MTN Consulting: Generative AI hype grips telecom industry; telco CAPEX decreases while vendor revenue plummets

Ever since Generative (Gen) AI burst into the mainstream through public-facing platforms (e.g. ChatGPT) late last year, its promising capabilities have caught the attention of many. Not surprisingly, telecom industry execs are among the curious observers wanting to try Gen AI even as it continues to evolve at a rapid pace.

MTN Consulting says the telecom industry’s bond with AI is not new though. Many telcos have deployed conventional AI tools and applications in the past several years, but Gen AI presents opportunities for telcos to deliver significant incremental value over existing AI. A few large telcos have kickstarted their quest for Gen AI by focusing on “localization.” Through localization of processes using Gen AI, telcos vow to eliminate language barriers and improve customer engagement in their respective operating markets, especially where English as a spoken language is not dominant.

Telcos can harness the power of Gen AI across a wide range of different functions, but the two vital telco domains likely to witness transformative potential of Gen AI are networks and customer service. Both these domains are crucial: network demands are rising at an unprecedented pace with increased complexity, and delivering differentiated customer experiences remains an unrealized ambition for telcos.

Several Gen AI use cases are emerging within these two telco domains to address these challenges. In the network domain, these include topology optimization, network capacity planning, and predictive maintenance, for example. In the customer support domain, they include localized virtual assistants, personalized support, and contact center documentation.

Most of the use cases leveraging Gen AI applications involve dealing with sensitive data, be it network-related or customer-related. This will have major implications from the regulatory point of view, and regulatory concerns will constrain telcos’ Gen AI adoption and deployment strategies. The big challenge is the mosaic of complex and strict regulations prevalent in different markets that telcos will have to understand and adhere to when implementing Gen AI use cases in such markets. This is an area where third-party vendors will try to cash in by offering Gen AI solutions that are compliant with regulations in the respective markets.

Vendors will also play a key role for small- and medium-sized telcos in Gen AI implementation, by eliminating constraints due to the lack of technical expertise and HW/SW resources, skilled manpower, along with opex costs burden. Key vendors to watch out for in the Gen AI space are webscale providers who possess the ideal combination of providing cloud computing resources required to train large language models (LLM) coupled with their Gen AI expertise offered through pre-trained models.

Other key points from MTN Consulting on Gen AI in the telecom industry:

- Network operations and customer support will be key transformative areas.

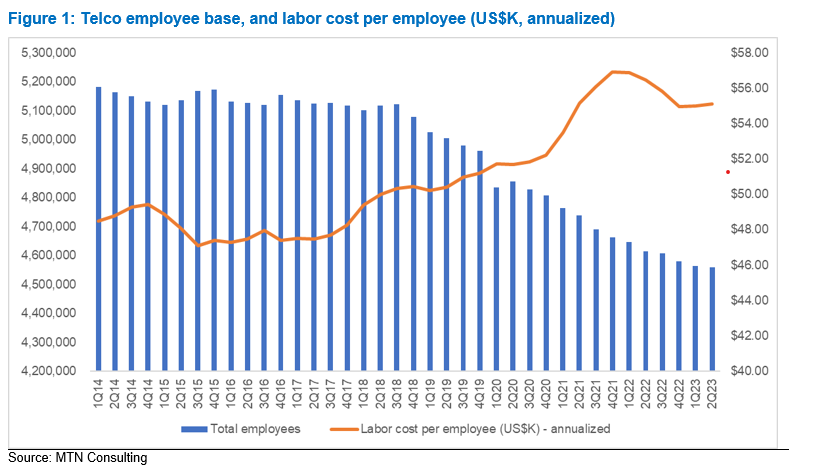

- Telco workforce will become leaner but smarter in the Gen AI era.

- Strict regulations will be a major barrier for telcos.

- Vendors key to Gen AI integration; webscale providers set for more telco gains.

- Lock-in risks and rising software costs are key considerations in choosing vendors.

………………………………………………………………………………………………………………………………

Separately, MTN Consulting’s latest forecast called for $320B of telco capex in 2023, down only slightly from the $328B recorded in 2022. Early 3Q23 revenue reports from vendors selling into the telco market call this forecast into question. The dip in the Americas is worse than expected, and Asia’s expected 2023 growth has not materialized.

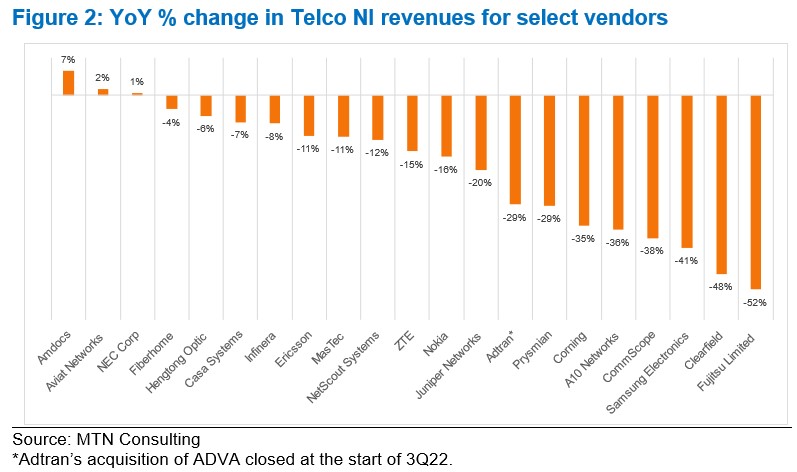

Key vendors are reporting significant YoY drops in revenue, pointing to inventory corrections, macroeconomic uncertainty (interest rates, in particular), and weaker telco spending. Network infrastructure sales to telcos (Telco NI) for key vendors Ericsson and Nokia dropped 11% and 16% YoY in 3Q23, respectively, measured in US dollars. By the same metric, NEC, Fujitsu and Samsung saw +1%, -52%, and -41% YoY growth; Adtran, Casa, and Juniper declined 29%, 7%, and 20%; fiber-centric vendors Clearfield, Corning, CommScope, and Prysmian all saw double digit declines.

MTN Consulting will update its operator forecast formally next month. In advance, this comment flags a weaker spending outlook than expected. Telco capex for 2023 is likely to come in around $300-$310B.

MTN Consulting’s Network Operator Forecast Through 2027: “Telecom is essentially a zero-growth industry”

MTN Consulting: Top Telco Network Infrastructure (equipment) vendors + revenue growth changes favor cloud service providers

Proposed solutions to high energy consumption of Generative AI LLMs: optimized hardware, new algorithms, green data centers

Cloud Service Providers struggle with Generative AI; Users face vendor lock-in; “The hype is here, the revenue is not”

Global Telco AI Alliance to progress generative AI for telcos

Amdocs and NVIDIA to Accelerate Adoption of Generative AI for $1.7 Trillion Telecom Industry

Bain & Co, McKinsey & Co, AWS suggest how telcos can use and adapt Generative AI

Generative AI Unicorns Rule the Startup Roost; OpenAI in the Spotlight

Generative AI in telecom; ChatGPT as a manager? ChatGPT vs Google Search

Generative AI could put telecom jobs in jeopardy; compelling AI in telecom use cases

MTN Consulting: Satellite network operators to focus on Direct-to-device (D2D), Internet of Things (IoT), and cloud-based services

MTN Consulting on Telco Network Infrastructure: Cisco, Samsung, and ZTE benefit (but only slightly)

MTN Consulting: : 4Q2021 review of Telco & Webscale Network Operators Capex

One thought on “MTN Consulting: Generative AI hype grips telecom industry; telco CAPEX decreases while vendor revenue plummets”

Comments are closed.

Technology industry body DigitalEurope called on the European Union (EU) to avoid over-regulating AI foundation models and create a situation that would force start-ups to leave the region, as the bloc enters final negotiations over crucial laws to govern the sector.

DigitalEurope issued an open letter, signed by 32 of the continent’s digital associations, explaining that only 8 per cent of companies in Europe currently use AI, significantly far from a European Commission target for 75 per cent by 2030.

In addition, it stated just 3 per cent of the world’s “AI unicorns” came from the EU, warning the continent’s competitiveness and financial stability depends on the ability of companies to deploy AI in areas such as green tech, health, manufacturing or energy.

To that end, it wants the EU’s upcoming AI Act, which is now the subject of final negotiations between lawmakers and member states, to “give AI in Europe a fighting chance” by not imposing excessive red tape on areas such as foundation models and general purpose AI (GPAI).

“For Europe to become a global digital powerhouse, we need companies that can lead on AI innovation also using foundation models and GPAI.”

The letter continued: “As European digital industry representatives, we see a huge opportunity in foundation models, and new innovative players emerging in this space, many of them born here in Europe. Let’s not regulate them out of existence before they get a chance to scale, or force them to leave.”

As part of a list of recommendations, signatories backed a joint proposal from France, Germany and Italy to limit the scope of AI rules for foundation models to certain transparency standards. DigitalEurope argued the AI Act did not need to regulate every new technology, and it supported an approach that focused on high-risk uses.

The letter also raised concerns that the AI Act, given its broad scope, could overlap with rules in other sectors such as healthcare.

https://www.mobileworldlive.com/ai-cloud/digital-groups-urge-eu-to-give-ai-a-fighting-chance/