Sigfox boosts its IoT global footprint, achieving national coverage in 17 countries

At Sigfox World IoT Expo last week in Prague-Czech Republic, Sigfox announced that its network now spans 36 countries, as part of its mission to offer a consistent level of connectivity quality and service anywhere in the world.

Here are the highlights of the Sigfox conference:

- Sigfox’s network is now available in 36 countries, including 17 countries with national coverage and the addition of four new operators in Costa Rica, Croatia, Thailand, and Tunisia.

- A new suite of connectivity services which includes the ability to turn any short-range wireless device into a long range IoT device, connect to the Sigfox network in markets where coverage hasn’t been deployed yet, and new interoperability capabilities which allows IoT devices to recognize and automatically adapt to local communications standards without any additional hardware.

- Partnering with GCT Semiconductor, Sigfox has now launched the first hybrid cellular/Sigfox IoT solution– a chip which can support LTE-M/NB-IoT/EC-GSM and Sigfox IoT connectivity.

- New partnerships with electronics manufacturer Alps Electric Europe, Bosch Connected Devices and Solutions, and strategy consultancy Roland Berger

“We’re excited to work with all of our new partners, this move marks yet another key milestone towards Sigfox’s vision of a global IoT network. We are looking forward to collaborating with our new Sigfox operators to help their local ecosystems to seamlessly scale IoT solutions wherever the Sigfox network is present in the world. Together, we’re building a future that will be better to live in,” said Rodolphe Baronnet-Frugès, Executive Vice President of Operators at Sigfox.

Sigfox operators are not only contributing to accelerate IoT development in their local markets, they are also committing to deploy and operate the network infrastructure and offer national coverage in their country. Up to now, almost 100 million euros have been invested by Sigfox operators to offer a unique access to the Sigfox IoT services, with the exact same quality of service.

This unique global offer is enriched with Sigfox new service Monarch, now allowing IoT devices to recognize and automatically adapt to every local communications standard in the world without roaming. By enabling ‘globe trotter’ assets that can seamlessly adapt as they move across borders, Monarch could be a game-changer for logistics, freight, and consumer goods industries.

……………………………………………………………………………………….

In Ireland, Sigfox Operator VT signed a €1-mill IoT subscription with Dunraven Systems, a market leader in the design and development of ultrasonic fuel tank monitors.

………………………………………………………………………………………..

In addition to its core IoT connectivity service, Sigfox offers a range of services to make even more simple to use Sigfox’s technology, to deploy and to adopt mass IoT solutions. These services allow to connect billions of wireless devices that are not yet connected to the internet.

Above illustration courtesy of Sigfox

………………………………………………………………………………………………………………..

This potential game-changing development has been made possible by the cognitive capabilities of the Sigfox network and its Software Defined Radio technology, where all the network and computing complexity is managed in the Cloud rather than on the device. This enables Sigfox to constantly improve its network features and make them available by simple software upgrade.

……………………………………………………………………………………………..

A key question for Sigfox is whether they’ll also support the new LPWAN standards and specs (LTE category M1, NB-IoT, LoRA WAN, etc). We’ve asked the company and are eagerly awaiting their reply. Stay tuned.

NSR: Satellite IoT market forecast at $2.9B by 2026

The global satellite M2M and IoT market is expected to grow to $2.9 billion in revenue by 2026, according to satellite based market research company NSR.

This growth will be driven by over 6.8 million in-service terminals, NSR said in their new report. Potential applications include (see chart below): land transport and especially cargo tracking, which is expected to be the most profitable and sought after segment of the emerging industry.

“Revenues are growing year-over-year across each of the 22 applications NSR identified, and will accelerate as new M2M capacity supply, in the form of new constellations, come online in the medium term,” NSR senior analyst and lead report author Alan Crisp said.

“Most increases in new demand for M2M service today stem from basic product offerings, as for many use cases bandwidth requirements remain in the kilobyte range,” Crisp added.

While most M2M and IoT services require only low bandwidth, NSR also predicts that over the next decade some verticals will demand additional bandwidth to support applications such as big data analytics, engine telematics and live data streaming.

The report states that a number of small satellite constellations will target low bandwidth and latency insensitive applications in agriculture and tracking market segments.

Despite the huge revenues predicted, the report notes that despite growing demand for IoT satellite services, the business case for IoT exclusive satellite constellations has yet to be proven – especially considering the exponential growth of LPWANs, LTE-M and NB-IoT terrestrial networks for IoT.

For example, last week China Mobile-Hong Kong demonstrated a smart parking service carried over its commercial NB-IoT network. Meanwhile, rival wireless network operators 3 Hong Kong (part of Hutchinson-HK) and SmarTone have also made recent announcements of NB-IoT deployments. 3 HK and Huawei have built the NB-IoT infrastructure with NB-IoT modules designed in accordance with the 3GPP standard to facilitate tests and development of NB-IoT applications.

This report answers key questions on the satellite M2M/IoT market:

- Which applications, frequencies and regions exhibit the greatest growth potential?

- How important are latency, security and high bandwidth requirements for upcoming M2M/IoT applications?

- What role will small satellites have with IoT connected devices, and how will this impact the existing satellite M2M/IoT operators?

- How can satellite benefit from the growth of Low Power Wide Area networks?

References:

https://www.telecomasia.net/content/satellite-iot-market-tipped-hit-29b-2026?src=related

AT&T’s Rural Broadband Expansion Continues: 9 More States Added

AT&T has brought its fixed wireless broadband service to nine more states, bringing the total coverage to more than 160,000 rural locations in 18 states. The service, partly funded by the U.S. federal Connect America Fund (CAF) program, provides homes and businesses with download speeds of at least 10 Mbps with a minimum of 1 Mbps upstream. The service uses licensed WCS (Band 30) 2.3 GHz spectrum.

This fixed wireless service has broadband usage caps of 160 GB per month, with additional 50 GB increments of data charged at $10 per month. It’s priced at $60 per month when bundled with other AT&T services.

The additional 9 states include:

- Arkansas

- California

- Illinois

- Indiana

- Kansas

- Michigan

- Ohio

- Texas

- Wisconsin

They join Alabama, Florida, Georgia, Kentucky, Louisiana Mississippi, North Carolina, South Carolina and Tennessee, where this AT&T rural broadband service is already available in certain markets. AT&T has plans to reach 400,000 locations by the end of this year, and over 1.1 million locations by 2020. This AT&T rural broadband expansion is partially funded by the Connect America Fund (CAF), the FCC’s program to expand rural broadband access.

“Closing the connectivity gap is a top priority for us,” said Cheryl Choy, vice president, wired voice and internet products at AT&T in a press release announcing the expansion. “Access to fast and reliable internet is a game changer in today’s world.”

AT&T may gain some competition for this fixed wireless service, at least in Mississippi. C Spire just announced their intention to aggressively expand fixed wireless service in Mississippi this week. They cited the advantage their 25 Mbps fixed wireless service has over certain CAF funded 10 Mbps fixed wireless options, a specific reference to AT&T.

“For many rural families and communities, the introduction of this service from AT&T will mark a new era of increased broadband speeds and access to cheaper and more diverse content.” said Bret Swanson, president, Entropy Economics. “AT&T’s move into these new communities will also yield additional economic benefits and can help create new jobs.”

To learn more about Fixed Wireless Internet from AT&T, go to att.com/internet/fixed-wireless.html.

References:

http://about.att.com/story/fixed_wireless_internet_in_9_new_states.html

AT&T Rural Broadband Expansion Continues Through CAF Funded Fixed Wireless Service

ABI Research: Start-ups to be rising stars of 5G challenging incumbents

The rise of 5G is promising to shake up the status quo in the mobile equipment industry by presenting opportunities for startups to grab market share away from the incumbent vendors, according to ABI Research.

In a new report, the market research firm identified 15 startups exhibiting strong potential to play a role in wireless network operators’ transformation to 5G through innovative products and services.

“Traditionally operators have deployed a handful of infrastructure vendors in their networks, especially in the core network. Stagnating average revenue per user and increasing network traffic are driving operators to be more cost-effective and innovative in network performance and operations management and network upgrades. The end-to-end digital transformation toward virtualized and software defined networks is creating the opportunity for operators to open their highly proprietary networks and vendor ecosystem to include innovative start-ups. The 15 companies we have profiled illustrate a strong business sense and innovative solutions,” says Prayerna Raina, Senior Analyst at ABI Research.

Operators are facing the need to address key network performance and traffic management issues ahead of the standardization and launch of 5G in 2020, the report states.

Startups such as Athonet, CellWize, CellMining, AirHop Communications, Core Network Dynamics, Blue Danube and Vasona Networks are developing innovative solutions in these areas and may challenge the long-established telecom industry status quo.

“The telco start-ups we have profiled are challenging the incumbents in every way. From the flexibility of the solution to value-added services and a strong R&D focus, these companies are not just innovative, but also reflect an understanding of telco operators’ operational models as well as revenue and network performance challenges. With strong financial backing and active engagement with major partners in their ecosystem, these startups have proven their ability to meet operator requirements in tests and field deployments,” Ms. Raina said.

These findings are from ABI Research’s Mobile Network Hot Tech Innovators report. This report is part of the company’s Mobile Network Infrastructure research service, which includes research, data, and analyst insights.

Technology trends including SDN and NFV for mobile networks, the evolution of the mobile edge computing and self-organizing network solutions will also lay the groundwork for 5G (even though none of those will be included in the ITU-R IMT 2020 standards). Other enabling technologies include the use of big data analytics (also not to be included in any 5G standard) to enhance and optimize network performance.

Question: Do you really think start-ups can take market share away from Nokia, Ericsson, Huawei, Qualcomm, and other incumbent wireless technology companies? Don’t forget Intel which is making a major effort to be a 5G technology provider with their mobile terminal platform.

References:

https://www.abiresearch.com/press/startups-are-rising-stars-5g/

https://www.telecomasia.net/content/startups-challenge-telecoms-status-quo-5g-rises

https://www.abiresearch.com/staff/bio/prayerna-raina/

https://www.quora.com/5G-Communications-What-companies-are-leading-in-5G-technologies

IEEE ComSoc Webinar: 5G: Converging Towards IMT-2020 Submission

2 New Reports: 1] European Broadband Availability & 4G-LTE Coverage + 2] Global Broadband Status

Research conducted by IHS Markit and Point Topic was published today by the European Commission (EC). The Broadband Coverage in Europe 2016 study found that at the end of June 2016, more than three-quarters of EU homes have access to high-speed broadband services and 4G LTE coverage was nearly ubiquitous with 96 percent of EU households covered by 4G LTE networks.

This is the fourth edition of the study delivered by IHS Markit and Point Topic to the EC which provides data and analysis on availability of broadband services by various technologies in 31 countries across Europe (EU-28, Iceland, Norway, and Switzerland).

The final report and accompanying data tables are available at the EC website.

Key findings:

- In the 12 months to the end of June 2016, 12.8 million new EU households gained access to high-speed broadband delivered via Next-Generation Access (NGA) networks

s:By mid-2016, high-speed broadband services (at least 30 Mbps download speeds) were available to 75.9 percent of EU households

- Very-high-speed-DSL (VDSL) continues to be the key driver of NGA coverage growth across the EU, increasing by 7.1 percentage points and reaching nearly a half (48.2 percent) of EU homes

- 4G-LTE networks expanded at a fast pace and covered 96 percent of EU households by the end of June 2016

- The gap between rural and national NGA coverage is closing, but remains significant with only 39.2 percent rural households across the EU having access to high-speed broadband services

“Availability of 4G-LTE services has become near-universal in many study countries,” said Alzbeta Fellenbaum, principal analyst at IHS Markit and manager of the project. “In 11 countries, LTE coverage reached 99 percent of households and overall, LTE coverage now reaches similar levels to those of 3G HSPA networks. This is a major improvement compared to just four years ago, when 4G LTE services were available to only 59.1 percent of EU homes.”

Copper upgrades continue to be key for high-speed broadband growth in Europe

Broadband network operators across Europe continue to focus their deployment strategies on upgrading existing copper DSL networks instead of investing in the typically more expensive deployments of fibre optic networks all the way to customers’ property.

“Since 2013, VDSL has been the fastest growing fixed broadband technology tracked by the study, and some countries have seen dramatic year-on-year growth in VDSL,” Fellenbaum said. “For instance, VDSL coverage in Italy more than doubled during the twelve-month period to mid-2016, as coverage increased by 33.6 percentage points. Iceland, Germany, Hungary and Slovakia also witnessed double-digit growth in VDSL coverage during the twelve-month period to mid-2016.”

Portugal breaks Baltic leadership in super-fast FTTP broadband availability for the first time

Availability of fiber-to-the-premise (FTTP) services in Portugal improved by 10.7 percentage points during the twelve-month period to mid-2016 and as a consequence of this growth, Portugal with 86.1 percent of home passed by FTTP networks has now surpassed Latvia (85.2 percent) and Lithuania (81.4 percent) to rank first in terms of FTTP coverage among all study countries.

However, big differences remain among European countries in terms of FTTP availability and while FTTP access is on offer in all study countries, in some of the countries FTTP services are available only on a very limited basis.

As in previous years, Greece and Belgium reported the lowest levels of FTTP coverage, at 0.6 percent and 0.4 percent. In the UK, FTTP coverage was only slightly higher at 1.8 percent. “This reflects the preference of operators in these countries to prioritise their deployment strategies on upgrading existing VDSL networks, rather than investing in the typically more expensive FTTP technology,” Fellenbaum reiterated.

Gap in rural broadband coverage shrinking

Access to broadband services in rural areas remains a key priority for the EU. At the end of June 2016, 92.6 percent of rural households across the EU28 had access to at least one fixed broadband technology. However, only 39.2 percent (12.0 million rural households) could benefit from NGA broadband.

Nevertheless, rural NGA coverage increased by 9.5 percentage points by mid-2016 and in total, 2.9 million additional rural households gained access to next generation broadband services between the end of June 2015 and 2016.

“Moreover, we have seen that the gap between rural and national coverage, for both overall fixed and NGA technologies, is declining compared to previous editions of the study suggesting increasing investment in rural broadband,” Fellenbaum said.

More information is available from the IHS Markit Operator Multiplay Intelligence Service and Broadband Media Intelligence Service.

For information about purchasing IHS Markit information, contact the sales department at IHS in the Americas at (844) 301-7334 or [email protected]; in Europe, Middle East and Africa (EMEA) at +44 1344 328 300 or [email protected]; or Asia-Pacific (APAC) at +604 291 3600 or [email protected].

………………………………………………………………………………………………….

The State of Broadband 2017: Broadband Catalyzing Sustainable Development report has been released by the UN Broadband Commission for Sustainable Development.

According to the report, while 48% of the global population is now online, some 3.9 billion people still do not have Internet access, with the digital gap growing between developed and developing countries.

In addition, only 76% of the world’s population lives within access of a 3G signal, and only 43% of people within access of a 4G connection. The disparities in gender access are also becoming wider in developing countries.

“Broadband is crucial to connecting people to the resources needed to improve their livelihoods, and to the world achieving the Sustainable Development Goals,” said ITU Secretary-General Houlin Zhao, who serves as co-Vice Chair of the Commission with UNESCO Director-General Irina Bokova.

“The goals for education, gender equality and infrastructure include bold targets for information and communication technology. The State of Broadband 2017 report outlines how broadband is already contributing to this and makes valuable recommendations for how it can increase this contribution into the future.”

Sheikh Saud Bin Nasser Al Thani, Group CEO, Ooredoo, said:

“The report shines a crucial light on the ongoing global challenge to help people across the world access the life-changing benefits of internet access. At Ooredoo, we continue to invest in mobile technology, people and resources that enable our communities – in particular underserved women and youth – to enjoy the internet and use it as a means to improve their lives and achieve their full potential. As we deploy the power of digital technology to give people access to the services and support they need, we urge governments, operators and regulators to continue working closely together to address the deepening digital inequality in global connectivity.”

Issued annually, The State of Broadband report is a unique global snapshot of broadband network access and affordability, with country-by-country data measuring broadband access against key advocacy targets set by the Commission in 2011.

The report also examines global trends in broadband connectivity and technologies, reflects on policy and regulatory developments, as well as the applications of broadband for sustainable development. It also presents several policy recommendations.

Promoting investment in broadband connectivity from a broad range of sectors, the report notes, can help achieve the full potential of these technologies and bring the world closer to the goal of an inclusive digital society accessible by all.

Huawei & Intel Partner for 3GPP “New Radio” Interoperability Testing

On Friday September 22nd, Huawei announced it will collaborate with Intel on the 3GPP “5G” New Radio (NR) based Interoperability Development Testing (IODT). The partnership will pave the way for pre-standard “5G” trials based on 3GPP release 15. Note yet again, that 3GPP release 15 is targeted at “5G” trials, while release 16 will be a submission to the ITU-R IMT 2020 (real) 5G standards.

“The companies will conduct testing in real mobile, over-the-air environments directly connecting Huawei’s infrastructure and Intel’s terminal platform,” Huawei said on Friday.

The company added: “As one of the first globally converged 5G spectrum, C-Band will provide basic coverage and bandwidth for 5G. Further, C-Band will serve as one of the world’s first commercialised 5G frequency bands. The verification of these features that Huawei and Intel have launched will point out the future direction for the industry.”

Based on Huawei’s 5G base station prototype and Intel’s 3rd Generation 5G Mobile Trial Platform (MTP), the companies will jointly verify the performance of key “5G” NR technologies which include: Sub-6GHz including C-Band, mmWave and mobility. The companies will conduct testing in mobile, over the air environments directly connecting Huawei’s infrastructure and Intel’s mobile terminal platform.

“Huawei is committed to driving the development and commercial deployment of 5G technologies. In the IMT-2020 field tests in Beijing, Huawei has fully demonstrated its competency and leadership in C-Band, mmWave, and downlink and uplink decoupling 5G technology. We are excited to work with Intel to help the industry drive the development of 5G terminals to promote sustainable development and ecosystem maturity of the industry chain,” said Yang Chaobin, President of 5G Product Line at Huawei.

“Intel has been actively collaborating with leading players in the Chinese 5G industry to accelerate 5G R&D tests and commercialization with Intel’s end-to-end 5G technology advantages. Based on the latest 5G NR technologies, this joint interoperability test with Huawei will further drive unified 5G standards and the industrial ecosystem in China and across the globe,” said Asha Keddy, vice president in the Communication and Devices Group at Intel Corporation.

Here’s the timeline for 3GPP release 15:

……………………………………………………………………………………………………

Ongoing 5G Collaboration & Trials:

At the global 5G testing summit at 2017 MWC this past February, Huawei, Intel, and their telecom operator partners jointly announced they would work to drive globally unified 5G standards through 5G testing, enhance cooperation among telecom operators, equipment manufacturers and vertical industry partners, create a unified 5G industry chain from chips, terminals, to network infrastructure and test equipment, and build a global 5G ecosystem. Commencement of IODT seems to be a viable way for Intel and Huawei to achieve this goal.

In January, Huawei demonstrated “5G” like speeds of ~ 35Gbps with Singapore telcos StarHub and M1. The company is working with wireless carriers all over the world (x-US) in “5G” trials.

Intel is working with U.S. carriers AT&T and Verizon on 5G trials. AT&T is using Intel’s 5G mobile trial platform in its Indiana, Texas, and Michigan trials, while Verizon relies on Intel for its 11 pre-commercial 5G trial networks across the nation. Intel is also planning to use the Olympic Games to showcase its 5G “platform.”

Intel and Verizon additionally trialed 5G during the Indianapolis 500 motor race in May, using technologies such as beam forming and beam tracking to attain speeds in excess of 6 Gbps.

–>Having missed out on 4G-LTE by backing WiMAX instead, Intel apparently is trying to catch up by putting a lot of engineering resources into 5G development and collaboration.

Huawei’s Conclusion:

“5G standards are moving quickly to unify, and China will be among the first countries to widely deploy 5G networks. Huawei and Intel will work closely to accelerate the era of 5G.”

References:

http://www.huawei.com/en/news/2017/9/Huawei-5G-collaboration-Intel

http://www.3gpp.org/news-events/3gpp-news/1614-sa_5g

http://www.3gpp.org/news-events/3gpp-news/1813-nr_rel15

http://www.3gpp.org/release-15

http://www.3gpp.org/news-events/3gpp-news/1898-webinar_ran_sep_2017

Cignal AI’s Forecast for 100G & 400G Coherent WDM Shipments

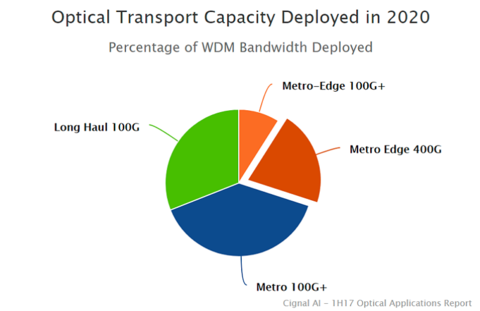

Ciena and Cisco rank as the predominant vendors of 100G and 400G Coherent WDM optical network equipment for 2017, respectively according to Cignal AI in their Optical Applications Report. The networking component and equipment market research firm notes that 400G coherent WDM system shipments are ramping up this year. The market research firm estimates that 400G technology will account for nearly one-quarter of all deployed WDM bandwidth in 2020.

The report also predicts that revenue for equipment originally designed for the data center interconnect (DCI) market will reach $1 billion by 2019, as these systems become widely adopted outside of traditional DCI applications.

Editor’s Note:

The lead author is the very well respected Andrew Schmitt, formerly with Infonetics (now IHS-Markit). Both 100G and 400G coherent will be widely adopted at the edge of the network by the end of 2021, according to the market research firm.

…………………………………………………………………………………

Cignal Al said that Cisco is growing 100G port deployments faster than all other vendors in the market. Meanwhile, Chinese coherent 100G port deployments grew at a healthy pace in the first half of 2017.

Complementing the 400G and 100G growth are two other key innovations—compact modular equipment and packet-OTN switching.

While modular equipment was initially designed to accommodate data center deployments, a host of traditional incumbent, wholesale, and cable MSOs will use these systems incorporated with open software to build disaggregated optical networks.

Cignal Al noted that compact modular equipment spending more than tripled in the first half of 2017 over the same period last year. Ciena, Cisco, and Infinera are the dominant suppliers for this sector. At the same time, traditional service providers such as Verizon are expanding advanced packet-OTN deployments. Packet-OTN systems revenue grew in the double digits in the first half of 2017, up from the same period in 2016. Cignal Al said Verizon’s deployment of these systems is rising and will affect vendor market share more materially in the second half of 2017.

“Cignal AI has close relationships with equipment and component manufacturers, as well as end users, and these relationships give us a unique insight into the optical equipment market. From this vantage point, we can forecast emerging technologies such as coherent 400G WDM usage,” states Andrew Schmitt, lead analyst for Cignal AI. “Pluggable 400G ZR modules should enter the market by 2019, and they will be the final nail in the coffin for 10G WDM networks.”

100G+ Coherent WDM:

- 400G coherent WDM volume starts to ramp this year, led by Ciena deployments and then followed by other suppliers six to nine months later.

- The introduction of small form factor 100G and 400G pluggable models will spur the largest optical market transformation since the “Optical Reboot” of 2012-2015 by virtually eliminating most 10G WDM deployments from the world’s optical infrastructure.

- Both 100G and 400G coherent will be widely adopted at the edge of the network by the end of 2021.

- Cisco is growing 100G port deployments faster than all other vendors in the market.

- Despite widespread expectations to the contrary, Chinese coherent 100G port deployments grew at a healthy pace in the first half of 2017.

About the Report:

This report tracks optical equipment spending and port shipments for specific types of equipment designed to meet the needs of a specific application. Cignal AI collects shipment information and guidance from equipment companies as well as the supply chain each quarter, and estimate each companies shipments in each of the defined categories. Forecasts are based on expected spending and shipment trends for given applications on a regional basis.

The report features revenue-based market size and share for the hardware categories and detailed port-based market size and vendor market share for 100G+ shipments. Vendors examined include Acacia, Adtran, ADVA Optical Networking, Ciena, Cisco, Coriant, ECI Telecom, Fujitsu, Huawei, Infinera, Inphi, NTT Electronics (NEL), Nokia and ZTE.

The report contains details on the following areas:

- Compact Modular hardware market share and forecasts

- 100G+ Coherent port shipments vendor market share

- 100G, 200G, and 400G+ Coherent and Direct Detect port shipments and forecast

- Advanced Packet-OTN Switching market share and forecasts

References:

https://cignal.ai/2017/09/cignal-ai-issues-industrys-first-forecast-for-400g-coherent-wdm-shipments/

https://cignal.ai/2017/09/1h17-optical-applications-report/

https://cignal.ai/marketresearch/opteq_ap/

http://www.ciena.com/insights/what-is/What-Is-Coherent-Optics.html

http://www.gazettabyte.com/home/2017/9/15/has-coherent-optical-transmission-run-its-course.html

https://www.nextplatform.com/2017/09/14/rare-peek-inside-400g-cisco-network-chip/amp/

https://www.cisco.com/c/en/us/solutions/service-provider/100-gigabit-solution/index.html

http://www.ciena.com/insights/articles/Move-Over-200G-400G-is-the-New-Sexy.html

Addendum:

Vodafone New Zealand just announced the world’s first live deployment of a 400G per wavelength optical system to carry core IP traffic between its Auckland data centers, using Ciena’s WaveLogic Ai coherent optics. AT&T’s recent trial of 400GbE also used Ciena’s WaveLogic Ai chipset

These two factors, illustrated above, enable the transport of 400Gb/s per wavelength and 30.4Tb/s of capacity per fiber, higher capacity than any other solutions available on the market, according to Ciena.

Broadband Forum’s vBG network spec targeted at SD-WANs; led by ONUG

The Broadband Forum has published TR-328, the Virtual Business Gateway, a network specification meant to facilitate the adoption of Software-Defined WAN (SD-WAN) technology. The Forum says that Virtual Business Gateway (vBG) (TR-328) “enables SD-WAN spearheaded by The Open Networking User Group (ONUG).”

–>We’ll try to unpack that quote later in this post, by examining SD-WAN projects in the ONUG.

“As operators look to transform their networks with greater use of software and virtualization, demand for solutions, such as the vBG and CloudCO, with these associated reference implementations and API’s is growing – the market is now ready for standards-based software deliverables for Open Broadband,” Robin Mersh, CEO of Broadband Forum, said in a press release.

The Forum said that “vBG accelerates the delivery of new-generation

standardized, carrier-class, interoperable business services such as enterprise class firewall and Wide Area Network optimization. SD-WAN, spearheaded by the Open Networking User Group (ONUG), is enabled by the vBG, which connects to other Broadband Forum initiatives such as CloudCO and the Network Enhanced Residential Gateway. The completion of the landmark specification

comes at the same time as the Forum begins work on two major software projects for Open Broadband and makes significant progress on its CloudCO project.”

The Broadband Forum said that the vBG system enables greater efficiency in service provider networks by virtualizing some of the functionality of a Business Gateway into a flexible hosting environment, which may be located at the customer premises, in the operator’s network, such as a CloudCO, or using a combination of the two approaches.

By using the vBG, a service provider could simplify customer-located and customer self-provisioning through a web portal, enabling it to enhance new service delivery times, shutting down unsuccessful services and up-selling value-added services. All of this can be done without the need to deploy specialized hardware devices to remote enterprise sites. Here are several illustrations of vBG in action:

Illustrations above courtesy of Broadband Forum

………………………………………………………………………………………………………

TR-328 Summary:

- TR-328 specifies the virtual Business Gateway (vBG) system architecture. The vBG system virtualizes some of the functionality of a Business Gateway into a flexible hosting environment which may be located at the customer premises, in the operator’s network, such as a CloudCO or using a combination of the two

- With the vBG system architecture, the functions provided traditionally by the BG are now distributed between a simplified on-site physical device called the pBG (physical Business Gateway) and a virtualized component – the virtual Business Gateway. The vBG hosting environment can benefit both from network equipment and recent network virtualization technology

- TR-328 describes the motivations to deploy the vBG System architecture, based on the use cases that it enables. In particular, it facilitates simplification of the customer located equipment, customer self-provision through a portal, rapid introduction of new services, decommissioning of unsuccessful ones, and upselling value-added services. All without the need to deploy specialized hardware devices to remote enterprise sites. Examples of value-added services include: enterprise class firewall and Wide Area Network optimization.

The vBG was published and the Open Broadband projects were launched during the Broadband Forum’s Q3 meeting, which took place in Helsinki Finland. The Open Broadband projects will be managed under the Broadband Forum’s “agile Open Broadband software” initiative, allowing for member and non-member participation to create a fast feedback loop between the specifications and the source code reference implementation that supports them. These new software projects are the first open source initiatives undertaken by the Broadband Forum.

…………………………………………………………………………………………….

| Related BB Forum specs | Title |

|---|---|

| TR-359 | A Framework for Virtualization |

| TR-345 | Broadband Network Gateway and Network Function Virtualization |

| TR-328 | Virtual Business Gateway |

| TR-317 | Network Enhanced Residential Gateway |

…………………………………………………………………………………………………….

Editor’s Note:

Up till now there have been no specifications for an internal SD-WAN or anything resembling an NNI to interconnect SD-WANs from different service providers. The new spec is not a standard as neither the Broadband Forum or Open Network User Group (ONUG) is an official standards organization – like ITU or IEEE.

………………………………………………………………………………………………

ONUG SD-WAN Activity:

As far as we can tell, the closest to a realizable SD-WAN specification is the ONUG’s Open SD-WAN Exchange (OSE) project. It’s said to be an open framework to enable inter-operability between SD-WANs and cloud providers.

ONUG says their OSE use cases address marketplace M&A, business partner connectivity, cloud/service provider network connectivity, technology transition, and vendor lock-in mitigation.

For more info on ONUG SD-WAN specification efforts, please see this presentation from ONUG’s Spring 2017 meeting. Related content:

……………………………………………………………………….

SD-WAN Market Update:

Last week, China Telecom Global announced global SD-WAN service with integrated security provided by Versa Networks (one of many SD-WAN software start-ups). Separately, Windstream said at a Goldman Sachs conference that the advent of SD-WAN and Office Suite will enable it to breathe much-needed life into its SMB ILEC and SMB CLEC units, which have seen revenue struggles in recent years.

IDC estimates that worldwide SD-WAN infrastructure and services revenues will see a compound annual growth rate (CAGR) of 69.6% and reach $8.05 billion in 2021. That forecast seems incredibly optimistic without agreed upon specs/standards for multi-vendor inter-operability and SD WAN inter network connectivity.

………………………………………………………………………………………

References:

https://www.broadband-forum.org/standards-and-software/major-projects/virtual-business-gateway

https://www.broadband-forum.org/news/download/pressreleeases/2017/PR11_BBF_Q3Helsinki_FINAL.pdf

http://www.fiercetelecom.com/telecom/broadband-forum-targets-sd-wan-trend-vbg-network-specification

https://www.onug.net/open-sd-wan-exchange-ose/

http://www.zdnet.com/article/china-telecom-announces-global-sd-wan-service/

IHS Markit: Top 5 Trends in Telecom Infrastructure Sharing in Emerging Markets

By Stéphane Téral, executive director of research and analysis, mobile infrastructure and carrier economics, IHS Markit

Editor’s Note: Two Charts from GSMA are inserted into Stephane’s post below.

Overview:

As service providers operate in saturated markets everywhere in the world, they increasingly focus on customer satisfaction and retention and on business and network transformation, which require increasing dedicated resources. However, significant revenue growth may no longer be achievable, so it is necessary to de-emphasize network operations through outsourcing and managed services as well as network sharing to preserve margins and sustain cash flow.

GSMA says annual mobile revenue growth will be 1 to 2% annually till 2020 (when 5G first starts to be deployed). \

…………………………………………………………………………………………………………………………………..

Below are five trends IHS Markit Technology is seeing in telecom infrastructure sharing in emerging markets:

Trend #1: Nigeria is the most successful network sharing country. Africa, India, and Latin America are three geographies where network sharing has been working well. Although India pioneered network outsourcing back in 2005 and since has moved fast to network sharing and managed services, it is EMEA that is leading this area now with network sharing deals all across Eastern Europe and Africa. We can’t really pick a particular country because consolidation among service providers led to pan-African shared networks. However, in Africa I think Nigeria, the most populous African country, is the most successful and innovative telecom infrastructure country.

Trend #2: IHS Towers is the largest tower company in emerging countries

EMEA-based IHS Towers has become the largest of its kind (www.ihstowers.com) and is contributing to the success of Nigeria. The IHS Towers business model consists of buying the cell towers from the service providers, and leasing and managing those towers for the service providers. This allows the company to minimize operational expenditures (opex costs), and service providers can better focus on the customer experience.

Trend #3: We’ll see more HIS Towers-like companies in the future

Mobile subscriptions are at saturation everywhere in the world, putting pressure on revenue growth. Therefore, more and more service providers will sell their towers to companies like IHS Towers, which is in a strong position to keep growing. There is also the opportunity for others to create competition in the tower business.

Trend #4: The tower business is moving from emerging to developed countries

This is already happening in Italy. Given the revenue crunch across Western Europe, it is only a matter of time before we see more and more service providers selling their towers to a towerco specialist.

Trend #5: Network function virtualization (NFV) will provide the next wave of operational efficiencies in network sharing

By moving more network functions from hardware to software, using off-the-shelf IT components and platforms, the cost of network nodes decreases and new services can be turned up and down at a power of a click. Overall, with the concept of network slicing, it will become easier to share networks among several service providers.

GSMA says regions where mobile subscriber penetration is lower will experience higher revenue growth through 2020.

…………………………………………………………………………………………………………………………………………………….

Many of the themes discussed in this research note are explored in greater depth in IHS Markit’s recent Mobile Infrastructure Market Tracker report.

For information on purchasing this report, contact the sales department at IHS Markit in the Americas at (844) 301-7334 or [email protected]; in EMEA at +44 1344 328 300 or [email protected]; or APAC at +604 291 3600 or [email protected]

References:

Global Data: 5G subs to outnumber 3G subs in South Korea by 2020

Is it possible for South Korea to have more 5G then 3G subscribers BEFORE the official “5G” = ITU-R WP5D – IMT 2020 standards are completed?

Indeed, South Korean mobile network operators plan to take an early lead in the deployment of 5G (perhaps because of the February 2018 Winter Olympics in Pyeongchang). That would help them overcome stagnating traditional wireless service revenues, according to market research firm GlobalData.

The South Korean market’s 5G subscriber base is forecast to outnumber the 3G base by 2020, two years after the world’s first commercial 5G deployment during next year’s Pyeongchang Winter Olympics, GlobalData said in its report.

That will occur at a time when mobile voice service revenues are expected to decline at an average rate of 7% per year through to 2021, GlobalData telecom market analyst Malcolm Rogers stated.

“Operators around the globe faced with the same challenge, evolve to something more than a pipe provider or offer services that come with more utility. However, the Korean operators have been among the most proactive in growing business outside the core of communication,” he said.

“Whereas operators in some markets have been slow to react to the digital disruption caused by OTTs and internet giants like Google and Amazon, the players in South Korea have been investing in new digital business for years.”

The main South Korea wireless network operators – SK Telecom, KT and LG U+ – are focusing on a range of non-core segments including industrial IoT, payment platforms, media and commerce, Rogers added.

From the report description (see Reference below):

SK Telecom and LG U+ now offer cellular based wireless payment platforms that allow small retailers, traders and vendors to conduct business from anywhere. All three major telecom providers have also invested in B2C and B2B e-commerce operations, venturing into an entirely new industry. 5G networks will enable operators to provide new services for industry, government and consumers. Korea Telecom (KT) has already completed trial to offer 5G enabled entertainment services such as high definition virtual reality and 8K mobile video while SKT and KT are developing driverless car solutions and security platforms based on 5G technologies.

……………………………………………………………………………………..

South Korea plans to complete the deployment of a commercial 5G mobile network in the second half of 2019, Heo Won-seok, director of ICT and Broadcasting Technology Policy at South Korea’s Ministry of Science, ICT and Future Planning, said during a keynote presentation at the Global 5G Event, May 25, 2017 in Tokyo, Japan.

KT recently launched an AI-based home assistant service while both SK Teleom and LG U+ are offering cellular based wireless payment platforms. All three carriers are investing in business-to-consumer and business-to-business e-commerce offerings, which is an entirely new industry for those network operators.

Against this backdrop, 5G networks are expected to allow the network operators to introduce new services targeting industry, government and consumer markets, according to GlobalData.

For example, KT is already exploring offering 5G-enabled entertainment services including 8k mobile video streaming, while SK Telecom and KT are developing driverless car solutions and security platforms based on 5G technologies.

References:

https://www.globaldata.com/south-korean-telcos-bank-5g-digital-traditional-business-stagnate/

https://www.telecomasia.net/content/5g-subs-overtake-3g-korea-2020

https://phys.org/news/2017-02-south-korea-olympics-5g-year.html

https://www.rcrwireless.com/20170525/5g/south-korea-launch-first-commercial-5g-network-2019