Bloomberg: Higher borrowing costs hurting indebted wireless companies; industry is 2nd largest source of distressed debt

S&P Global estimates total outstanding debt in the speculative-grade U.S. telecom and cable sector is about $275.4 billion. Most of the telecom debt issuers took advantage of historically low interest rates in 2020 and 2021 to refinance their capital structures and push out maturities until 2026 and 2027. Wireless carriers spent heavily on acquiring spectrum licenses and building out their 5G networks, which led to significant debt loads and a very low ROI. For example, AT&T’s total debt increased significantly due to the C-band auction for 5G spectrum. It jumped from $182.98 billion at the end of 2020 to $209.08 billion in March 2021. Similarly, Verizon’s total debt climbed from $151.24 billion to $180.70 billion during the same period. Large debt loads can limit a company’s ability to invest in new technologies and infrastructure.

Billionaires who built their fortunes building out wireless networks when debt cost almost nothing are seeing their wealth evaporate. For example:

- Altice founder Patrick Drahi’s wealth has dropped almost 18% to $4.4 billion this year, according to the Bloomberg Billionaires Index. Altice has been the poster child for the industry’s travails recently. Last month, Altice spokesmen told creditors of its French operations that they would have to take a hit (impairment charge) in the restructuring of the €24.3 billion debt pile.

- Rakuten Group Inc.’s Hiroshi Mikitani’s fortune has shrunk 69% since 2021 after a push into mobile increased the firm’s losses. Rakuten announced earlier this month that it was looking at combining its financial units into a single group.

- Dish Network Corp. Chairman Charles Ergen has seen his riches shrink nearly 80% in less than three years as the company tries to transition from pay-TV to wireless services. Dish has been searching for ways to address upcoming debt maturities after scrapping a debt swap earlier this year when bondholders pushed back on the deal. Private credit firms have offered financing, Bloomberg News previously reported.

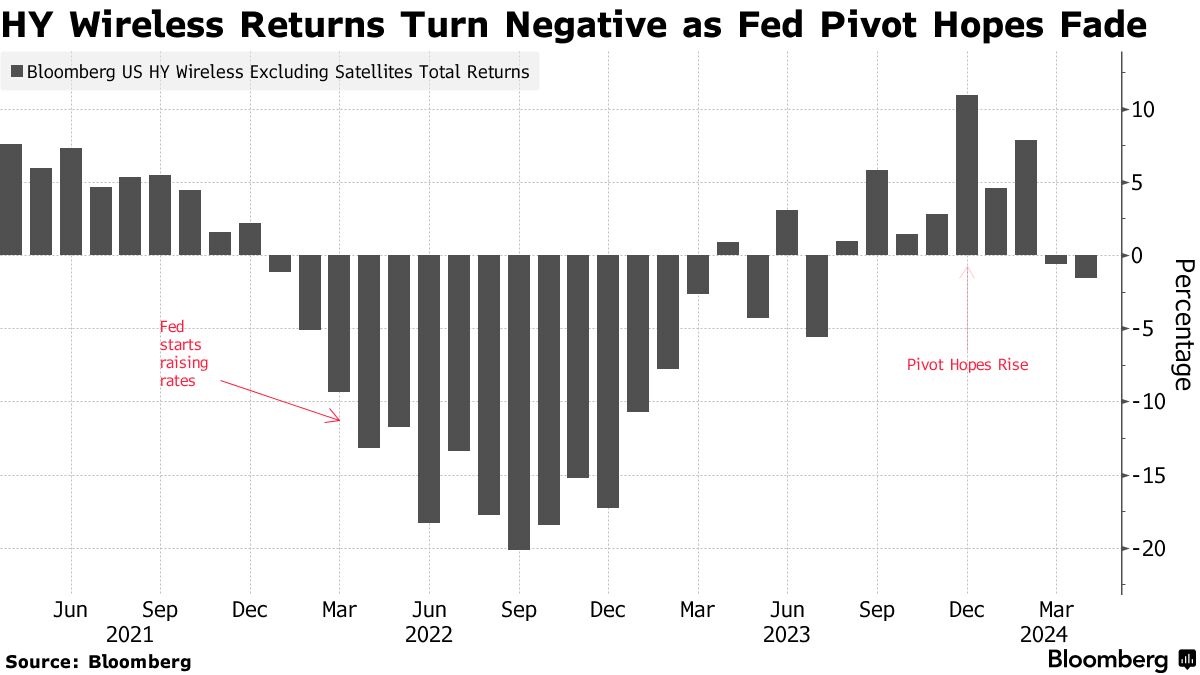

The stumbles in wireless highlight wider troubles across telecommunications, media and technology. Communications is the worst-performing junk sector in the US this year, Bloomberg Intelligence credit analyst Stephen Flynn wrote in a note this week, with several members of the index burdened with high leverage and facing large maturity walls. Annual returns from the industry’s junk bonds have turned negative this year as shown in this chart:

Wireless is the second biggest source of distressed debt globally (#1 is real estate) after the debt pile swelled to $35.3 billion, according to data compiled by Bloomberg News. That’s up more than 80% since early January! The fall in Altice bond prices sent the total level of distressed debt globally last week to the highest level since the middle of January.

Digicel, the Caribbean mobile operator founded by Irish businessman Denis O’Brien, imposed losses on bondholders and lenders earlier this year via what ratings company Moody’s described as a “distressed exchange.”

In summary, managing debt and addressing bad debt are crucial for the wireless industry to maintain financial stability and sustain growth. As interest rates fluctuate and operational challenges persist, wireless telecom companies must find effective strategies to mitigate these risks and optimize revenue assurance.

References:

https://www.bnnbloomberg.ca/telecom-tycoons-feel-pain-from-rising-mobile-woes-1.2065998