Race to 5G: It’s all about the Internet Of Things (IoT)

by Reinhardt Krause, Investor’s Business Daily (IBD)

Note: The content manager and moderator of this website strongly disagrees with the theme of this article. We don’t think IoT is a valid use case for 5G because most IoT devices are low bandwidth and low duty cycle. Also, the 5G standards won’t be finalized till late 2020 so talk of 5G deployment anytime before that is preposterous. Yet we present this IBD article (without adverts or stock charts) to provide another viewpoint as we strived for balanced content. Mr Krause’s IBD article has been shortened and edited for clarity and to suit our readership.

……………………………………………………………………….

Introduction:

Now the 5G, or fifth generation, wireless revolution is near (editor asks: really?), promising data speeds 50 to 100 times faster than 4G LTE networks. Sure it’ll improve smartphones, but that’s not the point. Analysts say 5G’s biggest impact will be to drive the proliferation of the Internet of Things — billions of connected devices.

The business case for 5G is all about IoT, an evolution, or maybe revolution, that will take the internet era into new territories. Companies including chipmakers, network equipment makers and telecom service providers are investing heavily in the technology, with the first products to roll out in 2017.

“With 5G, there are going to be many more device categories,” Matt Grob, Qualcomm chief technology officer, told IBD.

IoT encompasses such burgeoning arenas as self-driving cars, advanced robotics, telemedicine, automated factories, smart cities and the development of massive sensor networks in such fields as agriculture. Farmers will, for example, know exactly when to harvest for best yields based on air temperature and soil moisture.

Many of the companies aiming to put 5G on the fast track — Qualcomm (QCOM), Intel(INTC), Cisco Systems (CSCO) and Verizon Communications (VZ) to name a few — expect new revenue streams from the IoT and game-changing apps outside of smartphones.

Qualcomm To Ship First 5G Chips In 2017:

Qualcomm aims to ship its first 5G modem chips for phones in the second half of 2017, with follow-on chips targeting the IoT.

Qualcomm, like others, expects 5G to evolve on multiple tracks: IoT, smartphones and fixed residential. While Apple, Samsung and others will ship 5G smartphones only after standards are rubber-stamped, which observers say will be a work in progress until 2020 or later, carriers are closer with “fixed” 5G, a wireless broadband service provided from a fixed point to homes in limited areas. If fixed 5G to homes works well in trials, Verizon says it will pursue a commercial rollout city-by-city in 2018 and 2019. It hasn’t identified the cities yet.

With 4G networks, it costs wireless firms about $1 to deliver a gigabyte of data. 5G networks promise much better economics. It also will provide virtually uninterrupted communications for new apps.

“5G is going to bring lower costs per bit, lower latency and highly reliable services,” Grob said. “So it’s going to be great for autonomous vehicles, medical devices and for infrastructure and smart cities. There are more companies taking part in the standards development for 5G than ever.”

Medical applications include remote monitoring of devices like EKGs or blood pressure monitors. Smart city technologies include traffic signals that adjust to vehicle flows and sensor-based water systems that test for contaminants in real time.

The Internet of Things isn’t waiting on 5G. AT&T (T) already has some 8 million web-connected cars linked to its 4G network. U.K.-based Vodafone (VOD) says it had 41 million IoT connections as of Sept. 30. Cisco says its gear links 4.9 billion devices now and will connect 12.2 billion by 2020, and few will be 5G.

Vendors Jockey For 5G Position:

Some companies might get a good boost early in the 5G revolution, such as makers of network testing gear like Keysight Technology (KEYS). Independent testing is a big part of the standards-setting process.

Early on, analysts say Xilinx (XLNX) programmable chips will be useful for prototyping 5G products, while the higher radio frequency bands associated with 5G may create long-term opportunities for RF chip leaders Broadcom (AVGO) , Qorvo (QRVO) and Murata.

As small cells are deployed in urban areas, cell tower firm Crown Castle (CCI) and startup Tarana Wireless aim to capture share. Tarana’s biggest investor is AT&T. Some analysts view Zayo Holdings (ZAYO) as a takeover candidate, because small cell systems require fiber-optic links in metro areas for long-haul transport.

Next-generation data centers — to keep all these things humming on the internet — will be another battleground, as Cisco takes on Arista Networks (ANET), startup Affirmed Networks and others.

Meanwhile, startup SigFox, the LoRa alliance — with members including Cisco and IBM(IBM) — and others aim to provide all IoT devices with low-power connections via Wi-Fi and unlicensed spectrum.

5G backers aim to create flexible networks that provide both the high-bandwidth connections required by fast-moving, self-driving cars in urban areas and always-on, reliable, low-data-rate connections needed by parking meters, oil rig sensors or other devices.

While 4G networks provide cars with infotainment, 5G services are expected to provide real-time environmental data so, for example, driverless cars can avoid collisions.

To service various types of devices, wireless networks will need to utilize both very high radio frequencies not yet commercialized and lower-band airwaves. Improved radio antennas and more complex semiconductors are expected to make higher frequencies usable for 5G.

In urban areas, hundreds of “small cell” antennas hung on utility poles or buildings will work together, analysts say.

Wireless networks and telecom data centers will be upgraded to provide both high and low data rate services, again to service various types of sensors and devices. AT&T and Verizon are among the leaders in moving to software-defined-network technology. SDN will help usher in 5G. With it, wireless firms can improve network bandwidth allocation and provide cloud-based, on-demand services.

Power Of Connected Data Centers Unleashed By 5G:

Part of the 5G revolution involves connecting a network of data centers to the IoT. That’s a focus for Intel, Cisco, China’s Huawei and many other companies.

“5G will be a whole transformation of the network to virtualization, providing more flexibility and agility,” said Jean Luc Valente, vice president of product management for Cisco’s cloud and virtualization group. “With 5G, with connected cars, some data is going to be collected, maybe at a traffic light intersection. Those data nuggets will be (analyzed), maybe not in the back-end data center, maybe much closer in a micro-cloud.” The upshot, among many benefits, is that self-driving cars won’t collide.

Cisco aims to provide cloud-based IoT services as it shifts away from hardware sales. The company partnered in February with Intel and Sweden’s Ericsson (ERIC) to start selling a swath of 5G hardware and services. They are involved in 5G trials by Verizon and others.

As 5G sparks partnerships, it’s also generating M&As with 5G or IoT angles.

Qualcomm expects its pending acquisition of NXP Semiconductors (NXPI) to pay dividends in autonomous cars. Japan-based SoftBank acquired wireless chip designer ARM Holdings for $31 billion with an eye toward I0T.

AT&T says it will move to 5G faster if regulators approve its acquisition of media giant Time Warner (TWX), part of its strategy to whisk more video to mobile devices.

Cisco bought Jasper in March for $1.4 billion, gaining a cloud-based IoT platform. Verizon in February announced an agreement to acquire XO Communications, which owns high-frequency spectrum for 5G services, for $1.8 billion.

Internet leaders, too, are jockeying for leading roles in 5G. Facebook (FB) is working with equipment vendors and carriers on standards. Google-parent Alphabet (GOOGL) is developing open software for the IoT.

For Intel, 5G and IoT offer an opportunity to turn its money-losing mobile business around, says Citigroup. For Qualcomm, the shift to 5G should provide higher profit margins as the 4G generation matures.

5G Going for Gold at Winter Olympics:

South Korea’s KT and Verizon are forging ahead in prestandard deployment of 5G, aiming to drive technical specifications for 5G radio gear. KT plans to showcase 5G technology at the 2018 Winter Olympics, though just how isn’t known.

Aside from the Internet of Things and 5G mobility, Verizon is eyeing fixed 5G wireless broadband services to homes, potentially taking on cable TV companies. It’s not clear yet if 5G fixed broadband could provide high-speed internet in neighborhoods or blanket bigger areas, analysts say. The Verizon trials will help determine that.

Verizon has been investing across the board — in SDN, small cell technology and fixed wireless, says Adam Koeppe, vice president of technology planning at Verizon.

“We’re putting in the building blocks for what comes next. IoT is one of them,” he said. “The goal of the IoT device evolution is to have very low-cost modules, with long battery life. Think of sensors, smart meters — things that get embedded in day-to-day infrastructure and products that communicate on low bandwidth, on a sliver of spectrum, gobbling up very little of network resources.”

“Where 5G fits into the equation is scale,” Koeppe added. “IoT will be about tens of billions of devices connected to the network. When you think of truly connected societies — traffic lights, stop signs, parking meters and everything within a city connected and interacting with itself — that’s where 5G comes into play.”

Yet 5G-related revenue is still on the distant horizon for most companies, analysts say. The marketing hype has picked up long before 5G networks and services will be deployed.

IoT revenue is about 1% of global mobile revenue now and will grow at about 20% annually over the next five years, says market research firm Analysys Mason. Revenue is small in part because monthly revenue from IoT devices might come to just $1 or $2, not the $60 or more from smartphone users.

http://www.investors.com/news/technology/5g-internet-of-things-will-change-telecom/

Broadcast Incentive Auction Near Final Stages; Below Expectations Due to Less Interest from AT&T

by David Dixon, FBR & Co.

On December 1, the FCC broadcast incentive auction reached another milestone but still tracks below expectations. We believe AT&T is showing less-than-expected interest in the auction. AT&T is one of only two public companies in a three-company bidding process for the FirstNet RFP to build a nationwide, 22,000-site, interoperable wireless network for first responders.

We surmise that, absent the required SEC filing for a public company when being advised of rejection, AT&T has won the FirstNet RFP, providing access to 2×10 MHz of 700 MHz spectrum.

Yesterday, the reverse auction portion of Stage 3 ended with broadcasters setting a clearing cost of $40.3B for 108 MHz of spectrum, equivalent to $1.20/MHz/PoP, setting in motion Stage 3 of the telecom broadband service provider forward auction’s start on Monday. The previous stage of the forward auction generated $21B for 126 MHz, equaling $0.53/MHz/PoP.

Assuming less interest from AT&T, we expect Stage 3 forward auction proceeds of $27.3B for 70 MHz of spectrum, at $1.25/MHz/PoP, below the expected Stage 4 clearing price of $30B for 84 MHz required by broadcasters in the reverse auction.

………………………………………………………………………………………………………………………………………….

WSJ: The Federal Communications Commission has adjusted its target price for the forward portion of the wireless incentive auction to $40.3 billion, a 26% decline from the agency’s previous attempt to balance the supply of broadcaster spectrum with telecom demand. The forward auction is expected to resume Monday, December 5th with the FCC hoping service providers will meet that price.

In addition to the wireless carriers AT&T, Verizon, and T-Mobile US Inc., Comcast Corp.and Dish Network Corp. are also participating in the auction. Some bidders may not win licenses.

Among those that have filed to sell stations are CBS Corp. and Univision Communications Inc., as well as local PBS stations and investors such as billionaire Michael Dell.

http://www.wsj.com/articles/fcc-to-pay-less-for-airwaves-as-auction-moves-to-third-round-1480633266

……………………………………………………………………………………………………………………………………………

Other References:

https://www.fcc.gov/about-fcc/fcc-initiatives/incentive-auctions

https://www.fcc.gov/about-fcc/fcc-initiatives/incentive-auctions#block-menu-block-4

FCC Completes Reverse Auction as Forward Auction Looms Large

IHS: Sales of Branded Bare Metal Switches Hit $23 Million in 1st Half of 2016

By Cliff Grossner, Ph.D., senior research director, data center, cloud and SDN, IHS Markit

Highlights:

- Open networking using branded bare metal switching continues to make steady progress in the enterprise, with revenue growing 125 percent in the first half of 2016 (H1 2016) from the second half of 2015 (H2 2015)

- Dell launched the branded bare metal switching segment around two years ago and in H1 2016 claimed just over half of revenue market share

- Software-defined enterprise wide area network (SD-WAN) is gaining momentum thanks to the emergence of tier-1 service providers that have partnered with SD-WAN vendors to deploy over-the-top solutions

IHS Analysis:

The global data center and enterprise software-defined networking (SDN) market—including in-use Ethernet switches, SDN controllers and SD-WAN—totaled $1.1 billion in H1 2016. This was an increase of 42 percent from H2 2015, reflecting a ramp in customer deployments. All major geographical regions were up from H2 2015 for data center and enterprise SDN hardware and software.

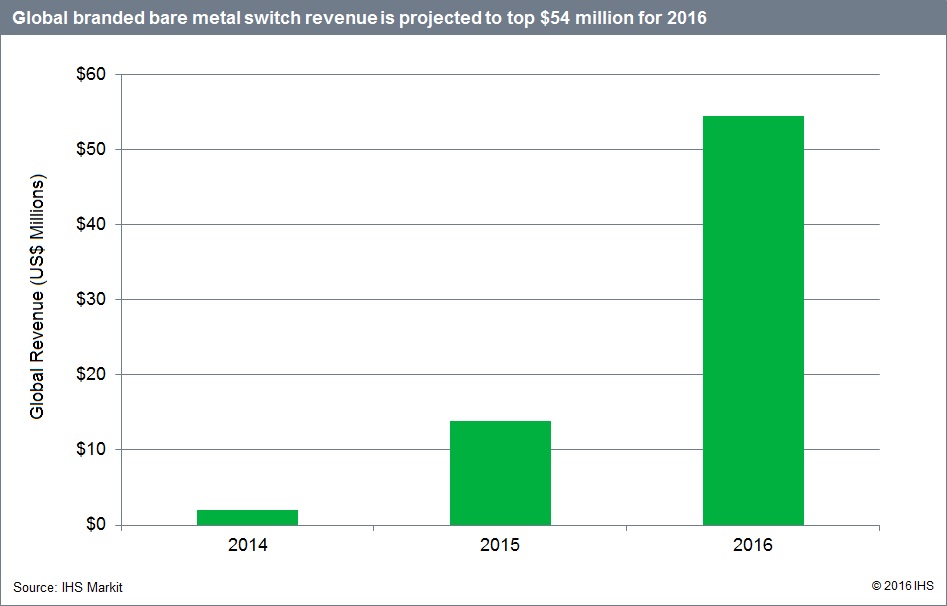

Branded bare metal switch revenue reached $23 million worldwide in H1 2016 and is projected to top $50 million for the full-year 2016, driven by tier-2 operator and enterprise deployments.

While this segment is tiny compared to the approximately $8 billion in annual data center Ethernet switch revenue, it’s in line with expectations given the market was launched by Dell just over two years ago. The hype surrounding branded bare metal switches has overshadowed reality, but the segment is rolling along at a respectable clip. Now that a good selection of branded bare metal switches and maturing switch OS software are available, the next efforts should be focused on priming the channel to enterprises.

The SD-WAN segment is still small—$33 million worldwide in H1 2016—but it continues to gain momentum with the recent entry of tier-1 service providers including AT&T, Verizon, CenturyLink, BT, SingTel and Sprint. It has been aided as well by a string of announcements from tier-2 operators such as Vonage, EarthLink, MetTel and TelePacific. SD-WAN is poised to accelerate, growing above 90 percent per year to 2020.

The market share leaders in the SDN market serving the data center and enterprise LAN market continue to solidify their positions as SDN “crosses the chasm.” Based on in-use SDN revenue, white box vendors are number one with 19 percent of revenue in H1 2016, while Cisco and VMware round out the top three.

Data Center and Enterprise SDN Report Synopsis:

The IHS Markit data center and enterprise SDN report provides market size, market share, forecasts, analysis and trends for SDN controllers; SDN-capable bare metal Ethernet switches and branded Ethernet switches; and SD-WAN appliances and control and management.

For information about purchasing this report, contact the sales department at IHS Markit in the Americas at (844) 301-7334 or[email protected]; in Europe, Middle East and Africa (EMEA) at +44 1344 328 300 or [email protected]; or Asia-Pacific (APAC) at +604 291 3600 or [email protected]

AT&T receives federal funding to test wireless internet in rural areas

AT&T and two other telecos are receiving more than $322 million in federal funding to provide high-speed internet service in areas of Arkansas that currently aren’t reached by copper or fiber-optic cables. The wireless technology is not new. Dozens of homegrown Internet service providers have used it to reach rural Arkansans — some for more than a decade.

“In these rural parts of these counties, there is nothing out there right now,” said Ed Drilling, president of AT&T Arkansas, which will use wireless technology for the connections.

Drilling said the wireless product is one solution for those parts of the state where residents rely on aging telephone lines or cellphones to connect to the Internet.

AT&T’s move into the space — and the millions in federal funding supporting it — concerns existing wireless Internet providers who say they were ineligible for the same subsidies from the Federal Communication Commission’s Connect America program. The telcos using the federal dollars to connect Arkansas customers via wires are CenturyLink and Windstream.

The FCC estimates that two customers per every home and business will be connected. The three companies have committed to connecting a total of 128,500 homes and businesses, meaning that roughly 257,000 Arkansans will be affected by the new installations.

About 550,000 Arkansans don’t have access to the sort of speeds the companies are required to offer, according to wireline data from the National Broadband Map. Arkansas ranked 34th in the country for broadband speed, according to the map, but that ranking was based on an older definition of broadband that much of rural Arkansas barely met when the data was collected in 2014. According to more recent data collected by the website broadbandnow.com, Arkansas now ranks 48th in the nation in terms of the percentage of its population that has access to broadband speeds of at least 25 megabits per second.

During legislative meetings held to find a solution for low broadband availability around the state, providers said it costs tens of thousands of dollars per mile to lay cable, depending on the terrain.

That makes it hard to make money or break even on new installations to rural Arkansas, where homes can be miles apart and where many will choose not to pay for Internet access.

“You can view it as what the railroads meant to these cities in the 19th century and what electricity meant in the early part of [the 20th] century, and what interstates mean in terms of connectivity and what a city needs to thrive,” Drilling said. “Unlike electricity, you don’t have pretty much the guarantee that every one of those living units is going to take the service.” He added that AT&T has the infrastructure in place to provide the wireless technology, which customers will pay to access.

http://www.arkansasonline.com/news/2016/nov/27/state-in-national-test-of-wireless-inte/

IHS Markit Report Analyzes the LTE-U Market Opportunity

By Stéphane Téral, senior research director, mobile infrastructure and carrier economics, IHS Markit, and Richard Webb, research director, mobile backhaul and small cells, IHS Markit

IHS Markit’s LTE-U Market Development Report analyzes the market opportunity for LTE-U, including license assisted access (LAA), LTE-WLAN aggregation (LWA), LTE WLAN integration with IPSec tunnel (LWIP) and MulteFire. Covered in the report are the unabated development of LTE-U spectrum and the options for combining Wi-Fi and LTE. The report also tracks service provider trials and deployments.

- Long Term Evolution–Unlicensed (LTE-U) report addresses key technologies and provides in-depth analysis on market and technology trends

- The unabated need for capacity means unlicensed spectrum must be harnessed to support LTE services and, later, 5G

- Whether LTE and Wi-Fi can work together in harmony is yet to be determined

The technologies covered in the report for leveraging licensed and unlicensed spectrum include:

- LTE-U (3GPP Release 10) – Aggregation of frequency division duplex (FDD) and time division duplex (TDD) licensed carriers with unlicensed carriers, including Wi-Fi; 5G is the initial target

- License assisted access (LAA) – LTE-U that meets “listen before talk” (LBT) regulations and minimum bandwidth occupancy; the 3GPP created Release 13 because LTE-U Release 10 cannot be adopted in Japan and Europe

- LTE-WLAN aggregation (LWA) – Aggregation of a new or existing Wi-Fi link (2.4GHz and 5GHz) with a licensed LTE carrier

- LTE WLAN integration with IPSec tunnel (LWIP) – A 3GPP Release 13 feature that enables Wi-Fi to be more optimally integrated into an LTE access network

- MulteFire – Combines the high performance of LTE with the deployment simplicity of Wi-Fi

It’s a big jungle out there, and the chief goal of combining licensed and unlicensed spectrum is to boost throughput and enhance user experience. There is a LTE spectrum crunch and unlicensed spectrum is critical to the mass deployment of LTE-Advanced Pro (LTE-A Pro) services. In fact, only one in four carriers has enough LTE spectrum to deploy LTE-A Pro services!

Implications for End-User Devices

Adoption could be challenged by smartphone design implications. LTE-U and LAA-capable smartphones will require additional radio frequency (RF) componentry. The RF transceiver will need to be redesigned to support the new unlicensed spectrum and all the various permutations of carrier aggregation with the anchor licensed LTE frequencies.

And in terms of vendor readiness, only one vendor has announced chipsets that support LTE-U and/or LAA. Pending the successful rollout of the initial LTE-U networks in the U.S. and Korea, other LTE chipset makers are anticipated to support LTE-U and LAA in their upcoming flagship chipsets.

Everybody Loves Wi-Fi!

Wi-Fi has very long and powerful legs. But what about legacy Wi-Fi networks? LWIP is the answer: LTE plus Wi-Fi equals super enhanced mobile broadband. The unabated need for capacity means unlicensed spectrum must be harnessed to support LTE services and, later, 5G. Multiple network operators (MNOs) have several ways to use unlicensed spectrum to enhance LTE performance: carrier versus link aggregation; and the neutral host model versus carrier owned. Different LTE-U options could enhance the operational model and overall business case for small cells as part of a network densification strategy.

However, the use of unlicensed spectrum by LTE is not without controversy. Wi-Fi is contested spectrum, so there is the potential for friction. In order for fair coexistence, rules are needed or it could delay widespread implementation. And standards are still being finalized and could give the market and injection of activity.

Mobile broadband needs LTE and Wi-Fi, but can they play well together? Stay tuned.

For More Information

For information about purchasing this report, contact the sales department at IHS Markit in the Americas at (844) 301-7334 or [email protected]; in Europe, Middle East and Africa (EMEA) at +44 1344 328 300 or [email protected]; or Asia-Pacific (APAC) at +604 291 3600 or [email protected]

Huawei Vision & Architecture for “All Cloud” Mobile Networks

At the 2016 Global Mobile Broadband Forum in Tokyo on November 25th, Edward Deng- President of Huawei Wireless Solution, described an integrated suite of solutions to enable the full “cloudification” of wireless networks. The company calls this solution ERA, signaling the arrival of the mobile cloud era. ERA includes three integrated solutions: one for cloud-based core networks (CloudEdge), cloud-based radio access networks (CloudRAN), and cloud-based air interface (CloudAIR).

Cloud network technology is a core focus of Huawei’s research and development. Since its release at the 2014 Mobile World Congress (MWC), Huawei’s CloudEdge solution has been deployed in over ten commercial sites and has obtained over 60 commercial contracts. Cloud core networks enable the convergence of multiple radio access technologies (RATs) as well as the provision of more flexible applications through network slicing and tailored scenario-based solutions.

Huawei aims to promote, drive, and lead the development of an All Cloud era. The company launched CloudRAN in April of this year to enable the cloudification of wireless network architecture, paving the way for cloud-based radio access networks. “The goal of CloudRAN is to redesign the entire architecture of wireless networks, transforming resource management, multi-connectivity, and elastic architecture into native capabilities to better meet the challenges of an uncertain future.” CloudRAN has passed business verification procedures in China, Italy, South Korea, and Japan, and is expected to be commercially deployed in Q3 of 2017.

Huawei is backing industry moves towards ‘All cloud’ mobile networks as it evolves it cloud focus in line with overarching trends. CloudEdge was actually launched back in 2014, with the team claiming it has been deployed in over ten commercial sites and has obtained over 60 commercial contracts, and CloudRAN is expected to be commercially deployed in Q3 of 2017. Deng claims CloudAIR uses advanced scheduling to allow different RATs (Radio Access Technologies) to share the same spectrum within a carrier band.

“Air interface is the most valuable resource that operators have. And if this most valuable resource doesn’t support efficient, on-demand, and agile network deployment, then a mobile network isn’t truly cloud-based,” said Deng. “Today, we launched the CloudAIR solution to help reshape air interface. Our focus is on improving the efficiency of air interface, enabling operators to deploy services more flexibly and, of course, enhancing user experience. CloudAIR is designed to enable more efficient sharing of air interface resources like spectrum, power, and channels.”

In a similar fashion to air interface cloudification, power cloudification supports inter-carrier, inter-RAT, inter-band, inter-site power sharing.

Channel cloudification is the third feature of CloudAIR. This allows for the implementation of artificial intelligence-based scheduling to enable any received signals to be recognized as available multi-path resources. This will facilitate convenient site selection and provide an improved user experience.

Huawei’s ERA, combines CloudEdge, CloudRAN and CloudAIR technology to launch a new era of cloud-based mobile networks. “The ERA solution will maximize the value of operator assets, enable on-demand network deployment, accelerate service provisioning, and empower mobile networks to be the true enablers of all industries around the world,” said Deng. “Through nonstop innovation, this solution will create unprecedented value for the industry.”

Details on how the technology works were not disclosed. However, Huawei said spectrum cloudification allows different RATs to share the same spectrum, dynamically allocating spectrum resources based on fluctuations in traffic.

“By enabling more efficient sharing and allocation of resources, spectrum cloudification creates real value for telecom customers,” said Deng. “It’s an important development trend in the industry, and it will take greater collaboration with industry partners to continue pushing things forward.”

Reference:

http://www.huawei.com/en/news/2016/11/Huawei-All-Cloud-Mobile-Networks

2016 Telecom Capex Flat with Asia Pacific Largest Spender

By Stéphane Téral, senior research director, mobile infrastructure and carrier economics, IHS Markit

Bottom Line:

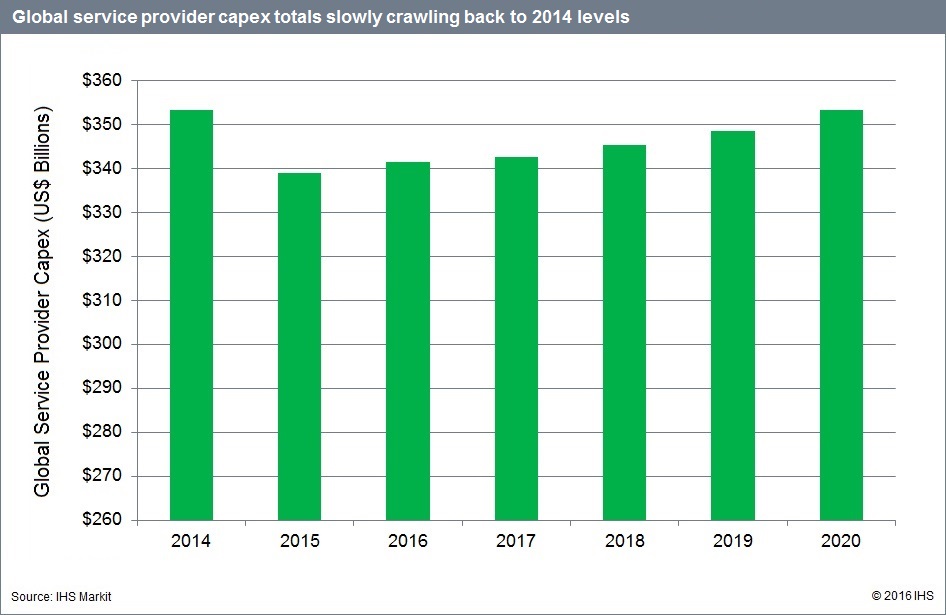

- There will be flat to very moderate growth in global service provider capital expenditures (capex) in 2016

- However, worldwide service provider capex spending is slowly crawling back to 2014 levels

- Asia Pacific is the world’s largest telecom spender and revenue contributor

IHS Analysis:

The telecom industry has been cyclical since the great telecom crash of March 2000, which is typical of deregulated industries. Investment goes through cycles of ups and downs that are more or less pronounced depending on how the major players react.

For 2016, large differences in regional investment agendas point to regional and national cycle de-synchronization—and, consequently, global flatness to very moderate growth in capital expenditures. This is a result of low-digit growth in North America, Europe, the Middle East and Africa (EMEA) and the Caribbean and Latin America (CALA) that is offset by a China-driven decline in Asia Pacific.

We forecast worldwide service provider capex to rise just 0.7 percent to US$341 billion by the end of this year, mainly propelled by a much-needed wave of investment in wireline broadband—for example, fiber to the X (FTTX)—in Europe. Spending on every type of hardware equipment except wireless and time-division multiplexing (TDM) voice will rise in 2016. Meanwhile, capitalized software that is captured in the non-telecom/datacom category—around half of total capex—is expected to grow by double-digit percentages.

As illustrated in the chart below, the service provider capex growth rate slowed down in 2015 followed by a pickup in 2016 that signals long-term flatness triggered by the combination of moderate desynchronized regional investment cycles, themselves triggered by very distinct agendas.

Telcos continue to account for the lion’s share of capex, at more than 88 percent. And from a geographic standpoint, Asia Pacific will remain the world’s largest spender (42 percent share), while North America stays roughly even, followed by EMEA and CALA.

Looking at earnings, the telecommunications service revenue picture remains mixed and contrasted across geographical regions. While global telecom service revenue declined 4 percent year-over-year in 2015, we project it to grow by over a percentage point this year to US$1.93 trillion. Asia Pacific is the world’s largest telecom revenue contributor, shadowed closely by North America—the globe’s most lucrative market.

Capex Report Synopsis:

The biannual IHS Markit service provider capex report provides worldwide and regional market size, forecasts through 2020, analysis and trends for revenue and capex by service provider type (telcos and cable operators) and capex by equipment type (broadband aggregation equipment; wireless infrastructure; IP routers and carrier Ethernet switches; optical equipment; IP and TDM voice infrastructure; video infrastructure; all other telecom/datacom network equipment; and CPE non-telecom/datacom network equipment).

For information about purchasing this report, contact the sales department at IHS Markit in the Americas at (844) 301-7334 or[email protected]; in Europe, Middle East and Africa (EMEA) at +44 1344 328 300 or [email protected]; or Asia-Pacific (APAC) at +604 291 3600 or [email protected]

Related articles:

Telecom’s Capex Tailspin Is Leaving Few Firms Unscathed

Ovum: Communications Provider Revenues & Capex Forecast: 2016–21

AT&T Expands Fiber Plant to Serve 4 Additional Markets; FTTH in Baton Rouge Area

AT&T has rolled out gigabit fiber-to-the-premises services in a handful of cities, mostly in the South. The venerable telco is moving closer to its goal of reaching 67 markets by mid-2019. AT&T Fiber is now available in 44 markets. The new markets include Baton Rouge, Louisiana; Birmingham, Alabama; Charleston, South Carolina; and Reno, Nevada. AT&T also announced expansion of AT&T Fiber in 16 existing markets.

AT&T claims they now have an addressable AT&T Fiber potential customer base of of 3 million locations, of which over 500K are apartments and condo units, or MDUs.

AT&T is expanding their AT&T Fiber locations, just as Google fiber retracts. They have made a point of highlighting this, gleefully so in some instances. As an incumbent provider with an extensive existing network, AT&T has distinct advantages over upstarts like Google fiber, who must overbuild markets at great expense and time.

References:

Also, AT&T Fiber Network Now Available in Baton Rouge, Louisiana Area:

AT&T today launched ultra-fast internet service in parts of the Baton Rouge area, including in parts of Central, Denham Springs, Zachery and surrounding communities. The company is offering a 1 gigabit connection to area homes, apartments and small business locations on their 100% fiber network powered by AT&T FiberSM.

In addition to the homes and small businesses connected to our 100% fiber network in the Baton Rouge area, AT&T connect nearly 20 area apartment and condo properties.

The Baton Rouge, LA area is one of 44 metros nationwide where AT&T ultra-fast internet service is currently available. The telco plans to reach at least 67 metros with their fastest internet service.

AT&T markets their ultra-fast service to over 3 million locations nationwide, of which over 500,000 include apartments and condo units. We’re on track to meet the 12.5 million locations planned by mid-2019.

“We are excited to add North Baton Rouge to the growing list of areas in Louisiana where our 100 percent fiber to the home network is bringing customers the fastest internet speeds available” stated Sonia Perez, state president, AT&T Louisiana. “At AT&T, we are committed to innovation and offering cutting-edge technologies, products and services that provide enhanced opportunities for the many ways our customers live, work and play.”

Verizon expects $1B annually in IoT revenue; XO acquisition leverages fiber assets

The Internet of Things (IoT) helped generate $217 million in revenue for Verizon Communications during the third quarter, a gain of 24% from a year earlier, with telematics accounting for most of that revenue. That’s according to John Stratton, Verizon’s executive VP and president of operations who spoke last week at Wells Fargo Technology, Media & Telecom investor event. Stratton predicted that Verizon would soon surpass $1 billion in IoT-based revenue per year.

So in the case of IoT, we see that the transport layer typically — analyst projection, folks like you would say 7% to 10% of the value would be found in the connection network layer. I look at those as sub-$1 ARPU. Fine. I will take it. Great cash flow. Highly profitable. But when I stack the services, my yields from those customers on the fleet side, on the OEM automotive side, dramatically higher, 10X, 15 times, 20 times with great margin potential.So as we think about our media investments, our telematics investments, things that we are doing in IoT in places like smart cities, what’s most important I think is the layer of connectivity between each of those tiers.

On the acquisition of XO Communications and leveraging the combined companies fiber plant, Stratton said:

When we first announced our intent to acquire XO, it was first seen as a fiber buy and it was before fiber was super sexy. So February of 2016 was a little bit earlier than some of the stuff that’s been going on lately and then people came around and said, oh, okay, we see it, it’s the spectrum assets that are maybe more interesting to Verizon.

Well, the fact is they are both really interesting and we love the spectrum for what it will enable us to do in the context of 5G, but, similarly to your question, the importance of those metro rings — top 50 cities, there’s good infrastructure in 45 of the top 50. If you think about what we used to call Verizon Business, but the long haul and metro assets that we have on that part of the business, it’s a really very nice complement. And the amount of fiber that Verizon has deployed in the US is dramatically higher than any other carrier.

Even before you get to 5G, the case around what we call One Fiber is extraordinarily compelling. So just the soul densification of the wireless network — if you look back, I (Verizon) have 55,000, 56,000 sites today — if you went back six, seven years ago, I had like 30,000 and if I look forward, I will have 100,000.So the fact is the largest wired networks in the world are going to be wireless networks. It’s just the nature of it. And so when I look at what’s required to serve my customer base for 4G LTE and then I combine that with the other fiber dependencies in the other parts of the business, even before I get to 5G, I have a very, very compelling case where I can take those capital dollars and for a minor incremental investment create new market opportunities. And this is the thing that we are really focused on.

And so as I think about where I’m deploying my wireless network, where we will be densifying that wireless network, what else can I do with that common fiber is a big deal.

In closing, Stratton said Verizon’s IoT business was growing at a 24% rate:

The IoT business that we see growing now at 24%, we see that stimulated even further through some of the actions and the acquisitions we’ve done there. But back to the fundamentals, from a top-line perspective, we are very confident in terms of our wireless business. We really love the position we are in in the industry broadly and then our space in it. It should be a good year for Verizon.

IHS: Self-Organizing Network Market Grew Nearly 50% in the Last 2 Years

By Stéphane Téral, senior research director, mobile infrastructure and carrier economics, IHS Markit

Bottom Line:

- Demand for self-organizing networks (SON) is swelling, driven by the need for automation as humans struggle to manage increasingly complex networks

- 3G Evolved High Speed Packet Access (HSPA+) has been the chief force behind SON, not Long Term Evolution (LTE)

- Nokia Networks’ acquisition of Eden Rock Communications in May 2015 has propelled the company to the head of the centralized SON (C-SON) vendor leaderboard.

IHS Analysis:

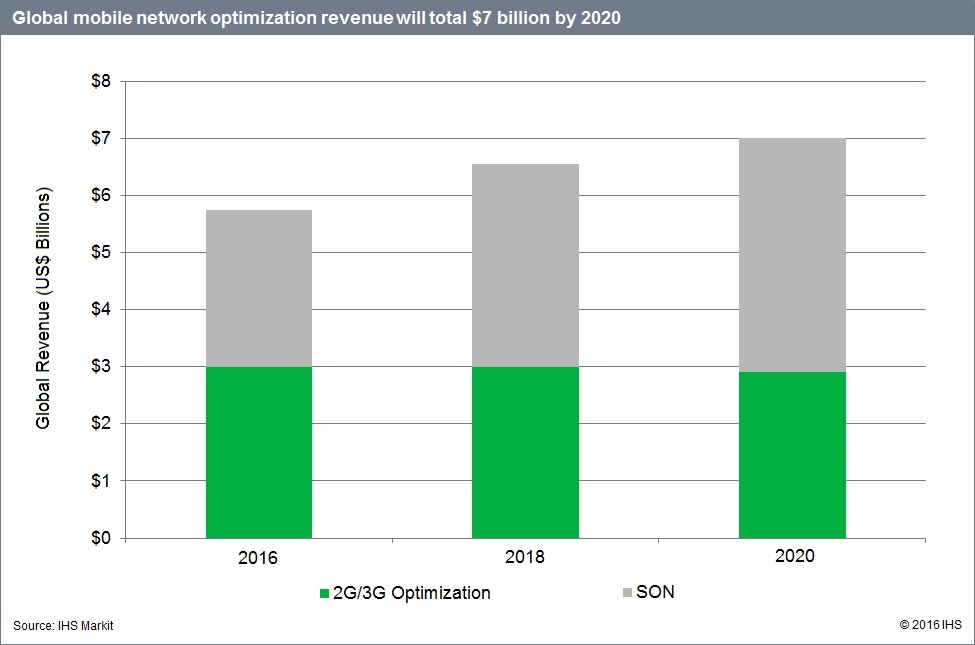

Combined, 2G/3G optimization and SON worldwide revenue grew 18% year-over-year in 2015, totaling $5.1 billion.

SON continues to explode. As a result of AT&T’s and KDDI’s 3G and 4G SON deployments, in addition to a flurry of minor ones around the world for 3G optimization, SON revenue reached $2.2 billion last year—48% more than the size of the 2014 market. At this stage, large European service providers such as BT/EE, Orange, Telefónica and Vodafone are deploying or have deployed SON across their multiple networks.

The chief driver for SON to date has been HSPA+. We found that more than 80% of mobile operators worldwide are using SON for 3G/HSPA/HSPA+ optimization.

As LTE rollouts are reaching their peak—with more than 500 commercial LTE networks worldwide—we are hearing from mobile operators that LTE is extremely reliable and fully optimized, while 3G optimization remains a chief concern and 2G is doing fine.

When it comes to the flavors of SON, C-SON still rules over distributed SON (D-SON). Moreover, the C-SON segment is no longer dominated by SON specialist vendors such as Amdocs and Cisco but rather by tier-1 mobile network vendor Nokia. Last year’s acquisition of Eden Rock Communications has really paid off for Nokia, which scored a major win at Orange in August 2016.

By 2020, the global 2G/3G optimization and SON market is forecast to hit $7 billion. As network complexity continues to rise, the need to reduce opex and remove humans—and the errors they inevitably introduce—from the equation goes on unabated.

SON Report Synopsis:

The annual IHS Markit SON and optimization software report provides worldwide and regional market size, forecasts through 2020, analysis and trends for the mobile network optimization market, including 2G and 3G optimization software and self-organizing network software by generation (3G, 4G) and by architecture (centralized, distributed). The report tracks tier-1 mobile infrastructure vendors with mobile network optimization tools, as well as specialist vendors.

For information about purchasing this report, contact the sales department at IHS Markit in the Americas at (844) 301-7334 or[email protected]; in Europe, Middle East and Africa (EMEA) at +44 1344 328 300 or [email protected]; or Asia-Pacific (APAC) at +604 291 3600 or [email protected].

Reference: