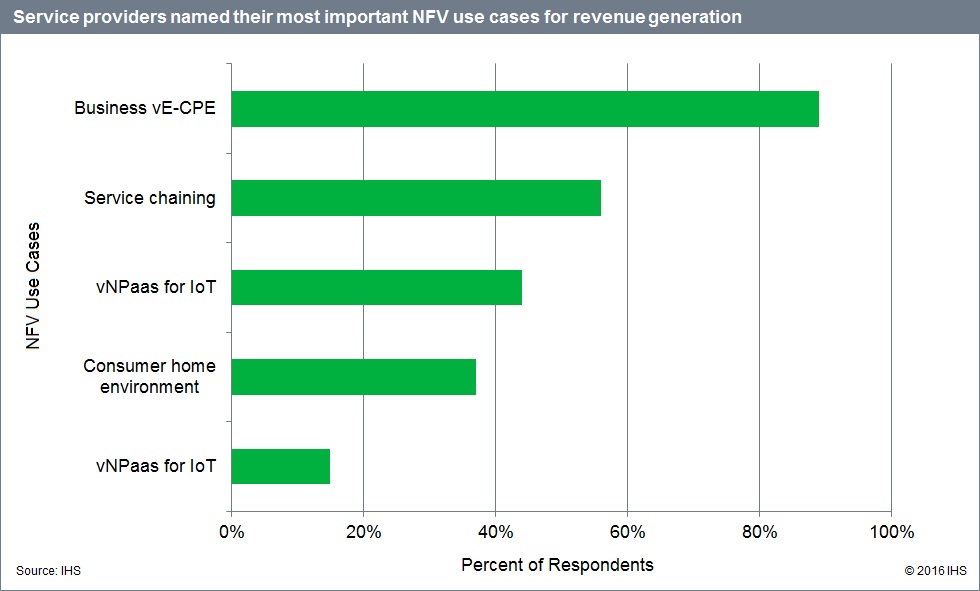

The vast majority of early NFV deployments in the next year, and overall, will be for business virtualized enterprise customer premises equipment (vE-CPE), also known as vBranch or enterprise vCPE. Growing in importance over the last several years, business vE-CPE can assist with revenue generation because it allows operators to replace physical CPEs with software so they can quickly innovate and launch new services.

The industry is still in the early stages of a long-term transition to SDN and NFV architected networks. Carriers will learn that some avenues are not as fruitful as expected, and telecom equipment manufacturers and software suppliers may well invent new approaches that open up newfound applications.

NFV Survey Synopsis:

The 26-page IHS Markit NFV strategies survey is based on interviews with purchase-decision makers at 27 service providers around the world that have deployed NFV in their networks or plan to do so in the future. Operators were asked about their strategies and timing for NFV, including deployment drivers and barriers, target use cases, applications and more.

For information about purchasing this report, contact the sales department at IHS Markit in the Americas at (844) 301-7334 or [email protected]; in Europe, Middle East and Africa (EMEA) at +44 1344 328 300 or [email protected]; or Asia-Pacific (APAC) at +604 291 3600 or [email protected].

From Light Reading website by Ray Le Maistre, Editor-in-Chief, Light Reading

Network/Data Center Operator category.

AT&T — AT&T Managed Internet Service on Demand

AT&T is one of the NFV standard-bearers that is being tracked by the rest of the industry as it forges ahead with the launch of commercial services based on NFV and SDN capabilities.

As the operator itself puts it, it is “putting software rather than hardware at the center of our network, which translates to lowered costs, accelerated rollout of new services and greater control to our customers. The Network on Demand platform is the first commercial offering in the US letting business customers order, change, and provision network services on their own and in near real time.” The operator also believes it is a global first deployment at the kind of scale AT&T has deployed.

Key to AT&T’s proposition is making life easier for its enterprise customers by enabling them to manage their services via an online self-service portal: “On Demand capabilities dramatically change how AT&T customers do business and manage systems, platforms and software. They speed up and simplify the process, and give users more flexibility in managing their own network,” notes the operator.

It’s fair to say that AT&T is putting into practice what many operators have been hoping to achieve from their SDN and NFV strategies.

Boingo Wireless — Offices and Networks Go Virtual

WiFi networking specialist Boingo hasn’t made a lot of noise about its NFV deployment strategy but it’s a smart approach that has helped the company build new business and operational opportunities.

Its NFV capabilities, developed in-house, are at the heart of its S.M.A.R.T. network strategy, which provides faster speeds and a differentiated, tiered connected experience to respective groups of consumers. Boingo’s NFV technology allows it to “dynamically scale to meet capacity demand created by consumers looking to download video, upload large files and stream media,” the company says.

That capability has played a critical role in Boingo’s relationship with Sprint, for which it offloads data traffic as part of a roaming agreement. When the Sprint relationship kicked in, the mobile carrier began “automatically offloading tens of millions of devices to Boingo networks in real time… Boingo was able to auto-scale from six servers to more than 50 immediately, without time-consuming configuration and launch processes.”

Boingo’s NFV strategy is a classic case of emerging technology being put to targeted business use.

Masergy Communications — Masergy Managed Network Functions f(n)

Here’s a statement that should be music to the ears of every company looking for virtualization inspiration: “Masergy deployed NFV solutions that actually solve a problem for its customers rather than just implementing technology that cuts its own operating costs.”

That quest to deploy cutting edge technology to engage with, and improve service experience for, customers began in 2014 but was commercialized in 2015 with the Virtual f(n) launch, which uses NFV technology to enable enterprise users to download virtual network functions (VNFs) such as routers, firewalls and session border controllers as simple software downloads to a shared hardware platform, in a similar way to a smartphone user downloading an app. “With Virtual f(n), Masergy was able to add incredibly agile and flexible solutions to its family of distributed, fully managed network functions,” the company notes.

Another case of NFV being deployed to meet real business needs.

SmartSky Networks — SmartSky 4G

If you want evidence that NFV is taking off, look no further than SmartSky Networks, which is using Brocade’s vEPC running on VMware’s vCloud NFV for its air-to-ground broadband network, SmartSky 4G, connecting airline passengers. The SmartSky network comprises more than 250 cell sites across the US located to provide airborne users with “an online experience comparable with that in their office or at home.”

According to SmartSky, the vEPC system manages the traffic to and from aircraft and enables “deployment in a commercial IaaS environment supporting rapid and cost-effective deployment of the geographically distributed network.” Using the vEPC will enable SmartSky to provide 4G services without the need to deploy redundant functions, helping to lower costs and boost performance compared with physical, node-based mobile packet core systems.

IHS: Welcome to 4G Land: LTE-Advanced Goes Mainstream

By Stéphane Téral, senior research director, mobile infrastructure and carrier economics, IHS Markit

Key Points:

- The migration from basic Long Term Evolution (LTE) to true 4G is well underway:

84 percent of IHS Markit’s service provider respondents are already running LTE‑Advanced (LTE-A) networks - Barriers to deploying 4G are nonexistent at this point, and the main driver for 4G is the lower cost per megabyte of data

- Easy upgradability and standards compliance are the top two LTE features among those surveyed

- Respondent carriers view Ericsson as the top LTE vendor, followed by Nokia and Huawei

IHS Markit Analysis:

IHS Markit asked service providers participating in its 4G survey whether they had deployed LTE-Advanced and found that a vast majority (84 percent) are already running a 4G network. This is significantly higher than a year ago, when around half of survey respondents were running LTE-Advanced—a clear indication of a quick migration from initial LTE rollouts to 4G through the implementation of carrier aggregation.

Case in point: according to recent Global Mobile Suppliers Association (GSA) data, 521 operators have now commercially launched LTE, LTE-Advanced or LTE-Advanced Pro networks in 170 countries. 147 of these operators have deployed LTE-Advanced, and 9 have commercially launched LTE-Advanced Pro. LTE-Advanced has now moved into mainstream deployments, and the GSA has raised its forecast to 560 LTE network deployments by the end of 2016.

The most deployed LTE-Advanced feature among operator respondents is inter-band carrier aggregation, followed by enhanced inter-cell interference coordination and LTE‑Advanced coordinated multipoint. Three- and four-component carrier aggregation is rising fast, and five component is coming soon.

Voice over LTE (VoLTE) is exploding: three-quarters of those surveyed are offering VoLTE, up from just a quarter last year. This will not necessarily lead to imminent 2G or 3G shutdown, but 2G is rising on the agenda.

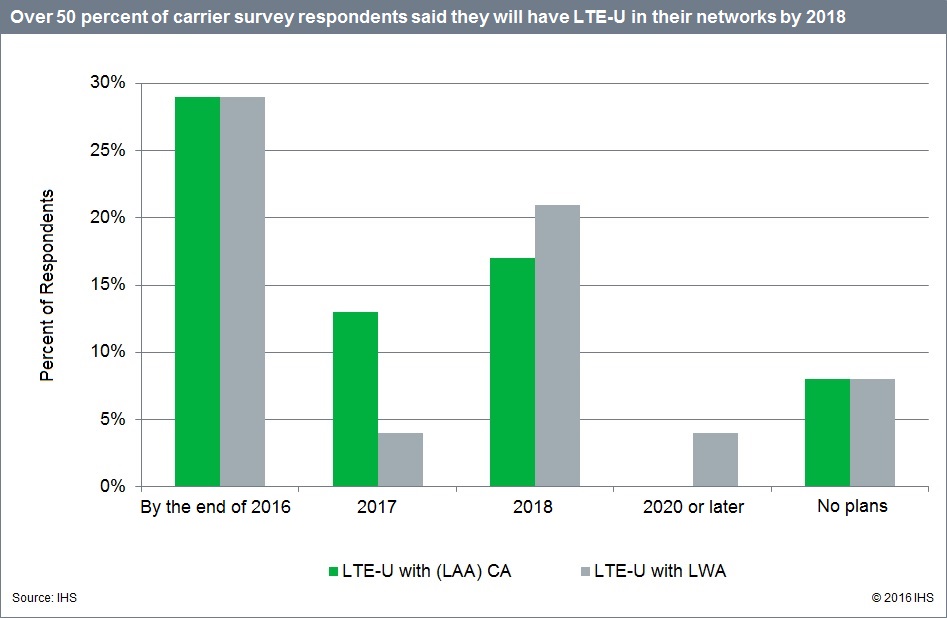

And when it comes to LTE in unlicensed spectrum (LTE-U), over 50 percent of respondents plan to deploy LTE-U by 2018. These respondents are operating in very competitive markets that push them to use as many spectrum ammunitions as possible to stay ahead of the capacity crunch curve to keep their subscribers happy and, of course, on their networks.

4G Survey Synopsis

For the 24-page 4G survey, IHS Markit interviewed purchase-decision makers at 24 global service providers that have deployed or trialed LTE or will do so by the end of 2017. The study covers LTE features and upgrade drivers and barriers; LTE-Advanced timing and features; LTE-U; VoLTE service timing and data/voice roaming; and operator ratings of LTE manufacturers (Ericsson, Huawei, Nokia, Samsung and ZTE). The operators participating in the study represent about half of the world’s telecom capex and revenue.

For information about purchasing this report, contact the sales department at IHS Markit in the Americas at (844) 301-7334 or [email protected]; in Europe, Middle East and Africa (EMEA) at +44 1344 328 300 or [email protected]; or Asia-Pacific (APAC) at +604 291 3600 or[email protected].

Verizon LTE Advanced covers more than 450 cities from coast to coast.

https://www.verizonwireless.com/featured/lte-advanced/?cmp=SOC-C-HQ-NON-S-AW-NONE-lTEATWFirstView-2S0OO0-CO-P-TWT-RE-PP-083016LTE

Complete Deep Research Report on 4G LTE Wireless Broadbandmarket spread across 103 pages, profiling 09 companies and supported with 101 tables and figures is at

http://www.deepresearchreports.com/contacts/inquiry.php?name=225815

The report provides a basic overview of the industry including definitions, classifications, applications and industry chain structure. The 4G LTE Wireless Broadband industry analysis is provided for the international markets including development trends, competitive landscape analysis, and key regions development status.

Development policies and plans are discussed as well as manufacturing processes and cost structures are also analyzed. This report also states import/export consumption, cost, price, revenue and gross margins.

Key Manufacturers Analysis of 4G LTE Wireless Broadband Industry: Gemalto NV, Huawei Technologies Co. Ltd., Sierra Wireless Inc., Telit Communications SpA, Novatel Wireless, Option, Quectel Wireless Solutions, u-blox and ZTE.

AT&T Joins Intel "Super 7" to collaborate on NFV & Integrated cloud platform

Executive Summary

AT&T has become the newest member of Intel’s Super 7 initiative, a coalition of technology companies — including Facebook, Google and Microsoft — that are seeking to revolutionize the data center. Under a new partnership, AT&T will use Intel’s semiconductor technology to advance its network virtualization strategy and integrated cloud platform.

AT&T SDN/NFV Initiatives

Several years ago AT&T initiated an ambitious plan that entailed making use of SDN and NFV as the means to transform and upgrade its network infrastructure, SVP Andre Fuetsch, Senior Vice President of Domain 2.0 Architecture & Design, recounts in an Aug. 17 blog post.

Andre Fuetsch is responsible for delivering the architecture and design of AT&T’s future networking evolution. This transformation will utilize software-defined networking and network function virtualization to deliver products and services to the customer with greatly reduced time to market and significant operational efficiencies. He leads a team of over 2,000 engineers and computer scientists working on programs encompassing both the business and mass market customer segments.

Recognizing the benefits collaboration could bring with the dominating leader of the server microprocessor market, AT&T management struck up a cloud network innovation partnership with Intel to realize its strategic aims. AT&T and Intel have been collaborating on projects aimed at incorporating next-generation 5G broadband wireless and unmanned aerial vehicle (UAV) drone technology into its evolving new ¨software-centric¨ network architecture,

Mr. Fuetsch wrote:

“Intel and AT&T have worked together for a long time. Most recently, we’ve been collaborating on technologies including 5G and drones. Bringing them into our software-centric network program was a natural fit. We’ll also be joining Intel’s “Super 7”. These are influential web and cloud companies on the cutting edge of network and data center design. We’re the first connectivity company to join this group. Call it the “Super 7+1”.

We’ll be optimizing NFV packet processing efficiency for our AT&T Integrated Cloud, or AIC. We’ll also define reference architectures and align NFV roadmaps to speed up our network transformation.

This means we’ll continue to get new software-based network services and capabilities to our customers faster than ever, just as we did with Network on Demand and Network Functions on Demand. Open source software running on hardware powered by Intel chips will enable many of these virtualized network functions. So we’re asking the developer community to stay engaged, too. Open source groups like OpenStack, OPNFV, OpenDaylight, ON.lab, OpenContrail, the Open Compute Project and others are vital to us.”

AT&T is joining Intel’s ¨Super 7,¨ a group of leading Web and cloud companies aiming to push the envelope and improve network and data center design. AT&T would be the first broadband carrier to join the group, making it ¨Super 7+1,¨ Fuetsch wrote.

Intel says its future depends on the new applications enabled by networks like AT&T’s, elevating the carrier into the same elite group of public and large private cloud computing companies it calls the “Super 7”: Amazon.com, Microsoft, Google, Facebook, Baidu, Alibaba and Tencent. Like those companies, AT&T will get early access to Intel silicon and other technologies. Patrick Moorhead, president of Moor Insights & Strategy, said it was odd to include AT&T in the group of the largest cloud companies, but it could help Intel ensure that its chips and devices will run well on 5G networks.

As a ¨Super 7¨ member, AT&T is looking to optimize NFV packet processing efficiency for the AT&T Integrated Cloud (AIC). Company researchers will also define reference NFV architectures and align them with its network transformation plans in a bid to bring them to fruition sooner.

Faster, lower cost introduction of new cloud software and services are among the key prospective benefits AT&T, Intel and others are looking to gain from SDN and NFV. Making use of open source software and Intel processors are core facets of their collaborative efforts. That includes staying actively engaged with open source groups such as OpenStack, OPNFV, OpenDaylight, ON.lab, OpenContrail, the Open Compute Project and others, Fuetsch noted.

Opinion: It remains to be seen if this and other SDN/NFV partnerships can be commercially successful in the absence of any definitive interoperability standards and their implementation by carriers and cloud service providers. We are HUGE SKEPTICS at this time!

References:

http://fortune.com/2016/08/17/intel-and-att-partnership-data/

http://www.telecompetitor.com/att-joining-intels-%C2%A8super-71%C2%A8-sdnnfv-initiative/

http://www.rcrwireless.com/20160818/telecom-software/att-deepens-intel-p…

http://siliconangle.com/blog/2016/08/17/intel-bets-on-5g-wireless-networks-and-ai-to-power-its-future/

IHS: 100G+ WDM & China Spending drives Global Optical Network Equipment Market Growth

by Heidi Adams, senior research director, transport networks, IHS Technology:

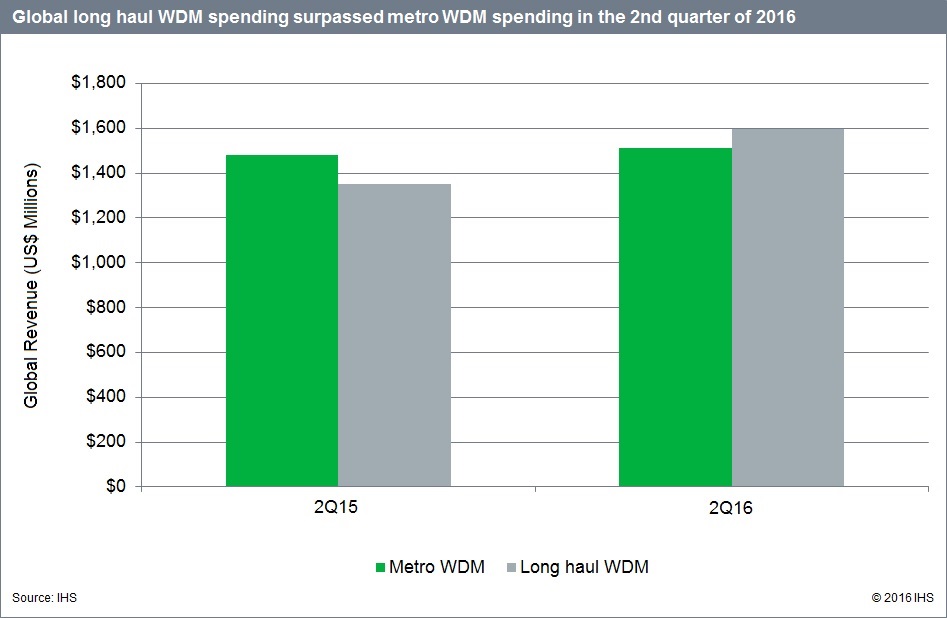

- The long-haul wavelength-division multiplexing (WDM) segment of the optical network hardware market outperformed the metro WDM sector in Q2 2016, with spending increasing 23 percent sequentially and 18 percent from a year ago

- Optical spending in China got a huge uplift in Q2 2016, growing 41 percent quarter-over-quarter and 22 percent year-over-year; China comprised over a quarter of global optical gear spending in the quarter

- Riding the wave of the strong spending cycle in China—coupled with solid gains in EMEA (Europe, Middle East, Africa) and CALA (Caribbean and Latin America—Huawei notched a 41 percent year-over-year revenue uptick in Q2 2016 and grabbed a 32 percent share of the optical hardware market

IHS Analysis

Driven by 100G+ long-haul WDM and a spending spree in China, the global optical network equipment market grew 15 percent sequentially in Q2 2016 and 7 percent from the year-ago quarter, to $3.5 billion.

In Q2 2016, the WDM equipment segment notched gains of 13 percent quarter-over-quarter and 10 percent year-over-year as 100G long-haul deployments accelerated and 200G+ deployments started to ramp. WDM long haul comprised just over half of WDM spending in the quarter.

Metro WDM growth was more muted in Q2 2016, increasing just 2 percent from Q2 2015. However, IHS Markit expects metro WDM growth to pick up toward the end of 2016 as new metro data center interconnect (DCI)–oriented products start shipping in volume and as major metro deployments in North America—principally by Verizon—begin to ramp.

The Synchronous Optical Networking (SONET) and Synchronous Digital Hierarchy (SDH) segment increased sequentially in Q2 2016 driven by project-specific spending, but it maintained its longer-term overall decline with spending down 8 percent year-over-year.

Optical Report Synopsis

The IHS Markit optical network hardware report tracks the global market for metro and long-haul WDM and SONET/SDH equipment, Ethernet optical ports, SONET/SDH ports and WDM ports. The report provides market size, market share, forecasts through 2020, analysis and trends. Vendors tracked include ADVA, Ciena, Cisco, Coriant, ECI, Fujitsu, Huawei, Infinera, NEC, Nokia, ZTE and others.

For information about purchasing this report, contact the sales department at IHS Markit in the Americas at (844) 301-7334 or [email protected]; in Europe, Middle East and Africa (EMEA) at +44 1344 328 300 or[email protected]; or Asia-Pacific (APAC) at +604 291 3600 or [email protected].

IHS References:

Optical Network Hardware Market Tracker – Regional, China, Japan, India

https://technology.ihs.com/Services/550805/optical-networks-intelligence-service

Comprehensive Mobile Market Assessment from Chetan Sharma, Mobile Marketing Expert

Highlights of the US Mobile Market Q2 2016

· 12 years ago, US mobile data revenues were less than 5% of the overall revenues. In Q2 2016, mobile data revenues crossed the 75% threshold becoming the second country after Japan to do so.

· Service revenue declined again, down 2% YoY. Overall revenue was flat as device revenue made up for the decline.

· Mobile data revenues increased 8% YoY while Voice revenues declined 31%.

· The overall ARPU was below $40 again.

· Net income saw a nice bump, increasing by 10% YoY with AT&T leading the way with 14% increase.

· Sprint’s capex was lowest in recent memory dropping almost 80% YoY.

· Device revenues declined sharply as consumers are upgrading at a slower pace than before and new device launches haven’t really motivated consumers to upgrade.

· The postpaid upgrade cycle was the slowest in recorded history reaching over 4.4 years in Q2. The overall industry upgrade cycle is over 2.5 years now.

· For the first time, IoT (including connected cars) net adds exceeded phone and tablets combined.

· There were more connected cars net-adds than there were phone net-adds. For the 7th straight quarter, AT&T added more cars than phones and tablets combined.

· AT&T is dominating the IoT Revenues and with Verizon, the duo is pretty much cleaning up the IoT revenue stream in the operator segment.

· AT&T’s connected car onboarding pace is 2x that of its connected tablets pace. Operator is expected to reach 10M connected car subscriptions very soon in roughly 12 quarters compared to 25 quarters it took for the tablets.

· Verizon and T-Mobile have captured the bulk of the postpaid growth in the last three years.

· EBITDA and Net Income saw double digit gains indicating operators are running a much tighter ship than before.

· Churn is at historic lows. Despite all the commotion in the market, fewer customers are churning each quarter. Next churn opportunity is coming next month with the new iPhone release.

· US is well positioned to cross 400M in subscriptions in 2016. As of Q2 2016, the subscription tally stood at roughly 390M.

· The mobile data consumption continues to rise. US is third behind Finland and Korea in terms of GB consumed per sub/month and first amongst nations with more 60M population.

· Verizon’s IoT+Telematics rose 25% YoY to $205M inching towards a $1B/yr run rate.

· Apple’s service revenue is now consistently greater than iPad and Mac revenue streams making it the number two revenue stream behind the gargantuan iPhone bucket.

· AT&T and Verizon on average made $17 per sub/mo while T-Mobile and Sprint roughly $1.6/sub/mo.

· Android ecosystem revenues and profits improved slightly primarily on the back of Samsung’s quarterly results. As expected, iPhone units and revenues dipped again.

· FCC’s Incentive Auction created a massive $86B clearing hurdle which is likely to translate into some issues with the process.

· Pokemon Go became the latest app sensation growing at almost 4x the rate of the last rocket ship- Angry Birds2

What’s next for the mobile broadband industry?

The logical conclusion is that mobile data growth will continue. The usage growth supports that view. In fact, we believe, that mobile data will subsume voice and messaging revenue streams and they will disappear from operator financials soon. It has already happened for some.

If you have been paying attention to our 4th wave analysis, you would have noticed that 4th wave already supplanted mobile data in terms of share. Mobile data revenue share peaked in 2012 and as expected, the industry is now completely dominated by the 4th wave. US became the first country to have 4th Wave revenue exceed access revenues in 2014 and in 2015, 4th wave revenues were greater than all the three major operator revenue streams – voice, messaging, and data.

Of course, operators like AT&T and Verizon haven’t been sitting idle. They have created new revenue streams, AT&T in particular has diversified its revenue stream to become a more complete “solution provider.” Verizon’s recent forays into digital with acquisitions of AOL and Yahoo are classic 4th wave execution plays. The intent shows a clear shift in management thinking on creating new revenue streams and look beyond their own subscriber base. IoT is also serving the top two operators well and the revenue curves in the early days mimic the early growth days of mobile data.

4th Wave Index

5 years ago, we put forth the theory of 4th wave to explain the upcoming changes in the mobile ecosystem. For the most part, the industry changes and tribulations have tracked the 4th wave curves. Last year, voice revenues declined by 23%, messaging revenues by 18%, while data revenues grew by 23%. 4th wave revenues which now dominate the ecosystem now grew by a 60% YoY.

The 4th Wave thesis captures the underlying shifts in industry dynamics that the value is shifting dramatically from access to applications. The quality of networks, the power of devices, the sophistication of applications and services have upended the industry landscape. The competitive dynamics are changing right in front of our eyes, predictably, but dramatically. Consider the fact that Uber is valued more than T-Mobile and Sprint combined, Facebook is valued more than AT&T or Verizon, and Google is valued more than all the US wireless operators combined. The success of the 4th Wave economy is not limited to a handful of Internet players from the US but rather it is a global phenomenon and it is happening across all industry verticals.

So, how does one value an operator vs. an app, a leading device manufacturer vs. a new wearable entrant. If you had a dollar to invest, where would you invest? Infrastructure, devices, platforms, or in services? It was clear that the industry needs a better way to benchmark progress of various companies as well as understand the competitive dynamics. It is also useful to understand the positioning of these companies in a very complex ecosystem. We need to assess a corporation’s strengths across multiple key dimensions in various sub categories and understand how these companies are prepared to compete in the 4th Wave economy.

Our 4th Wave Index offered first view on how a complex ecosystem can be studied. We took a look 29 key variables across four key dimensions: Infrastructure, Devices, Platforms, and Services and calculates the 4th Wave index. It is a useful benchmarking exercise to see if companies are slipping competitively or are making progress. Additionally, the model provides a view into what it will take these players to move from aspirants to challengers to leaders.

5G Economics

5G is gaining steam. All the major players have outline their preliminary plans to do trials on 5G with Verizon being the most aggressive in its intent. FCC become the first major regulator to set aside spectrum for 5G. There has been a lot of discussion on 5G from the technology point of view but not much from an economics point of view. We are taking a deeper look at the economics questions that the industry ought to be asking. Stay tuned for our research paper on the subject. We will discuss – what will be the cost structures, ROI, and the TCOs that will make it worthwhile for the operators to deploy 5G profitably. 5G is going to be a different ecosystem than the first four generations and the current cost model of building out networks might not be sustainable given the demand.

US is likely to be the key driving force in setting the standards and pushing the trials to deployments even though there is no Olympics as a motivator. But competition sure is.

Service Provider to Solution Provider

In our 2012 paper, “Operator’s Dilemma: The 4th Wave,” we argued that to stay relevant in the next phase of industry evolution, mobile operators need to focus on becoming digital lifestyle solution providers else their role will be relegated to access providers. While we are still early in the cycle, in the US, AT&T and Verizon are making investments to diversify their revenue streams. AT&T in particular has done a better job across multiple streams – content, home, IoT, health, transportation, retail, security, and other verticals. Some of the progress is visible in the financials and for others, one must dig deeper.

Verizon’s strategy has been two fold – IoT/Telematics and Media (advertising). It is clearly making excellent progress on the former while it is early to opine on the latter. Sprint has mostly retreated from its early 4th initiative to focus on nuts and bolts of the business. T-Mobile’s Binge-on strategy gives it a media play but something that prevents churn rather than generates “new” revenue.

Cable players have been reluctant participants in the mobile ecosystem but given the pressure on their core content business, wireless is their best bet to ensure the next decade of growth and sustainability. Comcast is expected to launch its MVNO later this year. How far will it go remains to be seen? Over the long-haul, cable service providers will have to become solution providers too.

IoT Revenue Streams and what it means for the ecosystem

Service provider IoT revenue passed the important $1B mark back in 2013. So far it is tracking the growth of the early days of mobile data. However, they are different curves influenced by different factors. Mobile data was relatively an easier curve to climb as the revenues went up with more data handsets coming online. The sales, business case, and ROI was straight forward. IoT is a bit more complicated as it across multiple vertical areas and it is not just about the data network, it is about the complete solution. The sales cycle and execution strategy is different and requires patience and resilience.

Spectrum Auction

FCC’s incentive auction began last quarter and ended with an $86 billion price tag. There isn’t that much reserve laying around to bid for the spectrum so we are likely to see more rounds of speculation and intrigue. No non-traditional player made it to the second round. The next round of action begins next week.

Regulations for the new age

Some of the regulations in the communications space are over a 100-year-old. Communications itself has drastically changed though the principle of transferring the bits from point A to B remains the same. T-Mobile reported that 54%+ of its voice calls are on VoLTE. IP messaging is many times the SMS global volume. Gradually, almost all voice and messaging will be on the IP layer – voice and messaging will just become apps on the data layer. So pretending and regulating these services as if it were 2000 doesn’t help. An ideal strategy for consideration should be that the IP layer gets regulated for fair pricing, competition, and consumer good while everything on the top of the IP layer gets regulated on a “same service, same rules” principle. The interconnection between apps to deliver services like connection to PSTN, E911, etc. can be addressed by fair market pricing principles. VR is going to become the next communication platform; IP messaging the next application development and commerce platform. To keep the regulatory regime simple and in with the times, by focusing on the access layer, one can guarantee that whatever takes place on the top has the opportunity to grow as the market desires. Similarly, data rules across all apps and services on top of the IP layer should be the same irrespective of the provider. This market shift is required to make the market more competitive and fair.

Commercial (with no pay to this author or IEEE- unlike SPONSORED CONTENT):

Our paper on 5G covers the past, present, and future of the network evolution.

Our Mobile Future Forward Summit in Sept will tackle the questions in-depth with some seasoned experts.

Mobile Future Forward – Sept 27th 2016, Seattle, WA

Mobile Future Forward is mobile industry’s premier thought-leadership summit that attracts the most influential minds in mobile who are instrumental in shaping the industry and in managing its growth of revenue and profits. We will explore the evolving universe ofconnected intelligence.

Extraordinary Participants. Invaluable Insights. Peerless Networking.

In proud partnership with Hyla Mobile, Netcracker, Neustar, OpenMarket, Oracle Communications, SAP, Tata Communications, and VoiceBox. Inquiries[email protected]

Can US Cellular Survive as a Regional Wireless Carrier with 4 Stronger National Carriers? David Dixon, FBR &Co

Can U.S. Cellular survive long term as a regional player against four much stronger national carriers in the same region? by David Dixon, FBR & Co.

Notes:

1. The 4 US national carriers are: AT&T, Verizon, Sprint and T-Mobile USA.

2. U.S. Cellular, is a regional wireless carrier which owns and operates the fifth-largest wireless telecommunications network in the United States, serving 4.9 million customers in 426 markets in 23 US states as of the first quarter of 2016. The company has its headquarters in Chicago, Illinois.

3. The Chicago White Sox (MLB-American League) play there home games at U.S. Cellular Field, formerly Comiskey Park. This author attended a White Sox-Cubs game there in July 2005.

U.S. Cellular has retained most of its subscribers in recent years, but the question remains how it will compete against four national carriers with nationwide LTE coverage that will likely extend to the U.S. Cellular region. The company has refocused on its strength as a core rural market operator, but the increasing pace of technology adoption suggests that U.S. Cellular will be challenged to keep pace with its larger competitors.

A greater alignment with AT&T through interoperability may help lower device costs. An LTE roaming agreement with AT&T or Sprint could benefit both companies as follows:

(1) AT&T and Sprint would avoid the deployment cost of a separate rural LTE network where it makes less economic sense (AT&T does not have 700 MHz LTE A block in rural areas, and Sprint has a limited network presence in the region), while AT&T and Sprint customers would benefit from additional coverage as their respective bases are seeded with 700 MHz LTE Band 12 devices over time;

(2) U.S. Cellular would benefit in urban areas by relying on the AT&T network or Sprint network where it has not deployed an LTE network. However, one-sided LTE roaming costs are likely to be high, which may pressure EBITDA more than expected. Yet a reciprocal LTE roaming agreement with Sprint should not be ruled out and is, in our view, more likely than an acquisition of the company as Sprint focuses its capital spending in urban areas.

We see greater than generally expected declines in high-margin roaming revenues as Sprint seeks to regain owner economics through a comprehensive roaming-reduction plan that includes additional geographic coverage. An overbuild by Sprint would pressure EBITDA.

We believe T-MobileUSA (TMUS) aggressive rollout of extendedrange LTE on 700 MHz may have driven the acceleration in roaming revenue declines. TMUS recently acquired 12 MHz of 700 MHz A-block spectrum from Leap Licenseco, Inc. in the Chicago metropolitan area. We expect this spectrum to be put into use very quickly, which could further weigh on USM’s high-margin roaming revenues.

2Q16 Results Recap:

- Consolidated revenues were $980.0M (+0.4% YOY), with company-defined adjusted EBITDA of $218.0M, versus consensus of $211.7M, and EPS of $0.32, versus consensus of $0.28.

- Total net customer adds were 50,000 (+100% YOY), composed of postpaid net adds of 36,000 (+111.8% YOY) and prepaid net adds of 14,000 (+75.0% YOY).

- Postpaid churn was 1.20%, and prepaid churn was 4.86%

References:

https://www.uscellular.com/coverage-map/coverage-indicator.html

Policy Scholar says CLECs better positioned than incumbent carriers

Note: This is an edited excerpt of a US Telecom article at:

https://www.ustelecom.org/blog/clecs-thriving-%E2%80%93-regulatory-help-not-needed

According to a research paper by Anna-Maria Kovacs, a visiting senior policy scholar at the Georgetown Center for Business and Public Policy, cash flow analysis shows that the competitive local exchange provider (CLEC) industry is better positioned than incumbent providers (ILECs & MSOs/CableCo’s), who once dominated the marketplace.

As AT&T points out, the incumbents’ copper-based TDM services are in a free fall as customers increasingly choose alternative, higher-speed services. Kovacs finds that the shift away from these legacy services has attracted cable industry competition and allows CLECs to compete effectively against the incumbents. Kovacs also points out that CLECs and cable companies (MSOs or CableCo’s) enjoy higher stock valuations than the wireline segments of the largest incumbent providers, illustrating that investors expect them to grow revenues and cash flow more rapidly.

The low cash flow for incumbent providers is a reflection of the continuously increasing cost of sustaining a nationwide network that now services about a third of the lines for which it was engineered. Meanwhile, the traditional CLECs have only built in high density areas to maximize revenue and preserve cash flow, the report said.

To help it compete in what has become a vibrant marketplace, CLECs are leaning on the Federal Communications Commission (FCC) for regulatory assistance, calling for monopoly-era regulation on last-mile fiber Ethernet connections.

Market data for Carrier Ethernet show that market is highly competitive with incumbents, CLECs, cable companies and others investing billions to build out infrastructure for business broadband services.

A better policy is establishing a framework in which broadband providers “compete vigorously and consumers enjoy the fruits of that competition,” said John Mayo, executive director of the Georgetown Center, in recommending the Kovacs report as a contribution to the policy discussion.

CLEC References:

http://blog.tmcnet.com/on-rads-radar/2016/07/the-last-clec-pivot.html

Analysis of T-Mobile USA & Sprint Earnings Reports by David Dixon of FBR & Co

I. T-Mobile USA (TMUS) Excellent 2Q Result on Solid Execution

T-Mobile reported another quarter of solid results that beat market consensus on every metric. With Sprint now making sustained positive strides in network improvement, a greater share of subscriber gains are now coming from Verizon (VZ) and AT&T. Management noted that it usually acquires 50% of postpaid additions from T and a greater portion now comes from VZ, which is encouraging. Recall that over the past few years Sprint lost most of its high-value subscribers to Verizon and these customers are now likely cycling off Verizon. TMUS has been rolling out LTE on 700MHz, increasing LTE coverage to 311M PoPs and slowly closing its network performance gap with the big 2 carriers. This progress is reflected in record-low postpaid churn of 1.27% in 2Q and a positive porting ratio of 1.43.

Specifically, TMUS achieved postpaid porting ratio of 1.64 against T, 1.43 against VZ, and 1.15 against Sprint. While it appears there may be a port-in disconnect with Sprint which also claimed positive port-ins with all carriers, but this may include a mix of TMUS postpaid and prepaid customers. Postpaid net subscriber adds were 890,000, with churn of 1.27% and prepaid net adds of 476,000 with churn of 3.91%.

■ License purchases underpins LTE coverage expansion:

In 2Q2016, TMUS entered into an agreement to acquire 12MHz of 700MHz A-Block spectrum license from Leap Licenseco (an AT&T subsidiary) which is crucial to its network expansion plans. Financial terms of the deal were not disclosed. This comes on top of 700MHz licenses TMUS acquired from Cavalier License Group and Continuum 700 in 1Q16. TMUS’ Extended Range LTE is tracking ahead of plans, covering 350 markets and more than 200M PoPs now. Furthermore, all current TMUS devices for sale support 700MHz, with the majority also supporting band 12.

■ Coverage Improvement should drive even greater network capacity challenges:

While coverage improvement is correlated to lower customer churn, it also brings a 4x order of magnitude increase in network capacity increases. This is largely due to increased indoor usage where customers previously abandoned usage because of poor network quality. Our latest vendor checks continue to suggest that T Mobile is closing in on a capacity crunch, which plays to our view that there is increased potential for an M&A deal with Sprint in 2017 irrespective of which administration is elected as we expect the circumstances that prevented a deal proceeding in 2013 to be quite different as regulators peek under the hood of both companies.

Q&A:

1. Can T-Mobile continue to take market share?

We believe Ericsson and Nokia in 2012 provided an elegant blueprint for T-Mobile to add capacity at low cost for three to four years under the current capex envelope. Today, our industry checks suggest that T-Mobile is facing capacity challenges and that adding 700 MHz coverage spectrum (although only used 17% of the time according to the latest Root Metrics results) will increase demand for capacity spectrum by 4x, exacerbating performance challenges. We also believe that capacity demand elasticity for BingeOn will prove challenging as a broader set of customers sign up for free video service. Indoor coverage is still the differentiator, and T-Mobile faces variable performance in this area due to its reliance on voice over Wi-Fi, but this should improve with 700 MHz spectrum and the ability to add 600 MHz ahead of the 39-month clearing time frame.

2. What is the outlook for a merger or acquisition of TMUS?

We believe T-Mobile US lack of new spectrum capacity, coupled with inferior coverage from both T-Mobile and Sprint, suggests a merger could be revisited under a new FCC administration in 2017. Given our contrarian outlook for capacity spectrum valuation one of the three valuation components for a wireless company (spectrum, network, and customers) we believe Comcast is less likely to seek to acquire T-Mobile but may instead enter the wireless segment through a low-cost coverage network and lowcost indoor capacity network. Lastly, we believe there is g

Conclusions:

While T-Mobile has benefited in earnings growth, lower churn, and subscriber growth from its network overhaul, we see limited organic growth opportunities beyond the next two years due to growing network capacity challenges.

II. Sprint’s Turnaround Gaining Momentum

Sprint’s fiscal 1Q results were a standout, showing accelerating momentum in its continuing turnaround while providing better-than-expected adjusted free cash flow guidance. Top-line stabilization, subscriber momentum, and low customer churn underpinned better-than-expected guidance of break-even FY16 adjusted free cash flow (FCF) and positive adjusted FCF in FY17. Sprint’s focus on positive FCF generation has driven a more aggressive next-generation network strategy, which, for the first time, is in line with industry trends.

Leveraging small cells and low-cost customer premise equipment (CPE) solutions to do more of the heavy lifting for data traffic consumption in metro areas should position Sprint as the lowest-cost and fastest deployer of incremental data capacity at a fraction of the cost of the traditional macro tower approach. Sprint is beginning to shift its messaging away from being the lowest-cost provider, which will help drive future revenue growth. Network Lease Co. is a further positive catalyst in 2016, in our view.

Postpaid net adds of 173,000 were much better than expected, with churn of 1.39%, which is the highest in company history. Prepaid net losses were 331,000, with churn of 5.55% and EPS of ($0.08). Porting ratios were positive with all carriers.

■ Network strategy continues to bear fruit. Nielsen testing and recordlow postpaid phone churn demonstrate that Sprint’s network improvement continues as it begins its pivot toward cost-effective small cells. While management noted the cost of a microcell from Nokia is 20% that of a traditional cell tower, the real kicker is the mass deployment of indoor small cells, which roll off the production line in September at scale.

■ Adjusted FCF guidance gaining credibility. Investors are still challenged by our view that management can sustain a substantially lower level of capex investment while improving network quality and customer churn, but we see more evidence of this. Management guided FY16 adjusted free cash flow of breakeven (including Android and iPhone handset financing) and guided to positive adjusted FCF in FY17. This bodes well for Sprint’s ability to lower interest costs on future debt obligations.

Q &A:

1. How can Sprint leverage its 2.5 GHz spectrum portfolio to improve network quality?

2.5 GHz spectrum is the basis of Sprint s LTE Plus network and makes up the bulk of Sprint’s spectrum portfolio. Sprint controls approximately 120 MHz of 2.5 GHz spectrum in 90% of the top 100 U.S. markets. If Softbank can create low-cost Pico and CPE solutions using 2.5 GHz spectrum to densify its network, Sprint will have the potential to become the lowest-cost and fastest data network among the national carriers that are migrating to a greater dependency on low-cost WiFi spectrum ahead of a migration to low-cost, shared LTE spectrum in the 3.5 GHz band and beyond.

2. How can Sprint shift away from expensive coverage improvement but still improve network quality?

Sprint is shifting away from high-cost, macro-coverage improvement to less costly surgical-capacity improvement. Despite network coverage improvement from Network Vision (NV), substantial coverage gaps still exist, and network congestion is compounding challenges. Network quality remains poor in the eyes of consumers. The good news is that 2.5 GHz deployment will be quick (though now targeted); and, in the postpaid segment, management has cleared the decks of 3G devices and is focusing on tri-band devices, which may provide 3G refarming opportunities at 1.9 GHz. LTE is now used by the postpaid segment 94% of the time. Key will be clearing 3G devices in the prepaid and wholesale segments.

Conclusions:

We continue to believe that Sprint has several potential sustainable advantages:

(1) the simplicity of its offering,

(2) a very strong value proposition,

(3) a solid product lineup expected to include devices with 800 MHz and 2.5 GHz spectrum support this year,

(4) improving network quality, and

(5) financial flexibility—all of which should benefit the company.

However, we think that the competitive intensity within the wireless space is continuing to ratchet up and that competitive responses are expected.

FBR: Verizon’s Investments in Mobile Media to Drive Long-Term Growth; 2 Risks

by David Dixon of FBR & Co. (edited for conciseness and clarity by Alan J Weissberger)

Summary:

Verizon reported 2Q16 results that fell short of Street expectations. Consolidated revenues declined 5.3% YOY to $30.5B, compared with consensus of $30.8B. Topline weakness was attributable to the shift towards unsubsidized plans and lower postpaid phone activations. However, excluding AOL and divested wireline assets, revenues would have declined 3.5% YOY. Despite continued growth in IoT, retail postpaid net adds of 615,000 were below consensus estimates of 784,000 due to higher tablet churn from the anniversary of the free tablet promotion two years ago.

Management expects the tablet promotion will continue to pressure churn through the remainder of the year, but could be mitigated by growing ARPA, in our view. While the quarter was disappointing, over the longer term, we still view VZ as best-in-class due to

(1) high-quality network,

(2) high-quality subscriber base,

(3) more efficient cost management helping to offset margin impact from shift towards unsubsidized model,

(4) growing media platform with the acquisition of AOL and YHOO, and

(5) consistent dividend growth.

Furthermore, heavy investment in 5G and spectrum refarming should put VZ in the forefront of 5G deployment. VZ is currently conducting technical trials in several markets following the completion of radio specifications.

Key Points:

■ 2Q16 results recap. Consolidated revenue of $30.5B (–5.3% YOY) below our $32.6B estimate and consensus’ $30.8B, driven primarily by a 8.4% YOY decline in wireless revenue and a 2.4% YOY decline in wireline revenue. Adjusted EBITDA of $11.1B (+0.2% YOY) was ahead of the consensus estimate of $11.0B but below our estimate of $11.8B. Postpaid net adds were 615,000, with churn of 0.94% and a prepaid net loss of 30,000. Adjusted EPS of $0.94 were ahead of the consensus estimate of $0.92.

■ Yahoo acquisition to boost digital media presence. Combined with AOL, VZ’s $4.8B complementary acquisition of YHOO will shore up its sagging media business, in our view. We believe original content on AOL/YHOO platforms could help VZ to become a major player in mobile media, offsetting weakness in the traditional wireless business.

■ Cost structure reductions moving forward. VZ continues to make progress in reducing its cost structure through head-count reductions, improved productivity, operational efficiency, and new labor contract benefits to offset weakness in wireless and wireline businesses. Capex spend is anticipated to increase in 2H16 following a downtick in wireline capex in 2Q as VZ focused on maintenance rather than new installations during the work stoppage.

Q &A:

1. Aside from being well positioned on spectrum for the macro network and densification, how to assess the small cell opportunity as an alternative to more macro network spectrum going forward?

A change in the industry network engineering business model is underway. Software-centric small cells on dedicated spectrum provide the opportunity for greater spectrum reuse and will manage more of the heavy lifting associated with data congestion. Verizon demonstrated this shift during the AWS3 auction: It modeled a lower-cost small cell network for Chicago and New York. We expect CEO Lowell McAdam to manage this shift from the top down to mitigate execution risk due to cultural resistance from legacy outdoor RF design engineers, whose roles are at risk as the macro network is de-emphasized. Enablers include LTE and increased spectrum supply across multiple spectrum bands, including licensed, unlicensed (500 MHz of 5 GHz spectrum), and shared frequencies (150 MHz of 3.5 GHz spectrum), amid a fundamental FCC spectrum policy shift from exclusive spectrum rights to usage-based spectrum rights, which should dramatically increase LTE spectrum utilization (similarly to Wifi).

Previously, outdoor small cells co-channeled with the macro network proved challenging. While they can carry substantial loads, they also destroy equivalent capacity on the macro network due to miscoordination and interference, so the macro network carried less traffic but still looked fully loaded. AT&T discovered this in its St. Louis trials that, in part, steered it toward buying $20 billion of AWS3 spectrum. However, the industry trend is toward LTE underlay networks, where small cells are put into other shared or unlicensed spectrum with supervision from (and/or) carrier aggregation with the macro network. It still requires good coordination across all cells for this to work; while Verizon s initial proposals for 5 GHz are downlink only, we think uplink will also be used longer term because uplink needs more spectrum resources for a given throughput. We see higher uplink usage trends in the Asian enterprise segment and from Internet of Things (security cameras).

2. Does Verizon have sufficient spectrum depth to drive revenue growth longer term? Or does it need to aggressively acquire spectrum in future spectrum auctions or in the secondary market (DISH)?

We believe the short answer is yes. Verizon carries 90% of data traffic on 40% of its spectrum portfolio; its combined nationwide CDMA and LTE spectrum depth is 115 MHz, ranging from 88 MHz (Denver) to 127 MHz (NYC). We expect AWS3 capacity spectrum to be deployed in 2017/18. Investors may not be crediting Verizon with potential to source more LTE spectrum from refarming of CDMA to LTE (22 MHz to 25 MHz) used today for CDMA data (22 MHz to 25 MHz). Critically, network performance data show Verizon s network close to the required performance threshold for a VoLTE-only service, suggesting additional refarming potential for the 850 MHz band (25 MHz) used today for CDMA voice and text. This band is likely to be transitioned in 5 MHz x 5 MHz LTE slivers to run parallel with the expected linear (voluntary) ramp, versus exponential (forced) ramp in VoLTE service. More low-band spectrum is key for the surging IoT and M2M segments, which are proving to be more thirsty than “bursty.”

Conclusions:

Verizon is a high-quality company with significant long-term wireless growth opportunities as mobile video and over-the-top Internet app business models evolve. However, there are risks for VZ:

1. A possible move may be to spin off the wireless operation. Verizon Wireless composes a material portion of the company’s total revenue and EBITDA. Therefore, while unlikely, any potential spin-off of Verizon Wireless could increase valuation uncertainty.

2. Verizon is exposed to overall economic momentum and is dependent upon economic recovery. Any unexpected downturn would likely result in lower spending in telecommunications and decreased investment in wireless, data, and broadband, as well as enterprise data initiatives.

AT&T Yahoo/Verizon accounts? Analysis of AT&T’s Business & Earnings, by David Dixon of FBR Group

What will AT&T do about it’s AT&T-Yahoo accounts (including email) now that Yahoo Internet Portal has been sold to Verizon? AT&T-Yahoo email has been deteriorating for months. Will AT&T now offer AT&T-Verizon email accounts?

Growing International Focus Bears Fruit, but Ongoing Domestic Weakness Is a Concern, David Dixon of FBR

Summary

AT&T reported largely in-line 2Q16 financial results and mixed subscriber results. Its focus on growing the newly acquired Mexican operations appeared to bear fruit, helping offset ongoing U.S. weakness. AT&T added 742,000 wireless net subscribers in Mexico in the quarter, and total Mexican wireless subscribers now approach 10M.

AT&T’s Mexican LTE deployment now serves 65M PoPs and is expected to reach 75M by year-end. While the LatAm macroeconomic environment is expected to remain challenging, we expect the upcoming Rio Olympics to build on recent subscriber momentum. In the U.S., total 2Q net adds of 1.36M were meaningfully below consensus of 1.78M. Management attributed net add weakness to the planned shutdown of the 2G network and a network outage caused by an equipment vendor. We believe the domestic net add weakness is more likely a result of shifting focus on profitability rather than subscriber count. With the LTE network buildout complete and AT&T diversifying into Mexico to alleviate churn pressures, further changes to smart phone upgrade eligibility are likely.

We think AT&T is challenged by T-Mobile USA (TMUS) for the low-end customer and is focused on maintaining share of the more profitable enterprise market as well as improving ARPU in the interim, ahead of TMUS facing capacity challenges in the coming one to two years, based on our vendor checks.

Key Points:

■ 2Q16 results recap: Including DIRECTV results, consolidated revenues increased 22.7% YOY to $40.5B, modestly below consensus’ estimate of $40.6B and higher than our estimate of $40.0B. By segment: business solutions delivered revenues of $17.6B, entertainment and Internet services had revenues of $12.7B, consumer mobility had revenues of $8.2B, and international had revenues of $1.8B.

Adjusted EBITDA of $13.4B were just shy of our Streetcomparable estimate of $13.6B. EBITDA margins declined 30 bps YOY to 33.0%. Consumer mobility postpaid net adds were 72,000, prepaid net adds were 365,000, and postpaid churn was 1.09%.

■ Further expansion of GigaPower: GigaPower now reaches 2.2M homes and is expected to increase to 2.6M or more by year-end. We believe AT&T’s fiber investment is a negative NPV decision but necessary to continue over many years until it equates to cable because a decision not to invest would drive a more negative NPV outcome due to the superior competitive positioning from the cable sector. Combined with a shift toward software-defined network (SDN), the expanded fiber footprint afforded by GigaPower should benefit T as the Internet of Things (IoT) becomes more prevalent and as 5G is deployed. We believe AT&T is the market leader in the burgeoning IoT segment, which was largely standardized this year and should underpin faster growth rates.

■ FY16 guidance maintained. Management reiterated prior issued guidance of double-digit consolidated revenue growth, adjusted EPS growth of mid single digits or better, stable consolidated margins, and $22.0B in capex.

■ We believe AT&T will benefit from the Olympics through cross-selling DIRECTV products in Latin America, partially offset by continued competition in the U.S. carrier market.

Q&A:

1. Can AT&T drive earnings growth? 6 to 18 months

Smartphone activations remain significant. Strategic initiatives with Samsung and Google, coupled with support of the Windows Phone ecosystem by MSFT, NOK, and other OEMs, are key to lower wireless subsidy pressure, but it is early days. We think AT&T will continue to consider pricing action to augment growth once the LTE network build is complete, but competitive intensity is likely to increase in FY16, so this will prove difficult absent consolidation or until T-Mobile US becomes spectrum challenged, which we think is still one year away and a function of T-Mobile US commitment to continue network investment.

2. How will AT&T fare in the changing wireless landscape in 2016 and beyond?

Our strategic concerns for AT&T include (1) the Apple eSIM impact, should Apple be successful in striking wholesale agreements; (2) the Google MVNO impact, which could strip the company of the last bastion of connectivity revenue; and (3) a Wi-Fi first network from Comcast, coupled with a wholesale agreement with a carrier, which would enable a competitor and increase pricing pressure

3. Does AT&T have a sustainable spectrum advantage compared with other carriers?

AT&T is behind Verizon in spectrum and out of spectrum in numerous major markets, according to our vendor checks. However, with additional density investment, it is reasonably well positioned to benefit from the combination of coverage layer (700 MHz and 850 MHz) and capacity layer (1,700 MHz, 1,900 MHz, and soon-to-be-confirmed 2,300 MHz) spectrum and will focus on LTE and LTE Advanced, as well as refarming 850 MHz/1,900 MHz spectrum for additional coverage and capacity. Yet this nonstandard LTE band will cost more capex and take longer to implement. In the short run, aggressive cell splitting is expected, and metro Wi-Fi and small-cell solutions with economic backhaul solutions are becoming available, allowing for greater surgical reuse of existing spectrum. Sprint s differentiation through Clearwire spectrum in FY16 is only likely to modestly affect AT&T relative to Verizon. Furthermore, with 70% 80% of wireless data traffic on Wi-Fi and only 20% of capacity utilized, this suggests a focus in this area to manage data usage growth.

Conclusions:

We expect the wireless segment to continue to be challenged by a resurgent T-Mobile USA. We are less bullish on near-term improvements in capex intensity, due to cultural challenges associated with the much-needed migration to software-centric networks, coupled with the need to upgrade its fiber plant aggressively to improve its competitive positioning and lay the foundation for efficiency improvement.