Rakuten Mobile

Rakuten Mobile partners with NTIA for commercial deployment of Open Radio Units in the U.S.

Rakuten Mobile today announced it will support the commercial deployment of open radio units (RUs) developed by U.S.-based vendors, as part of the National Telecommunications and Information Administration’s (NTIA) project to advance Open RAN development with funding by the Public Wireless Supply Chain Innovation Fund.

Rakuten Mobile has already built a nationwide mobile network based on Open RAN (O-RAN Alliance) specs in Japan. Leveraging this expertise, the company will collaborate with RU vendors selected by NTIA’s project, including Battelle Memorial Institute, Microelectronics Technology, Eridan Communications and Airspan Networks.

Rakuten Mobile will assist these vendors in the verification and integration processes required for the commercial deployment of their open RUs and support proof-of-concept trials in commercial networks. These trials will utilize Rakuten Symphony’s Open RAN-compatible distributed units (DUs) and centralized units (CUs).

The Public Wireless Supply Chain Innovation Fund aims to support the development of Open RAN, promote competition in the wireless market and strengthen the global supply chain. Each RU vendor will work toward the development and commercial deployment of RUs that comply with international standards, including those defined by the 3rd Generation Partnership Project (3GPP), a global body that develops technical standards for mobile telecommunications, and the O-RAN specifications established by the O-RAN Alliance, a worldwide community promoting the development of Open RAN specifications.

……………………………………………………………………………………………………………………….

Rakuten Mobile’s Benefits:

Despite huge losses, Rakuten CEO Hiroshi Mikitani said the benefits of the mobile business to Rakuten’s ecosystem are “huge.” Users on the Rakuten mobile network spend almost 50% more on Rakuten’s online shopping mall, with benefits spilling over into its credit card, travel, banking and brokerage operations, the 59-year-old CEO said. The amount of exclusive data Rakuten gathers from its users is “extremely powerful,” Mikitani said in an interview with Bloomberg TV. “We have no intent to compete against OpenAI or Google. But we will actively build a more vertically integrated, specialized AI.”

It’s been a costly gamble, however. The mobile business has stretched the company’s balance sheet, prompting the online retailer to sell a roughly 15% stake in its profit-churning credit card arm to Mizuho Financial Group Inc. It’s also raised funds by taking its banking business public in 2023.

References:

https://corp.mobile.rakuten.co.jp/english/news/press/2025/0120_01/

Biden-Harris Administration Awards $273 Million For Wireless Innovation (December 13, 2024)

Biden-Harris Administration Awards $117 Million For Wireless Innovation (January 10, 2025)

Bloomberg: Higher borrowing costs hurting indebted wireless companies; industry is 2nd largest source of distressed debt

S&P Global estimates total outstanding debt in the speculative-grade U.S. telecom and cable sector is about $275.4 billion. Most of the telecom debt issuers took advantage of historically low interest rates in 2020 and 2021 to refinance their capital structures and push out maturities until 2026 and 2027. Wireless carriers spent heavily on acquiring spectrum licenses and building out their 5G networks, which led to significant debt loads and a very low ROI. For example, AT&T’s total debt increased significantly due to the C-band auction for 5G spectrum. It jumped from $182.98 billion at the end of 2020 to $209.08 billion in March 2021. Similarly, Verizon’s total debt climbed from $151.24 billion to $180.70 billion during the same period. Large debt loads can limit a company’s ability to invest in new technologies and infrastructure.

Billionaires who built their fortunes building out wireless networks when debt cost almost nothing are seeing their wealth evaporate. For example:

- Altice founder Patrick Drahi’s wealth has dropped almost 18% to $4.4 billion this year, according to the Bloomberg Billionaires Index. Altice has been the poster child for the industry’s travails recently. Last month, Altice spokesmen told creditors of its French operations that they would have to take a hit (impairment charge) in the restructuring of the €24.3 billion debt pile.

- Rakuten Group Inc.’s Hiroshi Mikitani’s fortune has shrunk 69% since 2021 after a push into mobile increased the firm’s losses. Rakuten announced earlier this month that it was looking at combining its financial units into a single group.

- Dish Network Corp. Chairman Charles Ergen has seen his riches shrink nearly 80% in less than three years as the company tries to transition from pay-TV to wireless services. Dish has been searching for ways to address upcoming debt maturities after scrapping a debt swap earlier this year when bondholders pushed back on the deal. Private credit firms have offered financing, Bloomberg News previously reported.

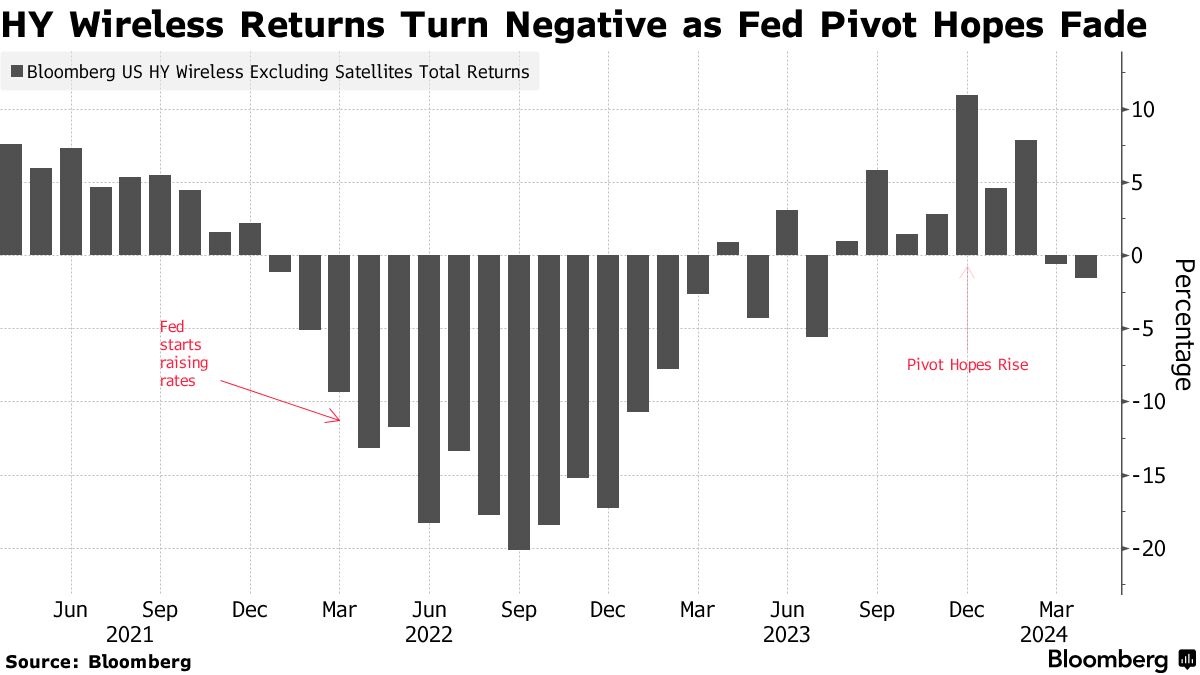

The stumbles in wireless highlight wider troubles across telecommunications, media and technology. Communications is the worst-performing junk sector in the US this year, Bloomberg Intelligence credit analyst Stephen Flynn wrote in a note this week, with several members of the index burdened with high leverage and facing large maturity walls. Annual returns from the industry’s junk bonds have turned negative this year as shown in this chart:

Wireless is the second biggest source of distressed debt globally (#1 is real estate) after the debt pile swelled to $35.3 billion, according to data compiled by Bloomberg News. That’s up more than 80% since early January! The fall in Altice bond prices sent the total level of distressed debt globally last week to the highest level since the middle of January.

Digicel, the Caribbean mobile operator founded by Irish businessman Denis O’Brien, imposed losses on bondholders and lenders earlier this year via what ratings company Moody’s described as a “distressed exchange.”

In summary, managing debt and addressing bad debt are crucial for the wireless industry to maintain financial stability and sustain growth. As interest rates fluctuate and operational challenges persist, wireless telecom companies must find effective strategies to mitigate these risks and optimize revenue assurance.

References:

https://www.bnnbloomberg.ca/telecom-tycoons-feel-pain-from-rising-mobile-woes-1.2065998

Where Have You Gone 5G? Midband spectrum, FWA, 2024 decline in CAPEX and RAN revenue

Telecom layoffs continue unabated as AT&T leads the pack – a growth engine with only 1% YoY growth?

MTN Consulting: Generative AI hype grips telecom industry; telco CAPEX decreases while vendor revenue plummets

Dell’Oro: Telecom Capex Growth to Slow in calendar years 2022-2024

FT: Telecom & Technology on the Ropes: Challenging Markets & Too Much Debt

Rakuten Mobile in joint venture with Tokyo Electric Power Company (TEPCO) to expand 4G/5G network

Japanese wireless network operator Rakuten Mobile has established a new joint venture company in its domestic market with Tokyo Electric Power Company (TEPCO) to deploy base stations at existing power grid sites as it looks to further expand its 4G and 5G coverage in a more efficient way.

The new company, called Rakuten Mobile Infrastructure Solution, began operating in Tokyo on July 1st. The entity has an initial nominal value of ¥300m (approximately $2.2m), with Rakuten Mobile owning a 51% stake in the venture and TEPCO holding the remaining 49% stake, the operator said in a statement (available in Japanese here).

Rakuten Mobile Infrastructure Solution is set to contribute to the telco’s vision for a stable communication environment by enhancing the efficiency of maintaining base stations through effective use of public assets. The new company will also look to develop installation specifications for Rakuten Mobile’s base station equipment and manage installation-related works.

The Japanese telecom industry upstart, which already covers 96% of the Japanese population with its 4G service, noted it is using “some power assets” to further build out its network.

Through the new company, Rakuten Mobile plans to expand its 4G and 5G networks, boost the density of base station deployments and “strengthen the development of communication infrastructure with the aim of providing stable services”. As it will use the existing power assets of TEPCO for the purpose (alongside the power company’s construction capabilities and know-how), the telco believes it can “improve the cost efficiency of base station maintenance”.

This is not the first engagement for the two companies: In March 2018, Rakuten Mobile secured an agreement to make use of TEPCO’s steel towers, power distribution poles, building roofs and other infrastructure, just a few months before it began building its greenfield cellular network, and in 2019 was part of a broader mobile operator initiative with TEPCO related to power grid infrastructure sharing.

References:

Rakuten Symphony Inc. to provide 4G and 5G infrastructure and platform solutions to the global market

Japan’s Rakuten Group today announced that they have resolved to incorporate Rakuten Symphony, a business organization of the Company, and start considering a capital and business alliance (in other words, investments).

As announced on August 4, 2021 in “Rakuten launches Rakuten Symphony to accelerate adoption of cloud-native, open RAN-based mobile networks worldwide,” alongside Rakuten Communications Platform (hereafter “RCP“), Rakuten Symphony, a new business organization, was newly launched by consolidating the products and services to be implemented.

Rakuten Symphony aims to provide a future-proof, cost-effective, communication cloud platform for carriers, businesses and government agencies around the world.

Rakuten Symphony is a global business organization that develops solution businesses in Japan, the United States, Singapore, India, Europe, and the Middle East / Africa. Through this incorporation, accountability (duties) will be clarified, flexible decision-making and business execution will be possible, and products, services, and solutions for telecommunications carriers will be consolidated across the board.

“We will be ready to provide 4G and 5G infrastructure and platform solutions to the global market.”

In addition, as announced in “1&1 and Rakuten agree far-reaching partnership to build Europe’s first fully virtualized mobile network based on new Open RAN technology” also on August 4, 1&1 has agreed to comprehensively adopt RCP. This business has been steadily accumulating its achievements. In order to further accelerate the global expansion of innovative mobile network solutions, Rakuten Symphony, Inc., a newly established corporation, will consider accepting capital, etc. in addition to business partnerships with strategic partners.

The Company will establish its position as a global leader in cloud-centric and virtualized Open RAN-based mobile networks, by expanding its communication platform business overseas, as well as its track record of expanding its mobile carrier business in Japan.

Mike Dano of Light Reading wrote:

It’s no surprise that Rakuten is pulling out all the stops to make Symphony a success. The operation’s Symphony contract with flagship customer 1&1 in Germany is worth between $2.3 billion and $2.7 billion over a ten-year period, reports Nikkei Asia. By contrast, Rakuten made about $1.8 billion in revenues at its Japanese mobile business in the last year.

“This business has been steadily accumulating its achievements,” Rakuten wrote this week, pointing specifically to its 1&1 deal.

Light Reading reported in March 2020 of Rakuten’s plans to sell a networking platform internationally. The offering was initially dubbed Rakuten Mobile Platform (RMP), and then Rakuten Communications Platform (RCP), but the company in August named it Symphony and said the operation targeted an addressable market of up to $100 billion.

Symphony is essentially the portfolio of technologies Rakuten uses in its Japanese mobile network – alongside other offerings from its partners – that it is now pitching to other service providers and networking hopefuls worldwide. According to Rakuten, companies can purchase all or parts of Symphony in order to quickly and easily roll out their own open RAN 5G networks.

Thus, Symphony is now on a collision course with a wide range of other players selling similar offerings. Ericsson, Amazon, Google and Mavenir are among the many providers hoping to assemble a product portfolio stretching across core networking, radio hardware and associated software and services, and then to rope in deals with customers ranging from enterprises to government agencies.

References:

https://global.rakuten.com/corp/news/press/2021/0930_03.html

https://www.lightreading.com/the-core/rakuten-rearranges-symphony-for-investments/d/d-id/772501?