GCC

The 5G Spectrum Conundrum for South Africa and GCC countries; 5G Status Report

According to IDC, there is a dire need to ensure that 5G spectrum policies in the Gulf Cooperation Council (GCC) [1.] region and South Africa include effective spectrum allocation and management strategies. This is key to ensuring that the evolution from 3G and 4G networks to 5G networks and capabilities is seamless, viable for ecosystem players, and accelerates digital transformation imperatives.

Note 1. The Gulf Cooperation Council (GCC) is a regional, intergovernmental political and economic union that consists of Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates.

Over the past few years, national regulatory authorities (NRAs) in the GCC region have allocated significant quantities of spectrum, particularly in the mid-band of 1-6GHz, to accelerate 5G deployments and adoption. What happens next needs to be the introduction of policies and practices that create a healthy and competitive ecosystem designed to accelerate the achievement of key national development imperatives, says Keoikantse Marungwana, IDC’s senior research and consulting manager and telecom and IoT lead for Sub-Saharan Africa.

“The NRAs have also made limited allocations of mmWave spectrum to support 5G growth, and this needs to be supported by telecom operators and tech suppliers who should focus on increasing and diversifying their capabilities and skill sets to ensure a successful transition to 5G,” adds Marungwana. “The 5G ecosystem is going to be more complex, it is going to include features such as 5G network slicing, spectrum sharing, and open RAN architectures along with 5G private networks and significant innovation. The innovation and market opportunity ushered in by 5G will require robust and forward-looking policies and regulatory frameworks that enhance this potential, not limit it.”

As the world shifts on its digital axis, many organizations have adopted tech and connectivity platforms designed to enhance collaboration and efficiencies, embarking on initiatives that deploy solutions that use the Internet of Things (IoT), artificial intelligence (AI), and more. They are focusing on platforms, systems, and solutions that enable them to leverage widely deployed 34G and LTE networks, and they are focused on sustainable investments that will allow them to transition to 5G and accelerate their initiatives. The potential of 5G is significant – it can enable innovation, transform use cases, and allow digital laggards to leapfrog into the future.

“Already, there have been some remarkable use cases across multiple industry verticals,” says Marungwana. “5G deployments worldwide have enabled use cases in manufacturing, mining, transportation, sports, and entertainment. The emerging spectrum allocation strategies currently on the table are set to create new excitement and new business models for an already flourishing ecosystem.”

To fully realize the value of this changing landscape, operators and buyers will need to establish clear business objectives and quantifiable outcomes if they are to benefit from this network evolution. Companies should focus on developing research-backed and insights-led investment propositions for spectrum and 5G adoption, whether this is for a 5G or IoT network rollout, an investment into a private LTE/5G network service, or the implementation of a popular use case that has proven value and legitimacy for the sector.

“Spectrum will remain highly contested and heavily monitored to ensure efficient utilization,” says Marungwana. “However, operators have a massive opportunity to transform business through new capabilities that are enabled by 5G networks across the various spectrum bands. They also have a responsibility as ecosystem anchors to support national imperatives and to lead the ecosystem by launching new solutions.”

Operators should look to creating innovative partnership frameworks that accelerate new use cases and business models. Many companies are looking for inventive ways to transform their businesses and they are turning to telecom providers for support, insights, and skilled expertise. Organizations sitting on the cusp of the 5G revolution want partners who can help them implement end-to-end value propositions that start at the factory or shop floor on industrial machines, and that move to the edge to the cloud and beyond.

“The telecom provider of today is a digital transformation partner that leads the business value discussion and uses spectrum, IoT, AI, edge, network, and cloud capabilities as the means, not the end,” says Marungwana. “However, there are challenges that have to be overcome before 5G and its burgeoning potential can be fully realized. While regulators, operators, and technology buyers are learning from previous experiences they need to accelerate 5G adoption while addressing multiple regulatory objectives – and this is a difficult balancing act.”

This is one challenge, as is the reality that incumbent providers may not have realized a return on their previous investments and are now expected to make further investments into 5G infrastructure and spectrum. For technology buyers, previous investments into emerging technologies may also not have reflected positively on their financial statements to date. Both these factors may yet play a role in delaying 5G adoption.

“However, the highlight is that new spectrum management approaches have been introduced worldwide, and this has led to new ecosystem players, innovative business models, and new solutions,” concludes Marungwana. “Stakeholders in the GCC, South Africa, and even other African markets can research these and evaluate the various deployment models and customer use cases; these will, in turn, inform their technology and business strategies for 5G going forward.”

IDC in the Middle East, Turkey, and Africa:

For the Middle East, Turkey, and Africa region, IDC retains a coordinated network of offices in Riyadh, Nairobi, Lagos, Johannesburg, Cairo, and Istanbul, with a regional center in Dubai. Our coverage couples local insight with an international perspective to provide a comprehensive understanding of markets in these dynamic regions. Our market intelligence services are unparalleled in depth, consistency, scope, and accuracy. IDC Middle East, Africa, and Turkey currently fields over 130 analysts, consultants, and conference associates across the region. To learn more about IDC MEA, please visit www.idc.com/mea. You can follow IDC MEA on Twitter at @IDCMEA.

………………………………………………………………………………………………………………………………………………………………………………………………………..

Meanwhile, the Qatar Tribune says that GCC countries are poised to benefit from the expansion of their 5G networks:

Earlier this month the UAE unveiled its “Industry 4.0” initiative, which aims to increase innovation and productivity, lower the industrial sector’s carbon footprint and add some $6.8bn to the economy by 2031. Industry 4.0 is a cornerstone of the government’s roadmap to ensure that the economy remains dynamic over the next half century. The plan will leverage Fourth Industrial Revolution technologies such as automation, additive manufacturing, blockchain, artificial intelligence (AI) and internet of things (IoT).

In the UAE, as elsewhere, such technologies often depend on 5G connectivity to generate optimum value. For this reason, a significant aspect of Industry 4.0 is a plan for Abu Dhabi-based ICT giant Etisalat to expand 5G coverage in the country, in partnership with Swedish multinational, Ericsson, which has been working in the UAE since the 1970s.

In fact, the 5G rollout in the UAE is already under way, thanks in part to Etisalat’s efforts to develop ICT infrastructure: the country boasts the world’s fastest mobile network and the GCC’s fastest fixed network. In addition, for three years it has had the highest fibre-to-the-home (FTTH) penetration rate in the world.

Ericsson has highlighted that one area in which 5G could add significant value is in smart agriculture in Al Ain, where industrial farmers are keen to bolster digitalization, for example by expanding the use of remote sensors and robotics. This is one of the ways in which 5G can potentially make industry more sustainable and productive in the region.

“Increasingly clients want to feel they are part of sustainability efforts, and that these efforts lead to tangible realities. In this regard, 5G can be a key enabler, thanks to the decentralized control and monitoring it can provide across facilities and systems,” Feras Albanyan, acting CEO at real estate development company Aqalat, told Oxford Business Group (OBG).

5G elsewhere in the GCC:

Several GCC countries – e.g. Saudi Arabia – began expanding 5G coverage in 2019. In a recent report, Ericsson anticipated that 5G will account for 73 percent of all mobile subscriptions in the GCC by 2026. This will represent the world’s second-highest 5G market penetration (behind South Korea).

Saudi Arabia’s Salam – known as the Integrated Telecom Company until June this year – is expanding its 5G and FTTH in the Kingdom, in line with Vision 2030 digital transformation plans. “As increasing numbers of devices are plugged into 5G networks, enhanced connectivity and higher speeds will generate an enormous wealth of data. This will lead to new insights and functionalities through AI-powered analytics and cloud services,” Essam Alshiha, CEO of Saudi Business Machines, told OBG.

Despite this momentum, there are certain question marks associated with wholesale 5G rollout:

“5G is far superior to 4G, but operators are often trapped by a purely marketing-driven approach to investments in 5G,” Osama Al Dosary, CEO of Salam, told OBG.

“The fear of telecom services being perceived as utilities generates enormous pressure on operators to seek ways to differentiate themselves. Yet it is important to prevent a disconnect between marketing discourse over what 5G means in terms of added functionalities and the real return on investment.”

Another cautionary tale comes from China, where, after years of investment, many major 5G operators have recently begun to dial back and focus on commercial apps that can be replicated at scale. A further challenge is the perennial question of ICT infrastructure and access.

“While many cloud services only require 4G connectivity, the merging of cloud computing and the IoT can be a driver of growth. However, this depends on telecoms companies managing to provide large-scale 5G connectivity in a financially sustainable way, which remains a challenge in Oman and elsewhere,” Maqbool Al Wahaibi, CEO of Oman Data Park, told OBG.

Lastly, there are some doubts as to whether customers themselves appreciate the benefits of 5G. For example, a recent survey found that U.S. consumers were largely ambivalent about 5G, with some 67 percent saying they are not likely to change from 4G, and a further 19 percent saying that they simply did not care.

It remains to be seen whether 5G will face similar issues in the GCC, although it should be highlighted that the region is already a world leader in terms of internet usage: by the end of 2020, it had the highest average monthly data traffic per smartphone in the world.

References:

https://www.idc.com/getdoc.jsp?containerId=prMETA48365921

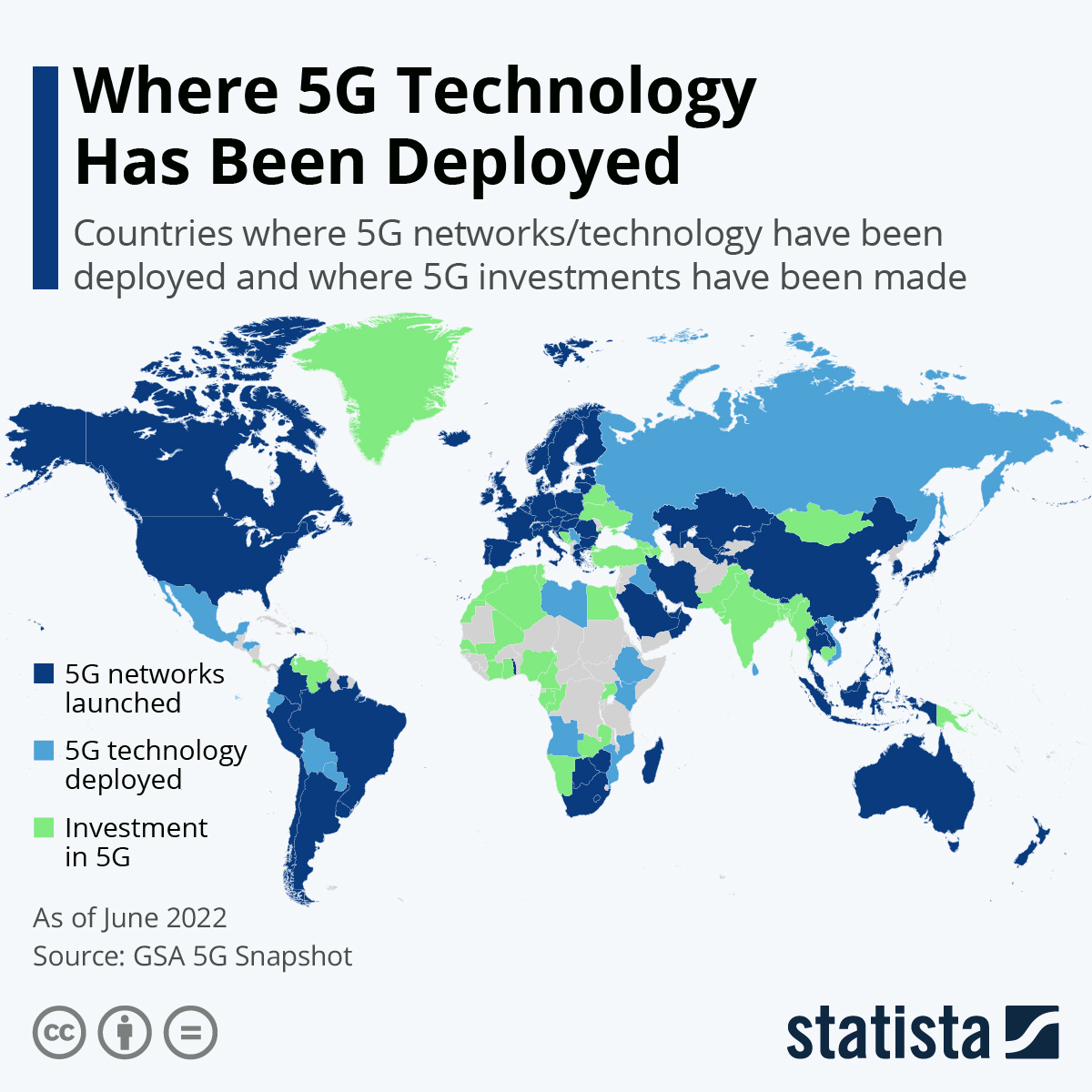

https://www.statista.com/chart/23194/5g-networks-deployment-world-map/

Right click to get Power options then select Advanced Options