TiECon 2014 Summary-Part 1: Qualcomm Keynote & IoT Track Overview

Introduction:

This is the first in a multi-part article series on TiECon 2014 – the two day annual conference of The Indus Entrepreneurs (TiE). We summarize the Qualcomm keynote in this blog post and touch on the Internet of Things (IoT) track.

With 4,200 attendees, this year’s TiECON was the largest of all time. That’s a testimonial to the superb organization and planning, which produced excellent content on a variety of topics and subject areas that were of interest to technologists, entrepreneurs and private investors. The top notch technical sessions included: keynotes, panel discussions, lightening rounds with start-ups, and break-through thinker presentations.

This author has covered TiECon for the last several years along with TiE-Silicon Valley (SV) events of interest to IEEE ComSoc readers. TiE-SV and IEEE ComSocSCV have had a strategic partnership since 2010. In Sept 2013, they held a well attended joint workshop – Quantified Self: The next frontier in mobile self-tracking .

Qualcomm CEO Steve Mollenkopf’s Opening Keynote:

The opening TiECon keynote was a fireside chat with Qualcomm CEO Steve Mollenkopf, who was introduced by Anand Chandrasekher, Sr. Vice President at the same company. The conversation was moderated by Mohan Gyani -now a private investor, but previously President and CEO of AT&T Wireless Mobility Services. The format was a Q &A type of “conversation.”

A 20 year Qualcomm veteran, Mr. Mollenkopf provides executive oversight to current and future technology development activities, further strengthening the company’s ability to successfully navigate an increasingly complex and competitive market for wireless infrastructure components and software. He also serves as a member of Qualcomm’s executive committee, helping to drive Qualcomm’s overall global strategy.

What is Qualcomm? “We are a technology company company that invests in core technology that’s needed for big changes in the (IT) industry. We try to be fairly flexible in the way in which we go to market, always through partners,” he said. Technology licensing (#1) and chipsets (# 2) are the Qualcomm deliverables which generate revenues and profits for the company.

Here are a few of Mollenkopf important points, observations and opinions:

- Scale is very important when pursuing innovation. Qualcomm’s scale (of operations and R&D investment) enables the company to pursue new areas of opportunity that smaller companies couldn’t afford to undertake.

- Corporate culture is the most strategic asset. It gets you through periods of uncertainty.

- Need to preserve a spirit of innovation which includes being nimble (i.e. quick to change direction/iterate) and learning from one’s mistakes.

- Qualcomm tends to focus on a small number of eco-system customers, but the company has a large partner base.

- Qualcomm likes to partner1 with other companies, because they can’t cover all aspects of the many technologies that are now coming together in the wireless/mobility marketplace.

- Qualcomm wants technology to move forward, rather than stagnate.

- Advice for entrepreneurs: embrace the uncertainty of not knowing what’s next; keep sights high; pay attention to new technologies; innovate; make changes along the way to be successful

1. Post TiECON quote for clarification: “We work in a particular space that requires a lot of focus, so we have a very concentrated customer base, but we have an enormous partner base. So our direct customers are really much smaller than a lot of other companies in terms of raw numbers, but we deal with a lot of ecosystem players and we try to be the behind-the-scenes partner for technology.”

Is technological change coming too fast? “There’s a gap between what people envision and what they can deliver. There is so much more we can do with (wireless) networks, e.g. a sea of sensors.”

How does the cloud effect Qualcomm? “For quite some time, (desirable and effective) cloud based services have been needed to be successful in the smart phone business. The portfolio of cloud services has driven smart phone growth. Many mobile device components were needed for that: graphics, wireless connectivity/radios, CPU core, multi-media/video, etc.”

What about the future? “Wireless networks will need to be able to move huge amounts of data through networks and this will be a huge opportunity for Qualcomm. We have to take advantage of that.”

“Future cloud services will need more wireless bandwidth to and from mobile devices and connected sensors. At the (wireless) network edge, a decision must be made as to how much data to send back to cloud servers,” Steve added. Note that this needed intelligence for decision making at the network edge was touched upon in future sessions and is not trivial.

Mollenkopf positioned Qualcomm as a company that “provides technology for (partner) companies to succeed without making a large investment (in wireless infrastructure). Qualcomm technology scales to a large number of developers.” And that will produce a huge amount of wireless devices. “We want to get services enabled on 200M (mobile) devices per quarter,” Steve added. Summing up Mollenkopf said, “As technology gets integrated into mobile devices there will be more of a need for Qualcomm chip sets.”

Steve said that mid to lower tier smart phones will produce future growth for the smart phone market. The high end is still growing, but it’s growth rate is not as high as it was.

Note: IDC forecasts that high end smartphone growth will be in single digits by 2017, while #1 maker Samsung has lowered its internal smart phone sales forecast for 2014.

Mollenkopf: “Qualcomm is getting the cost structure right for these lower priced smart phones2. A lot of the Intellectual Property (IP) for high end smart phones trickles down to the mid and lower end.”

2. Post TiECON quote for clarification: “We’ve been actually very successful in driving mid-tier and low-tier. Part of our business strategy is to see the transition of 2G networks onto 3G and onto 4G. And part of that is getting the cost structure right. So we’ve been, I think, fairly successful in doing that. If you look at our numbers, I think we’re actually adding customers in that area, which is good. Now if you look at the growth of the high-end segments, relative to what it was let’s say a couple of years ago, the growth rate is not as high and it’s also – it is still growing. And technology tends to be very, very important.”

Mohan Gyani in conversation with Qualcomm CEO Steve Mollenkopf at TiECON 2014

A huge gap exists between the amount of data people want to get on their mobile devices and what can be delivered (and stored) economically. Lots of innovation in wireless networks and services will be needed to enable the network to get much of that data moved back and forth (between the network and the device). Innovation at the business model level will also be important here, Steve said. Pricing of services and data by network operators is such an example.

Steve stated that the Internet of Things (IoT) was an extension of Qualcomm’s existing business as it requires both mobile connectivity and wireless LANs (e.g. WiFi, Zigbee, etc). Note that Qualcomm now owns Atheros Communications- a leading WiFi chip maker.

“Qualcomm is building a portfolio of products to enable the Internet of Everything (IoE),” Steve said. “Scale is very important to deliver on the very large surface area that will exist for the IoE/IoT,” he added.

What about “wearables?” “Health monitoring and wireless healthcare in general is a great, but different opportunity for Qualcomm. What’s needed is for the health care industry to fully embrace innovation in the IT industry. The supply chain for wearables is an opportunity.”

In closing, Mollenkopf said what every entrepreneur is told many times, “We need to make mistakes and (quickly) learn from failures.”

Internet of Things (IoT) Track Overview:

The major IoT trends and the disruptive opportunities which they may create were comprehensively covered during the no-nonsense, commercial free, IoT technical sessions on Friday, May 16th. We attended the IoT track, because that area has tremendous potential for use of various communications technologies- both wireless and wireline. It is likely to be adopted by many industry verticals (i.e. market segments). The areas that will be most impacted by IoT include: startup innovation, consumer value and enjoyment, societal benefit, entrepreneurial companies, established device and network vendors, and network/cloud service providers.

Note: Cisco and Qualcomm refer to IoT as the Internet of Everything or IoE.

McKinsey Global Institute’s Disruptive Technologies report calls out the Internet of Things (IoT) as a top disruptive technology trend that will have an impact of as much as $6 Trillion on the world economy by 2025 with 50 billion connected devices! Many are predicting 20 or 25 billion connected devices by 2020.

For sure, IoT will be a huge market, but not monolithic. Each vertical industry will have its own opportunities and challenges. Lack of industry standards, security (business), and privacy (consumer) are the biggest obstacles for IoT to overcome and be successful. These issues must be resolved for IoT to reach it’s promise and potential.

At Cisco Live annual conference, CEO John Chambers said the Internet of Everything (IoE) has changed the way the world looks at data and technology. “The simple concept, as you move forward with IoE, is that you have to get the right information at the right time to the right device to the right person to make the right decision. It sounds simple, but it is very, very difficult to do, and is almost impossible to do …….”

The IoT related sessions at TiECON 2014 included the following:

- Road Through the Cloud to the Internet of Things

- Lightning Round I (of start-up companies)

- IoT Overview

- Infrastructure of IoT

- Connected Things

- Bridging the old with the new

- Proximity’s Role in the Internet of Everything

- Lightning Round II (of start-up companies)

- IoT for the Masses

- Connected Health Comes Alive

- IoT in Business

- The Future of IoT

- The Internet of Things: What Really Matters

- Where are VCs Investing in IoT?

More information on the TiECON 2014 IoT track is at: http://tiecon.org/internet-of-things

Time and space constraints necessitates coverage of only a select few of the above IoT sessions. We’ve picked the one’s that provided new, pertinent information on relevant technologies, markets and barriers to success. They will be covered in part II, which will be posted in a few days.

In the meantime, please comment in the box below the article to express your preferences and/or opinions. Log in with your IEEE web account.

AT&T to Buy DirecTV for $49 Billion, but deal may depend on NFL Sunday Ticket renewal

As rumored for several months, AT&T Inc.agreed to buy satellite TV provider DirecTV for $48.5 billion, or $95 per share. Both companies described the deal as transformational as they seek to take on cable companies and online video providers, delivering content to multiple screens —on living room TVs, PCs, tablets and mobile phones. The takeover was most likely stimulated by Comcast’s pending merger with Time Warner Cable which was proposed in February. AT&T and DirecTV expect the deal to close within 12 months.

With 5.7 million U-verse TV customers and 20.3 million DirecTV customers in the U.S., the combined AT&T-DirecTV entity would serve 26 million customers. That would make it the second-largest pay TV operator behind a combined Comcast-Time Warner Cable, which would serve 30 million subscribers.

“What it does is it gives us the pieces to fulfill a vision we’ve had for a couple of years – the ability to take premium content and deliver it across multiple points: your smartphone, tablet, television or laptop,” AT&T’s Chairman and CEO Randall Stephenson said on a conference call with journalists on May 18th.

However, the proposed acquisition could face unique regulatory scrutiny from the Federal Communications Commission (FCC) and Department of Justice. Unlike the cable company merger, the AT&T-DirecTV deal would effectively cut the number of video providers from four to three for about 25 percent of U.S. households. That’s a situation that could result in higher prices for consumers and usually gives regulators cause for concern.

Stephenson said those concerns would be addressed with a number of what he called “unprecedented” commitments. Among them:

– DirecTV would continue to be offered as a standalone service for three years after the deal’s closing.

– AT&T would offer standalone broadband service for at least three years after closing, so consumers could consume video from Netflix and other online services, with download speeds of at least 6 megabits per second where feasible.

– AT&T would expand high-speed broadband access to 15 million more homes – beyond the 70 million that could now get AT&T service – within four years.

– AT&T vowed to abide by the open Internet order from 2010 that the Federal Communications Commission is now in the process of revising after a court struck it down.

– AT&T vowed to sell its roughly 9 percent stake in Latin American wireless carrier América Móvil for about $5 billion.

“This is going to prove to be a pro-competitive and pro-consumer transaction,” Stephenson said.

The announcement also explicitly emphasizes that the new partners are committed to net neutrality despite all the recent FCC happenings. The two companies will demonstrate “continued commitment for three years after closing to the FCC’s Open Internet protections established in 2010, irrespective of whether the FCC re-establishes such protections for other industry participants following the DC Circuit Court of Appeals vacating those rules.” (These are the rules that were recently struck down and only impact Comcast at the moment due to that company’s previous merger with NBCU.)

Stephenson and DirecTV CEO Michael White both said the merger would allow the combined company to offer video over multiple screens, but acknowledged that deals with content providers to expand service on multiple platforms still need to be negotiated.

AT&T can walk away from this merger if DirecTV isn’t able to renew its prize “Sunday Ticket” offering with the National Football League (NFL) on “substantially…the terms discussed between the parties,” AT&T said in a filing with the Securities and Exchange Commission. DirecTV’s current deal with the NFL expires at the end of the 2014 football season. AT&T said it wouldn’t be able to seek damages if DirecTV fails to renew the deal “so long as DirecTV used its reasonable best efforts to obtain such renewal.”

On a call with analysts Monday morning (May 19th), DirecTV Chief Executive Mike White reiterated that he is “highly confident” DirecTV can renew the deal “before the end of the year.” He noted that both he and AT&T CEO Randall Stephenson met with NFL Commissioner Roger Goodell and New England Patriots owner Robert Kraft to convey “why this transaction is great for the NFL…as well as great for us.”

The proposed merger/acquisition/deal is Mr. Stephenson’s biggest bet so far and is AT&T’s largest acquisition since its 2006 purchase of BellSouth for $85 billion. Mr. Stephenson became CEO in 2007 after his predecessor, Ed Whitacre, took a regional phone company and turned it into a national giant- in effect re-creating the Bell System and negating its divestiture.

As part of the deal, AT&T plans to sell its long-held $6 billion stake in Latin American phone giant America Movil SAB to avoid regulatory conflicts.

Assessment:

Growth is slowing in some markets, like pay TV and wireless subscriptions, and is exploding in others, like streaming video. Last year, pay TV subscribers in the U.S. fell for the first time, dipping 0.1 percent to 94.6 million, according to Leichtman Research Group.

While AT&T and DirecTV are doing better than cable companies at attracting TV subscribers, DirecTV’s growth in the U.S. has stalled while AT&T is growing the fastest of any TV provider. The companies are betting that bigger scale will give them the resources to invest in new capabilities and the leverage to create commercial arrangements in the media world.

AT&T, which has 5.7 million subscribers for its U-Verse TV service, will become a more powerful force in pay TV by joining with the larger DirecTV. Theoretically, as a bigger provider, a combined AT&T – DirecTV could get better rates from companies that license TV programming.

Many Wall Street analysts have questioned whether DirecTV has significant strategic value to AT&T, especially as U.S. wireless competition has picked up with the resurgence of T-Mobile and SoftBank Corp.’s acquisition of Sprint Corp. last year. DirecTV offers neither fixed-line or mobile Internet service, and its rights to airwave frequencies for satellite TV are not the kind that AT&T can use to improve its mobile phone network. Still, Mr. Stephenson has talked exuberantly about how the growth of online video helps boost demand for its Internet and mobile services.

AT&T has started approaching media companies about a potential “over the top” Web video service that would run on wireless broadband connections and serve up TV programming, people familiar with the matter said. Last month, AT&T entered a joint venture with the Chernin Group (media mogul Peter Chernin) to invest in online video services. The company said it is weighing a number of online-video options, including launching niche services or premium on line video streaming products like Netflix offers. In particular, the acquisition raises the prospect that AT&T customers might someday be able to watch TV program episodes or football games over a fast cellular broadband connection without subscribing to a traditional pay-TV service. But developing such offerings may be difficult. Nothing is likely to change in the short term for AT&T or DirecTV customers.

Other Opinions:

John Bergmayer, senior staff attorney with advocacy group Public Knowledge, warned that AT&T will need to demonstrate that new services would offset any harm to the wireless and video markets.

“The industry needs more competition, not more mergers,” he said. “The burden is on AT&T and DirecTV to show otherwise.”

“It just doesn’t make sense to me,” said New Street Research analyst Jonathan Chaplin, who asserts that AT&T would be better off buying Dish Network because of that company’s wireless-spectrum holdings.

Blair Levin, former chief of staff at the Federal Communications Commission and author of its road map for expanding Internet access, said it’s not immediately clear how the deal would impact consumers. While the deal could be perceived as eliminating a competitor in 25% of the country and result in higher prices, DirecTV is a national service and therefore prices may stay in check due to competition in other markets. AT&T will also be able to package wireless-phone service with home-TV subscriptions, which could result in better deals. Mr. Levin said AT&T’s acquisition of DirecTV was likely a response to Comcast’s Time Warner deal.

“Sometimes, deals are driven by hope and opportunity and sometimes they’re driven by fear and locking down customer bases,” Mr. Levin said.

Global optical spending down y-o-y, but up 8% for WDM; 100G takes off in Core+ PON Market report

OPTICAL MARKET HIGHLIGHTS:

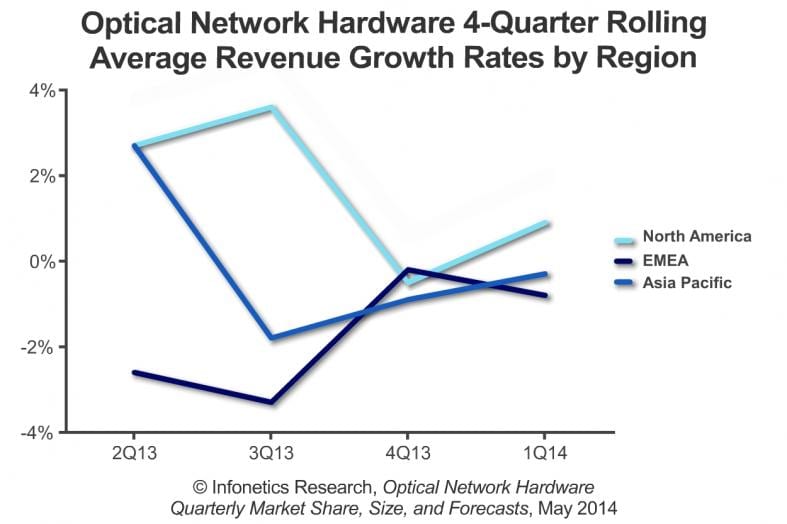

. Global optical spending is down yet again as legacy SONET/SDH continues to slide: Optical network hardware revenue, including WDM and SONET/SDH, declined 2% year-over-year in 1Q14

o On a rolling 4-quarter basis, total optical spending was roughly flat

. The WDM segment notched its 7th straight quarter of year-over-year growth, up 8%

. EMEA experienced a seasonal 4Q to 1Q drop, but this effect is no longer evident in the U.S., a result of large carriers changing spending patterns and smaller carriers operating on a more project-oriented, rather than calendar-oriented, purchasing cycle

. On a year-over-year basis for 1Q14, Huawei’s revenue market share slipped, Ciena’s soared 26%, and Alcatel-Lucent’s lifted 8%

ABOUT THE OPTICAL REPORT:

Infonetics’ quarterly optical hardware report provides worldwide and regional market size, market share, forecasts through 2018, analysis, and trends for metro and long haul SONET/SDH and WDM equipment, Ethernet optical ports, SONET/SDH/POS ports, and WDM ports. Vendors tracked: Adtran, Adva, Alcatel-Lucent, Ciena, Cisco, Coriant, Cyan, ECI, Fujitsu, Huawei, Infinera, NEC, Padtec, Transmode, Tyco Telecom, ZTE, and others.

. Networking ports hit $39 billion; 40G booming in the data center, 100G taking off in the core

. Infinera, Fujitsu, Cisco, Ciena, and Huawei top new optical networking vendor scorecard

. OTN switching is booming; Alcatel-Lucent, Ciena, and Infinera cashing in

. Optical gear spending flat in 4Q13 as North America sags and EMEA surges

“And this revenue is flowing primarily into the hands of five companies: Alcatel-Lucent, Ciena, Cisco, Huawei, and Infinera,” adds Schmitt.

RECENT OPTICAL RESEARCH from Infonetics:

Download Infonetics’ 2014 market research brochure, publication calendar, events brochure, report highlights, tables of contents, and more at http://www.infonetics.com/login.

. Analyst Note: Post-OFC Analysis-Equipment (Apr.)

. Analyst Note: Ericsson-Ciena Deal: P-OTS, SDN & 100G for Routers (Apr.)

. Analyst Note: 100G Market Update-4x Growth in 2013 (Apr.)

. ROADM Components Market Size & Forecasts (May)

. Packet-Optical, MPLS & Control Plane Strategies: Global Service Provider Survey (May)

INFONETICS WEBINARS:

Visit https://www.infonetics.com/infonetics-events to register for upcoming webinars, view recent webinars on demand, or learn about sponsoring a webinar.

. The Role of Service Delivery Platforms in M2M and IoT (May 20: Attend)

. Unlocking Revenues with Carrier Ethernet 2.0 Wholesale E-Access (May 29: Attend)

. How to Get the Best Out of DAS, Small Cells, and WiFi (June 5: Attend)

. Diameter Signaling Control for LTE Networks (June 12: Attend)

. The Roadmap for ROADM Network Expansion (View on-demand)

. 100G in the Metro: When and Where It Will Be Economical (View on-demand)

. Coherent Optics: Cheaper, Better, Faster (July 24: Sponsor)

TO BUY REPORTS, CONTACT:

- N. America (West), Asia Pacific: Larry Howard, [email protected], +1 408-583-3335

- N. America (East, Midwest), L. America: Scott Coyne, [email protected], +1 408-583-3395

- EMEA, India, Singapore: George Stojsavljevic, [email protected], +44 755-488-1623

- Japan, South Korea, China, Taiwan: http://www.infonetics.com/contact.asp

Research and Markets released a related optical networking report today:

Passive Optical Network (PON) Equipment Market – Global Industry Analysis, Size, Share, Growth, Trends And Forecast, 2013 – 2019

Passive optical network (PON) is a point to multipoint telecommunication network. PON is a fiber to home/premises (FFTH/FFTP) architecture which serves multi premises through unpowered optical splitters and a single optical fiber. Optical fiber splitters do not require electricity for signal transmission, which makes it an energy saving technology. The split ratio depends on the structure of the PON used, such as Gigabyte passive optical network (GPON) and Ethernet passive optical network (EPON) among others.

Major market participants profiled in this report include Huawei Technologies Comp. Ltd., Alcatel-Lucent S.A., Calix Inc., ZTE Corp. and Tellabs Inc. among others.

http://www.researchandmarkets.com/research/5h62hk/passive_optical

Sputtering Earnings at Alcatel-Lucent Reflect a Difficult Network Infrastructure Market

Slowing demand for wireless infrastructure products took a toll on first-quarter revenue at Alcatel-Lucent (ALU), but executives remain optimistic that company will regain its footing after a temporary lull — which they also attributed to a companywide restructuring. The company posted a €73 million loss in the first three months of the year, compared with a €353 million loss in the same period in 2013. ALU benefited from continuing cost-cutting, which is expected to total €1 billion by the end of next year. Alcatel-Lucent is undergoing a major restructuring that includes cutting an estimated 10,000 jobs worldwide.

Commenting on the earnings report, ALU CEO Michel Combes said:

“We began 2014 as we ended 2013 — totally focused on driving implementation of The Shift Plan. Having put the Group in the right financial direction last year we are encouraged by the continued progress shown in the first quarter of 2014. This confirms the industrial logic of the strategic choices we have made and provides a good start on which to build during the rest of 2014 as we work towards our objective of bringing the Group as a whole back to positive free cash flow by 2015.”

ALU may have overextended itself by “trying to do too many things,” it will establish a solid competitive foundation by redoubling its efforts in technologies such as ultra-broadband access, virtualization and the cloud.

The company said that “traction around our IP mobile packet core solutions” is particularly strong, and that the 7950 XRS IP Core router attracted four new deals during the quarter, including contracts with cable operators, one of the target markets identified by the CEO.

ALU claims they’ve sustained their strong position in IP edge routing (#2 ranking). Further expansion in IP core, Enhanced Packet Core (EPC) for LTE and data centers took place in 2013. The IP router division (with the above three components) has attained double digit growth the last three years.

Mt View, CA based Nuage Networks- a wholly owned ALU subsidiary- is part of their IP router division. Nuage had three customer wins in 2013 and is involved in 20+ trials. From the earnings call transcripti: “Our Nuage venture kept up momentum and added two new commercial wins during the quarter, including the recently announced Numergy, which brings the total to date to five.”

In the transport equipment business, the network equipment vendor noted that “terrestrial optics recorded its first quarter of year-over-year growth since 2011,” driven by 26 new deals for the 1830 Photonic Service Switch (PSS), while 100G shipments represented 30% of total WDM line cards shipments in the quarter, compared with 19% a year ago. Alcatel-Lucent is also engaged in two new 400G OTN trials, with Ontario Research and Innovation Optical Network (ORION) and Telekom Austria AG (NYSE: TKA; Vienna: TKA).

IP Platforms, which includes the company’s Network Function Virtualization (NFV) and cloud systems, recorded an increase in revenues from IMS (VoLTE), SDM (Subscriber Data Management) and Customer Experience (Motive) systems, but revenues were down due to declining sales of legacy platforms and “portfolio rationalization.”

In the Access business, Alcatel-Lucent says 4G/LTE revenues improved, driven by sales in the US, but 2G and 3G (which combined represent less than 25% of wireless access sales) were down. In fixed access, FTTX and VDSL2 sales are improving, and discussions with operators about the potential of G.fast (vectored DSL) have begun. A decline in legacy system sales countered those gains, though. (SeeTelekom Austria Tests G.fast.)

One of the most important events for Alcatel-Lucent during the first quarter was that it received a binding offer from China Huaxin for 85 percent of its Enterprise business unit, which makes IP telephony and Ethernet switching equipment. The deal values the unit at a!268 million, and is expected to close during the third quarter, Alcatel-Lucent said.

IP routing was the best-performing product category. Revenue from fixed access, wireless access and IP transport products also increased, while managed services struggled. The best-performing region was Asia Pacific, where sales grew by 19 percent, while sales in all other regions dropped.

On May 8th, Japanese wireless network operator NTT DoCoMo announced that Alcatel-Lucent was one of six vendors with which it will conduct experimental trials of emerging “5G” technologies (which have not been standardized yet). NTT doesn’t expect to have a 5G cellular system ready for commercial deployment until 2020, but it’s important for Alcatel-Lucent to get a foot in to secure its long-term prospects.

Alcatel-Lucent wasn’t the only networking equipment vendor that saw its quarter-on-quarter results worsen. It is suffering from the same malaise as other network infrastructure vendors, according to Mark Newman, chief research officer at Informa Telecoms & Media. Investments in wireless networks have trailed off, and because Alcatel-Lucent is in the middle of a reorganization it is more vulnerable than some competitors, Newman said.

Telecom infrastructure companies like ALU as well as Ericsson and Nokia (formerly Nokia-Siemens) are facing competition from fast-growing Chinese rivals like Huawei and ZTE. Those and other Chinese rivals are competing for lucrative contracts, particularly in emerging markets in Latin America and Asia. Network equipment vendors also are struggling to persuade many of their customers, which are primarily the world’s cellphone operators, to buy new networking equipment and increase the sector’s already large debt burden. It is not a pretty picture.

“We expect Alcatel-Lucent to show further improvement in profitability through the course of the year,” analysts at Liberum Capital in London told investors in a research note on Friday, May 9th.

References:

http://www.alcatel-lucent.com/investors/financial-results/q1-2014

http://www1.alcatel-lucent.com/4q2013/pdf/Q4-2013-master-earnings-slides-Feb06-web.pdf;jsessionid=FZJJNNO11MBORLAWFRSHJHFMCYWGQTNS

Network World/IDG News Service (5/9)

Light Reading (5/9), Light Reading (5/8)

Huawei to Invest more in Europe; Wants to be Perceived as a European Company

Huawei Technologies Co.’s chief executive Ren Zhengfei told reporters in London that the Chinese telecommunications-equipment maker plans to increase investment and hiring in Europe as part of an effort to change perceptions of a company he acknowledged has been seen as “mysterious.” Huawei wants to be perceived as more of a “European” company. As part of that directive, Huawei will increase investment in European research and development, and will extend an employee incentive plan to all key non-Chinese employees this year in order to attract and keep top talent, Mr. Ren said.

Ren said: “Right now we should not be expending too much effort in the United States as it might take 10 or 20 years for them to know that Huawei is a company with integrity. We will accelerate efforts in countries that have accepted us.”

Huawei CEO Ren Zhengfei (above) told Reuters:

“Our idea is to make people perceive Huawei as a European company.”

Ren started Huawei in 1987 after retiring from the Chinese military in 1983. Since then, he has built the company into the world’s largest maker of equipment for telecom networks behind Ericsson AB (ERICB), even without access to the U.S. telecommunications market, where Huawei has battled claims the company’s gear may provide opportunity for Chinese intelligence services to tamper with networks for spying. The closely held company has repeatedly denied those allegations, and doesn’t see a public listing as a way of building trust, Ren said.

Huawei has faced allegations in the U.S. that it is a security risk, as well as the threat of an European Union investigation into allegations that China is dumping or subsidizing products pertaining to mobile-telecommunications networks.

“My reluctance to meet with the media has been used as a reason to label Huawei as a mysterious company,” Mr. Ren said through a translator during an interview with Reuters. In a few years, “our idea is to make people perceive Huawei as a European company,” he said.

“By increasing our level of transparency, we still may not be able to address the U.S. government’s concerns,” Ren said. “The reality is that shareholders are greedy and want to squeeze every bit out of the company. Not listing on the stock market is one of the reasons we have overtaken our peers.” By contrast, Huawei’s employee-owned structure, he said, is “part of the reason Huawei could catch up and overtake some of our peers in our industry.”

Huawei grabbed nearly 22% of mobile-network infrastructure spending in Europe, the Middle East and Africa last year, up from just 12% in 2010, according to market-research firm Infonetics. By contrast, in North America, Huawei had only a 2.8% share of that market in 2013—prompting the company to pull back from investments there.

Even as Huawei fights cybersecurity concerns that have restricted access for its network equipment in the U.S. and Australia, the company said last month its sales will rise 77 percent to $70 billion by 2018, from $39.5 billion last year. Ren said the company would continue to increase its research spending, which rose last year to roughly $5 billion, at average 2013 exchange rates, compared with Ericsson’s $4.9 billion.

To reach its revenue target, Huawei is broadening its portfolio with smartphones, tablets and business-computing products, and cloud services. Ericsson, which divested its mobile-device business to focus on network equipment, has reported stalling revenue for two consecutive years. Ren acknowledges that Huawei faces a challenge to convince customers to buy its smartphones amid intense competition.

“There is no way to imitate the growth of Apple and Samsung,” he said. “We will have to work out the way for ourselves. We need to take a step-by-step approach.”

The approach has begun to pay off. Worldwide, the company sold more smartphones last year than any company aside from Samsung Electronics Co. and Apple Inc, as it boosted its share of the global market to 4.9 percent, from 4 percent in 2012, researcher International Data Corp. reported in January. The success has been possible as the company has faced fewer headwinds with consumer products than for its equipment that run mobile networks.

References:

http://www.bloomberg.com/news/2014-05-02/huawei-s-ren-plots-future-outsi…

http://online.wsj.com/news/articles/SB1000142405270230367840457953760327…?

Carrier WiFi Gaining Market Traction as Comcast Expands WiFi Coverage

Infonetics Research released excerpts from its 2014 Carrier WiFi Strategies and Vendor Leadership: Global Service Provider Survey, which explores the drivers, strategies, models, and technology choices that are shaping service provider WiFi deployments.

CARRIER WIFI SURVEY HIGHLIGHTS.

- Respondents have an average of around 32,000 access points currently, growing to just over 44,000 by 2015, representing 33% growth over the next year.

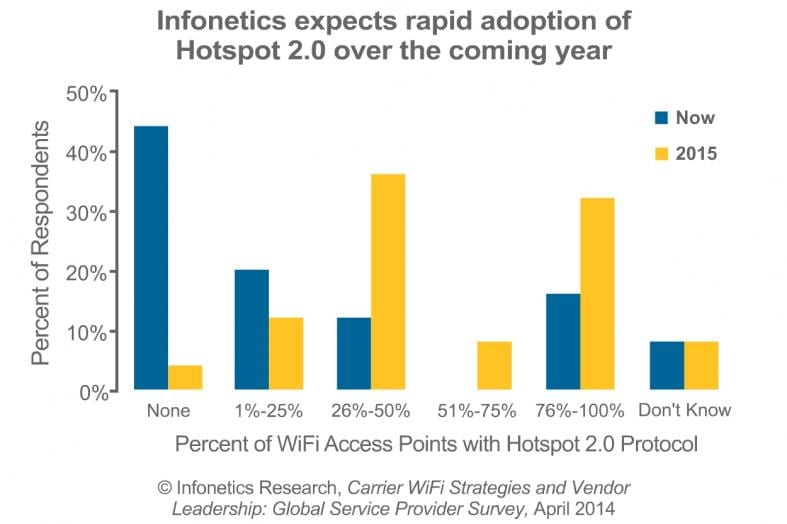

- 40% of Infonetics’ operator respondents expect to integrate Hotspot 2.0 into more than half their access points by the end of 2015.

- Among those surveyed, the top 3 monetization models for WiFi services are pre-pay, bundled with mobile broadband subscription, and tiered hotspots.

- WiFi as a separate overlay network currently leads the list of technologies and architectures for offloading data traffic; meanwhile, more sophisticated carrier WiFi architectures gain gradual traction as respondents look to bring WiFi into the mobile RAN via SIM-based service models or by deploying dual-mode WiFi/small cells.

- Respondents perceive Cisco and Ruckus Wireless as the top carrier WiFi manufacturers for second consecutive year

CARRIER WIFI ANALYST NOTE:

“Carrier WiFi deployments are evolving to deliver the same quality of experience as mobile and fixed-line broadband service environments, and this is driving WiFi networks to become more closely integrated. Hotspot 2.0, a key tool developed by the industry to aid this drive, shows rapid adoption by carriers participating in our latest carrier WiFi survey,” notes Richard Webb, directing analyst for mobile backhaul and small cells at Infonetics Research.

Webb adds: “Operators are betting pretty big on carrier WiFi, but they’re also keen to develop ways of monetizing services so that WiFi starts to pay for itself over the coming years. WiFi roaming and location-based services are examples of customer plans that are growing fast.”

CARRIER WIFI SURVEY SYNOPSIS:

For its 43-page WiFi strategies survey, Infonetics interviewed independent wireless, incumbent, competitive, and cable operators in Europe, Asia Pacific, the Middle East and Africa, North America, and Latin America that that have deployed WiFi in the public domain (or will soon). The report provides insights into carrier WiFi deployment drivers and locations; access point standards, form factors, features, ranges, and backhaul connections; hotspots; mobile data offload; service delivery models and challenges; customer plans; and opinions of WiFi equipment manufacturers. Vendors named in the survey include Alcatel-Lucent, Aruba Networks, Cisco, Ericsson/BelAir, Guoren, HP, Huawei, Motorola, NSN, Ruckus Wireless, Zhidakang, Xirrus, ZTE, and others.

To buy the report, contact Infonetics: http://www.infonetics.com/contact.asp

INDOOR WIRELESS SOLUTIONS WEBINAR AND FREE REPORT:

Join analyst Richard Webb May 6 at 11:00 EDT for Indoor Wireless Solutions: Technologies, Challenges and Backhaul, which compares picocells, metrocells, WiFi, DAS, and repeaters. Registrants receives a special Small Cells Market Report. Attend live or access the replay:

http://w.on24.com/r.htm?e=775881&s=1&k=4FBF544ACB6D1CB5462A6279E79E7A75

Separately, Comcast aims to expand its WiFi footprint to a whopping 8 million hotspots by the end of the year, far more than any other wireless provider. The largest MSO in the U.S. will focus on three different types of locations — outdoor public areas, business facilities, and neighborhood hotspots in private homes. The vast majority of hotspots will be added in customer homes, where the cabler is now installing access points with a second, public SSID signal on the new WiFi-enabled data gateways that it’s deploying throughout the nation.

http://www.lightreading.com/cable-video/cable-wi-fi/comcast-whips-up-mor…?

Infonetics: Small cell market on track to increase 65% in 2014; ABI + Res&Mkts + Mobile Experts predict healthy growth

Infonetics Research released excerpts from its latest Small Cell Equipment market size and forecast report, which tracks 3G microcells, picocells, and metrocells and LTE mini eNodeBs and metrocells.

SMALL CELL MARKET HIGHLIGHTS:

. As mobile operators have to approach a “critical mass” of data traffic before small cells even become a consideration, it is the developed countries (Japan, South Korea, the UK and US) that are driving early adoption

. 642,000 small cell units shipped in 2013, a 143% spike from 2012; over half of these units are of the 3G variety

. However, starting this year, 4G metrocells will close the gap with 3G, becoming the main growth engine

. Backhaul is no longer a major inhibitor to small cell deployment, but it will remain an issue for some mobile operators due to the locations in which they operate

. 5G is coming, fully loaded with small cells: NTT DOCOMO in Japan plans to have 5G commercially available in 2020, in time for the Tokyo Olympics

ANALYST NOTES:

“As we anticipated, the great small cell ramp did not happen in 2013 as many in the industry had hoped. Testing activity remained solid, but actual deployments were modest. Small cell revenue was just $771 million last year, a sharp contrast to the $24 billion 2G/3G RAN market,” reports Stéphane Téral, principal analyst for mobile infrastructure and carrier economics at Infonetics Research.

Richard Webb, directing analyst for mobile backhaul and small cells at Infonetics and co-author of the report, adds: “Nevertheless, the need to enhance existing saturated macrocellular networks that are struggling to maintain a decent mobile broadband experience, as well as to add capacity to existing LTE networks, is bringing some fuel to our forecast and, consequently, we expect the small cell market to grow 65% by year’s end, when it will reach $1.3 billion.”

ABOUT INFONETICS’ SMALL CELL REPORT:

Infonetics’ biannual small cell report provides worldwide and regional market size, forecasts through 2018, analysis, and trends for 3G microcells, picocells, and metrocells and LTE mini eNodeB and metrocells. The report also includes a small cell strategies tracker. Vendors tracked: Airspan, Airvana, Alcatel-Lucent, Argela, Contela, Ericsson, Huawei, ip.access, Juni, NEC, NSN, Samsung, SK Telesys, SpiderCloud, Ubiquisys, ZTE, and others.

To buy the report, contact Infonetics at:

http://www.infonetics.com/contact.asp

In late March 2014, ABI Research’s report on Outdoor Small Cells forecast a healthy 2014 growth in equipment revenue at a year-on-year rate of 33% to $1.8 billion. This growth comes thanks to operators like AT&T, Verizon, Vodafone, Telefonica, Softbank, SK Telecom, and Sprint driving shipments of both outdoor and Metrocell deployments.

“As mobile network operators implement small cell outdoor networks, several success factors emerge as critical for a successful deployment,” says Nick Marshall, principal analyst at ABI Research. “We see multiple solutions for backhaul, power, permitting, and siting employed by the operator community throughout the rest of 2014 and which will increase small cell momentum in 2015.”

In 2014, 4G small cells are the fastest growing small cell type in the market driven by venue and dense urban deployments. ABI Research forecasts the number of LTE small cells to grow by 2X in 2014 and by a similar factor each year through 2019 where the value of LTE small cells will reach more than half of a $10 billion equipment market.

https://www.abiresearch.com/press/small-cells-market-healthy-as-2014-dep…

Meanwhile, Research and Markets forecast the Global Wi-Fi-Enabled Small Cell market to grow at a CAGR of 185 percent over the period 2013-2018. One of the key factors contributing to this market growth is the increasing densification of the subscribers’ base. The Global Wi-Fi-Enabled Small Cell market has also been witnessing the increasing adoption of Hotspot 2.0 standard. However, the interference issues could pose a challenge to the growth of this market.

The report, the Global Wi-Fi-Enabled Small Cell Market 2014-2018, has been prepared based on an in-depth market analysis with inputs from industry experts. The report covers the Americas, and the APAC and EMEA regions; it also covers the Global Wi-Fi-Enabled Small Cell market landscape and its growth prospects in the coming years. The report also includes a discussion of the key vendors operating in this market.

The key purpose of all non-macrocell solutions in a telecom network is to address the inexorable demand for coverage and capacity. Such solutions include small cells, Wi-Fi, DAS, and the emerging CRAN. While the first three solutions have been in the market for a while, the CRAN is a relatively new architecture which, like DAS, concentrates the processing of the RAN of a mobile network in one or more centralized network nodes.

http://www.researchandmarkets.com/research/drnpw3/global

On April 1, 2014, Mobile Experts released a 94-page market study today, which provides detailed analysis of Small Cells and Low Power Base Stations. In this market study, deep insights are revealed to illustrate how the mobile infrastructure market is changing to address a need for concentrated mobile traffic in multiple scenarios.

Joe Madden, Principal Analyst at Mobile Experts explained, “During 2013, the deployment of 200,000 small cells in Asia has validated the accuracy of our forecasting over the past five years. This year, we’ve added revenue analysis and more quantitative ‘trigger points’ into our forecast based on real-world examples in Korea.”

The 94-page market study includes analysis on multiple types of Small Cells, and also for small base stations (often called microcells or picocells) which utilize a traditional RAN architecture. In addition, the study includes detailed analysis of Low Power Remote Radio Head applications, which are expected to enable Cloud RAN (C-RAN) functionality in the indoor environment.

http://mobile-experts.net/manuals/mexp-smallcell-14%20toc.pdf

AT&T Earnings Unchanged, Revenues Grow: G bit Internet Access may be Offered in Many New Metro Areas

On April 22nd, AT&T reported that its first-quarter earnings were unchanged from the first three months of last year, but revenue grew as the wireless business added 1,062,000 wireless subscribers in the quarter. That includes 625,000 smartphones and tablets in “post-paid” plans. Wireless service revenue grew 2 percent to $15.4 billion. Total wireless revenue, including phones and tablets sales, grew 7 percent to $17.9 billion.

First-quarter net income was $3.7 billion, or 70 cents per share, compared with $3.7 billion, or 67 cents, a year earlier, when AT&T had more shares outstanding. Adjusting for one-time items, including costs related to its March acquisition of Leap Wireless, income was 71 cents per share, compared with 64 cents in the same period last year. Analysts expected 70 cents. Revenue grew 4 percent to $32.5 billion, better than the $32.4 billion analysts expected, according to FactSet.

“Customers really like the new mobility value proposition and are choosing to move off device subsidies to simpler pricing while at the same time, they are continuing to move to smartphones with larger data plans,” AT&T CEO Randall Stephenson said in a statement.

In the landline business, revenue fell 0.4 percent to $14.6 billion. But its newer U-verse phone, TV and Internet service experienced solid growth. AT&T had 634,000 additional high-speed Internet subscribers and 201,000 TV subscribers.

http://about.att.com/story/att_first_quarter_earnings_2014.html

The company plans a major expansion of it’s newly announced gigabit Internet service.

AT&T says it is ready to offer its fiber-based GigaPower in many more cities, and has opened negotiations with more than 20 municipalities to discuss the viability of fiber to the home for its high-speed U-verse triple play service platform. The proposed expansion, a component of the carrier’s Project Velocity IP initiative, could see the delivery of 1 Gbps fiber-to-the-home service in a number of major metropolitan areas including Chicago, Los Angeles and San Francisco. Most of those new markets are currently served by Comcast and Time Warner Cable (which have agreed to merge). AT&T will only build out U-verse fiber to the home where it sees sufficient demand and a decent ROI.

AT&T executives have told investors recently that the deal has led them to recalibrate their priorities, prompting a more aggressive upgrade of their network. Lori Lee, Sr Executive VP of AT&T Home Solutions, said in a WSJ interview that the move would make AT&T a tougher competitor for the cable industry.

Earlier this month, AT&T said it was in advanced talk to bring speeds of up to one gigabit per second to six North Carolina cities, in addition to its current upgrading of Austin and plans for a similar service in Dallas.

The rollout is happening as Google builds up its own network of fiber in cities like Austin and Kansas City, Kans. In February, Google said it was eyeing dozens of municipalities where it wanted to expand its fiber network.

AT&T said Monday (April 21st) that it is looking to bring its higher speed service to Kansas City and the surrounding area, which was Google’s first location for its fiber service.

AT&T said the upgrades will fall under its planned spending to upgrade the bulk of its network to run on Internet technologies and won’t affect its 2014 budget.

The new cities are mostly ones where AT&T already offers its U-verse Internet and television services. AT&T has built a fiber-based network for the U-verse service, but typically uses copper wire to make the final connections to buildings.

http://online.wsj.com/news/articles/SB10001424052702304049904579515790508491128?

AT&T has already begun to roll out GigaPower in pockets of Austin, Texas, starting off with a 300 Austin, Texas, starting off with symmetrical speeds, and expecting to upgrade that to 1 Gbps by mid-2014. AT&T has previously announced plans to roll GigaPower to Dallas this summer and that it is in “advanced discussions” with the North Carolina Next Generation Network (NCNGN) to bring GigaPower to six cities in North Carolina, including Raleigh-Durham and Winston-Salem.

Here’s an updated list of current and potential AT&T U-verse GigaPower markets, and the incumbent cable operator that serves each market:

- Atlanta, Ga. (Alpharetta, Atlanta, Decatur, Duluth, Lawrenceville, Lithonia, McDonough, Marietta, Newnan, Norcross, and Woodstock). Incumbent MSO: Comcast

- Augusta, Ga. Incumbent MSO: Comcast

- Austin, Texas. Incumbent MSO: Time Warner Cable

- Charlotte, N.C. (Charlotte, Gastonia, and Huntersville). Incumbent MSO: TWC.

- Chicago, Ill. (Chicago, Des Plaines, Glenview, Lombard, Mount Prospect, Naperville, Park Ridge, Skokie, and Wheaton). Incumbent MSO: Comcast

- Cleveland, Ohio (Akron, Barberton, Bedford, Canton, Cleveland, and Massillon). Incumbent MSOs: TWC and MCTV.

- Dallas, Texas (Dallas, Farmer’s Branch, Frisco, Grand Prairie, Highland Park, Irving, Mesquite, Plano, Richardson, and University Park). Incumbent MSO: TWC.

- Fort Lauderdale, Fla. Incumbent MSO: Comcast.

- Fort Worth, Texas (Arlington, Euless, Fort Worth, and Haltom City). Incumbent MSOs: TWC and Charter Communications.

- Greensboro, N.C. Incumbent MSO: TWC.

- Jacksonville/St. Augustine, Fla. Incumbent MSO: Comcast.

- Houston, Texas (Galveston, Houston, Katy, Pasadena, Pearland, and Spring). Incumbent MSO: Comcast.

- Kansas City, Mo./Kan. (Independence, Kansas City, Leawood, Overland Park, and Shawnee). Incumbent providers: TWC, Comcast, SureWest, and Google Fiber (portions).

- Los Angeles, Calif. Incumbent MSO: TWC.

- Miami, Fla. (Hialeah, Hollywood, Homestead, Miami, Opa-Locka and Pompano Beach). Incumbent MSO: Comcast.

- Nashville, Tenn. (Clarksville, Franklin, Murfreesboro, Nashville, Smyrna and Spring Hill). Incumbent MSO: Comcast.

- Oakland, Calif. Incumbent MSO: Comcast.

- Orlando, Fla. (Melbourne, Oviedo, Orlando, Palm Coast, Rockledge, and Sanford). Incumbent MSO: Bright House Networks.

- Raleigh, Durham, N.C. (Apex, Garner, Morrisville, Carrboro, Chapel Hill, Durham, Raleigh). Incumbent MSO: TWC.

- St. Louis, Mo. (Chesterfield, Edwardsville, Florissant, Granite City, and St. Louis). Incumbent MSO: Charter.

- San Antonio, Texas. Incumbent MSO: TWC.

- San Diego, Calif. Incumbent MSO: Cox Communications.

- San Francisco, Calif. Incumbent MSO: Comcast.

- San Jose, Calif. (Campbell, Cupertino, Mountain View, and San Jose). Incumbent MSO: Comcast.

- Winston-Salem, N.C. Incumbent MSO: TWC.

Craig Moffett, senior research analyst at Moffet Nathanson Research, said in a recent research note that AT&T could be on the cusp of a grander GigaPower buildout plan that would help Google achieve its ambitions of nudging ISPs to beef up broadband capacity, but “on AT&T’s dime.”

See more at:

http://www.multichannel.com/blog/bauminator/google-fiber-fever/373793

Verizon brings 100G to U.S. Metro & Regional Areas

Verizon Communications (VZ) is rolling out 100G technology on select high-traffic metropolitan and regional networks in the U.S. The telco is implementing Fujitsu’s FLASHWAVE 9500 platform and the Tellabs+ 7100 system in its metro networks. Verizon will target metro areas where “traffic demand is highest,” the company said. It did not identify which markets will see the deployments.

“Metro deployment of 100G technology is the natural progression of Verizon’s aggressive deployment of 100G technology in its long-haul network,” said Lee Hicks, vice president of Verizon Network Planning. “It’s time to gain the same efficiencies in the metro network that we have in the long-haul network. By taking the long view, we’re staying ahead of network needs and customer demands as well as preparing for next-generation services.”

Verizon says the benefits of 100G scalability are especially relevant for signal performance, which is improved by using a single 100G wavelength as opposed to aggregating 10-10G wavelengths. Also, less space and reduced power requirements are needed to support 100G technology, compared with traditional 10G technology, so fewer pieces of equipment are needed to carry the same amount of traffic.

Verizon claims it’s been a leader in 100G technology and we tend to agree. Beginning in November 2007, the company successfully completed the industry’s first field trial of 100G optical traffic on a live system. Verizon currently has 39,000 miles of 100G technology deployed on its global IP network.

+ In Dec 2013, Tellabs was acquired by Marlin Equity Partners for $891 Million in cash (compare that to Google paying $19B for WhatsApp). http://www.tellabs.com/news/2013/marlin-completes-acquisition.pdf

References:

http://newscenter.verizon.com/corporate/news-articles/2014/04-15-100g-te…

http://www.channelpartnersonline.com/news/2014/04/verizon-unleashes-100g…

Infonetics: VoIP and Unified Communications to grow to $88 billion market by 2018

Infonetics Research released excerpts from its 2014 VoIP and UC Services and Subscribers report, which tracks service providers and their voice over IP (VoIP) and unified communications (UC) services revenue and subscribers.

VOIP AND UC SERVICES MARKET HIGHLIGHTS:

. The global business and residential VoIP services market grew 8% in 2013 from 2012,

to $68 billion

. SIP trunking shot up 50% in 2013 from the prior year, driven predominantly by activity in North America; EMEA is expected to be a strong contributor in 2014

. Sales of hosted PBX and unified communication (UC) services rose 13% in 2013 over 2012, and seats grew 35% due to continued demand for enterprise cloud-based services

. Global residential VoIP subscribers totaled 212 million in 2013, up 8% year-over-year

. Managed services are benefitting from the continued adoption of IP PBXs: Roughly 10%-20% of new IP PBX lines sold are part of a managed service or outsourced contract

. Infonetics expects continued strong worldwide growth in VoIP services revenue through 2018, when it will reach $88 billion

RELATED REPORT EXCERPTS:

. Infonetics’ April Voice, Video, and UC research brief: http://bit.ly/1iDYtXO

. Videoconferencing and collaboration show strongest growth among UC apps

. Carrier VoIP and IMS market gains 30%; Huawei, ALU, Ericsson, NSN ride the VoLTE wave

. Enterprise SBC market grew 42% in 2013

. Mergers and buyouts stir enterprise telephony market; UC revenue climbs 31% in 2013

. Exploding mobile device traffic, acquisitions heat up Diameter signaling controller market

“Business VoIP services have moved well beyond early stages to mainstream, strengthened by the growing adoption of SIP trunking and cloud services worldwide. Hosted unified communications are seeing strong interest up market as mid-market and larger enterprises evaluate and move more applications to the cloud, and this is positively impacting the market,” notes Diane Myers, principal analyst for VoIP, UC, and IMS at Infonetics Research.

VoIP AND UC REPORT SYNOPSIS:

Infonetics’ annual VoIP and unified communications report provides worldwide and regional market share, market size, forecasts through 2018, analysis, and trends for residential and business VoIP and UC services and subscribers. The report also includes a Hosted PBX/UC Tracker highlighting deployments by service provider, region, and vendor platform. Residential VoIP providers in the report include AT&T, Cablevision, Charter, Comcast, Cox, Embratel, Iliad, J:Com, Kabel Deutschland, KDDI, KPN, KT, LG Uplus, Liberty Global, NTT, ONO, Orange, Rogers, SFR, Shaw Communications, SK Broadband, Sky, SoftBank, TalkTalk, Telecom Italia, Time Warner Cable, Verizon, Vonage, and others.

To buy the report, contact Infonetics: http://www.infonetics.com/contact.asp

Related Article:

VoIP, The PSTN Killer, Won’t Kill Local Loops

- Many carrier frequencies on a pair. Orthogonal Frequency Division Multiplexing (OFDM) put hundreds of virtual modems in parallel, each on its own carrier frequency, over one wire pair.

- More efficient coding. How a bit appears on the wire changed from simple on/off signals (T-1) to 4-level signals (ISDN), to adding a phase change (quadrature coding in modems). The number of bits per baud (how many bits each digital symbol conveys) went from 1 to 64 and may go higher.

- Improved signal-to-noise (SNR) ratio. Echo canceling, first applied to voice, does wonders for data too.

- Interference canceling. The latest is highly adaptive “vectoring” among all the pairs in a cable.

Related Webinar: IMS IN THE CLOUD WITH NFV:

Join analyst Diane Myers April 16 for Deploying IMS in the Cloud with NFV, a live event that investigates the benefits of using IMS to leverage the cloud to achieve network scalability, cost, and flexibility, as well as how network functions virtualization (NFV) enables innovation:

http://w.on24.com/r.htm?e=763407&s=1&k=6DD532531DA28F11FF4CCCE20A63DBDE