Telecom layoffs continue unabated as AT&T leads the pack – a growth engine with only 1% YoY growth?

As we have repeatedly stated, the entire telecom industry is in a funk and the 2024 outlook is looks just as gloomy as this year. MTN claims that telecom is a zero growth industry (see References below) and that certainly seems to be true. Let’s start with AT&T – the largest telco in the U.S. with 229.2M wireless subscribers as of Q2-2022.

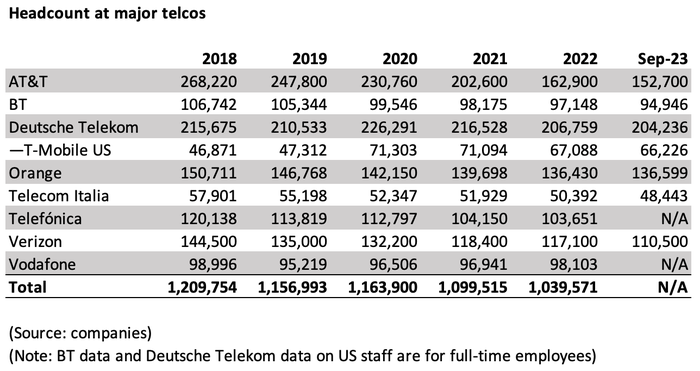

In the first nine months of 2023, AT&T has shed 10,200 employees, including nearly 4,000 in the recent third quarter alone. AT&T cut many more jobs – 39,700 in total – in 2022 when it was in the process of spinning out Warner Media to Warner Brothers Discovery (the deal closed on April 8, 2022).

AT&T’s CEO told reporters last week that the U.S. based teclo plans to reduce costs by another $2 billion over the next three years. That’s after Stankey boasted that the company has cut costs by $6 billion in the last three and in an “inflationary environment.”

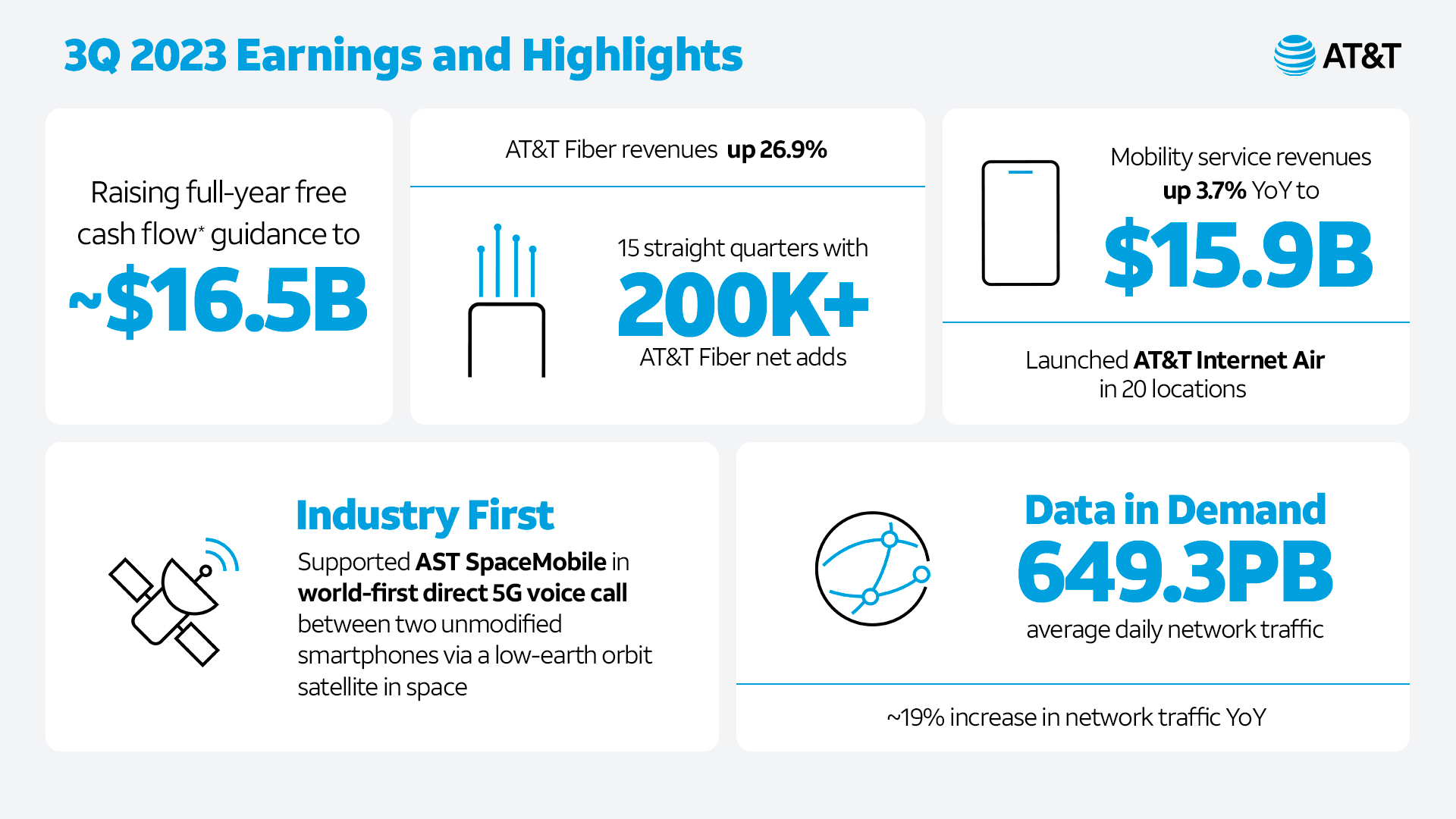

AT&T is hardly a growth company and has tons of debt. In the 3rd quarter of 2023, AT&T reported revenues of $30.4 billion, up only 1% year over year. Yet Stankey had the audacity to say in a press release, “Our investments in best-in-class 5G and fiber connectivity are fueling our growth engine. We’re gaining profitable customer relationships and becoming more efficient. This is powering our strong business performance.”

Today, LightReading announced the departure of a key AT&T executive. Jason Inskeep, previously the senior assistant VP for AT&T’s 5G Center of Excellence and focusing on the operator’s work in private wireless networking and edge computing, recently left the company for a senior director position at consulting firm Slalom.

Iain Morris of LightReading wrote on October 20th, “The future AT&T is conceivably a cohort of antenna-carrying robots, some AI that writes code and Stankey with his feet up on the table, providing the only whiff of humanity.”

AT&T is not the only U.S. telco reducing its workforce. Earlier this year, T-Mobile announced that it will be laying off ~5,000 workers or around 7% of its workforce. This latest job cutting move will primarily impact employees in corporate, back-office, and technology roles, while those in retail or customer care positions will not be affected.

……………………………………………………………………………………………………………………………….

Network Equipment Vendors Layoffs and Gloomy Outlook:

Last week, Nokia said the company plans to cut at least 9,000 jobs and as many as 14,000 over the next three years. That’s mainly due to weak 5G equipment demand. Nokia CEO Pekka Lundmark told reporters that Nokia’s sales have plummeted in North America (sales were down 40%) and that India’s 5G rollout is now slowing down as expected.

Over the next three years, his latest target is to reduce annual costs by between €800 million (US$843 million) and €1.2 billion ($1.3 billion). It’s a move that will reduce Nokia’s headcount by at least 9,000 roles from its current level of roughly 86,000. And at the upper end of the range, it will see an exodus of 14,000 employees, more than 16% of the total.

Ericsson CEO Borje Ekholm cautioned of persistent macroeconomic uncertainty into 2024 which it expects will impact customers’ investment ability, as the wireless network equipment vendor reported a year-on-year net loss of SEK30.5 billion ($2.8 billion) from net income of SEK5.4 billion in Q2 2022, due to a SEK32 billion charge related to the acquisition of cloud company Vonage in 2022. In February, Reuters reported that Ericsson will lay off 8,500 employees globally as part of its plan to cut costs, a memo sent to employees.

……………………………………………………………………………………………………………………..

Semiconductor Layoffs:

Wireless network chip maker Qualcomm is slashing 1,258 jobs in California, including nearly 200 in the Bay Area, in the latest tech layoffs to hit the region. Qualcomm said in state filings that it will lay off approximately 194 workers in its Santa Clara offices and another 1,094 employees at its San Diego headquarters. The cuts are slated to begin Dec. 13th, based on a notice submitted to state officials this week. The job cuts represent roughly 2.5% of Qualcomm’s workforce and mark the second round of layoffs for the wireless semiconductor company this year.

The Qualcomm layoff news comes about a month after the company announced a deal with Apple to provide 5G chips through at least 2026. Qualcomm is also the chip supplier for the newly announced Meta Quest 3. It is only 1 of 2 companies that sell 5G end point silicon on the merchant market (Taiwan based MediaTek is the other one).

It’s not a pretty picture to say the least for telecom industry employees.

References:

https://www.lightreading.com/ai-machine-learning/at-t-seems-on-a-mission-to-be-a-zero-employee-telco

https://www.lightreading.com/private-networks/at-t-s-private-wireless-chief-departs

https://about.att.com/story/2023/q3-earnings.html

Inside AT&T’s newly expanded $8 billion cost-reduction program & huge layoffs

High Tech Layoffs Explained: The End of the Free Money Party

MTN Consulting’s Network Operator Forecast Through 2027: “Telecom is essentially a zero-growth industry”

3 thoughts on “Telecom layoffs continue unabated as AT&T leads the pack – a growth engine with only 1% YoY growth?”

Comments are closed.

Lumen to cut 4% of employees, dial back fiber buildout pace: Amid a layoff of about 1,200 employees, Lumen also struck a deal with creditors that will commit $1.2 billion of new financing that Lumen will use to fuel its turnaround plan. The the reorg, plus other “optimization initiatives,” will save Lumen about $300 million per year.

Lumen expects to have its reorg “substantially completed” by the fourth quarter of 2023 and incur severance and related costs in the range of $55 million to $65 million, according to a 10-Q filing.

https://www.lightreading.com/finance/lumen-to-cut-4-of-employees-dial-back-fiber-buildout-pace

Nov 10, 2023 from Light Reading:

BT cut nearly 7,000 jobs, including contractors, between July and September this year, a fact little noticed by the mainstream press. The drop represents about 5% of its entire workforce. CEO Philip Jansen, due to be replaced at the start of next year, reckons BT can eliminate 55,000 jobs altogether by 2030. AI will claim about 10,000 of those, he previously told journalists.

Even before AI takes root, big telcos are hemorrhaging staff. Deutsche Telekom, Europe’s biggest, cut another 2,500 jobs in the recent third quarter and warned that nearly 7% of jobs at its T-Mobile US subsidiary – which employed exactly 66,226 people in September, according to its report – would be laid off in the next three quarters. Telecom Italia has cut about 2,000, or 4% of the total, since the start of the year. Vodafone, which had an average of 98,103 full-time employees in its last fiscal year (ending in March), aims to cut 11,000.

It is much, much worse in the US, where staff can be dismissed at a day’s notice and social safety nets are threadbare (it’s a progressive country, apparently). AT&T has cut more than 10,000 jobs this year, 6% of its total. Verizon has dispensed with 6,600, also 6%. A planned reduction of 7% at T-Mobile US would equate to roughly 5,000 jobs, including staff who aren’t full time, and follow the 4,000 cuts that happened last year. Charlie Ergen’s Dish Network, which discovered terrestrial mobile networks about 20 years too late, says hefty layoffs are coming.

AT&T, astonishingly, has shrunk by more than 115,000 employees in less than five years. France’s Orange has shed 14,000 jobs over the same period, about 9% of the total. Spain’s Telefónica employs 16,500 fewer people than it did at the end of 2018, when it had about 120,000 on its books.

The cloud could exact a further toll on telco staff. Operators like BT and Deutsche Telekom are holding out with efforts to build their own clouds for telco workloads. Others are inviting hyperscalers or technology specialists to do it for them. In that scenario, parts of an operator’s network could move into a highly automated public cloud facility. If government rules or service requirements make that tricky, hyperscalers are now offering to bring their hardware and software into a telco’s own facilities and effectively take charge. Operators would no longer need their own staff to manage and update those resources. A company like AWS could theoretically do this for dozens of telcos.

The current crop of “generative AI” is arguably not intelligent at all – just a very sophisticated pattern-recognition system that speed checks what humans have already produced and then churnalizes it like a lazy, unthinking reporter (we’ve all been there). Its bizarre hallucinations and cock-ups prove it does not even have a childlike understanding of what it is doing. Genuine AI would tick that box, and it is purely science fiction.

Yet people are struggling to tell the difference. Buying into the AI hype, organizations are clambering over themselves to use technologies produced and ultimately controled by a small number of Internet billionaires. And while these might not be intelligent, they are extremely complex and potentially dangerous systems that hardly anyone understands. This complexity, moreover, is increasingly hidden from view with phenomena such as “low code, no code” programming. Engineers can use Microsoft’s GitHub Copilot to write software. Intent-based networking means specifying an outcome and letting bots do the hard part.

As the telco workforce shrinks and the original innovators retire or die, the upshot is there are fewer people around who know how those systems really work. This might be acceptable if there were a benign, trustworthy and infallible AI to look after them. The likes of ChatGPT, Llama and Anthropic hardly qualify.

https://www.lightreading.com/ai-machine-learning/bt-exec-stokes-fear-of-ai-impact-on-jobs-by-likening-staff-to-horses

Fresh waves of job cuts have surfaced at Cisco Systems, which will slash dozens more workers in San Jose as tech companies eliminate hundreds of positions in the latest round of staffing reductions.

Cisco Systems has decided to chop another 53 jobs in the South Bay, according to an official WARN notice the legendary tech titan sent to the state Employment Development Department.

https://www.siliconvalley.com/2024/08/26/san-jose-cisco-tech-economy-jobs-layoffs-intel-amazon-google-facebook/amp/