Network as a Service (NaaS)

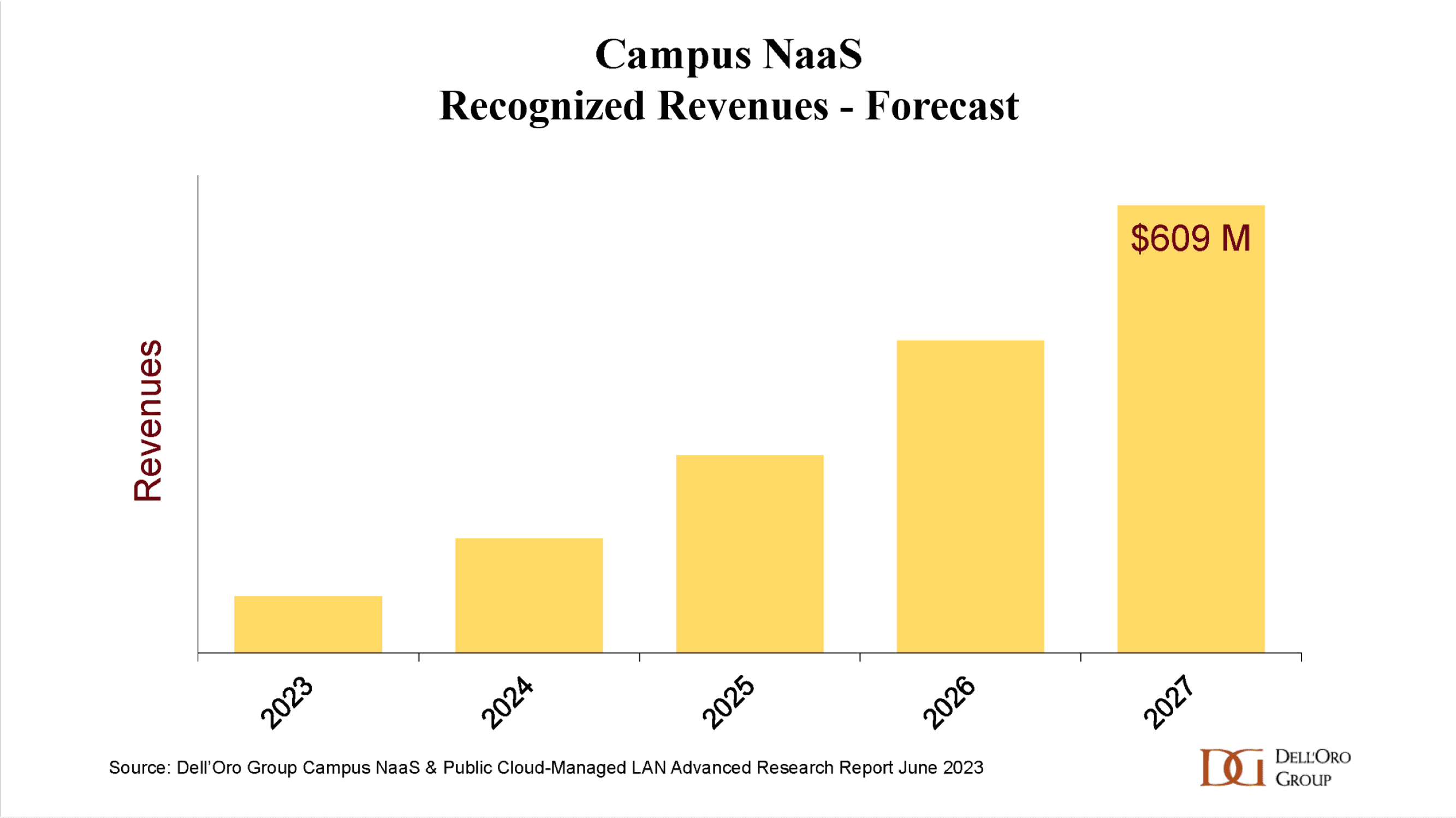

Dell’Oro: Bright Future for Campus Network As A Service (NaaS) and Public Cloud Managed LAN

|

||

|

Gartner: changes in WAN requirements, SD-WAN/SASE assumptions and magic quadrant for network services

Global network service providers are responding to clients’ transformational WAN requirements to support greater agility and reliability for digital business initiatives. In its review and analysis of global network services providers, Gartner makes the following assumptions:

-

By 2025, 50% of new software-defined WAN (SD-WAN) purchases will be part of a single-vendor secure access service edge (SASE) offering, which is a major increase from 10% in 2022.

-

By the end of 2025, at least 30% of enterprises will employ software-defined cloud interconnect (SDCI) services to connect to public communication service providers (CSPs), which is an increase from approximately 10% in 2020.

-

By 2026, 70% of enterprises will have implemented software-defined wide-area networks (SD-WANs), compared with approximately 45% in 2021.

-

By 2026, 45% of the enterprise locations will use only internet services for their WAN connectivity.

-

Growing interest in services like managed SD-WAN and SASE are transforming the enterprise networking market. These are additional ways, rapidly deployed, that organizations can help improve the agility of providers’ network solutions and differentiate themselves to the enterprise audience.

-

Enhancements to flexible networking technologies, such as NoD and bring your own (BYO) access, offer greater support for self-service. They also offer the rapid accommodation of new endpoints and new applications (including cloud services and the Internet of Things [IoT]) while controlling the organization’s WAN expenditure.

-

Flexible sourcing approaches, such as network as a service (NaaS), are gaining interest, although offers are still emerging and should be closely examined against alternatives.

-

The growing use of internet services for WAN transport remains strong and has forced providers to reevaluate their own internet service offerings as well as the extent they partner to peer with local ISPs for greater geographic reach and differentiation.

-

Gartner has also observed an increased demand for Ethernet and wavelength services to effectively address regional requirements for data center connectivity and very high bandwidth circuits, which are integral to the hybrid solution.

Leader in this global Magic Quadrant for network services include: NTT, AT&T, Orange Business Services, Tata Communications, Vodafone, BT and Verizon.

Figure 1: Magic Quadrant for Network Services, Global

Source: Gartner (February 2023)

Some enterprises are moving to internet services for cost reasons as outdated WAN equipment requires the replacement of traditional branch routers, according to Gartner Analyst Danielle Young. Legacy equipment is often being replaced with SD-WAN appliances and solutions, which Young said is “causing a relook at the WAN overall.”

“SD-WAN provides dynamic path selection based on business or application policy, centralized policy and management of appliances, virtual private network, and zero-touch configuration,” she told SDxCentral.

SD-WAN products are WAN transport- and carrier-agnostic, and notably can create secure paths across all WAN connections, including private, public, and wireless. SD-WAN products can also be hardware- or software-based and either managed directly by enterprises or embedded in a managed service offering, Young noted.

“Most often, enterprises are migrating from private networks to create hybrid networks, which utilize a range of connectivity options depending on bandwidth, reliability, and necessity, including using more readily available internet services,” she said. “Security will need to be addressed regardless of WAN connectivity (private or internet-based); and can be addressed through a variety of different approaches.”

………………………………………………………………………………………………………………………………………………………………………

Market Overview:

Gartner forecasts that the market for enterprise fixed data networking services in 2023 will be nearly $134 billion, an increase of approximately 2.6% from 2022 for a compound annual growth rate (CAGR) of 1.9% from 2021 through 2026. The number of global NSPs included in this research has decreased, and many more are operating in the broader market and did not meet all our inclusion criteria. In addition to large global providers, enterprises are increasingly willing to consider smaller or regional providers, including managed service providers, with little or no network infrastructure of their own, but who resell network services to their enterprise clients where needed.

Network Transport (“Underlay”) Trends:

WAN transport services (frequently called “underlay” services) continue to see rapid change, especially in terms of migrations and changes to primary connectivity. MPLS — the mainstay of enterprise networks for over two decades — is being augmented and often displaced by internet (transport) services. And while MPLS still brings benefits in terms of high availability and stable performance, it commands a slight premium in price to standard internet services. MPLS is still preferred as the primary link for the most critical locations and in places where internet performance is poor or variable, which includes emerging markets and those where the internet is heavily restricted, resulting in poor performance. The net result is a smaller number of higher-capacity MPLS lines being retained or deployed in new network designs.

Gartner has witnessed that many enterprises using a hybrid of internet and MPLS usually have more and larger internet lines than MPLS lines. Direct internet connectivity allows direct access to SaaS and general internet traffic and offers a wider variety of access types than MPLS, including dedicated internet access (DIA) over Ethernet, as well as broadband and cellular. DIA lines are typically priced similarly to MPLS lines of comparable capability, but can easily be sourced from multiple providers, while MPLS links generally need to be sourced from a single provider.

For global network deployments, traversing the internet brings additional challenges not found in national networks, including the risk of suboptimal routing and congestion as the traffic traverses multiple ISPs. There are a number of ways of overcoming this, including:

-

Sourcing all internet services from a single provider

-

Federations of ISPs that offer controlled routing among their members

-

Network-based SD-WAN gateways terminating the SD-WAN tunnels and passing the traffic over the provider’s backbone

-

Enhanced internet services that control routing in a way that is agnostic to ISPs and specific SD-WAN technology

Different providers have adopted different approaches from these options and may have multiple options available. Providers who have developed a differentiated internet approach include BT, Deutsche Telekom, NTT, Tata Communications and Vodafone.

Enterprises’ pace of adoption of cloud IT service delivery remains key to transforming their WAN architectures. Fortunately for enterprises, global NSPs have deployed a range of capabilities to address enterprises’ cloud connectivity needs (see How to Optimize Network Connectivity Into Public Cloud Providers The providers in this Magic Quadrant all offer CBCI service directly from their MPLS and Ethernet networks to the top three leading cloud service providers at a minimum. The key differentiators are with the connected specific cloud providers and cities, and the ability to add virtualized services (such as security) into the cloud connection points.

These CBCI services typically allow for the adjustment of capacity — and in some cases, the addition of new cloud endpoints — on demand under portal and/or API control. Such on-demand services may also be extended beyond cloud connectivity to larger enterprise locations and even used for the creation of extranet connections between enterprises. These “network on demand” services typically support bandwidth changes and policy modifications and allow multiple services such as internet and MPLS to be provisioned over a single access line and adjusted as required.

Access Technology Trends:

Traditional leased-line access, such as T1 or E1 lines, to internet services or MPLS are no longer proposed in new deals, except in very rare instances, such as in rural locations or some emerging markets. Pricing for these legacy service types is increasing, and in many cases, the services are reaching the end of their life (see Quick Answer Quick Answer: My Legacy Telecom Service Is Being Shut Down, So What Should I Do?) thereby forcing enterprises to be proactive in identifying new services and potentially new providers.

These legacy access lines have largely been replaced by optical Ethernet access to MPLS and internet, at 10 Mbps, 100 Mbps, 1 gigabit per second (Gbps) or 10 Gbps. The economics of Ethernet access remain attractive, resulting in a tenfold increase in speed, but typically increasing cost by only two to three times. In fact, in developed markets, enterprises now tend to purchase access lines with much higher speeds than they initially require, with the port capacity limited to their current needs. This allows them to easily and quickly upgrade capacity in response to changing requirements.

For smaller, less critical or remote locations, broadband (increasingly, “superfast broadband,” such as VDSL, cable modem or passive optical network [PON]) is the access technology of choice, despite having no SLAs or poorer SLAs than Ethernet access. In some geographies, including the U.S., internet providers have also introduced new access options labeled “business broadband” that offer only incremental SLA improvements compared with consumer offerings. When enterprises require large numbers of broadband connections, they can sometimes find that they are able to get better pricing than that offered by global service providers by sourcing broadband access directly or from aggregators. Many providers now support “bring your own broadband,” which refers to the service provider delivering managed services over broadband sourced by the enterprise.

Gartner is also seeing a renewed and growing demand for Ethernet WAN and wavelength services, in addition to the hybrid network needs. These services have started to regain traction as opportunities to meet very large bandwidth needs (100G) and be utilized more efficiently in a regional or metro environment to support local data centers. Although custom priced, overall pricing continues to decline as the supply of the underlying facilities are more readily available.

Finally, cellular connectivity (4G and emerging 5G) increasingly is being used for backup, rapid deployment or temporary locations, although it does not typically offer network performance or availability SLAs. As with broadband, enterprises may be able to get attractive deals for data-only mobile services themselves, which will then be managed by their global provider.

Network Overlay Trends:

New global network proposals are almost exclusively based on managed SD-WAN services with either a hybrid mix on MPLS and internet or all-internet-based underlay links. The global network providers have most commonly developed a portfolio of three to six SD-WAN vendors because the market is more fragmented and differentiated than the legacy CPE market it is replacing. In fact, Gartner believes that providers should support at least two SD-WAN vendors, offer strong integration and demonstrate a strong customer base. Providers that support a large number of SD-WAN vendors (10-plus) but have limited integration and fewer customers could present higher risks to the enterprise.

Some providers offer network-based SD-WAN gateways, allowing for easier migration to SD-WAN and improved scalability. Such gateways allow the network to use the internet for access and use the providers’ higher-quality backbones for the long haul, greatly improving reliability and performance. A similar outcome can be achieved by using stand-alone enhanced internet backbone services on ISP federations.

Managed SD-WAN services typically offer the option of local internet access (split tunneling) from every site, which is especially useful for access to SaaS applications, such as Microsoft Office 365. Perimeter security can be provided on-site or as a cloud-based service and is increasingly integrated into the WAN design that Gartner calls the secure access service edge (SASE).

An increasing number of global WANs incorporate managed application visibility, with some providers now offering application-level visibility by default. SD-WAN services, which operate based on application-level policies, also typically offer inherently higher levels of application visibility. WAN optimization is still deployed for some specific use cases where bandwidth is either limited (e.g., very small aperture terminal [VSAT]) or expensive (e.g., the Persian Gulf region).

Network functions such as edge routing, SD-WAN, security, WAN optimization and visibility can be delivered as on-site appliances. However, many providers prefer a uCPE VNF approach versus POP VNFs to support greater geographic breadth to the enterprise. Whether VNFs are running in NFV service nodes in the provider’s POPs or via on-premises uCPEs, which are essentially industry-standard servers deployed at the customers’ locations, either approach can support one or more virtual functions. This makes it easy to rapidly change the functions deployed in the network, which are also usually consumed as-a-service with a monthly subscription fee for each function. Some providers allow customers to run their own software, including edge compute applications, on these platforms. Ideally, a provider will offer both options to the enterprise.

All providers evaluated in this Magic Quadrant offer uCPE. The average number of unique uCPE vendors per provider remained the same at 2.6, and the average number of unique CPE-based VNF functions (typically consisting of SD-WAN, router, firewall and WAN optimization) has increased to 6.2. Many providers have added more vendors to a VNF, especially in the case of security. The average number of countries where uCPE and premises-based VNFs are offered is 144. In contrast, network-based VNFs are available in a much smaller number of countries (34 on average), although the number of average unique VNFs is similar to uCPE-based functions (5.9).

The network service providers are continuing to roll out managed SASE offerings as either best-of-breed dual vendor or single-vendor SASE solutions. This can eliminate the need to service chain and orchestrate SD-WAN functionality and several network security functions, thereby simplifying management and, often, offering better overall performance due to less complexity.

Automation and Operational Trends:

Global networks are also becoming more complex because transport is becoming a hybrid of MPLS and internet with cloud endpoints and a variety of backbone options. SD-WAN and NFV technologies add even more complexity. In addition, the internet, especially using broadband or cellular access, is an inherently less predictable service than MPLS. Visibility capabilities — sometimes referred to as performance analytics — can help by enabling enterprises to see the actual performance of their applications. Enhancements continue around performance reporting tools and portals, enabling the enterprise with improved visibility at the network application layers. And with a focus on continuing to enhance the customer experience, customer satisfaction with global NSPs is improving.

NSPs remain focused on improving their lead times, although they remain constrained by the lead times of third-party/local access providers. The increasing speeds of cellular services are making this technology more useful as a rapid deployment (interim) solution to bridge the gap of waiting for fixed connectivity. In addition, it provides a truly diverse backup option. However, the hype around 5G cellular replacing fixed connectivity should be treated with caution, due to maturity issues — especially lack of SLAs and coverage limitations (see Quick Answer: 3 Questions to Answer Before Buying Enterprise 5G).

Providers continue to improve their SLAs with more realistic objectives and more meaningful penalties for failing to meet those objectives. They are increasingly improving to include the right to cancel the contract in the event of chronic breach, ensure on-time delivery, require proactive notification, and complete timely change requests.

In a new trend Gartner has seen this year, many providers have begun adopting artificial intelligence for IT operations (AIOps) and network automation for service onboarding and customer experience improvements. AI is also being leveraged to simulate issues and provide predictive analytics for service improvement and reduced downtime or service degradation (see CSP Tech Trends for 2022: Implications for Network Infrastructure Providers).

Sourcing Trends:

Providers are increasingly focused on providing the managed network service “overlay” platform typically using SD-WAN, and optionally security (SASE), which can be delivered from cloud-native platforms or (less often) by using NFV/uCPE. The providers are more willing to support “bring your own access” and other flexible sourcing approaches for the “underlay” network transport components.

However, the majority of enterprises still buy most of their underlay services from their overlay provider, especially when using a hybrid underlay — that is, mixing MPLS and internet access. This integrated sourcing approach is the primary focus of this Magic Quadrant. Enterprises focused specifically on enterprise network operations services can consider most of the providers evaluated in this research, and also those in Magic Quadrant for Managed Network Services.

Most global network service providers are continuing to move toward a more platform-based approach using a software-driven, as-a-service model leveraging rich visibility and self-service via portals and APIs. A benefit of this approach is the ability to offer enterprises the opportunity for co-management where they can themselves manage aspects of the network, such as application and security policies, with benefits in terms of enhanced agility.

In addition, newer NaaS offerings offer a simplified consumption model with usage or subscription-based pricing, which may appeal from a sourcing perspective. However, NaaS appeals to only a small subset of enterprise customers that, among other things, don’t want to own hardware, perceive subscription-based pricing as optimal and have variable bandwidth needs (see What Is NaaS, and Should I Adopt It?).

Pricing Trends:

Downward pressure on global network service prices remains steady during the pandemic, and managed services pricing has also remained steady, though it will be carefully watched as the economy fluctuates and the talent crunch remains in play. To address cost containment amid providers’ investment strategies, some are focusing on extending their own networks, especially internet services, while others rely heavily on expanded partnerships with local providers. Most providers are making greater use of carrier-neutral communication hubs, such as those operated by Equinix, to cost-effectively interconnect with multiple access, backbone and cloud providers.

These hubs, particularly when combined with NFV and/or SD-WAN, have dramatically reduced the level of investment required to be competitive in the global network service market. This has allowed smaller providers to offer solutions competitive with those of the largest providers. However, maintaining a consistent set of service features and user experiences across these different elements remains a challenge.

Managed Services Trends:

Most global WANs are delivered on a managed service basis, with the on-site devices, such as routers and security appliances, provided and managed by the service provider. Transport links are usually sourced from the managed service provider, but might also be separately sourced by the enterprise, which would then give the managed service provider operational responsibility for them. The U.S. is different because, although a substantial fraction of U.S.-headquartered multinationals do use managed network services, a significant number still manage their networks in-house and only source the network underlay from their global providers.

At the same time, networks are moving more to a co-managed reality because more network functions — such as SD-WAN application policies, security policies and NoD bandwidth — are controllable by the enterprise via the providers’ portals and APIs. In this case, responsibilities for various network management functions are divided between the provider and the enterprise. This is especially true when network perimeter security functions are integrated into the SD-WAN solution (SASE), where a separate organization will often control the security policies and actions.

References:

Magic Quadrant for Network Services, Global, Published 22 February 2023 – ID G00766979 (Gartner subscription required to access)

https://www.sdxcentral.com/articles/is-the-future-of-wan-connectivity-internet-first/2023/03/

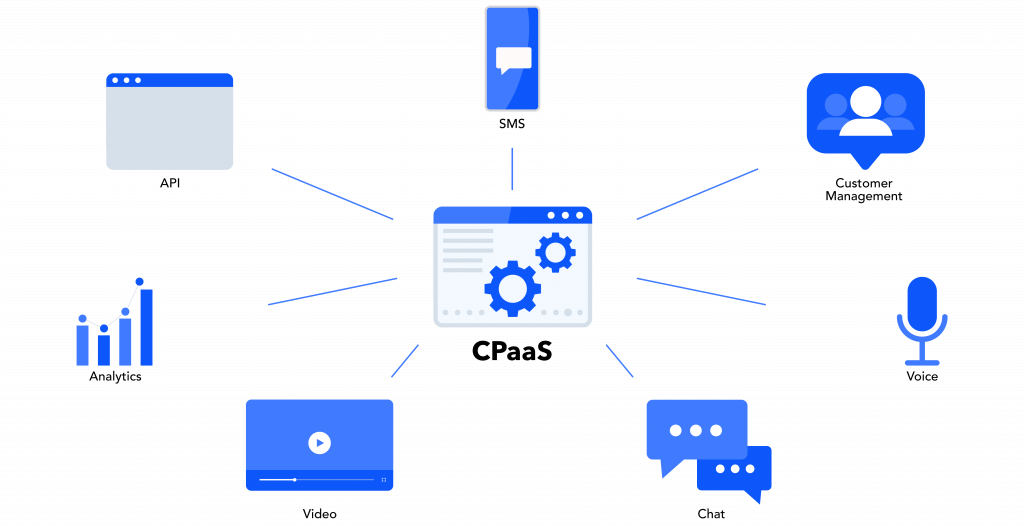

Juniper Research: CPaaS Gobal Market to Reach $29 Billion by 2025

A new study from Juniper Research has found the value of the CPaaS (Communications Platform-as-a-Service) [1.] market will reach $29 billion globally by 2025; rising from $16 billion in 2022. To capitalise on this substantial growth of 80% over the next three years, the report, CPaaS: Market Outlook, Emerging Opportunities & Forecasts 2023-2027, urges CPaaS vendors to focus on the development of managed services over their platforms. These services must enable the creation and management of rich media content over channels such as OTT business messaging, email and social media.

Note 1. Communications Platform as a Service is a cloud-based delivery model that allows organizations to add real-time communications capabilities, such as voice, video and messaging, to business applications by deploying application program interfaces (APIs).

…………………………………………………………………………………………………………………………………………………………

As markets become increasingly saturated with CPaaS service provision, CPaaS vendors must expand deeper into the SME (Small-to-Medium Enterprise) sector. In addition, the report predicts CPaaS vendors will further focus on the provision of value-added features that enable platform users to fully maximise the benefits of rich media channels though the inclusion of tools, including workflow builders and AI-based chatbot solutions.

Research author Sam Barker commented: “CPaaS vendors now compete on the capabilities of managed services to attract SMEs. As many of these smaller enterprises lack in-house development facilities, they will choose the CPaaS platform that provides the most comprehensive managed services for rich media channels.”

Emerging Channels to Disrupt CPaaS in 2023

SMS has historically been the cornerstone of CPaaS revenue. The report predicts SMS traffic revenue will still account for over 50% of all CPaaS revenue by 2025; owing to its established reliability in termination for traffic such as MFA (Multi-factor Authentication).

However, the report forecasts that rich media channels, such as email and social media, will continue to expand, and account for over $10 billion of revenue by 2025; representing over 40% of the CPaaS market value. As a result, platforms that fail to include managed services for rich media services in their three-year plans risk missing out on the substantial growth predicted for the CPaaS market.

Resources:

View the CPaaS market research: https://www.juniperresearch.com/researchstore/operators-providers/cpaas-research-report

Download the whitepaper: https://www.juniperresearch.com/whitepapers/how-cpaas-will-evolve-in-2023

Juniper Research provides research and analytical services to the global hi-tech communications sector; providing consultancy, analyst reports and industry commentary.

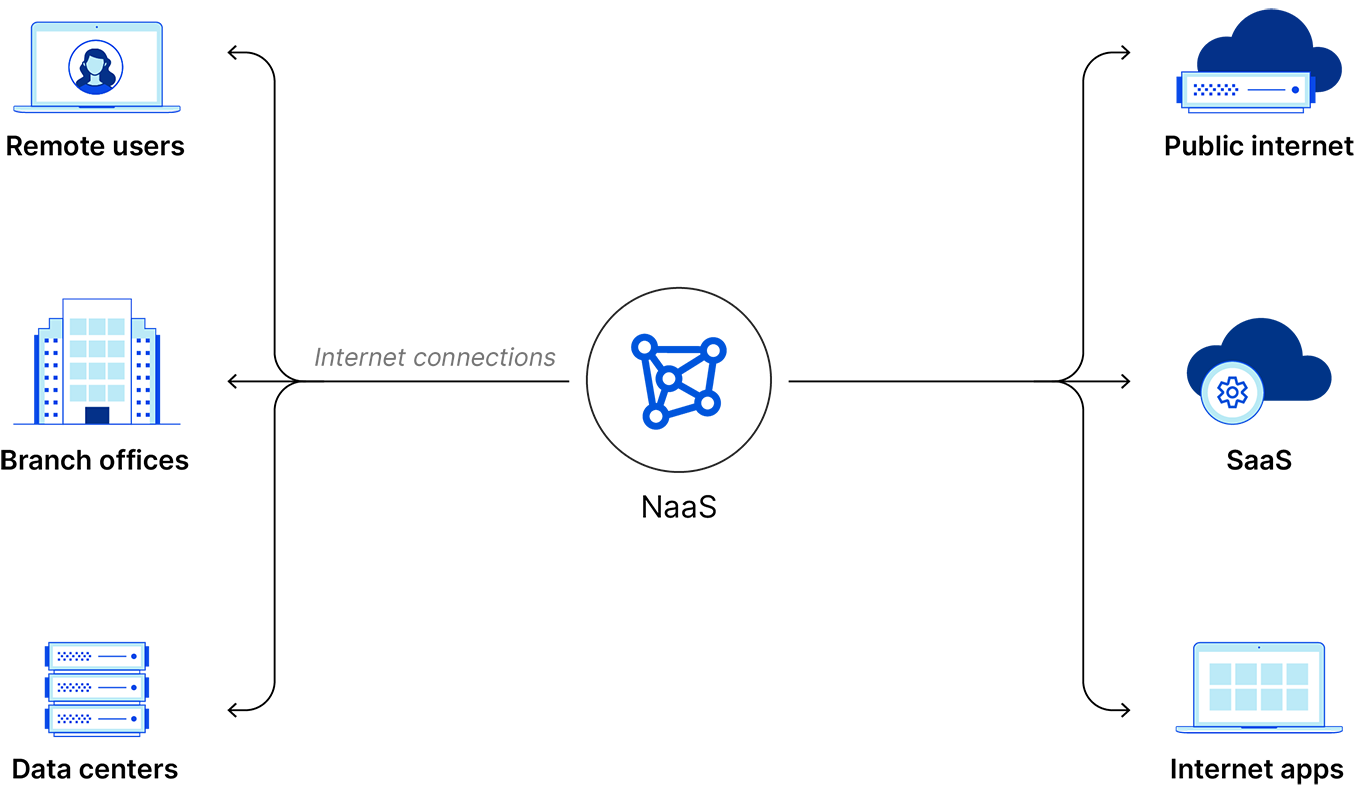

NaaS emerges as challenger to legacy network models; likely to grow rapidly along with SD WAN market

Enterprises are starting to think “much more strategically” about how to support remote and hybrid workers, with as-a-service network models beginning to take over the market, IDC Analyst Brandon Butler told SDxCentral. Organizations are increasingly looking to extend enterprise-class networks to remote and hybrid workers, a concept IDC calls “the branch of one.” IDC reported that 69% of global respondents to a recent survey are planning to invest in network transformation over the next 12 months, highlighting network-as-a-service (NaaS) as a challenger to legacy network models that necessitate substantial upfront capital.

“I would say in the early days there were a lot of what I would call band-aid solutions in terms of, well, maybe I’m just going to spin up some more VPN capacity to be able to support my remote and hybrid workers,” Butler told SDxCentral. IDC conducted a web survey of technology-buying decision makers in 402 medium to large organizations (with 500+ employees), across 13 countries in North America, Europe, and Asia/Pacific, and in nine industries to understand the role of Network as a Service in their network strategy. Here is what they found:

As organizations leverage the value of their networks to jumpstart digital transformation, the Network as a Service market is expected to grow rapidly, at a similar rate as the SD WAN market, which is forecast at a 41% compound annual growth rate from 2019 to 2024.

- The most important Network as a Service capabilities are a hybrid network and SD WAN [1.].

- Real-time, high-bandwidth capabilities are needed for the future network.

- Many enterprises outsource network services, mainly ongoing managed network services, preventative management, and network design.

- Virtualizing, automating, and modernizing the network as well as dealing with security threats are top priorities in a pandemic and post-pandemic world. Specifically – adding virtualized network and security services as well as cloud security are top of the list of things to upgrade.The majority of enterprises plan a network transformation in the next two years. Skills shortages, stakeholder buy-in, and legacy infrastructure hold back progress. The cost of doing nothing can be significant.

Note 1. According to Reasarch@Markets, the global SD-WAN market is projected to grow from USD 3.4 billion in 2022 to USD 13.7 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 31.9% during the forecast period.

In 2022, companies like Verizon and Aruba worked to bolster their NaaS offerings. The global NaaS market generated $11.2 billion in revenues in 2021, and is estimated to reach $72.2 billion in revenue by 2031, according to a report from Allied Market Research.

NaaS replaces legacy network architecture like hardware-based VPNs and MPLS connections or on-premises networking appliances like firewalls and load balancers. Enterprises use NaaS to operate and control a network without needing to purchase, own, or maintain network infrastructure.

Butler said these as-a-service models are “really helping organizations sort of transform how they’re thinking about their relationships with their vendors. Things like as-a-service models, they certainly take into account a sort of consumption model and having more subscriptions, and operating expenses versus capital expenses.”

NaaS models also bring in other benefits, like “being able to be faster or to be able to spin up services or spin down services, that sort of elasticity of them.”

The ability to add and remove features more dynamically, and manage networks from the cloud is another “tenant” that Butler said is key to as-a-service models.

“I always like to say that it’s it’s important to think about what the business needs from the IT department,” he added.

“That’s, I think, the best place to start in terms of what sort of business problems is your broader organization looking to solve and what goals does your organization have,” Butler said. “And then I think that can help determine what sort of technology solutions are the right fit to help meet those business goals.”

References:

https://www.sdxcentral.com/articles/interview/will-2023-be-the-year-of-naas/2023/01/

https://www.naasenterprisesurvey.com/#executive-summary

https://www.alliedmarketresearch.com/network-as-a-service-market

https://www.cloudflare.com/learning/network-layer/network-as-a-service-naas/

ABI Research: Network-as-a-Service market to be over $150 billion by 2030

Verizon and WiPro in Network-as-a-Service (NaaS) partnership

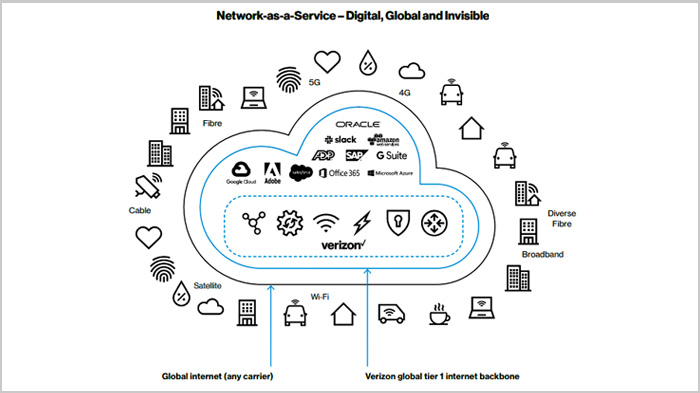

Verizon Business, today announced a global Network-as-a-Service (NaaS) partnership with Wipro Limited, an India based technology services and consulting company, that will accelerate the network modernization and cloud transformation journey for businesses. Wipro’s Network-as-a-Service (NaaS) solution, powered by Verizon Business will include a range of pre-configured and tested service chains on a subscription-based consumption model, designed to drive network consumption infrastructure on demand. The multi-year partnership will enable Wipro to transition customers from legacy cycles of deploying hardware, applications and services to an automated, self-healing, and highly secure network service environment.

Massimo Peselli, Senior Vice President and Chief Revenue Officer, Global Enterprise and Public Sector for Verizon Business said: “Many organizations want to get out of endless technology refresh cycles but they face the twin challenges of traditional hardware and fixed infrastructures. Our partnership with Wipro will enable businesses to future-proof their network in a manner that is more flexible, agile and predictive, centered around their specific needs.”

“This is a network-as-a-service partnership that includes managed services, hardware and security for the global market,” said Sowmyanarayan Sampath, executive vice president and CEO of Verizon Business. “The bulk of Wipro’s customers are global, and the system integrator caters to industry verticals such as retail and energy with a strong value system. We have a logical go-to-market strategy,” Sampath added.

A recent IDC survey of over 400 technology-buying decision makers across the globe revealed that 69% of respondents are planning a network transformation investment in the next 12 months. NaaS has increasingly begun challenging legacy commercial models that require large upfront capital costs by providing more flexible, subscription-based services that can more easily be modified as needs change. The technology has accelerated the implementation of new digital technologies such as AI/ML, 5G, IoT, advanced robotics, blockchain, AR/VR, and voice-assistance.

Jo Debecker, Senior Vice President & Global Head, Cloud and Infrastructure Services, Wipro Limited commented: “Our joint NaaS offering brings together two industry leaders to drive this unique value proposition that will help our customers keep pace with changing demands of the cloud and network infrastructure while achieving operational efficiencies and agility at scale.”

Today’s agreement brings together two network industry leaders.

- Verizon has been named a Leader in Gartner® Magic Quadrant Network Services, Global for the last 16 years and manages more than 4,300 networks globally.

- Wipro is a Leader in Gartner® Magic Quadrant for Managed Network Services and manages over 500+ Network and data center facilities across geographies and different industries.

References:

https://www.verizon.com/about/news/verizon-business-wipro-partner

https://www.naasenterprisesurvey.com/#executive-summary

ABI Research: Network-as-a-Service market to be over $150 billion by 2030

Global technology market intelligence firm ABI Research expects the Network-as-a-Service (NaaS) [1.] market to expand significantly, reaching over $150 billion by 2030.

Note 1. NaaS is a secure, cost-effective subscription-based model that lets businesses of all sizes consume network infrastructure on-demand and as needed. It offers scale-up or scale-down flexibility that many businesses require to stay competitive in today’s unpredictable data traffic environment.

Networks have been commoditized over the last few years and the cost of connectivity has fallen. Value has shifted from network infrastructure to the services built on top of the network. Enterprises need scalable solutions that offer cloud-native agility, multi-cloud accessibility, and services that can dynamically fluctuate to support digital transformation. This has led to significant interest in the NaaS market, according to ABI Research.

Image Credit: Verizon

The firm’s blog promoting their NaaS report notes that telecom operators currently lack business models that allow them to build on their physical connectivity advantages to gain control of the NaaS market.

“Telcos must seize the opportunity to dominate the NaaS market, as revenue generated from connectivity provision will continue to decline. However, their investment strategy, business, operational, and ‘go-to-market’ models are not ready to deliver a competitive NaaS solution, explains Reece Hayden, Distributed & Edge Computing Analyst at ABI Research. “The market is immature and highly fragmented, but telco market revenue will exceed US$75 billion by 2030 if they act now and transform technology, culture, and structure to better align with the requirements of the NaaS market.”

Currently, telcos face NaaS competition from two key players. Interconnection providers (e.g., Megaport and Packet Fabric) have built their agile solutions from the ground up, focusing energy on virtualization and software specialization. At the same time, cloud infrastructure providers (e.g., Amazon AWS, Google GCP, and Microsoft Azure) continue to offer cloud-specific NaaS solutions.

“Telecom operators remain in the best position to lead the market as long as they recognize their service/innovation limitations, invest/restructure successfully, and focus their messaging appropriately,” according to Hayden.

Telcos must look to transform three areas. First, telcos must virtualize network infrastructure to deliver cloud-native services and continue to invest heavily to integrate automation (AIOps) throughout network services, including paying attention to 5G slice-as-a-service and other ‘value-add services’ which are critical to monetization.

Second, telecom operators must restructure business and operating models with a look toward openness and partnerships across the industry and reduce internal fragmentation to drive cross-business service continuity.

Third, telcos must look to develop a problem-solving culture and realign their ‘go-to-market’ strategy to better position themselves within the NaaS market. This involves developing vertical and enterprise size-specific sales strategies and establishing consultative processes that educate enterprises to bridge the ever-present gap between awareness and understanding. Telco executives should focus more on service provision and up/reskilling their workforce.

NaaS adoption will rapidly grow over the next eight years. ABI Research expects that by 2030, just under 90% of enterprises will have migrated at least 25% of their global network infrastructure to be consumed within a NaaS model. However, this process will not be organic, suppliers will have to drive education and consultative practices, as significant skepticism within SMEs and MNCs pervades the market. “To drive short-run sales, suppliers must educate and tailor their sales strategy to focus on first adopters (startups and SMEs) and specific verticals,” Hayden recommends.

The outlook in the NaaS market is hugely positive for telcos, especially given the rising demand from startups and SMEs. “But a lot still needs to be done to bridge technological, cultural, and structural gaps,” Hayden concludes. “Although it seems like an expensive and risky uphill battle, developing NaaS will be crucial to the long-term upside. But, if telcos miss this opportunity and drop the ball, interconnection providers and hyperscalers will be waiting and willing to catch it.”

These findings are from ABI Research’s Network-as-a Service: Business, Operational, and Technological Strategies for Telco Digital Service Transformation application analysis report. This report is part of the company’s Distributed and Edge Computing research service, which includes research, data, and ABI Insights. Based on extensive primary interviews, Application Analysis reports present an in-depth analysis of key market trends and factors for a specific application, which could focus on an individual market or geography.

ABI’s NaaS report does not include IT equipment and software vendors like Cisco, Dell Technologies, and Hewlett Packard Enterprise (HPE), which have been bolstering their own NaaS hardware and software stacks while established sales channels into most enterprises.

About ABI Research:

ABI Research is a global technology intelligence firm delivering actionable research and strategic guidance to technology leaders, innovators, and decision makers around the world. Our research focuses on the transformative technologies that are dramatically reshaping industries, economies, and workforces today.

………………………………………………………………………………………………………………….

References:

https://www.verizon.com/about/news/network-service-explained

Cisco Plus: Network as a Service includes computing and storage too

Cisco Systems is extending the concept of software-as-a-service (SaaS) technology with the introduction of Cisco Plus, which is a network-as-a-service (NaaS) offering focused on cybersecurity and hybrid cloud services. The new service offering can also provide computing-as-a-service and data-storage-as-a-service.

- Cisco announcing plans to lead the industry with new Network-as-a-Service (NaaS) solutions to deliver simpler IT and flexible procurement for customers looking for greater speed, agility and scale

- Cisco also reveals plans to help customers build a SASE foundation today (with Cisco SD-WAN and security) with as-a-service offer coming soon

- Cisco Plus offers include flexible consumption for data center networking, compute and storage now, and commits to delivering the majority of its portfolio as-a-service over time

“I believe every organization would benefit from simplifying powerful technology,” said Todd Nightingale, Senior Vice President and General Manager, Enterprise Networking and Cloud, Cisco. “Network-as-a-service is a great option for businesses wanting to shift to a cloud operating model without a heavy lift. Cisco is leading the industry in its approach with Cisco Plus. Together with our partners, we intend to offer the majority of our technology portfolio in the simplest, most flexible way: cloud-driven, cloud-delivered, cloud-managed and as-a-service.”

“Network-as-a-service delivery is a great option for businesses wanting to shift to a cloud operating model that makes its easy and simple to buy and consume the necessary components to improve and grow their businesses,” said James Mobley, senior vice president and general manager of Cisco’s Network Services Business Unit.

Cisco Plus NaaS solutions will provide:

- Seamless and secure onramps to applications and cloud providers

- Flexible delivery models, including pay-per-use or pay-as-you-grow options

- End-to-end visibility from the client to the application to the ISP

- Unified policy engine to ensure the right users have access

- Security across everything, not bolted on as another point solution

- Real-time analytics providing AI/ML-driven insights for cost and performance tracking

- API extensibility across the technology stack

- Partners layering additional value and delivering their services faster

The NaaS rollout will first focus on a cloud-based solution as-a-service for secure access service edge (SASE). The Cisco SASE offer currently available enables customers to easily leverage future services with investment protection. Cisco is planning limited release NaaS solutions later this calendar year that will unify networking, security and visibility services across access, WAN and cloud domains.

While Cisco plans in the next few years to introduce what will likely be many service options under Cisco Plus, for now it is introducing two flavors. The first, Cisco Plus Hybrid Cloud, includes the company’s data-center compute, networking, and storage portfolio in addition to third-party software and storage components all controlled by the company’s Intersight cloud management package. Customers can choose the level of services they want for planning, design and installation Mobley said.

Cisco Plus Hybrid Cloud, which will be available mid-year, offers pay-as-you-go with delivery of orders within 14 days, Mobley said.

“As enterprises recommit to their digital transformation strategies, they are increasingly looking for more cloud-like, flexible consumption models for procuring and managing their IT, cloud and network infrastructure. These “as-a-service” deployment options provide much needed flexibility and scalability, along with a simplification of network deployments and ongoing operations. Cisco’s transition to as-a-service via Cisco Plus shows the company is committed to meeting customer needs for predictable costs, cloud-like agility, first-class security, and more.

“With Cisco Plus, it’s taking NaaS and its hybrid cloud offerings to the next level by including hardware and the full portfolio into this as-a-service offer, that provides cloud-like simplicity and flexibility of consumption on one end, and on the other, it provides a rich set of intelligent operational enhancements that go a long way to deliver enhanced IT experiences and outcomes. This has also been made possible by increased embedded intelligence now available in network and IT hardware and software, coupled with advanced telemetry options in many of these platforms.”

— Rohit Mehra, Vice President of Network Infrastructure, IDC.

“With Cisco Plus, we couldn’t be more excited that Cisco is diving deeper into the as-a-service era, helping us in our transformation to deliver IT as a service to our customers. In this way, we are better equipped to help our customers simplify their IT operations, and free up resources to invest in innovation of their core business.” — Jeffrey den Oudsten, CTO Office Solutions Director, Conscia Nederland

“There’s always been a push and pull in how to operationalize and finance IT infrastructure. Cisco Plus is the matching pair to a cloud operating model. Delivering Cisco Plus across the majority of Cisco’s portfolio helps us at Insight to further deliver the transformation to a cloud operating model our clients want. With Cisco Plus, organizations can not only operate their infrastructure as a cloud, but also consume it in a similar fashion, enabling a true hybrid, multi-cloud.” — Juan Orlandini, Chief Architect Cloud + Data Center Transformation, Insight

“At Presidio, we have seen this shift coming for a long time. Our customers are very clear: They want to consume reliable, best of breed infrastructure with consumption-based financial models. And with the launch of Cisco Plus, Presidio and Cisco in partnership are doing just that.” — Raphael Meyerowitz, Engineering VP, Office of the CTO, Data Center, Presidio

The second Cisco Plus service, which did not have an availability timeframe, will feature the company’s secure access services edge (SASE) components, such as Cisco’s SD-WAN and cloud-based Umbrella security software.

Security-as-a-service models offer many advantages for organizations including offloading the maintenance of hundreds or thousands of firewalls and other security appliances, said Neil Anderson, senior director of network solutions at World Wide Technology, a technology and supply-chain services provider.

“With SASE, enterprises can consume that from the cloud and let someone else take care of the toil, which frees up their security team to focus on threat vectors and prevention,” he said.

While the strategy behind delivering network components as a cloud-based service has been around for a few years, it is not a widely used enterprise-customer strategy. Cisco’s entry into NaaS is likely to change that notion significantly.

“Cisco has been on this journey for a few years now—starting with providing subscription-based offers for many of its software solutions—while working on simplifying and enriching the licensing and consumption experience,” Mehra said. “Customers understand and have embraced cloud-like IT-consumption models that are typically subscription-based and provide scalability and other on-demand capabilities,” Mehra said.

Terms such as NaaS are still largely new in an enterprise context to most IT practitioners, although they do understand that operational simplicity and flexibility will be crucial to their success in digital transformation, Mehra said.

While NaaS might be relatively new to some customers, others are already utilizing it, other experts said. For remote-access, customers are more than ready, and it’s starting to go mainstream, Anderson said.

“For connectivity to the cloud edge, it’s coming very soon, and the adoption of SASE models for security will accelerate the demand for NaaS services,” he said. “NaaS in the campus will probably take a bit longer, but we see that coming. Some customer segments, like retail, are probably ready today, while others like global financials will take longer to adopt.”

Networking is no longer just about connecting things within private networks because there is a world of networking to and between clouds to account for, Anderson said. “For example, with private WANs, I typically networked my sites to my other sites like a private data center. Now, I need to network my sites to cloud services, and I may be doing so with public-internet services,” Anderson said.

NaaS for the campus network is another use case on the horizon, he said. “To build campus networks in the past, we had access, distribution, and core layers, and the core spanned my campus and sometimes private data center. It was designed to aggregate traffic from users into my private data center,” Anderson said. “Today, much of the traffic is heading to the cloud—Office 365 is the tipping point for many organizations—so building a core network may not be necessary. I see a new architecture emerging where the goal is to tie each site, including each building of a campus, to the internet directly to connect users to cloud and enable traffic to [reach] the cloud sooner, ultimately improving the user experience.”

Naas is by no means a slam dunk, and there will be challenges for enterprises that use it. “For medium to large organizations with significant investments in existing remote, branch, campus and data-center networking network-security infrastructure, migrating to NaaS will be difficult and time consuming. Multi-vendor environments will further complicate the matter,” stated principal analyst at Doyle Research, Lee Doyle.

Widespread adoption of enterprise NaaS will occur slowly over the next five to 10 years Doyle stated. The best fits for adoption now are greenfield sites, temporary locations, and small branch offices. NaaS offerings will also be attractive to network remote, home and mobile workers who need secure, reliable application performance. Enterprise networks with the requirement to move traffic at high speeds on-site would be more difficult to deliver as a service, Doyle stated.

Key challenges, besides understanding of what NaaS will help deliver, face IT practitioners who are the potential customers as well as vendors and service providers, Mehra said.

“On the customer aspects, what we’ll need to watch will be the changing role of IT and how it can optimally consume these technologies as a service while retaining overall control of its IT environment,” Mehra said. “On the provider side, visibility across issues such as operational flexibility and simplicity will be one area to consider, while another will be the direction the industry takes on what metered-service options it makes available for its clients.”

The challenges depend on the industry and security requirements, WWT’s Anderson said. “If the organization is in a heavily regulated industry like financial, healthcare, or federal [government], one challenge will be trusting the integrated security needed,” Anderson said. “For example, there would be fewer challenges to enable everyone to connect to the internet, akin to a giant hotspot, but to adopt more of a zero-trust model, where you may need to securely isolate sessions and devices from one another, will require building trust in some integrated security technologies.”

“What Cisco is doing is very interesting because what NaaS is out there has been limited to mostly the WAN world but once you start targeting the enterprise that’s where the challenges are because customers still have to move bits and everything can’t be in the cloud,” Doyle said. “Instead of being in the first inning of a game we are really just now defining the rules of the game, so there’s a long way to go.”

References:

https://www.zdnet.com/article/cisco-launches-cisco-plus-a-step-toward-network-as-a-service/