DirecTV

Analysis: AT&T spins off Pay TV business; C-Band $23.4B spend weakens balance sheet

AT&T has agreed to create a new company for its U.S. video business unit together with private equity firm TPG Capital. The company will be called New DirecTV and include: today’s Direct TV, U-verse TV and AT&T TV (AT&T’s OTT video service) which AT&T said was “the future of TV” only 11 months ago. That was, indeed, a very short lived future!

The new company will have an estimated enterprise value of $16.25 billion. It will be headed by DirecTV CEO Bill Morrow and have its headquarters in El Segundo (California) and Denver (Colorado).

AT&T will own 70 percent of the new company, while TPG will hold 30 percent and will pay AT&T $1.8 billion in cash.

AT&T CEO John Stankey said the agreement is in line with the operator’s strategy to focus on core assets such as 5G, fiber optic network build-outs and HBO Max. The New DirecTV will provide “dedicated management focus” for the pay-TV operations while reducing AT&T’s huge debt burden.

AT&T bought DirecTV in 2015 for $48.5 billion but the actual value was closer to $66 billion including debt. AT&T recently struck $15.5 billion off the value of the DirecTV, reflecting the service’s dimmer prospects. AT&T said it would get about $7.8 billion in cash from the transaction to help pay down debts. Those proceeds include $5.8 billion that the new company will borrow from banks and pay back to AT&T.

“The disruption in pay TV did exceed our original expectations,” AT&T finance chief John Stephens said in an interview, adding that the satellite-TV business had helped generate cash for the company even as its customer base declined. Mr. Stephens said the new ownership structure is “a very attractive transaction, getting TPG’s expertise and that upfront cash payment.”

The new company will not include the WarnerMedia HBO Max streaming platform, AT&T’s Latin American video operations Vrio, AT&T’s regional sports networks, U-verse network assets and AT&T’s Sky Mexico investment.

At completion, all existing AT&T video subscribers will become New DirecTV customers and all existing content deals, including NFL Sunday Ticket on DirecTV, will become of the new company. New DirecTV will have a commercial agreement with AT&T and continue to provide bundled pay-TV services for mobile and internet customers.

New DirecTV video subscribers will also continue to receive HBO Max (which currently costs $15 per month) plus any associated discounts. AT&T and New DirecTV will also continue to serve customers through multiple distribution channels, including retail, online, call centers and indirect sellers; and share revenues for ad inventory management and ad sales.

The new company’s board will have two representatives from both AT&T and TPG, with Morrow holding the fifth seat. Most AT&T video services employees will move to New DirecTV. The new company plans to recognize its unionized labor force and will assume and honor all existing collective bargaining agreements.

The deal is expected to close in second half of this year. Under the terms of the agreement, AT&T will receive $7.8 billion from New DirecTV, including $7.6 billion in cash and the assumption from AT&T of $200 million worth of existing DirecTV debt. AT&T will use the proceeds to reduce its debt. TPG will contribute $1.8 billion in cash to New DirecTV in exchange for preferred units and its 30 percent stake in the new company.

“This agreement aligns with our investment and operational focus on connectivity and content, and the strategic businesses that are key to growing our customer relationships across 5G wireless, fiber and HBO Max. And it supports our deliberate capital allocation commitment to invest in growth areas, sustain the dividend at current levels, focus on debt reduction and restructure or monetize non-core assets,” said AT&T CEO John Stankey.

“As the pay-TV industry continues to evolve, forming a new entity with TPG to operate the U.S. video business separately provides the flexibility and dedicated management focus needed to continue meeting the needs of a high-quality customer base and managing the business for profitability. TPG is the right partner for this transaction and creating a new entity is the right way to structure and manage the video business for optimum value creation.”

“We look forward to working with AT&T, Bill and the entire talented team at the new DIRECTV to create a seamless customer experience through the separation of the company,” John Flynn, Principal at TPG said. “We are particularly excited by the opportunity to grow new DIRECTV’s streaming video service, leveraging the company’s leading pay-TV platform, talented labor force and large subscriber base to transition it into a leading next-generation video provider with best-in-class content and customer experience.”

AT&T lost 7 million domestic pay-TV subscribers over the last two years. Comcast lost about 2 million such customers over the same period. Dish Network Corp. , DirecTV’s satellite-TV rival, shed roughly 1 million subscribers.

Financing the Deal:

New DirecTV has secured $6.2 billion in committed financing from its bank group, $5.8 billion of which will be used to pay AT&T and assume the $200 million of agreed debt.

AT&T also agreed to cover up to $2.5 billion in losses tied to DirecTV’s NFL Sunday Ticket package.

AT&T financial impact:

AT&T’s net debt load, which was listed above $180 billion after the Time Warner transaction, recently stood around $148 billion.

In 2021, AT&T expects to apply the cash proceeds from the transaction toward debt reduction and does not expect a material impact to its 2021 financial guidance for:

• Consolidated revenue growth in the 1% range

• Adjusted EPS to be stable with 2020

• Gross capital investment in the $21 billion range with capital expenditures in the $18 billion range

Following close of the transaction, AT&T expects to deconsolidate the U.S. video operations from its consolidated results. The company will continue to look at ways of “monetizing non-core assets.”

Opinion – AT&T’s C-Band Spend Adds to Debt and Weakens its Balance Sheet:

The company added that it has proactively managed its debt portfolio, reducing near-term debt maturities by about $33 billion in 2020 and lowering the overall portfolio average rate to 4.1 percent at the end of 2020, down 20 basis points from first-quarter 2020 levels.

However, AT&T has not said how it would pay for the $23.4B they spent to acquire spectrum at the recently completed C-Band auction, other than the $14.7B it raised raised in a loan-credit agreement with Bank of America earlier this year.

Moody’s Investors Service on Wednesday told clients that AT&T’s C-Band spectrum splurge could pressure AT&T’s credit rating, which sits two notches above junk territory. In a brief note Thursday, Moody’s called the DirecTV deal “moderately credit positive” because it would produce cash to help cover the spectrum costs.

Oppenheimer analysts believe that spectrum build-out in new 5G deployments will take at least a year and the resulting revenue won’t show up for a few years. We believe that AT&T will be very hard pressed to fund the spectrum buildout within the next two or three years due to delays in installing hundreds of thousands of small cells and fiber to them for backhaul.

Analyst Craig Moffett had this to say: “At $23.4B, AT&T spent more than would have been expected a month ago, but expectations for their spend had been rising (notwithstanding the fact that they have onlyfinanced half of what they bought, and even that with only short-term debt), so the surprise may not be large there, either. But again, it’s a shock to see the number.”

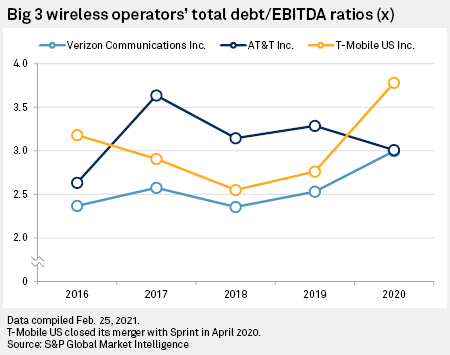

“AT&T emerges from the auction with leverage of 4.1x EBITDA (assuming all debt financing)……AT&T, in particular, will face enormous pressure to withdraw its hyper-aggressive promotional stance in order to produce enough free cash flow to sustain their dividend – but that is cold comfort for an industry whose ROI will inarguably be even worse than it has been in the past.”

Craig noted that C-Band spectrum will require many more small cells which require permits, time and effort to install. That will delay AT&T’s 5G network expansion using the newly acquired spectrum:

“3.5 GHz spectrum (again, as a rough proxy for C-Band) requires sixteen times as many cell sites as would 2.0 GHz spectrum for the same free space coverage. And because C-Band will have very limited ability to penetrate obstructions (trees, walls and windows, intervening buildings, etc.), real world propagation limitations will likely be even greater than what a free space model would suggest.”

References:

https://www.wsj.com/articles/at-t-to-spin-off-directv-unit-in-deal-with-tpg-11614288845 (paywall)

https://otp.tools.investis.com/clients/us/atnt2/sec/sec-show.aspx?FilingId=14659869&Cik=0000732717&Type=PDF&hasPdf=1 (SEC 8K report on $14.7B loan with BoA)