Germany

Germany’s Contentious 5G Auction May Squeeze Telcos

Germany’s auction of 5G frequencies, now into its 10th week, has drawn 6 billion euros ($6.7 billion) in bids so far. That amount raised in a record 405 auction rounds for the 41 blocks on offer is more than experts thought companies would spend all together for all rounds. The duration of this auction has no precedent in Germany, with country’s 4G auction in 2010 lasting for 224 rounds.

German telco market leader Deutsche Telekom has complained that the regulator has forced up prices by offering too little spectrum. Deutsche Telekom leads in 13 of the blocks, with competitor Vodafone ahead in 12 and Telefonica Deutschland in eight, according to auction results published by the Federal Network Agency (BNetzA).

Source: Deutsche Telekom

……………………………………………………………………………………………………

New entrant 1&1 Drillisch, a ‘virtual’ mobile player controlled by United Internet, leads in eight blocks, as billionaire CEO Ralf Dommermuth pursues his dream of becoming Germany’s fourth operator.

Drillisch, and United Internet, have slashed their dividend payouts to conserve cash so that they can stay in the game.

As the telecom industry prepares for the costly rollout of new 5G networks, with little prospect of any immediate revenue growth from new 5G services, the spectrum bill is a further squeeze. And while bidding has recently slowed, the contest is not yet over.

Industry leaders say that inflated auction costs would undermine their ability to invest the billions needed to build 5G networks – as happened in a pricey spectrum auction in Italy last year.

………………………………………………………………………………………………………….

German telcos appear to be grasping expensively for a small amount of spectrum in the 3.6GHz range, the “mid-band” that looks optimal for the delivery of 5G services. The fight would have been less damaging and drawn-out had German regulators put more of these airwaves up for sale, according to Timotheus Höttges, the head of Deutsche Telekom. Instead, they chose to hold back 100MHz for industrial and local settings, such as German factories, leaving 300MHz to the telcos. Supply constraints have driven up the bids.

Competition has been especially fierce because of 1&1 Drillisch. Having previously bought network capacity from Telefónica, and functioned as a mobile virtual network operator, the broadband company is now determined to build a fourth mobile network using spectrum it picks up in the auction. After round 406, 1&1 Drillisch accounted for more than €1.1 billion ($1.2 billion) of the amount bid. Since the auction began, its share price has lost a quarter of its value as investors worry about the consequences of spending so much.

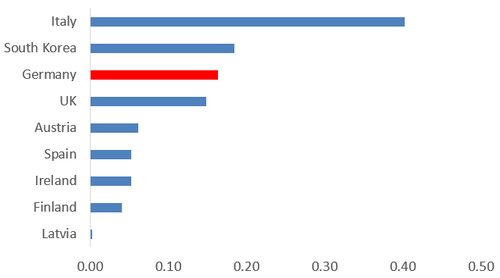

Outside Italy, Germany now values the mid-band at a higher level than any other European country that has licensed 5G spectrum. Were the auction to finish now, German telcos would pay about $0.16 per megahertz per head of population (per MHz pop, a common way of valuing spectrum) for 3.6GHz licenses. That edges Germany ahead of the UK, which raised about $0.15 (at current exchange rates) per MHz pop during a 3.4GHz auction in 2018. Spanish companies last year paid just €0.05 during a 3.6-3.8GHz auction (although this calculation does not consider usage fees they are also charged). Finland’s mid-band sale in October raised as little as $0.04.

However, the German auction is nowhere near Italy on this measure, and it will not even get close. After slapping just 200MHz of mid-band spectrum on the table, and slicing it like a badly cut pizza into uneven segments, Italian regulators made off with around $0.40 per MHz pop. The auction “winners” are now choking on their rewards. Telecom Italia and Vodafone, which landed the biggest mid-band concessions, are busy slashing jobs and pooling assets to ensure 5G rollout is affordable.

German telecom regulator Jochen Homann, the president of the Bundesnetzagentur, is said to have argued that bidders knew the conditions of the auction before it started and will have prepared accordingly. Yet analysts thought a spectrum sale would raise between €3 billion ($3.4 billion) and €5 billion ($5.6 billion), an upper limit the auction has now breached.

Light Reading says German authorities may still have cause to worry. While the country’s operators are in healthier shape than Italy’s, a large spectrum bill risks slowing down the pace of 5G rollout and jeopardizing national ambitions. With its large manufacturing sector, Germany is hopeful that 5G will support Industrie 4.0, a government initiative to bring communications technologies into factories and the workplace. The productivity boost this promises may be critical if Germany is to remain competitive with the US, China and other fast-developing Asian countries.

In the U.S., the FCC auctioned off 24GHz high-band spectrum in March 2019, with the announcement of more spectrum sales expected in the coming months. The U.S. has yet to allocate any mid-band spectrum.

References:

…………………………………………………………………………………………………………….

Related: World leaders in 5G: