Telcos need to do much more to gain significant cloud market share

Synergy Research Group said that the global cloud computing and storage market grew 24% annually for the period ending September 2017. The market research firm said that of the six cloud services and infrastructure market segments, operator and vendor revenues, IaaS (Infrastructure as a Service) and PaaS (Platform as a Service) had the highest growth rate at 47%, followed by enterprise SaaS (Software as a Service) at 31%, and hosted private cloud infrastructure services at 30%.

Data suggested that 2017 widened the gap between cloud services spending vs. hardware and software used to build public and private clouds. Synergy noted that 2016 was the year in which spending on cloud services overtook spending on cloud infrastructure.

John Dinsdale, a chief analyst and research director at Synergy Research Group, noted that in 2015 cloud became mainstream and by 2016 it started to dominate many IT market segments.

“Major barriers to cloud adoption are now almost a thing of the past, with previously perceived weaknesses such as security now often seen as strengths. Cloud technologies are now generating massive revenues for cloud service providers and technology vendors and we forecast that current market growth rates will decline only slowly over the next five years,” he concluded.

The researcher noted eight cloud services vendors were among the 2017 market segment leaders.

Figure 1: Movers and shakers in 2017 cloud market

…………………………………………………………………………………………………………….

Over the period Q4 2016 to Q3 2017, total spend on hardware and software to build cloud infrastructure approached $80 billion, split evenly between public and private clouds, though spend on public cloud is growing more rapidly.

Infrastructure investments by cloud service providers helped them to generate over $100 billion in revenues from cloud infrastructure services (IaaS, PaaS, hosted private cloud services) and enterprise SaaS – in addition to which that cloud provider infrastructure supports internet services such as search, social networking, email, e-commerce and gaming.

Meanwhile UCaaS (Unified Communications as a Service), while in many aspects is a different market, is also growing strongly and is driving some radical changes in business communications.

Carriers, for their part, are not standing still. According to Gartner Group, communications service providers (CSPs) worldwide face profound challenges related to traditional telco network-based to cloud-based service delivery across several functional and technical domains.

Gartner research director Martina Kurth said “CSPs are embarking upon an evolutionary path that unifies cloud instances of SDN/NFV, OSS/BSS (e.g. Paas/SaaS/Iaas) and enterprise IT. Coupled with microservices, container based service design principles and cloud integration services, CSPs endeavor to create synergies between their various cloud domains and drive flexibility and agility across their cloud deployments.”

Gartner predicts that vendors which are well positioned in the end-to-end Telco Cloud stack market, are also likely to take market share in corresponding future network and/or IT technology markets such as digital technology platforms and ecosystems, Data/AI, IoT and 5G.

Gartner Group says that a fully integrated, interoperable, cloud and virtualied telco protocol stack will pave the evolutionary technology adoption path from SDN/NFV to network slicing to 5G and IoT in the future. But no time frame was given for that to be realized.

IHS Operator Survey: Smart Central Offices in 85% of Service Provider Networks in 2018

By Michael Howard, executive director, research and analysis, carrier networks, IHS Markit, and Heidi Adams, senior research director, IP and optical networks, IHS Markit

Highlights:

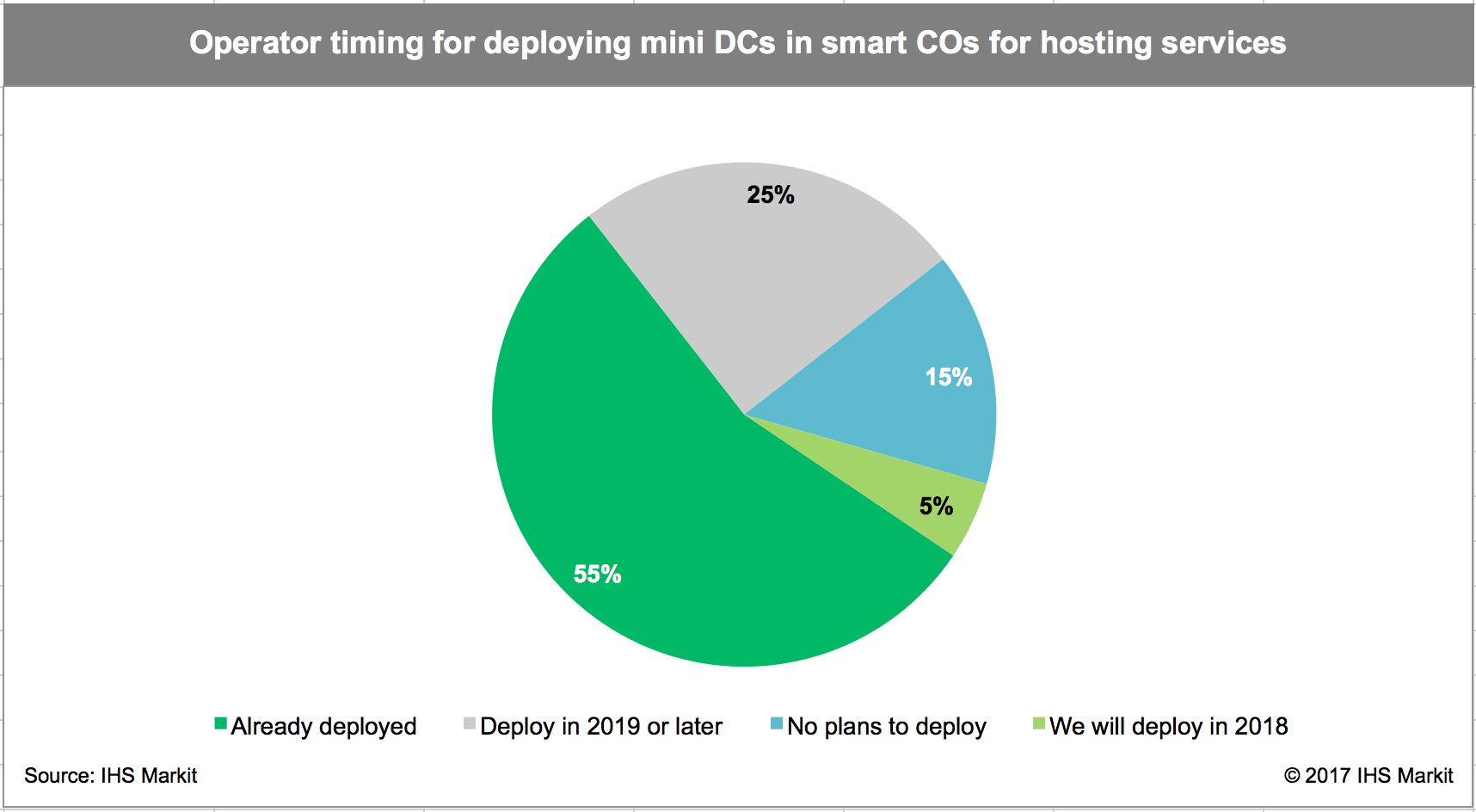

- In 2018, 85% of operator respondents to an IHS-Markit survey plan to create, or will have already deployed, smart central offices — that is, installing servers, storage and switching to create mini data centers in selected central offices. These mini data centers are used to offer cloud services, and as the network functions virtualization (NFV) infrastructure on which to run virtualized network functions (VNFs) such as vRouter, firewall, CG-NAT and IP/MPLS VPNs.

- More than half of operators (55%) surveyed plan to move each of 10 different router functions from physical edge routers to VNFs running on commercial servers in mini data centers in smart central offices, including customer edge (CE) router, route reflector (RR) and others.

- Seven out of 10 respondents plan to deploy central office rearchitected as a data center (CORD) in smart central offices.

- Operators expect 44% of their central offices will have mini data centers (or smart central offices) by 2023, and deploy CORD (Central Office Re-architected as a Data center) in half of those central offices.

IHS-Markit Analysis:

SDN and NFV are spurring fundamental changes in network architecture, network operations and how carriers are organized, which is illustrated by the purchasing decisions of operators worldwide. Nearly every operator around the world is undertaking major efforts.

More importantly, the move to SDN and NFV is changing the way operators make equipment purchase decisions, placing a greater focus on software. Although hardware will always be required, its functions will be refined, and software will drive services and operational agility.

A basic architectural change in motion is the deployment of new functions in large central offices that are closer to end customers. These also serve as locations for distributed broadband network gateways (BNGs), content delivery networks (CDNs), mini data centers and other new functions. Mini data centers (i.e., servers and storage) are used to deliver cloud services within a metropolitan area and house applications including augmented and virtual reality and gaming, to give users better response time as well as provide a place for NFV and VNFs, including vRouters, which run on servers. These central offices with mini data centers are known as “cloud central offices” or “smart central offices.”

Cloud services for business, and internet usage in general, have caused carrier network traffic patterns to change dramatically in and out of data centers. This is true not only for the hyperscale data centers of Google, Apple, Facebook, Amazon, Microsoft, Baidu, Alibaba and Tencent, but also for their smaller metro and regional megascale data centers, and large enterprises, as well as smaller data centers used by enterprises and government.

In a large metropolitan area, there might be 10 or more smart central offices aggregating traffic from smaller end offices. Based on our discussions with operators around the world, a common long-range plan is to identify 10 percent to 25 percent of central offices as smart central office locations — all candidates for CORD. The smart central office is the new location of the IP edge, which is creating a need for a new class of optical transport equipment and a new class of routers designed for data center interconnect (DCI) applications.

Routing, NFV and Packet-Optical Survey Synopsis

The 30-page 2017 IHS Markit routing, NFV and packet-optical strategies survey is based on interviews with router/CES purchase decision-makers at 20 global service providers that control a third of worldwide telecom capex and 27 percent of revenue. The survey covers hot and emerging topics in the carrier Ethernet, routing and switching space, with a focus on the IP edge. It looks at deployment plans, strategies and locations, router bypass, 100GE port mix, price per port and more.

…………………………………………………………………………………………………………………………………………

Notes & Clarifications:

- Smart central offices are simply central offices containing mini data centers that have servers, storage, and switching. Mini data centers can offer cloud services and typically include NFV infrastructure that supports virtualized network functions (VNFs) including vRouter, firewalls, carrier grade network address translation (CG-NAT), and IP/MPLS VPNs.

- IHS concluded that the reason more operators are leaning this direction is that deploying these functions in central offices brings them close to the end-user. This is part of the greater push by operators and service providers to focus on software to drive services, while refining hardware functions.

- If network operators re-architect their networks by distributing the core network, it would be closer to the end user. Virtualization allows operators to quickly deploy a core anywhere and to scale it at will. Edge computing could be deployed closer to the user without breaking the network topology. This is a major advantage that the telcos have over the cloud players – but they have not been able to capitalize on it. By pushing the core closer to the edge, and through virtualization of the network, operators could capitalize on this advantage.

- As operators push away from hardware into software, the smart central office is a new IP edge, and thus requires a class of routers for data center interconnect (DCI) applications and optical transport equipment.

CCS Insight: China to lead global 5G adoption which will take longer than 4G

CCS Insight forecasts that 5G connections will reach 1 billion worldwide in mid-2023, taking less time than 4G LTE to reach that milestone.

- As early as 2022, China will account for more than half of all 5G subscribers. By 2025 — following deployment in most world regions — it will still represent more than four in ten 5G connections globally.

- South Korea, Japan and the U.S. are fighting it out to be the first to launch commercial 5G networks, but China will take an early lead in the number of subscribers.

- 5G roll-out in Europe will trail by at least a year.

“We see China playing a far more influential role in 5G than it did in 4G. Size, scale and economic growth give China an obvious head start, but we expect network deployments to be much faster than in the early days of 4G,” CCS Insight VP of forecasting Marina Koytcheva said.

“China will dominate 5G thanks to its political ambition to lead technology development, the inexorable rise of local manufacturer Huawei and the breakneck speed at which consumers have upgraded to 4G connections in the recent past.”

As early as 2022, China will account for more than half of all 5G subscribers. Even by 2025 — following deployment in most world regions — it will still represent more than four in ten 5G connections globally. South Korea, Japan and the US are fighting it out to be the first to launch commercial 5G networks, but China will take an early lead in the number of subscribers. Despite the EU’s lofty ambitions, network roll-out in Europe will trail by at least a year.

The chart below provides a summary of CCS Insight’s 5G forecast:

5G subscriptions, 2018-2025

Source: CCS Insight Market Forecast: 5G Subscriptions, 2018-2015

……………………………………………………………………………………………………………………………………..

In the longer term, CCS Insight sees 5G adoption taking a broadly similar path to 4G LTE technology. Subscriptions to 5G networks will reach 2.6 billion in 2025, equivalent to more than one in every five mobile connections. However, CCS Insight cautions there are still some uncertainties.

These include how and where network operators will deploy vast numbers of new base stations, the lack of clear business case for operators, and consumers’ willingness to upgrade their smartphones. In Europe, market fragmentation, the availability of spectrum and the influence of regulators bring additional challenges.

CCS Insight sees mobile broadband access on smartphones as the principal area of 5G adoption. By 2025, it will represent a colossal 99% of total 5G connections, according to the forecast.

“The unrelenting hype that has surrounded 5G for several years has seen a diverse range of applications put forward as the main drivers of adoption,” CCS Insight principal analyst for operators Kester Mann said.

“Some of them will be relevant at different times of the technology’s development, but the never-ending need for speed and people’s apparently limitless demand for video consumption will dominate 5G networks.”

Nevertheless, CCS Insight says fixed wireless access, positioned as a complementary service to fixed-line broadband, as 5G’s first commercial application (but not standardized by ITU-R or specified by 3GPP). The U.S. will be an early adopter, led by leading advocates like AT&T and Verizon. However, the long-term opportunity will remain small and the forecast sees it representing only a tiny fraction of total connections.

Despite the industry’s seeming obsession that in the future everything will be connected, 5G will account for a relatively low number of connections in the Internet of Things (IoT) during the forecast period.

Here, 4G networks will satisfy demand until narrowband technology is fully supported within the 5G standard. Network operators have only recently begun investing in LTE related LP-WAN technologies such as NB-IoT and Cat-M to support devices that have life spans of several years. Significant numbers of 5G connections in this area are unlikely before the second half of the 2020s, according to the forecast.

So called “mission critical” services such as autonomous driving — regularly touted as a “killer” application in 5G — will have to wait even longer to come to fruition.

Geoff Blaber, VP Research, Americas at CCS Insight commented that “5G is about creating a network that can scale up and adapt to radically new applications. For operators, network capacity is the near-term justification; the Internet of Things (IoT) and mission-critical services may not see exponential growth in the next few years but they remain a central part of the vision for 5G. Operators will have to carefully balance the period between investment and generating revenue from new services.”

5G enthusiasm in Asia:

“High-income Asian markets are likely to be among the first 5G markets,” says the GSMA Intelligence Unit report. “For Korea and Japan, their Olympics in 2018 and 2020 [respectively] provide global showcases. China has a national ICT agenda with 5G an integral part.”

But the industry body cautioned against expecting too much too soon. “We anticipate 5G adoption will take longer than 4G because of slower network rollouts and uncertainties around the value proposition relative to LTE,” says the report. “Europe is a possible exception. The EU sees 5G as an opportunity to retake a leadership position in technology, and even now 4G is still relatively immature.”

Lukasz Nowicki, a principal at research firm Delta Partners was bullish on APAC’s 5G prospects in an October 2017 research note. “From the moment Ericsson showcased the potential of 5G networks in a Swedish lab in 2014, operators, equipment vendors, and device manufacturers joined the chorus of 5G enthusiasts,” says Nowicki. “They praise the near-zero-latency and above 1Gbps speeds enabling the emergence of futuristic and aspirational use-cases like augmented reality, virtual reality, and low latency ultra-reliable IoT.”

“Asia is an attractive market for 5G, with the estimated number of users reaching 670 million by 2025, accounting for 60% of the global 5G market,” says Nowicki.

References:

https://www.telecomasia.net/content/china-tipped-lead-global-5g-adoption-2023

https://www.telecomasia.net/content/5g-starts-find-traction

India: 5G roll-outs expected before 4G LTE is extensively deployed

by Rekha Jain of Livemint.com

Since 5G roll-outs in India are likely even before 4G LTE is extensively deployed, the adopted road map for 5G should ensure that the existing and near-future investments in 4G can be leveraged.

……………………………………………………………………………………………………………………

Even while telecom operators in India are in the midst of rolling out 4G LTE networks, the minister for telecom has announced that India would roll-out 5G networks by 2020 – a time frame that has been accepted by service providers in many parts of the world. South Korea and Japan want to showcase leading 5G applications in the Winter and Summer Olympics in January 2018 and Summer of 2020, respectively.

However, Indian operators face several challenges for 5G roll-outs from a business point of view. They have far less spectrum in comparison to international operators. This increases their cost of operations. Many of them are also weighed down by debt. Ever faster rounds of new technology introduction when prior technology investments have not been recouped add further complexity. This juggernaut of ever evolving generations of technology and forthcoming 5G require a supportive policy and regulatory environment. Without it, the telecom sector’s health and India’s economic competitiveness would be greatly impaired. The imperatives of remaining competitive and consumer demands of faster and higher quality services leave little choice to operators but to invest in 5G.

Google Expands Cloud Network Infrastructure via 3 New Undersea Cables & 5 New Regions

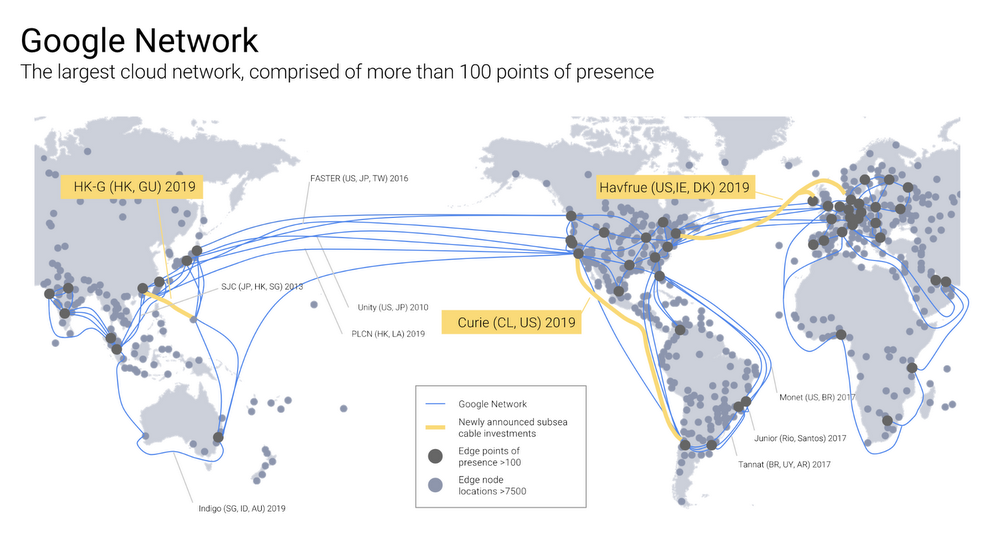

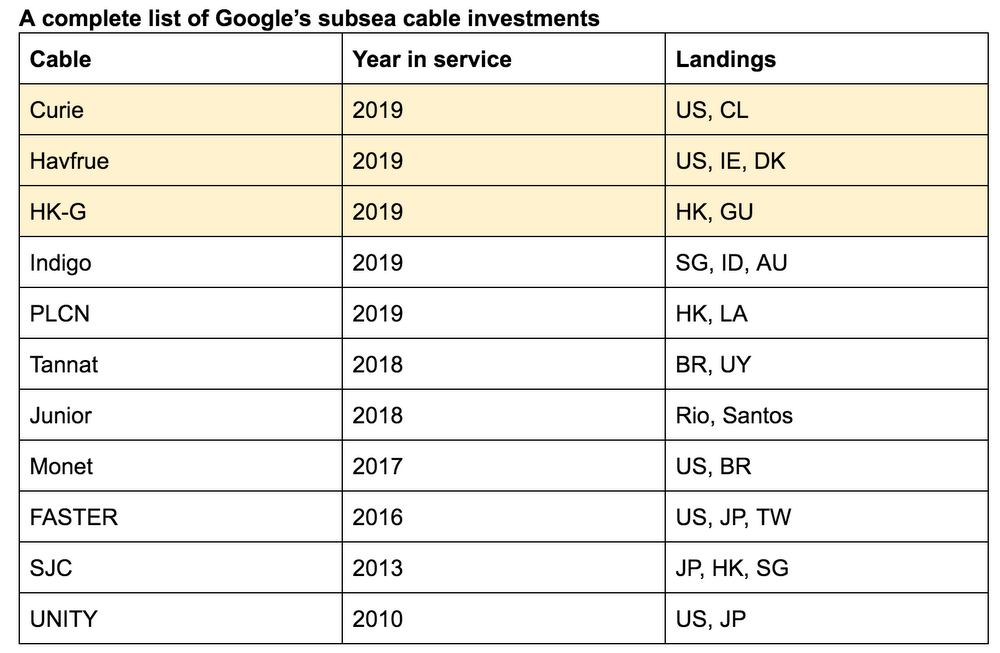

Google has plans to build three new undersea cables in 2019 to support its Google Cloud customers. The company plans to co-commission the Hong Kong-Guam (HK-G) cable system as part of a consortium. In a blog post by Ben Treynor Sloss, vice president of Google’s cloud platform, three undersea cables and five new regions were announced..

The HK-G will be an extension of the SEA-US cable system, and will have a design capacity of more than 48Tbps. It is being built by RTI-C and NEC. Google said that together with Indigo and other cable systems, HK-G will create multiple scalable, diverse paths to Australia. In addition, Google plans to commission Curie, a private cable connecting Chile to Los Angeles and Hvfrue, a consortium cable connecting the US to Denmark and Ireland as shown in the figure below.

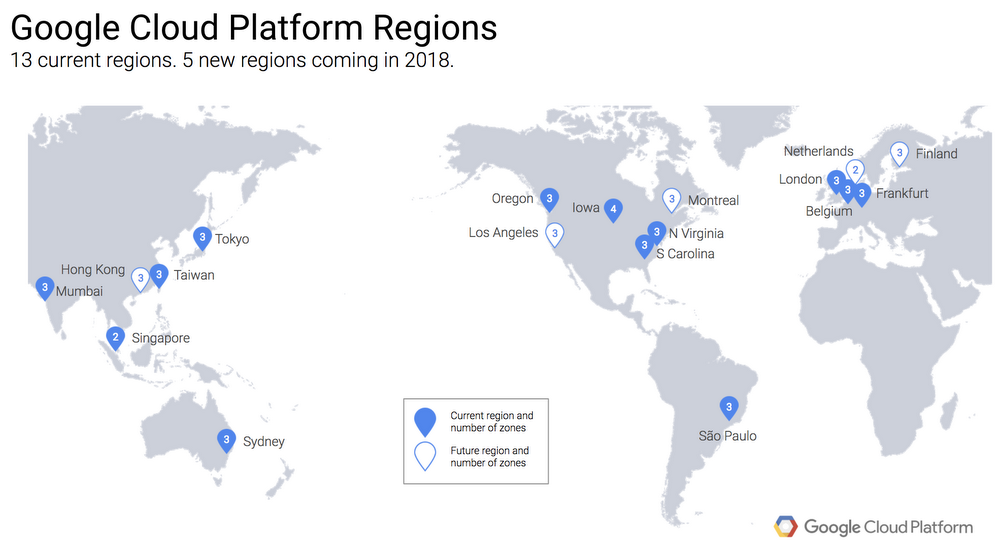

Late last year, Google also revealed plans to open a Google Cloud Platform region in Hong Kong in 2018 to join its recently launched Mumbai, Sydney, and Singapore regions, as well as Taiwan and Tokyo.

Of the five new Google Cloud regions, Netherlands and Montreal will be online in the first quarter of 2018. Three others in Los Angeles, Finland, and Hong Kong will come online later this year. The Hong Kong region will be designed for high availability, launching with three zones to protect against service disruptions. The HK-G cable will provide improved network capacity for the cloud region. Google promises they are not done yet and there will be additional announcements of other regions.

In an earlier announcement last week, Google revealed that it has implemented a compile-time patch for its Google Cloud Platform infrastructure to address the major CPU security flaw disclosed by Google’s Project Zero zero-day vulnerability unit at the beginning of this year.

Diane Greene, who heads up Google’s cloud unit, often marvels at how much her company invests in Google Cloud infrastructure. It’s with good reason. Over the past three years since Greene came on board, the company has spent a whopping $30 billion beefing up the infrastructure.

Google has direct investment in 11 cables, including those planned or under construction. The three cables highlighted in yellow are being announced in this blog post. (In addition to these 11 cables where Google has direct ownership, the company also leases capacity on numerous additional submarine cables.)

In the referenced Google blog post, Mr Treynor Sloss wrote:

At Google, we’ve spent $30 billion improving our infrastructure over three years, and we’re not done yet. From data centers to subsea cables, Google is committed to connecting the world and serving our Cloud customers, and today we’re excited to announce that we’re adding three new submarine cables, and five new regions.

We’ll open our Netherlands and Montreal regions in the first quarter of 2018, followed by Los Angeles, Finland, and Hong Kong – with more to come. Then, in 2019 we’ll commission three subsea cables: Curie, a private cable connecting Chile to Los Angeles; Havfrue, a consortium cable connecting the U.S. to Denmark and Ireland; and the Hong Kong-Guam Cable system (HK-G), a consortium cable interconnecting major subsea communication hubs in Asia.

Together, these investments further improve our network—the world’s largest—which by some accounts delivers 25% of worldwide internet traffic……………….l.l….

Simply put, it wouldn’t be possible to deliver products like Machine Learning Engine, Spanner, BigQuery and other Google Cloud Platform and G Suite services at the quality of service users expect without the Google network. Our cable systems provide the speed, capacity and reliability Google is known for worldwide, and at Google Cloud, our customers are able to to make use of the same network infrastructure that powers Google’s own services.

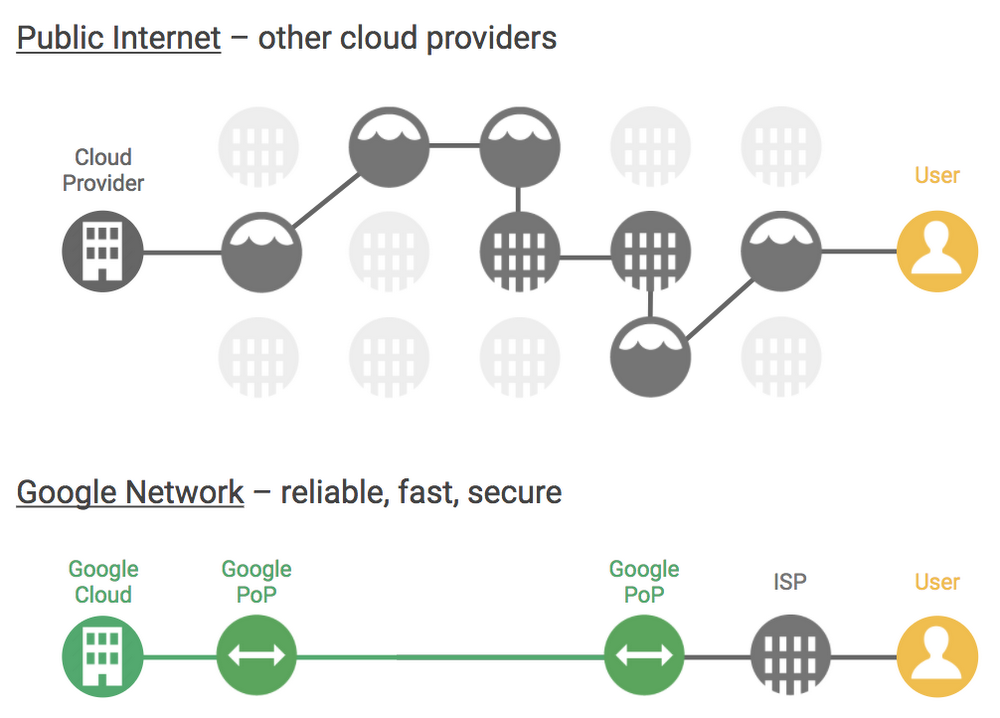

While we haven’t hastened the speed of light, we have built a superior cloud network as a result of the well-provisioned direct paths between our cloud and end-users, as shown in the figure below.

According to Ben: “The Google network offers better reliability, speed and security performance as compared with the nondeterministic performance of the public internet, or other cloud networks. The Google network consists of fiber optic links and subsea cables between 100+ points of presence, 7500+ edge node locations, 90+ Cloud CDN locations, 47 dedicated interconnect locations and 15 GCP regions.”

……………………………………………………………………………………………………………………………………………………………………………………………

Reference:

Cogent Communications CEO: MPLS VPNs to be replaced by VPLS & SD-WANs; Reasons to Deploy SD-WANs?

Dave Schaeffer, CEO of Cogent Communications, told investors during last week’s 2018 Citi Global TMT West Conference that there is a migration away from MPLS VPNs to Ethernet VPLS (Virtual Private LAN Service) [1] and SD-WANs.

“Cogent has focused on selling dedicated Internet access which is still the primary product (actually service) of our company. However, VPN services represent 17% of total revenues and 25% of corporate revenues. Most corporate customers supplement Internet access with a private network. The vast majority of those private networks are based on MPLS based services (e.g. MPLS VPNs), which are very difficult to install, manage, or modify. They’re also very expensive on a per transmitted bit basis.”

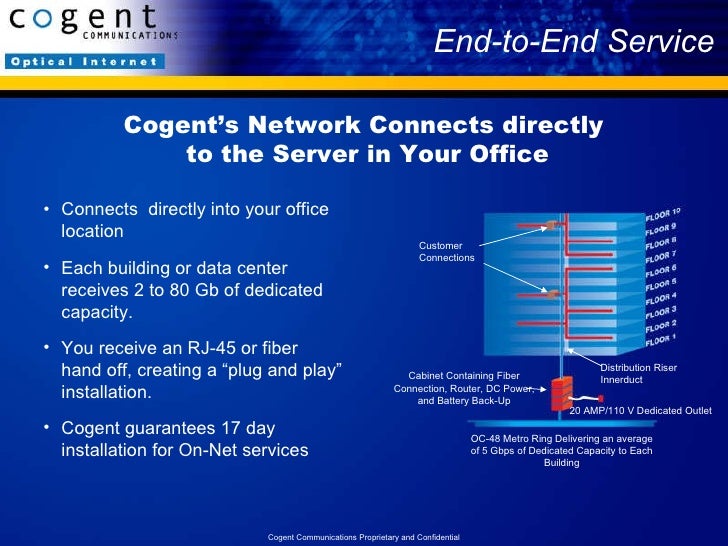

- VPLS, which is based on MPLS in the core network, has been a very successful offering for Cogent (see reference below). Shaeffer said that at the end of Q3-2017 an average of 12.5 customers out of 50 in a commercial building are using it (in addition to Internet access). VPLS has a huge advantage on a cost per bit basis over MPLS VPNs.

Note 1. Virtual Private LAN Service (VPLS) is a way to provide Ethernet-based multi-point to multi-point communication over IP or MPLS networks. It allows geographically dispersed sites to share an Ethernet broadcast domain by connecting sites through pseudo-wires.

- SD-WANs are very effective at low speeds. SD-WAN vendors are consolidating on IP SEC with 2**32 bit encryption (15% encryption overhead). At higher bandwidths (10M-100Mb/sec), the encryption tax has been 40% to 50% which resulted in a very low adoption of higher speed SD-WANs.

“As the equipment vendors have improved the efficiency of their processors, allowing encryption to occur in a multipath format through the processor instead of serially we’re seeing that efficiency go from like 40 or 50% to the high 80%. As that occurs, SD-WAN will become the dominant platform for location-to-location private networking and will replace MPLS,” Schaeffer added.

“The result for Cogent is an expansion in our addressable market. As we think about our corporate business in the U.S. and Canada, it is a $9 billion dedicated internet access market of which 10% of the market is on-net for Cogent and 90% is off-net.”

Schaeffer added that “out of the 90% off-net, roughly 40% of that total market is addressable through circuits we can buy from one of 90 off-net fiber providers.” However, approximately 1/2 of potential corporate customers don’t have fiber to their buildings.

“Fifty percent of corporate locations still don’t have fiber to them today and are therefore out of Cogent’s addressable market because we have made a conscious decision not to support fixed wireless, coax or twisted pair as a last mile connection due to low reliability, long provisioning times and low throughput,” Schaeffer said.

Since Cogent has decided not to use twisted pair, coax or fixed wireless for last mile access, there’s a large portion of the corporate market that it isn’t now able to address. But that might change with SD-WANs gaining popularity.

“What SD-WAN does is expands the market by allowing customers to bring their own bandwidth from locations that we are unwilling to purchase those sub optimal (non fiber based) tail circuits.”

Schaeffer said “the MPLS market is predicated on bandwidth costing 15 times as much per megabit as DIA (Dedicated Internet Access) bandwidth and that’s unsustainable. The U.S. MPLS addressable market, now worth $45 billion annually, will collapse to a $3 billion market (Schaeffer didn’t say when that would happen).” When that happens, Cogent believes their business will expand.

“We benefit two ways: our addressable market got a third bigger and we got a second reason for a customer to buy services from Cogent,” Schaeffer said. “That’s why we feel so confident about our corporate business continuing to perform even though our footprint expansion has continued to slow down.”

Author’s Note: It’s not clear how that will happen as Schaeffer didn’t say Cogent would offer SD-WANs.

Cogent’s network stretches over 199 markets throughout 41 countries in North America, Europe and Asia, with over 57,400 route miles of long-haul fiber and more than 31,070 miles of metropolitan fiber serving over 720 metropolitan rings.

Our end-to-end optical transport network consists of IP-over-WDM fiber links running up to 1200 Gbps intercity capacity and 320 Gbps on metropolitan rings, located in Cogent’s major markets throughout North America, Europe and Asia.

On the IP layer, Cogent’s Tier 1, IPv6 and MPLS enabled network has direct IP connectivity to more than 6,075 AS (Autonomous System) networks around the world with over 162.4 Tbps internetworking capacity.

Being a facilities-based carrier, Cogent takes advantage of full end-to-end control over its transport and routing technology to provide reliable and scalable service.

………………………………………………………………………………………………..

Separately, a survey from the SIP School asked this question:

What are the main reasons for you to deploy or investigate SD WAN solutions?

Answers from survey respondents:

- Better Use of Existing Links – 158

- Cost Savings – 148

- Improved WAN Performance – 114

- Failover – 95

- Security – 87

- Intelligent Routing – 83

- Analytics & Visibility – 50

…………………………………………………………………………………………………………….

References:

https://www.fiercetelecom.com/telecom/cogent-s-ceo-multi-location-sd-wan-services-will-replace-mpls

https://www.veracast.com/webcasts/citigroup/tmt2018/69111247817.cfm?0.0889053993034

China’s 5 Year Optical Component Plan to aid domestic parts makers

In December 2017, China’s Ministry of Industry and Information Technology (MIIT) released a five-year plan outlining a road map for commercial and technological progress in a broad set of optical technologies.

China has optical component makers, but they have generally produce lower-speed devices that lag U.S. companies by a product generation. China’s efforts to develop a domestic optical industry aims to support optical network equipment makers, such as Huawei and ZTE, according to Jefferies analyst Rex Wu.

The 63-page MIIT document is written in Chinese (Mandarin), but Cignal AI commissioned a professional English translation which summarizes the section of the plan about the Chinese optical components industry.

The goals and objectives outlined in the plan are exceptionally ambitious and should gravely concern incumbent component vendors. This document outlines strategic rather than rational economic objectives to catalyze market progress in Chinese component companies. Our interpretation is that this will increase the number of non-rational economic actors participating in the component market.

If executed, this plan will greatly increase the level of competition in an already fractured industry. It will also reduce or in some cases eliminate access for western component vendors to the largest market for optical communications components in the world – China.

……………………………………………………………………………………………………………

NeoPhotonics, Oclaro, Acacia, Lumentum, and Finisar sell the most optical components to China, says a UBS report. Those optical parts makers took a hit in 2017 as demand weakened from China’s telecom service providers. Analysts have been expecting a rebound in 2018 spurred by spending on fiber-optic networks, 5G wireless backhaul and data centers designed for cloud computing services.

China’s domestic optical component makers include O-Net, Accelink and Innolight.

“The government aims to have two to three Chinese optics companies in global top 10 in 2020, and one company in global top 3 in 2022,” Mr. Wu wrote in a Jefferies report to clients. “The market share of Chinese optics companies will reach over 30% worldwide in 2022,” according to the government’s plan, he added.

References:

https://cignal.ai/2018/01/chinas-5-year-optical-component-plan/

AT&T: Mobile 5G will use mm wave & small cells

AT&T says it will use small cells for its mobile “5G” service planned for 12 U.S. cities this year. The company’s first of these roll outs will use millimeter wave [1] spectrum, which offers higher capacity rates than low-band spectrum but does not propagate over large distances. That requires transmit/receive radios need to closer together than they are in LTE deployments.

Note 1. Millimeter wave (also millimeter band) is the band of spectrum between 30 gigahertz (Ghz) and 300 Ghz.

“Millimeter wave is more associated with small cell-like ranges and heights,” said AT&T’s Hank Kafka, VP of network architecture. “It can be on telephone poles or light poles or building rooftops or on towers, but generally if you’re putting it on towers it’s at a lower height than you would put a high-powered macrocell, because of the propagation characteristics.”

“5G will change the way we live, work and enjoy entertainment,” said Melissa Arnoldi, president, AT&T Technology and Operations. “We’re moving quickly to begin deploying mobile 5G this year and start unlocking the future of connectivity for consumers and businesses. With faster speeds and ultra-low latency, 5G will ultimately deliver and enhance experiences like virtual reality, future driverless cars, immersive 4K video and more.”

AT&T has announced 23 cities that are getting its 5G Evolution infrastructure, which the company describes as “the foundation for mobile 5G.” Those cities are Atlanta; Austin; Boston; Bridgeport, Connecticut; Buffalo, New York; Chicago; Fresno, CA; Greenville, South Carolina; Hartford, Connecticut; Houston; Indianapolis; Los Angeles; Louisville; Memphis; Nashville; New Orleans; Oklahoma City; Pittsburgh; San Antonio; San Diego; San Francisco; Tulsa, Oklahoma and Sacramento, California.

AT&T’s deployment of small cells to support mobile 5G will be largely independent of another 2017 AT&T infrastructure initiative – the build-out of the 700 MHz spectrum for FirstNet.

“Where appropriate we’re always going to try and get as much synergy as we can … but there’s a difference between dealing with small cell sites and dealing with macro sites,” Kafka said.

“You’ll find that a lot of radios that suppliers are putting out now are going to be upgradeable to support 5G,” Kafka said. “Some of the radios we’re deploying now do have that capability in the hardware.”

Kafka said that in some instances, tower crews might be able to add “5G” equipment near the base of the tower at the same time they add 700 MHz radios to the top. But the synergies between the two deployments are limited.

………………………………………………………………………………….

In sharp contrast to AT&Ts endorsement of millimeter wave technology, Sprint’s CTO John Saw said last week that he is not sure that using millimeter waves to deliver 5G services is a practical economic use of the high-band spectrum and that Sprint will be focusing on using its existing bandwidth to initially deploy 5G.

“What is the cost to deliver a bit over millimeter waves? Where is the business case on that?” John Saw asked at the Citi conference in Las Vegas.

………………………………………………………………………………………………………….

Verizon CTO Hans Vestberg told a CES panel last week that Verizon “will be first” to deploy 5G. Verizon is moving ahead with deployment of pre-standard fixed-wireless 5G service, starting with a rollout in Sacramento, California in the second half of this year. But Vestberg noted fixed-wireless is just one part of what Verizon plans to do with 5G.

“From 5G you can do different slices. We are now focusing on one slice, which is basically residential broadband to deliver superior performance quicker to market…That’s one use case, we can talk about many others.”

References:

https://www.rcrwireless.com/20180111/carriers/att-mobile-5g-will-rely-on-small-cells-tag4

https://policyforum.att.com/att-innovations/preparing-5g-need-small-cell-technology/

http://about.att.com/story/att_to_launch_mobile_5g_in_2018.html

https://techblog.comsoc.org/category/5g/

http://www.lightreading.com/mobile/5g/sprint-says-no-to-mmwave-yes-to-mobile-5g/d/d-id/739592

Internet Association to Join Law Suits to Restore Net Neutrality

Overview:

The Internet Association, a Washington trade group representing prominent tech companies including Facebook, Google and Netflix, announced plans Friday January 5th to help sue the federal government over its decision to rescind Obama era FCC regulations that guaranteed equal access to the Internet (AKA “net neutrality”). The Association said it would act as an “intervenor” in expected litigation over the FCC’s action.

That means that the Association won’t file its own lawsuit, but would join a legal action filed by others. Public interest groups and some state attorneys general have said they intend to challenge the repeal in court.

Net neutrality supporters argue that agency’s plan is illegal under federal laws that prohibit “arbitrary and capricious” changes in regulations, and that the agency didn’t gather sufficient public input on its proposal to overturn its old rules.

“The final version of Chairman Pai’s rule, as expected, dismantles popular net neutrality protections for consumers,” Michael Beckerman, president and CEO of the Internet Association, said in a statement. “This rule defies the will of a bipartisan majority of Americans and fails to preserve a free and open internet. IA intends to act as an intervenor in judicial action against this order and, along with our member companies, will continue our push to restore strong, enforceable net neutrality protections through a legislative solution.”

The FCC on Thursday posted the final text version of its new Internet rules, which it calls “Restoring Internet Freedom” (do you believe that?). Those rules are expected to enter the Federal Register in the coming weeks.

FCC Chairman Ajit Pai (pictured above), has said the repeal of the rules will free ISPs from regulatory burdens that harm investment. He was scheduled to speak at the Consumer Electronics Show in Las Vegas next week, but canceled due to death threats according to Recode which stated that the cancellation was in response to security concerns.

Pai has received sharp criticism since the vote, but defended his position by saying the rules were a heavy-handed approach to government regulation. Pai canceled a planned appearance at the CES technology conference in Las Vegas next week because of death threats, technology website Recode reported Friday. It is unclear whether the threats were connected to Pai’s net neutrality decision, which has drawn rancor on social media.

Congressional and Legal Challenges:

U.S. Senator Edward Markey (D-Mass.) is seeking to secure the votes that would force a vote to reverse the FCC’s action and restore the rules, via the Congressional Review Act. The move would be somewhat symbolic, as many Republicans support the FCC’s decision and President Donald Trump would be expected to veto such an action, if it were ever to reach his desk.

This week, California state Senator Scott Wiener, D-San Francisco, introduced a bill that requires telecommunications companies doing business in the state to guarantee equal Internet access. State Senate President Pro Tem Kevin De León, D-Los Angeles, is backing a similar bill. Efforts are also under way in New York and Washington state to write their own rules guaranteeing equal Internet access to consumers.

Several government officials and advocacy groups have said they plan legal action, but they all have to wait until the FCC repeal order is published in the Federal Register.

……………………………………………………………………………………………..

Opinions and Other Voices:

Noah Theran, an Internet Association spokesman, said open Internet rules helped level the playing field among companies, both small and large, in terms of their ability to reach people.

“The best websites and apps should win in a competitive marketplace because consumers like and use them, not because an ISP is picking winners and losers online by speeding up, blocking, or throttling access to certain sites,” Theran said in an email.

AT&T Senior Executive Vice President Bob Quinn said in a blog post after the December 2017 vote that “the Internet will continue to work tomorrow just as it always has.” He added that the company won’t block, censor or slow traffic to websites “based on content, nor unfairly discriminate in our treatment of Internet traffic.”

As expected, video streaming giant Netflix sharply criticized the December FCC vote to end net neutrality. “Today’s decision is the beginning of a longer legal battle. Netflix will stand with innovators, large and small, to oppose this misguided FCC order,” the Los Gatos, CA company said in a statement.

in 2006 Google co-founder Sergey Brin traveled to Washington, DC to make the case for net neutrality. Yet the internet giants were eerily quiet last year, other than filing comments with the FCC in support of the Obama-era rules, and placing a few notifications on their websites during the Day of Action. Apple is conspicuously missing from the group, but broke a long silence on the topic of net neutrality last year when it filed its own FCC comment in support of net neutrality.

Emmett Shear, CEO of the popular San Francisco video game streaming company Twitch, now owned by Amazon.com, said startups like his were able to succeed because of net neutrality.

“Without it, we might not be here today, and our streamers might not be here tomorrow,” Shear said in a blog post written in anticipation of the FCC’s reversal.

References:

https://internetassociation.org/statement-restoring-internet-freedom-order/

https://www.wired.com/story/tech-giants-to-join-legal-battle-over-net-neutrality/

https://www.fcc.gov/document/fcc-releases-restoring-internet-freedom-order

Internet Association Will Join Legal Battle to Fight FCC’s Net Neutrality Repeal

https://www.nytimes.com/2017/12/15/technology/net-neutrality-repeal.html

…………………………………………………………………………………………………………………………………………….

Addendum:

In response to an IEEE member email, I hereby provide background on the 2015 Net Neutrality FCC decision to classify the Internet as a regulated service under Title II of the 1934 Communications Act. Specifically:

Verizon Selects Samsung for First “5G” Fixed Wireless Broadband Deployment in 2018

Verizon has chosen Samsung Electronics as a major supplier in the U.S. telco’s push to offer high speed fixed access internet and other services over its wireless network. Financial terms of this “5G” business relationship weren’t disclosed. Samsung’s “5G” Fixed Wireless Access network products (including 5G home routers and 5G Radio Access units) will be used for commercial deployments.

Verizon says its “5G” fixed access network will launch in the second half of this year in Sacramento, CA, which is more than two full years before ITU-R WP5D completes its IMT 2020 standards. Verizon plans to add the same “5G” fixed broadband access service in four other U.S. markets later in 2018. It will use cellular antennas to beam high-speed internet into consumers’ homes. Samsung will make network equipment for Verizon—including the small boxes that will sit inside each home, receiving the signal and translating it into WiFi— the companies said Wednesday, January 3, 2018. Verizon said last month it would also use “5G” network equipment made by Ericsson for commercial launches in other U.S. markets.

Verizon estimates the market opportunity for initial 5G residential broadband services to be approximately 30 million households nationwide. In addition, it says that the 5G commercial launch will not have a material impact on its consolidated Capex in 2018 and that it expects its full-year 2018 capital spending program to be consistent with the past several years.

Last year, Verizon began “5G” fixed access trials, focused on home broadband service, in 11 U.S. markets from New Jersey to California. Samsung will provide network gear for Verizon’s launch in Sacramento, where customers will be offered the option of purchasing the faster wireless access capability. Verizon and Samsung collaborated on 5G trials in parts of California, Georgia, New Jersey, Massachusetts, Michigan, Texas, and Washington, D.C. Verizon and Samsung said that those trials revealed that a single 5G radio could reach the 19th floor of a multi-dwelling unit, and that broadband service was achieved using line of sight, partial Line of Sight (LOS) and even non-LOS connections. They also claimed that “environmental factors” such as rain and snow, did not interrupt “5G” based broadband service.

“The industry has been discussing 5G connectivity for years, and through our joint collaboration with partners like Samsung, we are beginning to make it a reality for our customers,” Ed Chan, chief technology architect and network planning at Verizon, said in a statement. “Sacramento is an ideal place to begin deploying 5G broadband services, providing a progressive environment for creating future use cases.”

“Together with Verizon, we have explored the vast potential of 5G through market trials across the U.S.,” added Mark Louison, SVP and GM, networks division, at Samsung Electronics America. “At the same time, Samsung applied lessons learned from these real-world trials to ensure that our complete end-to-end 5G portfolio is ready for commercial service. We are delighted to work with Verizon on this journey to create unprecedented user experiences powered by 5G.”

[Note that there’s been no mention of when “5G” mobile service might be available from Verizon.]

…………………………………………………………………………………………………………………………………………………………………………………………………………………………………….

“5G” carries the potential to disrupt the broadband fixed access market for triple play services. That market is currently dominated by cable/MSO providers like Comcast Corp. and Charter Communications Inc, but AT&T is also there with its U-verse and AT&T Fiber offerings.

Companies globally are investing billions of dollars in 5G despite continued debate over its ultimate uses beyond faster download speeds. The three main applications areas for IMT 2020 are:

1] Enhanced Mobile Broadband

2] Ultra-Reliable, Low Latency Communications

3] Massive Machine Communications, i.e. Internet of Things (IoT)

Note that fixed broadband Internet access is not one of them!

Here’s an ITU diagram of IMT 2020 5G Use Cases from from a September 2016 ITU presentation:

Arthur D. Little has written a report called “5G deployment models are crystallizing” in which it makes the case that telcos need to find use cases now, if not to reap the benefits of being early to market then as a defensive measure. Where in the past only other telcos had the wherewithal to roll out a new generation of wireless technology, ADL points out that that’s no longer true. Non-telecom players are moving into the 5G space, including Google, Facebook, Apple, Hitachi, Scania, NEC, Ericsson, and Comau. Government agencies and telecom operators expect broad “5G” availability in many markets by 2020, but again, that won’t be based on ITU-R ratified IMT 2020 standards.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

“5G is a reality,” said Kim Young-ky, president of Samsung’s networks business, in an interview with the Wall Street Journal.

South Korean technology giant Samsung, a fairly small player in the network equipment world, believes its knowledge making products and components could give it an edge with telecom customers seeking to sell connectivity to a wider range of devices. Samsung’s network business generated some 2 trillion ($1.9 billion) to 2.5 trillion won in 2017, according to research firm Counterpoint Technology Market Research. It targets annual revenue of 10 trillion won by 2022, a Samsung spokesman said.

The average U.S. consumer uses about five gigabytes of mobile data a month, Mr. Kim said. But after 5G becomes more ubiquitous in the next few years, he believes consumers will eventually use closer to 100 gigabytes monthly on new services such as virtual or augmented reality programs—or even from driverless cars that will require greater data speeds to rapidly process traffic conditions.

About two years ago, Samsung combined about 1,000 workers from different divisions including handsets, network and its central research-and-development group, to create a “Next Generation Communications Business” team dedicated to 5G.

“With 5G, it’s going to be expanding beyond your phone,” Kim Woo-june, a senior vice president in Samsung’s network business, said in an interview. The industry’s first mobile phones with 5G capabilities aren’t likely to debut until 2019, he added.

………………………………………………………………………………………………………………………………………………………………………………………………………………………………..

AT&T last month said it would launch a “5G” trial site in Texas, after tests in other markets. Sprint Corp. and T-Mobile US Inc. have said they are working on nationwide “5G” networks, targeting late 2019 or 2020.

References:

https://news.samsung.com/us/verizon-5g-commercial-launch/

http://www.broadcastingcable.com/news/platforms/samsung-gets-piece-verizon-s-5g-action/170867

https://www.wirelessweek.com/news/2018/01/verizon-partners-samsung-5g-fixed-wireless-launch

Related Articles on “5G” Deployments:

Verizon Exec: ‘Meaningful’ 5G Deployments to Start in 2018:

http://www.multichannel.com/news/finance/verizon-exec-meaningful-5g-deployments-start-2018/411354

…………………………………………………….

Verizon 5G to launch in Sacramento in 2018 | ZDNet

http://www.zdnet.com/article/verizon-5g-to-launch-in-sacramento-in-2018/

…………………………………………………….

Verizon Tips Launch of 5G-Based Residential Broadband Service

…………………………………………………….

Verizon commits to residential fixed broadband as first 5G use case, but analysts call the plan “murky”

http://www.telecomtv.com/articles/5g/verizon-commits-to-residential-fixed-broadband-as-first-5g-use-case-but-analysts-call-the-plan-murky-16206/

…………………………………………………….

AT&T Targets 5G Rollouts in 2018 After 3GPP Standards Acceleration

https://www.wirelessweek.com/news/2017/03/t-targets-5g-rollouts-2018-after-3gpp-standards-acceleration

……………………………………………….

AT&T Expects 5G in Late 2018 or Early ’19

http://www.lightreading.com/mobile/5g/atandt-expects-5g-in-late-2018-or-early-19/d/d-id/733953

…………………………………………………….

South Korea to launch first commercial 5G network in 2019

https://www.rcrwireless.com/20170525/5g/south-korea-launch-first-commercial-5g-network-2019