Dell’Oro Group

Dell’Oro: Global RAN Market to Drop 21% between 2021 and 2029

According to a new report from Dell’Oro Group, the overall RAN market is now facing a second consecutive year of steep declines. That follows 40 to 50% revenue growth between 2017 and 2021. While the pace of decline is expected to moderate after 2024, downward pressure is likely to persist until 6G becomes a reality.

In addition to the typical market fluctuations that have shaped the RAN landscape over the past 30-plus years, the overpromising of 5G and its inability to significantly alter the flat revenue trend among operators are fueling increased skepticism regarding the need for substantial investments in new technologies (like 5G Advanced, 5G RedCap or O-RAN).

“Some skepticism is warranted. After all, operators invested over $2 trillion in wireless capex between 2010 and 2023 to build out 4G and 5G, yet revenues remain flat,” said Stefan Pongratz, Vice President of RAN and Telecom Capex research at Dell’Oro Group. “Looking ahead, operators will need to optimize their spectrum roadmaps to address various data traffic scenarios. Our base case assumes that mobile data traffic growth will continue to slow, enabling operators to improve their capital intensity ratios, which will in turn put further downward pressure on the RAN market. However, additional capacity will eventually be required, and at that point, leveraging larger spectrum bands and the existing macro grid will likely offer the most cost-effective solution,” Pongratz added.

Additional highlights from the new 6G Advanced Research Report:

- Total RAN revenues are projected to trend downward until 2029

- 6G RAN revenues to approach $30 B by 2033

- Sub-7 GHz and CM-wave macros are expected to dominate the 6G mix by 2033

Dell’Oro Group’s 6G Advanced Research Report offers a complete overview of the RAN market by region and by technology, with tables covering manufacturers’ revenue for 5G NR and 6G by frequency, including Sub-7 GHz, cmWave, and mmWave. The report also covers Cloud RAN, small cells, and Massive MIMO. To purchase this report, please contact by email at [email protected].

References:

6G RAN to Approach $30 B by 2033, According to Dell’Oro Group

https://www.ericsson.com/en/blog/2023/6/cm-wave-spectrum-6g-potent-enabler

Dell’Oro: RAN market still declining with Huawei, Ericsson, Nokia, ZTE and Samsung top vendors

Dell’Oro & Omdia: Global RAN market declined in 2023 and again in 2024

Highlights of Dell’Oro’s 5-year RAN forecast

Dell’Oro: RAN market declines at very fast pace while Mobile Core Network returns to growth in Q2-2023

Dell’Oro: 2023 global telecom equipment revenues declined 5% YoY; Huawei increases its #1 position

Dell’Oro: Optical Transport, Mobile Core Network & Cable CPE shipments all declined in 1Q-2024

Apparently, there’s no place to hide in any telecom or datacom market? We all know the RAN market has been in a severe decline, but recent Dell’Oro Group reports indicate that Optical Transport, Mobile Core Network and Cable CPE shipments have also declined sharply in the 1st Quarter of 2024.

Here are a few selected quotes from Dell’Oro analysts:

“The North American broadband market is in the midst of a fundamental shift in the competitive landscape, which is having a significant impact on broadband equipment purchases,” said Jeff Heynen, Vice President with Dell’Oro Group. “In particular, cable operators are trying to navigate mounting, but predictable, broadband subscriber losses with the need to invest in their networks to keep pace with further encroachment by fiber and fixed wireless providers,” explained Heynen.

Omdia, owned by the ADVA, expects cable access equipment spending to grow later in 2024 and peak in 2026 at just over $1 billion, then drop off to $700 million in 2029.

………………………………………………………………………………………………………

“Customer’s excess inventory of DWDM systems continued to be at the center stage of the Optical Transport market decline in the first quarter of 2024,” said Jimmy Yu, Vice President at Dell’Oro Group. “However, we think the steeper-than-expected drop in optical transport revenue in 1Q 2024 may have been driven by communication service providers becoming increasingly cautious about the macroeconomic conditions, causing them to delay projects into future quarters,” added Yu.

…………………………………………………………………………………………………..

“Inflation has impacted the ability of some Mobile Network Operators (MNOs) to raise capital, and it has also impacted subscribers when it comes to upgrading their phones to 5G. Many MNOs have lowered their CAPEX plans and announced that they have fewer than expected 5G subscribers on their networks; which limits MNOs’ growth plans. As a result, we are lowering our expectations for 2024 from a positive growth rate to a negative one,” by Research Director Dave Bolan.

- As of 1Q 2024, 51 MNOs have commercially deployed 5G SA (Stand Alone) eMBB networks with two additional MNOS launching in 1Q 2024.

References:

Optical Transport Equipment Market Forecast to Decline in 2024, According to Dell’Oro Group

Optical Transport Equipment Market Forecast to Decline in 2024, According to Dell’Oro Group

Dell’Oro: 2023 global telecom equipment revenues declined 5% YoY; Huawei increases its #1 position

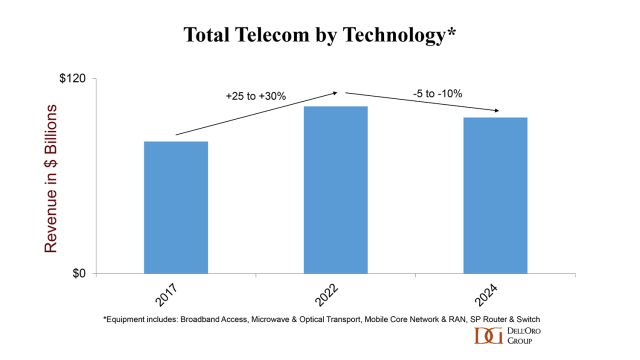

Preliminary Dell’Oro Group data found that worldwide telecom equipment revenues across the six telecom programs tracked – Broadband Access, Microwave & Optical Transport, Mobile Core Network (MCN), Radio Access Network (RAN), and SP Router & Switch – declined 5% year-over-year (YoY) for the full year 2023, performing worse than expected. First and foremost, challenging comparisons in some of the advanced 5G markets with higher 5G population coverage taken together with the slow transition towards 5G SA helped to partially explain steep declines in wireless-based investments. This capex deceleration was not confined to the RAN and MCN segments. Following a couple of years of robust PON investments, operators were able to curtail their home broadband capex as well. This reduction was more than enough to offset positive developments with optical transport and Service Provider routers.

The North America telecom equipment market declined faster than expected. Initial readings show that the aggregate telecom equipment market dropped by roughly a fifth in the North America region, underpinned by weak activity in both RAN and Broadband Access. On the bright side, regional dynamics were more favorable outside of the US. Our assessment is that worldwide revenues excluding North America advanced in 2023, as positive developments in the Asia Pacific region were mostly sufficient to offset weaker growth across Europe.

Also contributing to the regional and technology trends is the disruption caused by Covid hoarding and the supply chain crisis. Although this inventory correction was not felt everywhere and varied across the telecom segments, it was more notable in the RAN this past year.

Renewed concerns about macroeconomic conditions, Forex, and higher borrowing costs are also weighing down prospects for growth. The gains in the USD against the Yuan and the Yen are impacting USD-based equipment revenue estimates in China and Japan.

………………………………………………………………………………………………………………………………………………………………………………………………

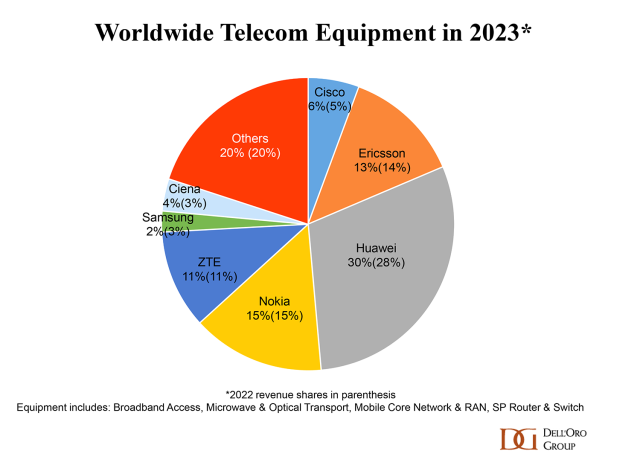

Dell’Oro says that Huawei maintained its lead as the top global telecom equipment company by revenue in 2023, despite efforts by the U.S. government and other countries to limit its addressable market and access to Android and the latest chips and semiconductor technology from TSMC. In fact, Dell’Oro’s assessment is that Huawei’s lead widened in 2023, in part because its limited exposure to the North America region was a benefit in 2023 on a relative basis.

Supplier rankings were mostly unchanged. However, vendor revenue shares shifted slightly in 2023. Still, the overall concentration has not changed – the top seven suppliers accounted for around 80% of the overall market.

Market conditions are expected to remain challenging in 2024, though the decline is projected to be less severe than in 2023. The analyst team is collectively forecasting global telecom equipment revenues to contract 0 to -5% in 2024. Risks are broadly balanced. In addition to currency fluctuations, economic uncertainty, and inventory normalization, there are multiple regions/technology segments that are operating in a non-steady state.

References:

Dell’Oro & Omdia: Global RAN market declined in 2023 and again in 2024

Dell’Oro: Broadband access equipment sales to increase in 2025 led by XGS-PON deployments

Global 5G Market Snapshot; Dell’Oro and GSA Updates on 5G SA networks and devices

Dell’Oro: Broadband network equipment spending to drop again in 2024 to ~$16.5 B

Dell’Oro: Mobile Core Network market has lowest growth rate since 4Q 2017

Dell’Oro: U.S. suppliers ~20% of global telecom equipment market; struggling in RAN business

Dell’Oro: RAN market declines at very fast pace while Mobile Core Network returns to growth in Q2-2023

A new report from Dell’Oro Group says RAN sales declined at their fastest pace in nearly seven years during Q2-2023. According to preliminary findings from the market research firm, following the ‘intense ramp-up’ from 2017 through 2021. While RAN revenues stabilized in 2022 and 1Q23, market conditions worsened in the second quarter, resulting in RAN declining at the fastest pace in nearly seven years. The decline was not unexpected by Dell’Oro, yet the magnitude of the reversal was much steeper than anticipated.

………………………………………………………………………………………………………………………………..

The RAN market decline was surely expected by IEEE Techblog readers, as this publication has warned for years about the commercial failure of 5G mobile networks.

………………………………………………………………………………………………………………………………..

“It is tempting to point the finger at data traffic patterns, 5G monetization challenges, and the odds stacked against an economy struggling with persistent levels of elevated inflation,” said Stefan Pongratz, Vice President at Dell’Oro Group. “Although these are, of course, important factors, we attribute the poor performance in the quarter to the clouds forming in North America. Alongside challenging 5G comparisons, the decline was amplified by the extra inventory accumulated over the past couple of years to mitigate supply chain risks,” Pongratz added.

Additional highlights from the Q2-2023 RAN report:

- Top 5 RAN suppliers for 1H23 include Huawei, Ericsson, Nokia, ZTE, and Samsung.

- Nokia recorded the largest RAN revenue share gains between 2022 and 1H23.

- Huawei’s quarterly RAN share reached the highest level in three years. Huawei’s 2Q23 RAN revenue share outside of North America was as large as Ericsson and Nokia combined.

- Ericsson and Samsung’s RAN revenue shares declined between 2022 and 1H23.

- Regional projections are mostly unchanged; however, the short-term outlook has been revised upward in APAC excluding China and downward in the North American region.

- Global RAN revenues are expected to decline in 2023.

…………………………………………………………………………………………………………….

In a separate report, Dell’Oro says the Mobile Core Network (MCN) market returned to growth in 2Q 2023. The China region returned to growth and Europe, the Middle East, and Africa (EMEA) had the strongest quarterly growth rate since 3Q 2020.

“The MCN market shined on many fronts this quarter. The China region returned to growth with increased spending by two of the four Mobile Network Operators (MNOs). The EMEA region had its best quarterly growth rate since 2020, Huawei had record high revenues for the quarter, and Ericsson had its highest growth rate since 2Q20, as examples,” stated Dave Bolan, Research Director at Dell’Oro Group. “As a result, we are raising our outlook for 2023 year-over-year (Y/Y) growth rate from low single-digit percent to mid-single-digit percent.”

“As of 2Q 2023, we counted 44 Mobile Network Operators (MNOs) that have launched commercial 5G SA networks. One was added in 2Q 2023, Telefónica – Spain. The North America and EMEA regions of the 5G MCN segment Y/Y growth rates were in the triple-digit percent, signaling capacity additions to the 5G SA networks in both regions,” continued Bolan.

Editor’s Note: Despite years of promises, neither AT&T or Verizon has yet to deploy a 5G SA core network, without which no 3GPP defined 5G features/functions are possible.

…………………………………………………………………………………………………………………………

Additional highlights from the 2Q 2023 Mobile Core Network and Multi-Access Edge Computing Report include:

- The top MCN vendors worldwide for 2Q 2023 were Huawei, Ericsson, Nokia, and ZTE.

- The top 5G MCN vendors worldwide for 2Q 2023 were Huawei, Ericsson, ZTE, and Nokia.

- Five MNOs launched commercial 5G SA networks in 1H 2023.

References:

RAN Declines at the Fastest Pace in Seven Years, According to Dell’Oro Group

Mobile Core Network Market Returns to Growth in 2Q 2023, According to Dell’Oro Group

Dell’Oro: RAN Market to Decline 1% CAGR; Mobile Core Network growth reduced to 1% CAGR

Dell’Oro: OpenRAN revenue forecast revised down

through 2027

Dell’Oro: U.S. suppliers ~20% of global telecom equipment market; struggling in RAN business

Dell’Oro: Broadband Equipment Spending to exceed $120B from 2022 to 2027

Dell’Oro Group predicts the broadband equipment market will surpass $120 billion in cumulative spending between 2022 and 2027. The market research firm says sales of PON equipment for fiber-to-the-home deployments, cable broadband access equipment, and fixed wireless CPE will show a 0.2% Compounded Annual Growth Rate (CAGR) from 2022 to 2027. Service providers continue to expand their fiber and DOCSIS 3.1/4.0 networks, while also increasing the reliability and sustainability of their broadband access networks.

“After three consecutive years of tremendous broadband network expansions and upgrades, 2023 is expected to show a return to normalized levels of spending,” said Jeff Heynen, Vice President of Broadband Access and Home Networking research at Dell’Oro Group. “After 2023, spending is expected to increase through 2026 and 2027, driven by 25 Gbps and 50 Gbps PON, Fixed Wireless CPE, as well as DAA and DOCSIS 4.0 deployments.”

Labor markets are “still being challenged” and a number of fiber based network operators (AT&T, Altice USA, Frontier) have reduced their expansion plans and homes passed targets. “To close out 2022 we did see a significant uptake in equipment purchases, and what happened there was supply chains appeased. A lot of orders that had been on the books for a long time have been fulfilled.”

Network equipment vendors are working through that inventory they had built up while taking on “additional equipment purchases.

Additional highlights from the Broadband Access & Home Networking 5-Year July 2023 Forecast Report:

- PON equipment revenue is expected to grow from $11.8 B in 2022 to $13.3 B in 2027, driven largely by XGS-PON deployments in North America, EMEA, and CALA.

- Revenue for Cable Distributed Access Equipment (Virtual CCAP, Remote PHY Devices, Remote MACPHY Devices, and Remote OLTs) is expected to reach $1.6 B by 2027, as operators ramp their DOCSIS 4.0 and fiber deployments.

- Revenue for Fixed Wireless CPE is expected to reach $2.7 B by 2027, led by shipments of 5G sub-6GHz and 5G Millimeter Wave units.

- Revenue for Residential Wi-Fi Routers will surpass $5.2 B in 2027, owing to massive shipments of Wi-Fi 7 units.

“Which isn’t going to float to manufacturers until you know, late 2024, really into 2025,” he said. “I think in the interim, XGS-PON in the European market is certainly going to catch up. We’re also seeing considerable growth in XGS-PON deployments now in China.”

In Dell’Oro’s five-year forecast published in January, Heynen expected fixed wireless subscriber growth, particularly in North America, would “start to moderate” beginning in 2024, due to factors like “capacity issues and fiber expansion.”

Heynen has increased his revenue predictions for the fixed wireless CPE market – which he previously tipped would hit $2.2 billion in five years – and now predicts subscriber growth to continue into 2025.

“Part of that is because of the net reduction in homes passed for fiber,” he said. “In the meantime, fixed wireless will be able to cover more ground while the operators who are building out fiber kind of extend their overall deployment plans.”

Further, operators like T-Mobile and Verizon “are seeing fixed wireless as a way to secure broadband subscribers away from cable operators. The U.S. market is really dynamic in terms of how services can be marketed.”

The Dell’Oro Group Broadband Access & Home Networking 5-Year Forecast Report provides a complete overview of the Broadband Access market with tables covering manufacturers’ revenue, average selling prices, and port/unit shipments for PON, Cable, Fixed Wireless, and DSL equipment. Covered equipment includes Converged Cable Access Platforms (CCAP), Distributed Access Architectures (DAA), DSL Access Multiplexers (DSLAMs), PON Optical Line Terminals (OLTs), Customer Premises Equipment ([CPE] for Cable, DSL, PON, Fixed Wireless), along with Residential WLAN Equipment, including Wi-Fi 6E and Wi-Fi 7 Gateways and Routers. For more information about the report, please contact [email protected].

Dell’Oro Group is a market research firm that specializes in strategic competitive analysis in the telecommunications, security, enterprise networks, data center infrastructure markets. Our firm provides in-depth quantitative data and qualitative analysis to facilitate critical, fact-based business decisions. For more information, contact Dell’Oro Group at +1.650.622.9400 or visit www.delloro.com.

References:

https://www.fiercetelecom.com/telecom/broadband-equipment-market-eclipse-120b-2027-delloro

Dell’Oro: XGS, 25G, and Early 50G PON Rollouts to Fuel Broadband Spending

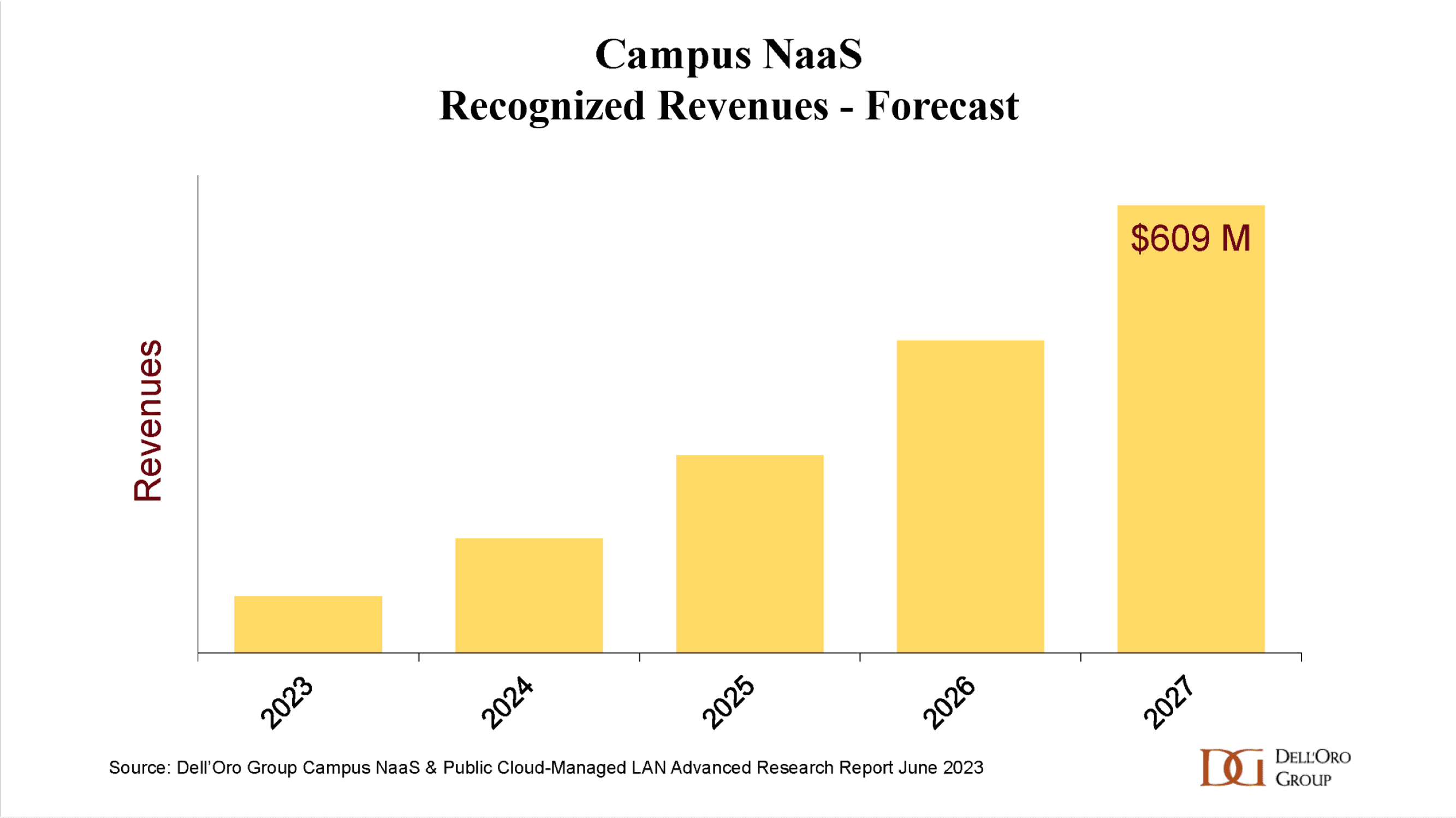

Dell’Oro: Bright Future for Campus Network As A Service (NaaS) and Public Cloud Managed LAN

Dell’Oro: FWA revenues on track to advance 35% in 2022 led by North America

Dell’Oro: PONs boost Broadband Access; Total Telecom & Enterprise Network Equipment Markets

Dell’Oro: U.S. suppliers ~20% of global telecom equipment market; struggling in RAN business

Futuriom and Dell’Oro weigh in on SD-WAN and SASE market: single vendor solutions prevail

Dell’Oro: Bright Future for Campus Network As A Service (NaaS) and Public Cloud Managed LAN

|

||

|

Futuriom and Dell’Oro weigh in on SD-WAN and SASE market: single vendor solutions prevail

Enterprise networking and IT cybersecurity professionals are turning to managed SD-WAN (software-defined wide area networking) and SASE (secure access service edge) services to deal with the increasing challenges caused by network complexity, according to a new report from market research firm Futuriom.

SD-WAN and SASE have been evolving and maturing for several years now, but the market is far from mature. It is still growing and is highly fragmented, both in terms of the companies involved in providing services and technology to enterprise users and in how SD-WAN and SASE capabilities are deployed and consumed by enterprises.

What’s needed more than ever are software-based platforms for integrating the management of network and security functions at the same time. This approach was first initiated by SD-WAN, which separated the software control from the hardware for branch-office networking. SD-WAN evolved and grew by adapting security functionality (SASE), which could be integrated into the network platform.

The market has expanded to include SASE functionality, which provides cybersecurity functions such as secure web gateway (SWG), cloud access security broker (CASB), firewall-as-a-service (FWaaS), intrusion detection, zero-trust network access (ZTNA), and many others to protect enterprise access to public networks and SaaS apps.

Futuriom’s survey took place in March and April of 2023. The total audience of 196 respondents came from three countries: the U.S. (127 respondents), Germany (37), and India (32).

Report Highlights and Key Findings:

- Survey respondents indicate strong demand for SD-WAN and SASE managed services. Our survey data and discussions with end users indicate that SD-WAN/SASE technology helps professionals with network and security challenges, including the growing complexity created by distributed applications, cloud connectivity, and sprawling security risks.

- Managing network complexity is the largest challenge driving managed services demand. When asked about the largest challenges in managing WANs, 85% of respondents identified complexity, followed by expertise and knowledge (68%). Rounding out the responses were cost (60%) and time (47%). (Multiple responses were allowed.)

- Hybrid work and the need for zero-trust network access (ZTNA) are key drivers of SD-WAN/SASE technology. In the survey, 98% of respondents said that hybrid work has increased demand for SASE and ZTNA. When we asked respondents if ZTNA is a crucial component of SASE and SD-WAN offerings, 92% said yes.

- Hybrid (cloud/edge deployment) and single-pass architectures will be important components of SASE/SD-WAN services going forward. When respondents were asked if they wanted a hybrid solution that can accommodate networking and security both on premises and using cloud points of presence (PoPs), 98% said yes. In addition, 94% of respondents said they prefer a single-pass architecture.

- There will continue to be a diversity of SD-WAN/SASE deployment models. The two most popular models for deployment are best-of-breed combination (34%) and single-vendor (23%), but survey results show a wide diversity of deployment models.

Companies covered in this report: Aryaka, Amazon, AT&T, British Telecom, Cato Networks, Check Point Software, Cisco, Colt, Comcast, Deutsche Telekom/T-Systems, Forcepoint, Fortinet, HPE (Aruba), Hughes, Juniper Networks, Lumen Technology, NTT, Orange, Palo Alto Networks, Tata Communications, Telefónica, Telstra, VMware, Verizon, Versa Networks, Vodafone, Windstream, Zscaler.

…………………………………………………………………………………………………………………………

Separately, Dell’Oro Group reported that the portion of the SASE market, where vendors offer both SD-WAN and SSE (security service edge) solutions, grew an impressive 55% year-over-year (YoY) in 1Q 2023. By doing so, single-vendor SASE overtook the multi-vendor SASE portion of the market, consisting of vendors that can only offer the SD-WAN or SSE component. The overall SASE market revenue rose by over 30 percent for the fifth consecutive quarter in 1Q 2023 and, by doing so, was not far off the $2B mark.

“Even as enterprises have been more judicious in how they spend security budget, the robust growth of the SASE market is a testament to the strong commitment by enterprises and the value they bring to secure users’ access to cloud-based applications from anywhere,” said Mauricio Sanchez, Research Director at Dell’Oro Group. “The vendors that can offer both the SD-WAN and SSE components are setting themselves apart in an extremely competitive market,” added Sanchez.

Additional highlights from the 1Q 2023 SASE and SD-WAN Quarterly Report:

- For the first time since Dell’Oro started tracking SASE in 1Q 2019, there was a revenue position change in the number one spot, with Zscaler overtook Cisco.

- Palo Alto Networks overtook Broadcom (Symantec) for the number three overall SASE revenue position.

- Check Point, HPE/Aruba, and Netskope became single-vendor SASE players.

- Both SSE and SD-WAN revenue grew above 30 percent YoY.

- Unified SASE solutions–defined as SASE solutions where SD-WAN and SSE have been tightly integrated into a single technology stack–eclipsed $200M for the third consecutive quarter, representing over 140% growth.

- Overall SASE revenue growth on a regional basis varied from 27% in North America to 49% percent in the Caribbean and Latin America.

- The Access Router market revenue surged forward by over 15% YoY on improved hardware supply.

The Dell’Oro Group SASE & SD-WAN report includes manufacturers’ revenue covering the SASE and Access Router markets. In addition, the report analyzes the SASE market from two perspectives, technology (SD-WAN networking and SSE security) and implementation (unified and disaggregated). The report also provides unit information for the Access Router market. To purchase this report, please contact us at [email protected].

References:

https://www.futuriom.com/articles/news/results-from-our-sd-wan-sase-managed-services-survey/2023/06

LightCounting: Wireless infrastructure market dropped both YoY and sequentially in 1Q23

In the 1stQ2023, the global wireless infrastructure market declined 3% YoY and 17% sequentially, according to LightCounting. Starting a new year with a sequential decline is typical but a YoY drop is abnormal and suggests a declining pattern is in the making. This trend confirms that we have entered the post-peak era.

While the U.S. market posted its steepest drop, the strong 5G rollouts in India and a 5G rebound in Japan, along with stable and sustained activity in EMEA and China, respectively, were not enough to keep the wireless infrastructure market out of the decline. On the open vRAN front, DISH in the U.S., Rakuten Mobile in Japan, and a few Rakuten Symphony customers kept the market flat YoY and produced double digit sequential growth.

Despite a weak quarter, Huawei retook its lead at the expense of Ericsson, which reported weak 1Q23 results that led to a market share loss. In the meantime, Nokia benefited from the 2 leaders’ market share loss and gained 1% point. ZTE also gained share at the expense of Huawei and Ericsson while Samsung’s share remained stable.

“We have passed the 5G peak and have entered the second year of a disinvestment cycle. The 5G investment cycle that started in 2019 and ended in 2021 was driven by hundreds of communications service providers (CSPs), including the world’s largest cellular footprints (i.e., China). At the moment, India’s massive 5G rollout is preventing the situation from getting worse but this will end soon,” said Stéphane Téral, Chief Analyst at LightCounting Market Research.

As a result, this year, LightCounting expects the wireless infrastructure market to slightly decline in 2023 (compared to 2022) with India in the lead. In the long run, our service provider 20-year wireless infrastructure footprint pattern analysis points to a 2022-2028 CAGR of -3% characterized by low single-digit declines through 2027, which appears to be the bottom leading to flatness or slight growth in 2028. In fact, we expect 5G to slightly pick up in 2027, driven by upgrades needed to prepare networks for 6G. Given the ongoing 6G activity, we believe something labeled 6G will be deployed in 2028.

Highlights from Dell’Oro’s 1Q 2023 RAN report:

- Top 5 RAN 1Q 2023 RAN suppliers include Huawei, Ericsson, Nokia, ZTE, and Samsung.

- Top 4 RAN 1Q 2023 RAN suppliers outside of China include Ericsson, Nokia, Huawei, and Samsung.

- Nokia recorded the highest growth rate among the top 5 suppliers, while Ericsson and Samsung both lost some ground in the first quarter.

- The report also shows that Nokia’s RAN revenue share outside of China has been trending upward over the past five quarters.

- The Asia Pacific RAN market has been revised upward to reflect the higher baseline in India.

Open RAN and vRAN highlights from Dell’Oro’s 1Q 2023 RAN report:

- After more than doubling in 2022, Open RAN revenue growth was in the 10 to 20 percent range in the first quarter while the vRAN market advanced 20 to 30 percent.

- Positive developments in the Asia Pacific region were dragged down by more challenging comparisons in the North America region.

- Short-term projections remain unchanged – Open RAN is still projected to account for 6 to 10 percent of the 2023 RAN market.

- Top 5 Open RAN suppliers by revenue for the 2Q 2022 to 1Q 2023 period include Samsung, NEC, Fujitsu, Rakuten Symphony, and Mavenir.

| Historical data accounts for sales of the following vendors: | ||

| Vendor | Segments | Source of Information |

| Affirmed Networks (acquired by Microsoft, April 2020) | vEPC, 5GC | Estimates |

| Altran | vRAN | Estimates |

| Altiostar | vRAN (CU, DU) | Estimates |

| Amdocs | 5GC | Estimates |

| ASOCS | vRAN (DU) | None, supplies other RAN/vRAN vendors |

| Baicell | RAN (RU) | None, supplies other RAN/vRAN vendors |

| Benetel | Open RAN (RU) | None, supplies other RAN/vRAN vendors |

| Cisco | EPC, vEPC, 5GC | Survey data and estimates |

| China Information and Communication Technologies Group (CICT) | RAN | Estimates |

| Comba Telecom | RAN/vRAN (RU) | None, supplies other RAN/vRAN vendors |

| CommScope (acquired Phluido vRAN patents, October 2020) | vRAN (RU, DU) | Estimates |

| Corning | vRAN | Estimates |

| Dell | vRAN (DU) | None, supplies other RAN/vRAN vendors |

| Enea | 5GC | Estimates |

| Ericsson | RAN, vRAN, 2/3G Core, EPC, vEPC, 5GC | Estimates |

| Fairwaves | RAN/vRAN (RU) | None, supplies other RAN/vRAN vendors |

| Fujitsu | RAN | Survey data and estimates |

| HPE | 2G/3G core, 5GC | Estimates |

| Huawei | RAN, vRAN, 2/3G Core, EPC, vEPC, 5GC | Survey data and estimates |

| JMA Wireless | vRAN | Estimates |

| KMW | RAN/vRAN (RU) | None, supplies other RAN/vRAN vendors |

| Kontron | vRAN (DU) | None, supplies other RAN/vRAN vendors |

| Mavenir (acquired ip.access, September 2020) | vEPC, vRAN, 5GC | Survey data and estimates |

| Metaswitch (acquired by Microsoft, May 2020) | 5GC, vEPC and 2G/3G core | Estimates |

| Movandi | RAN/vRAN (RU/repeater) | Estimates |

| MTI Mobile | vRAN (RU) | None, supplies other RAN/vRAN vendors |

| Node-H | vRAN (small cells) | Estimates |

| Nokia | RAN, vRAN, 2/3G Core, EPC, vEPC, 5GC | Survey data and estimates |

| NEC (including Blue Danube) | RAN, vRAN (RU), EPC, 5GC | Survey data and estimates |

| Oracle | 5GC | Estimates |

| Parallel Wireless | vRAN (CU, DU) | Estimates |

| Pivotal | RAN/vRAN (RU/mmWave repeater) | Estimates |

| Quanta Cloud Technology (QCT) | vRAN (DU) | None, supplies other RAN/vRAN vendors |

| Qucell | RAN, vRAN | Estimates |

| Ribbon Communications | 2G/3G core | Survey data and estimates |

| Samsung | RAN, vRAN, vEPC, 5GC | Estimates |

| Silicom | Open RAN (DU) | None, supplies other RAN/vRAN vendors |

| SuperMicro Computer | vRAN (DU) | None, supplies other RAN/vRAN vendors |

| Verana Networks | RAN/vRAN (RU/mmWave) | Estimates |

| ZTE | RAN, vRAN, 2/3G Core, EPC, vEPC, 5GC | Survey data and estimates |

Dell’Oro: U.S. suppliers ~20% of global telecom equipment market; struggling in RAN business

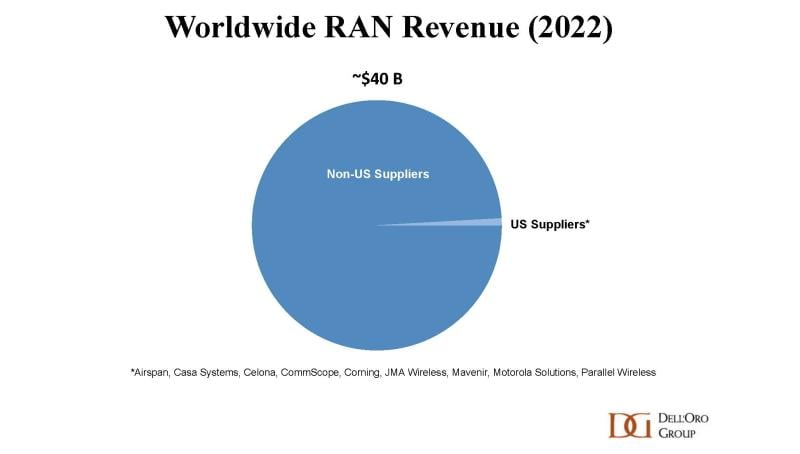

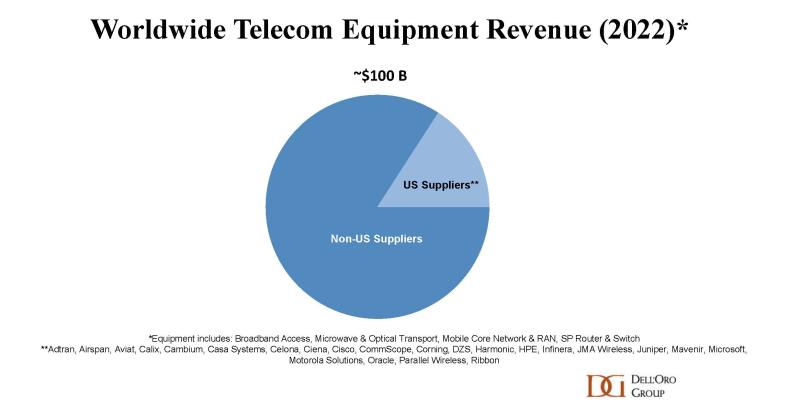

According to Stefan Pongratz of Dell’Oro, U.S. suppliers collectively accounted for around 16% of the global telecom equipment market in 2022, underpinned by strong presence in broadband access, optical transport and Service Provider Routers. Not surprisingly, this global view is masking the progress to some degree. If we exclude China, we estimate that the 20+ American suppliers comprise ~20% of the broader telecom equipment market.

U.S. suppliers appear to be struggling more in the RAN market. Per Dell’Oro’s 4Q22 RAN report, the American-based vendors still accounted for less than 1% of the global RAN market in 2022. Even if China is removed, the aggregate revenue share remains in the same range.

…………………………………………………………………………………………………………………………………………………………………….

Editor’s Note: The big 5 have dominated the global RAN market for over 15 years. Huawei, Ericsson, Nokia, ZTE, and Samsung together have about 95% of the global RAN market. Pongratz expects global RAN revenues to decline at a low-single-digit rate for 2023, with a surge in spending from India-based operators to fuel their 5G plans offset by dropping demand in China, Europe, and North America.

“After four years of extraordinary growth that catapulted the RAN market to record levels in 2021, the RAN market is now entering a new phase,” Pongratz wrote. “Even with 5G still increasing at a healthy pace, comparisons are more challenging and the implication for the broader RAN market is that growth is decelerating.”

…………………………………………………………………………………………………………………………………………………………………….

Dell’Oro estimates that the collective RAN revenues for the U.S. suppliers had an increased of 60% in 2022 relative to 2020, in part because of the improved entry points with Open RAN. U.S. network equipment vendors are fairly optimistic about the growth prospects:

- Mavenir is targeting 30%+ growth in 2023. While the mobile core network continues to drive the lion’s share of its revenue mix, Mavenir’s 10,000+ macro-site brownfield pipeline is expected to play a pivotal role in reaching this $1 billion group revenue target for FY23.

- Celona is working with 100+ customers and has seen a 300%+ increase in the number of connected devices across its 5G installed base. The vendor is now targeting to more than double its revenues this fiscal year.

- JMA has not shared any growth objectives for its wireless business. Even so, the vendor has announced multiple DoD wins and believes its all-American team is well positioned to support advanced private 5G networks for the U.S. government.

- Verana Networks is set to work on a trial with Verizon later this year.

- Dell is planning to enter the vRAN market over the next year, allegedly.

- Airspan’s equipment and software revenue growth slowed in 2022. Still, trial activity is on the rise and Airspan remains hopeful that its 400+ private network wins will soon have a more meaningful impact on the topline.

At the same time, it is early days in this process of re-shaping the RAN. And even if global market concentration as measured by the Herfindahl-Hirschman Index (HHI) is actually trending in the right direction, vendors with smaller footprints are still trying to figure out the best near-term and long-term approaches to improve their respective RAN positions – some think that open RAN can be an entry point for brownfield macro opportunities while others believe the likelihood of winning is greater in greenfield settings (public or private).

Open RAN might help to open the door, but this movement does not change the fact that RAN remains a scale game and double-digit RAN revenue shares are still required to maintain competitive portfolios.

Currently, this vendor asymmetry between RAN and the broader telecom equipment market then also implies that the U.S. suppliers are actually doing rather well beyond the wireless scope. In fact, if we remove the RAN from the picture, we estimate that the U.S. vendors accounted for around a fourth of the global non-RAN telecom equipment market. Better yet, if we take it one step further and also strip out China, the data shows that the American team comprised around one third of the non-RAN telco equipment market excluding China.

Dell’Oro’s assessment is that the U.S. suppliers hold a strong position in the non-RAN telecom equipment market. When it comes to RAN, however, the data shows that the American-based suppliers are moving in the right direction, especially in private wireless. But the overall progress has been slow, and it is still a long road ahead before we can establish that the U.S. suppliers are back at full speed in the broader public plus private 5G RAN business

…………………………………………………………………………………………………………………………………………………………

Stefan Pongratz is a vice president at the Dell’Oro Group. He joined Dell’Oro in 2010 after spending 10 years with the Anritsu Company. Pongratz is responsible for the firm’s Radio Access Network and Telecom Capex programs and has authored advanced research reports on the wireless market assessing the impact and the market opportunity with small cells, C-RAN, 5G, IoT and CBRS.

References:

https://www.fiercewireless.com/wireless/what-state-us-ran-and-non-ran-suppliers-pongratz

Dell’Oro: Worldwide Telecom Equipment Market Growth +3% in 2022; MTN: +2% Network Infrastructure Growth in 2022

Dell’Oro: Private 5G ecosystem is evolving; vRAN gaining momentum; skepticism increasing

Dell’Oro: 5G RAN growing; total RAN growth is slowing over next 5 years

Dell’Oro: RAN Market Disappoints in 2Q-2022

Dell’Oro: Market Forecasts Decreased for Mobile Core Network and Private Wireless RANs

Dell’Oro: Optical Transport market to hit $17B by 2027; Lumen Technologies 400G wavelength market

According to a recent forecast report by Dell’Oro Group, the Optical Transport equipment demand is forecast to increase at a 3 percent compounded annual growth rate (CAGR) for the next five years, reaching $17 billion by 2027. The cumulative revenue during that five year period is expected to be $81 billion.

“We expect annual growth rates to fluctuate in the near term before stabilizing to a more typical 3 percent growth rate,” said Jimmy Yu, Vice President at Dell’Oro Group. “There is still a large amount of market uncertainty this year due to the economic backdrop—economists are predicting a high chance of a recession in North America and Europe. However, at the same time, most optical systems equipment manufacturers are reporting record levels of order backlog entering the year, and we expect that most of this backlog could convert to revenue when component supply improves this year,” added Yu.

Additional highlights from the Optical Transport 5-Year January 2023 Forecast Report:

- Optical Transport market expected to increase in 2023 due to improving component supply.

- WDM Metro market growth rates in next five years are projected to be lower than historic averages due to the growing use of IP-over-DWDM.

- DWDM Long Haul market is forecast to grow at a five-year CAGR of 5 percent.

- Coherent wavelength shipments on WDM systems forecast to grow at 11 percent CAGR, reaching 1.2 million annual shipments by 2027.

- Installation of 400 Gbps wavelengths expected to dominate for most of forecast period.

About the Report

The Dell’Oro Group Optical Transport 5-Year Forecast Report offers a complete overview of the Optical Transport industry with tables covering manufacturers’ revenue, average selling prices, unit shipments, wavelength shipments (by speed up to 1.2+ Tbps). The report tracks DWDM long haul, WDM metro, multiservice multiplexers, optical switch, Disaggregated WDM, DCI, and ZR Optics.

……………………………………………………………………………………………………………………………………………………

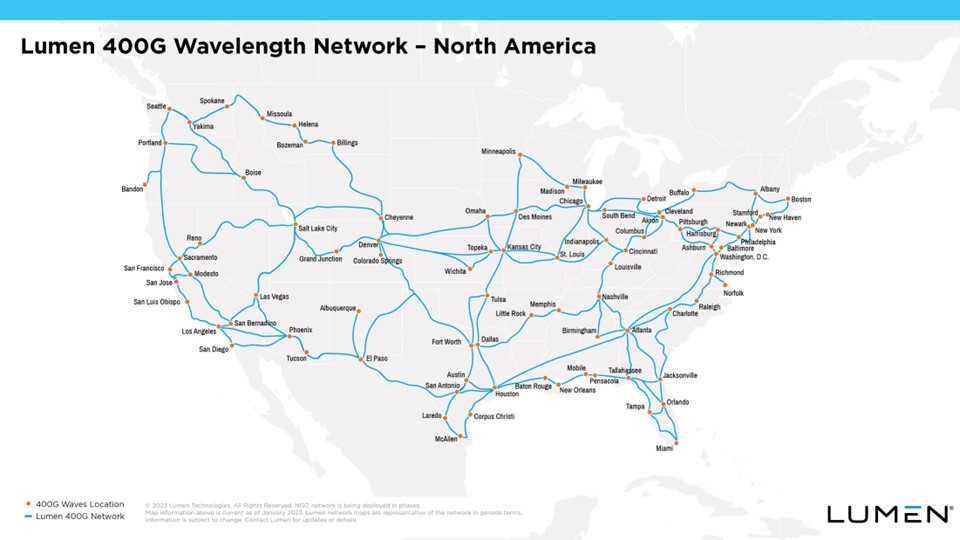

Separately, Lumen Technologies is expanding its 400G wavelength network across North America. Lumen said it has now deployed the network in 70 markets. More than 240 data centers have access to Lumen’s 400G Wavelength Services, and the network has over 800 Tbit/s of capacity.

Lumen said it plans to continue its intercity 400G expansion this year, pushing the network “deeper into the metro edge.” The company noted that wavelength services will assist customers in moving workloads to the cloud, and provide private, dedicated connections.

Enterprise customers can also examine network options, plan out their wavelengths and get cost estimates with Lumen’s Topology Viewer.

References:

https://www.prnewswire.com/news-releases/lumen-kicks-up-its-400g-offering-across-the-us-301730126.html