iPhone

China’s mobile data consumption slumps; Apple’s market share shrinks-no longer among top 5 vendors

Mobile data demand is in a steep decline in China, the world’s largest 5G market by subscribers. China’s MIIT numbers released this week show per user data consumption (DOU) grew just 8.1% in the first half of the year. That compares to a 68% increase in 2019, the year that 5G licenses were issued. That fell to 13% in 2022 and 11% at end- 2023. Since then, there’s been a decrease in growth of nearly three percentage points in six months.

| Indicator name | unit | Cumulative from January to June | Year-on-year

Growth ( %) |

| Total volume of telecommunication business (at constant prices of the previous year) | 100 million yuan | 8992 | 11.1 |

| Operating income | 100 million yuan | 10712 | 2.8 |

| Including: Telecommunication business income | 100 million yuan | 8941 | 3.0 |

| Total call duration of fixed-line outgoing calls | 100 million minutes | 380 | -3.4 |

| Total mobile phone call duration | 100 million minutes | 10688 | -4.6 |

| Mobile SMS traffic | 100 million | 9407 | 0.5 |

| Mobile Internet access traffic | 100 million GB | 1604 | 12.6 |

| Average mobile Internet access traffic per household in the month (DOU) | GB/household · month | 18.15 | 8.1 |

| Note: 1. The duration of fixed-line outgoing calls and mobile phone calls includes the corresponding IP phone call duration.

2. Starting from February 2024, the 5G mobile Internet access traffic and the number of 5G mobile Internet users of China Radio and Television Network Group Co., Ltd. (hereinafter referred to as China Radio and Television) will be included in the industry summary data, and the data for the same period last year will be adjusted synchronously. |

|||

“While China has rapidly rolled out 5G and continues to perform well vs other markets, there is a limit to the number of people in the market that will engage in advanced data services; the slowdown in traffic growth is an indication that we could be reaching that limit,” according to GSMA.

Commercial 5G standalone (SA) networks, now present in seven APAC countries (Australia, India, Japan, the Philippines, Singapore, South Korea, and Thailand), will help fuel this growth, alongside 5G Advanced, RedCap and AI, creating opportunities to launch new 5G applications and kick start a fresh round in 5G investments for enterprises and consumers.

The authors of the report, GSMA Intelligence, expect 5G to add almost $130 billion to the Asia Pacific economy in 2030, with the manufacturing industry forecast to benefit the most, driven by new 5G-enabed applications including smart factories, smart-grids, and IoT-enabled products. Financial services and public administration are also expected to be big beneficiaries, as they turn to 5G to digitally transform services and operations. To help support this growth the GSMA today launched the GSMA APAC Fintech Forum, a new community programme to unite the connected fintech and commerce sectors with Asia Pacific’s mobile network operators through new technologies.

…………………………………………………………………………………………………………………………………………

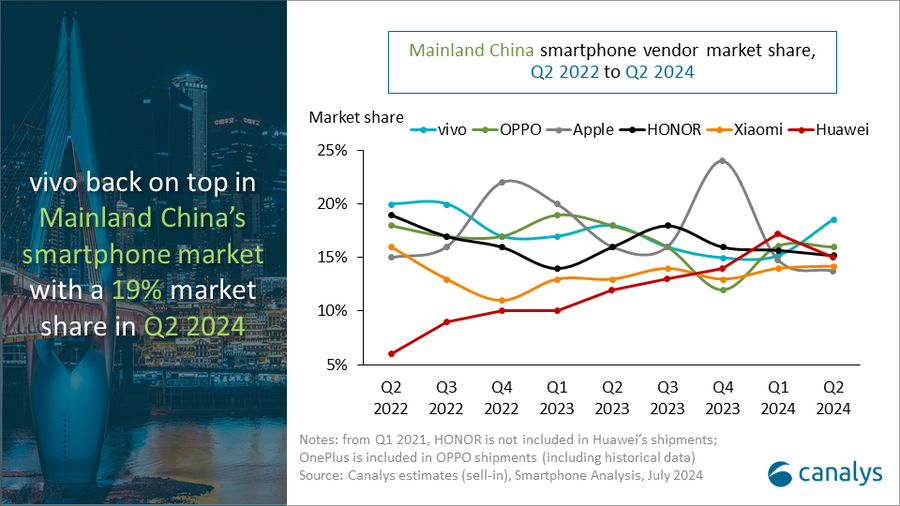

Meanwhile, Apple’s smartphone market share in China shrank by two percentage points in the second quarter of 2024 and the company is no longer one of the top vendors, according to data from market research firm Canalys. The decline underscores the difficulties the U.S. tech giant faces in its third-largest market.

Huawei’s smartphone shipments surged 41 per cent year on year in the the quarter, bolstered by the launch of its new Pura 70 series in April. Chinese smartphone vendors held the top five spots in the second quarter.

“It is the first quarter in history that domestic vendors dominate all the top five positions,” said Canalys Research Analyst Lucas Zhong. “Chinese vendors’ strategies for high-end products and their deep collaboration with local supply chains are starting to pay off in hardware and software features. HONOR’s latest Magic V3, which leverages GenAI, has significantly enhanced the user experience of foldable devices. Conversely, Apple is facing a bottleneck in mainland China. The vendor’s current channel strategy maintains a healthy inventory level and aims to stabilize retail prices and protect margins of channel partners. In the long term, the Chinese high-end market is ripe with opportunity. Local brands such as Huawei, HONOR, OPPO, and vivo are leading the way by incorporating technologies such as GenAI into products and services. Additionally, the localization of Apple’s Intelligence services in mainland China will be crucial in the next 12 months.”

People’s Republic of China (Mainland) smartphone shipments and annual growth

Canalys Smartphone Market Pulse: Q2 2024

|

Vendor |

Q2 2024 |

Q2 2024 |

Q2 2023 |

Q2 2023 |

Annual |

|

vivo |

13.1 |

19% |

11.4 |

18% |

15% |

|

OPPO |

11.3 |

16% |

11.4 |

18% |

-1% |

|

HONOR |

10.7 |

15% |

10.3 |

16% |

4% |

|

Huawei |

10.6 |

15% |

7.5 |

12% |

41% |

|

Xiaomi |

10.0 |

14% |

8.6 |

13% |

17% |

|

Others |

14.8 |

21% |

15.1 |

24% |

-2% |

|

Total |

70.5 |

100% |

64.3 |

100% |

10% |

|

Notes: from Q1 2021, HONOR is not included in Huawei’s shipments; OnePlus is included in OPPO shipments. |

|||||

References:

https://www.miit.gov.cn/gxsj/tjfx/txy/art/2024/art_e2f06366bb134479a40cf4cf86445b1e.html

https://canalys.com/newsroom/china-smartphone-market-Q2-2024

https://www.lightreading.com/5g/slowing-mobile-numbers-cast-doubt-on-gsma-s-buoyant-forecasts

GSMA: China’s 5G market set to top 1 billion this year

MIIT: China’s Big 3 telcos add 24.82M 5G “package subscribers” in December 2023