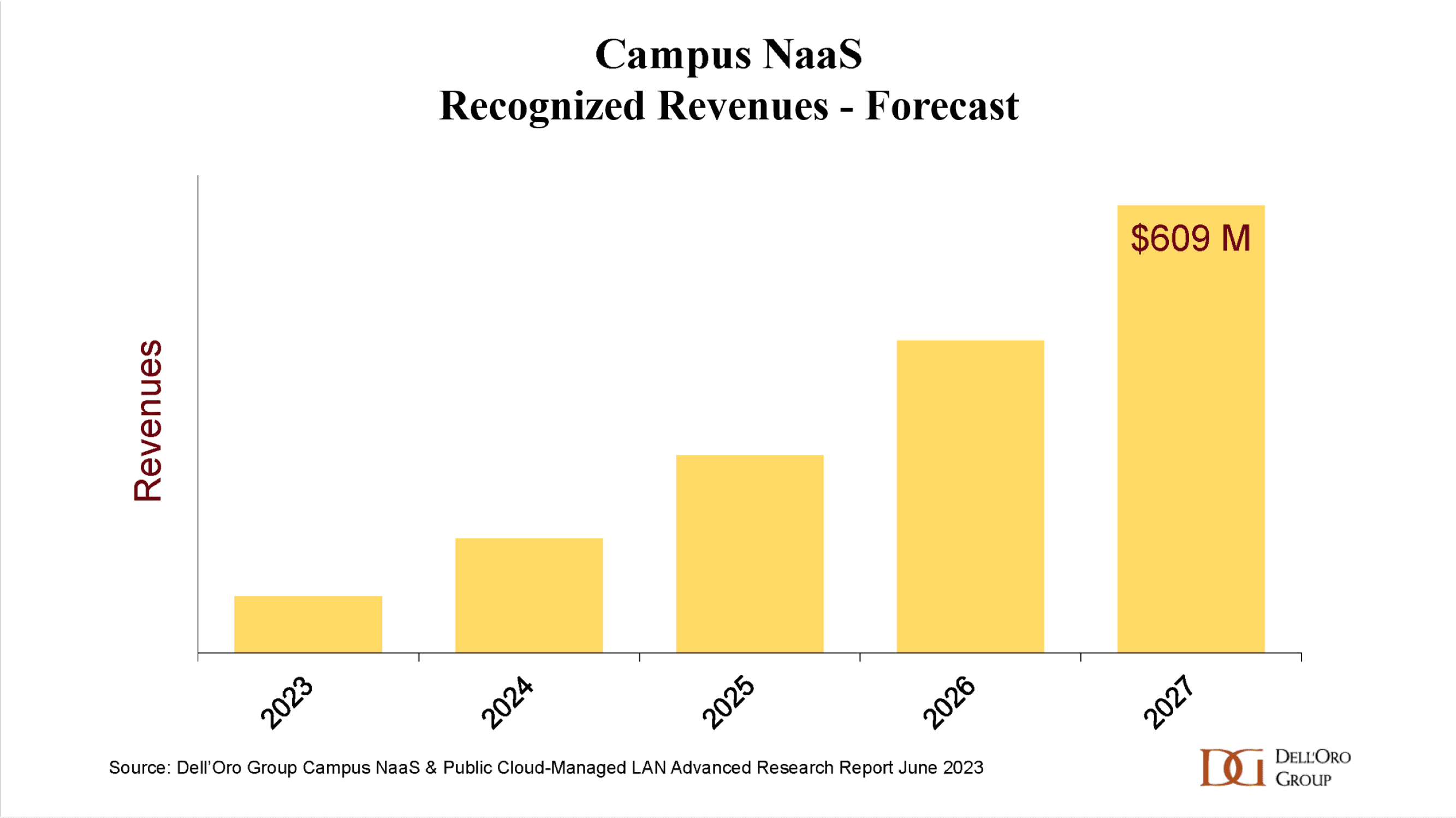

| Dell’Oro Group believes that Campus NaaS revenues will grow quickly over the next five years, eclipsing the growth rate of the Public Cloud-Managed LAN market.

“Campus NaaS is an emerging market and vendors are approaching it from different angles,” said Siân Morgan, Wireless LAN Research Director at Dell’Oro Group. “All of the Campus NaaS variants are inspired by the cloud-consumption model, but that’s where their similarities end. Each version is targeted at different segments and has different growth potential. Some offers will help vendors gain market share, while others could expand the overall size of the market.”

“LAN equipment manufacturers are expected to generate a record level of revenues this year, but we are predicting a contraction in 2024. We expect to see Campus NaaS gain traction as the LAN Market slows down. The recurring price structure and maintenance-free technology are two elements that will resonate with certain segments of enterprises,” added Morgan.

Additional highlights from the brand new Campus NaaS and Public Cloud-Managed LAN Advanced Research Report:

- Recurring license revenues are becoming a material force for revenue growth, and these will gain pace as Public Cloud-Managed LAN revenues grow to $9 B in 2027.

- The North American region will remain the largest revenue opportunity, both for Campus NaaS and Public Cloud-Managed LAN.

- Three types of Campus NaaS are emerging: Campus NaaS Enabler; Turnkey Campus NaaS; and Wi-Fi as a Utility. Each type of Campus NaaS has different characteristics and growth drivers.

- New vendors are jumping into the fray. Startups are emerging from stealth mode, incumbent vendors are evolving their offers, an there is an opportunity for vendors from adjacent markets to take market share.

- The 5-year CAGR of Campus NaaS is enhanced by its recurring revenue profile.

Siân concluded, “The benefits of Campus NaaS offers last well beyond the revenues recognized annually. The forecasted total contract value for 2027 is $1.8 B.”

|