Is Sprint Poised to Make a Strategic Misstep under New CEO? FBR Capital Markets

Posted on behalf of David Dixon, FBR Capital Markets

Sprint CEO Marcello Claure has undertaken a strategic review of Sprint’s competitive positioning according to our vendor checks. Claure is an entrepreneur who seeks to move quickly to reposition the company. While he is not a network engineer, he understands that the network is a strategic asset and is seeking approval to undertake a major network investment program, which we believe is approximately $25 billion over the next five years, and could realign the company with Ericsson. The challenge is the deteriorating FCF position of the company and a desire to achieve FCF positive status. This suggests a materially lower annual capex spending program of $3 billion is warranted, but at this level, Sprint is at risk of under-investing and at risk of weakening its franchise value further unless the company embraces a technological shift that is underway. Recall that management is expected to provide full calendar-year 2015 capex during the next earnings call. This will be shaped by the company’s strategic decision on its network strategy.

Mr. Claure has brought in Truco as his strategic Network Advisors led by trusted friend Sol Trujillo. Claure and Trujillo developed a solid, trusted relationship while Claure was at Brightstar and Trujillo led Telstra (he was formerly head of US West). However, this strategic advisory group is advocating a premature network rip and replace programsimilar to what was undertaken under Network Vision and similar to what has recently been undertakenby CSL Limited in Hong Kong. The question for investors is whether CEO Claure can be convinced to makethe right decision for Sprint investors at this juncture ahead of a major industry technology shift.

At this stage it appears he may be too reliant on the Truco advisory group which many believe are backward network engineering thinkers, trying to convince the company to adopt the second (high cost high risk)strategic approach described below. This would be an unfortunate misstep and a missed opportunityto embrace the technology shift underway in our view.Improving indoor and outdoor coverage and capacity is a major strategic challengefor Sprint.Coverage capex is expensive while Sprint can manage data usage growth within its existing footprintvery cheaply with aggressive 2.5GHz deployments on the macro network.

We see three strategies open to Sprint to improve coverage and progressively deploy VoLTE (an IP based LTE application that would allow the company to wind down its CDMA footprint and re-farm spectrum for LTE):

(1) Add macro cell sites.

Management could agree to add more macro cell sites (approximately 10,000)– The cost is high at approximately $3 billion capex and higher opex due to higher backhaul and siterental expenses. Furthermore, the time to deploy is long – up to 18 months to get a site underway.Network Vision proved this cannot be done quickly. For this reason the best macro site based coverageimprovement strategy was through M&A with T Mobile to create a bona fide healthy third operator thatcould better compete with AT&T and Verizon with dramatically improved consistency of service through a densified network grid of cell sites that could also facilitate the elimination of the CDMA networkthrough an accelerated refarming strategy similar to the advantage that AT&T and Verizon have todayin this regard.

(2) Convert its 1.9GHZ spectrum to uplink.

Management could improve coverage by converting 1.9GHz spectrum to uplink (FD LTE) and aggregate the 1.9GHz downlink spectrum with 2.5GHz downlink. Thisis Ericsson’s preferred approach in our view that fits neatly with its challenge in being behind theindustry in TD LTE yet needing to re establish a 4G relationship with Sprint and cement is networkterritory. Under this strategy there is significant deployment risk. For example, Sprint needs to ripand replace the baseband unit (BBU) at each site which is premature in our view. While this is aneasier undertaking relative to a site rip and replace, there is still significant interoperability testing (IOT) network optimization and development issues to address.

The Network vision program highlighted significant deployment issues and nothing has improved in the E&C industry to suggest Sprint could successfully complete a major rip and replace project. In fact the environment has worsened. For example, Ericsson acknowledges it had twice the size of the team they have now. Previously, higher capex spending drove a healthy ecosystem and the industry had a lot more incentive to commit to Sprint.

Bottom line, if pursuing this path, management would need to be more pragmatic about the upgradetimeline of three to five years. We believe CEO Claure favors this strategy but this plays into the hands of Ericsson which was rejected by China Mobile as a TD LTE vendor and had to fire most of its engineeringbase in this area as a result. TD LTE is an industry trend and we believe this option is a backward stepfor the company ahead of a major technology shift that is underway across the industry to embrace lowcost LTE overlay networks using low cost small cells on dedicated spectrum bands.

(3) Focus on indoor small cells on dedicated 2.5GHz spectrum to improve coverage and achieve more offload.

In our view this is the lowest risk and lowest cost strategy for the company. The use of adedicated spectrum band, (i.e. inside LTE Band 41 – 2.5GHz spectrum) to create an LTE overlay networkis the industr

ZTE, Huawei and NSN (now 100% owned by Nokia) are key vendors and trials are occurring this year ahead of commercial deployment in 2017. NSN is moving ahead nicely and both NSN and Alcatelhave received official requests from China Mobile so they will have to make TD LTE and massive MIMO a reality in 3 years so the question is why proceed with a high risk rip and replacement of the network prematurely with high deployment risk.

Recall that management is expected to provide full calendar-year 2015 capex during the next earningscall. This will be shaped by the company’s strategic decision on its network strategy and could rangefrom $3 billion to $5.5 billion in our view as a result.

Note: IEEE ComSoc is grateful that FBR Capital Markets permits us to share it’s very incisive telco research at this web site. Special thanks and acknowlegement to David Dixon, the author of the above post.

Cutting through the Hype: Will the real 4G (LTE-A) please stand up and tell us what 5G is?

Introduction:

While LTE roll-outs continue to increase, especially in developed countries, LTE Advanced (true 4G as defined by ITU-R) has not been deployed on a large scale anywhere that we know of (ABI Research disagrees- see section below). We’re told by Stephane Teral (quoted below), LTE Advanced is just a software upgrade from LTE. If that’s so why don’t we see large scale LTE Advanced deployment in the U.S.?

For example, Verizon has announced it would have 110% LTE coverage in the U.S. by the end of 2015. But they haven’t announced full LTE Advanced (AKA LTE-A) capabilities.

http://www.verizonwireless.com/news/LTE/Overview.html

Infonetics: LTE Deployments Stimulate 10% Growth in Mobile Infrastructure Market in 2014:

Infonetics Research, now part of IHS Inc. (NYSE: IHS), today reported that for the full-year 2014, LTE alone pushed mobile infrastructure revenue up 10 percent over 2013, to $46.8 billion worldwide, due in large part to China Mobile’s massive TDD LTE deployment.

“We have consistently said that LTE was supposed to pull the entire mobile infrastructure market out of the funk, and so far it has. LTE revenue grew 69 percent in 2014 from the previous year,” said Stéphane Téral, principal analyst for mobile infrastructure and carrier economics at Infonetics Research, now part of IHS. “That said, we’ve reached the peak of LTE buildouts on this planet+, and we believe market dynamics will cause the mobile macro infrastructure industry to enter a long-tail decline beginning in 2016 until 5G eventually kicks in.”

+ Over the last couple of years, Stephane has repeatedly told this author: “If you want to increase LTE buildouts, do so on another planet.” Today, he reiterated that comment along with one on LTE Advanced: “Mobile network operators are upgrading to LTE-Advanced but that is mainly a software job driving software revenue not hardware, which is what my forecast is all about. We’re done with blanketing the planet with eNBs as we know them; for more eNB business, get a seat on SpaceX and go to Mars!

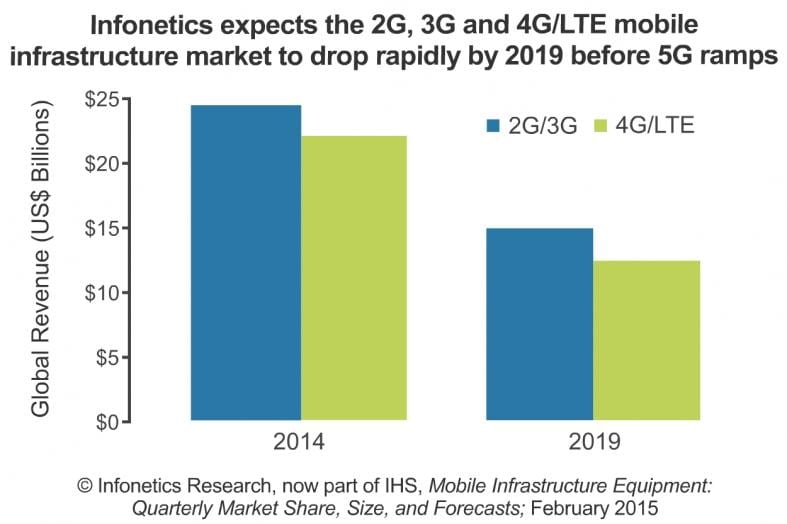

Stephane expects the mobile infrastructure market to drop by almost half from nearly $47 billion to $27 billion from 2014 to 2019!

MOBILE INFRASTRUCTURE MARKET REPORT:

Infonetics’ fourth quarter 2014 (4Q14) and year-end Mobile Infrastructure Equipment report tracks more than 50 categories of equipment, software and subscribers based on all existing generations of wireless network technology. Here are a few HIGHLIGHTS:

. Infonetics/IHS expects the 2G/3G/4G mobile infrastructure market to drop from nearly $47 billion to $27 billion from 2014 to 2019, as the planet reaches the end of macrocell mobile deployments

. By Infonetics’/IHS’s count, China Mobile has rolled out 700,000 eNodeB units as of January 2015 and plans to add another 300,000 this year

. The rest of the world is moving fast to LTE too, with the Global Mobile Suppliers Association (GSA) estimating that over 450 commercial LTE networks will be launched by the end of 2015

. In 4Q14, global macrocell mobile infrastructure revenue totaled $12 billion, up 8 percent from 3Q14, and up 10 percent from 4Q13 as unabated TDD-LTE activity in China overshadowed strong LTE and 3G activity in Europe and the Middle East

. For the full-year 2014, the overall 2G/3G/4G infrastructure market share leaders are Ericsson, Huawei and Nokia Networks (in alphabetical order)

. Nokia Networks continues to advance, helped by a strong position in the US due to Sprint and T-Mobile US, as well as massive LTE deployments in China

To purchase the report, contact Infonetics: www.infonetics.com/contact.asp

LTE Advanced Explained:

LTE Advanced consists of many different components–from carrier aggregation to HetNets to coordinated multipoint and more. Because of this, not all operators are likely to deploy LTE Advanced n the same way with the same feature sets. In fact, most experts say that every LTE-A deployment will be unique.

https://www.qualcomm.com/invention/research/projects/lte-advanced

Mike Haberman, Verizon’s vice president of network support, said last December that Verizon is testing carrier aggregation right now on its network to ensure it can work properly, and devices that can support carrier aggregation will come into the market after that. Carrier aggregation, which is the most well-known and widely used technique of the LTE Advanced standard, bonds together disparate bands of spectrum to create wider channels and produce more capacity and faster speeds.

However, an LTE network that includes just one feature, e.g. Carrier Aggregation, can’t really be called LTE-A in this author’s opinion.

ABI Research on LTE Advanced:

ABI Research states that at the end of 2014, LTE-Advanced covered its first 100 million people worldwide, just 4 years since the network’s inception. ABI Research predicts that the coverage will reach 1 billion in 4 more years.

At the end of 2014, there were 49 commercially available LTE-Advanced networks around the world. Western European operators lead the commercialization with 20 operators, followed by 13 in Asia-Pacific; however, North America still commands the largest population coverage at 7.8%. “All four major operators of the United States have either commercially deployed (AT&T and Sprint) or have been actively deploying (Verizon and T-Mobile) their LTE-Advanced networks,” comments Lian Jye Su, Research Associate of Core Forecasting.

Globally, a number of major auctions are expected to take place in several major markets in 2015. The Telecom Regulatory Authority of India has just recently confirmed a LTE spectrum auction on the 25th of February. In France, the government has recently approved the reassignment of the 700 MHz band for telecom services. At this moment, the FCC of the United States is currently conducting an auction for AWS-3 spectrum. “As heavy subscribers’ data traffic growth has exploded, ABI Research anticipates fierce competition for more spectrum, as well as an active migration to VoLTE and higher data modulation schemes such as LTE and LTE-Advanced, which has higher spectral efficiency,” adds Jake Saunders, VP and Practice Director of Core Forecasting.

https://www.abiresearch.com/press/lte-advanced-coverage-reaches-100-million-people-t/

Whither 5G?

Consequently, all the recent hype about 5G seems premature. While 3GPP is working on the essential components of 5G, the ITU-R hasn’t fully defined it yet. Here’s the official ITU-R progress report on 5G:

“The detailed investigation of the key elements of “5G” are already well underway, once again utilizing the highly successful partnership ITU-R has with the mobile broadband industry and the wide range of stakeholders in the “5G” community. In 2015, ITU-R plans to finalize its “Vision” of the “5G” mobile broadband connected society. This view of the horizon for the future of mobile technology will be instrumental in setting the agenda for the World Radio communication Conference 2015, where deliberations on additional spectrum will take place in support of the future growth of IMT.”

http://www.itu.int/en/ITU-R/study-groups/rsg5/rwp5d/imt-2020/Pages/default.aspx

Alcatel-Lucent’s View of 5G:

5G is “still a technology push story, not a market pull one,” Michael Peeters, Wireless CTO for Alcatel-Lucent, told Mobile World Live.

http://www.mobileworldlive.com/alcalu-sees-technology-push-5g-hype-driver-regrets-4-5g-moniker

“Operators have two primary approaches to 5G: one which is driven by their research organisations which need to understand whatever 5G may be in order to be ready and to drive the direction of research and standards; and another which is driven by commercial and operational needs which are trying to understand how 5G fits into future operations and revenue streams. It is clear that today the first one is the more important one,” he said.

There are two “likely, or rather, visible” paths for operators looking to make the most of 5G, Peeters continued.

The first will be through the continued support of “ultra broadband applications”, solving capacity issues where heavy users are connected to networks. And the second is “enabling the world of ubiquitous IoT” – “where an infinity of devices (real, or virtual i.e. applications) each use almost zero bandwidth, but nonetheless eat up all of the control plane of the network.”

A Wireless Expert’s Views on 5G:

Here’s the Introduction section of a recent blog post by Chetan Sharma: Technology & Strategy Consulting:

Exposed url: http://www.chetansharma.com/5G.htm

“The deployment of LTE otherwise known as 4G is in full swing. Operators in US, Japan, Korea, Finland, Australia, and others started deploying the new technology some years ago and are nearing completion of their network build out. Others in Europe and Asia are on an aggressive schedule to catch-up. We can expect that a majority of the operators will have LTE up and running in the next couple of years. Operators have sunsetted 2G. In some instances they even stopped investing in 3G and are putting all of their investments in the 4G bucket. As mobile networks transition to all IP, operators will be able to re-farm their spectrum assets for 4G deployments. Beyond LTE, operators are looking at LTE-A to provide more efficiency and network bandwidth to consumers.

In mature LTE markets like the US, Korea, and Japan, the talk has shifted to the next generation technology evolution – 5G. Even Europe, which still has a long way to go before their 4G is built out have set their sights on 5G to recapture the mantle and the pride of the GSM days. Korea and Japan led the world in 3G but lost the lead of 4G to the US. They both are eager to be considered leaders in 5G. Japanese government has set the ambitious goal of having 5G by the Tokyo Olympics in 2020. US regulators have started to talk about 5G and the future spectrum needs as well.

Since the launch of 1G networks in late seventies and the eighties, we are now onto the 5th iteration of the network technology evolution. We have gone through a lot of technology skirmishes but with 4G and likely with 5G, we are narrowing the differences between technology options giving significant technology scale advantages to the ecosystem.

As network technologies have evolved, the application landscape has changed as well. 1G or AMPS was all about basic voice services. GSM and CDMA (2G) digitized mobile and we saw basic messaging and data services introduced into the market. 3G (WCDMA, EVDO) introduced the potential of data services to the ecosystem and the consumers. The launch of iMode in Japan became the poster child of data services for much of the 3G evolution around the globe. Midway in the 3G growth, new players like Apple and Google entered the ecosystem and laid the foundation of unprecedented data and application growth. Business models and control points in the ecosystem changed overnight. The insatiable data demand led to the acceleration of the 4G services in many leading markets. For the first time, the network technology was data-led. We are clearly moving towards an IP infrastructure where voice is just another app running on the data network.

In fact, data is the primary revenue engine for the services providers and rest of the ecosystem. In Japan, almost 80% of the revenue now comes from data services. In the US, we are approaching 60%. Other nations are not far behind. Even the emerging markets have caught up very fast and in some instances leap-frogging their western counterparts in certain application and services segments.

All through last four generations, the fundamental business model of “metering” remained the same. Barring some exceptions, there has been a direct correlation of usage and revenues. Will 5G be any different?

Another significant standard that has evolved is Wi-Fi. The impact of Wi-Fi on the mobile ecosystem can’t be overstated. It has become so pervasive that we have ask the question how long before nationwide Wi-Fi first networks start to make a run for the wallet share in major markets. How will Wi-Fi fit in with 5G, will the two standards merge?

Will 5G offer new business models or explore a different relationship between usage and cost? Will consumers warm up to the idea of value-based pricing? Or Will access just become a commodity layer like water and electricity and most of the value will reside in the platform and application layers? Though we have started to see the shifts (as discussed in detail in our 4th wave series of papers), how fast will future accelerate? Will the ecosystem landscape be markedly different than what we have in place today?

We won’t know the answer to some of these questions for a while but it is worth exploring the lessons from the past and potential disruptions that 5G could bring to the ecosystem that benefits the end customers. In the end, it might not be about the technology at all but about the business models that shape the technology landscape. This paper explores 5G through the lens of the past and explores the wireless world beyond 2020.”

Conclusions:

We’ll leave it to the reader to sort out the buzz/hype from market reality. To this author, it’s alarming that Infonetics projects the ENTIRE MOBILE INFRASTRUCTURE MARKET TO DECLINE precipitously over the next four years, while wireless network equipment vendors are talking the talk about 5G!

Infonetics: Bare Metal Switches Propel Data Center Switch Market to Grow 8% in 2014

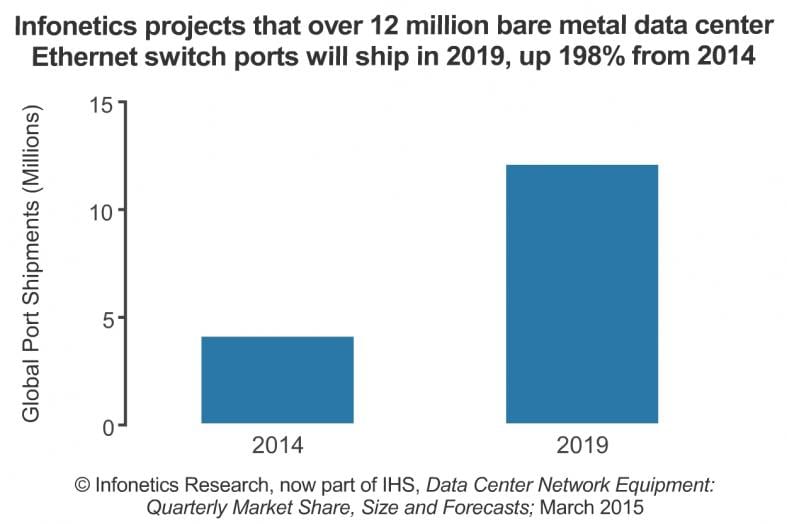

Infonetics Research, now part of IHS Inc. (NYSE: IHS), forecasts that bare metal switches (which decouple hardware from software and offer greater agility and cost savings over traditional data center switches) will make up just under a quarter of all data center ports shipped worldwide in 2019, up from 11 percent in 2014.

Infonetics’ fourth quarter 2014 (4Q14) and year-end Data Center Network Equipment vendor market share, size and forecast report tracks data center Ethernet switches, bare metal Ethernet switches, Ethernet switches sold in bundles, application delivery controllers (ADCs) and wide area network (WAN) optimization products.

DATA CENTER MARKET HIGHLIGHTS:

. Global data center network equipment revenue-including data center Ethernet switches, Application Delivery Controllers (ADCs) and WAN optimization appliances (WOAs)-grew 8 percent in 2014 from 2013, to $11.2 billion

. In the fourth quarter of 2014 (4Q14), the data center Ethernet switch market was up 5 percent sequentially, affected positively by Cloud Service Providers and financial institution spending

. The ADC segment has grown consistently on a year-over-year basis for the last 7 quarters

. Interest in optimizing the WAN via software-defined WAN (SD-WAN) is strong, but the WAN optimization segment has yet to return to long-term growth

. 25GE ports will begin shipping in 4Q15, representing a new 25/100GE architecture for data center fabrics targeted at large CSPs, a key high-end market segment

. Following double-digit increases in 2011 through 2014, long-term growth in the data center market is expected to slow down by 2019, braked by the migration to software-defined networking (SDN) and the shift to the cloud

Author’s Note: ADCs are one of many network box functions which are “virtual appliance” candidates via NFV.

“Up till now, bare metal switching has been attractive mainly to the large cloud service providers (CSPs) like Google and Amazon who provide their own switch software integrated into data center orchestration and management platforms. But with vendors such as Dell and HP jumping into the mix with branded bare metal switches, adoption of bare metal switching is going to accelerate as tier 2 CSPs and large enterprises endeavor to achieve the nimbleness demonstrated by Google,” said Cliff Grossner, Ph.D., directing analyst for data center, cloud and SDN at Infonetics Research,

DATA CENTER REPORT SYNOPSIS:

Infonetics’ quarterly data center equipment report provides worldwide and regional market size, vendor market share, forecasts through 2019, analysis and trends for data center network equipment, including data center Ethernet switches, ADCs, WOAs and Ethernet switches sold in bundles. Vendors tracked: A10, Alcatel Lucent Enterprise, Arista, Array Networks, Aryaka, Barracuda, Blue Coat, Brocade, CloudGenix, Cisco, Citrix, Dell, Exinda, F5, HP, Huawei, IBM, Ipanema, Juniper, Kemp, NEC, Radware, Riverbed, Siaras, Silver Peak, Talari, VeloCloud, Viptela and others.

To purchase the report, contact Infonetics: www.infonetics.com/contact.asp

RELATED RESEARCH (http://www.infonetics.com/market-research-report-highlights.asp?cvg=DataCenterandStorageNetworking)

. New Era of Data Centers Coming via 25GE; Intel’s Grantley Chip Driving Growth

. Data Center SDN Market Share Up for Grabs

. Cloud-as-a-Service (CaaS) Is on Fire, Shows Infonetics Cloud Survey

Closing Comments:

We see three different types of Data Center Switches:

1. Conventional vendor specific designs with some provision for open networking, e.g. Cisco, Juniper, HP, Dell, Arista.

2. Bare metal switches using commodity hardware like Broadcom switch silicon and standard/semi-custom microprocessors from Intel.

3. A new breed of “open hardware” switches is coming from the Open Compute Project (OCP).

[IMHO, this hasn’t gotten enough publicity/press coverage]

Facebook’s Wedge, a 10-Gigabit switch to link all the servers in a rack, which the company recently proposed as a contribution to OCP. Late last year, OCP accepted its first open switch design, a 10-Gigabit Ethernet switch from Taiwan-based Accton Technology. “This is an industry first. Nowhere else can you go and just get the design package for a switch,” Facebook’s Omar Baldonado said. “Anybody can build this.”

Accton announced it plans to start selling Wedge-based switches this quarter, and other vendors plan to use the design, too. Broadcom, Mellanox and Alpha Networks have also contributed hardware designs that are being reviewed by OCP.

If the new designs become popular, it could mean huge competition for the large incumbent computer/switch makers, like Cisco, HP, and Dell, which for several years have faced inroads from open-source software. The Facebook products involve both hardware and software.

In addition, two other companies making switching software, Cumulus Networks and Big Switch Networks, are donating software to the project. Facebook is donating switch management software that it has developed.

The other Facebook donation to OCP is a new version of a low-power server that uses a semi-custom processor from Intel. Up to 192 of the chips can be fit into a single rack of servers at relatively low power consumption but high performance.

Also at the last Open Compute meeting, Hewlett-Packard announced a new server it is producing in conjunction with Foxconn, the Taiwanese manufacturer that also builds products for Apple. HP and Foxconn entered a joint venture last year, aiming to sell low-priced servers to providers of telecommunications and Internet services. The design appears to use many Open Compute features.

For more information:

http://bits.blogs.nytimes.com/2015/03/10/facebooks-status-update-for-com…

Cellular Communications Solutions for IoT: Telit LTE module and AT&T’s IoT/M2M Platform

Introduction:

Most of the wireless connectivity options for IoT are for personal or local area communications. Those that require longer distances will use some combination of 2G/3G/4G cellular service, with a data plan optimized for machine to machine communications. Last Thursday at Arrow’s IoT Immersions sponsored conference in Santa Clara, CA, module maker Telit and wireless telco giant AT&T provided details on their respective IoT technologies, markets and applications.

Telit’s LTE- only Module:

Telit Wireless Solutions is an enabler of the global machine-to-machine (m2m) movement. The company talked about long range cellular communications for the IoT and its LTE single mode module for IoT endpoint devices.

Telit says there are over 7 billion devices connected to cellular networks world-wide. Over 10 billion cellular connected devices was forecast by 2020. There were 25 million worldwide cellular proucts shipped in 2014.

“Anything that has a battery and electricity could have low cost cellular access with a Telit module. You don’t need to tether an endpoint to a smartphone to get cellular connectivity.”

Examples of cellular IoT applications cited were: defibulators to treat patients suffering from cardiac arrest, industrial smart grid, HVAC (heating, ventilating, and air conditioning), Point of Sale (PoS). Cellular includes 2G, two different versions of 3G (UMTS/HSPA and CDMA/EVDO) and 4G-LTE. Verizon was forecast to have 110% U.S. nationwide LTE coverage by the end of this year (2015).

Telit’s LE910-V2 – LTE-only module is an addition to the firm’s xE910 family. It’s designed to optimize bandwidth and performance, while limiting the cost of transitioning from 2G to 4G. The single-mode LTE module, with no fallback in 3G and 2G networks: it is the perfect optimized solution for regions where the 4G technology already has penetration rates above the 90% level. The LTE 3GPP Release 9 module delivers data rates of 150 Mbps downlink and 50 Mbps uplink. With no fallback to other cellular modes, this LTE module was said to be less expensive and less power hungry than multi-mode cellular modules. An example application for this single mode LTE module was said to be a parking meter (although this author doesn’t know why LTE’s speed/low latency would be required in this case).

AT&T’s GSM SIM IoT Management System and IoT Applications:

Randy Amerine of AT&T talked about cellular applications for the Industrial IoT (IIoT) and discussed the carrier’s GSM SIM Management platform that’s use for provisiioning and configuration of IoT endpoints. The telco’s IIoT solutions were said to be scalable, secure and capable of cloud based big data analytics.

IoT applications the telco is interested in include: home automation (including security systems), connected car, medical electronics, energy industry, manufacturing, heavy industrial equipment, transportation (e.g. fleet management) & logistics, field services and sales force automation.

AT&T claims to have the largest share of the connected device market with 19.8M IoT devices or 47% of the U.S. total IoT market in 2013. There are GSM location tracking capabilities in over 100 countries with roaming access in more than 200 countries.

AT&T is a founding member of the Industrial Internet Consortium where over 100 companies are now involved. As part of that effort:

- IBM and AT&T are collorating on IoT solutions for cities, institutions, and enterprises.

- GE and AT&T are working on remotely controlled industrial machines.

The ability to sense, respond and analyze are critically important IoT capabilities. Connect, manage and innovate are also important attributes. Four “quadrants” for IoT adoption were said to be based on individual business case and risk management analysis. They are:

- Prove business case and technology chosen

- Production Beta test

- Production Phase 1

- Full Production

AT&T’s Foundry in Plano, TX was identified as the place to engage and partner with AT&T to progress a company’s IoT application(s) using their 3G/4G cellular network. AT&T is phasing out 2G and converting existing users to 3G.. The AT&T contact there is Aaron Hoffmeister who provided the following links which have “Contact Us” functionality:

AT&T Innovation: http://about.att.com/innovation

AT&T Foundry: http://about.att.com/innovation/foundry

AT&T has provided cellular IIoT solutions for:

- Global container monitoring

- Security monitoring and alerting

- Tractors and other heavy equipment

- Refrigerators and cooling equipment

- Cargo tracking and monitoring

Industrial shredding/ trash collection was cited as a specific example. Trash bins are monitored for consistent levels so that pickups/hauling occur as needed. That improves efficiency and reduces dispatch costs up to 50%. It took only three weeks for this application to become profitable for the vendor (their cost savings surpassed the IoT capital expense in that short time).

Randy said something most of us are quite familiar with- as 3G/4G wireless capacity grows, so does that aggregate data that actually uses that cellular network. We thought that was mostly due to consumer video streaming. But Randy observed that wireless data consumed by IoT devices continues to increase geometrically. That was a surprise as we thought most IoT applications would be low duty cycle and low bandwidth.

AT&T’s fully integrated IoT solution platform includes: IoT application services, business rules engine, data model, agents/device protocol adapters, connected products, and management applications.

Mr. Amerine provided the following links via email that may be of interest to readers:

M2M 360 www.att.com/m2m360

M2M 360 Video http://www.youtube.com/watch?v=PSoGAqTn_Fk&feature=related

AT&T Control Center http://www.jasper.com/iot-service-platform/connected-devices

Approved Modules www.att.com/modules

NY Times Interview with Ralph de la Vega, the head of AT&T’s mobile and business solutions:

In this interview, Mr. de la Vega said:

“When we say Internet of Things we say everything from wearables to light bulbs, but it includes locomotives, jet engines, cargo containers, cars, trucks, trains, automobiles. I don’t think you’ll see too many things in the future that are not connected. Once you connect those things then it adds huge value for tracking where different pieces of equipment are and their status, so businesses can run more effectively.”

AT&T claims to be a leader in the connected car and Vega had this to say about it:

“We are pioneers in the connected-car space and are ahead of our time in spotting the trend that all cars will have connectivity in the future. Car manufacturers all want connectivity because that’s the easiest and fastest way to update the software. The days of having to take your vehicle to a dealer to update maps are long gone.

Tesla is one of the more aggressive manufacturers when it comes to updating the software in their vehicles over-the-air, which all manufacturers are moving to. When the car breaks down what happens to the car? Did the battery go dead? They can also track the history of what happens to the car for diagnostics.

From the user’s point of view, there isn’t an autonomous driving vehicle that’s not connected that I know of. How you interact with the autonomous driving vehicle is with a smartphone. All cars will have an autonomous driving feature, so you can talk to the car while using your smartphone.

We added 800,000 connected cars in the fourth quarter of 2014 alone. That is pretty significant.”

Closing Comment:

AT&T operates an extensive Wi-Fi network including more than 34,000 AT&T Wi-Fi Hot Spots at popular restaurants, hotels, bookstores and retailers, and provides access to more than 1 million Hot Spots globally through roaming agreements. Therefore, it’s quite surprising that the telco hasn’t talked about using WiFi for any of it’s IoT network offerings. When I asked Randy about WiFi, he said that his IoT involvement was ONLY using the company’s cellular network.

Verizon sees growth from OTT Video and IoT: Morgan Stanley Conference

Speaking at a Morgan Stanley conference March 2nd, Verizon CFO Fran Shammo outlined that future path and gave a few hints about the OTT service, which will be launching this summer, according to a transcript from Seeking Alpha.

Shammo said Verizon’s efforts around Internet of Things (IoT) and OTT will extend to its 100 million subscriber base. In IoT alone, he said that Verizon has seen $600 million to date in revenue for that market and is projecting growth of 45 percent year-over-year for that category. However, no new network provisioning or management of IoT was disclosed.

Verizon introduced Verizon Vehicle earlier this year, an after-market connected car service that will add on to accounts and be available to non-subscribers for $15 to $13 per vehicle per month.

Verizon’s as-yet unnamed OTT video service is finally nearing a launch date after years of planning and development. Marni Walden, who heads Verizon’s Product and New Business Innovation, will be leading the new video operation.

Shammo reiterated the roles a number of assets like Verizon Digital Media Services, EdgeCast, upLynk and OnCue will play in the service. He also said that Verizon’s LTE multicast technology, which the carrier has demoed at live events like the Super Bowl, will be a component of the service. That implies it will be a mobile video service that probably won’t compete with VZ’s FiOS TV service which offers both real time/linear TV and VoD to fiber to the home subscribers

Mr. Shammo has previously indicated that Verizon’s OTT service will not be a linear-TV model like DISH’s new Sling TV offering. In terms of growing Verizon’s wireless business, Shammo said is looking at four percent top-line revenue growth and focusing less on ABPU and ARPU as service and equipment revenues continue to shift in the wake of an industry-wide move toward EIP programs.

Of course, all wireless carriers, especially AT&T and Verizon, could have good reason to be concerned about future growth given Google’s recent confirmation that it will be entering the market as an MVNO. Google’s move could potentially squeeze wireless pricing depending on what kind of offers the company puts forward. Shammo said that he isn’t overly concerned at this point:

“One will have to see how they execute on that and see how the market responds to that and then we’ll act accordingly,” Shammo said, according to a Seeking Alpha transcript.

We wonder how AT&T, Sprint and T-Mobile will respond to the forthcoming VZ OTT service…..

Reference:

http://seekingalpha.com/article/2966366-verizon-communications-vz-presen…

Google leads Network Operator Consortium to Specify Automated, Vendor Neutral Provisioning/Configuration

Introduction:

Google’s keynote talk on this topic at last Thursday’s Light Reading New IP conference was very profound. Google and its eight partners (identified below) in this OpenConfig initiative want to specify a vendor neutral type of provisioning & configuration system that will work with any type or brand of network equipment. It’s called OpenConfig. In this post, I provide a brief summary of why it’s important and to provide links to other articles about it.

Why it’s important:

3. Here’s a link to most recent IEEE ComSocSCV session on Open Networking I helped organized and recruited the speakers (Guido & Christos). Their presentos can be downloaded once you open the url.

SDN & NFV -Oct 2014 meeting: http://comsocscv.org/showevent.php?id=1409231402

Anonymous Comment from IEEE Member Discussion Group (IEEE members may join for free at comsocscv.org)

“It will be interesting to see if Google can 1) hang together and play nicely, and if 2) if they can come to an agreement. One must remember that, right now at least, Google has “googles” of money. Not all their consortium pals are so flush. This (in my opinion) would impact the kinds of decisions they make, based on who can afford the different options posed. It might also impact how much involvement and dedication they can afford to put into the consortium. I know that when things have gotten ‘tight’ in my former employment, cooperation with our competitors was one of the first things to get funding cuts, even if it was potentially beneficial to our company. Most companies are worried about profits right now, and next quarter’s financial reports. Worrying about next year is right out of the question.”

Global Cloud Service Strategies: Infonetics Survey Sees Disconnect on Public Cloud as a Service (CaaS)

Infonetics Research, now part of IHS Inc. (NYSE: IHS), conducted in-depth surveys with service providers around the world about their cloud service plans and learned that 82 percent plan to offer hybrid cloud CaaS (cloud-as-a-service) by 2016.

Infonetics interviewed pure-play cloud service providers and incumbent, competitive and mobile operators for its latest study, Cloud Service Strategies: Global Service Provider Survey, which examines all types of off-premises cloud services, including infrastructure-as-a-service (IaaS), cloud-as-a-service (CaaS), platform-as-a-service (PaaS) and software-as-a-service (SaaS).

Note: some vendors use the acronym CaaS to mean Communications as a Service

CLOUD SERVICE SURVEY HIGHLIGHTS

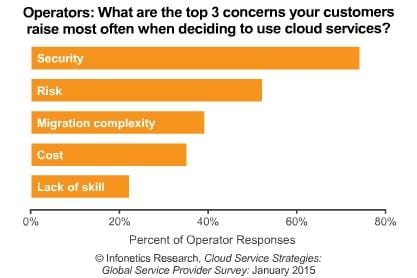

. A large majority of providers surveyed indicate security is a top customer concern when adopting cloud services

. Infonetics continues to see a disconnect on public cloud CaaS: Cloud service providers (CSPs) continue to invest in public cloud CaaS, while CaaS-using enterprises are signaling a shift from public cloud to private and hybrid cloud architectures

. Key go-to-market strategies for cloud service providers include offering a comprehensive range of services and bundling off-premises cloud services with network connectivity

“Cloud service providers are catching the hybrid cloud CaaS wave, an emerging market where we can expect lots of innovation as the introduction of new IaaS and SaaS off-premises cloud services begin to wane,” Cliff Grossner, Ph.D., directing analyst for data center, cloud and SDN at Infonetics Research, said.

“Cloud providers’ top challenges are non-technical: Meeting customer concerns about loss of control over private data, and helping customers overcome resistance to procedural change or understand how to take advantage of off-premises cloud services,” Grossner said.

CLOUD SURVEY SYNOPSIS:

For its 32-page cloud service strategies survey, Infonetics interviewed operators in North America, EMEA and Asia Pacific about their deployment of off-premises cloud services and plans for evolving their cloud services offerings over the next two years. The study provides insights into operators’ target market segments and verticals, go-to-market strategies, challenges, and cloud service offerings by type (IaaS, CaaS, PaaS, SaaS).

To purchase the report, contact Infonetics: www.infonetics.com/contact.asp

RELATED RESEARCH (http://www.infonetics.com/market-research-report-highlights.asp)

. Cloud services to top $200 billion by 2018; Google, IBM, Amazon lead market

. Growth spike expected in virtual security appliances market, driven by SDN and NFV

. Survey respondents rate Microsoft, IBM, Amazon, Google, Cisco top cloud providers

KPMG Survey Report:

The Cloud Takes Shapereport is based on the responses of more than 650 senior executives in some 16 countries representing multiple industries, and provides a valuable perspective on the challenges and complexities of cloud adoption facing today’s organizations. As clients move more of their core business processes to the Cloud, they’re finding it challenging to connect their legacy applications and new Cloud solutions – data integration and data management are key potential trouble spots that must be managed closely.

FCC Says Broadband Deployment Lacking; Redefinition (25M/3M) Has Huge Implications for AT&T, Verizon & Comcast

In its 2015 Broadband Progress report, released January 29th, the FCC states that U.S. broadband deployment, especially in rural areas, is failing to keep pace with today’s advanced, high-quality voice, data, graphics and video offerings.

http://transition.fcc.gov/Daily_Releases/Daily_Business/2015/db0129/DOC-331760A1.pdf

In an effort to stimulate deployment, the FCC voted 3-2 to change the definition of “broadband” for wireline networks in Section 706 of the Telecommunications Act of 1996 . The redefinition is from 4 Mbps downstream and 1 Mbps upstream (set in 2010) to 25 Mbps downstream and 3 Mbps upstream. The 2010 broadband hurdle rates were said to be “inadequate for evaluating whether advanced broadband is being deployed to all Americans in a timely way,” the FCC found.

“Using the new higher broadband rate benchmark, the 2015 Broadband Progress report finds that 55 million Americans – 17% of the population – lack access to advanced broadband. Moreover, a significant digital divide remains between urban and rural America. Over half of all rural Americans lack access to 25 Mbps/3 Mbps service. The divide is still greater on Tribal lands and in U.S. territories, where nearly 2/3 of residents lack access to today’s speeds. And 35% of schools across the nation still lack access to fiber networks capable of delivering the advanced broadband required to support today’s digital-learning tools.”

Using the new broadband definition, approximately 20% of U.S. wired Internet connections today do not qualify as broadband, including many (mostly DSL connections) that formerly did qualify. For example, this author and many others have AT&T U-Verse Internet, which typically provides downstream rates of either 11Mb/sec or 22Mb/sec (the Uverse Upstream rate is not stated by AT&T). Others have 4Mb/sec and higher ADSL based Internet access. As of yesterday, we don’t have broadband anymore!

The change is designed to protect consumers by ensuring that cablecos (MSOs), telcos, and other Internet access providers don’t offer subpar download speeds as call them “broadband.” It’s also meant to stimulate the telecom/cableco industry into offering higher-quality services to the one-fifth of the population that has little or no Internet access, according to FCC Chairman Tom Wheeler. “We have a problem” when 20 percent of the U.S. doesn’t have access to the new speed. And we have a responsibility to that 20 percent,” Wheeler said.

It appears the FCC is paying more attention on cable’s growing broadband monopoly, as AT&T and Verizon back away from unwanted ADSL Internet access markets to focus on their triple play offerings (U-verse and FiOS, respectively) and 4G-LTE nationwide wireless access. Not only do those telcos not want to upgrade their DSL lines, they’re paying for state laws that ensure nobody else can either. It’s a paradigm that’s needed changing for most of the last decade, and few thought that Wheeler would try to do that. It remains to be seen if AT&T will upgrade U-verse Internet customer speeds as they are almost always served by DSL (only some greenfield U-verse deployments get fiber to the building). Verizon FiOS uses fiber access, which already provides higher speeds than 25M/3M to all its customers.

The redefinition also creates a huge problem for Comcast. Suddenly, the company’s share of the broadband market becomes a lot larger — and that gives regulators and politicians concerned about market concentration/monopoly power more cause to closely scrutinize Comcast’s plans to merge with Time Warner Cable. If that merger closes, approximately 63% of U.S. households would have only one choice for a broadband provider at the new faster speeds, according to a December 2014 memo from the FCC.

Time Warner Cable CEO Rob Marcus said he didn’t think the commission’s “somewhat arbitrary” definition would affect the deal with Comcast. “I don’t anticipate that that has any practical implications for life going forward or for the (the Department of Justice) analysis of the deal,” Marcus said in an earnings call Thursday, January 29th.

Comcast has said its market share would grow by less than 1% because Time Warner Cable has virtually no broadband customers at speeds above 25 Mbps. No customer will have fewer choices after the merger because Comcast and Time Warner Cable serve different areas, Comcast has repeatedly stated.

There’s still the chance that regulators could block the transaction or seek specific concessions before approving it. The reviews by the FCC and Justice Department, which is evaluating the merger’s impact on competition, have already been delayed several times as the anniversary of the deal’s announcement nears.

“The market suggests that odds of the deal closing are no higher than 50-50,” Craig Moffett, an analyst at Moffett Nathanson, said in a note to clients Thursday. The merger “has lost its air of inevitability,” he said. Earlier this month, Moffett had said he expected regulators to sign off on the deal. “But if it is rejected, combined Comcast’s share of the broadband market would be the reason,” he wrote in Jan. 8th note to clients.

Comcast says it’s better to measure broadband by including slower speeds, giving it about 35.5% market share in the U.S.

Meanwhile, the debate over a new downstream/upstream rate definition for broadband service mirrors the battle lines over network neutrality. The big Internet content companies including Google, Facebook, Yahoo and Netflix favor strong net neutrality action by the FCC, while the cable and telecommunications companies want the FCC to refrain from reclassifying broadband as a regulated service under Title II of the Communications Act. Earlier this month, Wheeler strongly hinted that Title II will be the basis for new net neutrality rules governing the broadband industry. Title II lets the FCC regulate telecommunications providers as common carriers. President Obama urged the commission to use Title II to impose net neutrality rules that ban blocking, throttling, and paid prioritization (AKA “paid peering).

In a filing with the FCC last week, Matthew Brill, counsel for the National Cable and Telecommunications Association, called the proposed broadband reclassification as “arbitrary and capricious.” He termed the assumptions behind it “hypothetical” that “dramatically exaggerate the amount of bandwidth needed by the typical broadband user.”

AT&T 4Q2014 Earnings Review & Analysis + Future Growth from DTV & Mexico wireless companies

AT&T announced its 4thQ2014 earnings yesterday which slightly topped estimates.

- AT&T’s Wireless segment reported operating revenues of $19.9 billion, up 7.7% from the fourth quarter of the previous year. The Wireline segment had revenues of $14.6 billion which was down 1.0% year-over-year.

- In the fourth quarter, AT&T had 405,000 U-verse high speed Internet subscriber net adds, which would make a grand total of over 12 million U-verse high speed Internet subscribers. 73,000 U-verse TV subscribers were added.

- Total revenue at of AT&T’s wireline segment was $14,572 million, down 1% year over year (yoY). Also, Service revenues were down 1.3% to $14,240 million. Equipment revenues grossed $332 million, up 17.7%. Operating expenses increased 1.2% to $13,107 million. Meanwhile, the operating income increased 0.8% to $1,465 million. Quarterly operating margin stood at 10.1% against 9.9% in the year-ago quarter.

- At the end of fourth-quarter 2014, AT&T had 24.778 million voice connections, down 13% year over year. In the reported quarter, the company lost 1.442 million voice connections, down 78.7%. At the end of the preceding quarter, AT&T had 16.028 million high-speed broadband connections, down 2.4% year over year. The company also lost 0.458 million broadband connections compared with a loss of 0.002 million connections in the prior-year quarter.

- Similarly, at the end of 4Q-2014, AT&T had 5.943 million video connections, up 8.8%. However, the company lost 0.124 million video connections in the said quarter.

- Highlights of 4Q-2014 Earnings: http://www.att.com/gen/landing-pages?pid=5718 http://www.att.com/Investor/Earnings/4q14/ib_4q14.pdf

- Earnings Conference Call:

http://phx.corporate-ir.net/phoenix.zhtml?c=113088&p=irol-EventDetails&EventId=5178862

- The company expects continued consolidated revenue growth and earnings growth should be in the low-single digit range. Margins are expected to expand across all of AT&T’s segments.

- For fiscal 2015, AT&T expects adjusted earnings per share to grow in the range of low single digit. Capital expenditures are expected at around $18 billion.

Randall Stephenson, AT&T chairman and CEO, commented about AT&T’s future during a fourth quarter earnings call that was broadcast online:

“Our transactions with DIRECTV and Mexican wireless companies Iusacell and Nextel Mexico will make us a very different company. We’ll be unique in the industry because we’ll be able to offer integrated capabilities across a diversified base of services, customers, geographies and technology platforms. After we close DIRECTV, our largest revenue stream will come from business-related accounts, followed by U.S. TV and broadband, U.S. consumer mobility and then international mobility and TV.”

“We will be the only company with mobile Internet spanning both countries,” Stephenson said of the company expanding into Mexico. “We have the makings for strong and very viable Mexico strategy. We like these assets. We think these assets are sufficient to go in there and compete and take share.“

Stephenson was talking about the diversification of AT&T’s revenue stream through it’s pickup of DirectTV, as well as recent acquisitions of wireless players in Mexico. When asked whether AT&T might be considering moving into the Canadian wireless market, Stephenson said he had enough on his plate. “On Canada, I think right now we have about as much as a company can handle,” he said.

Aside from moving into different geographies, Stephenson stressed that AT&T’s DirecTV acquisition will allow it to deliver video content across devices.

“We’re looking at multiple channels and channel lineups that we’ll be able to deliver to our wireless subscribers,” Stephenson said. “Stay tuned…this is of high priority to us.”

Stephenson made the comments as both AT&T and Verizon are under pressure to find new revenue streams. AT&T’s fourth quarter subscriber numbers leaned heavily on tablets, which have picked up the slack as smartphones reach saturation. AT&T added 854,000 net postpaid subscribers, a 51 percent increase over the same quarter last year. AT&T added just 148,000 net postpaid smartphones and 969,000 postpaid tablets in the quarter.

For reference, Verizon added about 600,000 smartphones and 1.4 million tablets in the fourth quarter. Stephenson said AT&T would update more specific guidance once the DirecTV purchase is approved.

FBR’s David Dixon wrote in a note to clients (and this author):

AT&T reported 4Q14 mixed results as it continues to face stiff competition from Verizon and its smaller rivals – Sprint and T-Mobile. While the company was able to achieve 3.8% YoY revenue growth in 4Q2015, adjusted wireless service EBITDA (Earnings before Interest, Taxes and Amortization) margins declined by approximately 60 bps YoY, driven by a higher number of smartphone upgrades and gross subscriber adds. Although AT&T was able to deliver net adds of 854,000, surpassing consensus expectations of 793,000, much of the growth was driven by lower-ARPU tablet net adds of 969,000. Postpaid churn increased by 11 bps YoY to 1.22%.

During the fourth quarter, AT&T increased LTE network coverage to over 300 million PoPs. Despite improvement in network quality and root metric ranking results, AT&T still faces the challenge of being a premium-priced provider amid customer perception of an inferior network to that of Verizon (this takes time to change), which will likely continue to affect churn. Diversification into DTV, the growing Mexican market, and mobile video delivery will likely alleviate some churn pressure. AT&T management expects to close the DTV transaction in 1H15.

* Diversification is key to growth. AT&T has embarked on diversification into the Mexican wireless carrier market in the face of domestic competitive pressures that are unlikely to abate. We see a favorable Mexican regulatory environment and view AT&T’s desire to mitigate churn risk in the U.S. market positively. AT&T management believes DTV and Mexican acquisition will achieve adjusted EPS in the single-digit range and deliver multi-year synergies that are higher than previously announced.

* Project VIP (Velocity IP) completion drives capex reduction. With the majority of Project VIP milestones complete, management expects FY15 capex to be around $18 billion, a decline of approximately $3.2 billion compared with FY14. The company will shift focus to free cash flow generation to help pay down debt (from DTV acquisition).

Our strategic concerns for AT&T in 2015 and beyond include:

(1) Apple eSIM impact should Apple be successful striking wholesale agreements;

(2) Google MVNO impact, which could strip the company of the last bastion of connectivity revenue; and

(3) a WiFi first network from Comcast, coupled with a wholesale agreement with a carrier, which

would enable a competitor and increase pricing pressure.

Author’s Note: Cablevision has already announce a VoIP/WiFi network in New York. Called Freewheel, the service will offer unlimited data, talking and texting worldwide for $29.95 a month, or $9.95 a month for Cablevision’s Optimum Online customers — a steep discount compared with standard offerings from traditional cellular carriers. Freewheel customers initially must use a specific Motorola Moto G smartphone, which is being sold for $99.95. The service goes on sale next month, and no annual contract is required.

http://www.nytimes.com/2015/01/26/business/media/cablevision-to-introduce-wi-fi-based-phone-plan.html?_r=0

New ETSI Group on millimetre Wave Transmission (ISG mWT)

ETSI’s recently announced Industry Specification Group on millimetre Wave Transmission (ISG mWT) held its first meeting at ETSI on 14-15 January 2015 and immediately commenced work developing a set of five specifications.

At this meeting Mr. Renato Lombardi of Huawei Technologies was elected as the chairman of the Industry Specification Group while Mr. Nader Zei of NEC Europe was elected as the vice chairman.

“ISG mWT was conceived as an industry wide platform to prepare for large scale usage of millimetre wave spectrum in current and future transmission networks by improving the conditions to make millimetre wave spectrum a suitable and convenient choice for all stakeholders. The ISG aims to be a worldwide initiative with global reach and to address the whole industry: national regulators, standards organizations, telecom operators, product vendors and key component vendors.” said Mr. Lombardi, newly elected chairman of ETSI’s ISG mWT.

During the meeting, a plan was agreed to develop five new specifications. These cover:

- An analysis of the maturity and field proven experience of millimetre wave transmission

- Potential applications and use cases of millimetre wave transmission

- An overview of V-band and E-band worldwide regulations

- An analysis of V-band street level interference

- Analysis of the millimetre wave semiconductor Industry technology status and evolution.

Millimetre wave spectrum, in the 30GHz to 300GHz range, offers more available spectrum than in lower bands with larger channel bandwidths granting a fibre like capacity. The spectrum can be made available readily and can be reused easily, and lower licensing costs lead to lower total cost of ownership and lower cost per bit of radio systems.

Participation in the millimetre Wave Transmission Industry Specification Group is open to all ETSI members as well as organizations who are not members, subject to signing ISG Agreements. A complete list of ISG mWT members is published on the ETSI Portal pages for mWT.

For information on how to participate please contact: [email protected]

References:

http://www.etsi.org/news-events/news/861-2014-new-industry-specification-group-on-millimetre-wave-transmission-at-etsi

https://portal.etsi.org/Portals/0/TBpages/mWT/Docs/Introduction%20to%20mWT%20ISG%20v1-0.pdf

http://www.etsi.org/technologies-clusters/technologies/millimetre-wave-transmission

About ETSI

ETSI produces globally-applicable standards for Information and Communications Technologies (ICT), including fixed, mobile, radio, converged, aeronautical, broadcast and internet technologies and is officially recognized by the European Union as a European Standards Organization. ETSI is an independent, not-for-profit association whose more than 700 member companies and organizations, drawn from 64 countries across five continents worldwide, determine its work programme and participate directly in its work.

For More Information on ETSI, Contact: Claire Boyer:

Tel: +33 (0)4 92 94 43 35 Mob: +33 (0)6 87 60 84 40

Email: [email protected]