Open Networking/SDN Reference Models + Bare Metal Switches increase market share in Data Centers

Introduction:

“Open networking, which leverages open source software and open hardware designs and allows anyone to innovate, is set to change networking, just as open source changed the server and OS marketplace,” said Cliff Grossner, Ph.D., research director for data center, cloud and Software Defined Networking (SDN) at IHS.

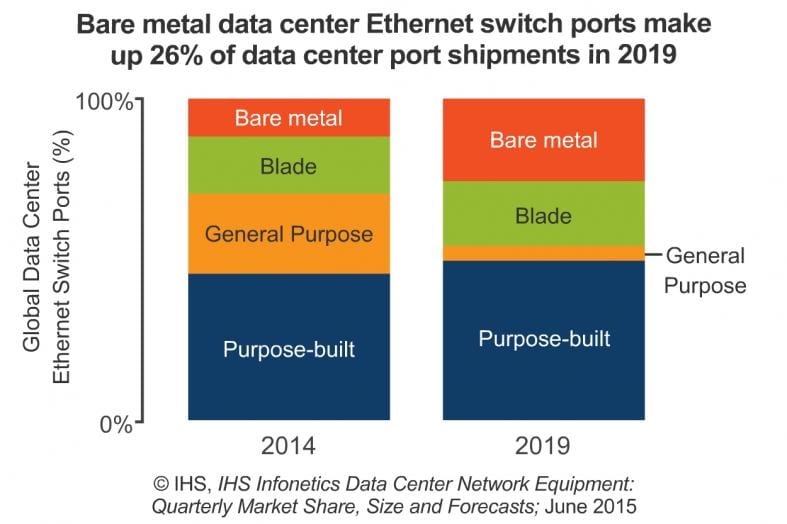

“This move to open networking is heightening the importance of bare metal switches, as evidenced by all the vendor announcements at Interop in April. Dell is expanding its open networking portfolio with three new branded bare metal switches providing options from 1GE to 100GE Ethernet. And Citrix entered the SD-WAN market with Cloudbridge Virtual WAN Edition, which allows enterprises to create a virtualized WAN,” Grossner said.

Open Networking/SDN Reference Models:

Mr. Grossner and this author are collaborating on a report/article defining Open Networking Reference Architectures, Business Models, and Vendors Market Share. We’ve identified the following reference architectures:

DATA CENTER MARKET HIGHLIGHTS:

- The global data center network equipment market-including data center Ethernet switches, application delivery controllers (ADCs) and WAN optimization appliances (WOAs)-declined 14% sequentially in 1Q15, to $2.6 billion.

- The data center Ethernet switch segment continues to grow on a year-over-year basis (+4% in 1Q15 from 1Q14); positive forces include large enterprises and the public sector.

- F5 took the #1 spot for virtual ADC appliance revenue from Citrix in 1Q15.

DATA CENTER REPORT SYNOPSIS:

The quarterly IHS-Infonetics Data Center Network Equipment market research report tracks data center Ethernet switches, bare metal Ethernet switches, Ethernet switches sold in bundles, application delivery controllers (ADCs) and WAN optimization appliances (WOA). The research service provides worldwide and regional market size, vendor market share, forecasts through 2019, analysis and trends. Vendors tracked include A10, ALE, Arista, Array Networks, Aryaka, Barracuda, Blue Coat, Brocade, CloudGenix, Cisco, Citrix, Dell, Exinda, F5, HP, Huawei, IBM, Ipanema, Juniper, Kemp, NEC, Radware, Riverbed, Siaras, Silver Peak, Talari, VeloCloud, Viptela and others.

To purchase the report, please visit: www.infonetics.com/contact.asp

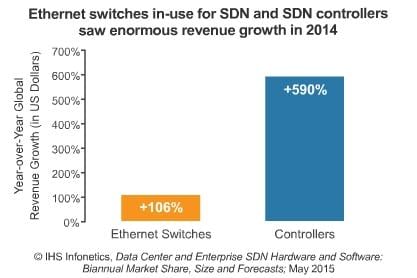

In an IHS-Infonetics report released earlier this month (June 3, 2015), Cliff forecast that the in-use software-defined networking (SDN) market (Ethernet switches and controllers) will reach $13 billion in 2019, up from $781 million in 2014, as the availability of branded bare metal switches and use of SDN by enterprises and smaller cloud service providers (CSPs) drive growth.

“The SDN market is still forming, and the top market share slots will change hands frequently, but currently the segment leaders are Dell, HP, VMware and White Box,” said Cliff Grossner, Ph.D., research director for data center, cloud and SDN at IHS.

“SDN will cross the chasm in 2016, with SDN in-use physical Ethernet switches accounting for 10 percent of Ethernet switch market revenue,” Grossner said.

SD-WAN WEBINAR:

Join analyst Cliff Grossner June 16 at 11:00 AM ET for Adopting Software-Defined WAN for Agility and Cost Savings, an event providing recommendations for buyers of new SD-WAN products and services.

Register at: http://w.on24.com/r.htm?e=993468&s=1&k=5A40BFBD0F05E1431D43F6D4D920370A

End Note: This author will be covering the annual Open Network Summit this week in Santa Clara, CA. Email any questions/concerns/issues to: [email protected]

For previous articles by this author, kindly refer to this website (https://techblog.comsoc.org/author/aweissberger/) and to http://viodi.com/category/weissberger