AT&T Internet Air

AT&T’s fiber business grows along with FWA “Internet Air” in Q4-2023

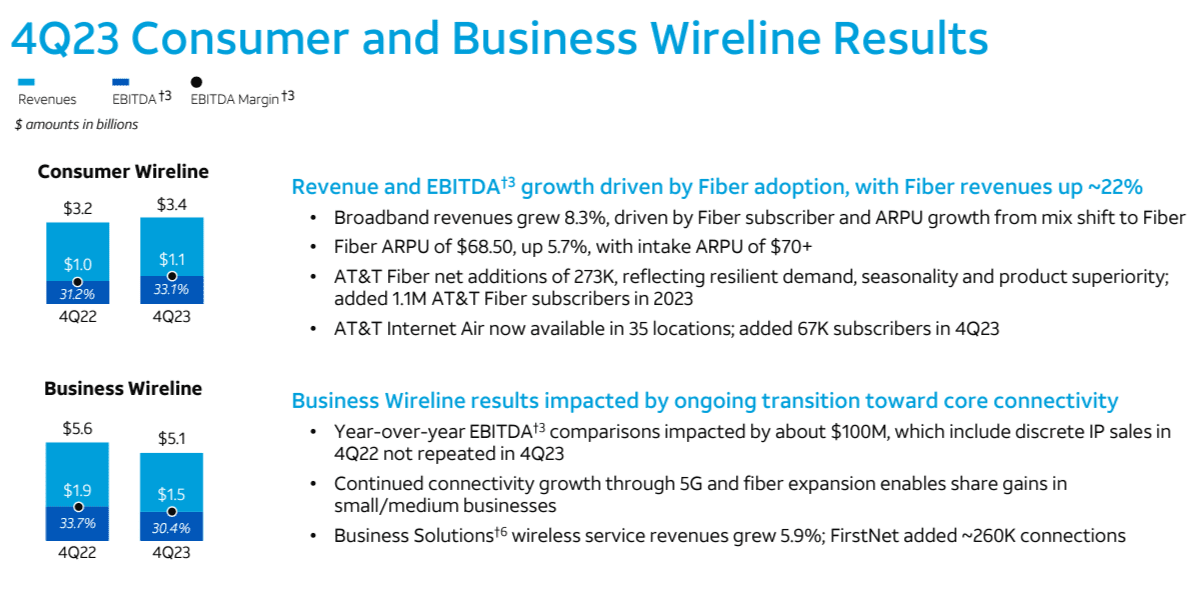

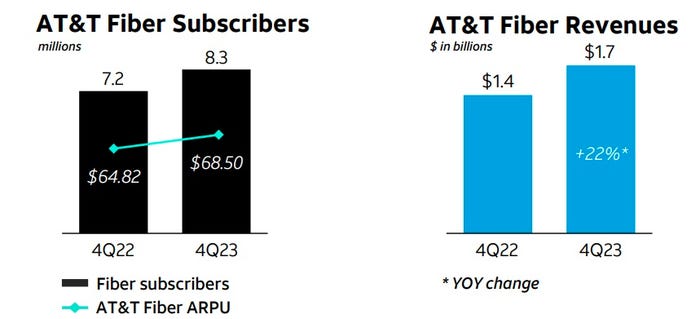

AT&T added 273,000 residential fiber subs in Q4, down slightly from year-ago adds of +280,000 and a gain of +296,000 in the prior quarter. AT&T ended 2023 with 8.3 million fiber subs. The U.S. based carrier added about 400,000 fiber locations in Q4, extending that reach to 21.1 million. AT&T remains committed to expanding its fiber-to-the-premises (FTTP) footprint to 30 million locations by 2025, Stankey said.

Fiber-related revenues hit $1.67 billion, up from $1.37 billion in the year-ago quarter. Fiber average revenue per user (ARPU) reached $68.50, up from $64.82 a year earlier.

AT&T says it has the nation’s largest fiber network, which now passes 26 million+ consumer and business locations; on track to pass 30 million+ locations with fiber by the end of 2025.

…………………………………………………………………………………………………………………

AT&T’s new fixed wireless access (FWA) service dubbed “Internet Air” gained ground in the fourth quarter of 2023. Internet Air added 67,000 subscribers in Q4 of 2023, extending its total to 93,000. Those quarterly FWA subscriber additions were a “surprise,” New Street Research analyst Jonathan Chaplin said in a research note issued after AT&T posted earnings. Yet they are way below Verizon’s FWA numbers which came in at 375,000 FWA subs added in the Q4 of 2023.

However, AT&T’s FWA offering will remain a limited and targeted product in the operator’s home broadband arsenal. “I don’t expect that we are going to be pushing the [Internet Air] product the same way that some others in the market are pushing it today,” AT&T CEO John Stankey said on today’s earnings call. “We made a conscious choice as a company that we want to dedicate capital to invest in fiber, which we believe is a more sustainable long-term means to deal with stationary and fixed broadband needs.”

AT&T will continue to use Internet Air on a selective basis, relying on it as an alternative for customers transitioning off of the telco’s aging copper plant, in pockets of some markets where AT&T offers fiber service, as well as markets where AT&T has no existing wireline business.

……………………………………………………………………………………………………………………….

AT&T claims it has the largest and most reliable wireless network in North America. Its mid-band 5G spectrum now covers 210 million+ people, achieving its end-of-year targets. It expects wireless service revenue growth in the 3% range for 2024.

Stankey said 2024 will be the “proving year” for the Gigapower joint venture with BlackRock that will initially bring open access fiber networks to about 1.5 million locations outside of AT&T’s legacy wireline footprint. Initial Gigapower markets include Las Vegas, three cities in Arizona (Mesa, Chandler and Gilbert), parts of northeastern Pennsylvania (including Wilkes-Barre and Scranton) and segments of Alabama and Florida.

AT&T also said that it now has a FirstNet customer base consisting of more than 5.5 million connections.

“We accomplished exactly what we said we would in 2023, delivering sustainable growth and consistent business performance, resulting in full-year free cash flow of $16.8 billion, ahead of our raised guidance. As we advance our lead in converged connectivity, we will continue to scale our best-in-class 5G and fiber networks to meet customers’ growing demand for seamless, ubiquitous broadband, and drive durable growth for shareholders,” said CEO John Stankey.

References:

https://about.att.com/story/2024/q4-earnings-2023.html

https://edge.media-server.com/mmc/p/keicd3et/ (4Q 2023 earnings call)

https://investors.att.com/news-and-events/events-and-presentations

https://www.lightreading.com/fixed-wireless-access/at-t-nears-100k-internet-air-subs

AT&T and BlackRock’s Gigapower fiber JV may alter the U.S. broadband landscape

Telecom layoffs continue unabated as AT&T leads the pack – a growth engine with only 1% YoY growth?

NTT advert in WSJ: Why O-RAN Will Change Everything; AT&T selects Ericsson for its O-RAN